FX

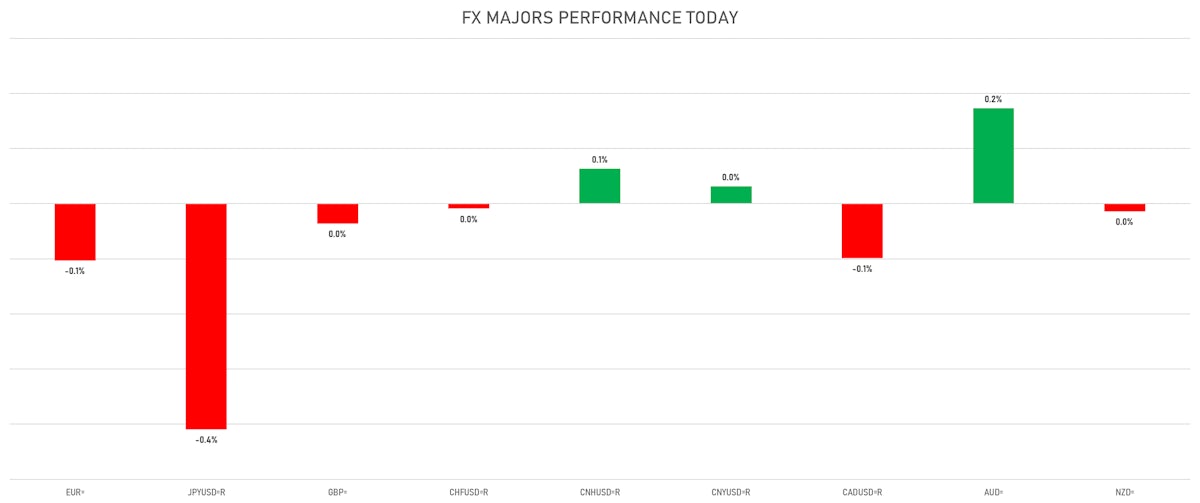

Modest Volatility In Major Currencies Except For The Continued Fall Of The Japanese Yen

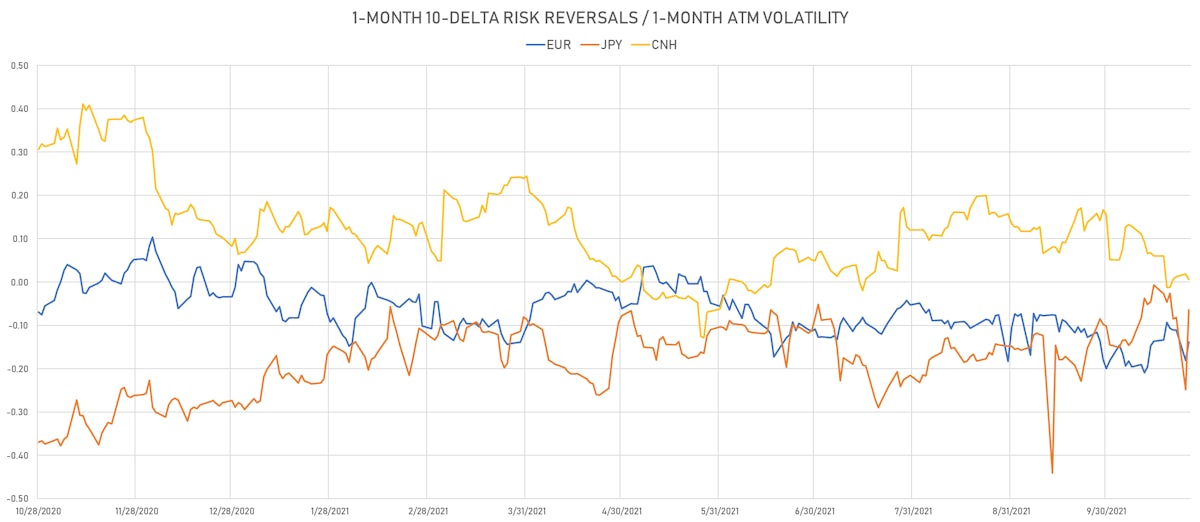

Interestingly, despite the big rise in spot USDJPY over the past 3 months (from 110 in July to 114 and change today), the skew in 1-Month implied volatilities is close to zero (symmetric vol smile), suggesting a fairly neutral market positioning at current prices, perhaps a sign that the move has further to go

Published ET

JPY 1-Month Implied Volatility Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

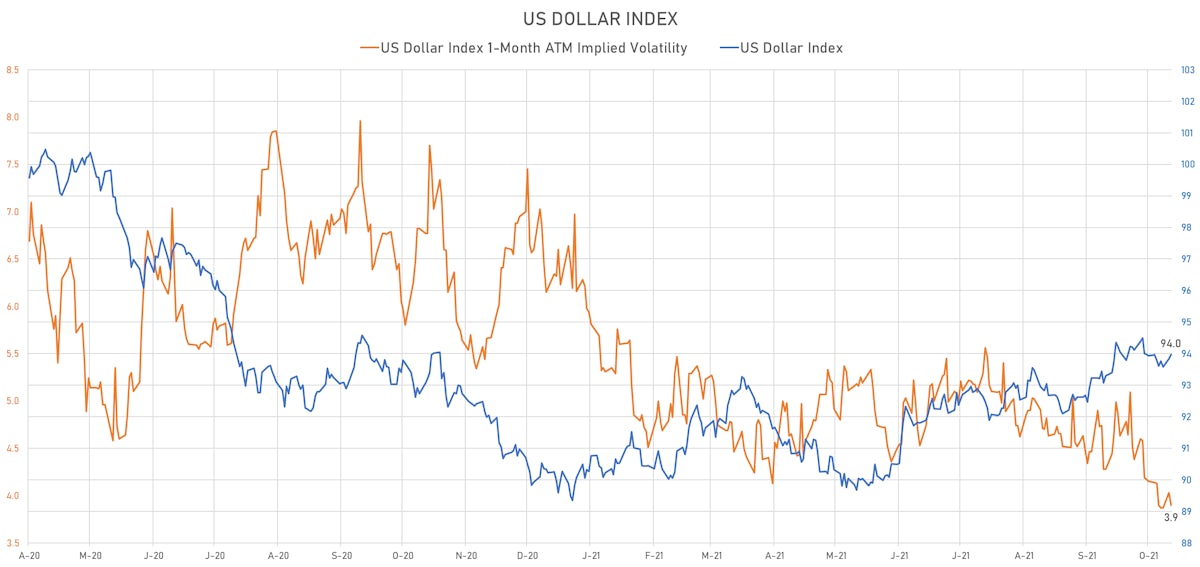

- The US Dollar Index is up 0.15% at 93.97 (YTD: +4.44%)

- Euro down 0.10% at 1.1594 (YTD: -5.1%)

- Yen down 0.41% at 114.19 (YTD: -9.6%)

- Onshore Yuan up 0.03% at 6.3820 (YTD: +2.3%)

- Swiss franc down 0.01% at 0.9199 (YTD: -3.7%)

- Sterling down 0.04% at 1.3763 (YTD: +0.7%)

- Canadian dollar down 0.10% at 1.2391 (YTD: +2.8%)

- Australian dollar up 0.17% at 0.7504 (YTD: -2.5%)

- NZ dollar down 0.01% at 0.7159 (YTD: -0.4%)

MACRO DATA RELEASES

- Brazil, CPI, Broad National - 15 (IPCA-15), Change Y/Y for Oct 2021 (IBGE, Brazil) at 10.34 % (vs 10.05 % prior), above consensus estimate of 10.09 %

- Brazil, CPI, Broad national - 15 (IPCA-15), Change P/P for Oct 2021 (IBGE, Brazil) at 1.20 % (vs 1.14 % prior), above consensus estimate of 0.97 %

- New Zealand, Exports, Total, FOB, Current Prices for Sep 2021 (Statistics, NZ) at 4.40 Bln NZD (vs 4.35 Bln NZD prior)

- New Zealand, Imports, Total, CIF, Current Prices for Sep 2021 (Statistics, NZ) at 6.57 Bln NZD (vs 6.49 Bln NZD prior)

- New Zealand, Trade Balance, Current Prices for Sep 2021 (Statistics, NZ) at -2,171.00 Mln NZD (vs -2,144.00 Mln NZD prior)

- New Zealand, Trade Balance, Current Prices for Sep 2021 (Statistics, NZ) at -4.09 Bln NZD (vs -2.94 Bln NZD prior)

- Singapore, Production, Change P/P for Sep 2021 (Statistics Singapore) at -2.80 % (vs 5.70 % prior), below consensus estimate of 0.30 %

- Singapore, Production, Change Y/Y for Sep 2021 (Statistics Singapore) at -3.40 % (vs 11.20 % prior), below consensus estimate of -0.50 %

- United Kingdom, CBI Distributive Trades, Retailing, Volume of sales, balance for Oct 2021 (CBI, UK) at 30.00 (vs 11.00 prior), above consensus estimate of 13.00

- United States, Conference Board, Consumer confidence for Oct 2021 (The Conference Board) at 113.80 (vs 109.30 prior), above consensus estimate of 108.30

- United States, House Prices, S&P Case-Shiller, Composite-20, Change P/P for Aug 2021 (Standard & Poor's) at 1.20 % (vs 1.50 % prior), below consensus estimate of 1.50 %

- United States, House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Aug 2021 (Standard & Poor's) at 19.70 % (vs 19.90 % prior), below consensus estimate of 20.00 %

- United States, New Home Sales for Sep 2021 (U.S. Census Bureau) at 0.80 Mln (vs 0.74 Mln prior), above consensus estimate of 0.76 Mln

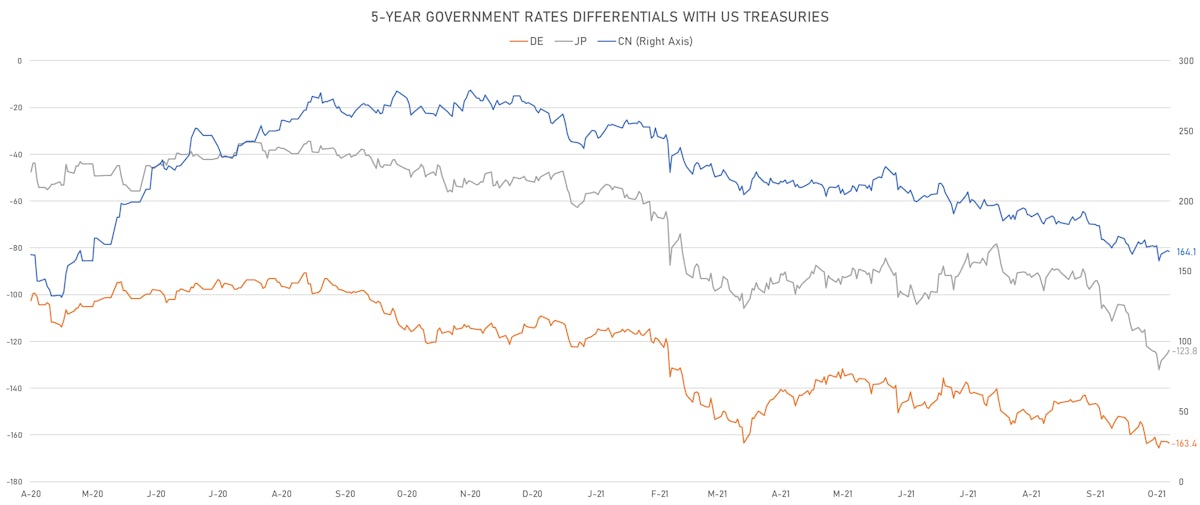

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.5 bp at 163.4 bp (YTD change: +52.3 bp)

- US-JAPAN: -1.5 bp at 123.8 bp (YTD change: +75.5 bp)

- US-CHINA: +0.6 bp at -164.1 bp (YTD change: +93.0 bp)

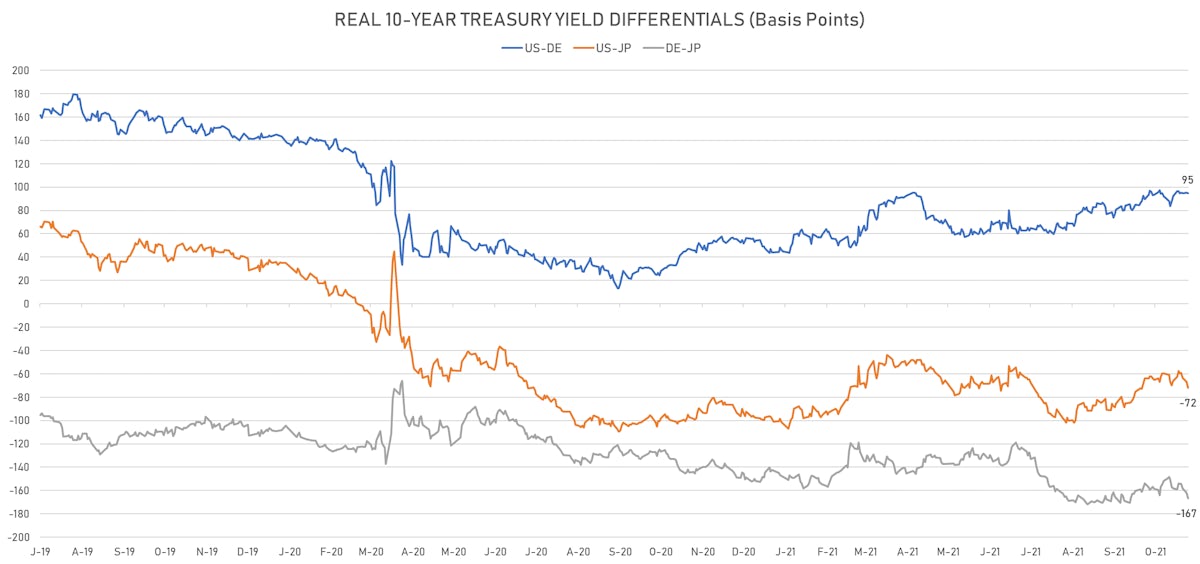

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.3 bp at 94.8 bp (YTD change: +48.7bp)

- US-JAPAN: -5.0 bp at -72.0 bp (YTD change: +29.5bp)

- JAPAN-GERMANY: +4.7 bp at 166.8 bp (YTD change: +19.2bp)

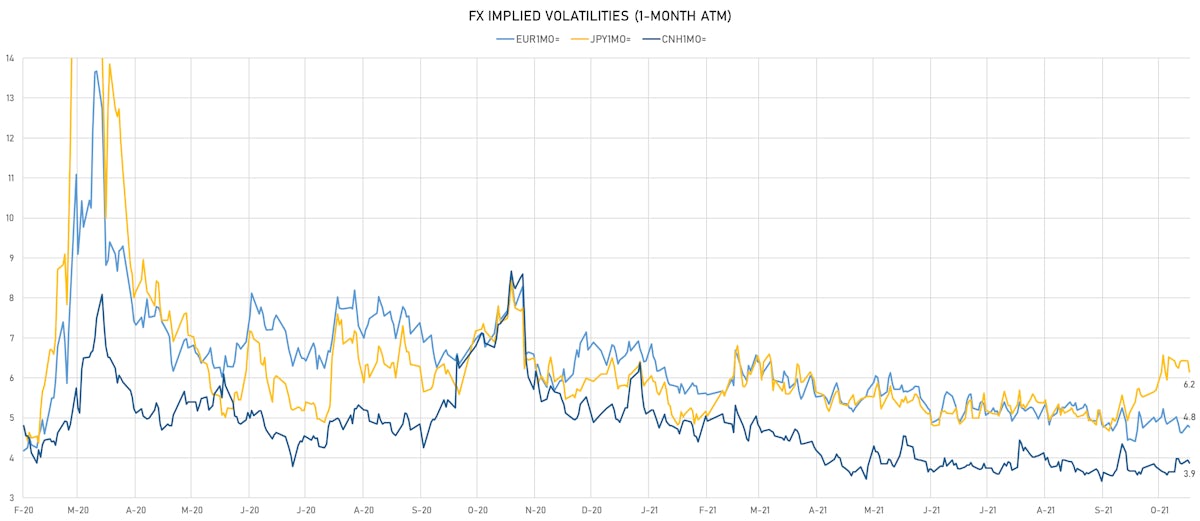

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.14, down -0.01 (YTD: -1.03)

- Euro 1-Month At-The-Money Implied Volatility currently unchanged at 4.78 (YTD: -1.9)

- Japanese Yen 1M ATM IV currently at 6.15, down -0.3 (YTD: +0.1)

- Offshore Yuan 1M ATM IV currently at 3.88, down -0.1 (YTD: -2.1)

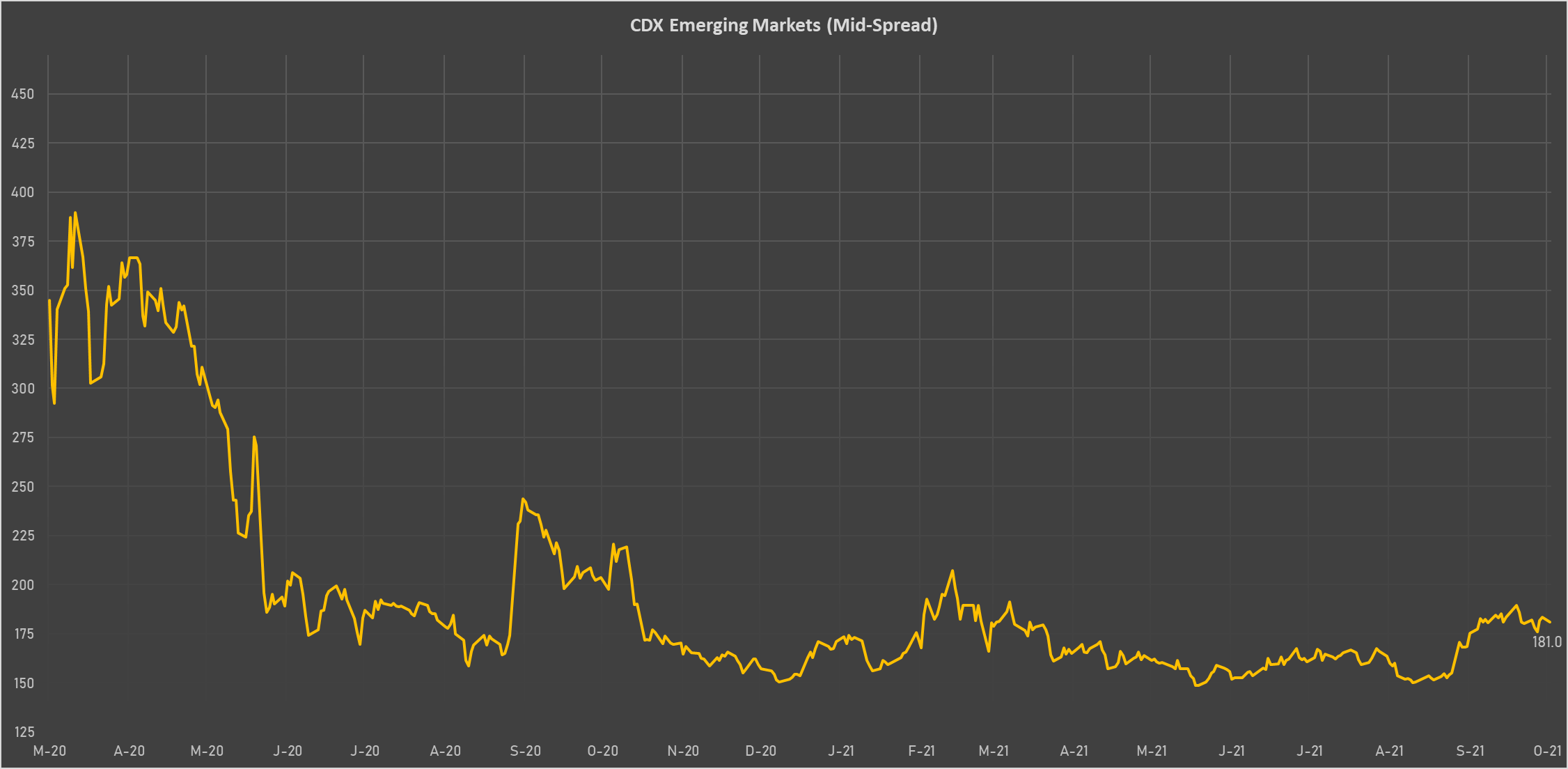

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Peru (rated BBB): up 1.2 basis points to 84 bp (1Y range: 52-105bp)

- Panama (rated BBB-): down 1.3 basis points to 90 bp (1Y range: 44-93bp)

- Chile (rated A-): down 1.5 basis points to 82 bp (1Y range: 43-89bp)

- Colombia (rated BB+): down 2.8 basis points to 152 bp (1Y range: 83-175bp)

- Russia (rated BBB): down 1.5 basis points to 79 bp (1Y range: 72-117bp)

- Indonesia (rated BBB): down 2.4 basis points to 80 bp (1Y range: 66-97bp)

- Mexico (rated BBB-): down 2.8 basis points to 94 bp (1Y range: 79-127bp)

- Philippines (rated BBB): down 1.9 basis points to 56 bp (1Y range: 33-65bp)

- Turkey (rated BB-): down 15.4 basis points to 443 bp (1Y range: 282-560bp)

- Oman (rated BB-): down 8.6 basis points to 241 bp (1Y range: 223-452bp)

LARGEST FX MOVES TODAY

- Malawi Kwacha up 1.7% (YTD: -4.7%)

- Haiti Gourde up 0.9% (YTD: -27.6%)

- Solomon Is Dollar up 0.8% (YTD: +0.2%)

- Qatari Riyal up 0.8% (YTD: 0.0%)

- South Africa Rand down 0.9% (YTD: -1.0%)

- Botswana Pula down 1.0% (YTD: -4.6%)

- Fiji Dollar down 1.0% (YTD: -1.5%)

- Belize Dollar down 1.1% (YTD: 0.0%)

- Barbados Dollar down 1.5% (YTD: 0.0%)

- Myanmar Kyat down 1.9% (YTD: -32.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 41.9%

- New Zambian kwacha up 23.3%

- Haiti Gourde down 27.6%

- Myanmar Kyat down 32.0%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.6%

- Venezuela Bolivar down 74.1%

- Sudanese Pound down 87.5%