FX

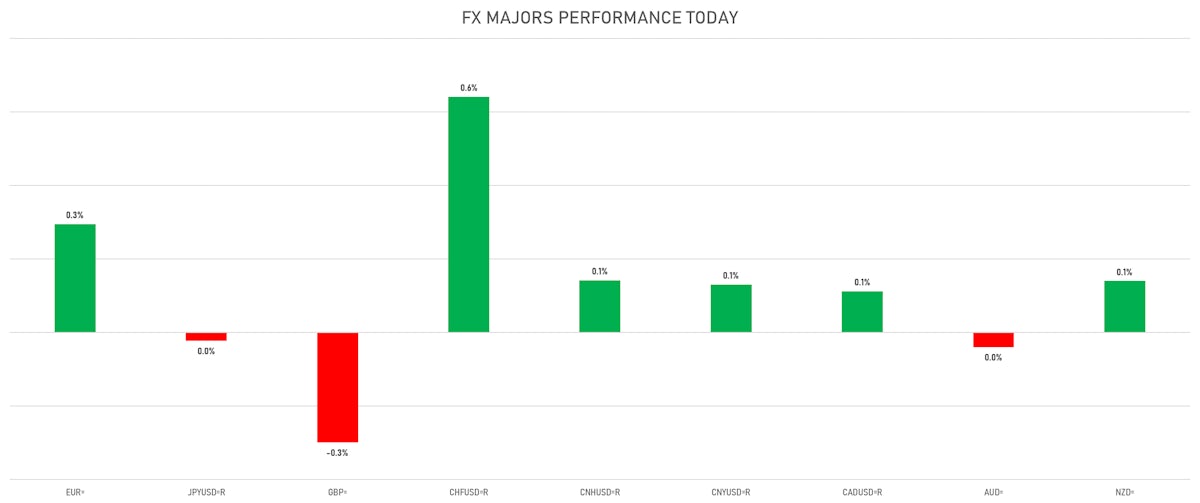

Modest Rebound In The Euro Today In An Otherwise Pretty Quiet Session For FX

US rates volatility in the past week reverberated in global markets, most visibly in basis swaps like the JPY currency basis as well as Euro FRA-EONIA (pictured here)

Published ET

IMM March 2023 FRA EONIA Spread & JPY 2Y currency basis swap | Source: Refinitiv

QUICK SUMMARY

- The US Dollar Index is down -0.25% at 93.91 (YTD: +4.36%)

- Euro up 0.30% at 1.1596 (YTD: -5.1%)

- Yen up 0.03% at 113.95 (YTD: -9.4%)

- Onshore Yuan up 0.09% at 6.4007 (YTD: +2.0%)

- Swiss franc up 0.54% at 0.9103 (YTD: -2.8%)

- Sterling down 0.30% at 1.3650 (YTD: -0.2%)

- Canadian dollar up 0.10% at 1.2379 (YTD: +2.9%)

- Australian dollar up 0.05% at 0.7525 (YTD: -2.2%)

- NZ dollar up 0.24% at 0.7181 (YTD: -0.1%)

MACRO DATA RELEASES

- Brazil, PMI, Manufacturing Sector for Oct 2021 (Markit Economics) at 51.70 (vs 54.40 prior)

- Canada, PMI, Manufacturing Sector, Markit Mfg PMI SA for Oct 2021 (Markit Economics) at 57.70 (vs 57.00 prior)

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for Oct 2021 (Markit Economics) at 50.60 (vs 50.00 prior), above consensus estimate of 50.00

- Czech Republic, PMI, Manufacturing Sector for Oct 2021 (Markit Economics) at 55.10 (vs 58.00 prior), below consensus estimate of 57.00

- Denmark, PMI, Manufacturing Sector for Oct 2021 (DILF, Denmark) at 71.90 (vs 65.20 prior)

- Germany, Retail Sales, Total excluding motor vehicles and automotive fuel, Change P/P for Sep 2021 (Destatis) at -2.50 % (vs 1.10 % prior), below consensus estimate of 0.60 %

- Germany, Retail Sales, Total excluding motor vehicles and automotive fuel, Change Y/Y for Sep 2021 (Destatis) at -0.90 % (vs 0.40 % prior), below consensus estimate of 1.80 %

- Greece, PMI, Manufacturing Sector for Oct 2021 (Markit Economics) at 58.90 (vs 58.40 prior)

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Oct 2021 (Markit Economics) at 55.90 (vs 53.70 prior), above consensus estimate of 54.00

- Indonesia, CPI, Change P/P for Oct 2021 (Statistics Indonesia) at 0.12 % (vs -0.04 % prior), above consensus estimate of 0.11 %

- Indonesia, CPI, Change Y/Y for Oct 2021 (Statistics Indonesia) at 1.66 % (vs 1.60 % prior), in line with consensus estimate

- Indonesia, CPI, Core, Change Y/Y for Oct 2021 (Statistics Indonesia) at 1.33 % (vs 1.30 % prior), below consensus estimate of 1.36 %

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Oct 2021 (Markit Economics) at 57.20 (vs 52.20 prior)

- Ireland, PMI, Manufacturing Sector for Oct 2021 (Markit Economics) at 62.10 (vs 60.30 prior)

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for Oct 2021 (Markit Economics) at 53.20 (vs 53.00 prior)

- Malaysia, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Oct 2021 (Markit Economics) at 52.20 (vs 48.10 prior)

- Mexico, PMI, Manufacturing Sector for Oct 2021 (Markit Economics) at 49.30 (vs 48.60 prior)

- Myanmar, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Oct 2021 (Markit Economics) at 43.30 (vs 41.10 prior)

- Netherlands, PMI, Manufacturing Sector, NEVI PMI for Oct 2021 (Markit Economics) at 62.50 (vs 62.00 prior)

- Norway, PMI, Manufacturing Sector for Oct 2021 () at 58.50 (vs 59.20 prior)

- Peru, CPI, Total, Change P/P, Price Index for Oct 2021 (INEI, Peru) at 0.58 % (vs 0.40 % prior), above consensus estimate of 0.23 %

- Russia, PMI, Manufacturing Sector for Oct 2021 (Markit Economics) at 51.60 (vs 49.80 prior)

- South Korea, CPI, Change P/P, Price Index for Oct 2021 (KOSTAT - Korea) at 0.10 % (vs 0.50 % prior), in line with consensus estimate

- South Korea, CPI, Change Y/Y, Price Index for Oct 2021 (KOSTAT - Korea) at 3.20 % (vs 2.50 % prior), above consensus estimate of 3.15 %

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Oct 2021 (Markit Economics) at 50.20 (vs 52.40 prior)

- Sweden, PMI, Manufacturing Sector for Oct 2021 (Swedbank and Silf) at 64.40 (vs 64.60 prior)

- Switzerland, PMI, Manufacturing Sector, Manufacturing PMI for Oct 2021 (Credit Suisse Group) at 65.40 (vs 68.10 prior), below consensus estimate of 65.50

- Taiwan, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Oct 2021 (Markit Economics) at 55.20 (vs 54.70 prior)

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Oct 2021 (Markit Economics) at 51.20 (vs 52.50 prior)

- Unable to collect data for the field 'TR.InstrumentDescription' and some specific identifier(s). for Oct 2021 (Markit Economics) at 50.90 (vs 48.90 prior)

- United Kingdom, PMI, Manufacturing Sector for Oct 2021 (Markit Economics) at 57.80 (vs 57.70 prior), above consensus estimate of 57.70

- United States, Construction Spending, Change P/P for Sep 2021 (U.S. Census Bureau) at -0.50 % (vs 0.00 % prior), below consensus estimate of 0.40 %

- United States, ISM Manufacturing, PMI total for Oct 2021 (ISM, United States) at 60.80 (vs 61.10 prior), above consensus estimate of 60.50

- United States, ISM Manufacturing, Prices for Oct 2021 (ISM, United States) at 85.70 (vs 81.20 prior)

- United States, PMI, Manufacturing Sector, Total, Final for Oct 2021 (Markit Economics) at 58.40 (vs 59.20 prior)

- Vietnam, IHS Markit, PMI, Manufacturing Sector, Manufacturing PMI for Oct 2021 (Markit Economics) at 52.10 (vs 40.20 prior)

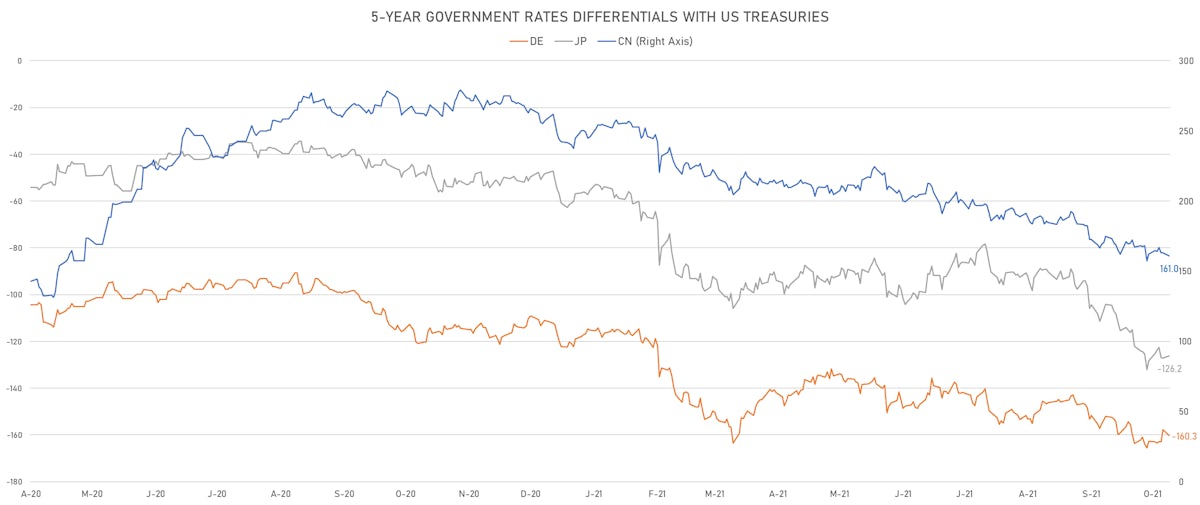

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.5 bp at 160.3 bp (YTD change: +49.2 bp)

- US-JAPAN: -1.0 bp at 126.2 bp (YTD change: +77.9 bp)

- US-CHINA: +2.3 bp at -161.0 bp (YTD change: +96.2 bp)

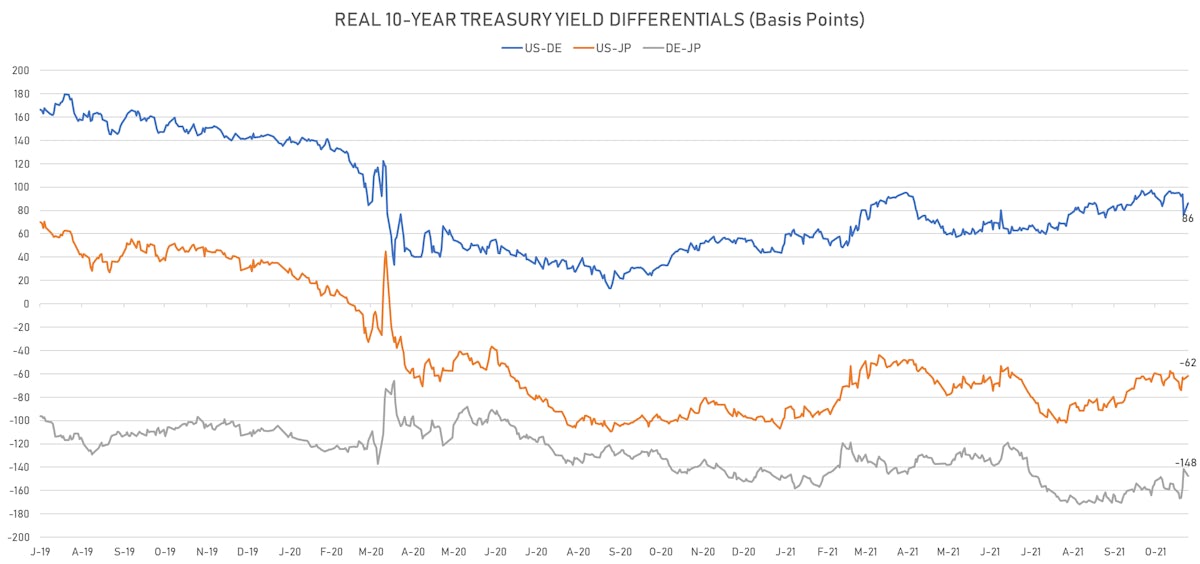

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +9.5 bp at 86.0 bp (YTD change: +39.9bp)

- US-JAPAN: +3.3 bp at -61.6 bp (YTD change: +39.9bp)

- JAPAN-GERMANY: +6.2 bp at 147.6 bp (YTD change: 0.0bp)

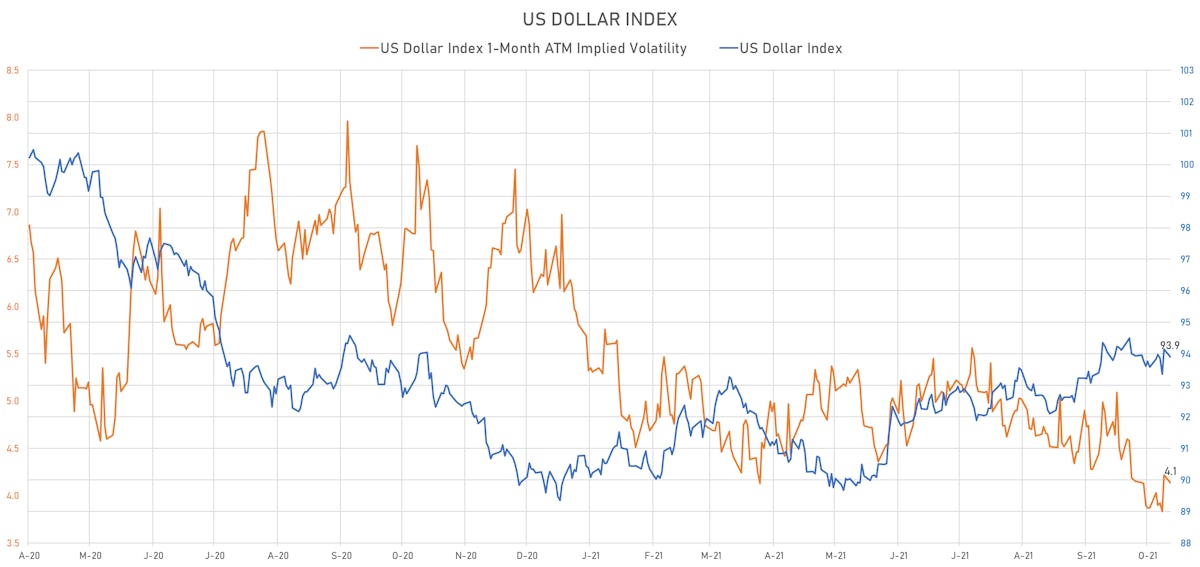

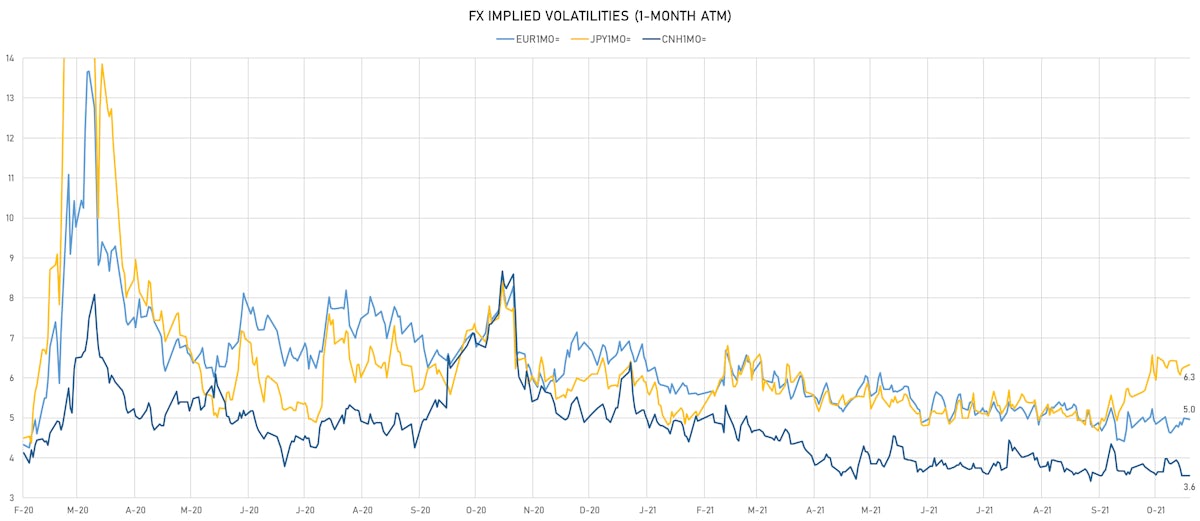

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.35, up 0.14 (YTD: -0.82)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 4.96 (YTD: -1.7)

- Japanese Yen 1M ATM IV currently at 6.33, up 0.1 (YTD: +0.2)

- Offshore Yuan 1M ATM IV currently unchanged at 3.55 (YTD: -2.4)

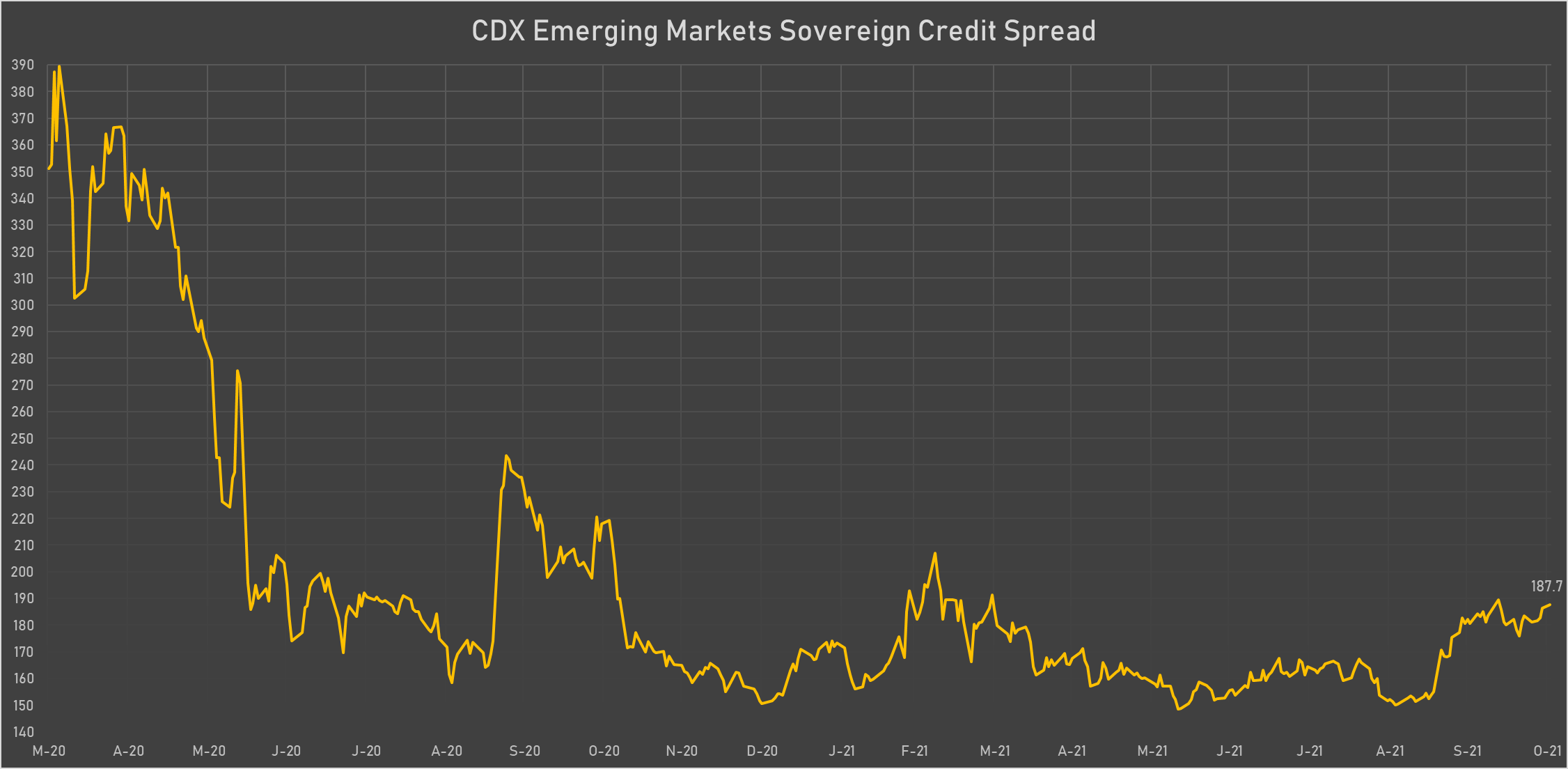

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): up 107.7 basis points to 2,557 bp (1Y range: 1,071-2,463bp)

- Colombia (rated BB+): up 5.3 basis points to 167 bp (1Y range: 83-175bp)

- Russia (rated BBB): up 2.3 basis points to 83 bp (1Y range: 72-117bp)

- Mexico (rated BBB-): up 2.6 basis points to 104 bp (1Y range: 79-127bp)

- Brazil (rated BB-): up 4.9 basis points to 250 bp (1Y range: 141-246bp)

- Vietnam (rated BB): up 1.5 basis points to 101 bp (1Y range: 89-123bp)

- Bahrain (rated B+): up 3.2 basis points to 288 bp (1Y range: 159-330bp)

- Philippines (rated BBB): up 0.4 basis points to 57 bp (1Y range: 33-65bp)

- Malaysia (rated BBB+): up 0.4 basis points to 53 bp (1Y range: 33-64bp)

- Turkey (rated BB-): down 6.8 basis points to 440 bp (1Y range: 282-560bp)

LARGEST FX MOVES TODAY

- Israeli shekel up 1.5% (YTD: +3.3%)

- Liberian Dollar up 0.9% (YTD: +9.5%)

- Russian Rouble down 0.9% (YTD: +3.5%)

- Jamaican Dollar down 0.9% (YTD: -7.7%)

- Falklands Pound down 0.9% (YTD: +0.3%)

- South Africa Rand down 1.4% (YTD: -4.8%)

- Mexican Peso down 1.4% (YTD: -4.7%)

- Haiti Gourde down 2.6% (YTD: -26.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 42.3%

- New Zambian Kwacha up 22.5%

- Ethiopian Birr down 17.1%

- Turkish Lira down 22.2%

- Haiti Gourde down 26.8%

- Myanmar Kyat down 29.3%

- Surinamese dollar down 34.1%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Sudanese Pound down 87.5%