FX

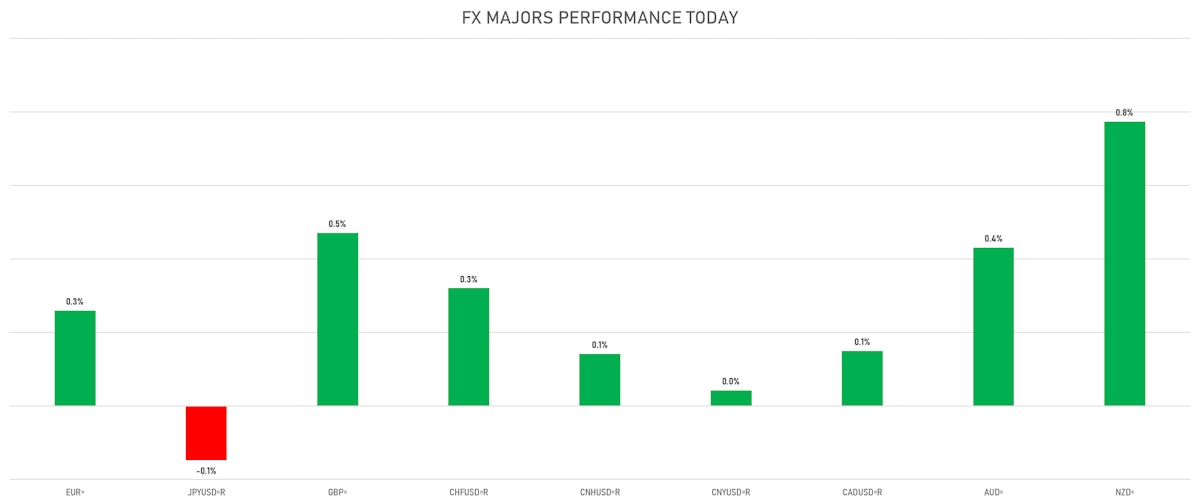

Broad Rise In Major Currencies Against The US Dollar, With The Yen The Lone Laggard

With the recent rates volatility, currencies have become uncorrelated with rates differentials, instead moving in line with money market basis swaps that better reflect term premium stress (see below the euro spot rate and June 2022 FRA-EONIA)

Published ET

Hourly Euro Spot Rate & June 2022 FRA EONIA Swap Spread (inverted scale) | Source: Refinitiv

QUICK SUMMARY

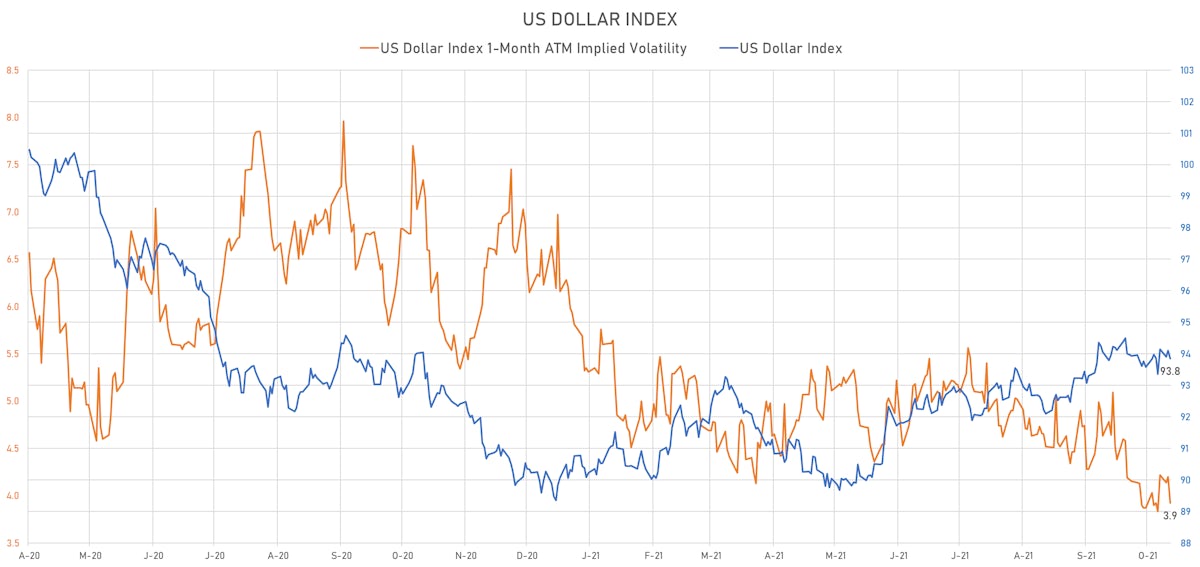

- The US Dollar Index is down -0.27% at 93.85 (YTD: +4.30%)

- Euro up 0.26% at 1.1607 (YTD: -5.0%)

- Yen down 0.15% at 114.13 (YTD: -9.5%)

- Onshore Yuan up 0.04% at 6.3956 (YTD: +2.0%)

- Swiss franc up 0.32% at 0.9116 (YTD: -2.9%)

- Sterling up 0.47% at 1.3678 (YTD: +0.0%)

- Canadian dollar up 0.15% at 1.2391 (YTD: +2.8%)

- Australian dollar up 0.43% at 0.7460 (YTD: -3.0%)

- NZ dollar up 0.77% at 0.7164 (YTD: -0.3%)

MACRO DATA RELEASES

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Sep 2021 (AU Bureau of Stat) at -4.30 % (vs 6.80 % prior), below consensus estimate of -2.00 %

- China (Mainland), PMI, Services Sector, Business Activity, Caixin PMI for Oct 2021 (Markit Economics) at 53.80 (vs 53.40 prior)

- Euro Zone, Unemployment, Rate for Sep 2021 (Eurostat) at 7.40 % (vs 7.50 % prior), in line with consensus

- India, IHS Markit, PMI, Services Sector, Business Activity for Oct 2021 (Markit Economics) at 58.40 (vs 55.20 prior), above consensus estimate of 55.70

- Malawi, Policy Rates, Bank rate for 03 Nov (Reserve Bank Malawi) at 12.00 % (vs 12.00 % prior)

- Malaysia, Policy Rates, Overnight Policy Rate for 03 Nov (BNM, Malaysia) at 1.75 % (vs 1.75 % prior), in line with consensus

- Poland, Policy Rates, Reference Rate (7-Day NBP Bill Rate) for Nov 2021 (Central Bank, Poland) at 1.25 % (vs 0.50 % prior), above consensus estimate of 1.00 %

- Russia, CPI, Change P/P for Oct 2021 (RosStat, Russia) at 1.10 % (vs 0.60 % prior), above consensus estimate of 1.00 %

- Russia, CPI, Change Y/Y for Oct 2021 (RosStat, Russia) at 8.10 % (vs 7.40 % prior), above consensus estimate of 8.00 %

- Russia, PMI, Services Sector, Business Activity for Oct 2021 (Markit Economics) at 48.80 (vs 50.50 prior)

- Saudi Arabia, IHS Markit, PMI, Composite, Output, IHS Markit PMI for Oct 2021 (Markit Economics) at 57.70 (vs 58.60 prior)

- Turkey, CPI, Change P/P, Price Index for Oct 2021 (TURKSTAT) at 2.39 % (vs 1.25 % prior), below consensus estimate of 2.76 %

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change P/P for Oct 2021 (Nationwide, UK) at 0.70 % (vs 0.10 % prior), above consensus estimate of 0.40 %

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change Y/Y for Oct 2021 (Nationwide, UK) at 9.90 % (vs 10.00 % prior), above consensus estimate of 9.30 %

- United Kingdom, Reserves, Gross, Government, Current Prices for Oct 2021 (HM Treasury) at 200,923.27 Mln USD (vs 202,168.68 Mln USD prior)

- United States, ISM Non-manufacturing, NMI/PMI for Oct 2021 (ISM, United States) at 66.70 (vs 61.90 prior), above consensus estimate of 62.00

- United States, Manufacturers New Orders, Total manufacturing, Change P/P for Sep 2021 (U.S. Census Bureau) at 0.20 % (vs 1.20 % prior), above consensus estimate of 0.00 %

- United States, PMI, Composite, Output, Final for Oct 2021 (Markit Economics) at 57.60 (vs 57.30 prior)

- United States, PMI, Services Sector, Business Activity, Final for Oct 2021 (Markit Economics) at 58.70 (vs 58.20 prior)

- United States, Policy Rates, Fed Funds Target Rate for 04 Nov (FOMC, U.S.) at 0.125 % (vs 0.125 % prior), in line with consensus

- United States, Policy Rates, Fed Interest On Excess Reserves for 04 Nov (FED, U.S.) at 0.15 % (vs 0.15 % prior)

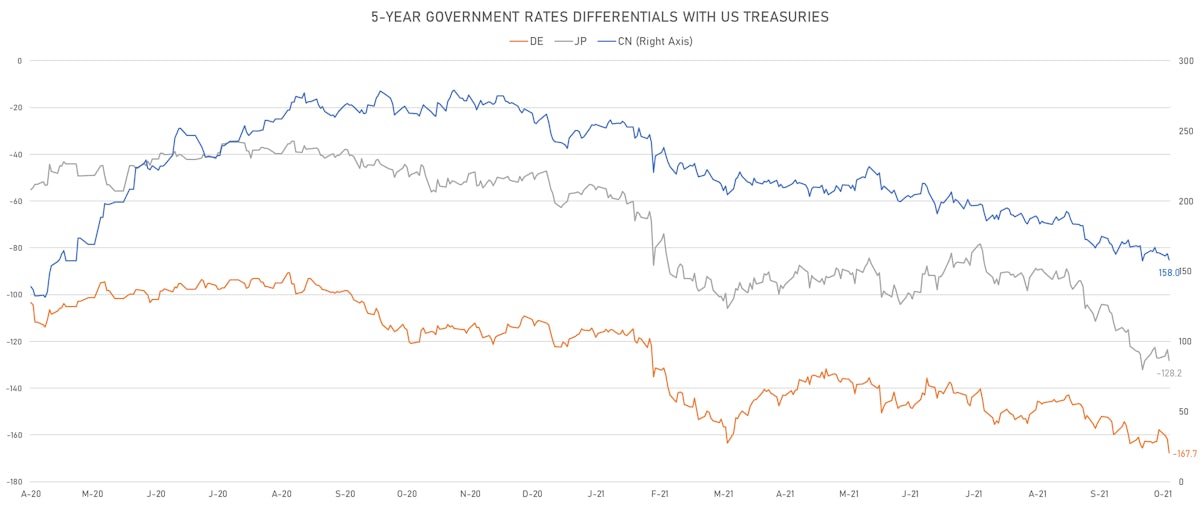

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +5.9 bp at 167.7 bp (YTD change: +56.6 bp)

- US-JAPAN: +4.7 bp at 128.2 bp (YTD change: +79.9 bp)

- US-CHINA: +4.5 bp at -158.0 bp (YTD change: +99.1 bp)

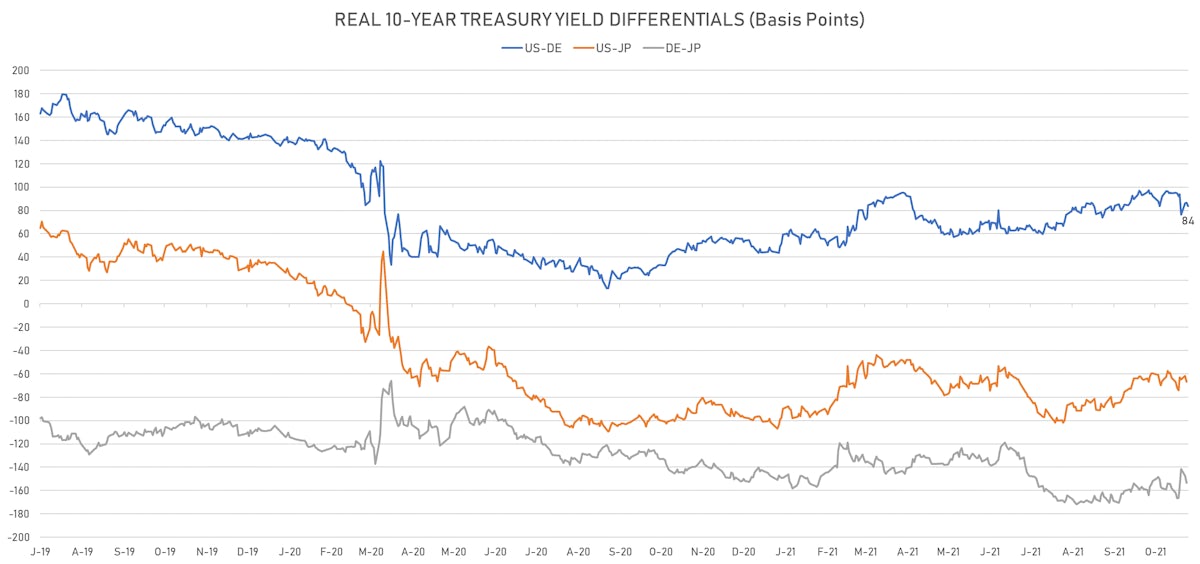

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.8 bp at 83.7 bp (YTD change: +37.6bp)

- US-JAPAN: -5.3 bp at -66.9 bp (YTD change: +34.6bp)

- JAPAN-GERMANY: +5.8 bp at 153.4 bp (YTD change: +5.8bp)

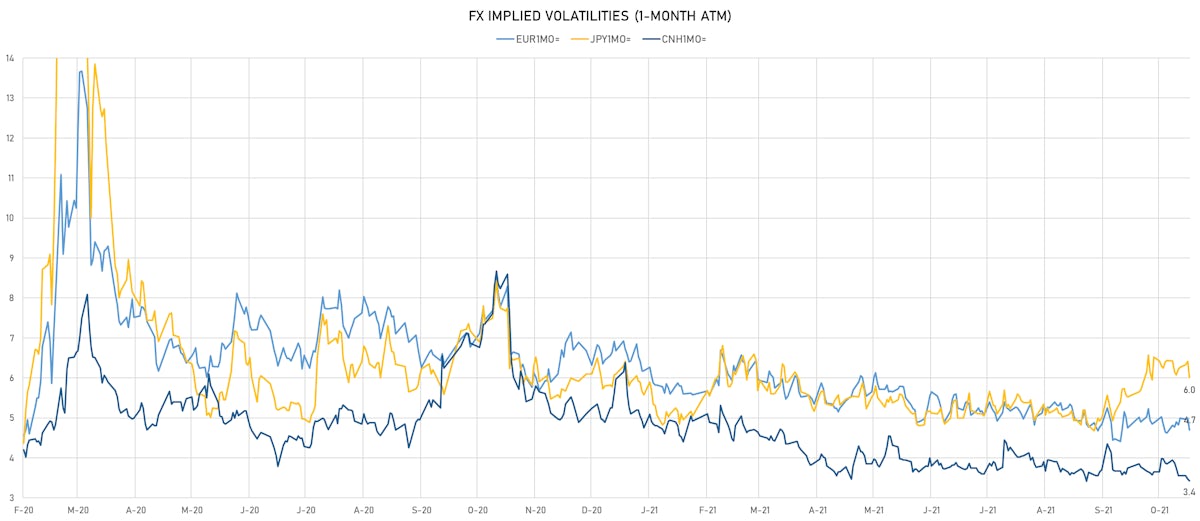

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.28, down -0.04 (YTD: -0.89)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.70, down -0.3 (YTD: -2.0)

- Japanese Yen 1M ATM IV currently at 6.01, down -0.4 (YTD: -0.1)

- Offshore Yuan 1M ATM IV currently at 3.43, down -0.1 (YTD: -2.6)

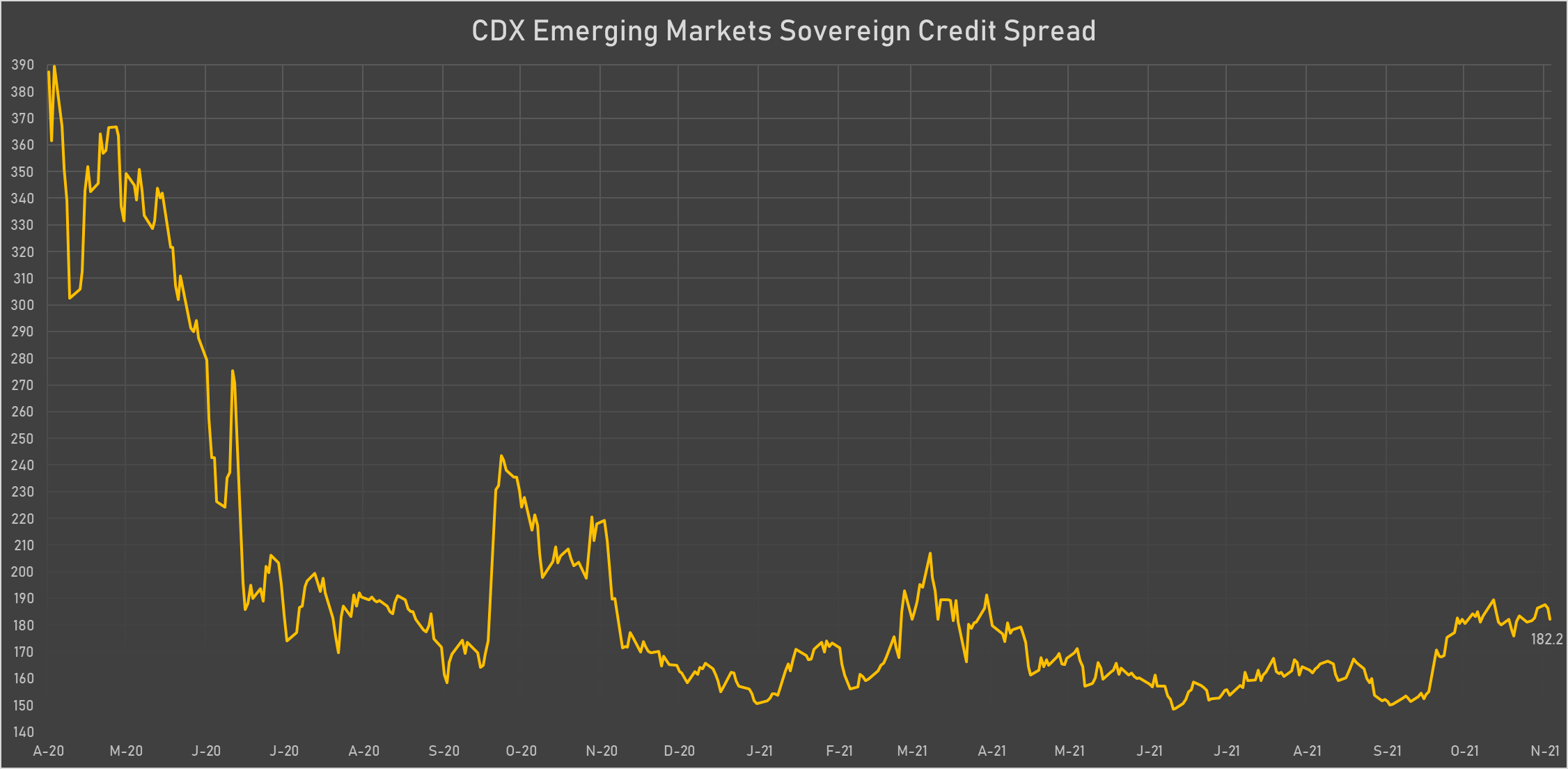

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Russia (rated BBB): up 1.9 basis points to 86 bp (1Y range: 72-117bp)

- Vietnam (rated BB): up 2.1 basis points to 99 bp (1Y range: 89-119bp)

- Morocco (rated BB+): up 1.3 basis points to 93 bp (1Y range: 84-108bp)

- Oman (rated BB-): down 3.1 basis points to 243 bp (1Y range: 223-448bp)

- Brazil (rated BB-): down 3.9 basis points to 248 bp (1Y range: 141-252bp)

- Malaysia (rated BBB+): down 0.9 basis points to 54 bp (1Y range: 33-64bp)

- Turkey (rated BB-): down 7.8 basis points to 424 bp (1Y range: 282-541bp)

- Indonesia (rated BBB): down 1.7 basis points to 81 bp (1Y range: 66-94bp)

- Mexico (rated BBB-): down 2.2 basis points to 102 bp (1Y range: 79-121bp)

- Chile (rated A-): down 2.4 basis points to 83 bp (1Y range: 43-89bp)

LARGEST FX MOVES TODAY

- Brazilian Real up 2.3% (YTD: -6.5%)

- Mexican Peso up 1.3% (YTD: -3.3%)

- South Africa Rand up 1.1% (YTD: -3.6%)

- Samoa Tala up 1.1% (YTD: +1.1%)

- Polish Zloty up 0.9% (YTD: -5.3%)

- Mauritius Rupee up 0.9% (YTD: -8.0%)

- Colombian Peso down 0.8% (YTD: -10.6%)

- Vanuatu Vatu down 2.4% (YTD: -1.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 62.8%

- Turkish Lira down 23.0%

- Haiti Gourde down 26.1%

- Myanmar Kyat down 28.0%

- Surinamese dollar down 34.1%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 75.0%

- Sudanese Pound down 87.5%