FX

Surprise No-Hike Decision By The BOE, Disappointing German Manufacturing Orders Take The Sterling And Euro Down Against The Dollar

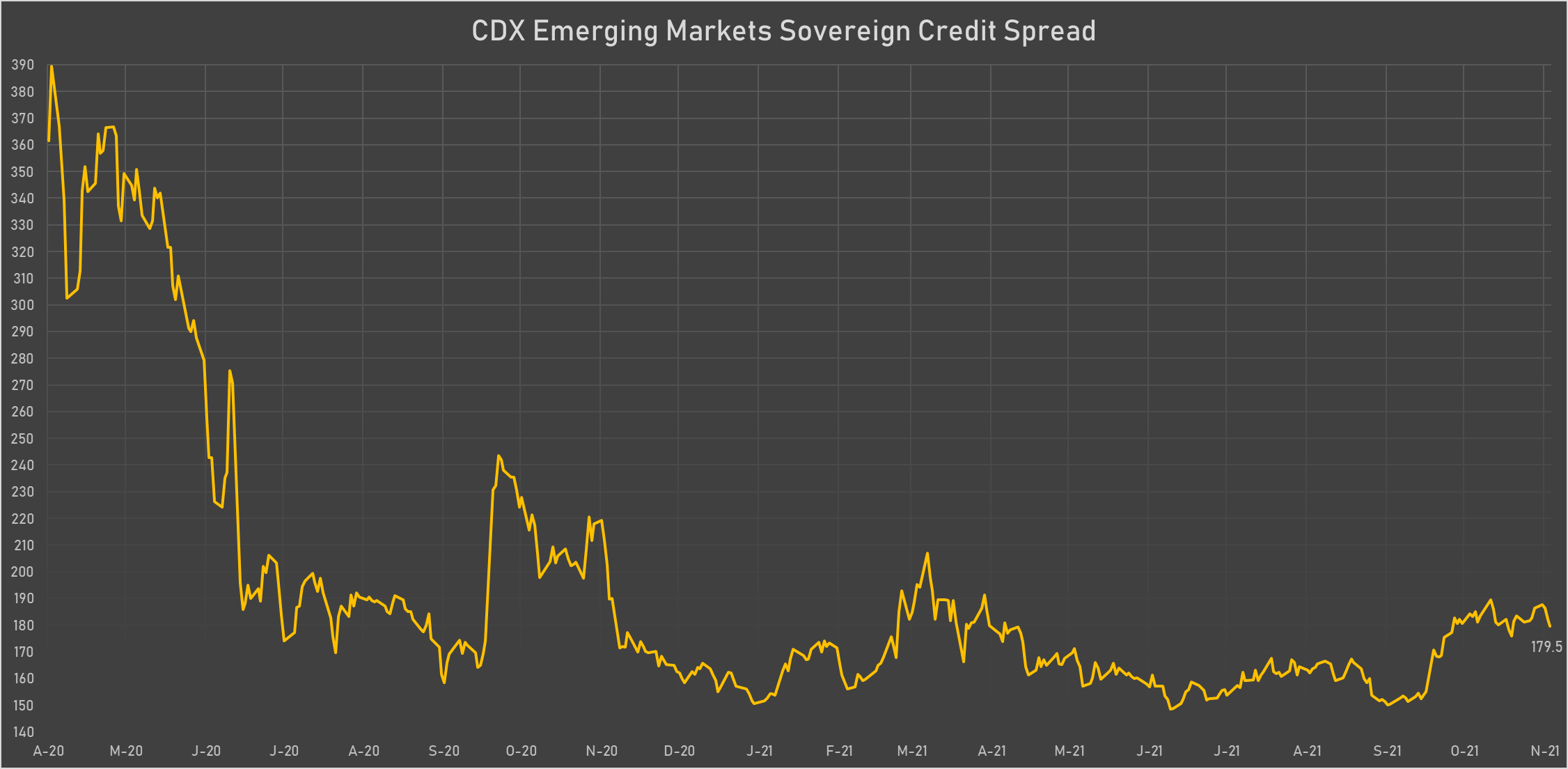

Positive risk sentiment across emerging markets, with sovereign $ spreads tightening and currencies gaining despite fall in energy commodities after OPEC+ decision

Published ET

GBP Spot Rate & December LIFFE 3-Month BBA LIBOR Future Implied Yield | Source: Refinitiv

QUICK SUMMARY

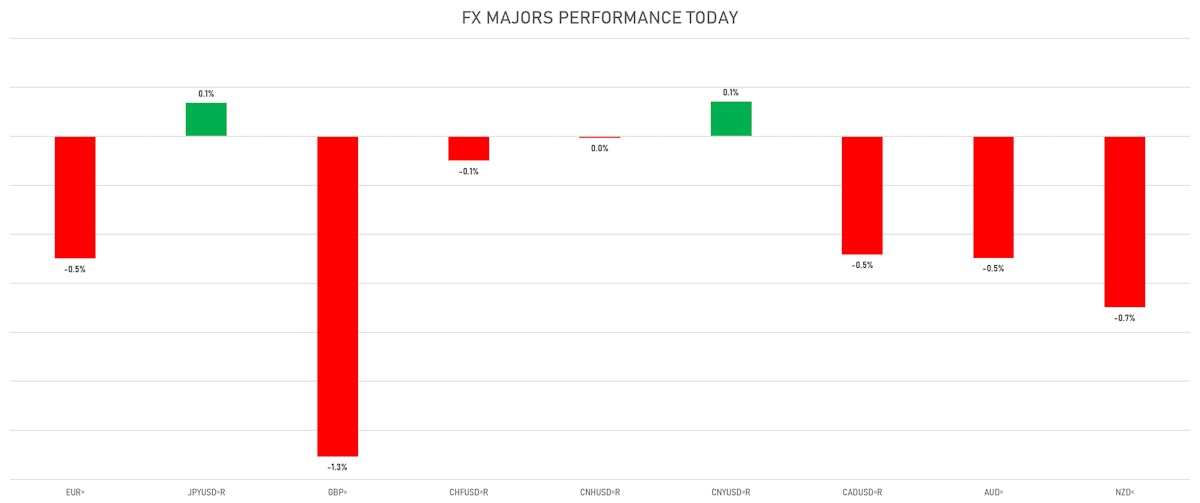

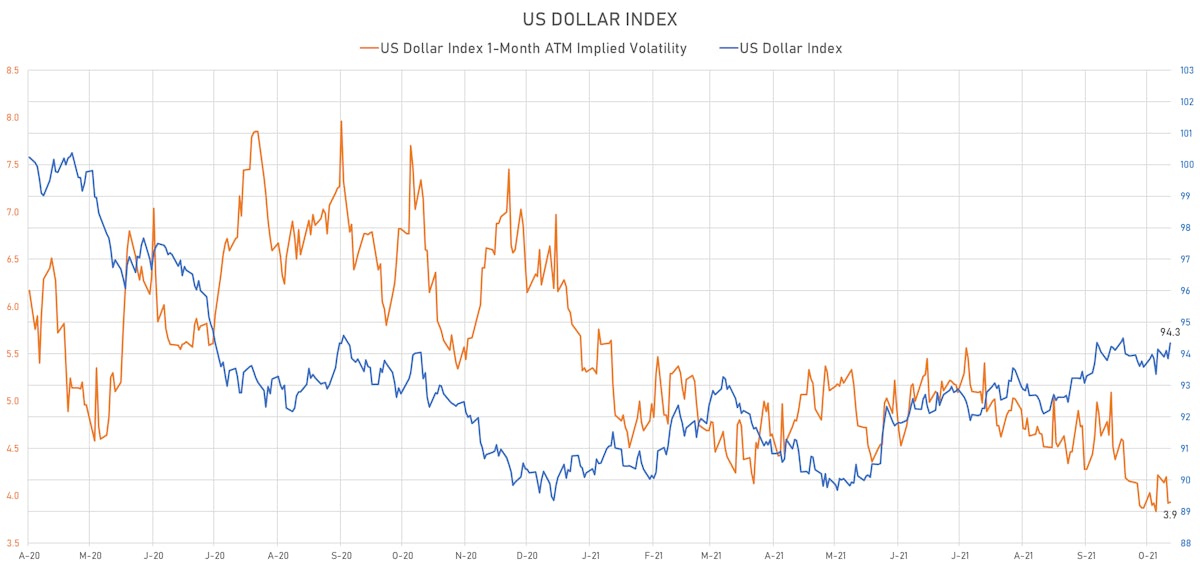

- The US Dollar Index is up 0.52% at 94.34 (YTD: +4.84%)

- Euro down 0.50% at 1.1552 (YTD: -5.4%)

- Yen up 0.14% at 113.85 (YTD: -9.3%)

- Onshore Yuan up 0.14% at 6.3970 (YTD: +2.0%)

- Swiss franc down 0.10% at 0.9123 (YTD: -3.0%)

- Sterling down 1.31% at 1.3505 (YTD: -1.2%)

- Canadian dollar down 0.48% at 1.2451 (YTD: +2.3%)

- Australian dollar down 0.50% at 0.7408 (YTD: -3.7%)

- NZ dollar down 0.70% at 0.7108 (YTD: -1.1%)

MACRO DATA RELEASES

- Australia, Current Account, Goods and Services, Net for Sep 2021 (AU Bureau of Stat) at 12,243.00 Mln AUD (vs 15,077.00 Mln AUD prior), above consensus estimate of 12,200.00 Mln AUD

- Australia, Retail Sales, Change P/P for Q3 2021 (AU Bureau of Stat) at -4.40 % (vs 0.80 % prior), above consensus estimate of -4.60 %

- Brazil, PMI, Composite, Output, Total for Oct 2021 (Markit Economics) at 53.40 (vs 54.70 prior)

- Brazil, PMI, Services Sector, Business Activity for Oct 2021 (Markit Economics) at 54.90 (vs 54.60 prior)

- Brazil, Production, General industry, Change P/P for Sep 2021 (IBGE, Brazil) at -0.40 % (vs -0.70 % prior), below consensus estimate of -0.30 %

- Brazil, Production, General industry, Change Y/Y for Sep 2021 (IBGE, Brazil) at -3.90 % (vs -0.70 % prior), above consensus estimate of -4.00 %

- Canada, Trade Balance, Total, fob for Sep 2021 (CANSIM, Canada) at 1.86 Bln CAD (vs 1.94 Bln CAD prior), above consensus estimate of 1.55 Bln CAD

- Czech Republic, Policy Rates, Repo Rate (2 Week) for 05 Nov (Czech National Bank) at 2.75 % (vs 1.50 % prior), above consensus estimate of 2.00 %

- Euro Zone, PMI, Composite, Output, Final for Oct 2021 (Markit Economics) at 54.20 (vs 54.30 prior), below consensus estimate of 54.30

- Euro Zone, PMI, Services Sector, Business Activity, Final for Oct 2021 (Markit Economics) at 54.60 (vs 54.70 prior), below consensus estimate of 54.70

- France, PMI, Composite, Output, Final for Oct 2021 (Markit/CDAF, France) at 54.70 (vs 54.70 prior), in line with consensus

- France, PMI, Services Sector, Business Activity, Final for Oct 2021 (Markit Economics) at 56.60 (vs 56.60 prior), in line with consensus

- Germany, New Orders, Manufacturing industry, Change P/P for Sep 2021 (Deutsche Bundesbank) at 1.30 % (vs -7.70 % prior), below consensus estimate of 2.00 %

- Germany, PMI, Composite, Output, Final for Oct 2021 (Markit Economics) at 52.00 (vs 52.00 prior), in line with consensus

- Germany, PMI, Services Sector, Business Activity, Final for Oct 2021 (Markit Economics) at 52.40 (vs 52.40 prior), in line with consensus

- Japan, Jibun Bank, PMI, Services Sector, Service PMI for Oct 2021 (Markit Economics) at 50.70 (vs 47.80 prior)

- Norway, Policy Rates, Central Bank Rate Decision for 05 Nov (Norges Bank) at 0.25 % (vs 0.25 % prior), in line with consensus

- South Africa, Standard Bank PMI for Oct 2021 (Markit Economics) at 48.60 (vs 50.70 prior)

- United Kingdom, Policy Rates, Bank Rate for Nov 2021 (Bank of England) at 0.10 % (vs 0.10 % prior)

- United Kingdom, Policy Rates, GB BOE QE Corporate Bond Purchases, Current Prices for Nov 2021 (Bank of England) at 20.00 Bln GBP (vs 20.00 Bln GBP prior), in line with consensus

- United States, Jobless Claims, National, Initial for W 30 Oct (U.S. Dept. of Labor) at 269.00 k (vs 281.00 k prior), below consensus estimate of 275.00 k

- United States, Trade Balance, Total, Goods and services for Sep 2021 (U.S. Census Bureau) at -80.90 Bln USD (vs -73.30 Bln USD prior), below consensus estimate of -80.50 Bln USD

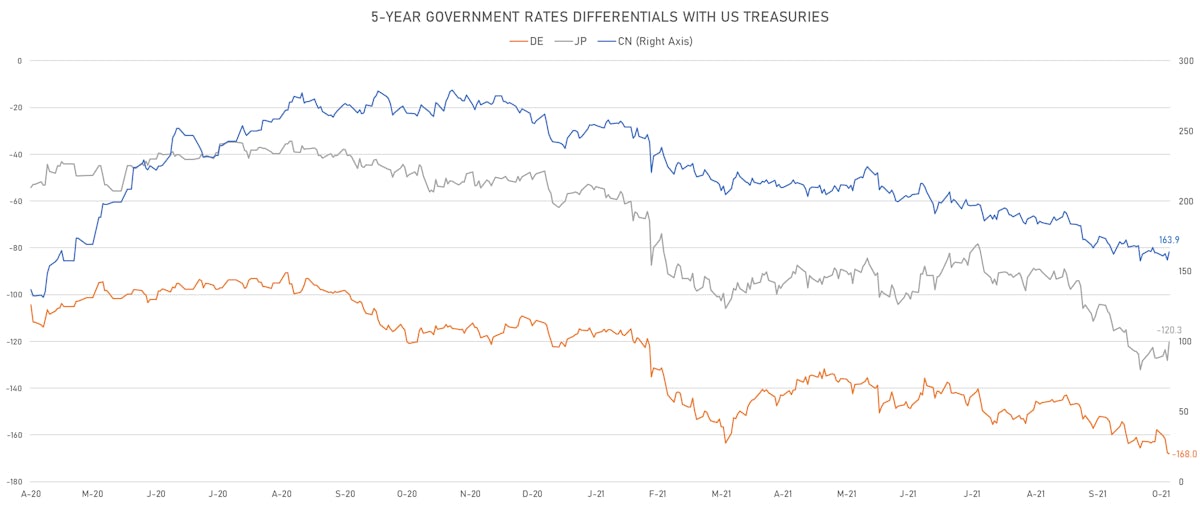

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.3 bp at 168.0 bp (YTD change: +56.9 bp)

- US-JAPAN: -7.9 bp at 120.3 bp (YTD change: +72.0 bp)

- US-CHINA: -5.9 bp at -163.9 bp (YTD change: +93.2 bp)

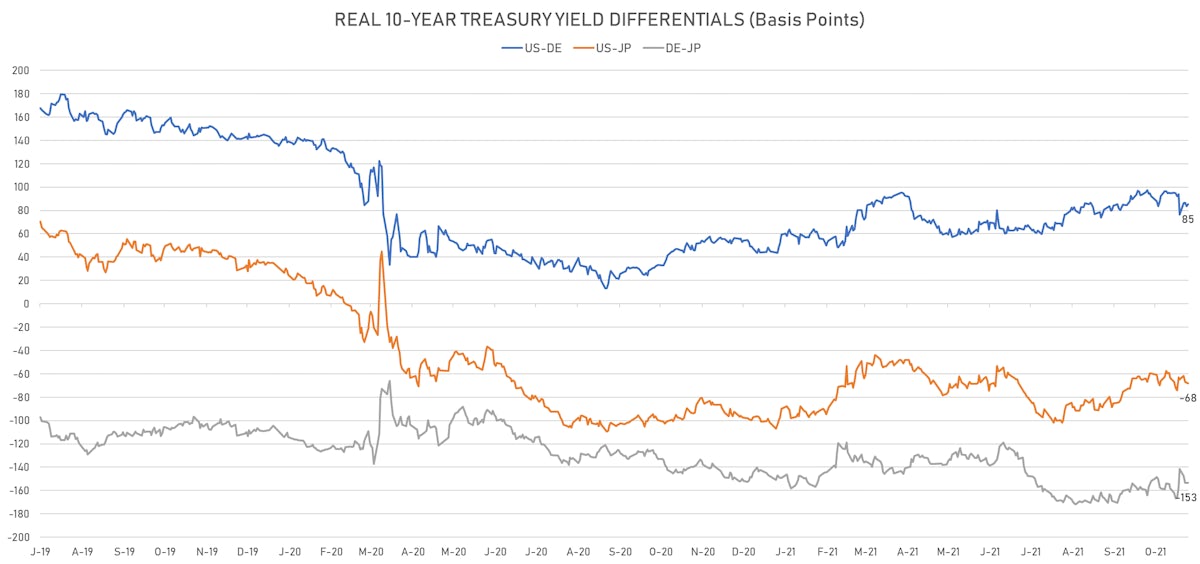

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.5 bp at 85.2 bp (YTD change: +39.1bp)

- US-JAPAN: -1.2 bp at -68.1 bp (YTD change: +33.4bp)

- JAPAN-GERMANY: -0.1 bp at 153.3 bp (YTD change: +5.7bp)

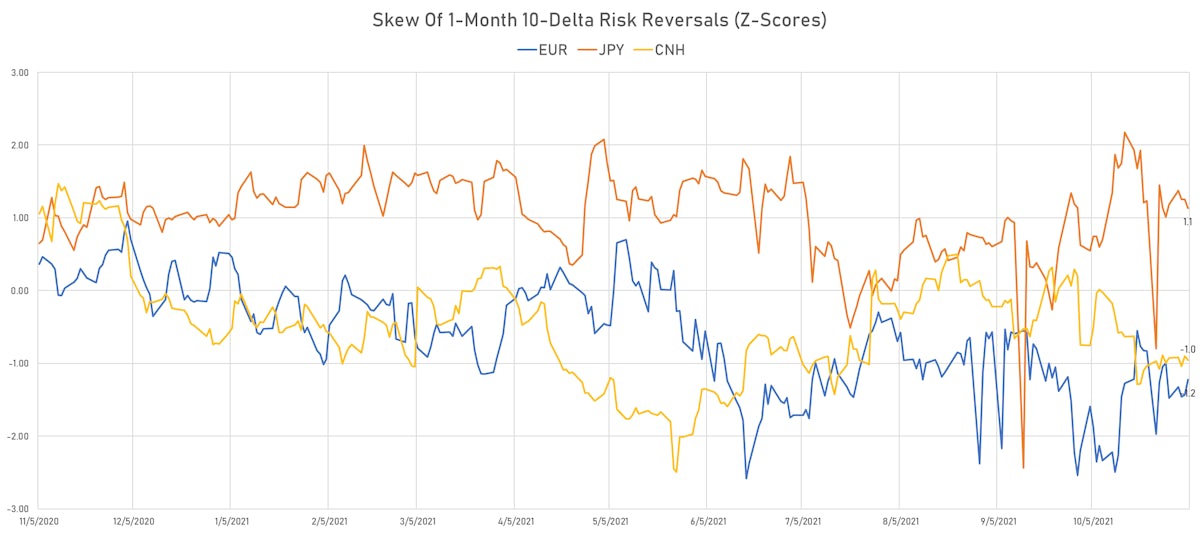

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.11, down -0.17 (YTD: -1.06)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 4.75 (YTD: -1.9)

- Japanese Yen 1M ATM IV currently at 5.93, down -0.1 (YTD: -0.2)

- Offshore Yuan 1M ATM IV currently at 3.31, down -0.1 (YTD: -2.7)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Indonesia (rated BBB): down 1.6 basis points to 80 bp (1Y range: 66-94bp)

- Russia (rated BBB): down 1.9 basis points to 84 bp (1Y range: 72-117bp)

- Malaysia (rated BBB+): down 1.2 basis points to 53 bp (1Y range: 33-64bp)

- Panama (rated BBB-): down 2.2 basis points to 89 bp (1Y range: 44-93bp)

- Peru (rated BBB): down 2.4 basis points to 89 bp (1Y range: 52-105bp)

- Brazil (rated BB-): down 7.8 basis points to 239 bp (1Y range: 141-252bp)

- Vietnam (rated BB): down 3.5 basis points to 100 bp (1Y range: 89-119bp)

- South Africa (rated BB-): down 7.3 basis points to 201 bp (1Y range: 178-264bp)

- Turkey (rated BB-): down 15.4 basis points to 409 bp (1Y range: 282-541bp)

- Chile (rated A-): down 3.8 basis points to 79 bp (1Y range: 43-89bp)

LARGEST FX MOVES TODAY

- Botswana Pula up 1.6% (YTD: -5.2%)

- Vanuatu Vatu up 1.6% (YTD: -2.0%)

- St Helena Pound down 0.7% (YTD: -0.7%)

- New Zealand $ down 0.7% (YTD: -1.1%)

- Brazilian Real down 0.9% (YTD: -7.3%)

- Hungarian Forint down 0.9% (YTD: -4.7%)

- Polish Zloty down 0.9% (YTD: -6.2%)

- Colombian Peso down 1.1% (YTD: -11.5%)

- British Pound down 1.3% (YTD: -1.2%)

- Samoa Tala down 1.7% (YTD: -0.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 63.6%

- New Zambian Kwacha up 21.8%

- Ethiopian Birr down 17.1%

- Turkish Lira down 23.4%

- Haiti Gourde down 26.1%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 74.9%

- Sudanese Pound down 87.5%