FX

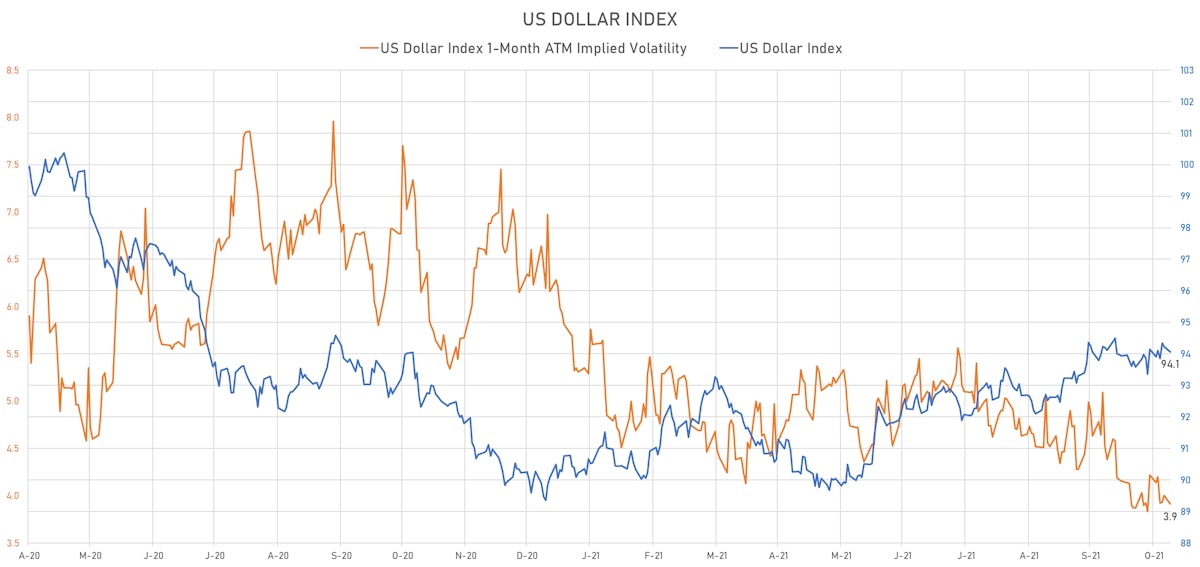

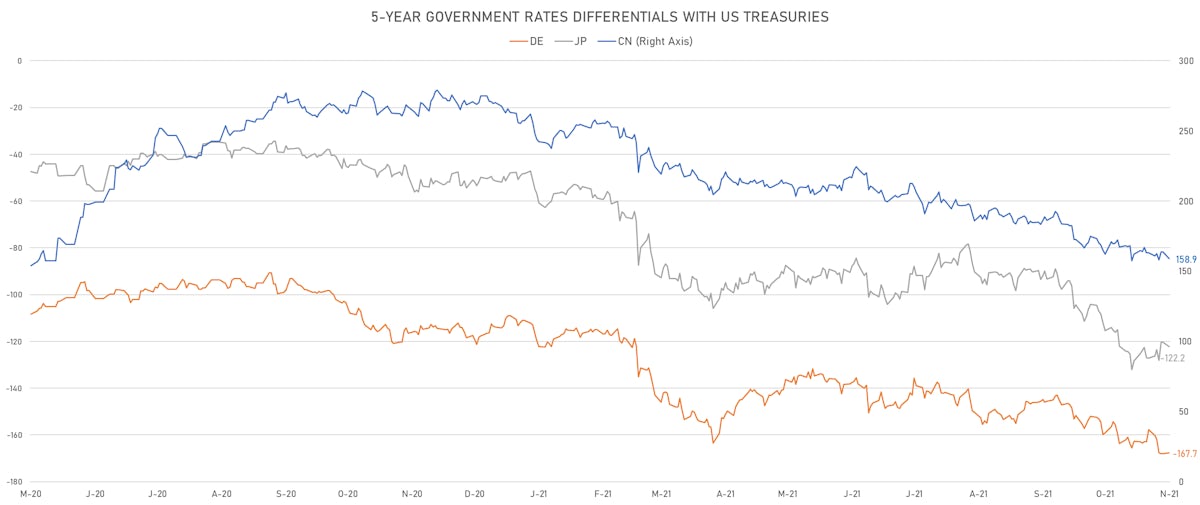

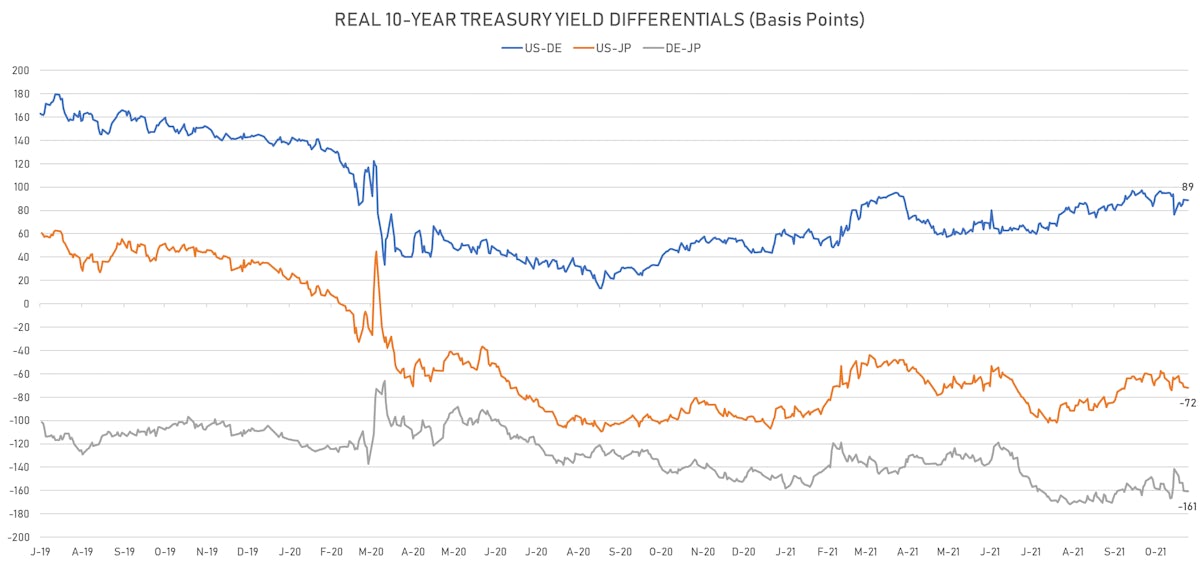

Rates Differentials Push The Euro, Yen And Sterling Up Against The US Dollar

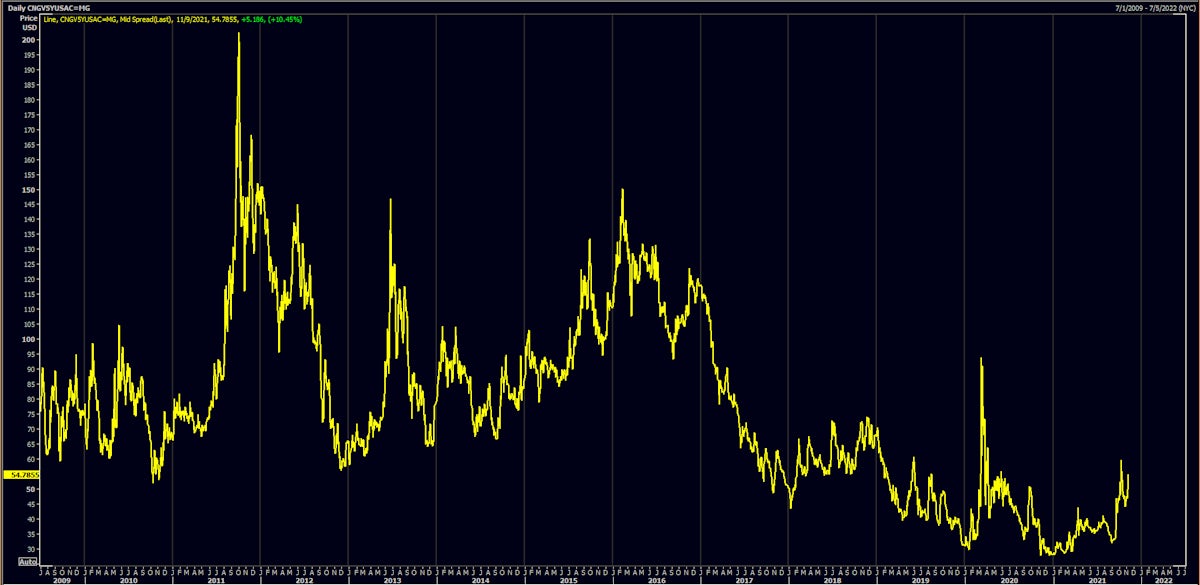

China's sovereign USD credit spreads are widening this week, with continuing press reports about Chinese property developers; looking at the aggregate size of US$ debt issued in the Chinese real estate sector ($47bn in HY +$38bn in IG according to ICE BofA indices), we see no systemic risk there ($85bn is less than 3% of $ reserves held in the China)

Published ET

China Sovereign 5Y USD CDS Mid Spread | Source: Refinitiv

QUICK SUMMARY

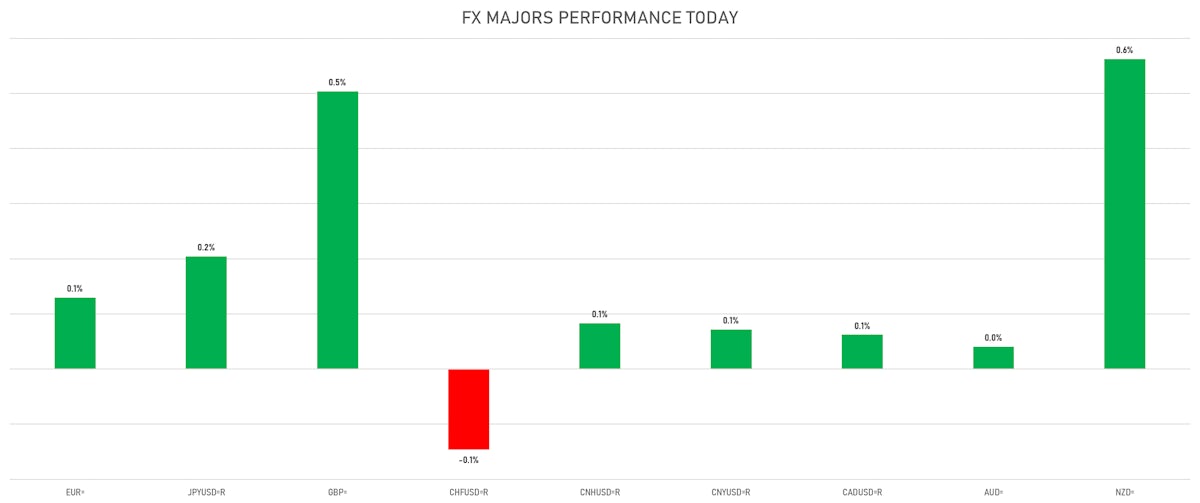

- The US Dollar Index is down -0.18% at 94.06 (YTD: +4.54%)

- Euro up 0.13% at 1.1581 (YTD: -5.2%)

- Yen up 0.20% at 113.18 (YTD: -8.8%)

- Onshore Yuan up 0.07% at 6.3902 (YTD: +2.1%)

- Swiss franc down 0.15% at 0.9136 (YTD: -3.1%)

- Sterling up 0.50% at 1.3562 (YTD: -0.8%)

- Canadian dollar up 0.06% at 1.2449 (YTD: +2.3%)

- Australian dollar up 0.04% at 0.7404 (YTD: -3.8%)

- NZ dollar up 0.56% at 0.7155 (YTD: -0.4%)

MACRO DATA RELEASES

- Chile, CPI, Change P/P, Price Index for Oct 2021 (INE, Chile) at 1.30 % (vs 1.20 % prior), above consensus estimate of 0.92 %

- China Oct exports rose 27.1% y/y in US$ terms, beating economists’ expectations of a 22.8% increase; imports rose 20.6% vs est. 26.2%; trade surplus US$84.54 bn, hitting a new record

- China Oct Forex reserve added US$17 bn from end-Sep to US$3.22 trillion

- Czech Republic, Production, Change Y/Y for Sep 2021 (CSU, Czech Rep) at -4.00 % (vs -1.40 % prior), below consensus estimate of -0.90 %

- Czech Republic, Trade Balance, CIF/FOB (National Concept), Current Prices for Sep 2021 (CSU, Czech Rep) at -13.30 Bln CZK (vs -28.10 Bln CZK prior), below consensus estimate of -7.00 Bln CZK

- Czech Republic, Unemployment, Rate for Oct 2021 (MPSV, Czech Republic) at 3.40 % (vs 3.50 % prior), below consensus estimate of 3.50 %

- Euro Zone, sentix, Investors sentiment for Nov 2021 (Sentix) at 18.30 (vs 16.90 prior), above consensus estimate of 15.50

- France, Reserve Assets, Current Prices for Oct 2021 (MINEFI, France) at 216,645.00 Mln EUR (vs 213,268.00 Mln EUR prior)

- Hungary, Trade Balance, Preliminary, Current Prices for Sep 2021 (HCSO, Hungary) at 1.00 Mln EUR (vs -751.00 Mln EUR prior), above consensus estimate of -62.00 Mln EUR

- Japan, Current Account, Balance, Current Prices for Sep 2021 (BOJ/MOF Japan) at 1,033.70 Bln JPY (vs 1,665.60 Bln JPY prior), below consensus estimate of 1,060.10 Bln JPY

- Latvia, CPI, Change P/P for Oct 2021 (Statistics, Latvia) at 1.10 % (vs 1.10 % prior)

- Latvia, CPI, Change Y/Y for Oct 2021 (Statistics, Latvia) at 6.00 % (vs 4.80 % prior)

- New Zealand, Electronic card transactions, Retail industry, Change P/P for Oct 2021 (Statistics, NZ) at 10.10 % (vs 0.90 % prior)

- New Zealand, Electronic card transactions, Retail industry, Change Y/Y for Oct 2021 (Statistics, NZ) at -7.60 % (vs -14.90 % prior)

- Norway, Production, Manufacturing, Change P/P for Sep 2021 (Statistics Norway) at 0.60 % (vs 0.00 % prior)

- South Africa, Reserves, Gross gold and other foreign reserves, Current Prices for Oct 2021 (SA Reserve Bank) at 57.52 Bln USD (vs 57.06 Bln USD prior)

- South Africa, Reserves, Reserve Bank, international liquidity position, Current Prices for Oct 2021 (SA Reserve Bank) at 55.43 Bln USD (vs 55.01 Bln USD prior)

- Switzerland, Unemployment, Rate for Oct 2021 (SECO, Switzerland) at 2.70 % (vs 2.80 % prior), in line with consensus

- Taiwan, Exports, Change Y/Y for Oct 2021 (MoF, Taiwan) at 24.60 % (vs 29.20 % prior), above consensus estimate of 24.40 %

- Taiwan, Imports, Change Y/Y for Oct 2021 (MoF, Taiwan) at 37.20 % (vs 40.40 % prior), above consensus estimate of 30.70 %

- Taiwan, Trade Balance, Current Prices for Oct 2021 (MoF, Taiwan) at 6.12 Bln USD (vs 6.45 Bln USD prior), below consensus estimate of 6.63 Bln USD

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.9 bp at 165.1 bp (YTD change: +54.0 bp)

- US-JAPAN: -1.2 bp at 119.1 bp (YTD change: +70.8 bp)

- US-CHINA: +0.3 bp at -163.6 bp (YTD change: +93.5 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.4 bp at 88.6 bp (YTD change: +42.5bp)

- US-JAPAN: -0.9 bp at -72.1 bp (YTD change: +29.4bp)

- JAPAN-GERMANY: +0.5 bp at 160.7 bp (YTD change: +13.1bp)

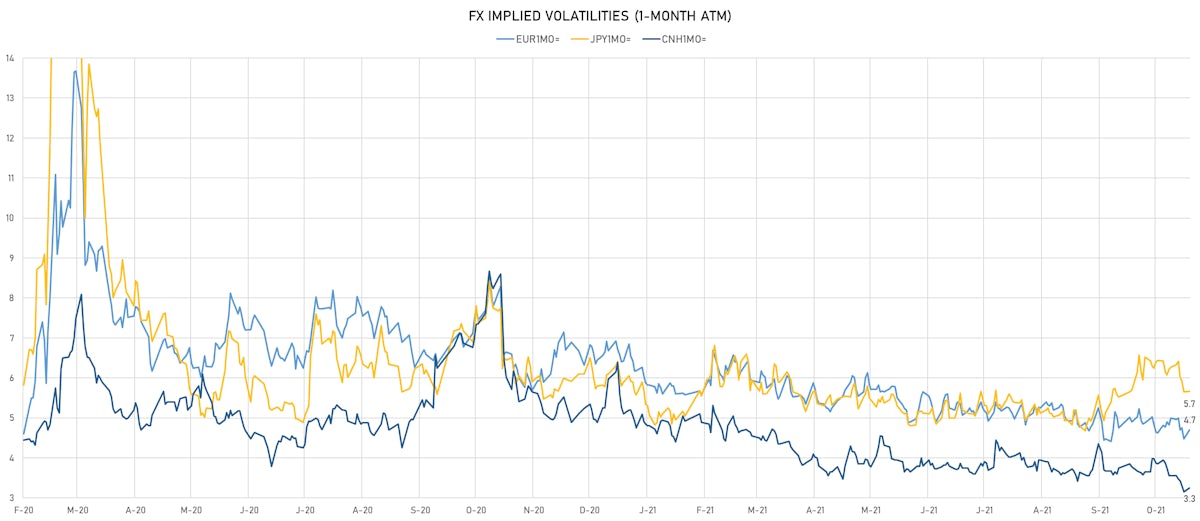

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.11, down -0.04 (YTD: -1.06)

- Euro 1-Month At-The-Money Implied Volatility currently at 4.70, up 0.2 (YTD: -2.0)

- Japanese Yen 1M ATM IV unchanged at 5.67 (YTD: -0.4)

- Offshore Yuan 1M ATM IV currently at 3.25, up 0.1 (YTD: -2.7)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- China (rated A+): up 4.7 basis points to 54 bp (1Y range: 27-58bp)

- Indonesia (rated BBB): up 3.4 basis points to 82 bp (1Y range: 66-94bp)

- Philippines (rated BBB): up 1.5 basis points to 61 bp (1Y range: 33-65bp)

- Malaysia (rated BBB+): up 1.1 basis points to 57 bp (1Y range: 33-64bp)

- Panama (rated BBB-): down 0.6 basis points to 87 bp (1Y range: 44-93bp)

- Turkey (rated BB-): down 6.0 basis points to 392 bp (1Y range: 282-481bp)

- Bahrain (rated B+): down 5.5 basis points to 280 bp (1Y range: 159-314bp)

- Egypt (rated B+): down 13.2 basis points to 438 bp (1Y range: 283-464bp)

- South Africa (rated BB-): down 5.8 basis points to 188 bp (1Y range: 178-241bp)

- Russia (rated BBB): down 2.8 basis points to 79 bp (1Y range: 72-117bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 2.7% (YTD: -2.8%)

- Jamaican Dollar up 1.4% (YTD: -7.3%)

- Chilean Peso up 1.1% (YTD: -11.5%)

- South Africa Rand up 0.9% (YTD: -1.6%)

- Thai Baht up 0.9% (YTD: -8.4%)

- Uruguayan Peso up 0.8% (YTD: -2.9%)

- Norwegian Krone up 0.8% (YTD: +0.8%)

- Angolan Kwanza up 0.7% (YTD: +9.6%)

- New Zealand $ up 0.7% (YTD: -0.4%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 59.4%

- New Zambian kwacha up 21.0%

- Turkish Lira down 23.3%

- Haiti Gourde down 26.1%

- Myanmar Kyat down 29.3%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 75.0%

- Sudanese Pound down 87.5%