FX

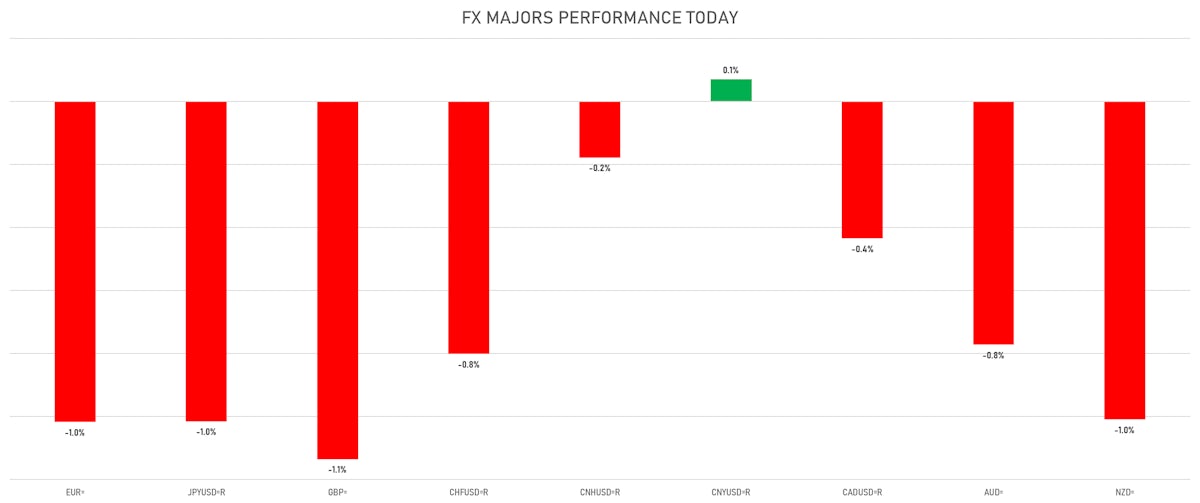

Most Currencies Fall Against The Dollar, With Huge Moves In Short Rates Differentials After Hot CPI Print

Dollar gains were very broad, with many EM currencies further hindered by widening credit spreads; gold had a great day with the inflation scare, though its current price is still about $100/oz. below where it was at the start of the year

Published ET

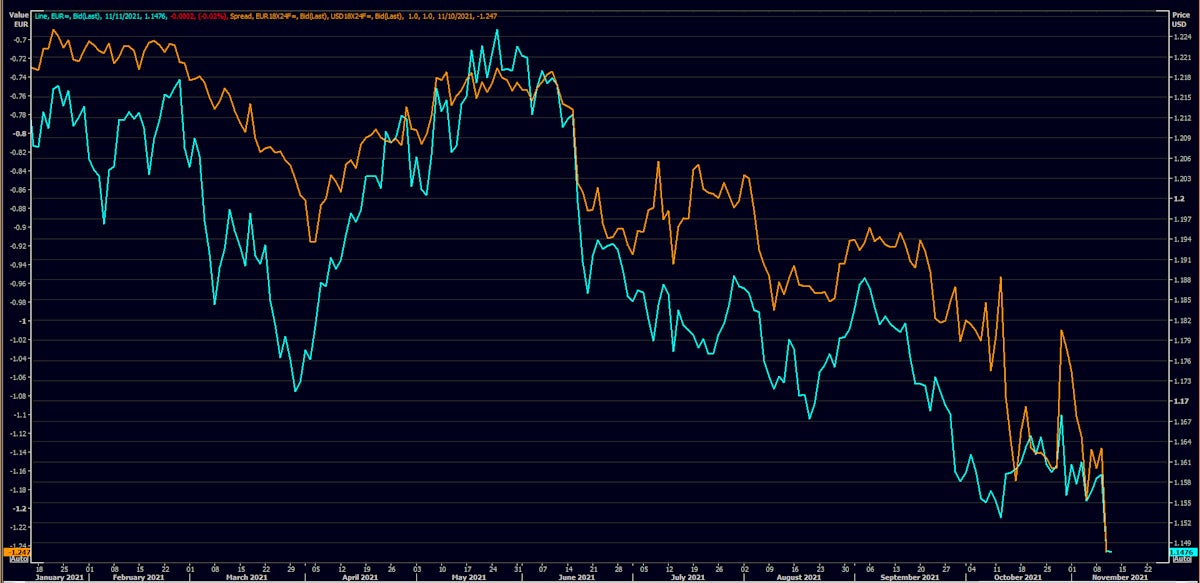

Euro Spot Rate vs USD-EUR 18x24 Forward Rates Differential | Source: Refinitiv

QUICK SUMMARY

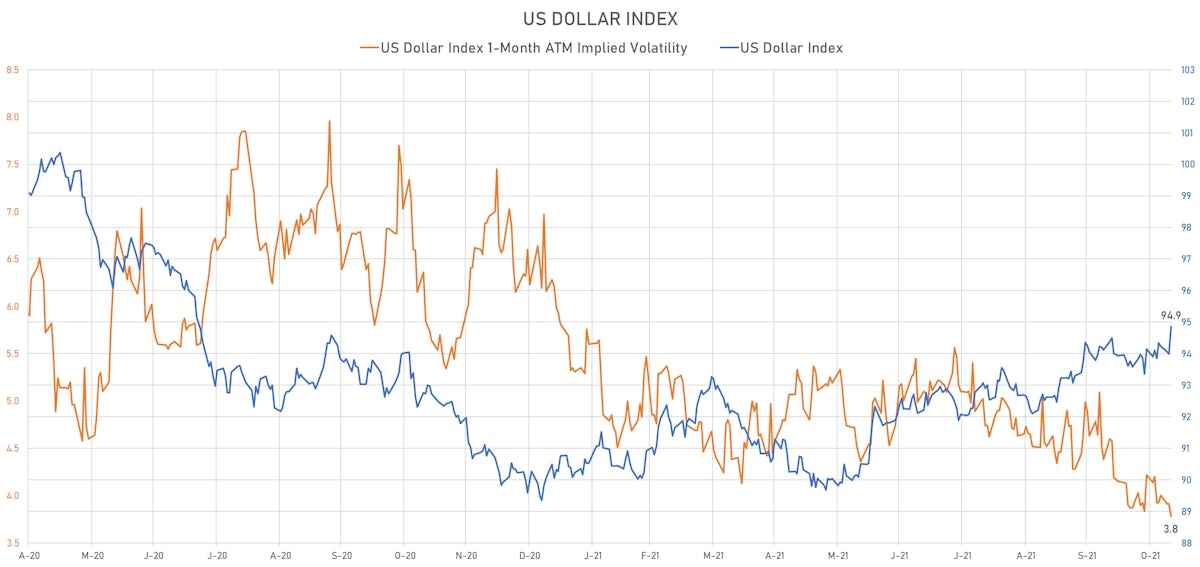

- The US Dollar Index is up 0.92% at 94.86 (YTD: +5.42%)

- Euro down 1.02% at 1.1473 (YTD: -6.1%)

- Yen down 1.02% at 114.04 (YTD: -9.5%)

- Onshore Yuan up 0.07% at 6.3882 (YTD: +2.2%)

- Swiss franc down 0.80% at 0.9185 (YTD: -3.6%)

- Sterling down 1.14% at 1.3400 (YTD: -2.0%)

- Canadian dollar down 0.44% at 1.2489 (YTD: +1.9%)

- Australian dollar down 0.77% at 0.7318 (YTD: -4.9%)

- NZ dollar down 1.01% at 0.7054 (YTD: -1.8%)

MACRO DATA RELEASES

- Brazil, CPI, Broad national index (IPCA), Change P/P for Oct 2021 (IBGE, Brazil) at 1.25 % (vs 1.16 % prior), above consensus estimate of 1.05 %

- China (Mainland), CPI, Average, Change Y/Y, Price Index for Oct 2021 (NBS, China) at 1.50 % (vs 0.70 % prior), above consensus estimate of 1.40 %

- China (Mainland), Monetary Financial Institutions, Social Financing, Current Prices for Oct 2021 (PBC) at 1590.00 Bln CNY (vs 2900.00 Bln CNY prior), below consensus estimate of 1,600.00 Bln CNY

- China (Mainland), Monetary Financial Institutions, Uses of Funds, New loans, Current Prices for Oct 2021 (PBC) at 826.20 Bln CNY (vs 1660.00 Bln CNY prior), above consensus estimate of 800.00 Bln CNY

- China (Mainland), Money supply M2, Change Y/Y for Oct 2021 (PBC) at 8.70 % (vs 8.30 % prior), above consensus estimate of 8.30 %

- China (Mainland), Producer Prices, Change Y/Y, Price Index for Oct 2021 (NBS, China) at 13.50 % (vs 10.70 % prior), above consensus estimate of 12.40 %

- Czech Republic, CPI, Change Y/Y, Price Index for Oct 2021 (CSU, Czech Rep) at 5.80 % (vs 4.90 % prior), above consensus estimate of 5.50 %

- Denmark, CPI, All Items, Change Y/Y, Price Index for Oct 2021 (statbank.dk) at 3.00 % (vs 2.20 % prior)

- Germany, HICP, Final, Change Y/Y, Price Index for Oct 2021 (Destatis) at 4.60 % (vs 4.60 % prior), in line with consensus

- Japan, Producer Prices, Domestic, total, Change P/P, Price Index for Oct 2021 (Bank of Japan) at 1.20 % (vs 0.30 % prior), above consensus estimate of 0.40 %

- Japan, Producer Prices, Domestic, total, Change Y/Y, Price Index for Oct 2021 (Bank of Japan) at 8.00 % (vs 6.30 % prior), above consensus estimate of 7.00 %

- Norway, CPI, All Items, Change P/P, Price Index for Oct 2021 (Statistics Norway) at -0.30 % (vs 1.00 % prior), below consensus estimate of 0.10 %

- Norway, CPI, All Items, Change Y/Y for Oct 2021 (Statistics Norway) at 3.50 % (vs 4.10 % prior), below consensus estimate of 3.90 %

- Thailand, Policy Rates, 1-Day Repurchase Rate (Key Policy Rate) for 10 Nov (Bank of Thailand) at 0.50 % (vs 0.50 % prior), in line with consensus

- United States, CPI, All items, Change P/P for Oct 2021 (BLS, U.S Dep. Of Lab) at 0.90 % (vs 0.40 % prior), above consensus estimate of 0.60 %

- United States, Jobless Claims, National, Initial for W 06 Nov (U.S. Dept. of Labor) at 267.00 k (vs 269.00 k prior), above consensus estimate of 265.00 k

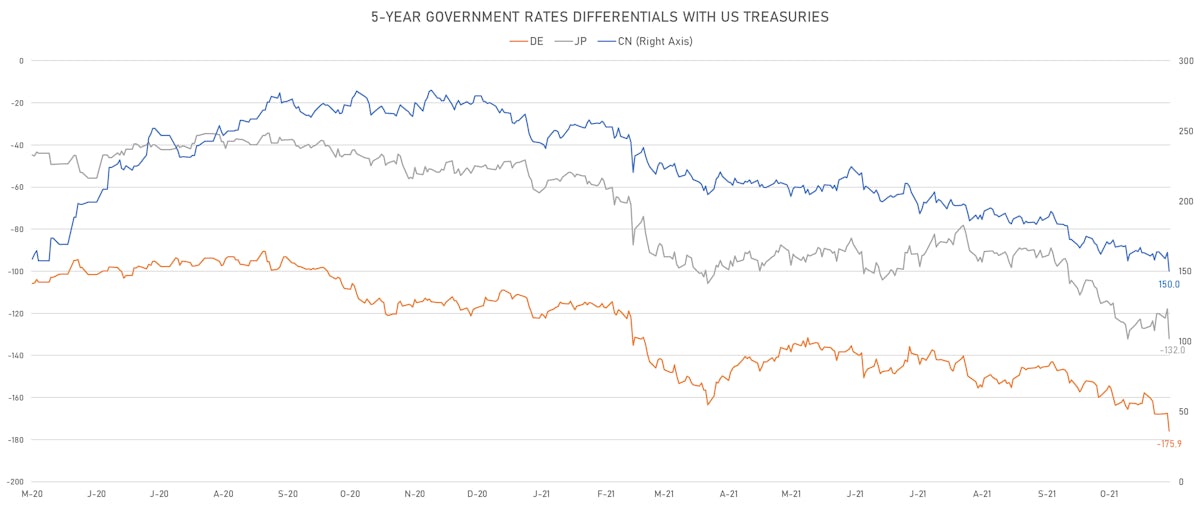

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +8.4 bp at 175.9 bp (YTD change: +64.8 bp)

- US-JAPAN: +13.2 bp at 131.1 bp (YTD change: +82.8 bp)

- US-CHINA: +13.0 bp at -150.6 bp (YTD change: +106.5 bp)

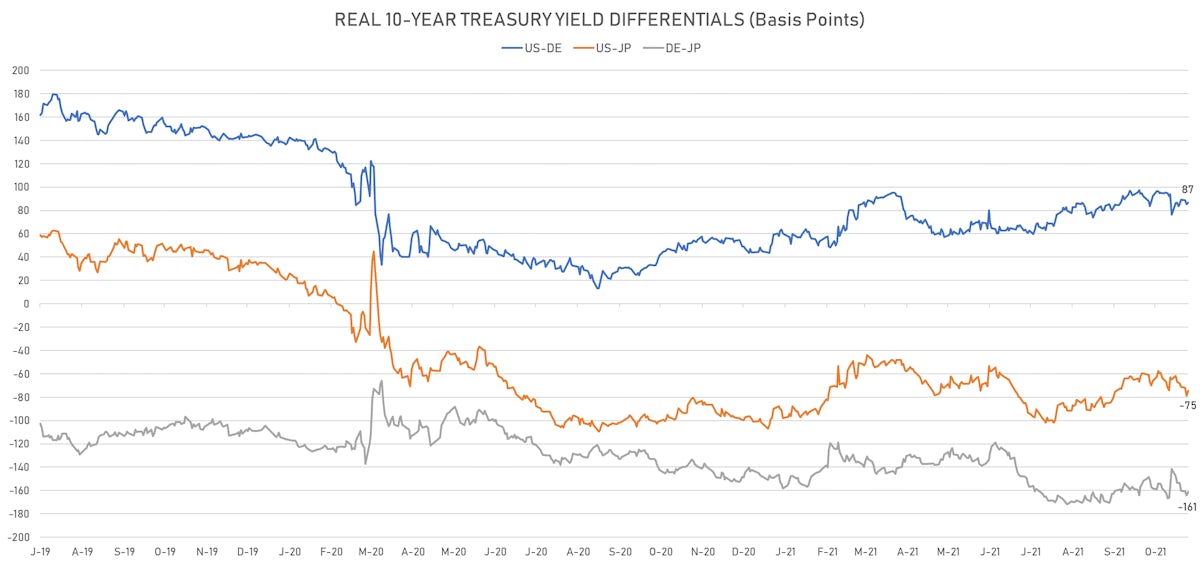

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.3 bp at 86.6 bp (YTD change: +40.5bp)

- US-JAPAN: +4.2 bp at -74.5 bp (YTD change: +27.0bp)

- JAPAN-GERMANY: -2.9 bp at 161.1 bp (YTD change: +13.5bp)

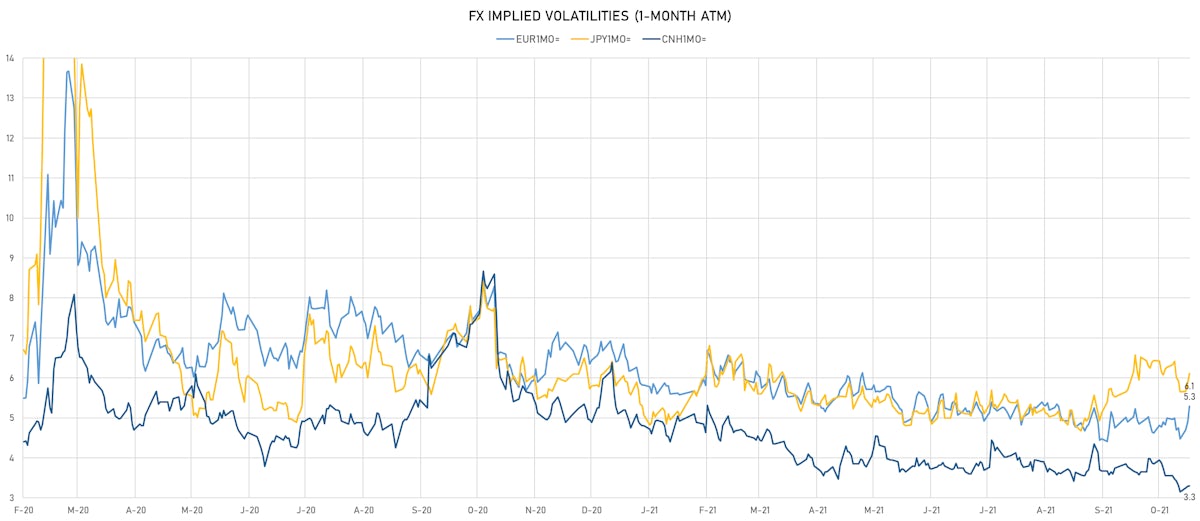

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.17, up 0.03 (YTD: -1.00)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.29, up 0.4 (YTD: -1.4)

- Japanese Yen 1M ATM IV currently at 6.11, up 0.2 (YTD: +0.0)

- Offshore Yuan 1M ATM IV unchanged at 3.30 (YTD: -2.7)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): up 167.0 basis points to 2,617 bp (1Y range: 1,071-2,589bp)

- Colombia (rated BB+): up 6.9 basis points to 170 bp (1Y range: 83-175bp)

- Chile (rated A-): up 2.4 basis points to 77 bp (1Y range: 43-89bp)

- Peru (rated BBB): up 2.6 basis points to 89 bp (1Y range: 52-105bp)

- Turkey (rated BB-): up 7.7 basis points to 405 bp (1Y range: 282-481bp)

- Russia (rated BBB): up 1.6 basis points to 83 bp (1Y range: 72-117bp)

- Panama (rated BBB-): up 1.6 basis points to 88 bp (1Y range: 44-93bp)

- Bahrain (rated B+): up 4.8 basis points to 272 bp (1Y range: 159-312bp)

- Indonesia (rated BBB): down 2.9 basis points to 83 bp (1Y range: 66-94bp)

- China (rated A+): down 3.4 basis points to 53 bp (1Y range: 27-58bp)

LARGEST FX MOVES TODAY

- Myanmar Kyat up 5.7% (YTD: -25.3%)

- Danish Krone down 1.0% (YTD: -6.0%)

- British Pound down 1.1% (YTD: -2.0%)

- Turkish Lira down 1.2% (YTD: -24.6%)

- Polish Zloty down 1.4% (YTD: -7.0%)

- Swedish Krona down 1.5% (YTD: -5.4%)

- Mexican Peso down 1.5% (YTD: -3.6%)

- Norwegian Krone down 1.6% (YTD: -0.9%)

- Hungarian Forint down 1.8% (YTD: -6.3%)

- South Africa Rand down 2.6% (YTD: -4.9%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 61.0%

- Turkish Lira down 24.6%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.1%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 75.2%