FX

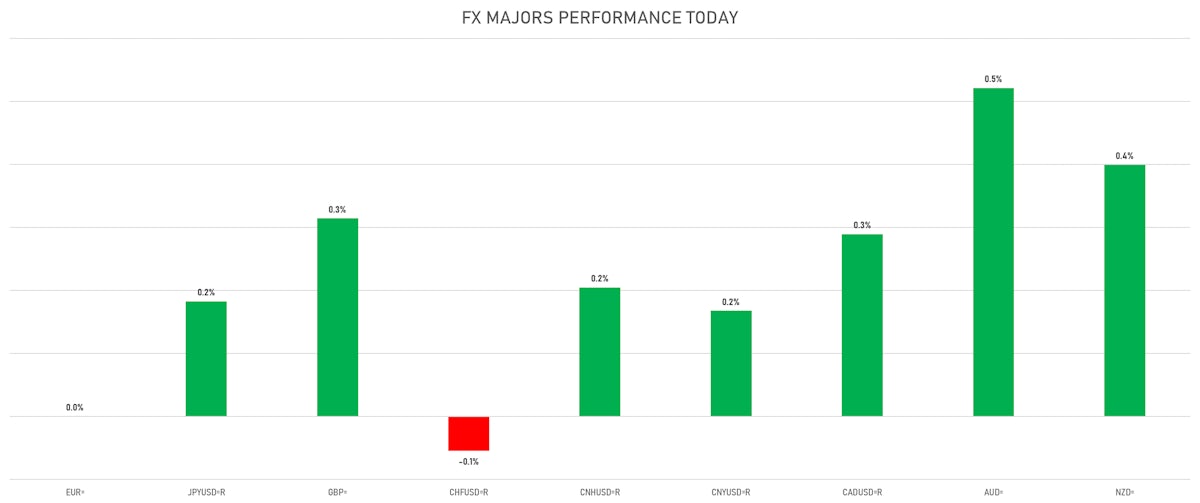

Broad Rebound In Majors Currencies Today On Disappointing US Macro Data

Weakness in commodities took down many emerging market currencies: with the big drop in natural gas prices (down 13% on NYMEX this week) the Russian rouble fell 2.4% for the week

Published ET

CitiFX Economic Surprise Indices Today | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.09% at 95.07 (YTD: +5.66%)

- Euro unchanged at 1.1450 (YTD: -6.2%)

- Yen up 0.18% at 113.85 (YTD: -9.3%)

- Onshore Yuan up 0.17% at 6.3787 (YTD: +2.3%)

- Swiss franc down 0.06% at 0.9213 (YTD: -3.9%)

- Sterling up 0.31% at 1.3413 (YTD: -1.9%)

- Canadian dollar up 0.29% at 1.2542 (YTD: +1.5%)

- Australian dollar up 0.52% at 0.7332 (YTD: -4.7%)

- NZ dollar up 0.40% at 0.7047 (YTD: -1.9%)

MACRO DATA RELEASES

- Euro Zone, Production, Total, excluding construction (EA19), Change P/P for Sep 2021 (Eurostat) at -0.20 % (vs -1.60 % prior), above consensus estimate of -0.50 %

- Euro Zone, Production, Total, excluding construction (EA19), Change Y/Y for Sep 2021 (Eurostat) at 5.20 % (vs 5.10 % prior), above consensus estimate of 4.10 %

- India, CPI, Rural and urban, General, Change Y/Y, Price Index for Oct 2021 (MOSPI, India) at 4.48 % (vs 4.35 % prior), above consensus estimate of 4.32 %

- India, Production, Change Y/Y, Volume Index for Sep 2021 (MOSPI, India) at 3.10 % (vs 11.90 % prior), below consensus estimate of 4.80 %

- Malawi, Policy Rates, Bank rate for 03 Nov (Reserve Bank Malawi) at 12.00 % (vs 12.00 % prior)

- Poland, GDP, Total (flash estimate), Change Y/Y for Q3 2021 (CSO, Poland) at 5.10 % (vs 11.20 % prior), above consensus estimate of 4.70 %

- Slovakia, CPI, Change P/P for Oct 2021 (Stat Office of SR) at 0.60 % (vs 0.80 % prior), above consensus estimate of 0.50 %

- Slovakia, CPI, Change Y/Y for Oct 2021 (Stat Office of SR) at 5.10 % (vs 4.60 % prior), above consensus estimate of 5.00 %

- Slovakia, CPI, Core CPI, Change P/P for Oct 2021 (Stat Office of SR) at 0.70 % (vs 0.30 % prior), above consensus estimate of 0.50 %

- Slovakia, CPI, Core CPI, Change Y/Y for Oct 2021 (Stat Office of SR) at 5.50 % (vs 4.90 % prior), above consensus estimate of 5.40 %

- Spain, CPI, All Items, Change Y/Y, Price Index for Oct 2021 (INE, Spain) at 5.40 % (vs 5.50 % prior), below consensus estimate of 5.50 %

- Spain, CPI, All Items, Total, Final, Change P/P, Price Index for Oct 2021 (INE, Spain) at 1.80 % (vs 2.00 % prior), below consensus estimate of 2.00 %

- Spain, HICP, Total, Final, Change P/P, Price Index for Oct 2021 (INE, Spain) at 1.60 % (vs 1.70 % prior), below consensus estimate of 1.70 %

- Spain, HICP, Total, Final, Change Y/Y, Price Index for Oct 2021 (INE, Spain) at 5.40 % (vs 5.50 % prior), below consensus estimate of 5.50 %

- United States, JOLTS Job Openings for Sep 2021 (BLS, U.S Dep. Of Lab) at 10.44 Mln (vs 10.44 Mln prior), above consensus estimate of 10.30 Mln

- United States, University of Michigan, Total-prelim, Volume Index for Nov 2021 (UMICH, Survey) at 66.80 (vs 71.70 prior), below consensus estimate of 72.40

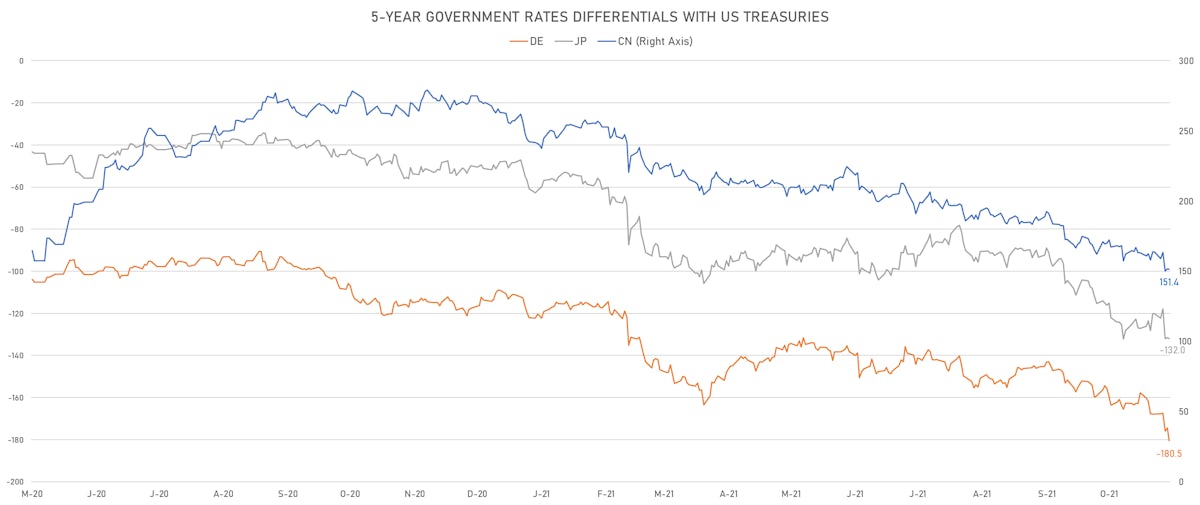

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +6.1 bp at 180.5 bp (YTD change: +69.4 bp)

- US-JAPAN: +0.5 bp at 132.0 bp (YTD change: +83.7 bp)

- US-CHINA: +0.4 bp at -151.4 bp (YTD change: +105.7 bp)

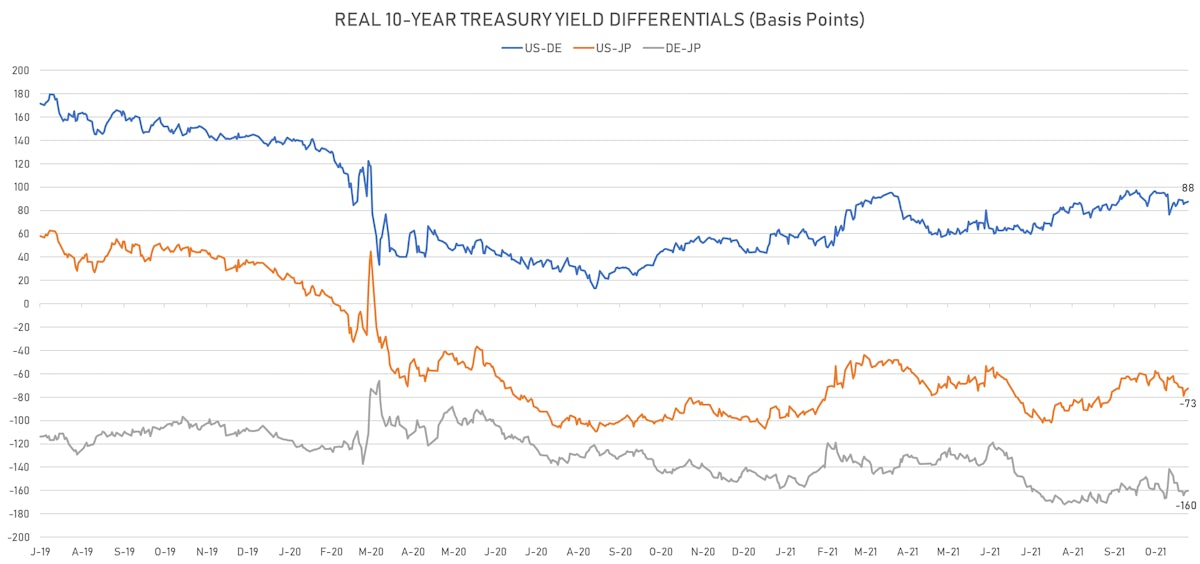

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.0 bp at 87.6 bp (YTD change: +41.5bp)

- US-JAPAN: +1.9 bp at -72.6 bp (YTD change: +28.9bp)

- JAPAN-GERMANY: -0.2 bp at 160.2 bp (YTD change: +12.6bp)

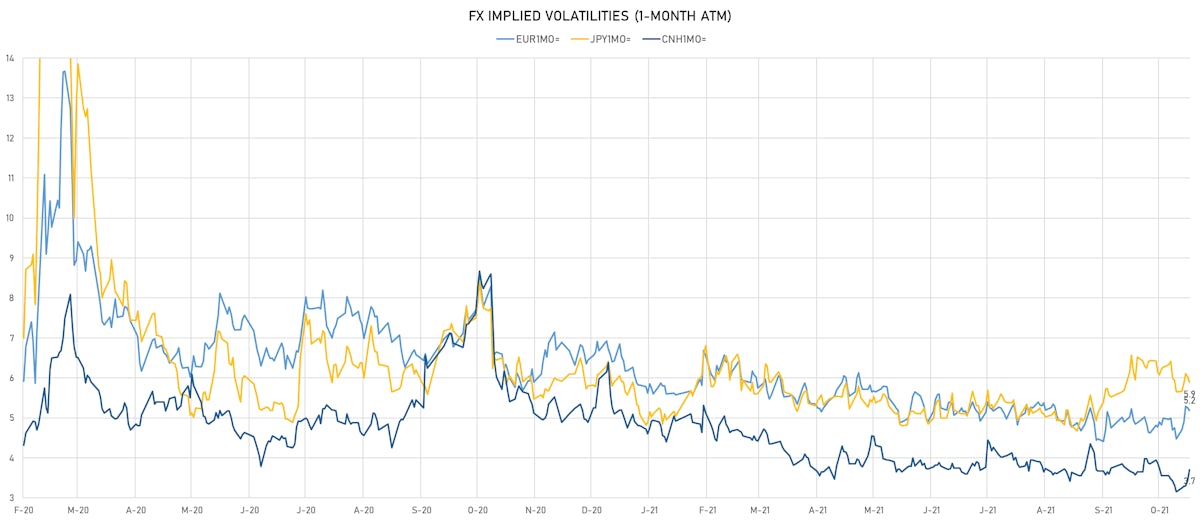

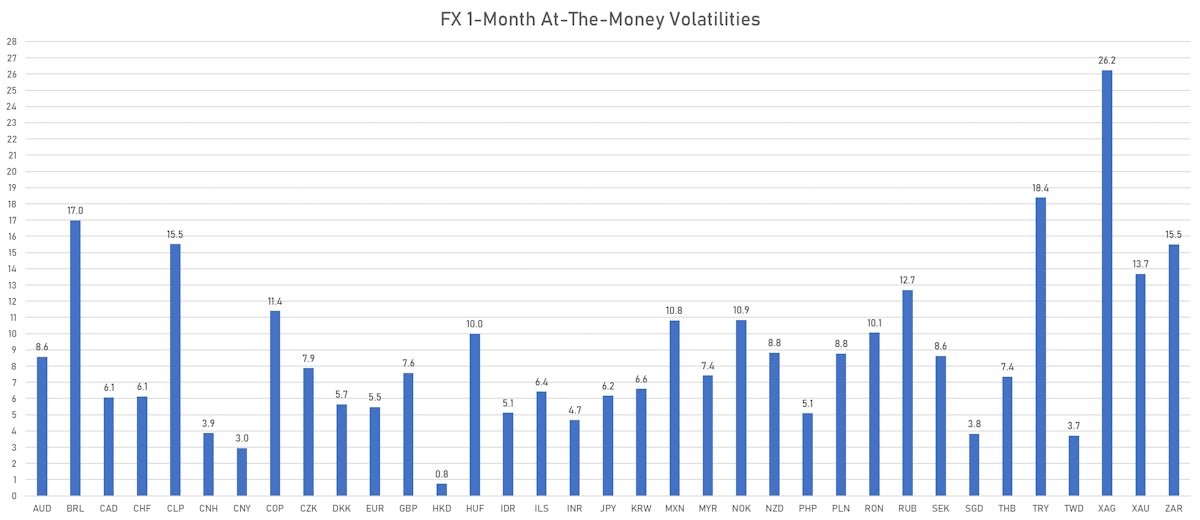

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.57, up 0.45 (YTD: -0.60)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.19, down -0.1 (YTD: -1.5)

- Japanese Yen 1M ATM IV currently at 5.90, down -0.1 (YTD: -0.2)

- Offshore Yuan 1M ATM IV currently at 3.70, up 0.3 (YTD: -2.3)

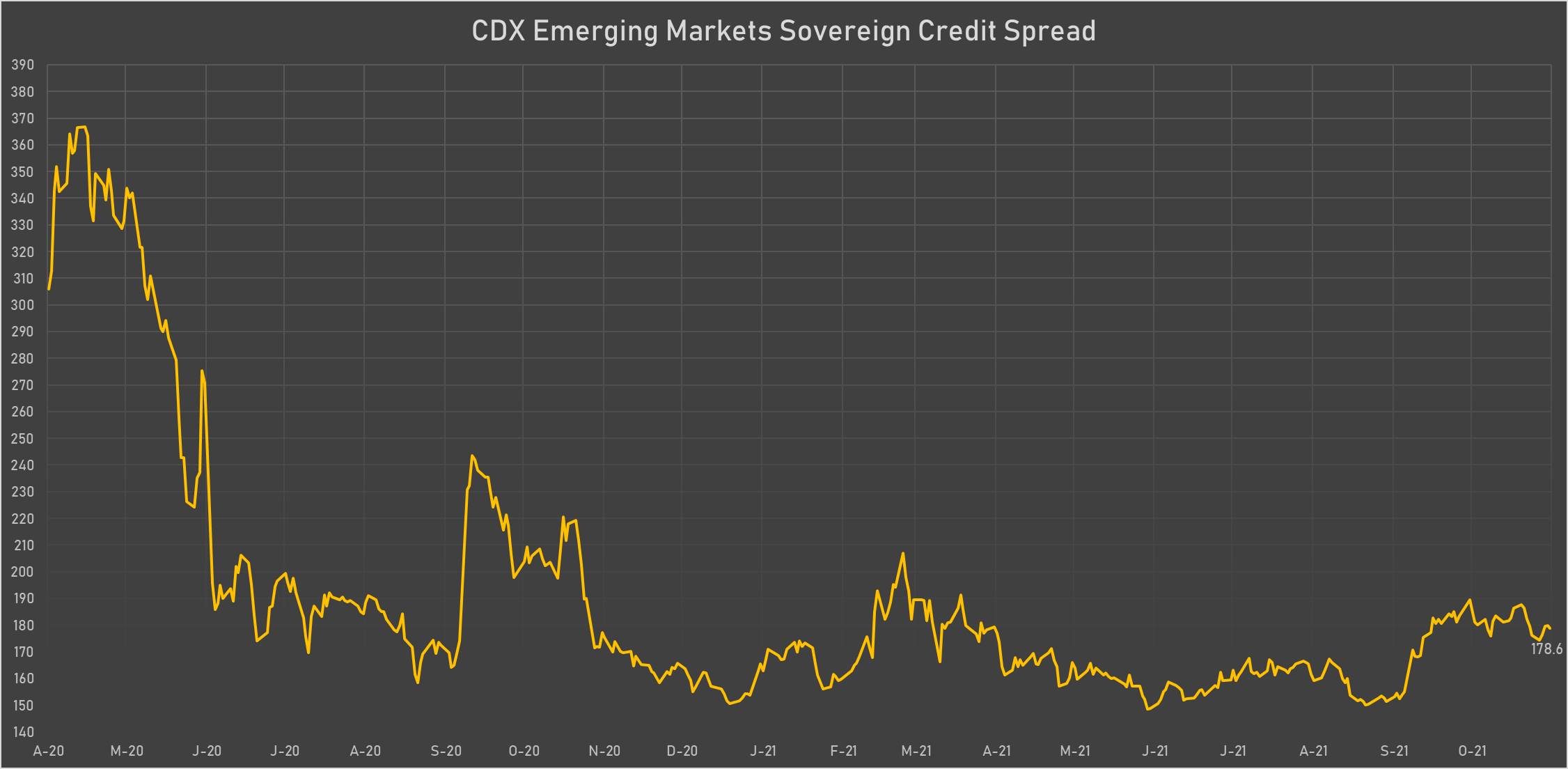

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Russia (rated BBB): up 9.5 basis points to 93 bp (1Y range: 72-117bp)

- Oman (rated BB-): up 7.4 basis points to 241 bp (1Y range: 223-416bp)

- Egypt (rated B+): up 7.3 basis points to 446 bp (1Y range: 283-464bp)

- Colombia (rated BB+): up 2.0 basis points to 172 bp (1Y range: 83-175bp)

- South Africa (rated BB-): down 1.9 basis points to 194 bp (1Y range: 178-241bp)

- Mexico (rated BBB-): down 1.0 basis points to 96 bp (1Y range: 79-115bp)

- Peru (rated BBB): down 1.2 basis points to 88 bp (1Y range: 52-105bp)

- Bahrain (rated B+): down 4.2 basis points to 266 bp (1Y range: 159-307bp)

- Morocco (rated BB+): down 2.0 basis points to 88 bp (1Y range: 84-108bp)

- China (rated A+): down 1.6 basis points to 52 bp (1Y range: 27-58bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 2.6% (YTD: -3.8%)

- Tunisian Dinar up 1.2% (YTD: -4.6%)

- Samoa Tala up 0.9% (YTD: -0.6%)

- Brazilian Real down 1.1% (YTD: -4.9%)

- Pakistani rupee down 1.2% (YTD: -8.5%)

- Russian Rouble down 1.8% (YTD: +1.6%)

LARGEST FX MOVES THIS WEEK

- Myanmar Kyat up 5.7% (YTD: -25.3%)

- Liberian Dollar up 2.1% (YTD: +13.7%)

- Polish Zloty down 2.1% (YTD: -7.9%)

- Lao Kip down 2.1% (YTD: -12.8%)

- Swedish Krona down 2.2% (YTD: -6.0%)

- Russian Rouble down 2.4% (YTD: +1.6%)

- Turkish Lira down 2.7% (YTD: -25.4%)

- Hungarian Forint down 3.2% (YTD: -7.4%)

- Pakistani rupee down 3.2% (YTD: -8.5%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles Rupee up 57.5%

- Myanmar Kyat down 25.3%

- Turkish Lira down 25.4%

- Haiti Gourde down 26.1%

- Surinamese dollar down 33.9%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.7%

- Venezuela Bolivar down 75.2%

- Sudanese Pound down 87.5%