FX

Dovish Lagarde Comments On Rates Take The EUR/USD Below The 1.1400 Handle For First Time Since July 2020

Commodity currencies like the CAD and AUD rose nicely against the dollar, with Chinese macro data coming in mostly better than expected today (even the FAI miss wasn't catastrophic)

Published ET

Euro spot rate vs EUR-USD 18x24 Forward Rates Differential | Sources: Refinitiv

QUICK SUMMARY

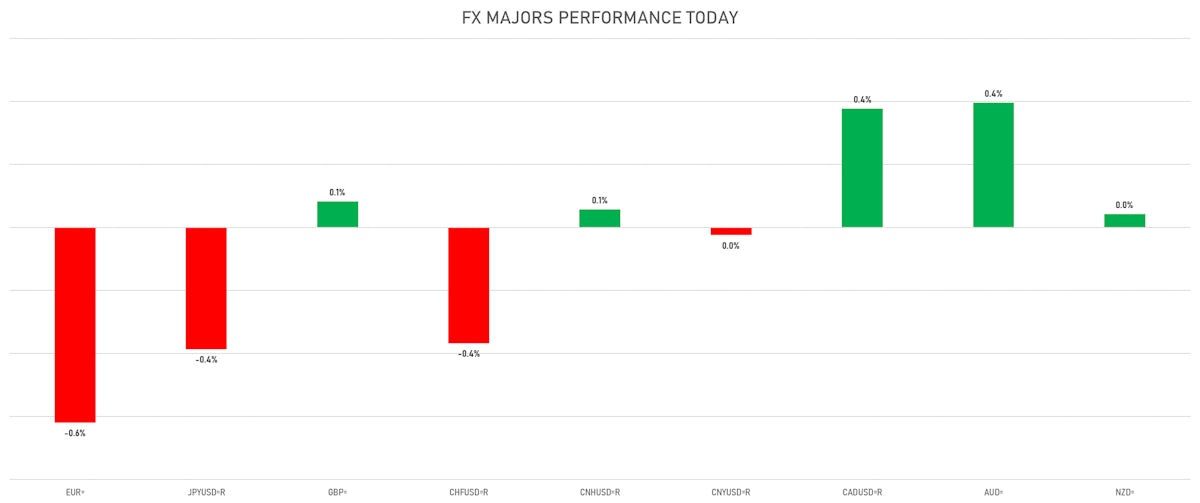

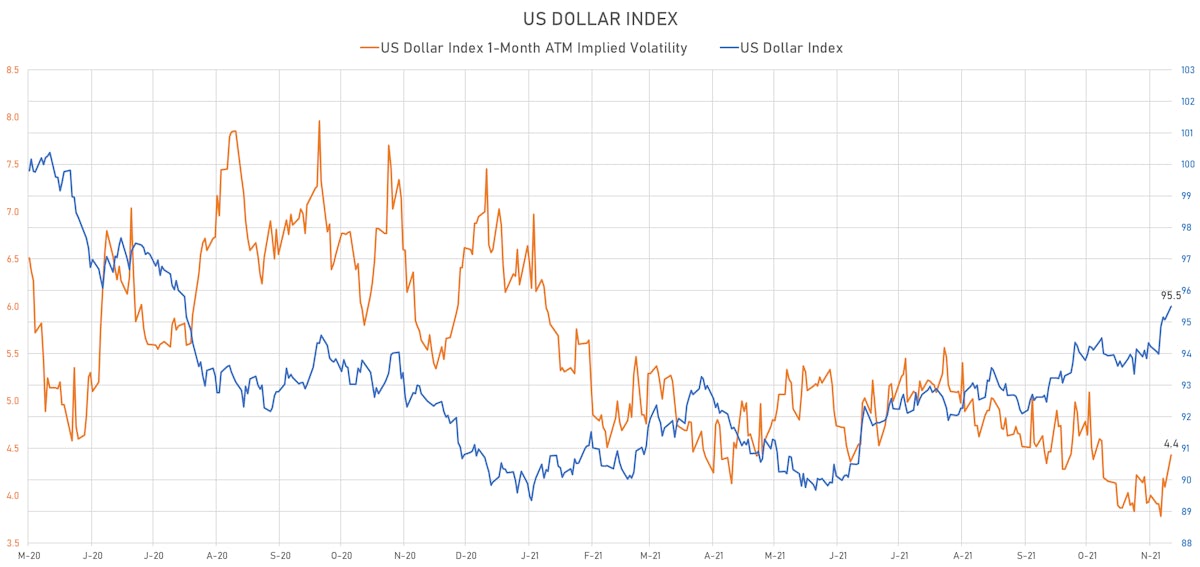

- The US Dollar Index is up 0.44% at 95.49 (YTD: +6.13%)

- Euro down 0.62% at 1.1379 (YTD: -6.8%)

- Yen down 0.39% at 114.29 (YTD: -9.7%)

- Onshore Yuan down 0.02% at 6.3817 (YTD: +2.3%)

- Swiss franc down 0.37% at 0.9244 (YTD: -4.3%)

- Sterling up 0.08% at 1.3424 (YTD: -1.8%)

- Canadian dollar up 0.38% at 1.2492 (YTD: +1.9%)

- Australian dollar up 0.40% at 0.7361 (YTD: -4.3%)

- NZ dollar up 0.04% at 0.7050 (YTD: -1.9%)

WEEKLY IMM NET SPEC POSITIONING

- All: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduction in net long US$ positioning

- Euro: reduction in net long US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduced their net short US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: increase in net long US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

MACRO DATA RELEASES

- Canada, Manufacturers Shipments, Change P/P for Sep 2021 (CANSIM, Canada) at -3.00 % (vs 0.50 % prior), above consensus estimate of -3.20 %

- Canada, Wholesale Trade, Sales, all trade groups, Change P/P for Sep 2021 (CANSIM, Canada) at 1.00 % (vs 0.30 % prior), below consensus estimate of 1.10 %

- China (Mainland), Investment in Fixed Assets, Urban, Change Y/Y for Oct 2021 (NBS, China) at 6.10 % (vs 7.30 % prior), below consensus estimate of 6.20 %

- China (Mainland), Production, Value added, industry, Change Y/Y for Oct 2021 (NBS, China) at 3.50 % (vs 3.10 % prior), above consensus estimate of 3.00 %

- China (Mainland), Retail Sales, Consumer goods, Change Y/Y for Oct 2021 (NBS, China) at 4.90 % (vs 4.40 % prior), above consensus estimate of 3.50 %

- Czech Republic, Current Account, Balance, Current Prices for Sep 2021 (Czech National Bank) at -10.04 Bln CZK (vs -37.80 Bln CZK prior), above consensus estimate of -16.25 Bln CZK

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Oct 2021 (ECB) at 1,019.30 Bln EUR (vs 1,002.40 Bln EUR prior)

- Finland, Official reserve assets, Current Prices for Oct 2021 (Bank of Finland) at 14,378.00 Mln EUR (vs 14,319.00 Mln EUR prior)

- India, Wholesale Prices, Change Y/Y, Price Index for Oct 2021 (Econ Adviser, India) at 12.54 % (vs 10.66 % prior), above consensus estimate of 10.90 %

- Indonesia, Exports, Change Y/Y for Oct 2021 (Statistics Indonesia) at 53.35 % (vs 47.64 % prior), above consensus estimate of 46.85 %

- Indonesia, Imports, Change Y/Y for Oct 2021 (Statistics Indonesia) at 51.06 % (vs 40.31 % prior), below consensus estimate of 56.06 %

- Indonesia, Trade Balance, Current Prices for Oct 2021 (Statistics Indonesia) at 5.74 Bln USD (vs 4.37 Bln USD prior), above consensus estimate of 3.87 Bln USD

- Israel, CPI, Change P/P, Price Index for Oct 2021 (Statistics, Israel) at 0.10 % (vs 0.20 % prior), below consensus estimate of 0.40 %

- Israel, CPI, Change Y/Y, Price Index for Oct 2021 (Statistics, Israel) at 2.30 % (vs 2.50 % prior), below consensus estimate of 2.60 %

- Nigeria, CPI, Change Y/Y for Oct 2021 (NBS, Nigeria) at 15.99 % (vs 16.63 % prior)

- Nigeria, CPI, Food, Change Y/Y, Price Index for Oct 2021 (NBS, Nigeria) at 18.34 % (vs 19.57 % prior)

- Peru, GDP, Change Y/Y for Sep 2021 (INEI, Peru) at 9.71 % (vs 11.83 % prior), below consensus estimate of 10.20 %

- Poland, CPI, Change P/P, Price Index for Oct 2021 (CSO, Poland) at 1.10 % (vs 1.00 % prior)

- Poland, CPI, Change Y/Y, Price Index for Oct 2021 (CSO, Poland) at 6.80 % (vs 6.80 % prior)

- Poland, Current Account, Balance, Current Prices for Sep 2021 (Central Bank, Poland) at -1,339.00 Mln EUR (vs -1,686.00 Mln EUR prior), below consensus estimate of -1,200.00 Mln EUR

- Sweden, CPI, All Items, Change P/P, Price Index for Oct 2021 (SCB, Sweden) at 0.20 % (vs 0.50 % prior)

- Sweden, CPI, All Items, Change Y/Y, Price Index for Oct 2021 (SCB, Sweden) at 2.80 % (vs 2.50 % prior), above consensus estimate of 2.70 %

- Sweden, CPI, Underlying inflation CPIF, Change P/P, Price Index for Oct 2021 (SCB, Sweden) at 0.20 % (vs 0.50 % prior), above consensus estimate of 0.00 %

- Sweden, CPI, Underlying inflation CPIF, Change Y/Y, Price Index for Oct 2021 (SCB, Sweden) at 3.10 % (vs 2.80 % prior), above consensus estimate of 2.90 %

- Thailand, GDP, Change P/P for Q3 2021 (NESDB, Thailand) at -1.10 % (vs 0.40 % prior), above consensus estimate of -2.50 %

- Thailand, GDP, Change Y/Y for Q3 2021 (NESDB, Thailand) at -0.30 % (vs 7.50 % prior), above consensus estimate of -0.80 %

- United States, New York Fed, General Business Condition for Nov 2021 (FED, NY) at 30.90 (vs 19.80 prior), above consensus estimate of 21.20

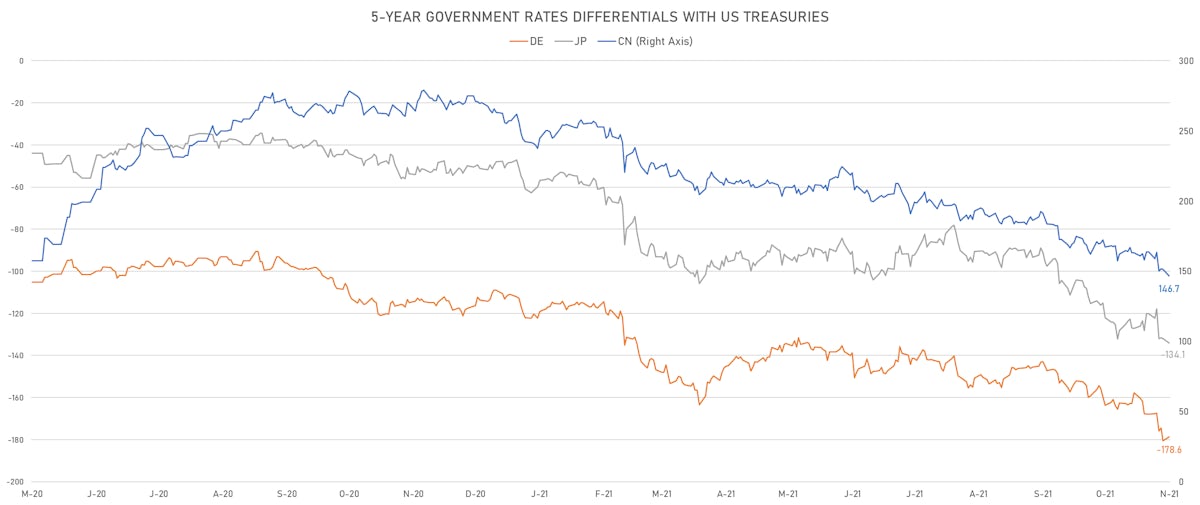

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.8 bp at 177.7 bp (YTD change: +66.6 bp)

- US-JAPAN: +0.6 bp at 132.6 bp (YTD change: +84.3 bp)

- US-CHINA: +3.1 bp at -148.3 bp (YTD change: +108.8 bp)

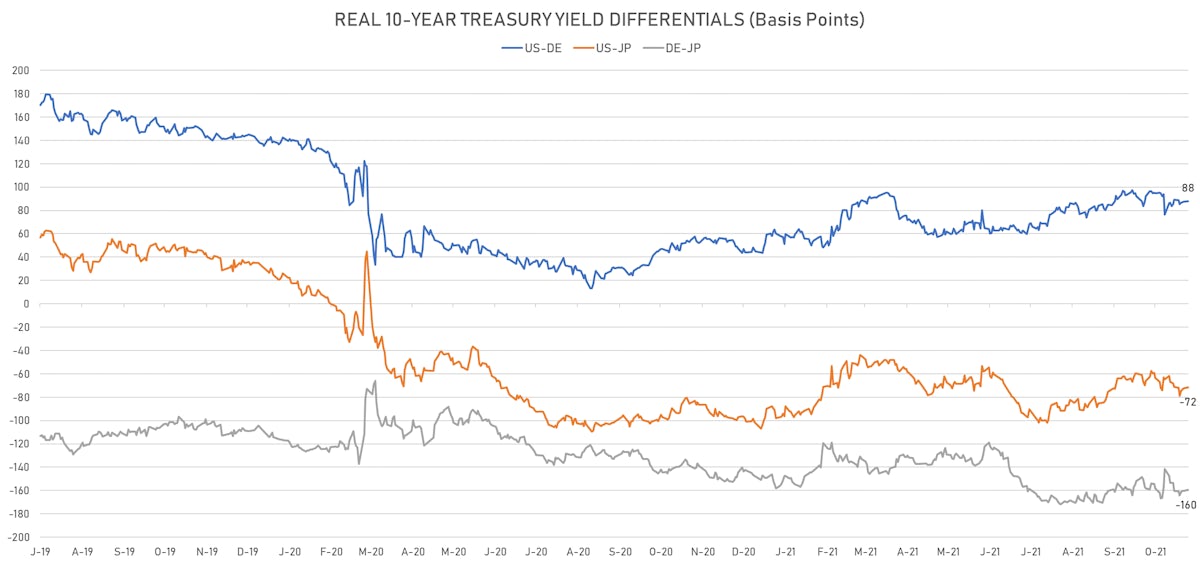

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.4 bp at 88.0 bp (YTD change: +41.9bp)

- US-JAPAN: +1.1 bp at -71.5 bp (YTD change: +30.0bp)

- JAPAN-GERMANY: -0.7 bp at 159.5 bp (YTD change: +11.9bp)

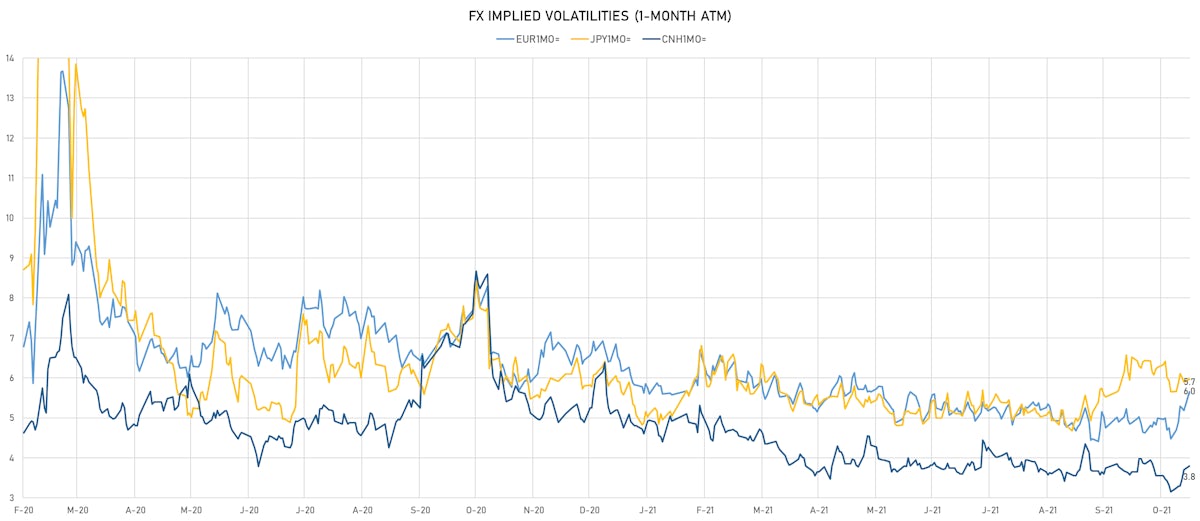

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.45, down -0.12 (YTD: -0.72)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.65, up 0.5 (YTD: -1.0)

- Japanese Yen 1M ATM IV currently at 5.98, up 0.1 (YTD: -0.1)

- Offshore Yuan 1M ATM IV currently at 3.80, up 0.1 (YTD: -2.2)

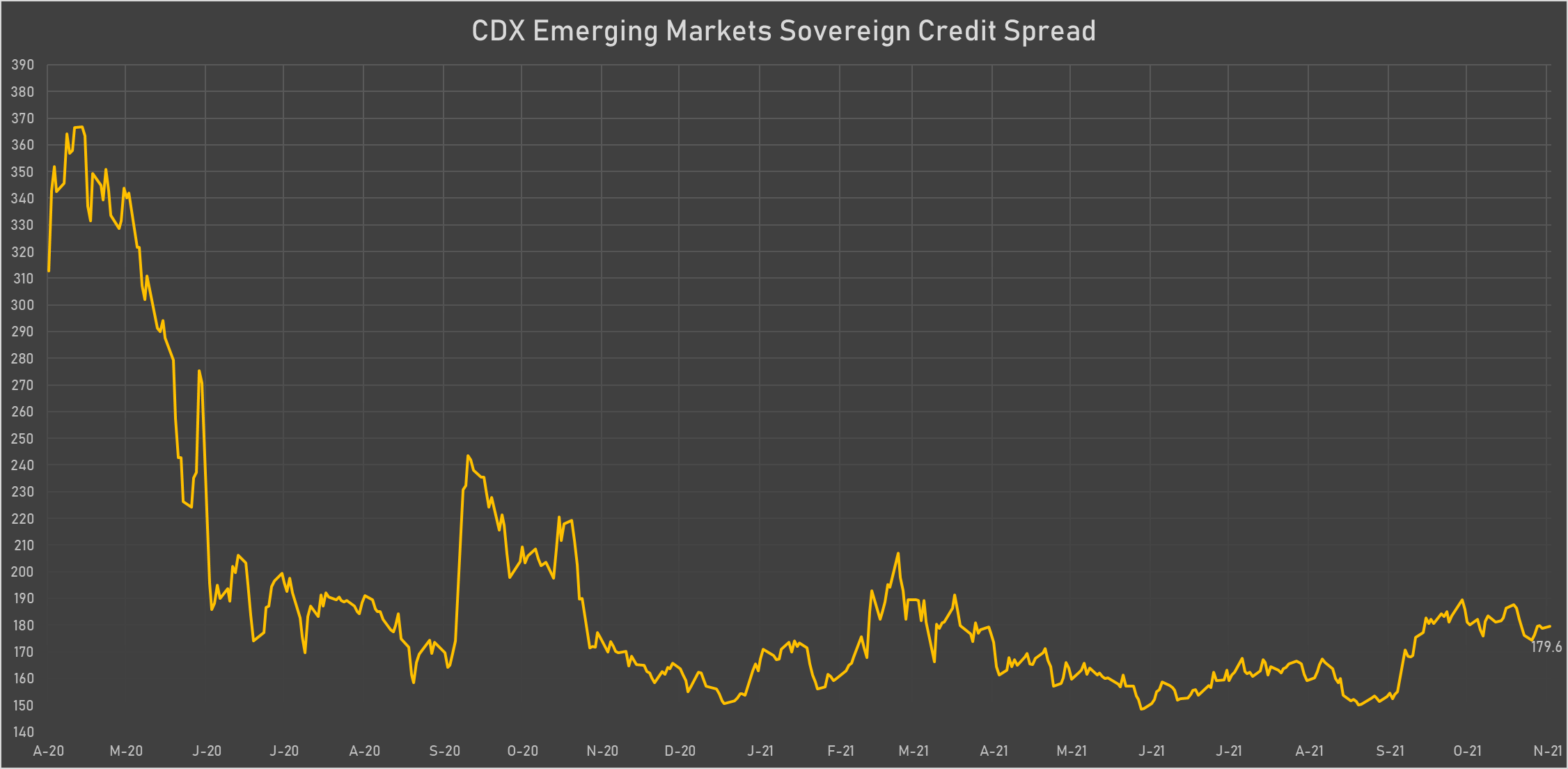

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Russia (rated BBB): up 14.5 basis points to 98 bp (1Y range: 72-117bp)

- Oman (rated BB-): up 5.1 basis points to 239 bp (1Y range: 223-416bp)

- Colombia (rated BB+): up 3.0 basis points to 173 bp (1Y range: 83-175bp)

- Egypt (rated B+): up 5.3 basis points to 444 bp (1Y range: 283-464bp)

- Peru (rated BBB): down 1.4 basis points to 87 bp (1Y range: 52-105bp)

- Indonesia (rated BBB): down 1.6 basis points to 83 bp (1Y range: 66-94bp)

- South Africa (rated BB-): down 3.7 basis points to 192 bp (1Y range: 178-241bp)

- Malaysia (rated BBB+): down 1.2 basis points to 58 bp (1Y range: 34-64bp)

- Mexico (rated BBB-): down 2.8 basis points to 95 bp (1Y range: 79-115bp)

- China (rated A+): down 2.0 basis points to 52 bp (1Y range: 27-58bp)

LARGEST FX MOVES TODAY

- South Africa Rand up 0.8% (YTD: -3.5%)

- Turkish Lira down 0.9% (YTD: -26.3%)

- Cape Verde Escudo down 1.0% (YTD: -3.8%)

- Haiti Gourde down 1.0% (YTD: -26.8%)

- CFA Franc BEAC down 2.2% (YTD: -5.9%)

- Afghani down 2.6% (YTD: -17.9%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 60.9%

- New Zambian kwacha up 21.0%

- Myanmar Kyat down 25.3%

- Turkish Lira down 26.3%

- Haiti Gourde down 26.8%

- Surinamese dollar down 34.1%

- Syrian Pound down 49.4%

- Venezuela Bolivar down 75.2%