FX

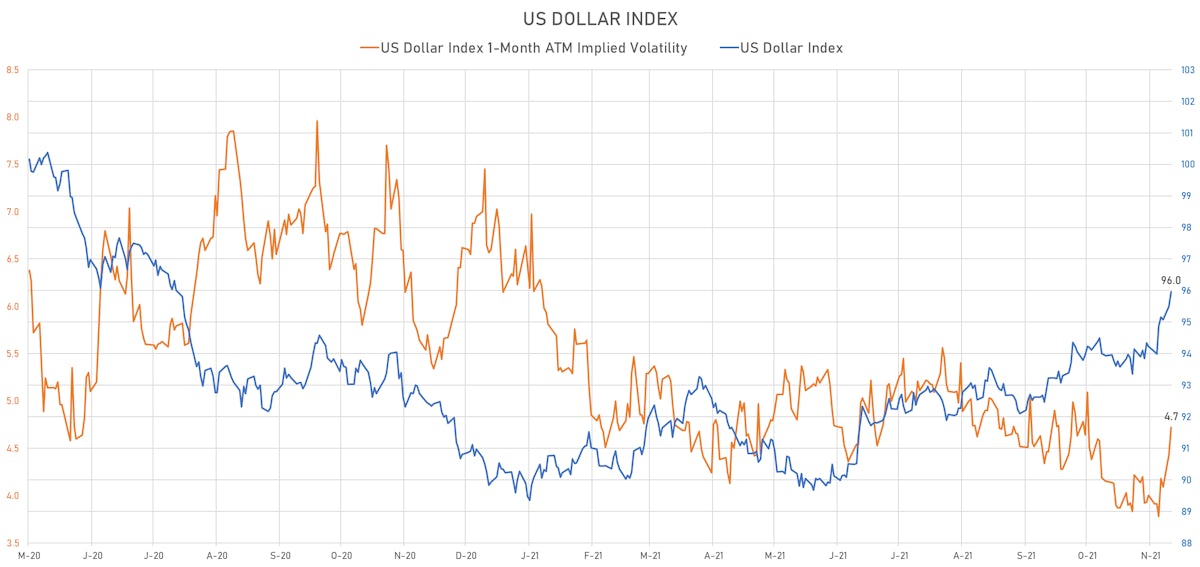

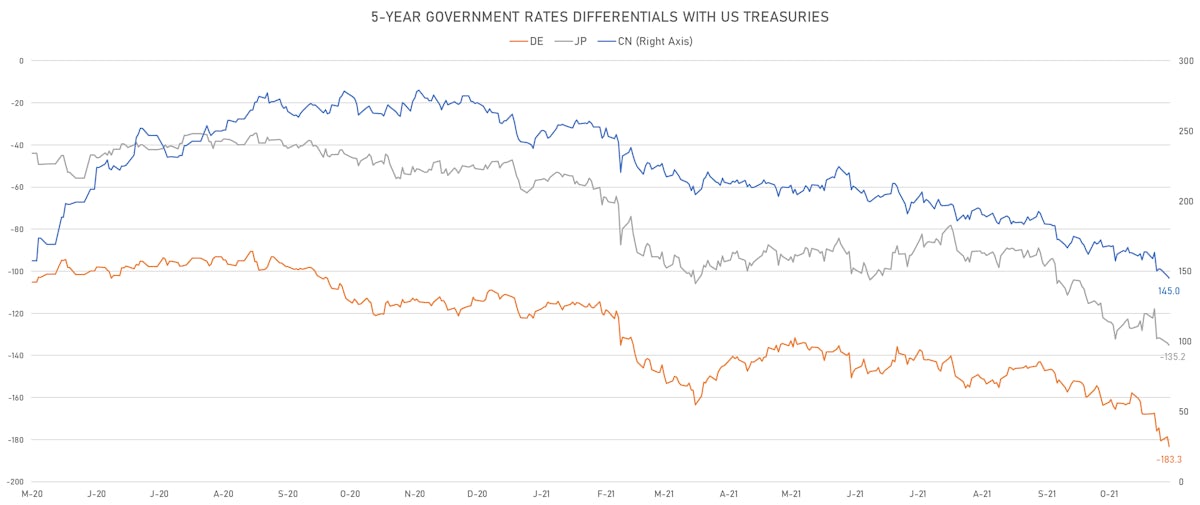

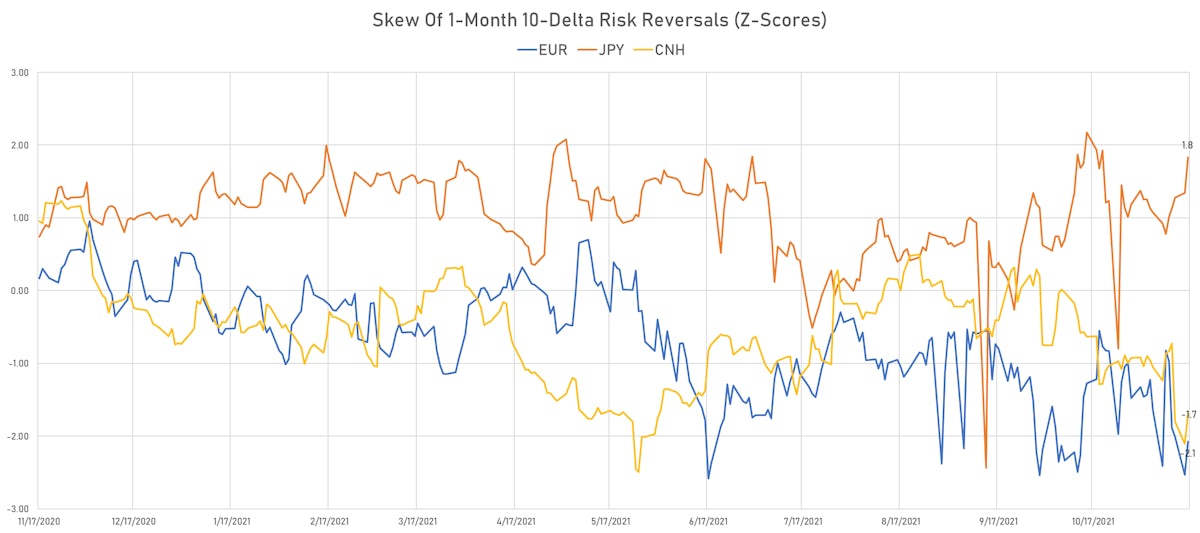

US Dollar Makes Broad Gains Against Global Currencies; Widening Short Rates Differentials Main Driver For Euro, JPY Fall This Week

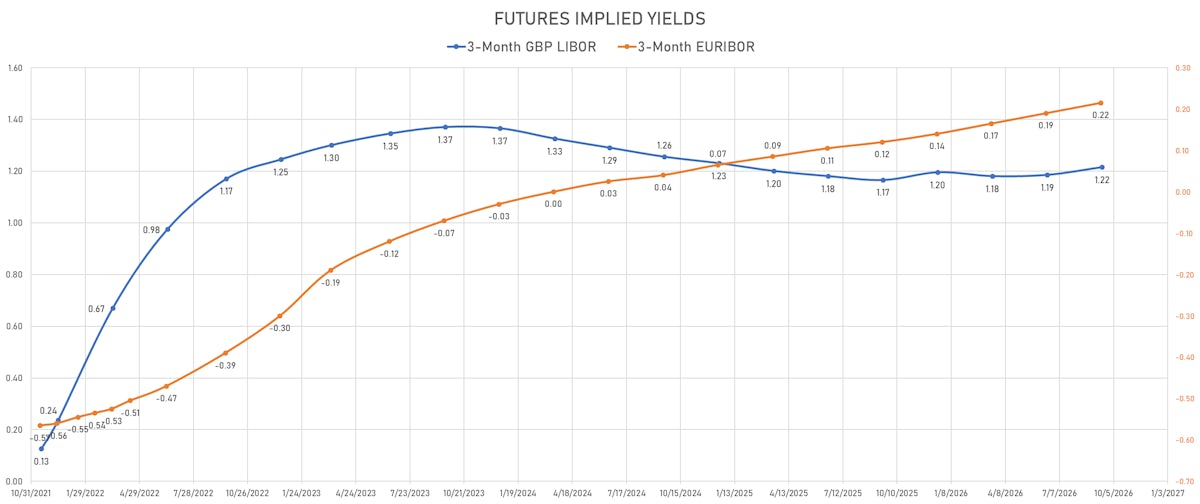

The Sterling forward rates curve is still pricing in a BOE monetary policy error: a very short hiking cycle that would be over by the end of 2023, followed by a policy reversal (rate cuts) from 2024

Published ET

3-Month GBP LIBOR & EURIBOR Futures Implied Yields | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

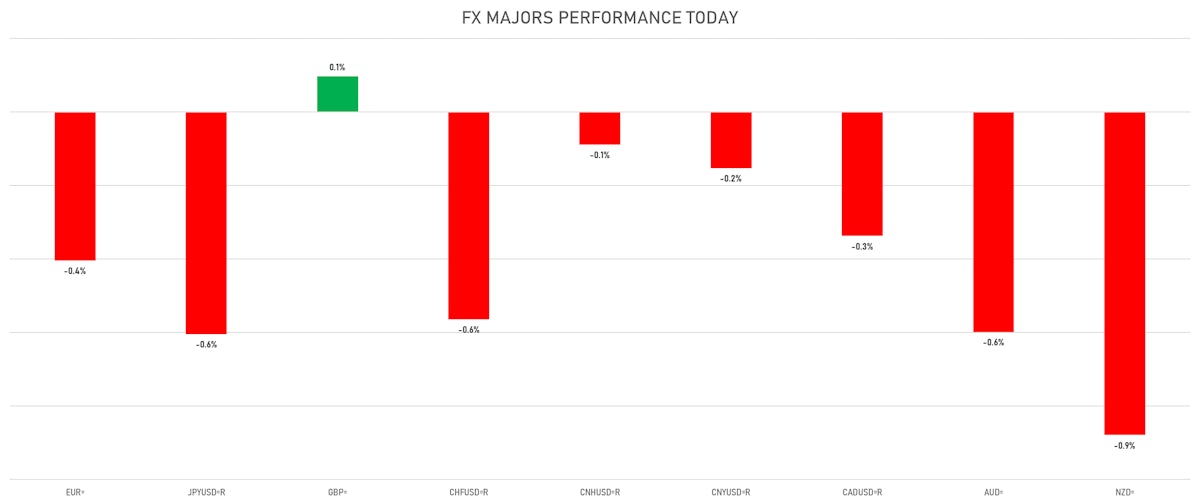

- The US Dollar Index is up 0.50% at 95.97 (YTD: +6.65%)

- Euro down 0.40% at 1.1321 (YTD: -7.3%)

- Yen down 0.60% at 114.83 (YTD: -10.1%)

- Onshore Yuan down 0.15% at 6.3919 (YTD: +2.1%)

- Swiss franc down 0.56% at 0.9299 (YTD: -4.9%)

- Sterling up 0.10% at 1.3431 (YTD: -1.8%)

- Canadian dollar down 0.34% at 1.2561 (YTD: +1.4%)

- Australian dollar down 0.60% at 0.7300 (YTD: -5.1%)

- NZ dollar down 0.88% at 0.6985 (YTD: -2.8%)

MACRO DATA RELEASES

- Canada, Housing Starts, All areas for Oct 2021 (CMHC, Canada) at 236.60 k (vs 251.20 k prior), below consensus estimate of 255.00 k

- Colombia, GDP, Change Y/Y for Q3 2021 (DANE, Colombia) at 12.80 % (vs 17.60 % prior), above consensus estimate of 12.40 %

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change P/P for Q3 2021 (Eurostat) at 2.20 % (vs 2.20 % prior), in line with consensus

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change Y/Y for Q3 2021 (Eurostat) at 3.70 % (vs 3.70 % prior), in line with consensus

- France, HICP, Change Y/Y, Price Index for Oct 2021 (INSEE, France) at 3.20 % (vs 3.20 % prior), in line with consensus

- France, HICP, Final, Change P/P, Price Index for Oct 2021 (INSEE, France) at 0.40 % (vs 0.50 % prior), below consensus estimate of 0.50 %

- Hungary, Policy Rates, Base Rate for Nov 2021 (Cent. Bank, Hungary) at 2.10 % (vs 1.80 % prior), in line with consensus

- Hungary, Policy Rates, Overnight Deposite Rate for Nov 2021 (Cent. Bank, Hungary) at 1.15 % (vs 0.85 % prior), in line with consensus

- Italy, HICP, Final, Change P/P, Price Index for Oct 2021 (ISTAT, Italy) at 0.90 % (vs 0.80 % prior), above consensus estimate of 0.80 %

- Italy, HICP, Final, Change Y/Y, Price Index for Oct 2021 (ISTAT, Italy) at 3.20 % (vs 3.10 % prior), above consensus estimate of 3.10 %

- Japan, Exports, Change Y/Y for Oct 2021 (MoF, Japan) at 9.40 % (vs 13.00 % prior), below consensus estimate of 9.90 %

- Japan, Imports, Change Y/Y for Oct 2021 (MoF, Japan) at 26.70 % (vs 38.60 % prior), below consensus estimate of 31.90 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change P/P for Sep 2021 (Cabinet Office, JP) at 0.00 % (vs -2.40 % prior), below consensus estimate of 1.80 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change Y/Y for Sep 2021 (Cabinet Office, JP) at 12.50 % (vs 17.00 % prior), below consensus estimate of 17.40 %

- Japan, Trade Balance, Current Prices for Oct 2021 (MoF, Japan) at -67.40 Bln JPY (vs -622.80 Bln JPY prior), above consensus estimate of -310.00 Bln JPY

- Netherlands, GDP, Total, Flash, Change P/P for Q3 2021 (CBS - NL) at 1.90 % (vs 3.80 % prior), above consensus estimate of 1.70 %

- New Zealand, Milk Auction, Average Price, Constant Prices for W 16 Nov (GlobalDairy Trade) at 4,287.00 USD (vs 4,207.00 USD prior)

- United Kingdom, Unemployment, Claimant count, Absolute change for Oct 2021 (ONS, United Kingdom) at -14.90 k (vs -51.10 k prior)

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Sep 2021 (ONS, United Kingdom) at 4.30 % (vs 4.50 % prior), below consensus estimate of 4.40 %

- United States, Production, Change P/P for Oct 2021 (FED, U.S.) at 1.60 % (vs -1.30 % prior), above consensus estimate of 0.70 %

- United States, Retail Sales, Total including food services, Change P/P for Oct 2021 (U.S. Census Bureau) at 1.70 % (vs 0.70 % prior), above consensus estimate of 1.40 %

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.5 bp at 183.2 bp (YTD change: +72.1 bp)

- US-JAPAN: +1.1 bp at 135.3 bp (YTD change: +87.0 bp)

- US-CHINA: +2.6 bp at -144.0 bp (YTD change: +113.1 bp)

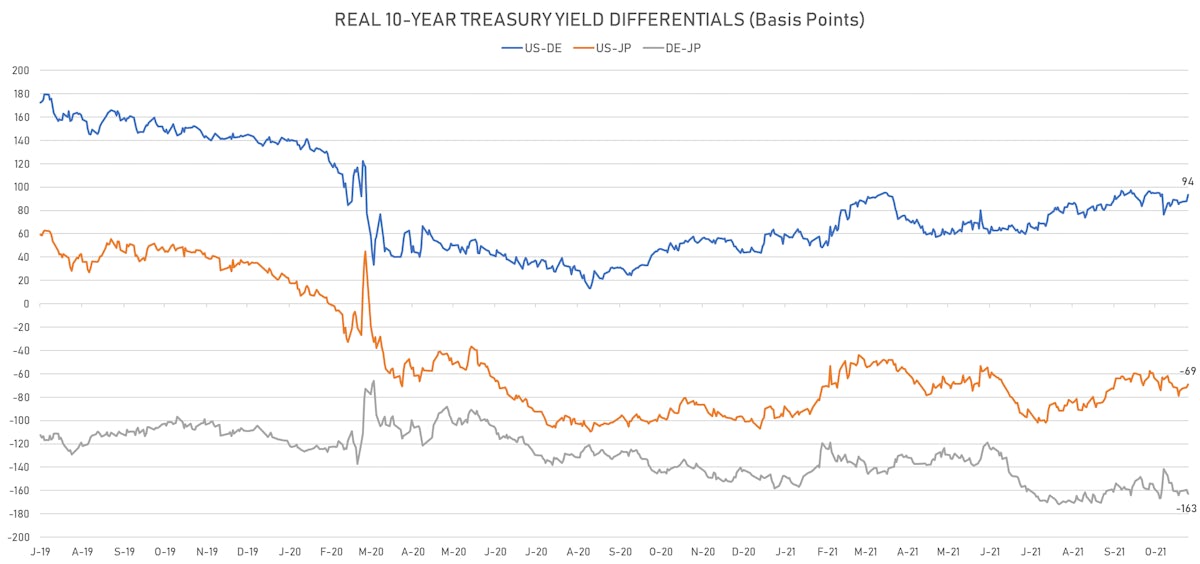

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +5.5 bp at 93.5 bp (YTD change: +47.4bp)

- US-JAPAN: +2.3 bp at -69.2 bp (YTD change: +32.3bp)

- JAPAN-GERMANY: +3.2 bp at 162.7 bp (YTD change: +15.1bp)

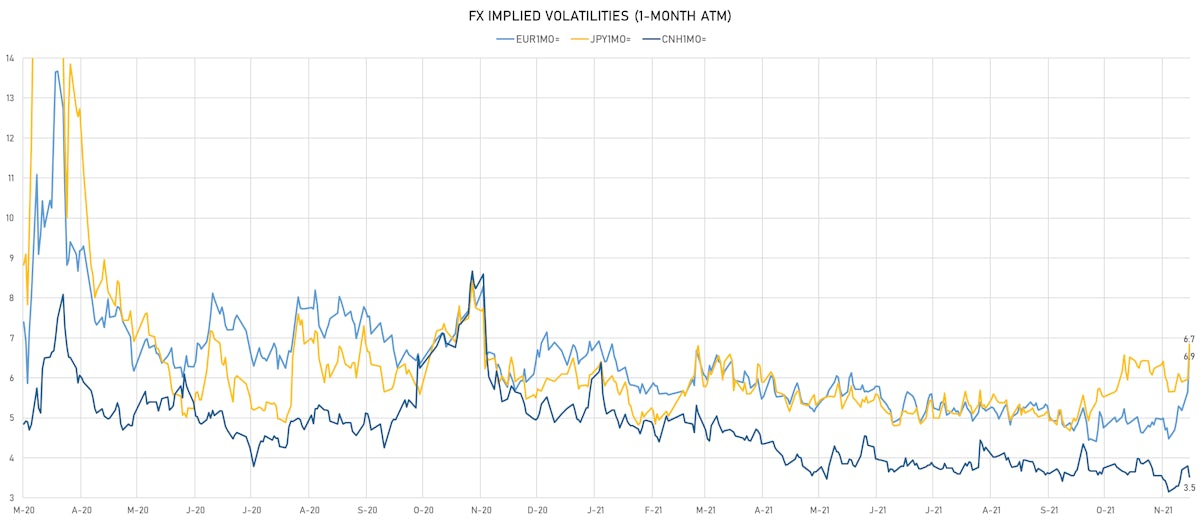

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.54, up 0.09 (YTD: -0.63)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.73, up 1.1 (YTD: +0.0)

- Japanese Yen 1M ATM IV currently at 6.85, up 0.9 (YTD: +0.8)

- Offshore Yuan 1M ATM IV currently at 3.53, down -0.3 (YTD: -2.5)

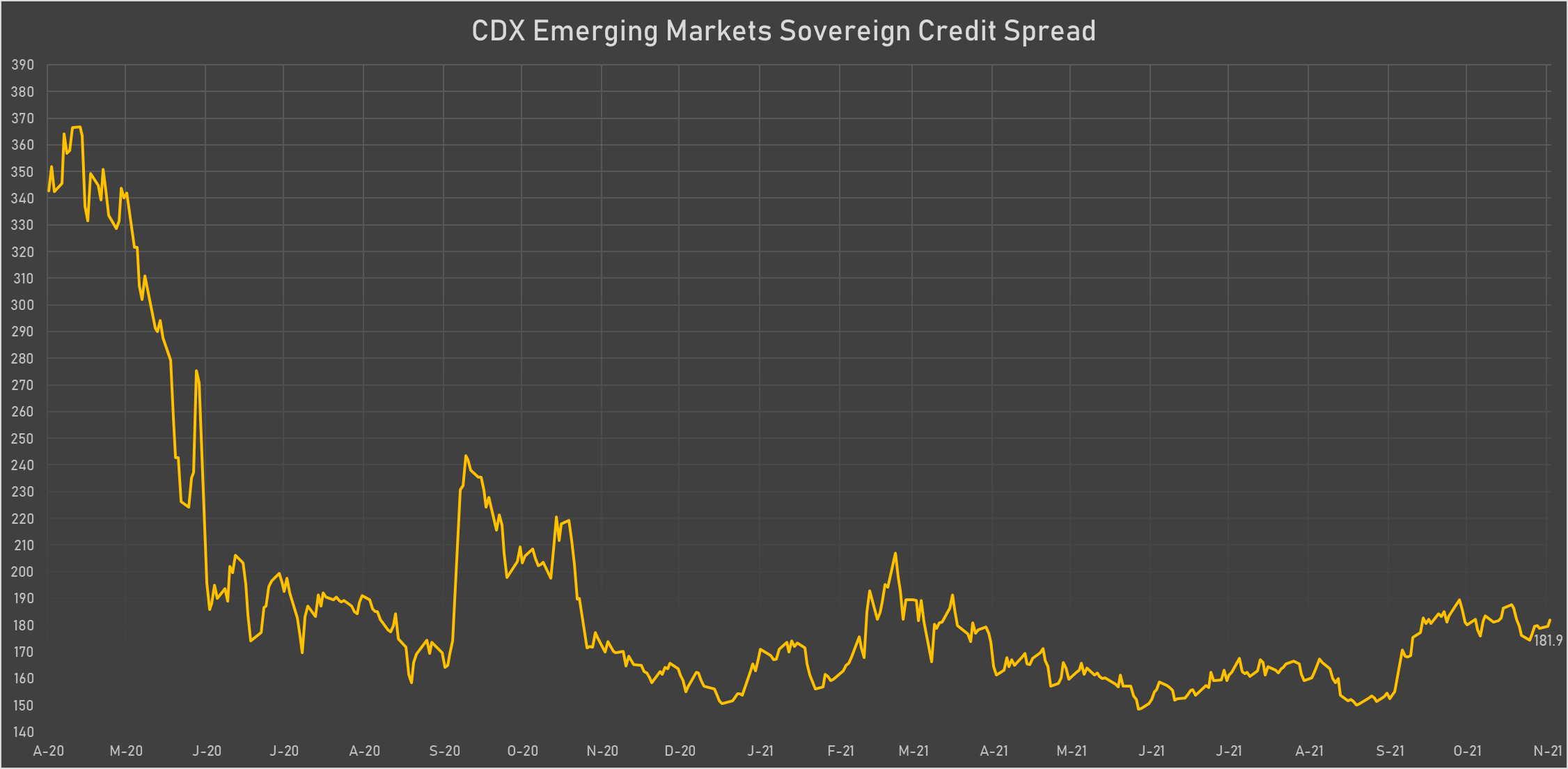

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Chile (rated A-): up 2.0 basis points to 78 bp (1Y range: 43-89bp)

- Russia (rated BBB): up 2.4 basis points to 101 bp (1Y range: 72-117bp)

- Turkey (rated BB-): up 7.3 basis points to 413 bp (1Y range: 282-481bp)

- South Africa (rated BB-): up 3.1 basis points to 195 bp (1Y range: 178-241bp)

- Colombia (rated BB+): up 2.2 basis points to 175 bp (1Y range: 83-175bp)

- Brazil (rated BB-): up 2.5 basis points to 237 bp (1Y range: 141-252bp)

- China (rated A+): up 0.5 basis points to 52 bp (1Y range: 27-58bp)

- Vietnam (rated BB): down 1.0 basis points to 101 bp (1Y range: 89-112bp)

- Oman (rated BB-): down 2.6 basis points to 236 bp (1Y range: 223-416bp)

- Morocco (rated BB+): down 1.5 basis points to 88 bp (1Y range: 84-108bp)

LARGEST FX MOVES TODAY

- Afghani up 1.1% (YTD: -16.9%)

- Haiti Gourde up 1.0% (YTD: -26.1%)

- Comoro Franc down 1.0% (YTD: -7.7%)

- Swedish Krona down 1.1% (YTD: -7.3%)

- Tunisian Dinar down 1.2% (YTD: -6.2%)

- Botswana Pula down 1.3% (YTD: -6.7%)

- South Africa Rand down 1.8% (YTD: -5.2%)

- Ethiopian Birr down 1.9% (YTD: -18.6%)

- Chilean Peso down 1.9% (YTD: -12.5%)

- Turkish Lira down 2.6% (YTD: -28.3%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 60.8%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.1%

- Turkish Lira down 28.3%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 75.4%