FX

Yen, Euro, Swissie Rebound After Large Falls Over The Last Couple Of Days

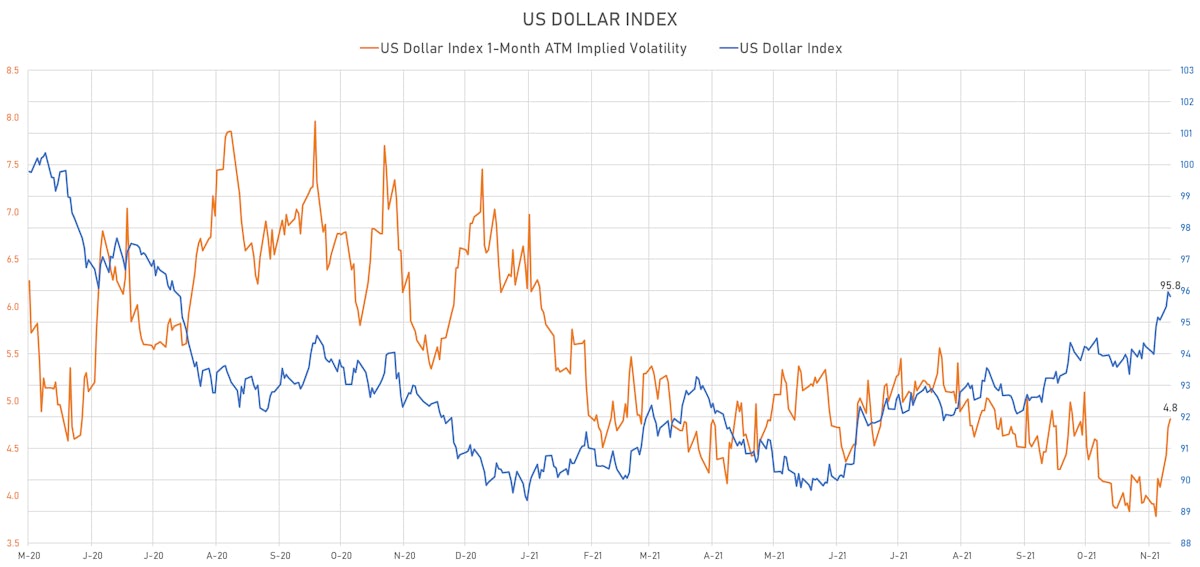

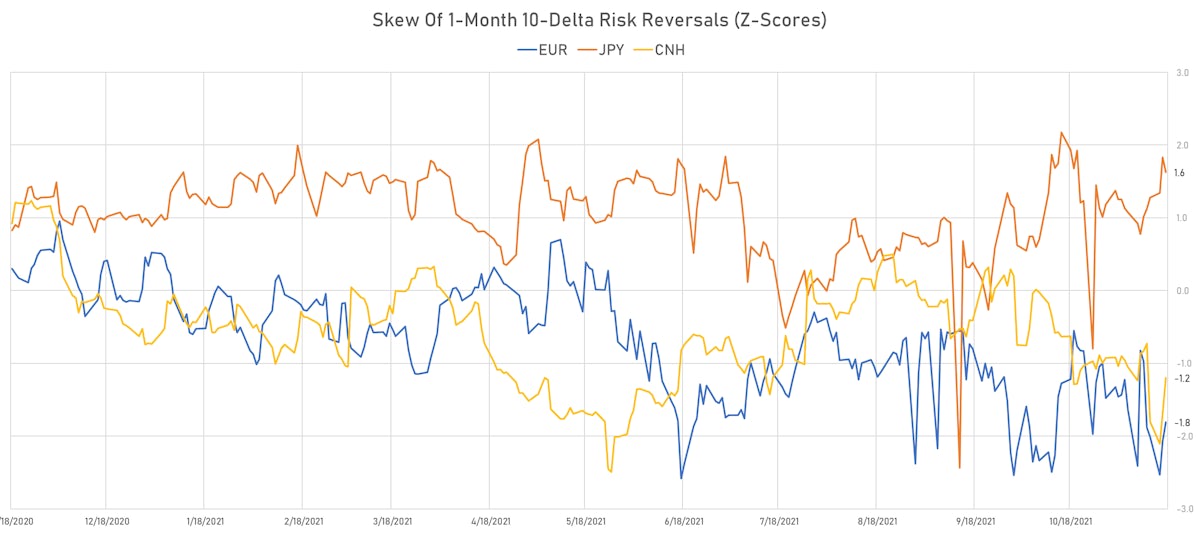

Volatility in major currencies has dramatically increased in the past week, in line with rates volatility; a notable exception is the Chinese yuan, which is kept well anchored by central bank interventions

Published ET

EUR, JPY, CNH 1-Month ATM Implied Volatilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

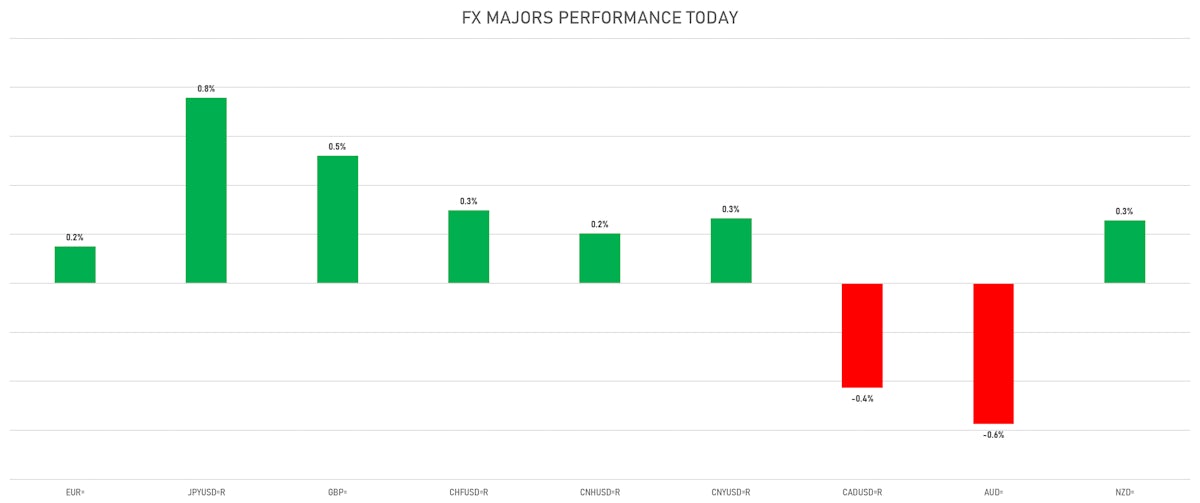

- The US Dollar Index is down -0.16% at 95.82 (YTD: +6.48%)

- Euro up 0.15% at 1.1336 (YTD: -7.2%)

- Yen up 0.76% at 113.95 (YTD: -9.4%)

- Onshore Yuan up 0.27% at 6.3762 (YTD: +2.4%)

- Swiss franc up 0.30% at 0.9273 (YTD: -4.5%)

- Sterling up 0.52% at 1.3497 (YTD: -1.3%)

- Canadian dollar down 0.43% at 1.2617 (YTD: +0.9%)

- Australian dollar down 0.58% at 0.7260 (YTD: -5.6%)

- NZ dollar up 0.26% at 0.7009 (YTD: -2.4%)

MACRO DATA RELEASES

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change P/P for Q3 2021 (AU Bureau of Stat) at 0.60 % (vs 0.40 % prior), above consensus estimate of 0.50 %

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change Y/Y for Q3 2021 (AU Bureau of Stat) at 2.20 % (vs 1.70 % prior), in line with consensus

- Austria, HICP, Change P/P, Price Index for Oct 2021 (Statistics Austria) at 0.70 % (vs 0.90 % prior)

- Austria, HICP, Change Y/Y for Oct 2021 (Statistics Austria) at 3.70 % (vs 3.30 % prior)

- Canada, CPI, All items, Change P/P, Price Index for Oct 2021 (CANSIM, Canada) at 0.70 % (vs 0.20 % prior), in line with consensus

- Canada, CPI, All items, Change Y/Y for Oct 2021 (CANSIM, Canada) at 4.70 % (vs 4.40 % prior), in line with consensus

- Canada, CPI, Core CPI (Bank of Canada), Change P/P, Price Index for Oct 2021 (CANSIM, Canada) at 0.60 % (vs 0.30 % prior)

- Canada, CPI, Core CPI (Bank of Canada), Change Y/Y, Price Index for Oct 2021 (CANSIM, Canada) at 3.80 % (vs 3.70 % prior)

- Euro Zone, CPI, Change P/P, Price Index for Oct 2021 (Eurostat) at 0.80 % (vs 0.50 % prior), in line with consensus

- Euro Zone, CPI, Change Y/Y for Oct 2021 (Eurostat) at 4.10 % (vs 4.10 % prior), in line with consensus

- Euro Zone, CPI, Total excluding energy, food, alcohol and tobacco, Change Y/Y for Oct 2021 (Eurostat) at 2.00 % (vs 2.10 % prior), below consensus estimate of 2.10 %

- Euro Zone, HICP, Overall index excluding energy, food, alcohol and tobacco, Change P/P for Oct 2021 (Eurostat) at 0.30 % (vs 0.30 % prior), in line with consensus

- Russia, GDP, Total-prelim, Change Y/Y for Q3 2021 (RosStat, Russia) at 4.30 % (vs 10.50 % prior), below consensus estimate of 4.60 %

- Singapore, Exports, Domestic non-oil, Change Y/Y for Oct 2021 (Statistics Singapore) at 17.90 % (vs 12.30 % prior), above consensus estimate of 15.00 %

- Singapore, Exports, Non-oil domestic exports, Change P/P for Oct 2021 (Statistics Singapore) at 4.20 % (vs 1.20 % prior), above consensus estimate of 0.40 %

- South Africa, CPI, Urban Areas, Headline, Change P/P, Price Index for Oct 2021 (Statistics, SA) at 0.20 % (vs 0.20 % prior), in line with consensus

- South Africa, CPI, Urban Areas, Headline, Change Y/Y, Price Index for Oct 2021 (Statistics, SA) at 5.00 % (vs 5.00 % prior), in line with consensus

- South Africa, Retail Sales, Change Y/Y for Sep 2021 (Statistics, SA) at 2.10 % (vs -1.30 % prior), above consensus estimate of -0.20 %

- United Kingdom, CPI, All items (CPI), Change P/P, Price Index for Oct 2021 (ONS, United Kingdom) at 1.10 % (vs 0.30 % prior), above consensus estimate of 0.80 %

- United Kingdom, CPI, All items (CPI), Change Y/Y for Oct 2021 (ONS, United Kingdom) at 4.20 % (vs 3.10 % prior), above consensus estimate of 3.90 %

- United Kingdom, Input Prices, Materials and fuel purchased, all manufactured products, Change P/P for Oct 2021 (ONS, United Kingdom) at 1.40 % (vs 0.40 % prior), above consensus estimate of 1.10 %

- United Kingdom, Input Prices, Materials and fuel purchased, all manufactured products, Change Y/Y for Oct 2021 (ONS, United Kingdom) at 13.00 % (vs 11.40 % prior), above consensus estimate of 12.10 %

- United Kingdom, Output Prices, All manufactured products, Change P/P, Price Index for Oct 2021 (ONS, United Kingdom) at 1.10 % (vs 0.50 % prior), above consensus estimate of 0.80 %

- United Kingdom, Output Prices, All manufactured products, Change Y/Y, Price Index for Oct 2021 (ONS, United Kingdom) at 8.00 % (vs 6.70 % prior), above consensus estimate of 7.30 %

- United Kingdom, Output Prices, Manufacturing other than food, beverages, tobacco and petroleum products, Change P/P, Price Index for Oct 2021 (ONS, United Kingdom) at 0.70 % (vs 0.50 % prior)

- United Kingdom, Output Prices, Manufacturing other than food, beverages, tobacco and petroleum products, Change Y/Y, Price Index for Oct 2021 (ONS, United Kingdom) at 6.50 % (vs 5.90 % prior)

- United Kingdom, Retail Prices, All items (RPI), Change P/P for Oct 2021 (ONS, United Kingdom) at 1.10 % (vs 0.40 % prior), above consensus estimate of 0.80 %

- United Kingdom, Retail Prices, All items (RPI), Change Y/Y for Oct 2021 (ONS, United Kingdom) at 6.00 % (vs 4.90 % prior), above consensus estimate of 5.70 %

- United Kingdom, Retail Prices, All items excluding mortgage interest payments (RPIX), Change Y/Y for Oct 2021 (ONS, United Kingdom) at 6.10 % (vs 5.00 % prior)

- United States, Building Permits for Oct 2021 (U.S. Census Bureau) at 1.65 Mln (vs 1.59 Mln prior), above consensus estimate of 1.64 Mln

- United States, Housing Starts for Oct 2021 (U.S. Census Bureau) at 1.52 Mln (vs 1.56 Mln prior), below consensus estimate of 1.58 Mln

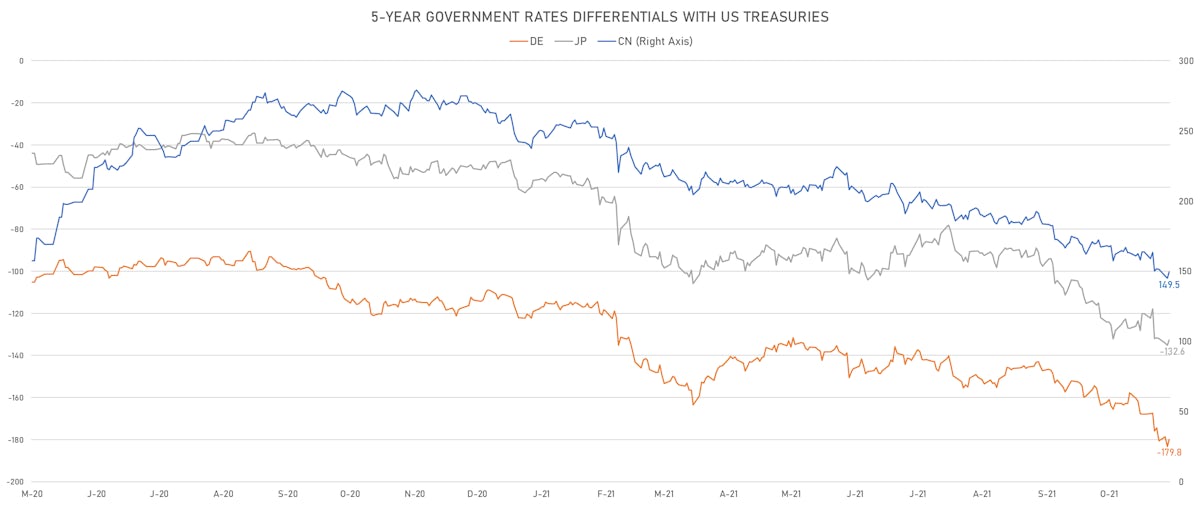

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -4.5 bp at 178.9 bp (YTD change: +67.8 bp)

- US-JAPAN: -4.8 bp at 130.5 bp (YTD change: +82.2 bp)

- US-CHINA: -5.7 bp at -150.6 bp (YTD change: +106.5 bp)

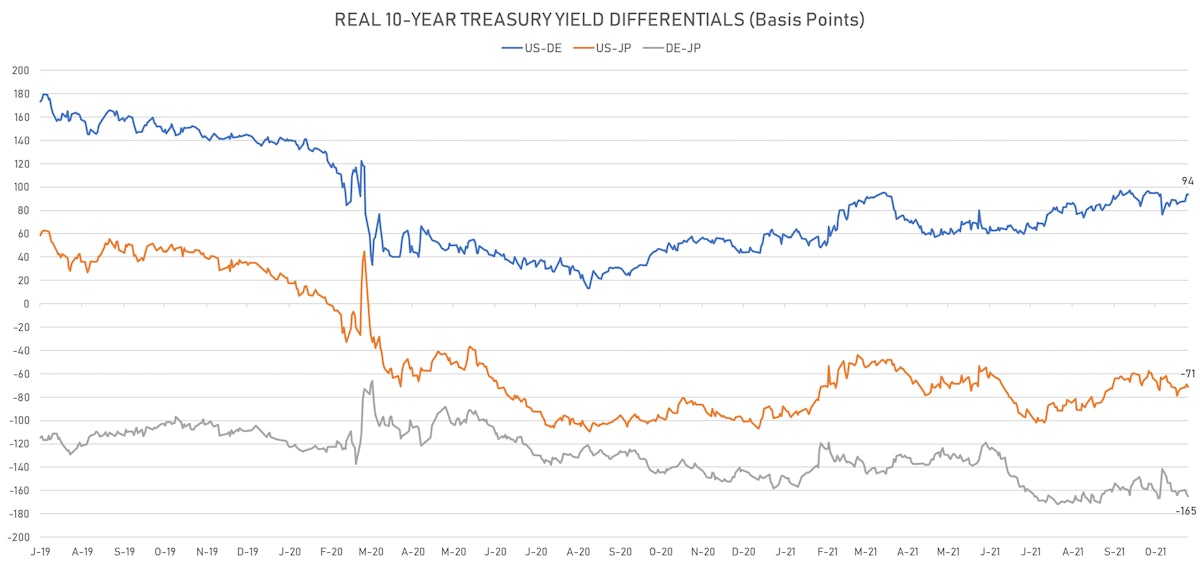

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.2 bp at 93.7 bp (YTD change: +47.6bp)

- US-JAPAN: -1.9 bp at -71.1 bp (YTD change: +30.4bp)

- JAPAN-GERMANY: +2.1 bp at 164.8 bp (YTD change: +17.2bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.93, up 0.39 (YTD: -0.24)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.49, down -0.2 (YTD: -0.2)

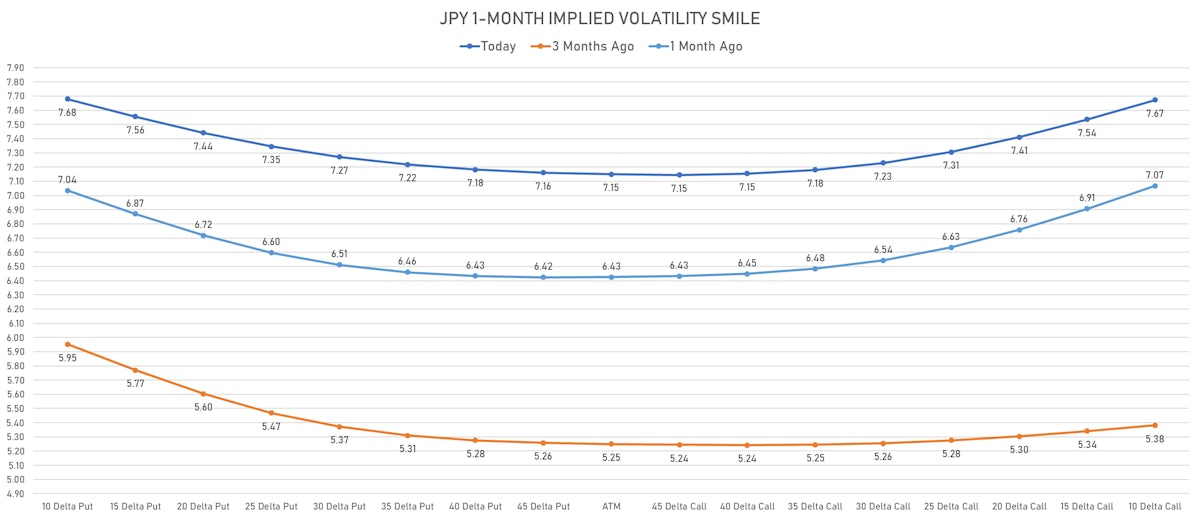

- Japanese Yen 1M ATM IV currently at 7.00, up 0.2 (YTD: +0.9)

- Offshore Yuan 1M ATM IV currently at 3.65, up 0.1 (YTD: -2.3)

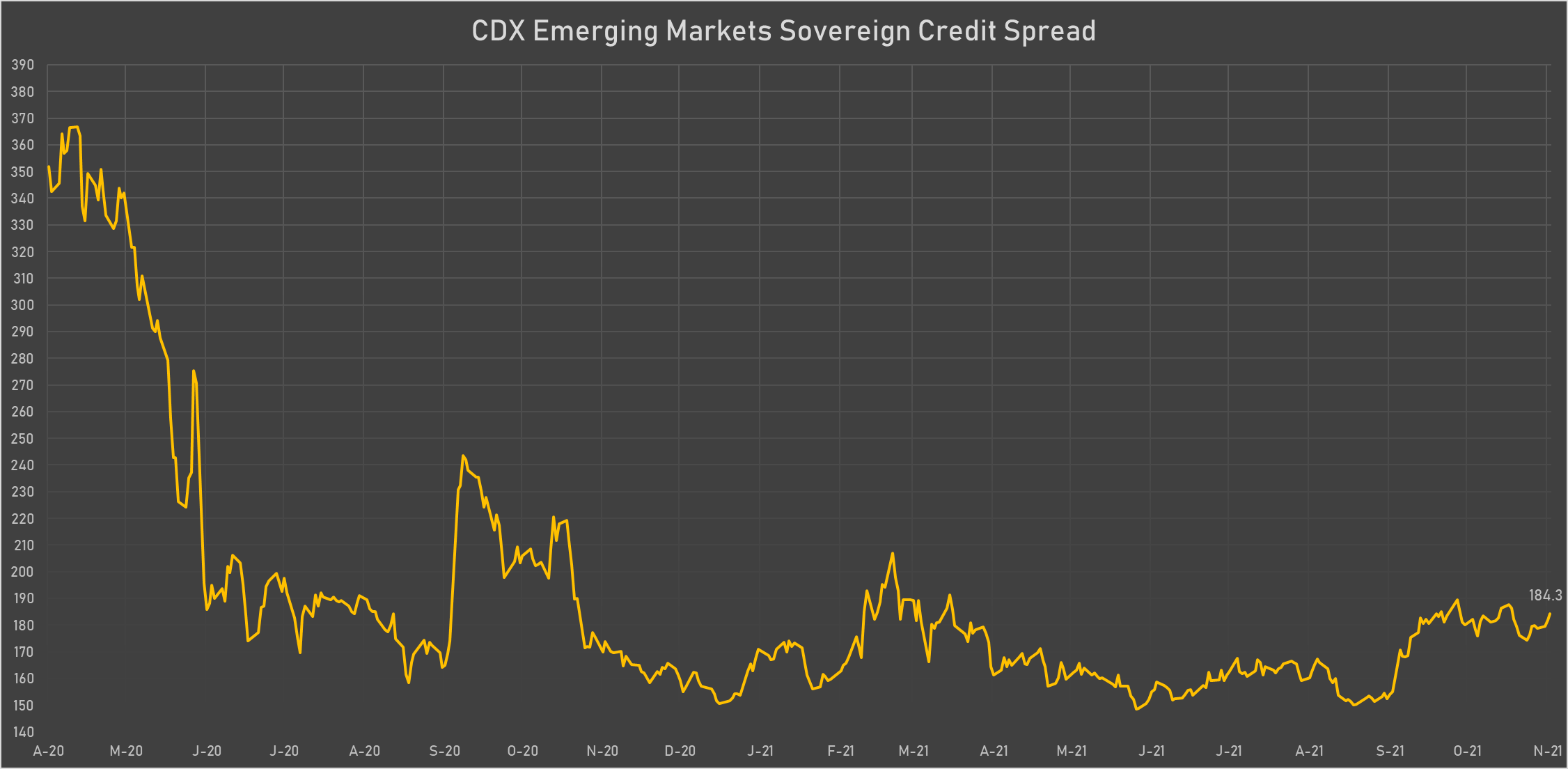

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Indonesia (rated BBB): down 2.6 basis points to 79 bp (1Y range: 66-94bp)

- Russia (rated BBB): down 2.3 basis points to 98 bp (1Y range: 72-117bp)

- Morocco (rated BB+): down 0.9 basis points to 87 bp (1Y range: 84-108bp)

- China (rated A+): down 0.7 basis points to 51 bp (1Y range: 27-58bp)

- Peru (rated BBB): up 0.9 basis points to 88 bp (1Y range: 52-105bp)

- South Africa (rated BB-): up 2.9 basis points to 198 bp (1Y range: 178-241bp)

- Colombia (rated BB+): up 3.1 basis points to 178 bp (1Y range: 83-175bp)

- Chile (rated A-): up 9.0 basis points to 87 bp (1Y range: 43-89bp)

- Turkey (rated BB-): up 11.1 basis points to 424 bp (1Y range: 282-481bp)

- Argentina (rated CCC): up 28.6 basis points to 2,634 bp (1Y range: 1,071-2,698bp)

LARGEST FX MOVES TODAY

- Iceland Krona up 0.8% (YTD: -3.0%)

- Japanese Yen up 0.8% (YTD: -9.4%)

- Russian Rouble up 0.7% (YTD: +2.1%)

- Qatari Riyal down 0.6% (YTD: -0.6%)

- Pakistani rupee down 0.7% (YTD: -8.5%)

- Angolan Kwanza down 0.9% (YTD: +8.6%)

- Haiti Gourde down 1.0% (YTD: -26.8%)

- Chilean Peso down 2.1% (YTD: -14.4%)

- Turkish Lira down 5.2% (YTD: -31.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 41.0%

- New zambian kwacha up 20.3%

- Haiti Gourde down 26.8%

- Turkish Lira down 31.8%

- Surinamese dollar down 34.1%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 75.5%