FX

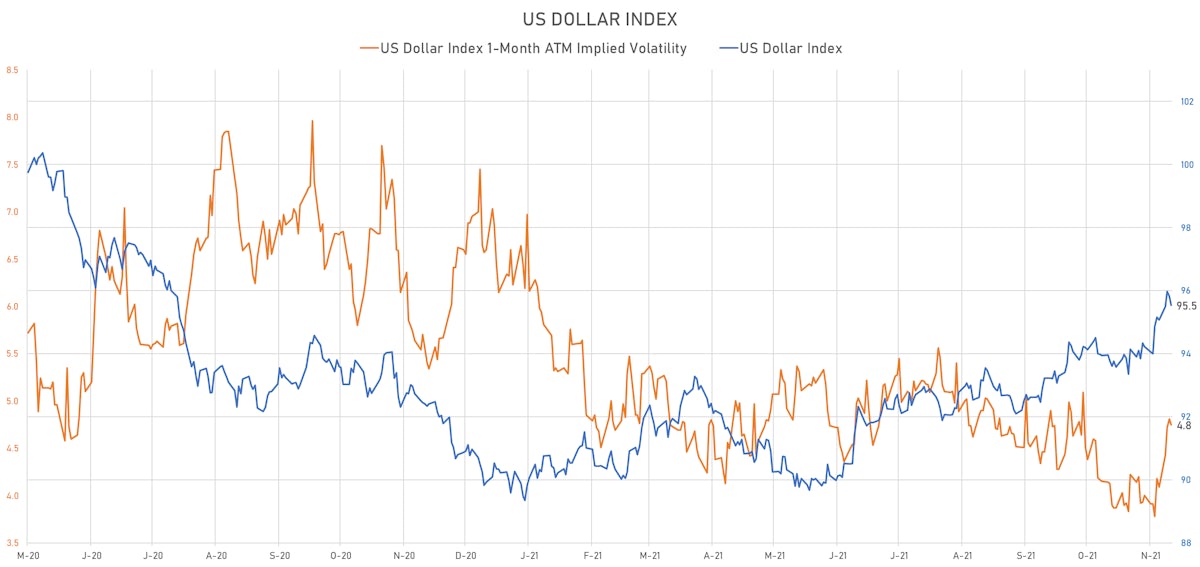

Modest Weakness In The USD, With Front Rates Differentials Helping The Euro Rebound

A 100bp cut in the Turkish central bank policy rate (despite high local inflation and a wide trade deficit) took the lira for a little dive, down over 3% against the dollar today, while Turkish sovereign USD 5Y CDS spreads were about 21bp wider

Published ET

Turkish Lira Spot Rate & Turkish Government 5Y USD CDS Mid-Spread | Source: Refinitiv

QUICK SUMMARY

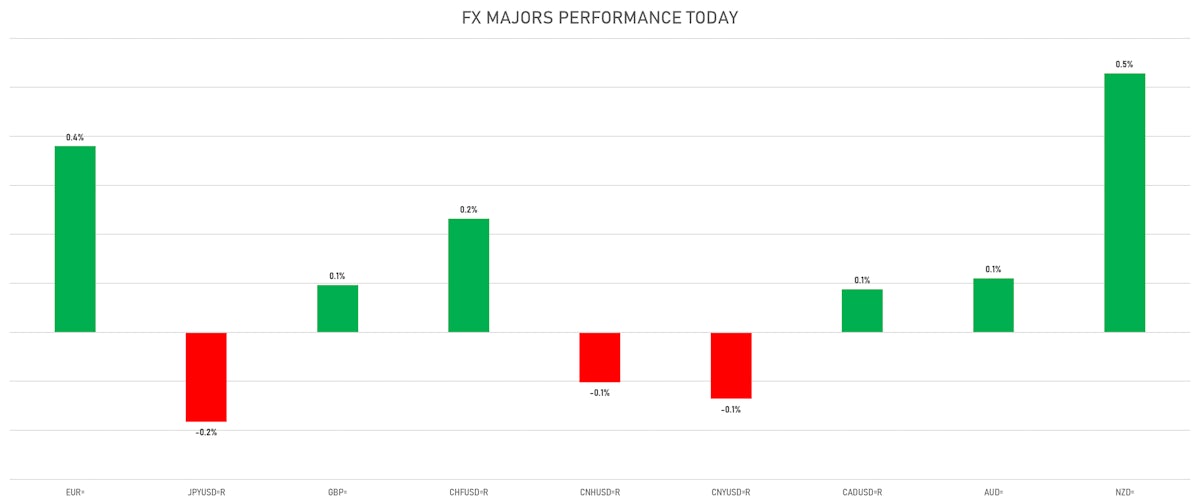

- The US Dollar Index is down -0.30% at 95.53 (YTD: +6.17%)

- Euro up 0.38% at 1.1362 (YTD: -7.0%)

- Yen down 0.18% at 114.32 (YTD: -9.7%)

- Onshore Yuan down 0.14% at 6.3851 (YTD: +2.2%)

- Swiss franc up 0.23% at 0.9261 (YTD: -4.4%)

- Sterling up 0.10% at 1.3493 (YTD: -1.3%)

- Canadian dollar up 0.09% at 1.2599 (YTD: +1.1%)

- Australian dollar up 0.11% at 0.7274 (YTD: -5.5%)

- NZ dollar up 0.53% at 0.7034 (YTD: -2.1%)

MACRO DATA RELEASES

- Chile, GDP, Change Y/Y for Q3 2021 (Central Bank, Chile) at 17.20 % (vs 18.10 % prior), below consensus estimate of 17.60 %

- Indonesia, Policy Rates, 7-Day Reverse Repo for Nov 2021 (Bank Indonesia) at 3.50 % (vs 3.50 % prior), in line with consensus

- Indonesia, Policy Rates, Deposit Facility Rate for Nov 2021 (Bank Indonesia) at 2.75 % (vs 2.75 % prior), in line with consensus

- Indonesia, Policy Rates, Lending Facility Rate for Nov 2021 (Bank Indonesia) at 4.25 % (vs 4.25 % prior), in line with consensus

- Japan, CPI, Nationwide, All Items, Change Y/Y for Oct 2021 (MIC, Japan) at 0.10 % (vs 0.20 % prior)

- Japan, CPI, Nationwide, All Items, Less fresh food, Change Y/Y for Oct 2021 (MIC, Japan) at 0.10 % (vs 0.10 % prior), in line with consensus

- Nigeria, GDP, Growth rate, Change Y/Y for Q3 2021 (NBS, Nigeria) at 4.03 % (vs 5.01 % prior), above consensus estimate of 2.50 %

- Philippines, Policy Rates, Reverse Repo, O/N (Borrowing) Key Rate for 18 Nov (Bangko Sentral ng) at 2.00 % (vs 2.00 % prior), in line with consensus

- South Africa, Policy Rates, Prime Overdraft Rate for Nov 2021 (SA Reserve Bank) at 7.25 % (vs 7.00 % prior)

- South Africa, Policy Rates, Repo Rate for Nov 2021 (SA Reserve Bank) at 3.75 % (vs 3.50 % prior), above consensus estimate of 3.50 %

- Sweden, Unemployment, Rate, Total (SCB), 15-74 years for Oct 2021 (SCB, Sweden) at 7.60 % (vs 8.20 % prior)

- Thailand, Exports, Total, customs basis, Change Y/Y for Oct 2021 (Bank of Thailand) at 17.35 % (vs 17.11 % prior), above consensus estimate of 17.00 %

- Thailand, Imports, Total, customs basis, Change Y/Y for Oct 2021 (Bank of Thailand) at 34.64 % (vs 30.31 % prior), above consensus estimate of 32.30 %

- Thailand, Trade Balance, Total, customs basis (USD), Current Prices for Oct 2021 (Bank of Thailand) at -0.37 Bln USD (vs 0.61 Bln USD prior), below consensus estimate of -0.23 Bln USD

- Turkey, Policy Rates, CBRT OVERNIGHT BORROWING RATE (EP) for Nov 2021 (Central Bank, Turkey) at 13.50 % (vs 14.50 % prior)

- Turkey, Policy Rates, Central Bank 1 Week Repo Lending Rate for Nov 2021 (Central Bank, Turkey) at 15.00 % (vs 16.00 % prior), in line with consensus

- Turkey, Policy Rates, Late Liquidity Window Rate for Nov 2021 (Central Bank, Turkey) at 19.50 % (vs 20.50 % prior)

- Turkey, Policy Rates, Overnight Lending Rate for Nov 2021 (Central Bank, Turkey) at 16.50 % (vs 17.50 % prior)

- United States, Jobless Claims, National, Continued for W 06 Nov (U.S. Dept. of Labor) at 2.08 Mln (vs 2.16 Mln prior), below consensus estimate of 2.12 Mln

- United States, Jobless Claims, National, Initial for W 13 Nov (U.S. Dept. of Labor) at 268.00 k (vs 267.00 k prior), above consensus estimate of 260.00 k

- United States, Philadelphia Fed, General business activity for Nov 2021 (FED, Philadelphia) at 39.00 (vs 23.80 prior), above consensus estimate of 24.00

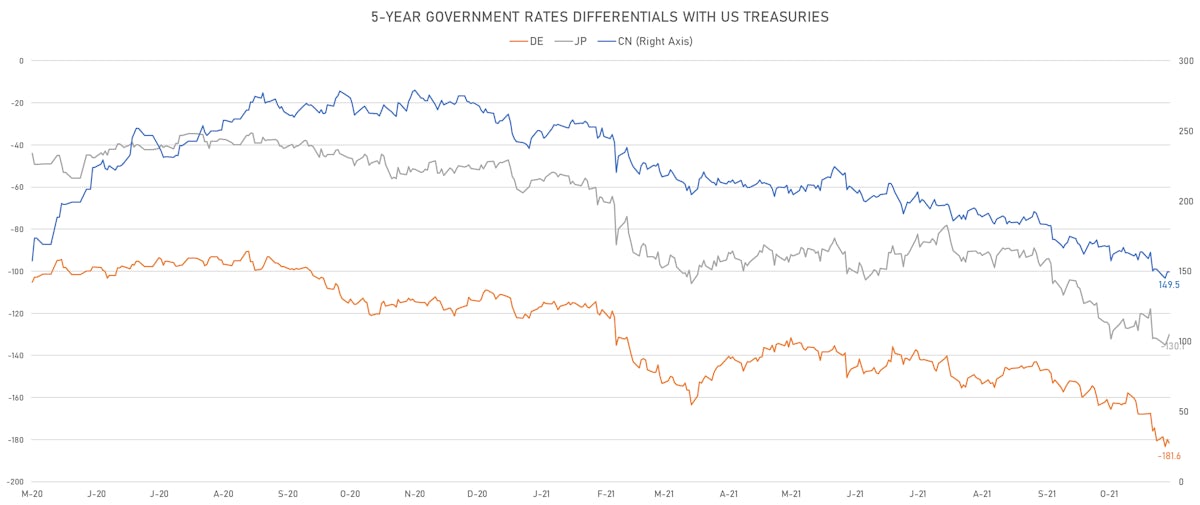

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.4 bp at 183.2 bp (YTD change: +72.1 bp)

- US-JAPAN: -1.0 bp at 131.6 bp (YTD change: +83.3 bp)

- US-CHINA: +1.6 bp at -147.9 bp (YTD change: +109.2 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.4 bp at 90.3 bp (YTD change: +44.2bp)

- US-JAPAN: -2.9 bp at -74.0 bp (YTD change: +27.5bp)

- JAPAN-GERMANY: -0.5 bp at 164.3 bp (YTD change: +16.7bp)

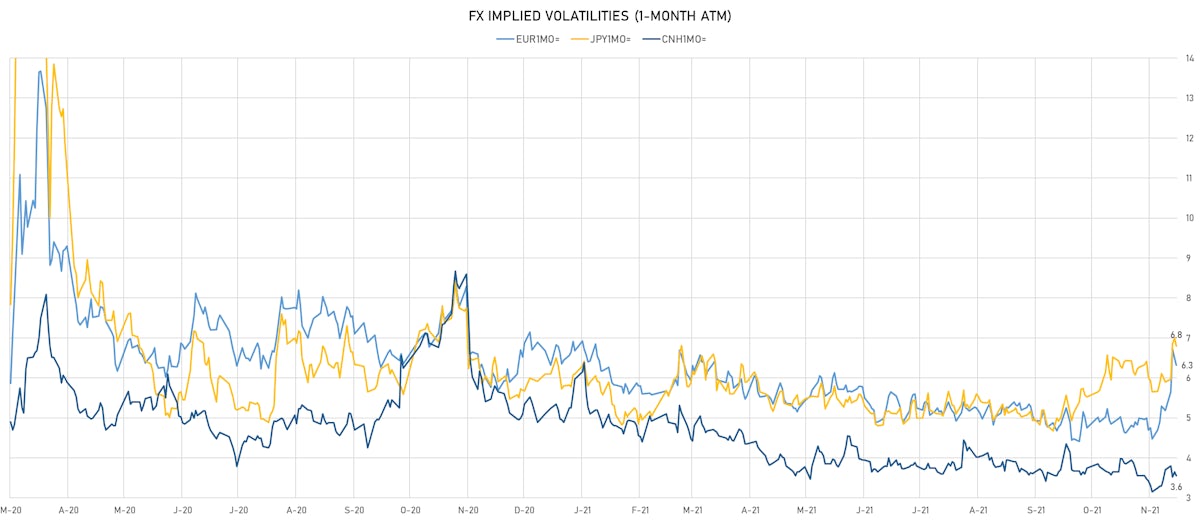

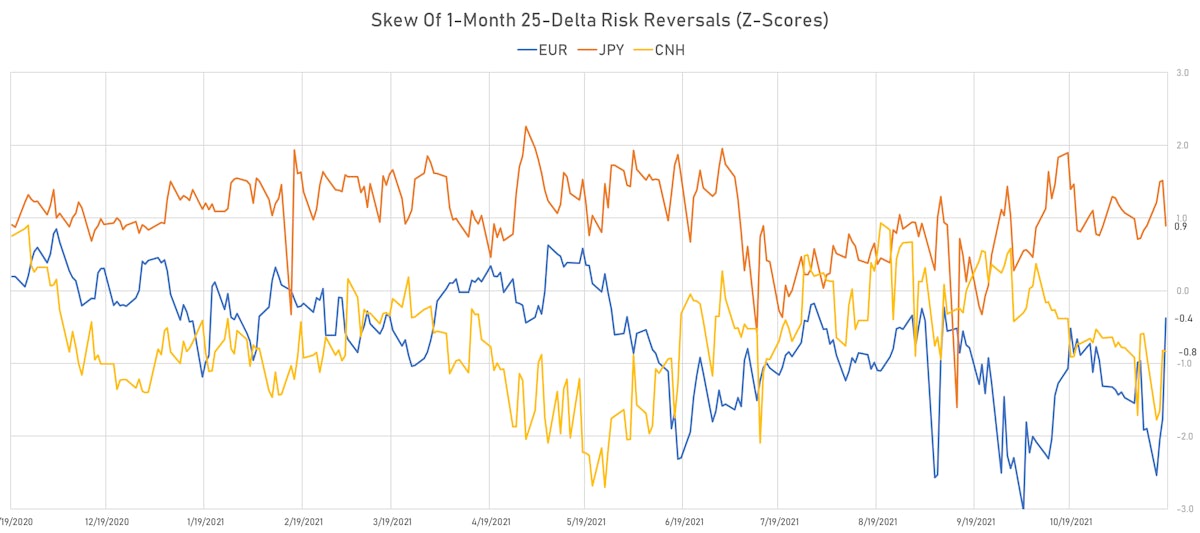

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.71, down -0.22 (YTD: -0.46)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.33, down -0.2 (YTD: -0.4)

- Japanese Yen 1M ATM IV currently at 6.80, down -0.2 (YTD: +0.7)

- Offshore Yuan 1M ATM IV currently at 3.55, down -0.1 (YTD: -2.4)

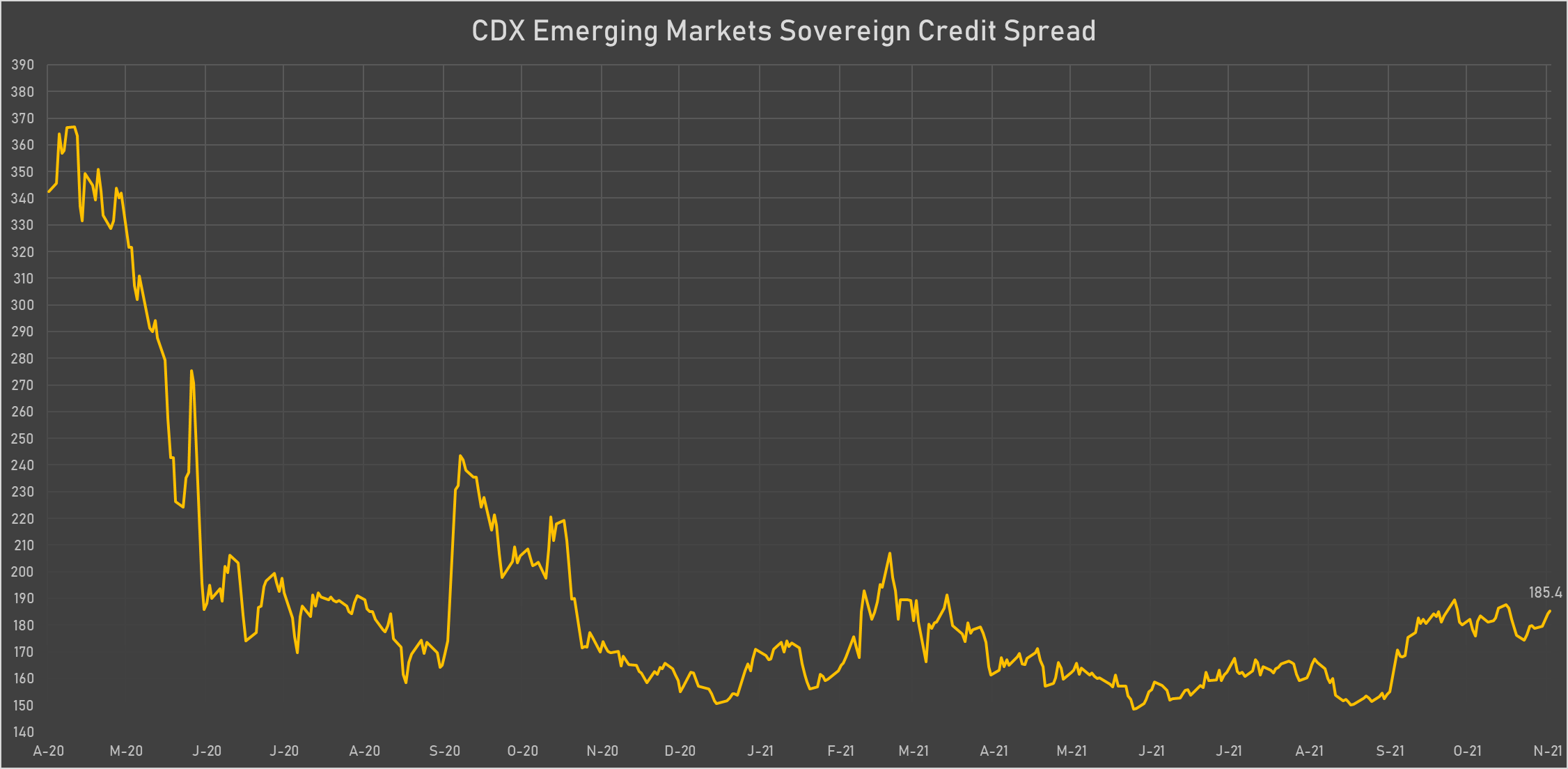

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- China (rated A+): down 1.2 basis points to 50 bp (1Y range: 27-58bp)

- Indonesia (rated BBB): down 1.1 basis points to 78 bp (1Y range: 66-94bp)

- Mexico (rated BBB-): down 1.0 basis points to 96 bp (1Y range: 79-115bp)

- Morocco (rated BB+): down 0.7 basis points to 87 bp (1Y range: 84-108bp)

- Chile (rated A-): up 0.6 basis points to 87 bp (1Y range: 43-89bp)

- South Africa (rated BB-): up 1.5 basis points to 200 bp (1Y range: 178-241bp)

- Russia (rated BBB): up 1.6 basis points to 100 bp (1Y range: 72-117bp)

- Colombia (rated BB+): up 1.7 basis points to 180 bp (1Y range: 83-178bp)

- Bahrain (rated B+): up 2.7 basis points to 271 bp (1Y range: 159-307bp)

- Turkey (rated BB-): up 21.3 basis points to 446 bp (1Y range: 282-481bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 1.0% (YTD: -26.1%)

- Iceland Krona up 1.0% (YTD: -2.3%)

- Malawi Kwacha down 0.8% (YTD: -6.3%)

- CFA Franc BEAC down 0.9% (YTD: -6.7%)

- South Africa Rand down 0.9% (YTD: -6.1%)

- Belize Dollar down 1.1% (YTD: 0.0%)

- Botswana Pula down 1.2% (YTD: -7.8%)

- Venezuela Bolivar down 1.3% (YTD: -75.8%)

- Barbados Dollar down 1.5% (YTD: 0.0%)

- Turkish Lira down 3.2% (YTD: -33.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles Rupee up 61.4%

- New Zambian Kwacha up 20.1%

- Haiti Gourde down 26.1%

- Turkish Lira down 33.0%

- Surinamese Dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 75.8%

- Sudanese Pound down 87.5%