FX

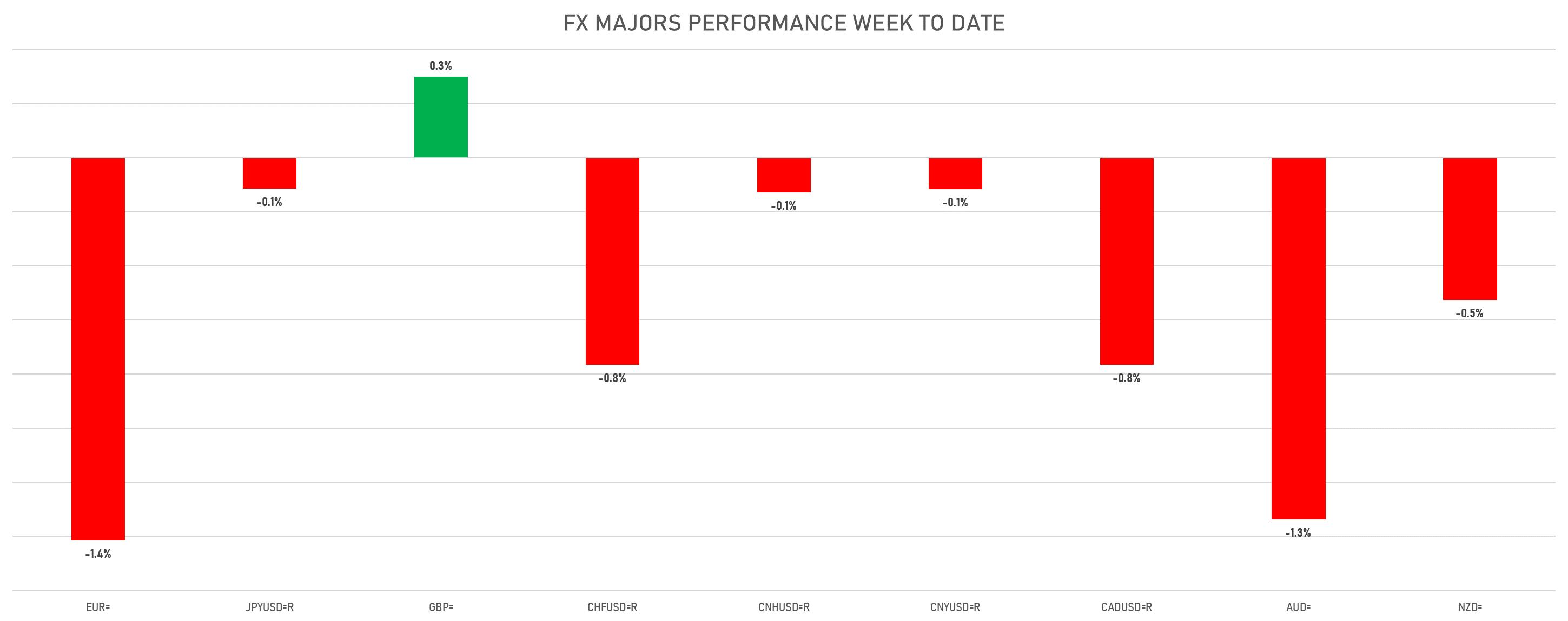

Among Majors, The Euro Was The Big Loser This Week, Falling 1.4% Against The US Dollar

The divergence in the monetary policies of the Fed and ECB were amplified on Friday by the full lockdown in Austria, which pushed short rates further apart

Published ET

The EUR/USD spot rate has been moving in tandem with short rates differentials recently | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

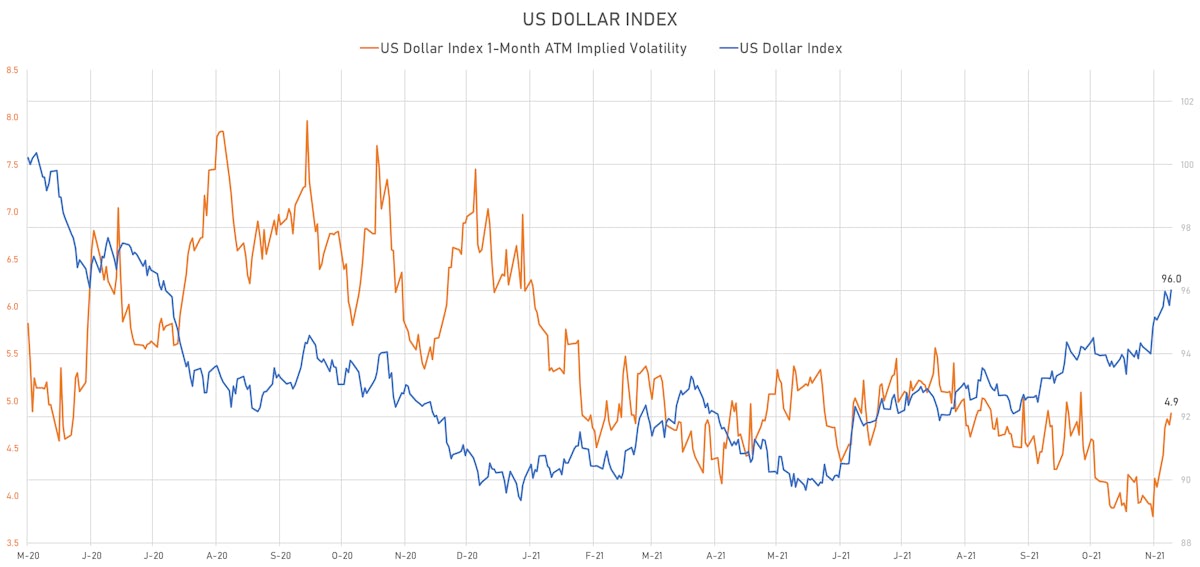

- The US Dollar Index is up 0.51% at 96.02 (YTD: +6.71%)

- Euro down 0.71% at 1.1288 (YTD: -7.6%)

- Yen up 0.23% at 113.98 (YTD: -9.4%)

- Onshore Yuan down 0.01% at 6.3863 (YTD: +2.2%)

- Swiss franc down 0.22% at 0.9281 (YTD: -4.6%)

- Sterling down 0.26% at 1.3453 (YTD: -1.6%)

- Canadian dollar down 0.29% at 1.2638 (YTD: +0.8%)

- Australian dollar down 0.62% at 0.7234 (YTD: -6.0%)

- NZ dollar down 0.36% at 0.7010 (YTD: -2.4%)

MACRO DATA RELEASES

- Canada, Retail Sales, Change P/P for Sep 2021 (CANSIM, Canada) at -0.60 % (vs 2.10 % prior), above consensus estimate of -1.70 %

- Canada, Retail Sales, Retail Sales Ex-Autos MM, Change P/P for Sep 2021 (CANSIM, Canada) at -0.20 % (vs 2.80 % prior), above consensus estimate of -1.00 %

- Germany, Producer Prices, Total industry, Change P/P, Price Index for Oct 2021 (Destatis) at 3.80 % (vs 2.30 % prior), above consensus estimate of 1.90 %

- Germany, Producer Prices, Total industry, Change Y/Y, Price Index for Oct 2021 (Destatis) at 18.40 % (vs 14.20 % prior), above consensus estimate of 16.20 %

- Norway, GDP, Change P/P for Q3 2021 (Statistics Norway) at 3.80 % (vs 1.10 % prior), above consensus estimate of 3.30 %

- Norway, GDP, Mainland Norway, Change P/P for Q3 2021 (Statistics Norway) at 2.60 % (vs 1.40 % prior), above consensus estimate of 2.50 %

- Norway, Gross Domestic Product, Change P/P for Sep 2021 (Statistics Norway) at 2.20 % (vs 2.00 % prior), above consensus estimate of 0.80 %

- Norway, Gross Domestic Product, Mainland Norway, Change P/P for Sep 2021 (Statistics Norway) at 0.60 % (vs 1.10 % prior), above consensus estimate of 0.40 %

- Poland, Employment, Average paid in enterprise sector, Change Y/Y for Oct 2021 (CSO, Poland) at 0.50 % (vs 0.60 % prior), in line with consensus

- Poland, Wages and Salaries, Average Monthly, Gross, Nominal, Enterprise sector, total, Change Y/Y, Current Prices for Oct 2021 (CSO, Poland) at 8.40 % (vs 8.70 % prior), below consensus estimate of 9.00 %

- Slovakia, Unemployment, Rate, Total, registered for Oct 2021 (UPSVAR, Slovakia) at 6.80 % (vs 7.10 % prior), below consensus estimate of 7.00 %

- United Kingdom, GfK Consumer confidence index for Nov 2021 (GfK Group) at -14.00 (vs -17.00 prior), above consensus estimate of -18.00

- United Kingdom, Retail Sales, Change, Total including automotive fuel, Change Y/Y for Oct 2021 (ONS, United Kingdom) at -1.30 % (vs -1.30 % prior), above consensus estimate of -2.00 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change P/P for Oct 2021 (ONS, United Kingdom) at 1.60 % (vs -0.60 % prior), above consensus estimate of 0.60 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change Y/Y for Oct 2021 (ONS, United Kingdom) at -1.90 % (vs -2.60 % prior), above consensus estimate of -3.10 %

- United Kingdom, Retail Sales, Total including automotive fuel, Change P/P for Oct 2021 (ONS, United Kingdom) at 0.80 % (vs -0.20 % prior), above consensus estimate of 0.50 %

LARGEST FX MOVES TODAY

- Samoa Tala up 1.1% (YTD: -0.9%)

- Haiti Gourde up 1.0% (YTD: -25.4%)

- Bangladesh Taka down 1.1% (YTD: -2.1%)

- Pacific Franc down 1.2% (YTD: -8.1%)

- Norwegian Krone down 1.2% (YTD: -3.9%)

- Czech Koruna down 1.3% (YTD: -4.7%)

- Polish Zloty down 1.3% (YTD: -10.2%)

- Hungarian Forint down 1.8% (YTD: -8.9%)

- Turkish Lira down 2.1% (YTD: -33.8%)

- Rwanda Franc down 2.9% (YTD: -1.7%)

WEEKLY CFTC DATA

- ALL: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduction in net long US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: increase in net long US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

LARGEST FX MOVES THIS WEEK

- Eritrean Nakfa down 2.6% (YTD: -2.6%)

- Nicaragua Cordoba down 2.6% (YTD: -3.3%)

- Brazilian Real down 2.8% (YTD: -7.5%)

- Namibian Dollar down 2.8% (YTD: -6.4%)

- South Africa Rand down 3.0% (YTD: -6.5%)

- Lesotho Loti down 3.1% (YTD: -6.5%)

- Swaziland Lilageni down 3.1% (YTD: -6.5%)

- Chilean Peso up 3.8% (YTD: -14.2%)

- Turkish Lira down 10.4% (YTD: -33.8%)

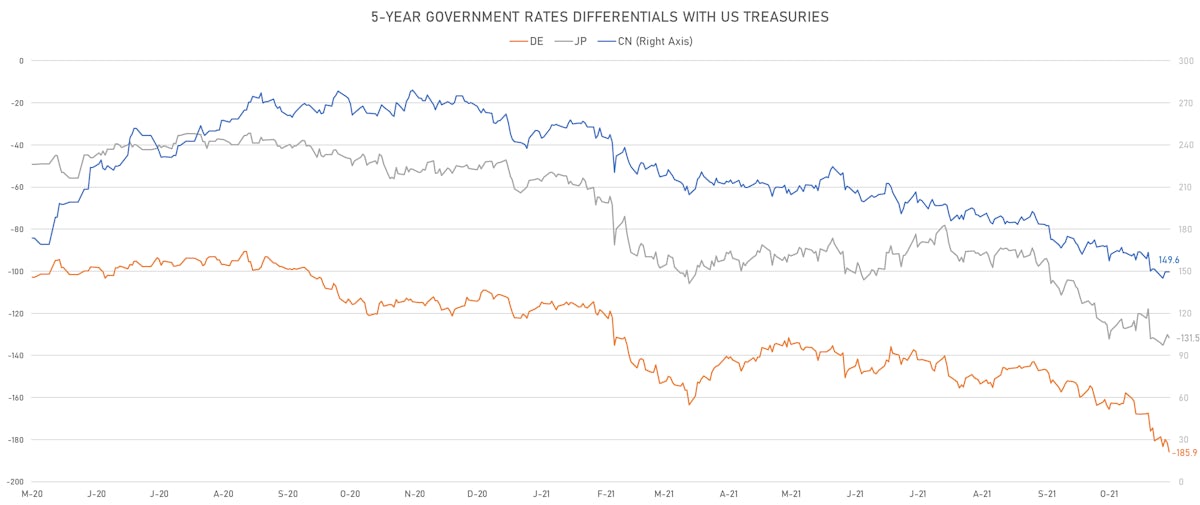

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.3 bp today at 185.9 bp (YTD change: +74.8 bp)

- US-JAPAN: +1.4 bp at 131.5 bp (YTD change: +83.2 bp)

- US-CHINA: -0.1 bp at -149.6 bp (YTD change: +107.5 bp)

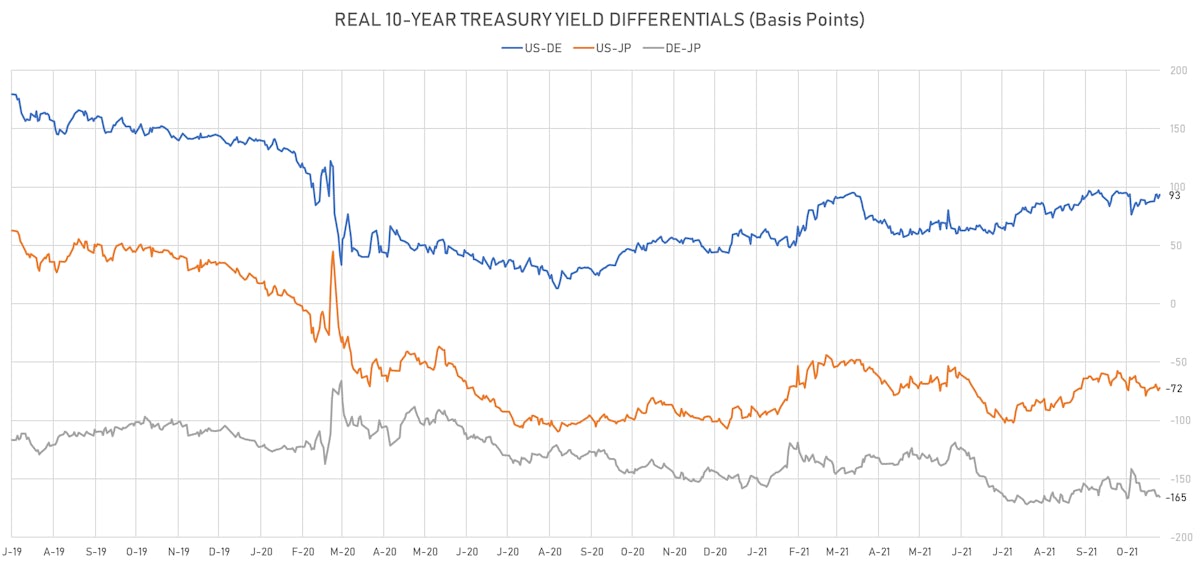

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.1 bp at 93.4 bp (YTD change: +47.3bp)

- US-JAPAN: +2.2 bp at -71.8 bp (YTD change: +29.7bp)

- JAPAN-GERMANY: +0.9 bp at 165.2 bp (YTD change: +17.6bp)

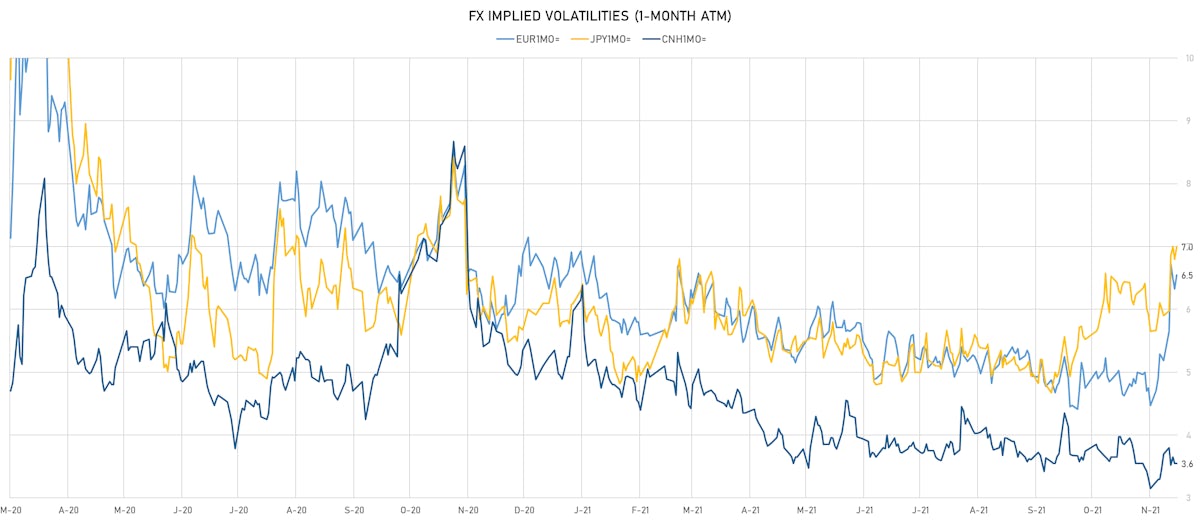

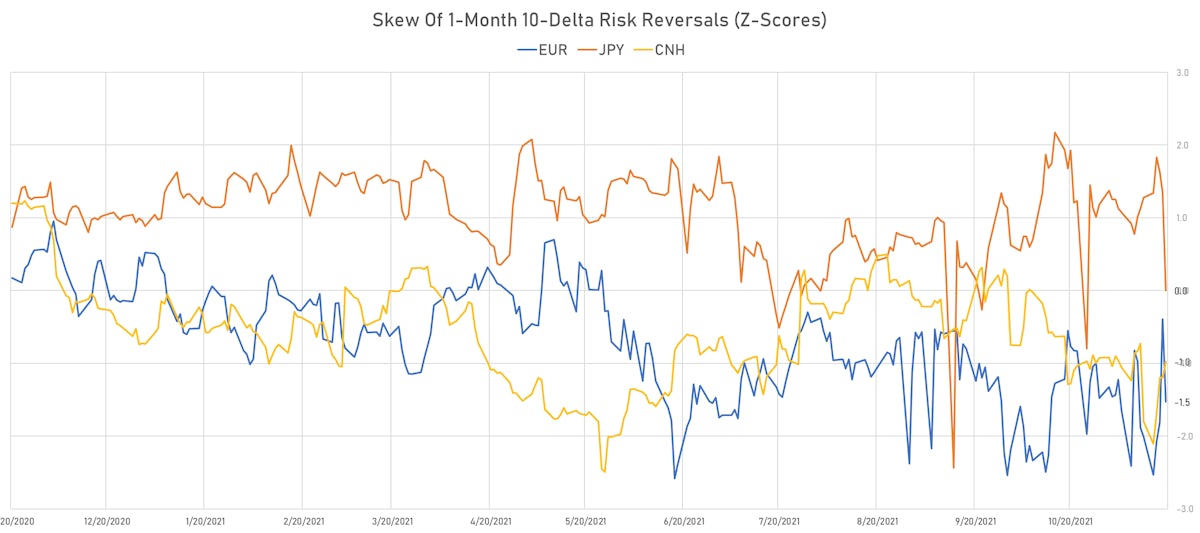

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.74, up 0.03 (YTD: -0.43)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.55, up 0.2 (YTD: -0.1)

- Japanese Yen 1M ATM IV currently at 7.00, up 0.2 (YTD: +0.9)

- Offshore Yuan 1M ATM IV unchanged at 3.55 (YTD: -2.4)

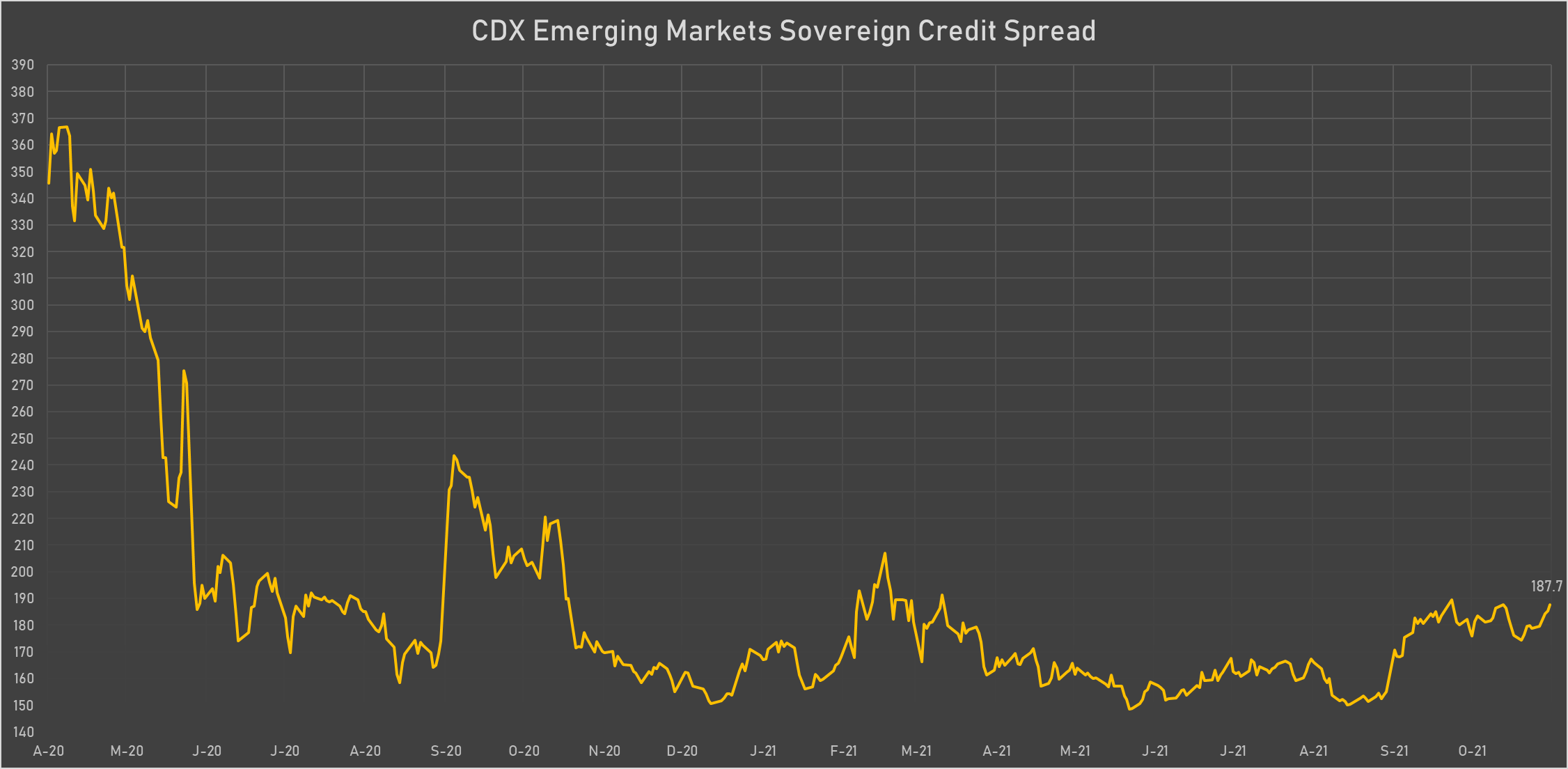

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 29.8 basis points to 2,594 bp (1Y range: 1,074-2,698bp)

- Bahrain (rated B+): down 5.8 basis points to 266 bp (1Y range: 159-307bp)

- Vietnam (rated BB): down 2.2 basis points to 98 bp (1Y range: 89-112bp)

- Philippines (rated BBB): down 2.1 basis points to 62 bp (1Y range: 34-65bp)

- Malaysia (rated BBB+): down 1.4 basis points to 56 bp (1Y range: 34-64bp)

- Indonesia (rated BBB): down 1.4 basis points to 77 bp (1Y range: 66-94bp)

- Russia (rated BBB): up 1.1 basis points to 101 bp (1Y range: 72-117bp)

- Chile (rated A-): up 1.1 basis points to 89 bp (1Y range: 43-89bp)

- South Africa (rated BB-): up 4.1 basis points to 204 bp (1Y range: 178-241bp)

- Egypt (rated B+): up 18.9 basis points to 463 bp (1Y range: 283-464bp)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 40.6%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 25.4%

- Turkish Lira down 33.8%

- Surinamese dollar down 34.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 75.5%