FX

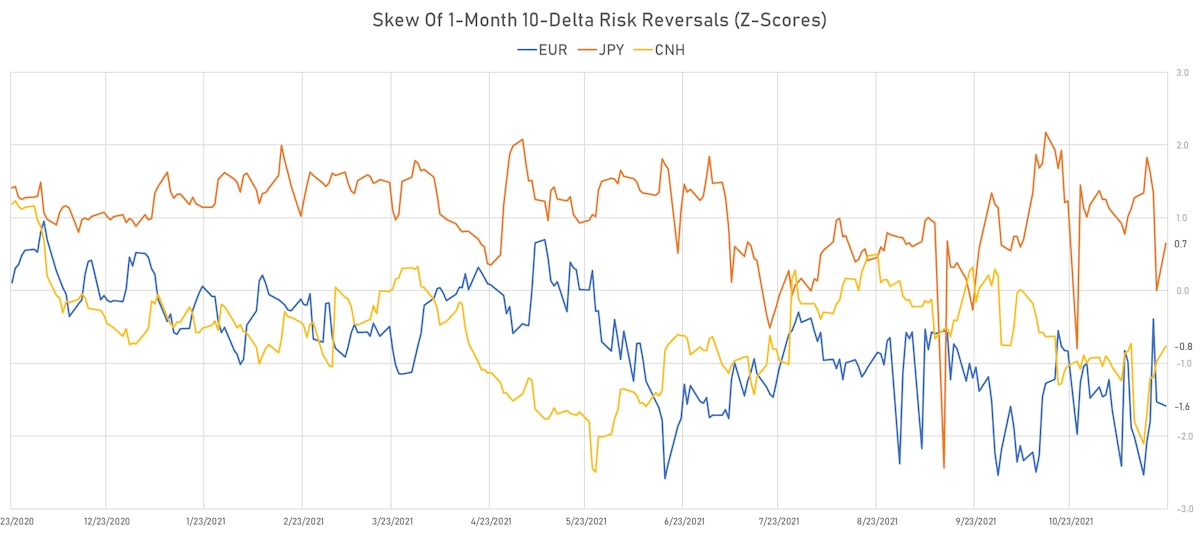

US Dollar Makes Large Gains Against Major Currencies, As Considerable Volatilities In Rates Differentials Seep Into FX

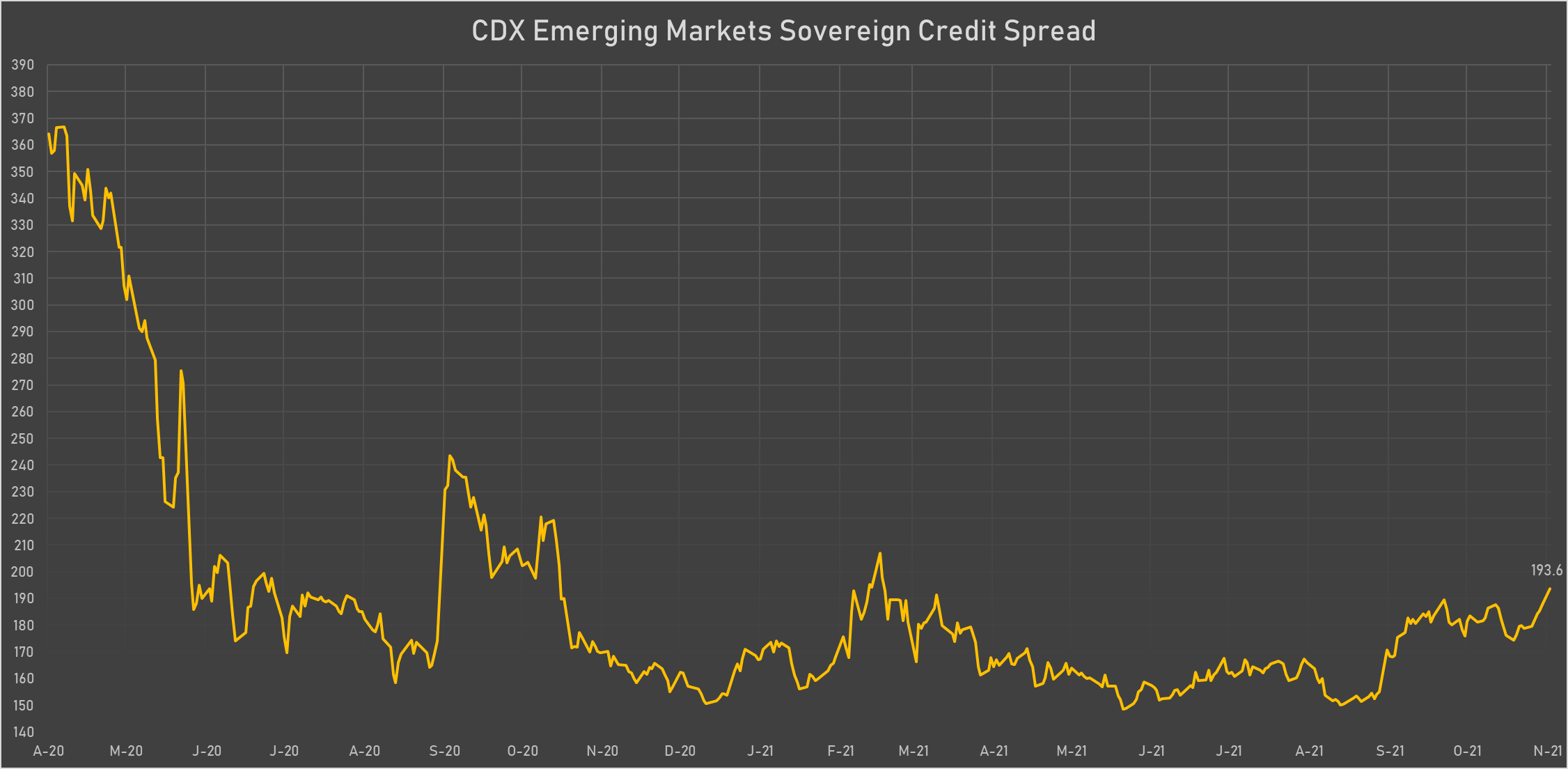

EM currencies weakened and CDS spreads widened as they usually do when the dollar strengthens; a notable exception was the Chilean peso, up 2% today as the extreme left came in second place after the first round of the presidential election, with a conservative candidate in the lead

Published ET

CitiFX Long-Term Macro Risk Index | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

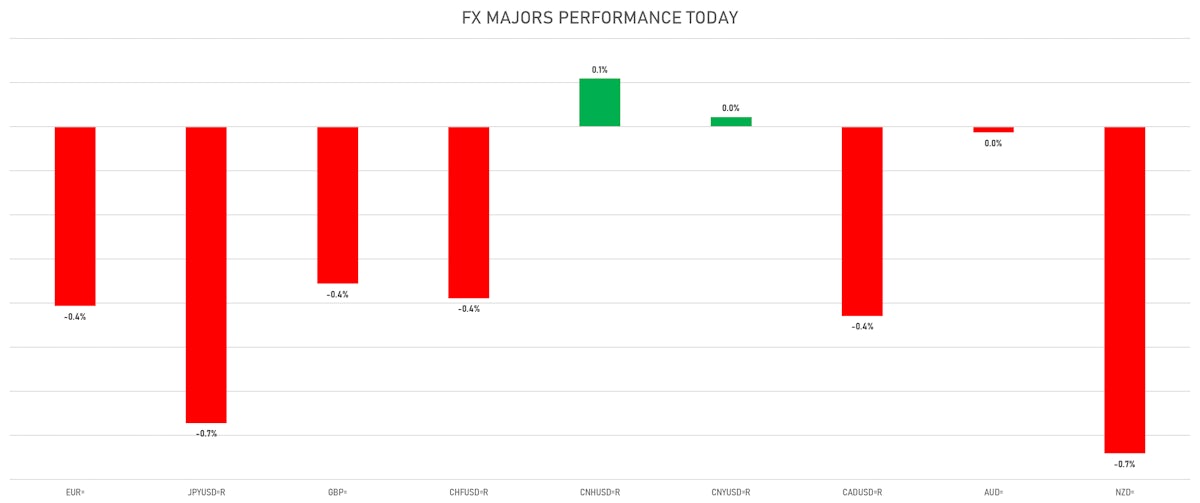

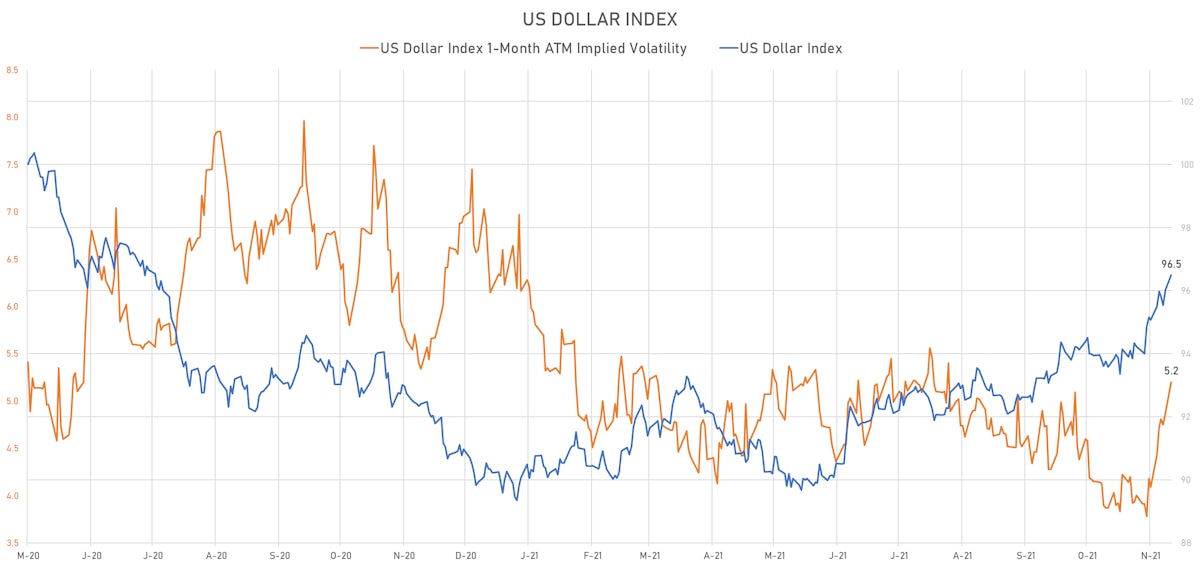

- The US Dollar Index is up 0.49% at 96.49 (YTD: +7.24%)

- Euro down 0.41% at 1.1242 (YTD: -8.0%)

- Yen down 0.67% at 114.76 (YTD: -10.0%)

- Onshore Yuan up 0.02% at 6.3842 (YTD: +2.2%)

- Swiss franc down 0.39% at 0.9320 (YTD: -5.0%)

- Sterling down 0.36% at 1.3404 (YTD: -2.0%)

- Canadian dollar down 0.43% at 1.2695 (YTD: +0.3%)

- Australian dollar down 0.01% at 0.7233 (YTD: -6.0%)

- NZ dollar down 0.74% at 0.6958 (YTD: -3.2%)

MACRO DATA RELEASES

- Australia, Markit PMI, Composite for Nov 2021 (Markit Economics) at 55.00 (vs 52.10 prior)

- Australia, Markit PMI, Manufacturing for Nov 2021 (Markit Economics) at 58.50 (vs 58.20 prior)

- Australia, Markit PMI, Services for Nov 2021 (Markit Economics) at 55.00 (vs 51.80 prior)

- Denmark, Consumer confidence indicator for Nov 2021 (statbank.dk) at -2.00 (vs 3.30 prior)

- Euro Zone, EC Consumer Survey, All Respondents, Consumer Confidence Indicator, Balance for Nov 2021 (DG ECFIN, France) at -6.80 (vs -4.80 prior), below consensus estimate of -5.50

- Ghana, Policy Rates, Monetary Policy Rate, Methodology Break August 2015 for Nov 2021 (Bank of Ghana) at 14.50 % (vs 13.50 % prior), above consensus estimate of 13.50 %

- Israel, Policy Rates, Bank of Israel Headline Rate for Nov 2021 (Bank of Israel) at 0.10 % (vs 0.10 % prior), in line with consensus

- New Zealand, Retail Sales, Change P/P for Q3 2021 (Statistics, NZ) at -8.10 % (vs 3.30 % prior)

- New Zealand, Retail Sales, Change Y/Y, Price Index for Q3 2021 (Statistics, NZ) at -5.20 % (vs 33.30 % prior)

- Poland, Producer Prices, Total industry, Change Y/Y for Oct 2021 (CSO, Poland) at 11.80 % (vs 10.20 % prior), above consensus estimate of 10.80 %

- Poland, Production, Change Y/Y for Oct 2021 (CSO, Poland) at 7.80 % (vs 8.80 % prior), above consensus estimate of 5.30 %

- Taiwan, Export Orders Received, Change Y/Y for Oct 2021 (MoEA, Taiwan) at 14.60 % (vs 25.70 % prior), below consensus estimate of 22.80 %

- Taiwan, Unemployment, Rate for Oct 2021 (DGBAS, Taiwan) at 3.84 % (vs 3.92 % prior)

- United States, Existing-Home Sales, Single-Family and Condos, total for Oct 2021 (NAR, United States) at 6.34 Mln (vs 6.29 Mln prior), above consensus estimate of 6.20 Mln

- United States, Existing-Home Sales, Single-Family and Condos, total, Change P/P for Oct 2021 (NAR, United States) at 0.80 % (vs 7.00 % prior)

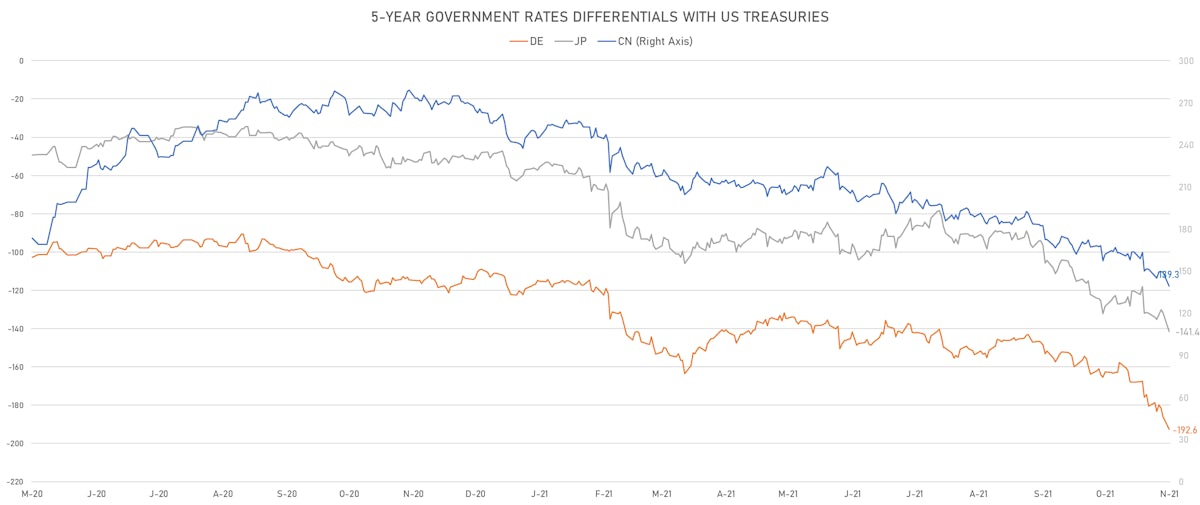

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +6.7 bp at 192.6 bp (YTD change: +81.6 bp)

- US-JAPAN: +9.9 bp at 141.4 bp (YTD change: +93.2 bp)

- US-CHINA: +9.3 bp at -140.3 bp (YTD change: +116.9 bp)

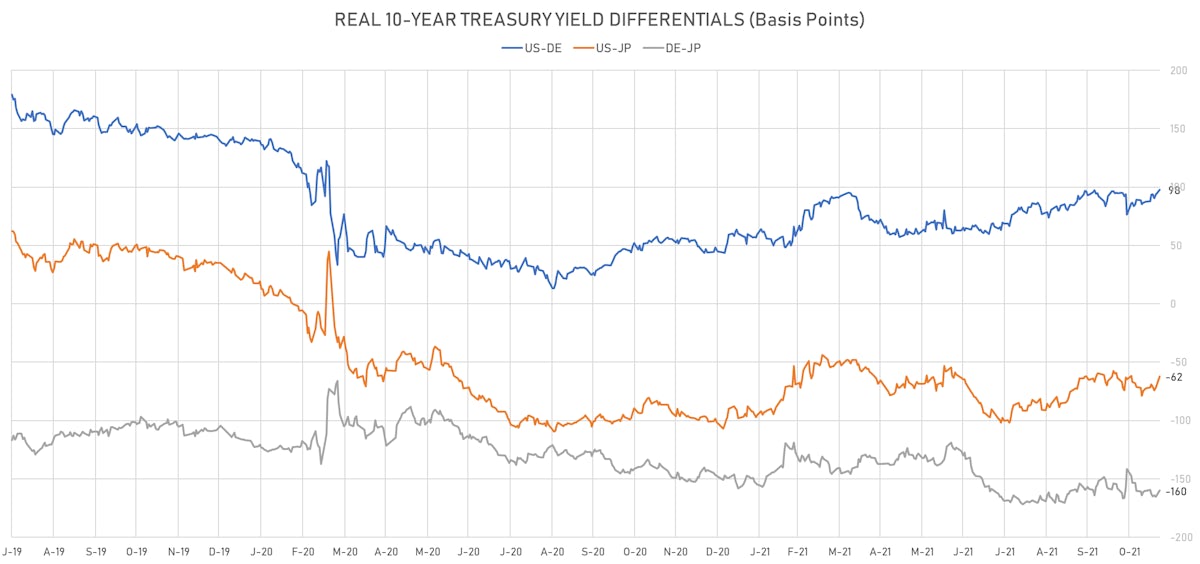

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.4 bp at 97.8 bp (YTD change: +51.7bp)

- US-JAPAN: +9.6 bp at -62.2 bp (YTD change: +39.3bp)

- JAPAN-GERMANY: -5.2 bp at 160.0 bp (YTD change: +12.4bp)

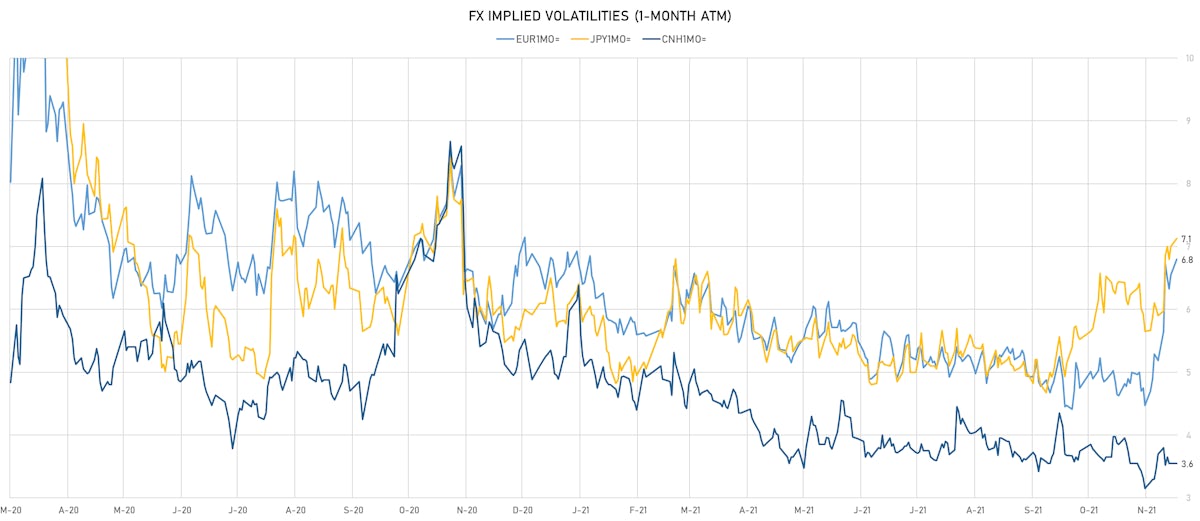

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.91, up 0.17 (YTD: -0.26)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.80, up 0.3 (YTD: +0.1)

- Japanese Yen 1M ATM IV currently at 7.13, up 0.1 (YTD: +1.0)

- Offshore Yuan 1M ATM IV unchanged at 3.55 (YTD: -2.4)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Chile (rated A-): down 5.6 basis points to 82 bp (1Y range: 43-89bp)

- Vietnam (rated BB): down 3.2 basis points to 97 bp (1Y range: 89-112bp)

- Philippines (rated BBB): down 3.1 basis points to 61 bp (1Y range: 34-65bp)

- Indonesia (rated BBB): down 2.5 basis points to 77 bp (1Y range: 66-94bp)

- Malaysia (rated BBB+): down 2.1 basis points to 56 bp (1Y range: 34-64bp)

- Mexico (rated BBB-): up 2.0 basis points to 98 bp (1Y range: 79-115bp)

- Oman (rated BB-): up 4.2 basis points to 240 bp (1Y range: 223-368bp)

- South Africa (rated BB-): up 12.9 basis points to 213 bp (1Y range: 178-241bp)

- Russia (rated BBB): up 13.0 basis points to 113 bp (1Y range: 72-117bp)

- Egypt (rated B+): up 29.3 basis points to 473 bp (1Y range: 283-464bp)

LARGEST FX MOVES TODAY

- Chilean Peso up 2.0% (YTD: -12.5%)

- Bangladesh Taka up 1.1% (YTD: -1.0%)

- Ukraine Hryvnia down 0.8% (YTD: +5.8%)

- Haiti Gourde down 1.0% (YTD: -26.1%)

- North Macedonian denar down 1.1% (YTD: -8.6%)

- Hungarian Forint down 1.1% (YTD: -9.8%)

- Turkish Lira down 1.3% (YTD: -34.6%)

- Belarusian ruble down 1.4% (YTD: +4.9%)

- Samoa Tala down 1.6% (YTD: -2.5%)

- Russian Rouble down 1.7% (YTD: -1.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 67.3%

- New Zambian kwacha up 19.9%

- Ethiopian Birr down 18.6%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.1%

- Surinamese dollar down 34.1%

- Turkish Lira down 34.6%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Sudanese Pound down 87.5%