FX

Good Macro Data In Europe Helped Rates Differentials Firm Up, Driving The Euro Slightly Higher Today

The big story in FX was the huge drop in the Turkish Lira, down over 11% in a single day to its lowest level ever, after Erdogan praised the current accommodative monetary policy in the midst of double-digit inflation

Published ET

Turkish Lira spot price intraday (inverted Y axis) | Source: Refinitiv

QUICK SUMMARY

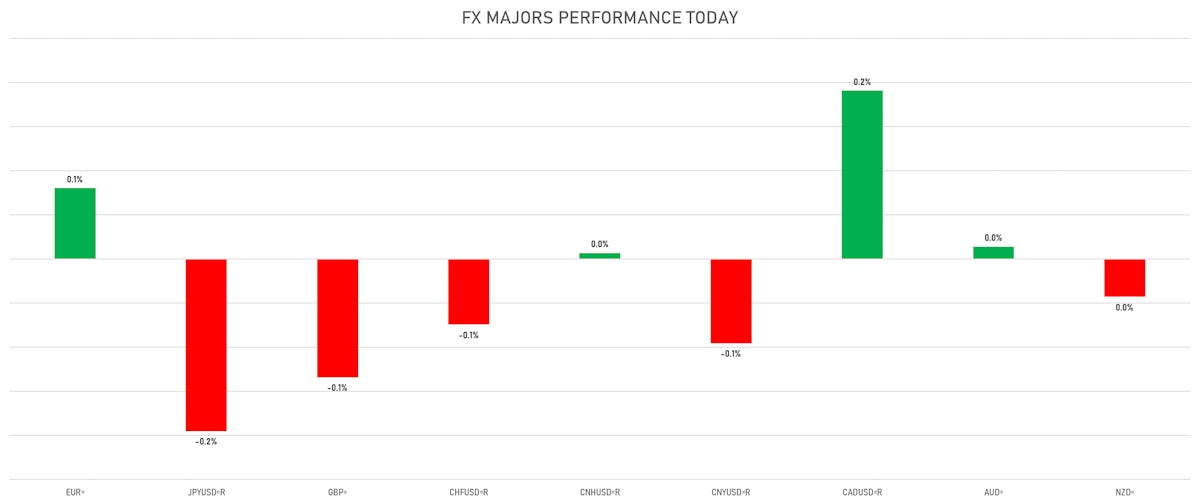

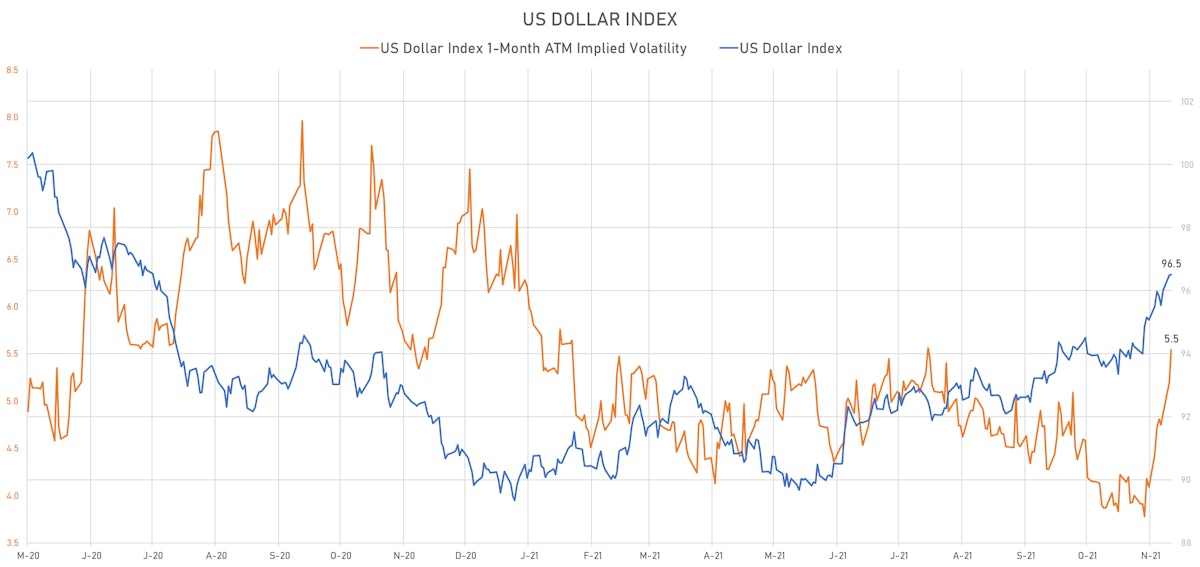

- The US Dollar Index is up 0.01% at 96.51 (YTD: +7.25%)

- Euro up 0.08% at 1.1243 (YTD: -7.9%)

- Yen down 0.20% at 115.11 (YTD: -10.3%)

- Onshore Yuan down 0.10% at 6.3910 (YTD: +2.1%)

- Swiss franc down 0.07% at 0.9334 (YTD: -5.2%)

- Sterling down 0.13% at 1.3378 (YTD: -2.2%)

- Canadian dollar up 0.19% at 1.2677 (YTD: +0.5%)

- Australian dollar up 0.01% at 0.7224 (YTD: -6.1%)

- NZ dollar down 0.04% at 0.6953 (YTD: -3.2%)

MACRO DATA RELEASES

- Euro Zone, PMI, Composite, Output, Flash for Nov 2021 (Markit Economics) at 55.80 (vs 54.20 prior), above consensus estimate of 53.20

- Euro Zone, PMI, Manufacturing Sector, Total, Flash for Nov 2021 (Markit Economics) at 58.60 (vs 58.30 prior), above consensus estimate of 57.30

- Euro Zone, PMI, Services Sector, Business Activity, Flash for Nov 2021 (Markit Economics) at 56.60 (vs 54.60 prior), above consensus estimate of 53.50

- France, PMI, Composite, Output, Flash for Nov 2021 (Markit Economics) at 56.30 (vs 54.70 prior), above consensus estimate of 53.60

- France, PMI, Manufacturing Sector, Total, Flash for Nov 2021 (Markit/CDAF, France) at 54.60 (vs 53.60 prior), above consensus estimate of 53.00

- France, PMI, Services Sector, Business Activity, Flash for Nov 2021 (Markit/CDAF, France) at 58.20 (vs 56.60 prior), above consensus estimate of 56.00

- Germany, PMI, Composite, Output, Flash for Nov 2021 (Markit Economics) at 52.80 (vs 52.00 prior), above consensus estimate of 51.00

- Germany, PMI, Manufacturing Sector, Total, Flash for Nov 2021 (Markit Economics) at 57.60 (vs 57.80 prior), above consensus estimate of 56.90

- Germany, PMI, Services Sector, Business Activity, Flash for Nov 2021 (Markit Economics) at 53.40 (vs 52.40 prior), above consensus estimate of 51.50

- New Zealand, Policy Rates, Official Cash Rate (OCR) for 24 Nov (RBNZ) at 0.75 % (vs 0.50 % prior), in line with consensus

- Nigeria, Policy Rates, Monetary Policy Rate for 23 Nov (Central Bank Nigeria) at 11.50 % (vs 11.50 % prior), in line with consensus

- United Kingdom, Markit/CIPS PMI, Composite, Flash for Nov 2021 (Markit Economics) at 57.70 (vs 57.80 prior), above consensus estimate of 57.50

- United Kingdom, Markit/CIPS PMI, Manufacturing Flash for Nov 2021 (Markit Economics) at 58.20 (vs 57.80 prior), above consensus estimate of 57.30

- United Kingdom, Markit/CIPS PMI, Services, Flash for Nov 2021 (Markit Economics) at 58.60 (vs 59.10 prior), above consensus estimate of 58.50

- United States, PMI, Composite, Output, Flash for Nov 2021 (Markit Economics) at 56.50 (vs 57.60 prior)

- United States, PMI, Manufacturing Sector, Total, Flash for Nov 2021 (Markit Economics) at 59.10 (vs 58.40 prior), above consensus estimate of 59.00

- United States, PMI, Services Sector, Business Activity, Flash for Nov 2021 (Markit Economics) at 57.00 (vs 58.70 prior), below consensus estimate of 59.00

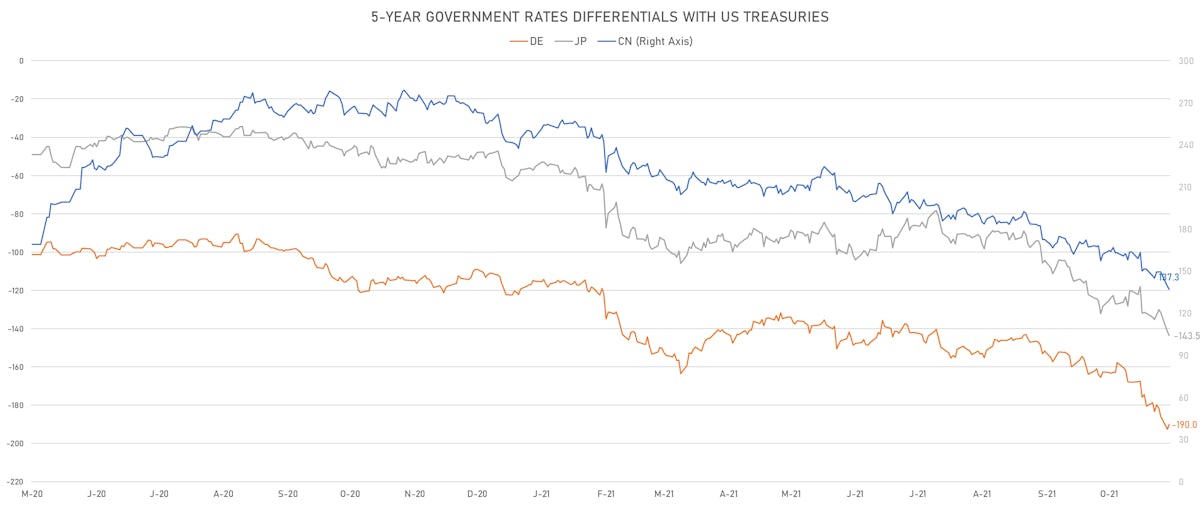

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -4.6 bp at 188.1 bp (YTD change: +77.0 bp)

- US-JAPAN unchanged at 141.0 bp (YTD change: +92.7 bp)

- US-CHINA: +0.5 bp at -138.8 bp (YTD change: +118.4 bp)

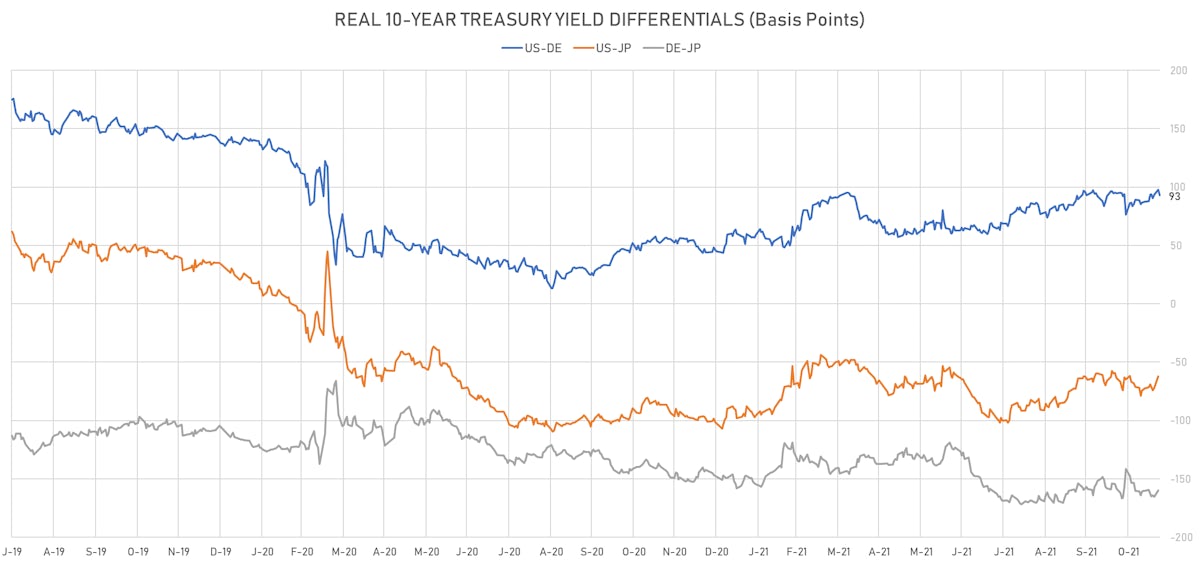

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -4.9 bp at 92.9 bp (YTD change: +46.8bp)

- US-JAPAN: unchanged at -62.2 bp (YTD change: +39.3bp)

- JAPAN-GERMANY: unchanged at 160.0 bp (YTD change: +12.4bp)

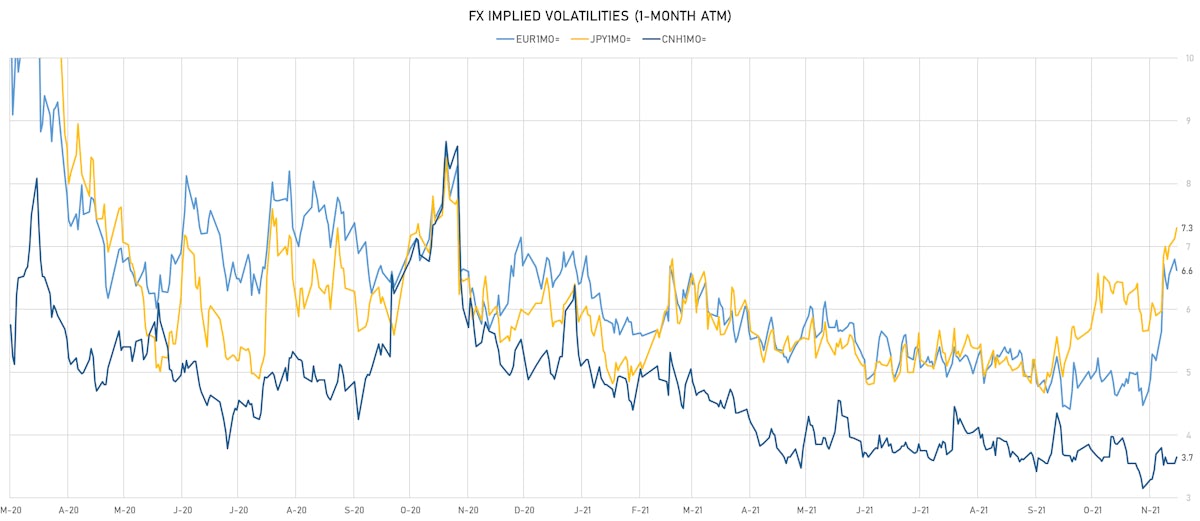

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.96, up 0.05 (YTD: -0.21)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.63, down -0.2 (YTD: 0.0)

- Japanese Yen 1M ATM IV currently at 7.30 (YTD: +1.2)

- Offshore Yuan 1M ATM IV currently at 3.65, up 0.1 (YTD: -2.3)

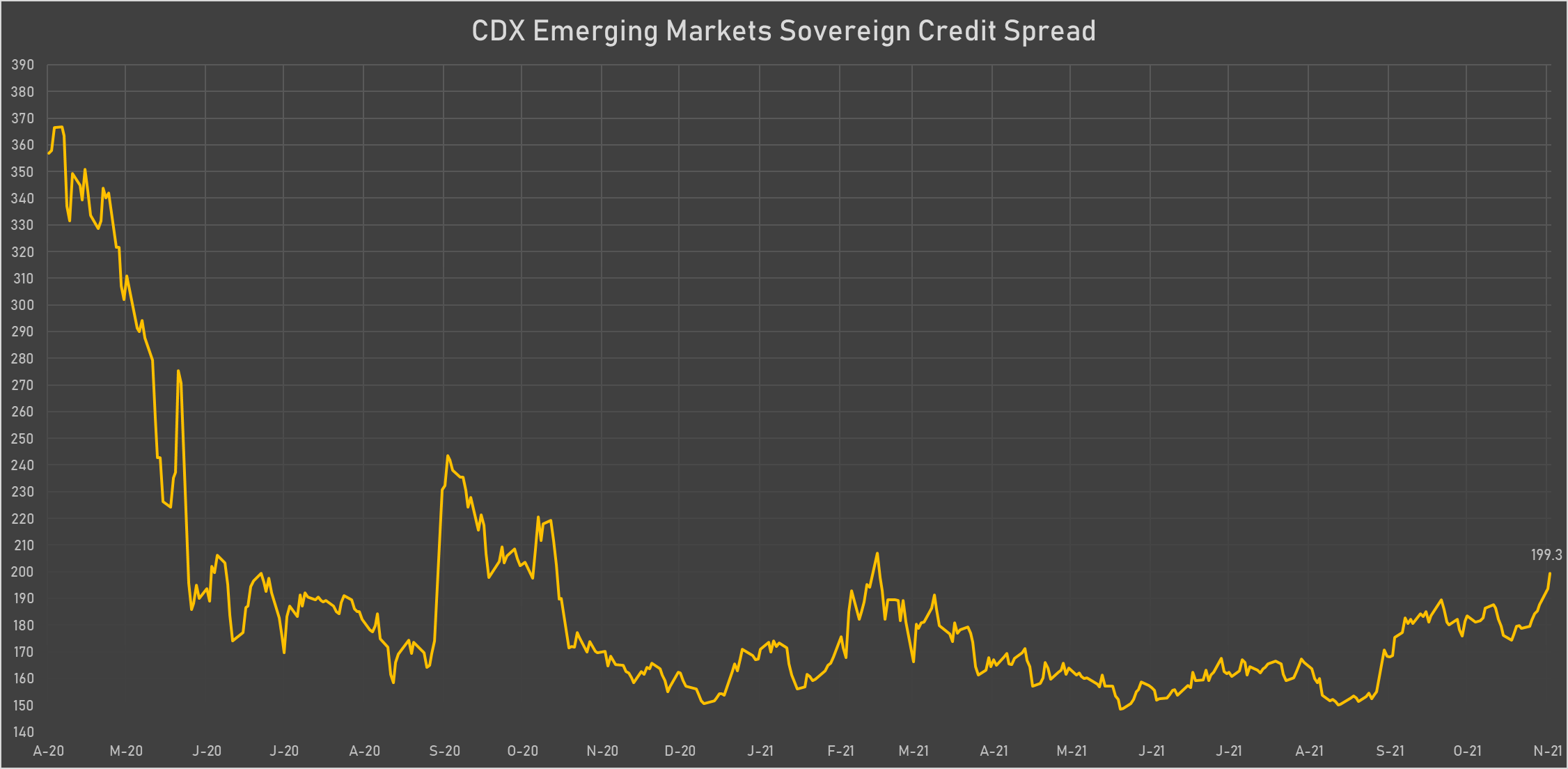

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Russia (rated BBB): down 9.6 basis points to 103 bp (1Y range: 72-117bp)

- Panama (rated BBB-): up 2.1 basis points to 91 bp (1Y range: 44-93bp)

- Peru (rated BBB): up 2.2 basis points to 91 bp (1Y range: 52-105bp)

- Chile (rated A-): up 2.8 basis points to 85 bp (1Y range: 43-89bp)

- Mexico (rated BBB-): up 5.3 basis points to 103 bp (1Y range: 79-115bp)

- Brazil (rated BB-): up 6.4 basis points to 246 bp (1Y range: 141-252bp)

- South Africa (rated BB-): up 7.8 basis points to 220 bp (1Y range: 178-241bp)

- Colombia (rated BB+): up 7.9 basis points to 191 bp (1Y range: 83-183bp)

- Turkey (rated BB-): up 39.0 basis points to 482 bp (1Y range: 282-481bp)

- Argentina (rated CCC): up 70.9 basis points to 2,706 bp (1Y range: 1,074-2,698bp)

LARGEST FX MOVES TODAY

- Angolan Kwanza up 1.0% (YTD: +9.8%)

- Russian Rouble up 0.9% (YTD: -0.2%)

- Malawi Kwacha up 0.8% (YTD: -4.7%)

- Qatari Riyal up 0.8% (YTD: 0.0%)

- Colombian Peso down 0.6% (YTD: -13.3%)

- CFA Franc BEAC down 0.7% (YTD: -7.7%)

- Mexican Peso down 0.9% (YTD: -6.4%)

- Tunisian Dinar down 0.9% (YTD: -6.7%)

- Israeli shekel down 1.4% (YTD: +2.6%)

- Turkish Lira down 11.2% (YTD: -42.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 57.9%

- New Zambian kwacha up 19.7%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.1%

- Surinamese dollar down 33.8%

- Turkish Lira down 42.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 71.0%

- Venezuela Bolivar down 75.5%