FX

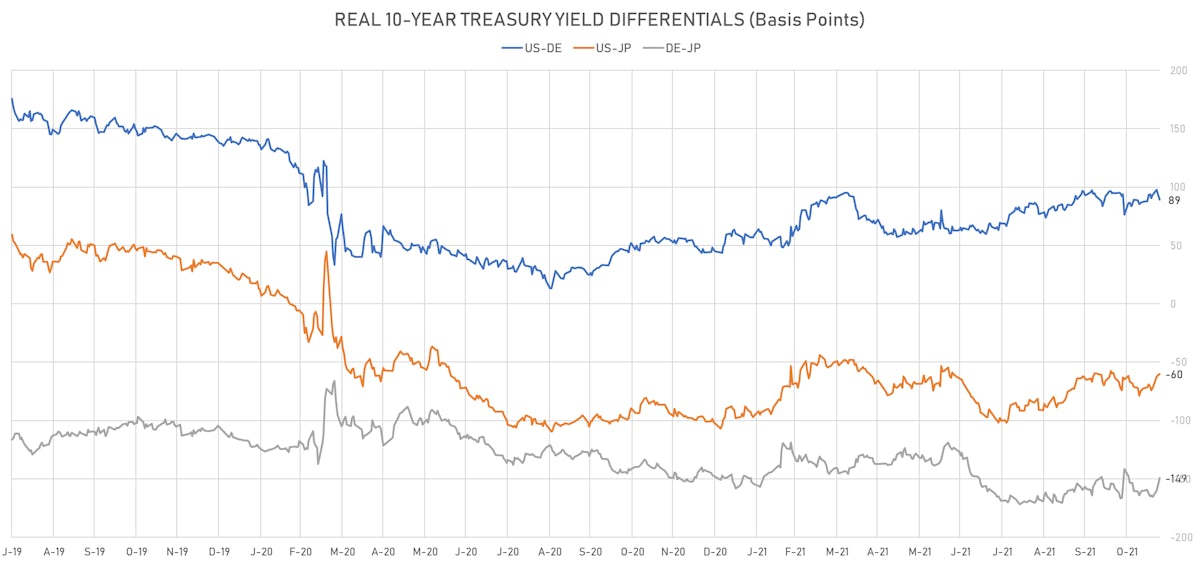

The Rise In US Short Rates And Widening In Rates Differentials Bring Down Yen, Euro

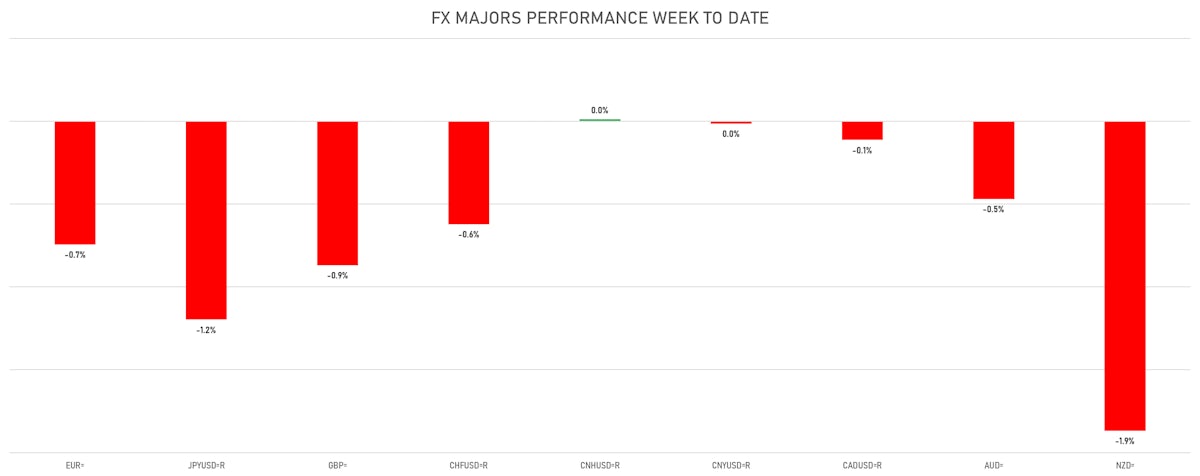

Notable moves today: the Turkish Lira rebounded nicely (up 6%), while the Kiwi dollar fell over 1% after a 25bp hike in the guiding rate (in line with consensus) disappointed bulls who had hoped for 50bp

Published ET

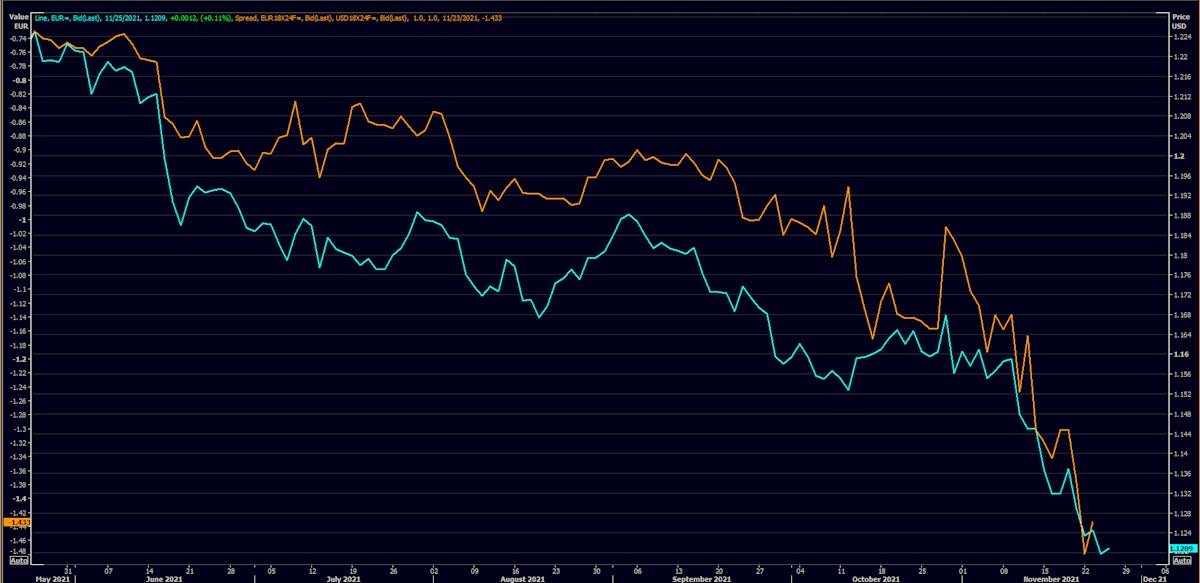

EUR/USD Spot Rate vs EUR-USD 18x24 Forward Rates Differential | Source: Refinitiv

QUICK SUMMARY

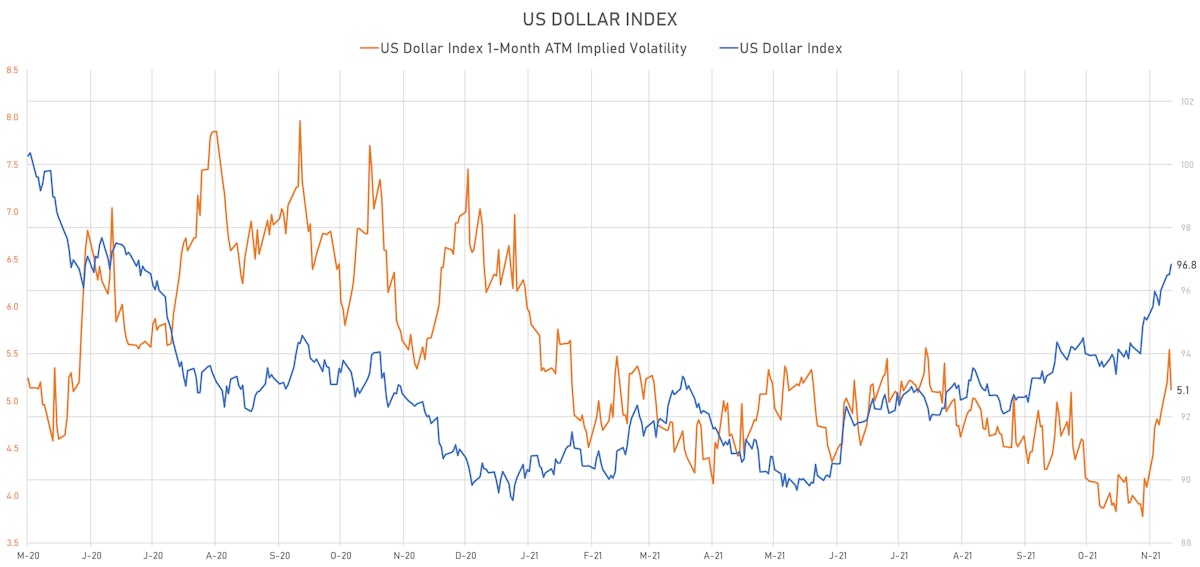

- The US Dollar Index is up 0.34% at 96.83 (YTD: +7.61%)

- Euro down 0.37% at 1.1204 (YTD: -8.3%)

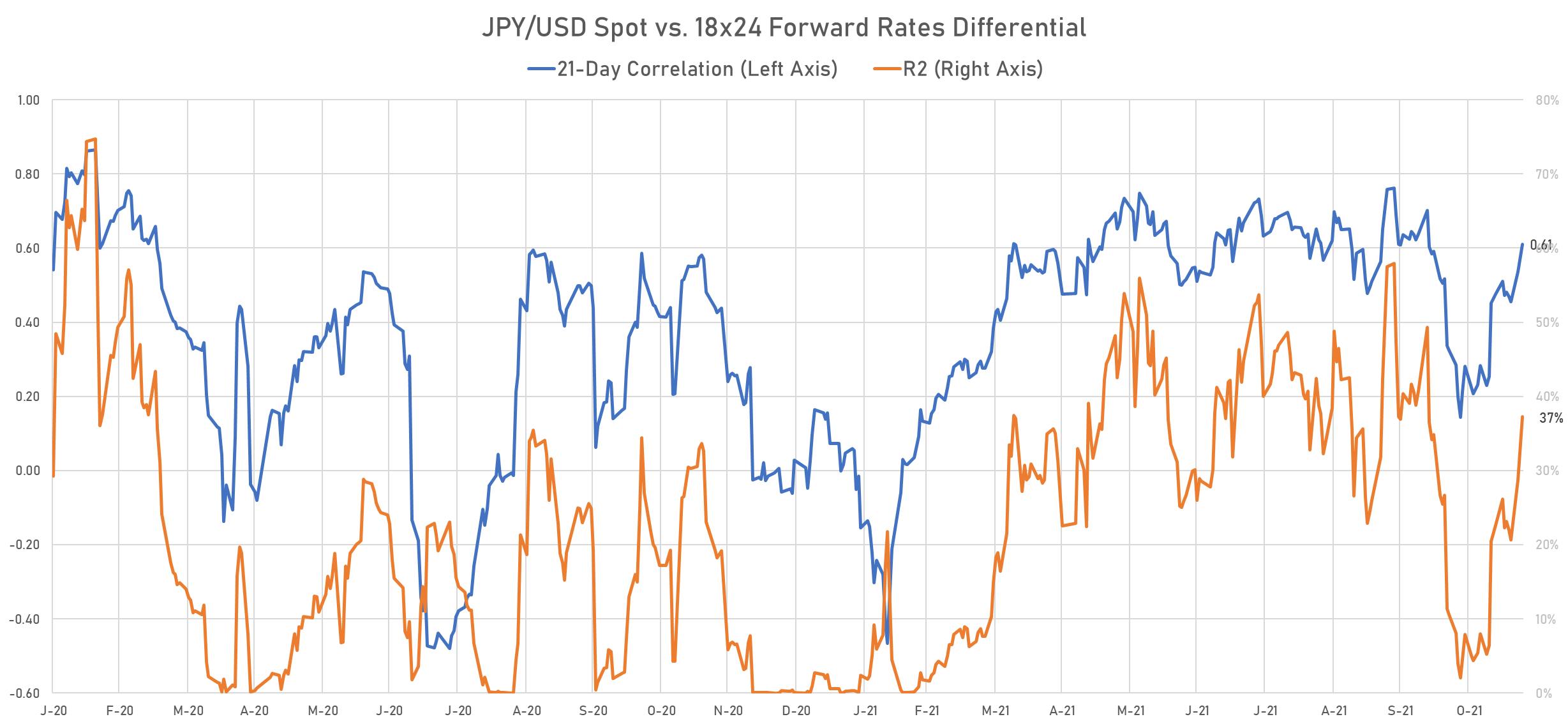

- Yen down 0.20% at 115.38 (YTD: -10.5%)

- Onshore Yuan up 0.06% at 6.3884 (YTD: +2.2%)

- Swiss franc down 0.12% at 0.9340 (YTD: -5.2%)

- Sterling down 0.29% at 1.3335 (YTD: -2.5%)

- Canadian dollar up 0.09% at 1.2658 (YTD: +0.6%)

- Australian dollar down 0.37% at 0.7200 (YTD: -6.4%)

- NZ dollar down 0.98% at 0.6879 (YTD: -4.3%)

MACRO DATA RELEASES

- France, Business Sentiment, Composite business climate, manufacturing industry for Nov 2021 (INSEE, France) at 109.00 (vs 107.00 prior), above consensus estimate of 106.00

- Germany, Climate Germany (Incl.Services), Volume Index for Nov 2021 (Ifo, Univ. of Munich) at 96.50 (vs 97.70 prior), below consensus estimate of 96.60

- Germany, Ifo Business Climate Germany Expectation (Incl.Services), Volume Index for Nov 2021 (Ifo, Univ. of Munich) at 94.20 (vs 95.40 prior), below consensus estimate of 95.00

- Germany, Ifo Business Climate Germany Situation (Incl. services), Volume Index for Nov 2021 (Ifo, Univ. of Munich) at 99.00 (vs 100.10 prior), in line with consensus

- Russia, Production, IP Total , Change Y/Y for Oct 2021 (RosStat, Russia) at 7.10 % (vs 6.80 % prior), above consensus estimate of 6.00 %

- Singapore, GDP, Change Y/Y for Q3 2021 (Statistics Singapore) at 7.10 % (vs 6.50 % prior), above consensus estimate of 6.50 %

- United States, GDP, Total-2nd Estimate, Change P/P for Q3 2021 (BEA, US Dept. Of Com) at 2.10 % (vs 2.00 % prior), below consensus estimate of 2.20 %

- United States, Jobless Claims, National, Initial for W 20 Nov (U.S. Dept. of Labor) at 199.00 k (vs 268.00 k prior), below consensus estimate of 260.00 k

- United States, Manufacturers New Orders, Durable goods total, Change P/P for Oct 2021 (U.S. Census Bureau) at -0.50 % (vs -0.30 % prior), below consensus estimate of 0.20 %

- United States, New Home Sales for Oct 2021 (U.S. Census Bureau) at 0.75 Mln (vs 0.80 Mln prior), below consensus estimate of 0.80 Mln

- United States, Personal Consumption Expenditure, Change P/P for Oct 2021 (BEA, US Dept. Of Com) at 1.30 % (vs 0.60 % prior), above consensus estimate of 1.00 %

- United States, University of Michigan, Consumer Sentiment Index, Volume Index for Nov 2021 (UMICH, Survey) at 67.40 (vs 66.80 prior), above consensus estimate of 66.90

- Zambia, Policy Rates, BOZ Policy Rate for Nov 2021 (Bank of Zambia) at 9.00 %

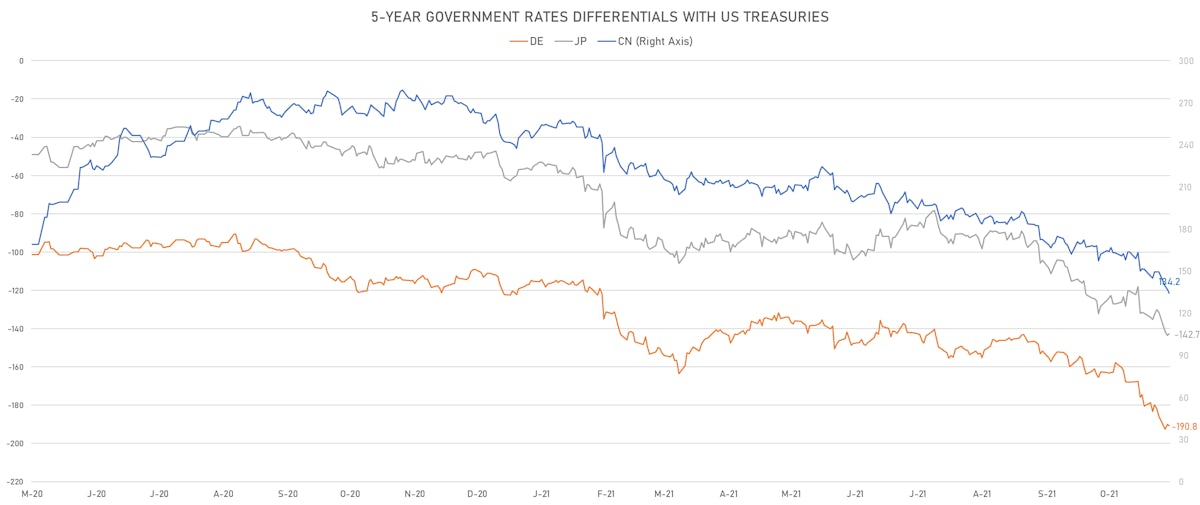

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.8 bp at 190.8 bp (YTD change: +79.7 bp)

- US-JAPAN: -0.9 bp at 142.6 bp (YTD change: +94.3 bp)

- US-CHINA: +2.9 bp at -134.4 bp (YTD change: +122.7 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.8 bp at 89.1 bp (YTD change: +43.0bp)

- US-JAPAN: +2.2 bp at -60.0 bp (YTD change: +41.5bp)

- JAPAN-GERMANY: -10.9 bp at 149.1 bp (YTD change: +1.5bp)

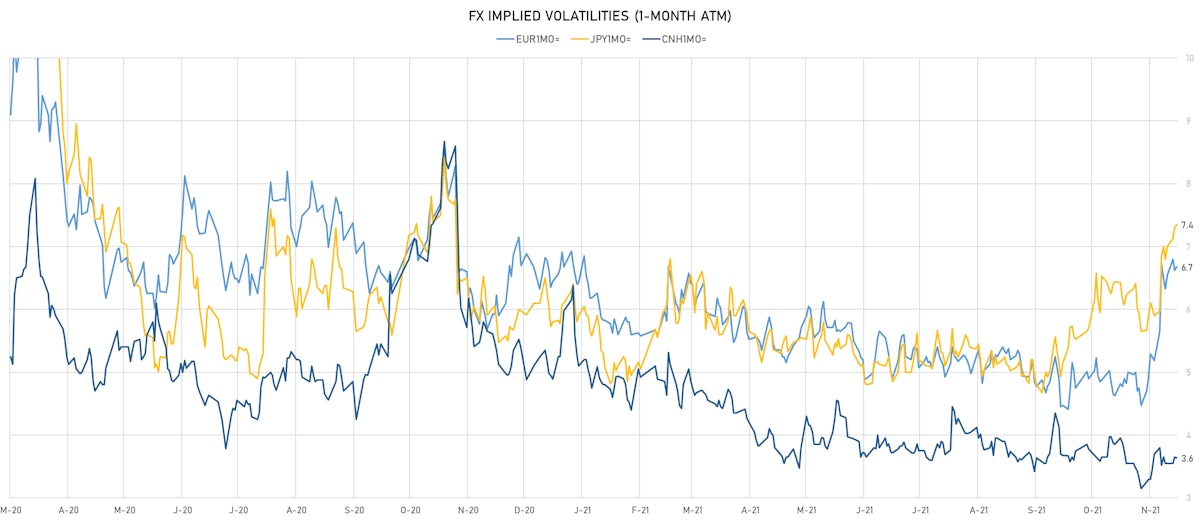

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.93, down -0.03 (YTD: -0.24)

- Euro 1-Month At-The-Money Implied Volatility at 6.68 (YTD: 0.0)

- Japanese Yen 1M ATM IV currently at 7.35 (YTD: +1.3)

- Offshore Yuan 1M ATM IV currently at 3.64 (YTD: -2.3)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Turkey (rated BB-): down 7.4 basis points to 475 bp (1Y range: 282-482bp)

- Malaysia (rated BBB+): up 1.2 basis points to 57 bp (1Y range: 34-64bp)

- Panama (rated BBB-): up 1.4 basis points to 92 bp (1Y range: 44-93bp)

- Philippines (rated BBB): up 1.6 basis points to 63 bp (1Y range: 34-65bp)

- Peru (rated BBB): up 1.7 basis points to 93 bp (1Y range: 52-105bp)

- Indonesia (rated BBB): up 2.0 basis points to 80 bp (1Y range: 66-94bp)

- Colombia (rated BB+): up 3.7 basis points to 195 bp (1Y range: 83-191bp)

- Mexico (rated BBB-): up 6.9 basis points to 110 bp (1Y range: 79-115bp)

- Russia (rated BBB): up 7.1 basis points to 111 bp (1Y range: 72-117bp)

- Argentina (rated CCC): up 56.6 basis points to 2,748 bp (1Y range: 1,074-2,698bp)

LARGEST FX MOVES TODAY

- Turkish Lira up 6.0% (YTD: -37.8%)

- Thai Baht down 0.7% (YTD: -9.8%)

- Swedish Krona down 0.8% (YTD: -9.6%)

- Malawi Kwacha down 0.8% (YTD: -5.5%)

- Algerian Dinar down 0.8% (YTD: -5.4%)

- Russian Rouble down 1.0% (YTD: -0.9%)

- Haiti Gourde down 1.0% (YTD: -26.8%)

- New Zealand $ down 1.1% (YTD: -4.3%)

- Mexican Peso down 1.1% (YTD: -7.2%)

- Mauritius Rupee down 1.3% (YTD: -9.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles Rupee up 67.2%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.8%

- Surinamese Dollar down 34.2%

- Turkish Lira down 37.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 71.0%

- Venezuela Bolivar down 75.7%