FX

Euro And Yen Spot Rates Down Today, As Changes In Real Rates Differentials Favor US Dollar

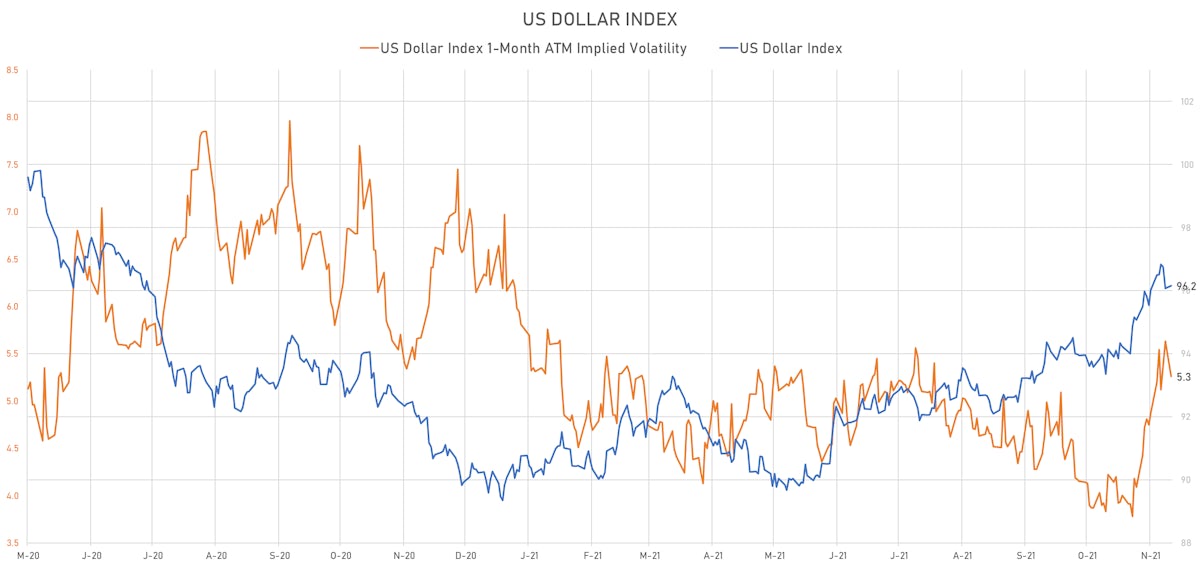

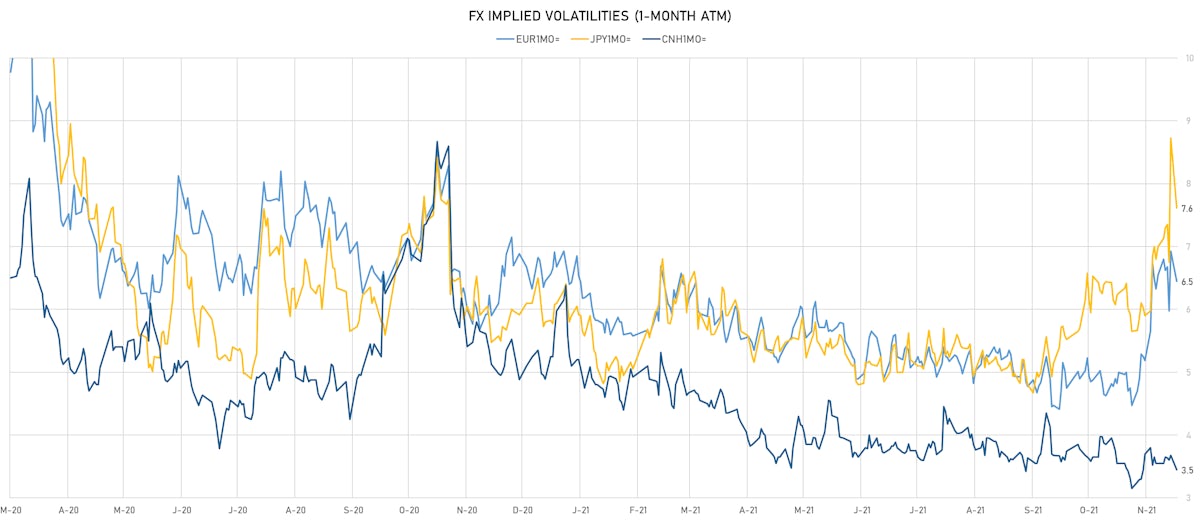

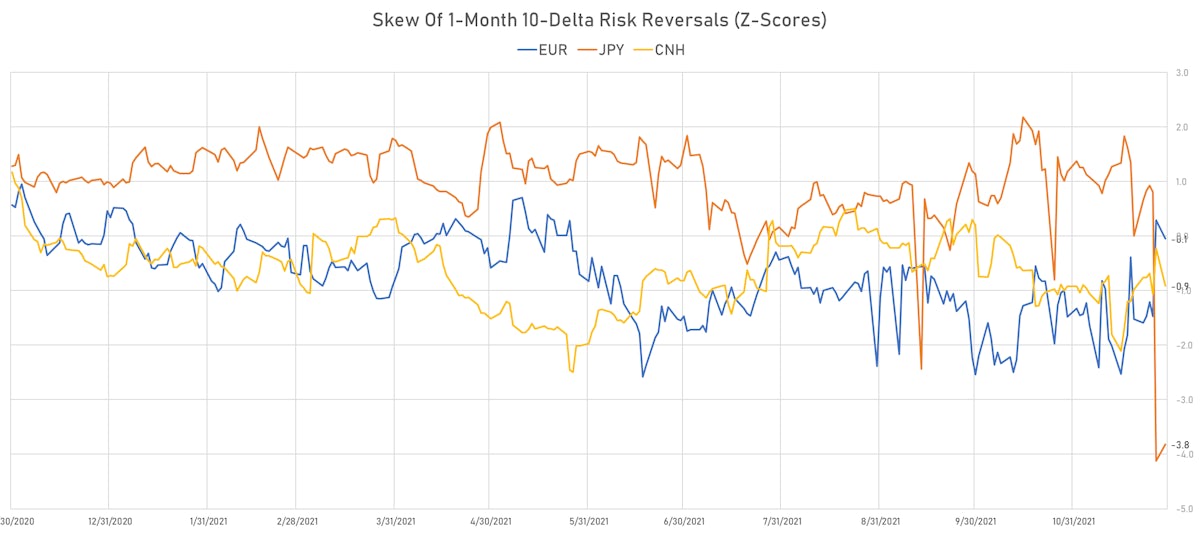

Implied volatilities fell back to start the week, after a dramatic risk-off move on Friday generated a 5 standard-deviations drop in 1-Month 10-delta JPY risk reversals

Published ET

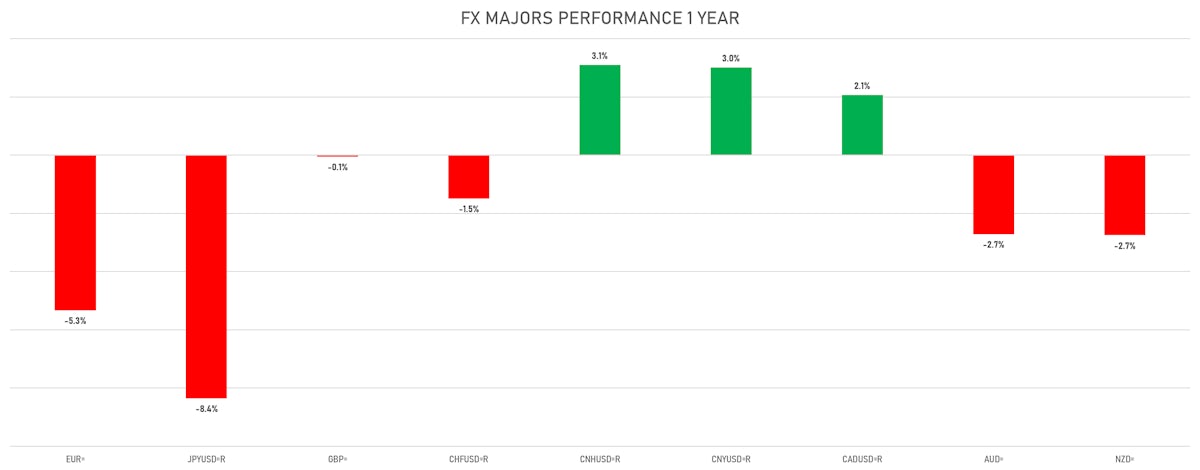

One-Year Performance Of Major Currencies Against The US$ | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

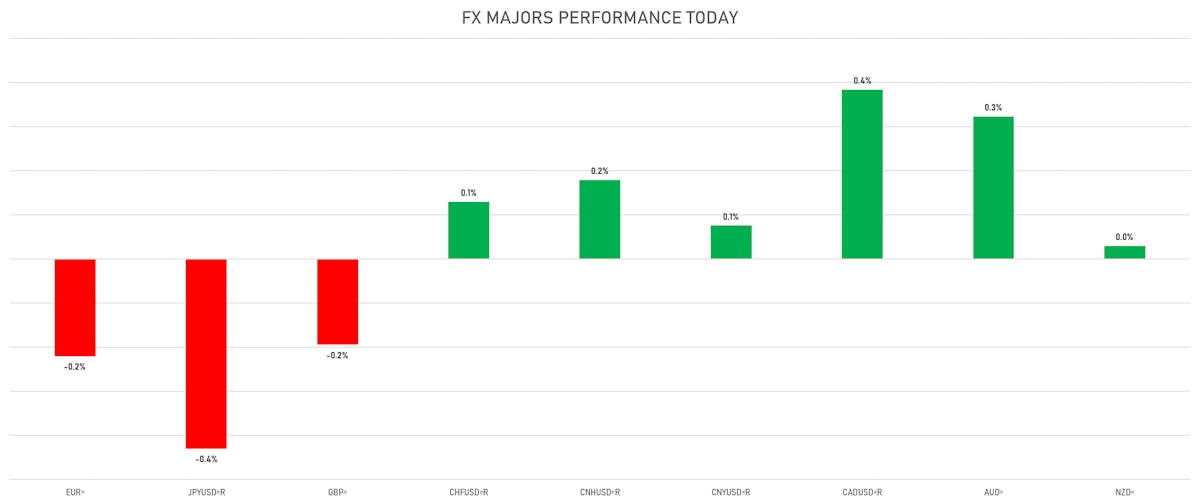

- The US Dollar Index is up 0.09% at 96.16 (YTD: +6.87%)

- Euro down 0.22% at 1.1292 (YTD: -7.5%)

- Yen down 0.43% at 113.78 (YTD: -9.3%)

- Onshore Yuan up 0.08% at 6.3875 (YTD: +2.2%)

- Swiss franc up 0.13% at 0.9230 (YTD: -4.1%)

- Sterling down 0.19% at 1.3314 (YTD: -2.6%)

- Canadian dollar up 0.38% at 1.2737 (YTD: 0.0%)

- Australian dollar up 0.32% at 0.7146 (YTD: -7.1%)

- NZ dollar up 0.03% at 0.6828 (YTD: -5.0%)

MACRO DATA RELEASES

- Australia, Inventories, Change P/P for Q3 2021 (AU Bureau of Stat) at -1.90 % (vs 0.20 % prior), below consensus estimate of 0.00 %

- Brazil, Composite Index, IGP-M inflation, Change P/P, Price Index for Nov 2021 (FGV, Brazil) at 0.02 % (vs 0.64 % prior), below consensus estimate of 0.21 %

- Canada, Current Account, Balance for Q3 2021 (Statistics Canada) at 1.37 Bln CAD (vs 3.58 Bln CAD prior), below consensus estimate of 4.80 Bln CAD

- Canada, Industrial Product Prices, (NAPCS), Industrial product price index, Change P/P, Price Index for Oct 2021 (CANSIM, Canada) at 1.30 % (vs 1.00 % prior)

- Euro Zone, All Respondents, Total, Consumer Confidence Indicator, Balance for Nov 2021 (DG ECFIN, France) at -6.80 (vs -6.80 prior), in line with consensus

- Euro Zone, Business climate indicator for Nov 2021 (DG ECFIN, France) at 1.80 (vs 1.76 prior)

- Euro Zone, Economic Sentiment, Economic Sentiment Indicator (ESI), Overall for Nov 2021 (DG ECFIN, France) at 117.50 (vs 118.60 prior), in line with consensus

- Euro Zone, Manufacturing Sector, Confidence indicator for Nov 2021 (DG ECFIN, France) at 14.10 (vs 14.20 prior), above consensus estimate of 13.90

- Euro Zone, Service Sector, Confidence indicator, Balance for Nov 2021 (DG ECFIN, France) at 18.40 (vs 18.20 prior), above consensus estimate of 16.60

- Germany, CPI, Flash, Change P/P, Price Index for Nov 2021 (Destatis) at -0.20 % (vs 0.50 % prior), above consensus estimate of -0.40 %

- Germany, CPI, Flash, Change Y/Y, Price Index for Nov 2021 (Destatis) at 5.20 % (vs 4.50 % prior), above consensus estimate of 5.00 %

- Germany, HICP, Flash, Change P/P, Price Index for Nov 2021 (Destatis) at 0.30 % (vs 0.50 % prior), above consensus estimate of -0.30 %

- Germany, HICP, Flash, Change Y/Y, Price Index for Nov 2021 (Destatis) at 6.00 % (vs 4.60 % prior), above consensus estimate of 5.50 %

- Italy, Producer Prices, Industry, Change Y/Y for Oct 2021 (ISTAT, Italy) at 20.40 % (vs 13.30 % prior)

- Kenya, Policy Rates, Central Bank Rate for Nov 2021 (Central Bank, Kenya) at 7.00 % (vs 7.00 % prior), in line with consensus

- Malaysia, Exports, Total, free on board, Change Y/Y for Oct 2021 (Statistics, Malaysia) at 25.50 % (vs 24.70 % prior), above consensus estimate of 21.80 %

- Malaysia, Imports, Total, cost insurance freight, Change Y/Y for Oct 2021 (Statistics, Malaysia) at 27.90 % (vs 26.50 % prior), above consensus estimate of 26.80 %

- Spain, HICP, Change Y/Y, Price Index for Nov 2021 (INE, Spain) at 5.60 % (vs 5.40 % prior), below consensus estimate of 5.60 %

- Turkey, Trade Balance, Current Prices for Oct 2021 (TURKSTAT) at -1.44 Bln USD (vs -2.55 Bln USD prior)

- United Kingdom, Net lending to individuals, secured on dwellings for Oct 2021 (Bank of England) at 1.60 Bln GBP (vs 9.52 Bln GBP prior), below consensus estimate of 4.75 Bln GBP

- United Kingdom, Number of loans approved for house purchase total for Oct 2021 (Bank of England) at 67.20 k (vs 72.65 k prior), below consensus estimate of 71.25 k

- United Kingdom, changes (excluding the Student Loans Company) unsecured lending to individuals for Oct 2021 (Bank of England) at 0.71 Bln GBP (vs 0.23 Bln GBP prior), above consensus estimate of 0.40 Bln GBP

- United States, Pending Home Sales, United States, Change P/P for Oct 2021 (NAR, United States) at 7.50 % (vs -2.30 % prior), above consensus estimate of 0.90 %

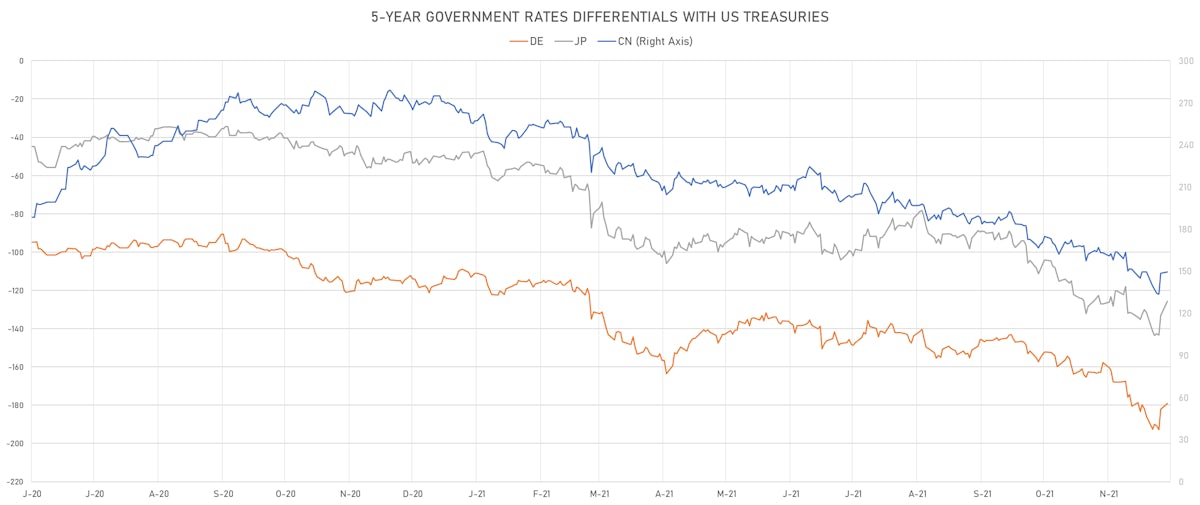

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.1 bp at 180.3 bp (YTD change: +69.2 bp)

- US-JAPAN: +0.8 bp at 126.6 bp (YTD change: +78.3 bp)

- US-CHINA: +0.2 bp at -149.4 bp (YTD change: +107.7 bp)

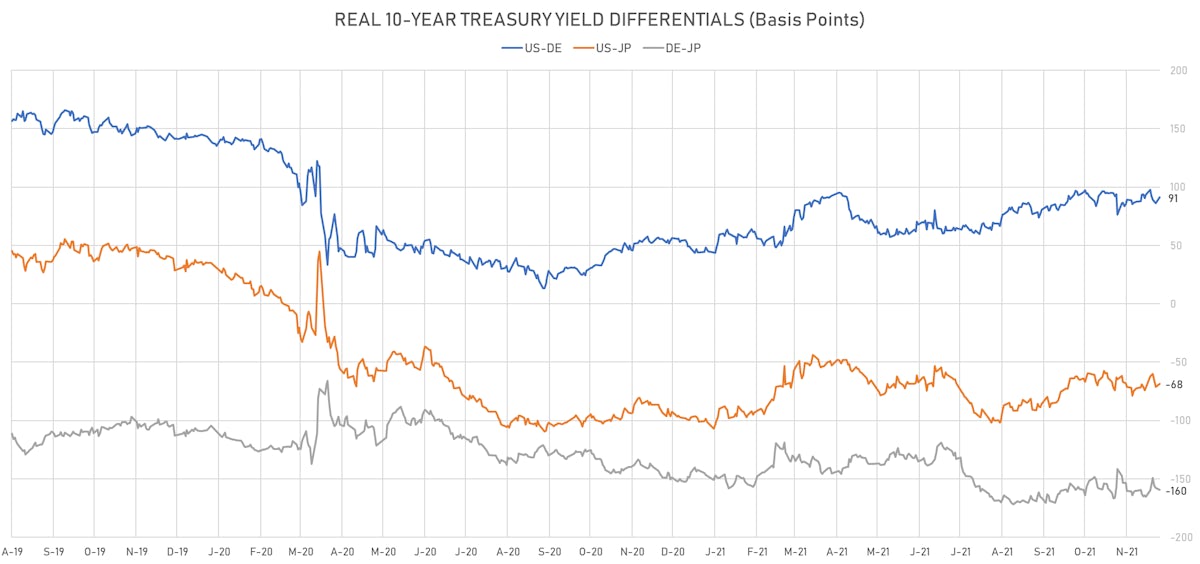

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.8 bp at 91.2 bp (YTD change: +45.1bp)

- US-JAPAN: +2.7 bp at -68.4 bp (YTD change: +33.1bp)

- JAPAN-GERMANY: +2.1 bp at 159.6 bp (YTD change: +12.0bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.40, up 0.43 (YTD: +0.23)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.45, down -0.5 (YTD: -0.2)

- Japanese Yen 1M ATM IV currently at 7.62, down -1.1 (YTD: +1.5)

- Offshore Yuan 1M ATM IV currently at 3.45, down -0.2 (YTD: -2.5)

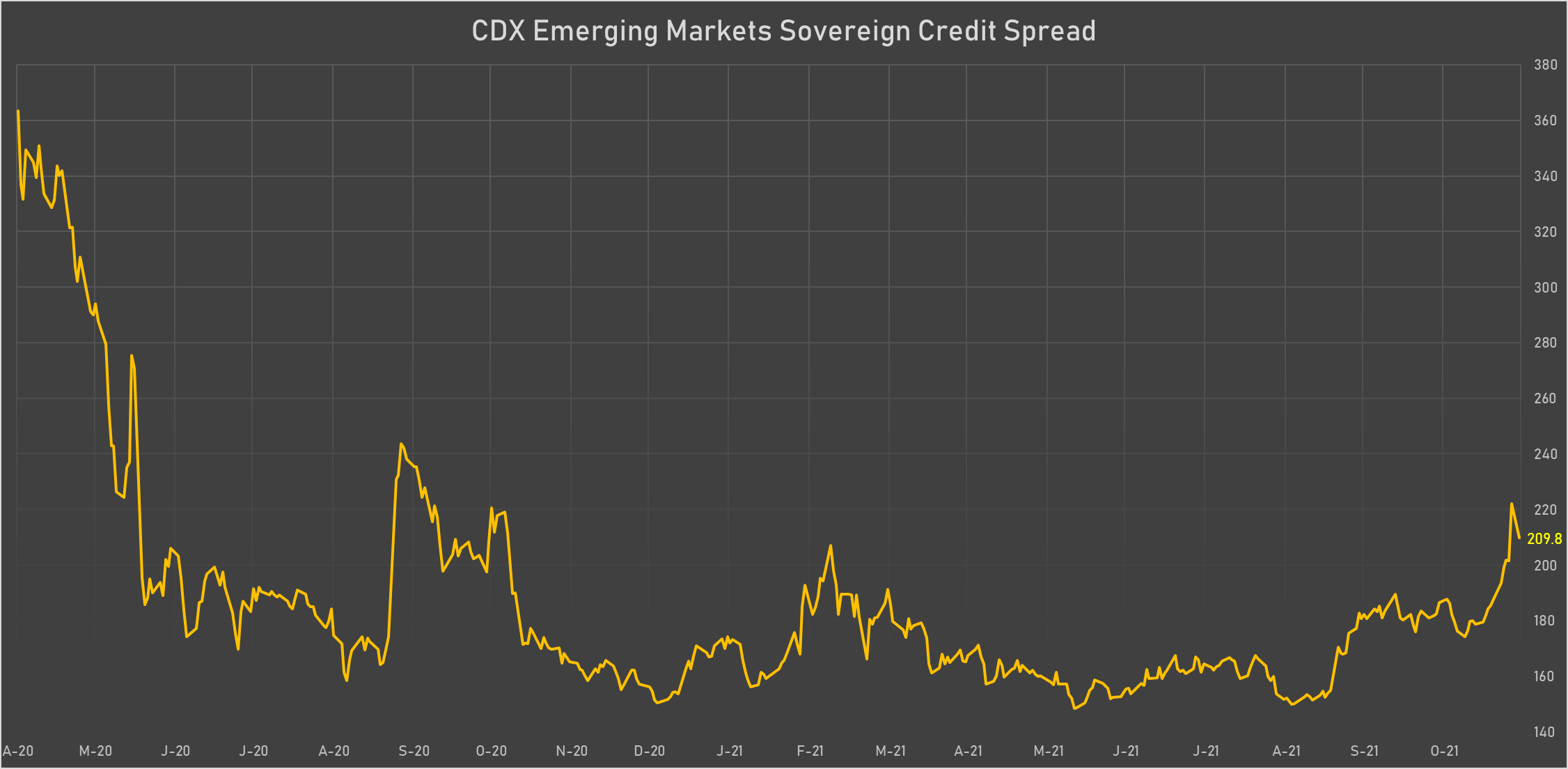

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Malaysia (rated BBB+): up 2.0 basis points to 58 bp (1Y range: 34-64bp)

- China (rated A+): up 2.9 basis points to 50 bp (1Y range: 27-58bp)

- Philippines (rated BBB): up 3.4 basis points to 66 bp (1Y range: 34-66bp)

- Indonesia (rated BBB): up 4.4 basis points to 84 bp (1Y range: 66-94bp)

- Mexico (rated BBB-): up 4.5 basis points to 116 bp (1Y range: 79-124bp)

- Vietnam (rated BB): up 5.0 basis points to 103 bp (1Y range: 89-112bp)

- Peru (rated BBB): up 7.9 basis points to 101 bp (1Y range: 52-105bp)

- South Africa (rated BB-): up 19.2 basis points to 241 bp (1Y range: 178-246bp)

- Colombia (rated BB+): up 22.1 basis points to 217 bp (1Y range: 83-216bp)

- Turkey (rated BB-): up 28.2 basis points to 501 bp (1Y range: 282-497bp)

LARGEST FX MOVES TODAY

- Aruba Florin up 2.2% (YTD: +2.2%)

- Barbados Dollar up 1.5% (YTD: +1.5%)

- Russian Rouble up 1.4% (YTD: -0.5%)

- Norwegian Krone up 1.4% (YTD: -4.8%)

- Swedish Krona up 1.4% (YTD: -9.1%)

- North Antilles Guilder up 1.3% (YTD: +1.3%)

- Belize Dollar up 1.2% (YTD: +1.2%)

- Chilean Peso down 1.5% (YTD: -15.9%)

- Mauritius Rupee down 2.6% (YTD: -10.0%)

- Turkish Lira down 3.2% (YTD: -41.6%)