FX

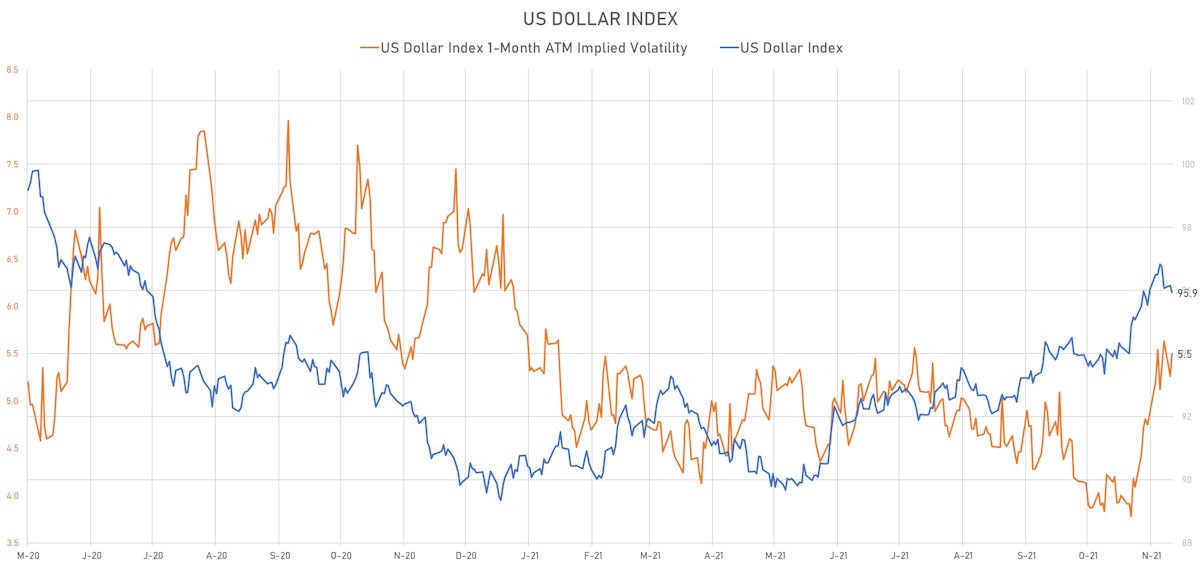

The US Dollar Index Dipped Further Today, Despite Strong Tailwind In Short-Term Rates Differentials

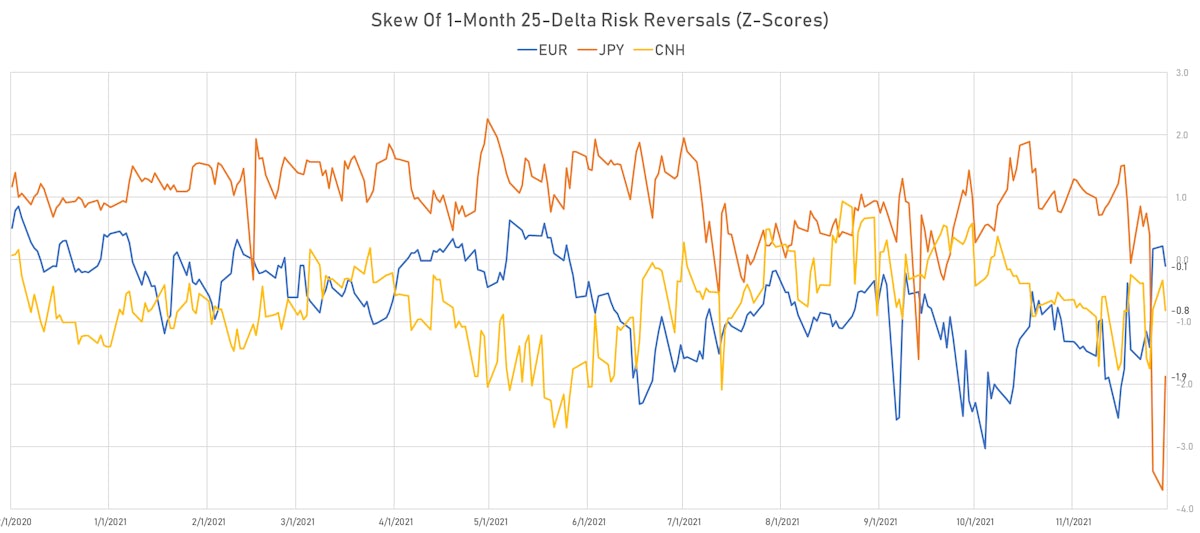

The magnitude of Friday's risk-off rise in the Japanese yen was easy to spot in 1-month 25-delta risk reversals (see chart below), with the one-year z-score moving down over 4 standard deviations

Published ET

1-Year Z-Scores In EUR, JPY, CNH Risk Reversals | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

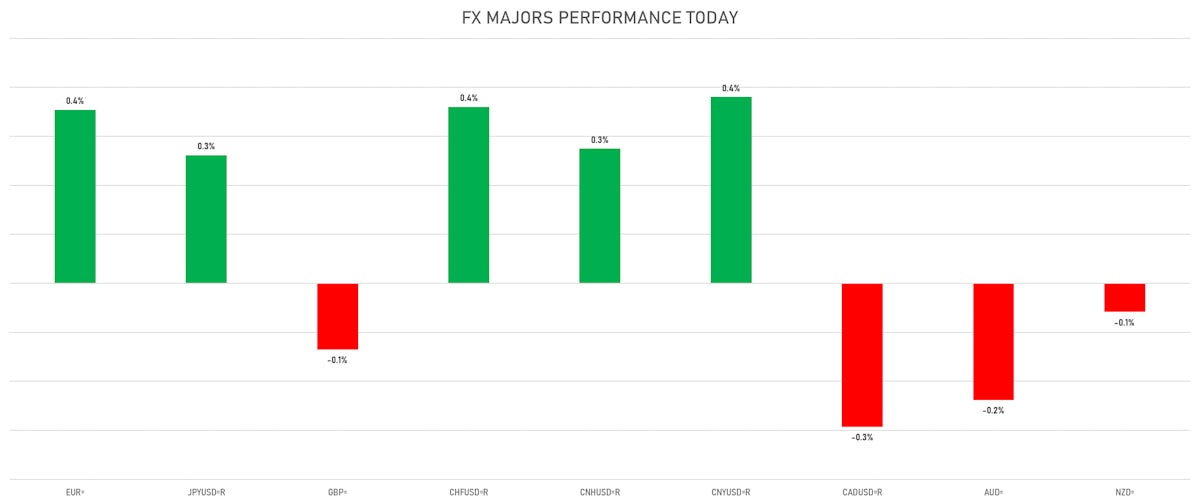

- The US Dollar Index is down -0.24% at 95.93 (YTD: +6.61%)

- Euro up 0.35% at 1.1331 (YTD: -7.2%)

- Yen up 0.26% at 113.21 (YTD: -8.8%)

- Onshore Yuan up 0.38% at 6.3640 (YTD: +2.6%)

- Swiss franc up 0.36% at 0.9190 (YTD: -3.7%)

- Sterling down 0.14% at 1.3293 (YTD: -2.8%)

- Canadian dollar down 0.29% at 1.2778 (YTD: -0.3%)

- Australian dollar down 0.24% at 0.7123 (YTD: -7.4%)

- NZ dollar down 0.06% at 0.6820 (YTD: -5.1%)

MACRO DATA RELEASES

- Australia, Current Account, Balance for Q3 2021 (AU Bureau of Stat) at 23.90 Bln AUD (vs 20.50 Bln AUD prior), below consensus estimate of 27.80 Bln AUD

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Oct 2021 (AU Bureau of Stat) at -12.90 % (vs -4.30 % prior), below consensus estimate of -2.00 %

- Australia, Net exports, Goods and Services, Total, Contributions to GDP Growth for Q3 2021 (AU Bureau of Stat) at 1.00 % (vs -1.00 % prior), in line with consensus

- Canada, GDP, All industries, Change P/P for Sep 2021 (CANSIM, Canada) at 0.10 % (vs 0.40 % prior), in line with consensus

- Canada, GDP, Total at market prices, annualised, Change P/P for Q3 2021 (CANSIM, Canada) at 5.40 % (vs -1.10 % prior), above consensus estimate of 3.00 %

- China (Mainland), PMI, Manufacturing Sector for Nov 2021 (NBS, China) at 50.10 (vs 49.20 prior), above consensus estimate of 49.60

- Denmark, GDP, Total, chain linked-prelim, Change P/P for Q3 2021 (statbank.dk) at 0.90 % (vs 2.80 % prior)

- Denmark, GDP, Total, chain linked-prelim, Change Y/Y for Q3 2021 (statbank.dk) at 3.60 % (vs 9.80 % prior)

- Denmark, Unemployment, Rate, Net for Oct 2021 (statbank.dk) at 2.70 % (vs 2.90 % prior)

- Euro Zone, CPI, Change Y/Y for Nov 2021 (Eurostat) at 4.90 % (vs 4.10 % prior), above consensus estimate of 4.50 %

- Euro Zone, CPI, Total excluding energy and unprocessed food, Change Y/Y, Price Index for Nov 2021 (Eurostat) at 2.60 % (vs 2.10 % prior), above consensus estimate of 2.30 %

- France, GDP, Total growth, Change P/P for Q3 2021 (INSEE, France) at 3.00 % (vs 3.00 % prior), in line with consensus

- France, HICP, Flash, Change Y/Y, Price Index for Nov 2021 (INSEE, France) at 3.40 % (vs 3.20 % prior), above consensus estimate of 3.20 %

- Germany, Unemployment, Change, Absolute change for Nov 2021 (Deutsche Bundesbank) at -34.00 k (vs -39.00 k prior), below consensus estimate of -25.00 k

- Germany, Unemployment, Rate, Registered for Nov 2021 (Deutsche Bundesbank) at 5.30 % (vs 5.40 % prior), in line with consensus

- Hungary, Policy Rates, Overnight Deposite Rate for Dec 2021 (Cent. Bank, Hungary) at 1.60 % (vs 1.15 % prior)

- India, GDP, At basic price, Change Y/Y for Q2 2021 (CSO, India) at 8.40 % (vs 20.10 % prior), in line with consensus

- Italy, GDP, Final, Change P/P for Q3 2021 (ISTAT, Italy) at 2.60 % (vs 2.60 % prior), in line with consensus

- Italy, GDP, Final, Change Y/Y for Q3 2021 (ISTAT, Italy) at 3.90 % (vs 3.80 % prior), above consensus estimate of 3.80 %

- Italy, HICP, Preliminary, Change P/P, Price Index for Nov 2021 (ISTAT, Italy) at 0.80 % (vs 0.90 % prior), above consensus estimate of 0.10 %

- Italy, HICP, Preliminary, Change Y/Y, Price Index for Nov 2021 (ISTAT, Italy) at 4.00 % (vs 3.20 % prior), above consensus estimate of 3.30 %

- Portugal, GDP, Change P/P for Q3 2021 (INE, Portugal) at 2.90 % (vs 2.90 % prior)

- Switzerland, KOF composite leading indicator for Nov 2021 (KOF, Switzerland) at 108.50 (vs 110.70 prior), below consensus estimate of 109.00

- Switzerland, Reserves, Official reserve assets, Current Prices for Oct 2021 (Swiss National Bank) at 990,882.90 Mln CHF (vs 1,007,560.04 Mln CHF prior)

- Turkey, Gross Domestic Product (%YOY), Change Y/Y for Q3 2021 (TURKSTAT) at 7.40 % (vs 21.70 % prior), below consensus estimate of 7.50 %

- United States, Conference Board, Consumer confidence for Nov 2021 (The Conference Board) at 109.50 (vs 113.80 prior), below consensus estimate of 111.00

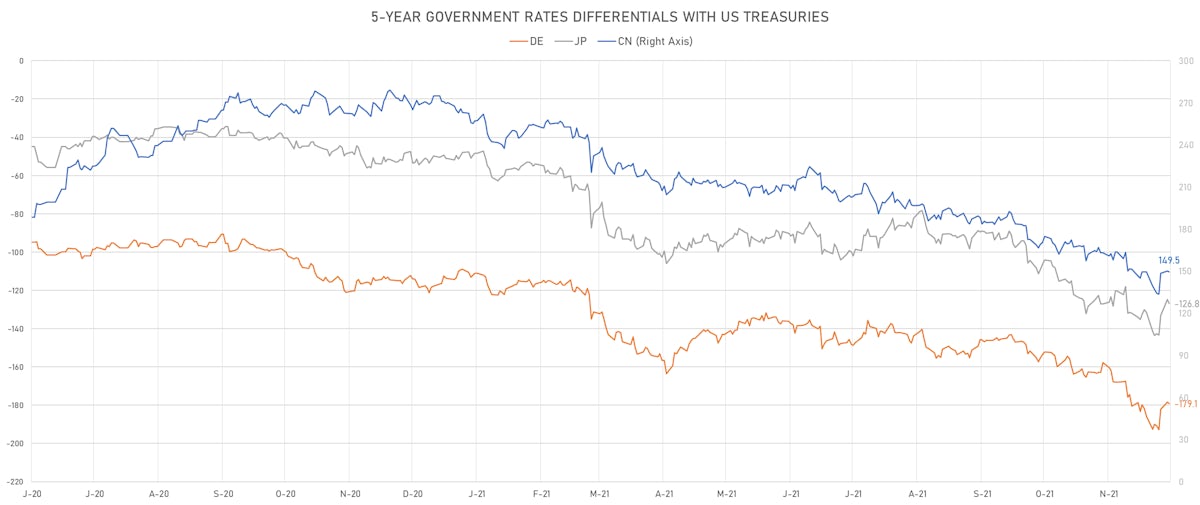

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.3 bp at 182.8 bp (YTD change: +71.7 bp)

- US-JAPAN: +4.7 bp at 129.5 bp (YTD change: +81.2 bp)

- US-CHINA: +4.1 bp at -146.2 bp (YTD change: +110.9 bp)

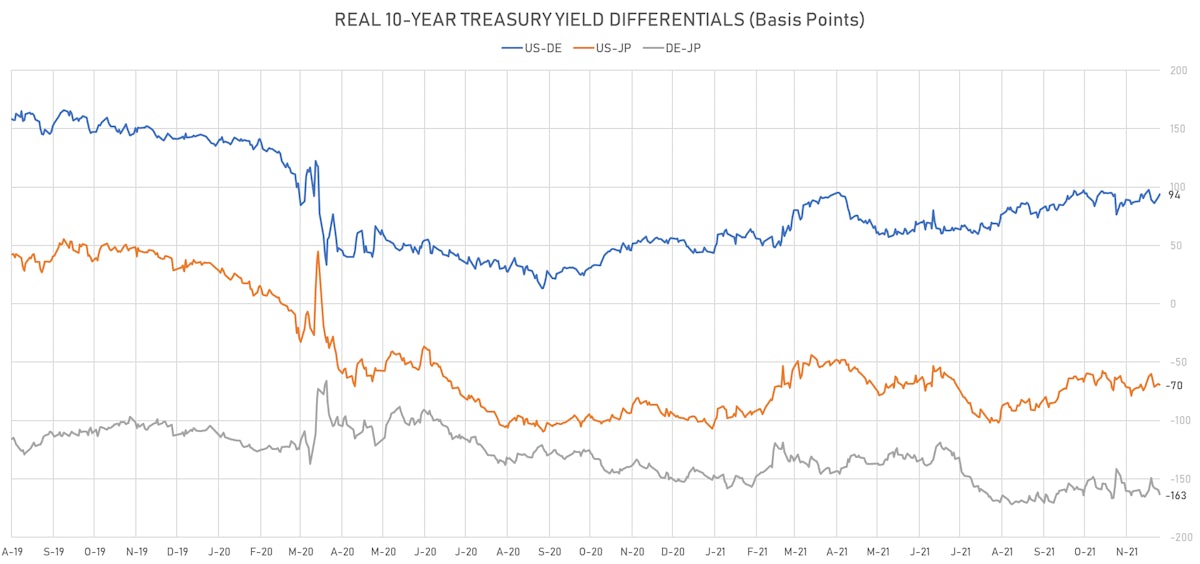

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.7 bp at 93.9 bp (YTD change: +47.8bp)

- US-JAPAN: -1.1 bp at -69.5 bp (YTD change: +32.0bp)

- JAPAN-GERMANY: +3.8 bp at 163.4 bp (YTD change: +15.8bp)

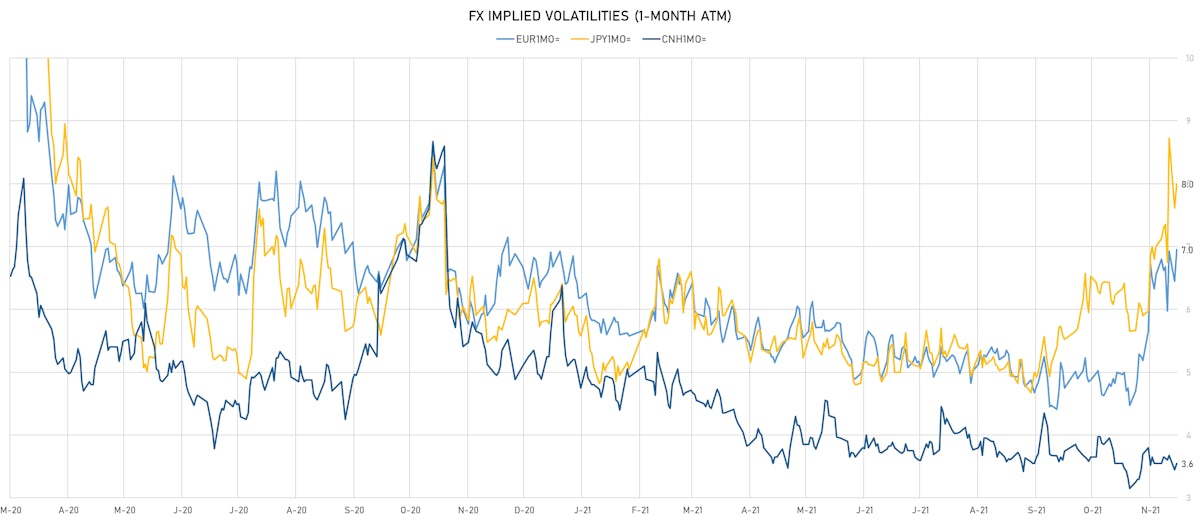

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.01, down -0.39 (YTD: -0.16)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.95, up 0.5 (YTD: +0.3)

- Japanese Yen 1M ATM IV currently at 8.00, up 0.4 (YTD: +1.9)

- Offshore Yuan 1M ATM IV currently at 3.55, up 0.1 (YTD: -2.4)

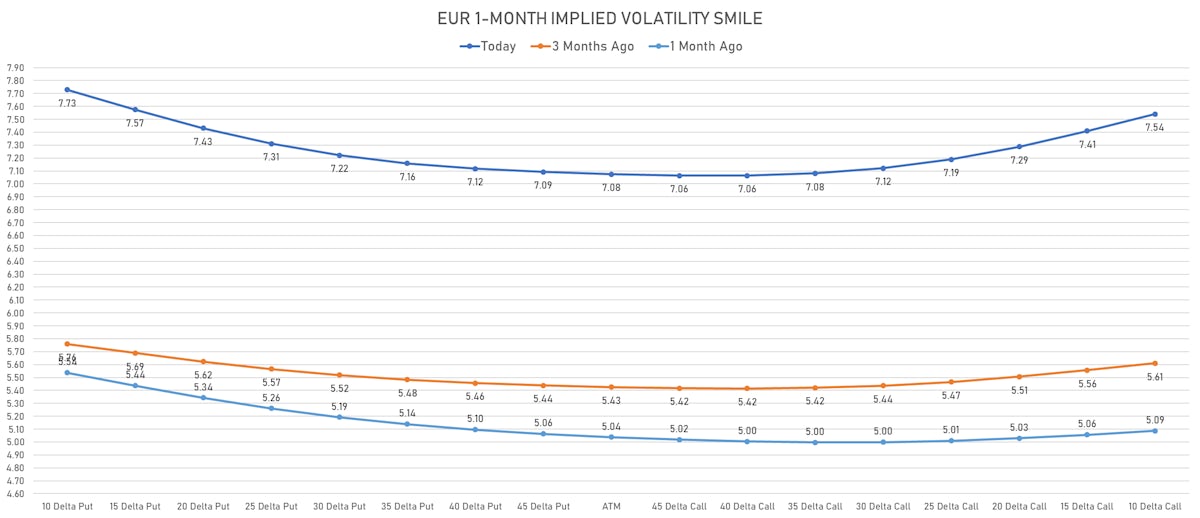

- Euro 1-Month implied volatilities shows very little skew / directional bias after the huge rise in ATM volatility

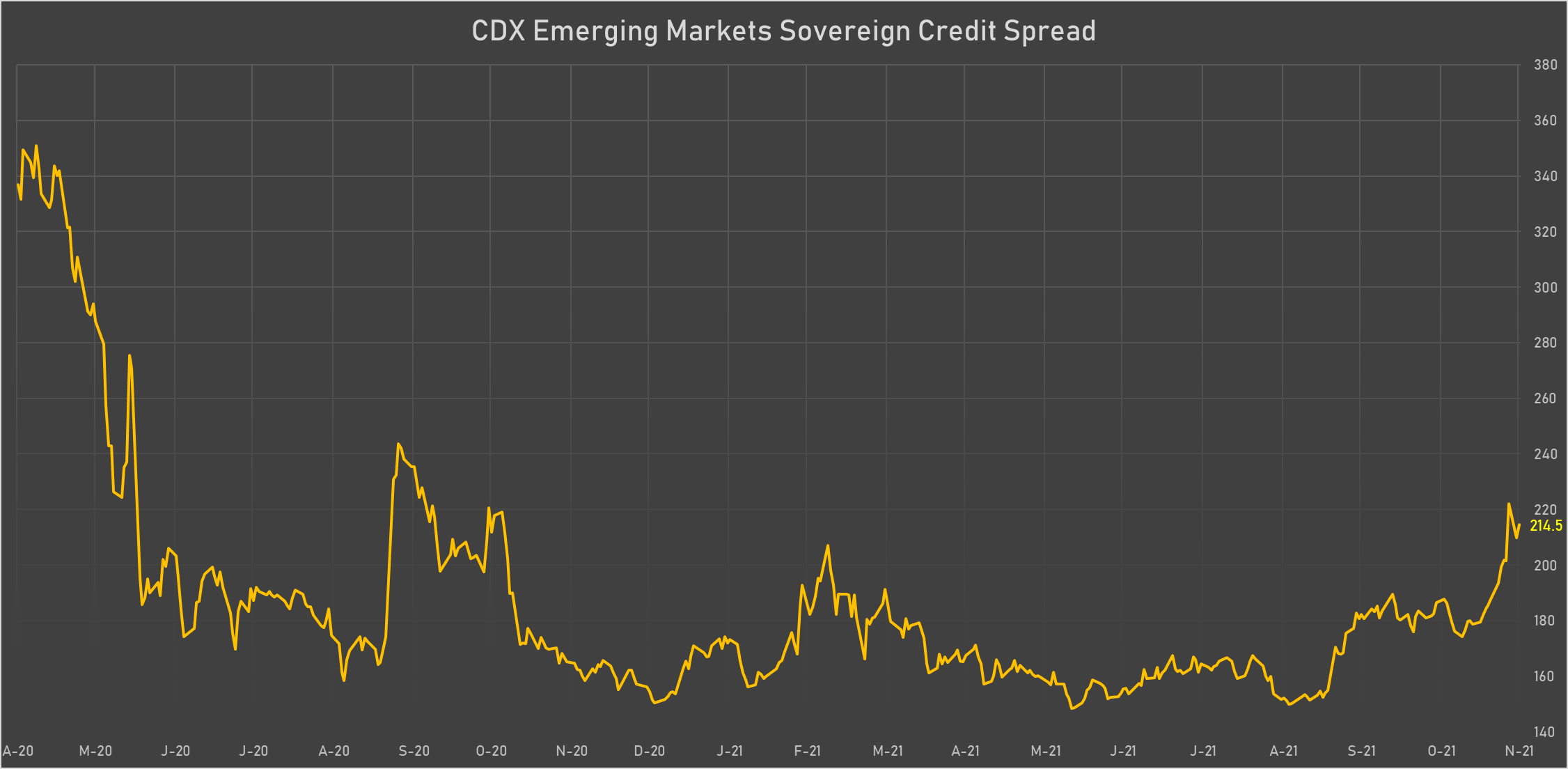

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- China (rated A+): up 1.0 basis points to 53 bp (1Y range: 27-58bp)

- Chile (rated A-): up 2.0 basis points to 94 bp (1Y range: 43-95bp)

- Mexico (rated BBB-): up 2.5 basis points to 117 bp (1Y range: 79-124bp)

- Indonesia (rated BBB): up 2.5 basis points to 87 bp (1Y range: 66-94bp)

- Russia (rated BBB): up 3.2 basis points to 115 bp (1Y range: 72-122bp)

- Saudi Arabia (rated A): up 3.3 basis points to 54 bp (1Y range: 43-71bp)

- South Africa (rated BB-): up 4.0 basis points to 245 bp (1Y range: 178-246bp)

- Colombia (rated BB+): up 10.0 basis points to 225 bp (1Y range: 83-217bp)

- Egypt (rated B+): up 20.0 basis points to 512 bp (1Y range: 283-492bp)

- Argentina (rated CCC): up 160.8 basis points to 3,131 bp (1Y range: 1,092-2,950bp)

LARGEST FX MOVES TODAY

- Chilean Peso up 2.1% (YTD: -14.1%)

- South Africa Rand up 1.6% (YTD: -7.6%)

- Mauritius Rupee up 1.3% (YTD: -8.8%)

- Botswana Pula up 1.3% (YTD: -7.7%)

- Angolan Kwanza up 1.2% (YTD: +12.2%)

- Myanmar Kyat down 1.8% (YTD: -26.7%)

- Turkish Lira down 4.7% (YTD: -45.0%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 61.3%

- Myanmar Kyat down 26.7%

- Haiti Gourde down 26.8%

- Surinamese Dollar down 34.1%

- Turkish Lira down 45.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%