FX

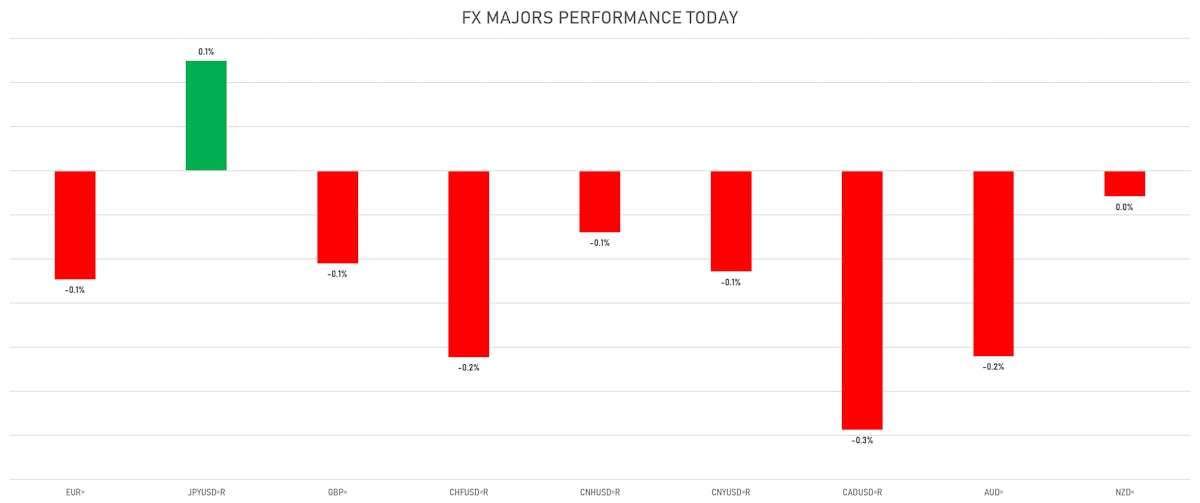

Modest Losses For Major Currencies Against The US Dollar, With The Exception Of The Yen

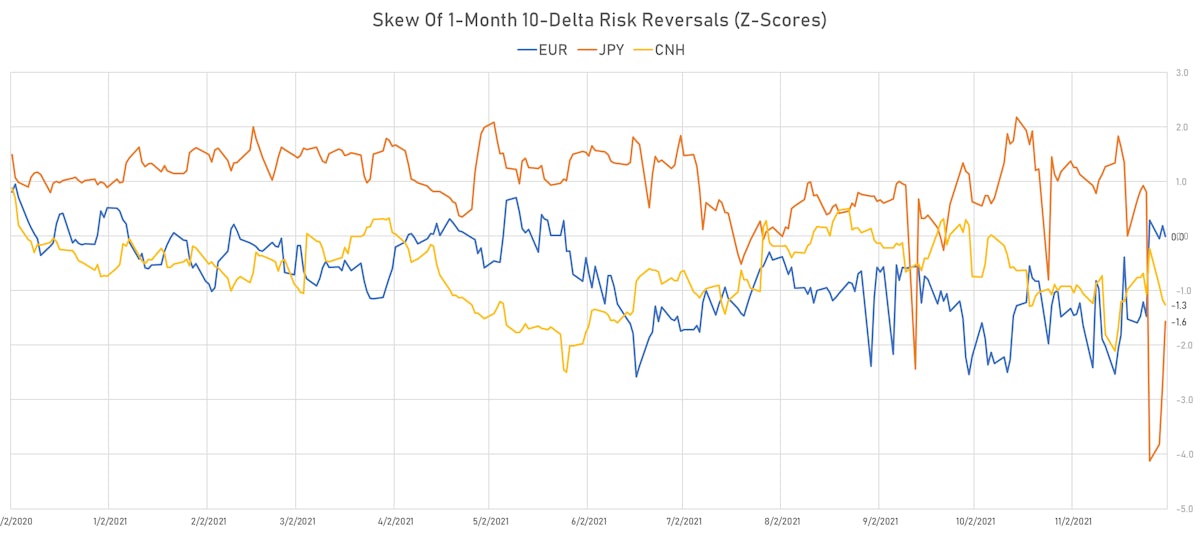

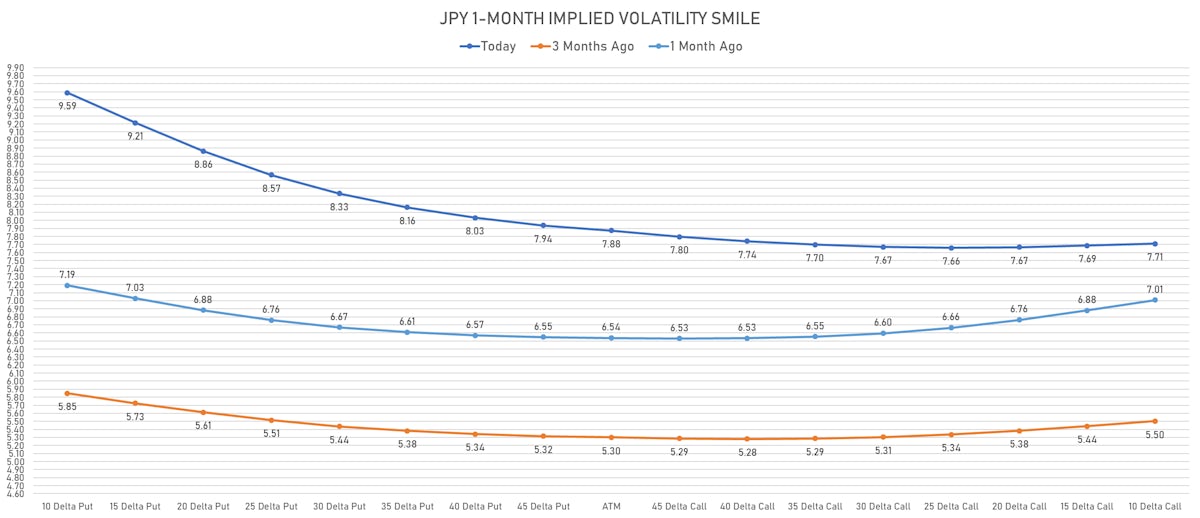

Volatility in US rates and credit has caused Japanese investors to sell some exposure to positive carry assets, creating upward pressure on the JPY and big moves in out-of-the-money JPY implied volatility

Published ET

Changes In The JPY 1-Month Implied Volatility Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

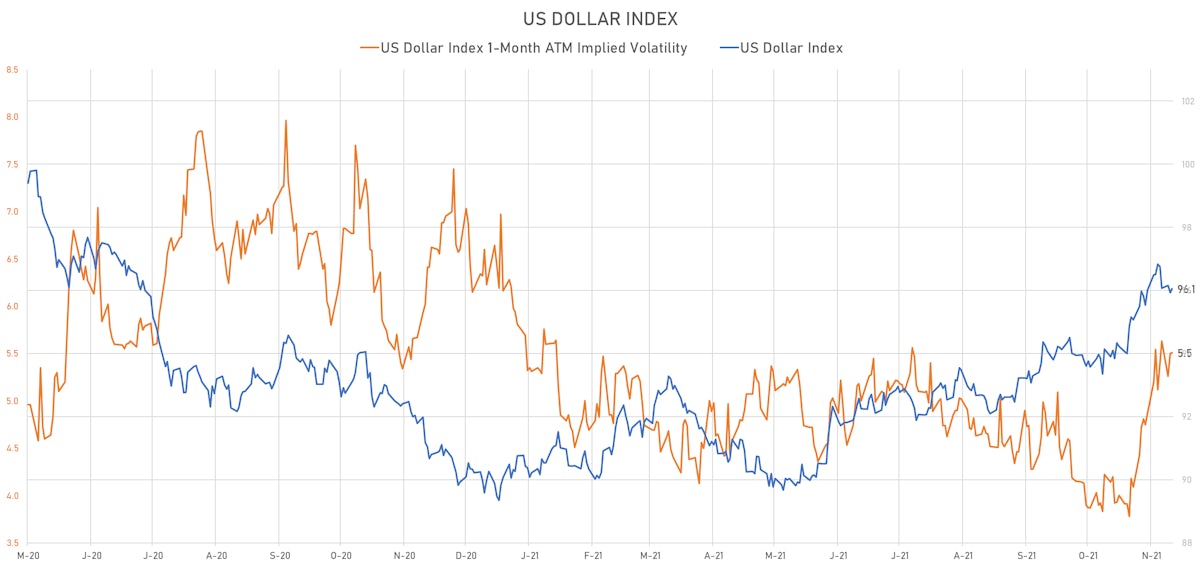

- The US Dollar Index is up 0.13% at 96.05 (YTD: +6.75%)

- Euro down 0.12% at 1.1322 (YTD: -7.3%)

- Yen up 0.12% at 113.03 (YTD: -8.6%)

- Onshore Yuan down 0.11% at 6.3689 (YTD: +2.5%)

- Swiss franc down 0.21% at 0.9201 (YTD: -3.9%)

- Sterling down 0.11% at 1.3281 (YTD: -2.9%)

- Canadian dollar down 0.29% at 1.2813 (YTD: -0.6%)

- Australian dollar down 0.21% at 0.7108 (YTD: -7.6%)

- NZ dollar down 0.03% at 0.6819 (YTD: -5.1%)

MACRO DATA RELEASES

- Angola, Policy Rates, BNA Basic Reference Rate for 30 Nov (Central Bank, Angola) at 20.00 % (vs 20.00 % prior)

- Australia, GDP, Change P/P for Q3 2021 (AU Bureau of Stat) at -1.90 % (vs 0.70 % prior), above consensus estimate of -2.70 %

- Australia, GDP, Change Y/Y for Q3 2021 (AU Bureau of Stat) at 3.90 % (vs 9.60 % prior), above consensus estimate of 3.00 %

- Brazil, PMI, Manufacturing Sector for Nov 2021 (Markit Economics) at 49.80 (vs 51.70 prior)

- Canada, PMI, Manufacturing Sector, Markit Mfg PMI SA for Nov 2021 (Markit Economics) at 57.20 (vs 57.70 prior)

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for Nov 2021 (Markit Economics) at 49.90 (vs 50.60 prior), below consensus estimate of 50.50

- Euro Zone, PMI, Manufacturing Sector, Total, Final for Nov 2021 (Markit Economics) at 58.40 (vs 58.60 prior), below consensus estimate of 58.60

- France, PMI, Manufacturing Sector, Total, Final for Nov 2021 (Markit Economics) at 55.90 (vs 54.60 prior), above consensus estimate of 54.60

- Germany, PMI, Manufacturing Sector, Total, Final for Nov 2021 (Markit Economics) at 57.40 (vs 57.60 prior), below consensus estimate of 57.60

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Nov 2021 (Markit Economics) at 57.60 (vs 55.90 prior), above consensus estimate of 55.10

- Indonesia, CPI, Change Y/Y for Nov 2021 (Statistics Indonesia) at 1.75 % (vs 1.66 % prior), above consensus estimate of 1.70 %

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Nov 2021 (Markit Economics) at 53.90 (vs 57.20 prior)

- Italy, PMI, Manufacturing Sector for Nov 2021 (Markit Economics) at 62.80 (vs 61.10 prior), above consensus estimate of 61.10

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for Nov 2021 (Markit Economics) at 54.50 (vs 54.20 prior)

- Mexico, PMI, Manufacturing Sector for Nov 2021 (Markit Economics) at 49.40 (vs 49.30 prior)

- Russia, PMI, Manufacturing Sector for Nov 2021 (Markit Economics) at 51.70 (vs 51.60 prior)

- Russia, Unemployment, Rate for Oct 2021 (RosStat, Russia) at 4.30 % (vs 4.30 % prior), below consensus estimate of 4.40 %

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Nov 2021 (Markit Economics) at 50.90 (vs 50.20 prior)

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Nov 2021 (Markit Economics) at 52.00 (vs 51.20 prior)

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change P/P for Nov 2021 (Nationwide, UK) at 0.90 % (vs 0.70 % prior), above consensus estimate of 0.50 %

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change Y/Y for Nov 2021 (Nationwide, UK) at 10.00 % (vs 9.90 % prior), above consensus estimate of 9.30 %

- United Kingdom, PMI, Manufacturing Sector for Nov 2021 (Markit Economics) at 58.10 (vs 58.20 prior), below consensus estimate of 58.20

- United States, ISM Manufacturing, PMI total for Nov 2021 (ISM, United States) at 61.10 (vs 60.80 prior), above consensus estimate of 61.00

- United States, PMI, Manufacturing Sector, Total, Final for Nov 2021 (Markit Economics) at 58.30 (vs 59.10 prior)

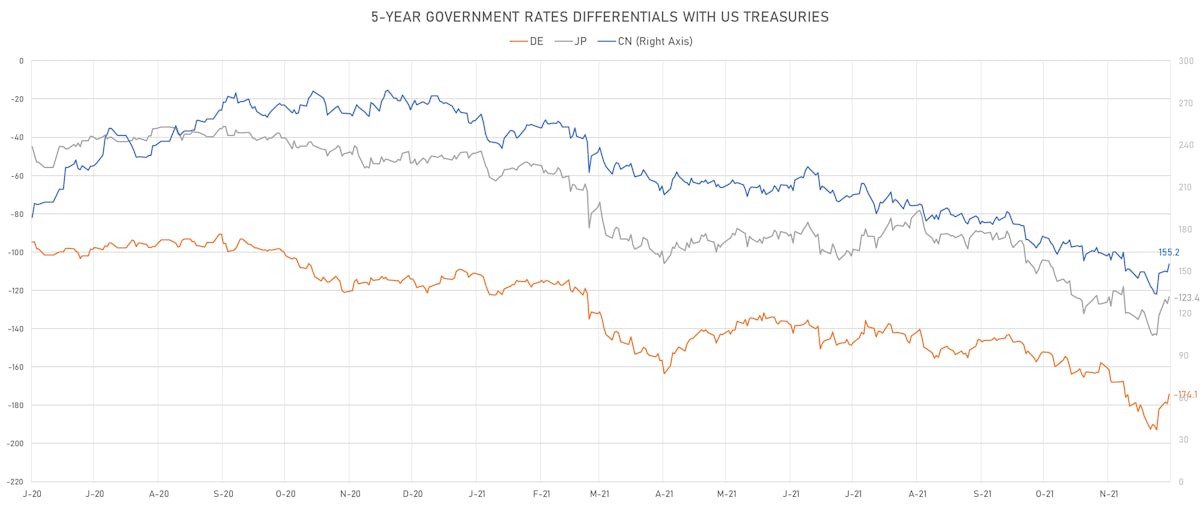

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.2 bp at 176.9 bp (YTD change: +65.8 bp)

- US-JAPAN: -0.9 bp at 125.9 bp (YTD change: +77.6 bp)

- US-CHINA: -3.2 bp at -152.7 bp (YTD change: +104.4 bp)

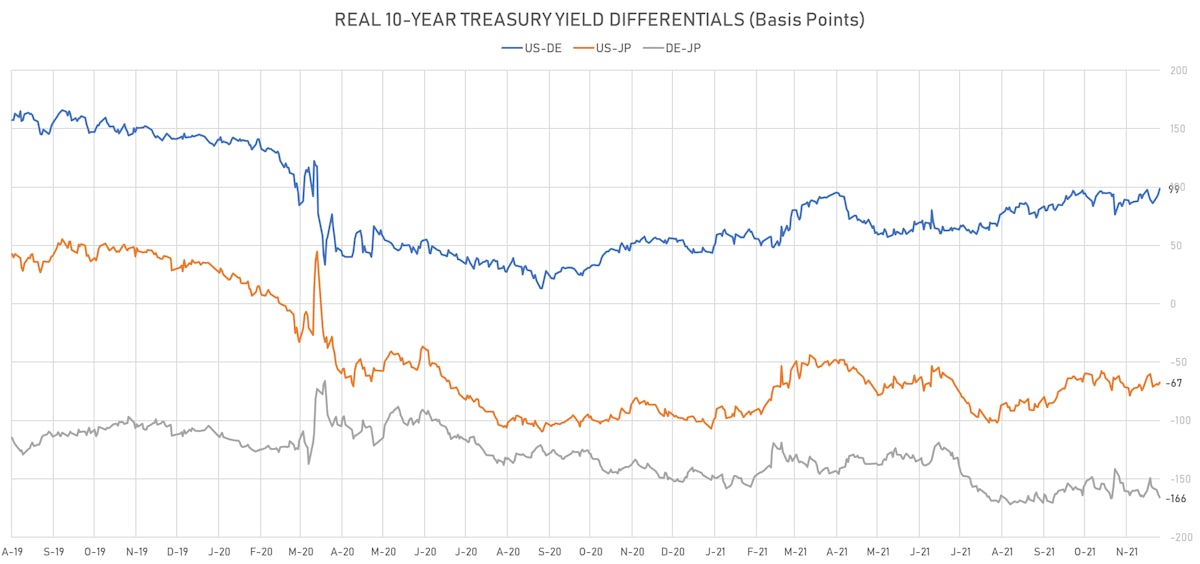

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.8 bp at 98.7 bp (YTD change: +52.6bp)

- US-JAPAN: +2.2 bp at -67.3 bp (YTD change: +34.2bp)

- JAPAN-GERMANY: +2.6 bp at 166.0 bp (YTD change: +18.4bp)

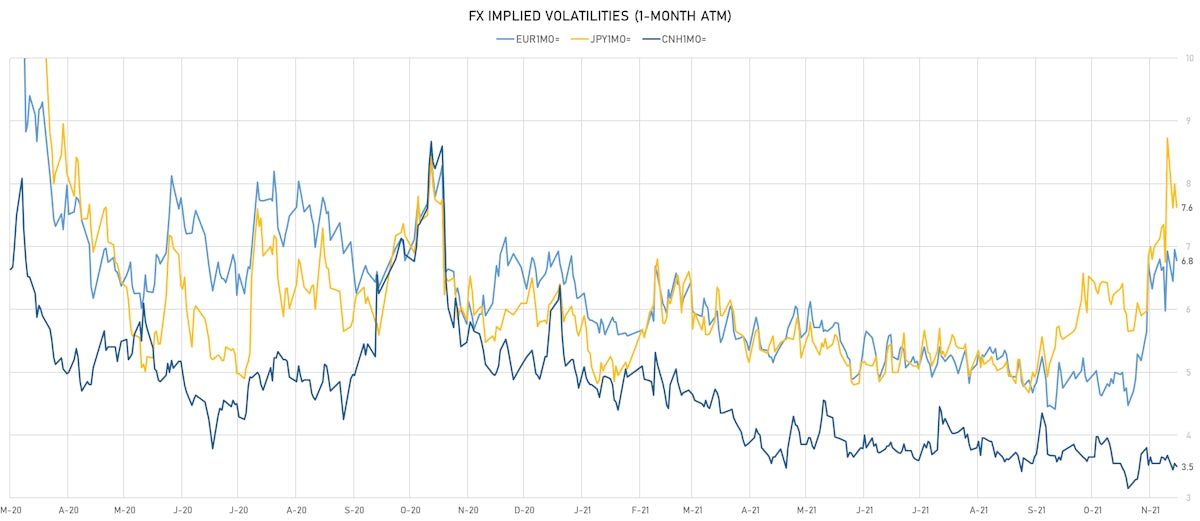

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.13, up 0.12 (YTD: -0.04)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.78, down -0.2 (YTD: +0.1)

- Japanese Yen 1M ATM IV currently at 7.63, down -0.4 (YTD: +1.5)

- Offshore Yuan 1M ATM IV unchanged at 3.50 (YTD: -2.5)

- JPY risk reversals are coming back to more normal levels after huge moves in recent days

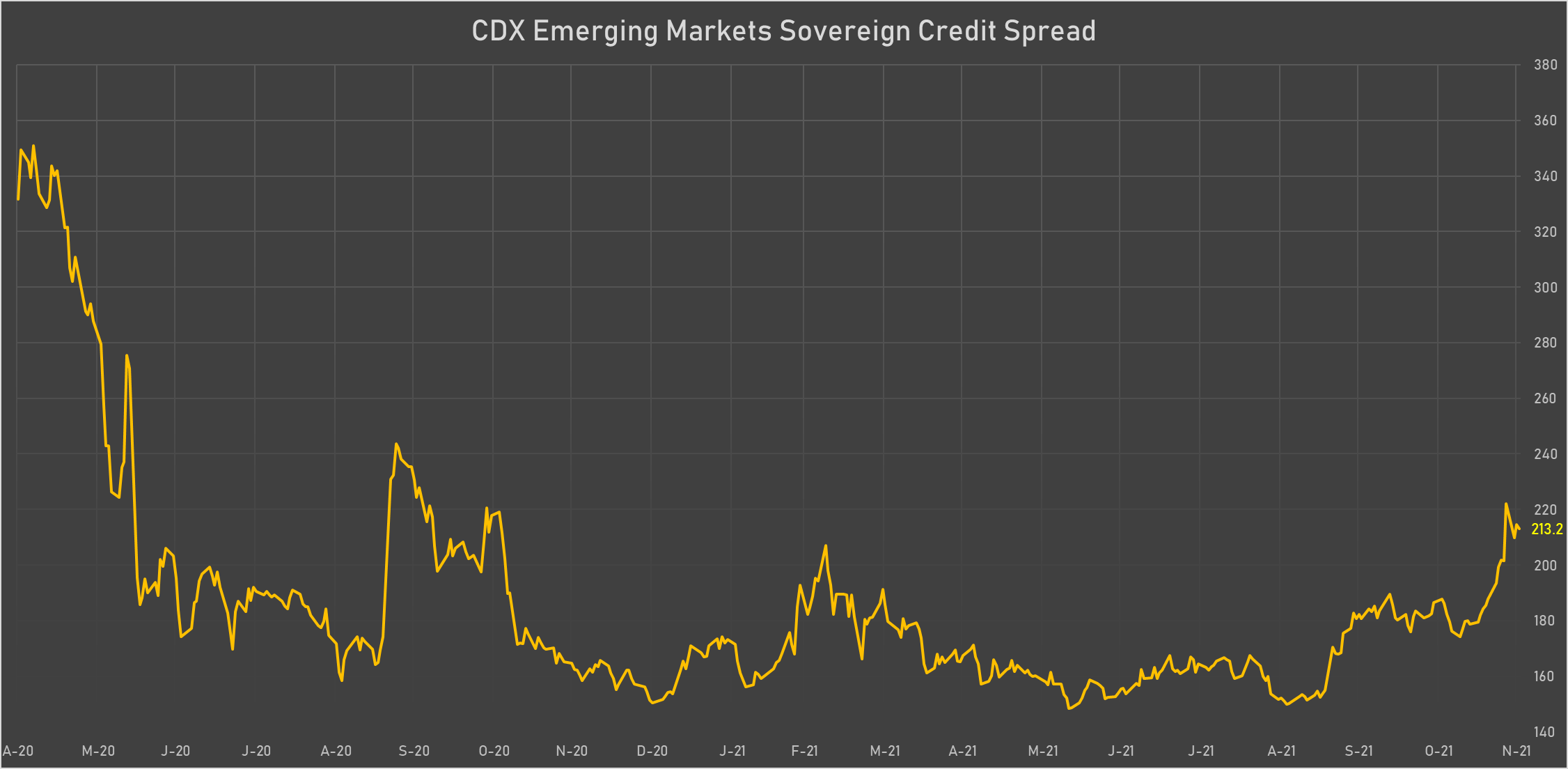

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Colombia (rated BB+): down 14.0 basis points to 213 bp (1Y range: 83-227bp)

- Brazil (rated BB-): down 11.1 basis points to 248 bp (1Y range: 141-266bp)

- South Africa (rated BB-): down 9.9 basis points to 235 bp (1Y range: 178-246bp)

- Panama (rated BBB-): down 3.8 basis points to 99 bp (1Y range: 44-103bp)

- Russia (rated BBB): down 3.5 basis points to 112 bp (1Y range: 72-122bp)

- Peru (rated BBB): down 3.5 basis points to 98 bp (1Y range: 52-105bp)

- Saudi Arabia (rated A): down 2.6 basis points to 51 bp (1Y range: 43-71bp)

- Malaysia (rated BBB+): up 1.7 basis points to 61 bp (1Y range: 34-64bp)

- Philippines (rated BBB): up 1.9 basis points to 71 bp (1Y range: 34-68bp)

- Turkey (rated BB-): up 17.7 basis points to 525 bp (1Y range: 282-507bp)

LARGEST FX MOVES TODAY

- Myanmar Kyat up 1.8% (YTD: -25.3%)

- Turkish Lira up 1.6% (YTD: -44.8%)

- Haiti Gourde up 1.0% (YTD: -26.1%)

- Kazakhstan Tenge up 0.9% (YTD: -3.4%)

- Qatari Riyal down 0.8% (YTD: -0.8%)

- Malawi Kwacha down 0.8% (YTD: -5.5%)

- Norwegian Krone down 1.0% (YTD: -5.7%)

- South Africa Rand down 1.0% (YTD: -8.2%)

- Brazilian Real down 1.2% (YTD: -8.8%)

- Chilean Peso down 1.4% (YTD: -15.3%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles Rupee up 62.1%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.1%

- Surinamese Dollar down 34.1%

- Turkish Lira down 44.8%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%