FX

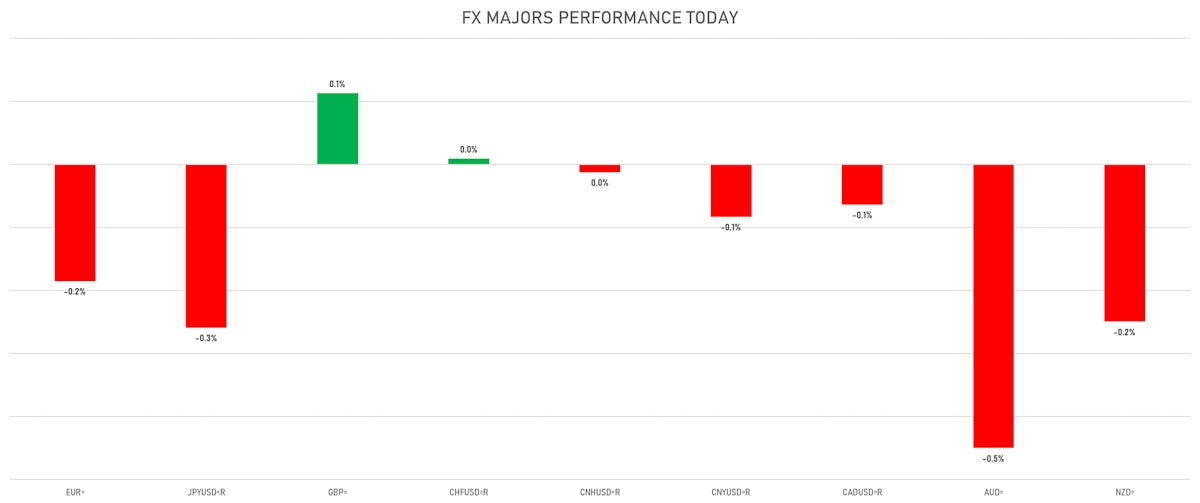

Not A Great Deal Of Movement For The US Dollar Index Today, With Slight Weakening In The EUR And JPY

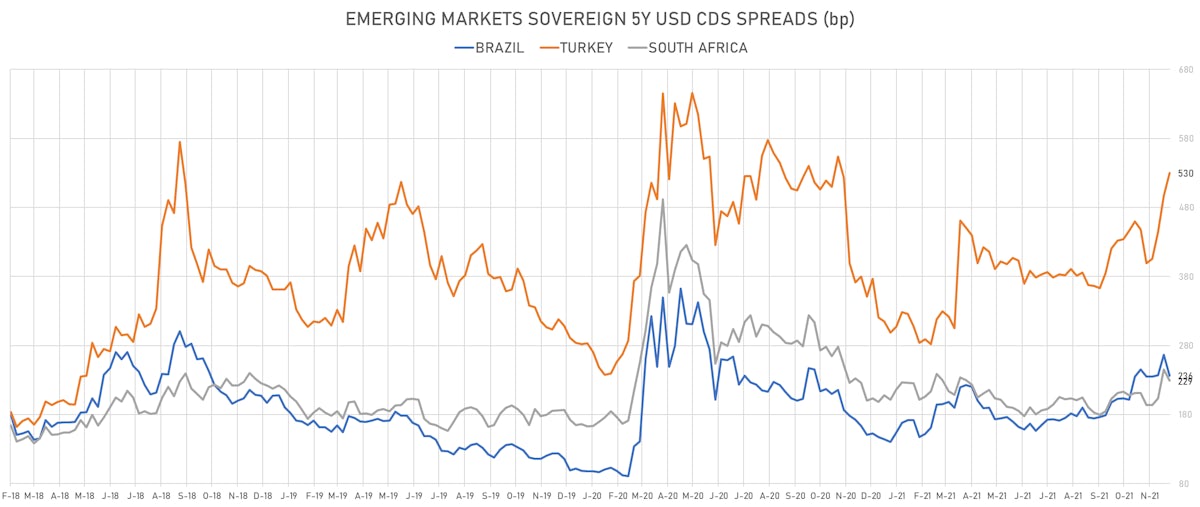

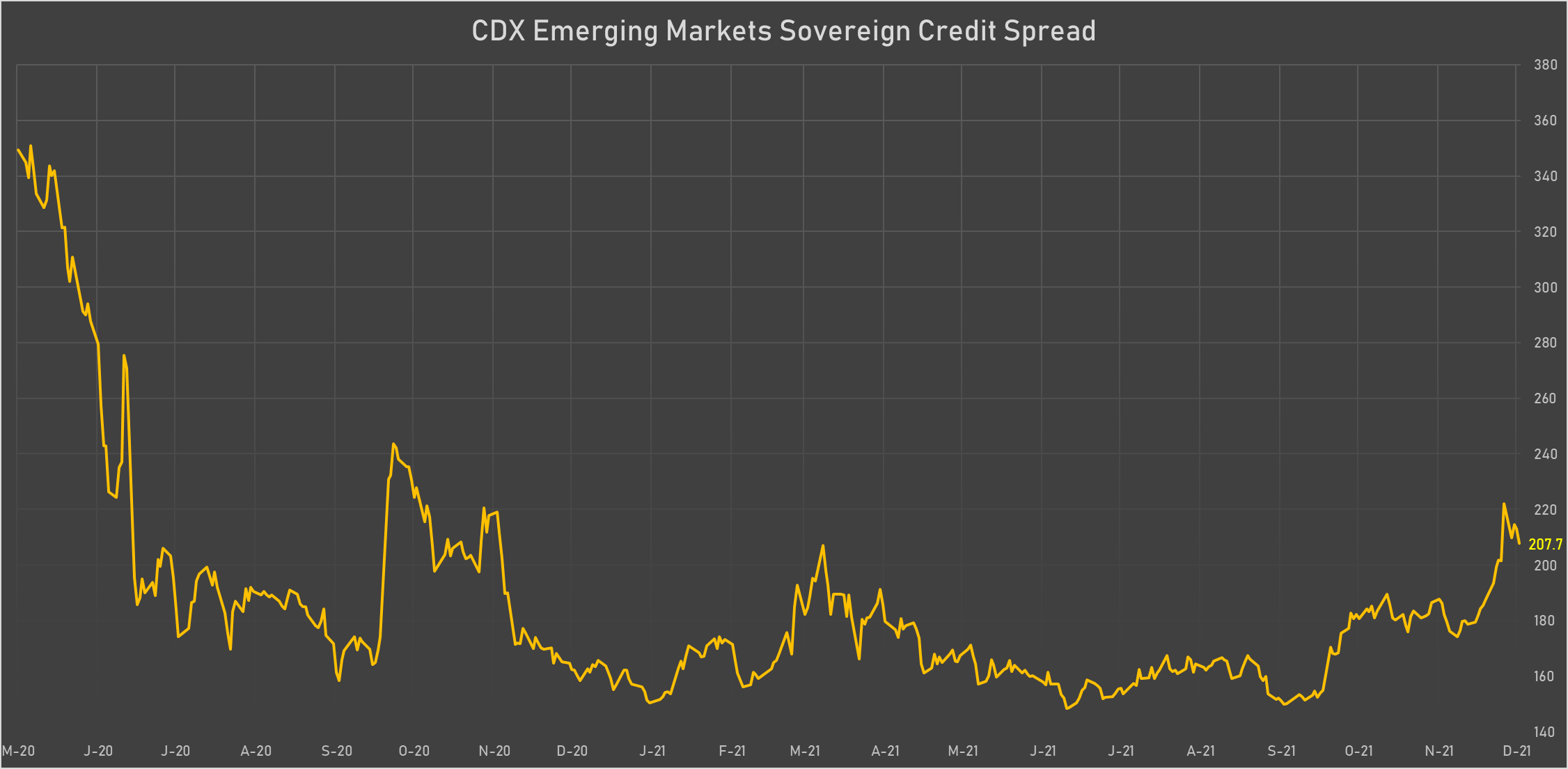

Emerging market currencies rebounded today with the risk-on sentiment, lower sovereign credit spreads and a bounce in commodities; the notable exception was the Turkish Lira, which fell hard again, now just below the 14.00 level

Published ET

Brazil, South Africa, Turkey 5Y USD CDS Spreads (basis points) | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

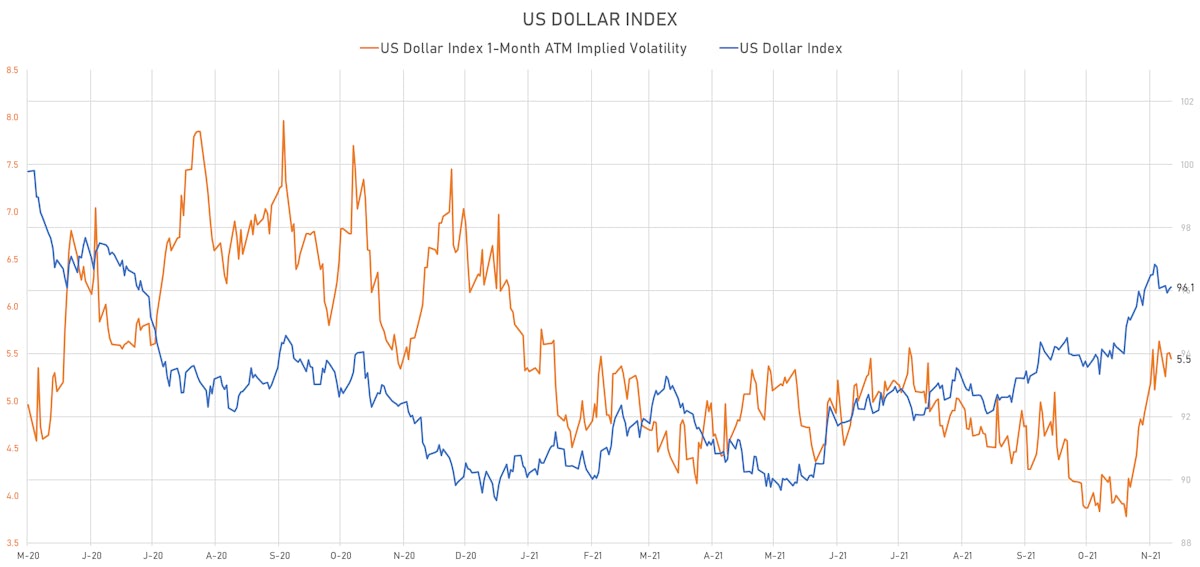

- The US Dollar Index is up 0.06% at 96.11 (YTD: +6.81%)

- Euro down 0.19% at 1.1298 (YTD: -7.5%)

- Yen down 0.26% at 113.08 (YTD: -8.7%)

- Onshore Yuan down 0.08% at 6.3741 (YTD: +2.4%)

- Swiss franc up 0.01% at 0.9199 (YTD: -3.8%)

- Sterling up 0.11% at 1.3292 (YTD: -2.8%)

- Canadian dollar down 0.06% at 1.2827 (YTD: -0.7%)

- Australian dollar down 0.45% at 0.7072 (YTD: -8.1%)

- NZ dollar down 0.25% at 0.6790 (YTD: -5.5%)

MACRO DATA RELEASES

- Australia, Current Account, Goods and Services, Net for Oct 2021 (AU Bureau of Stat) at 11,220.00 Mln AUD (vs 12,243.00 Mln AUD prior), above consensus estimate of 11,000.00 Mln AUD

- Austria, GDP, Change P/P for Q3 2021 (Statistics Austria) at 3.80 % (vs 3.30 % prior)

- Botswana, Policy Rates, Bank Rate for Dec 2021 (Bank of Botswana) at 3.75 % (vs 3.75 % prior)

- Brazil, CPI, Sao Paulo, General, Change P/P for Nov 2021 (FIPE, Brazil) at 0.72 % (vs 1.00 % prior)

- Brazil, GDP, Market prices, chain-weighted, Change P/P for Q3 2021 (IBGE, Brazil) at -0.10 % (vs -0.10 % prior), below consensus estimate of 0.00 %

- Brazil, GDP, Market prices, chain-weighted, Change Y/Y for Q3 2021 (IBGE, Brazil) at 4.00 % (vs 12.40 % prior), below consensus estimate of 4.20 %

- Euro Zone, Domestic Producer Prices, Total excluding construction (EA19), Change P/P, Price Index for Oct 2021 (Eurostat) at 5.40 % (vs 2.70 % prior), above consensus estimate of 3.50 %

- Euro Zone, Domestic Producer Prices, Total excluding construction (EA19), Change Y/Y, Price Index for Oct 2021 (Eurostat) at 21.90 % (vs 16.00 % prior), above consensus estimate of 19.00 %

- Euro Zone, Unemployment, Rate for Oct 2021 (Eurostat) at 7.30 % (vs 7.40 % prior), in line with consensus

- Italy, Unemployment, Rate for Oct 2021 (ISTAT, Italy) at 9.40 % (vs 9.20 % prior), above consensus estimate of 9.10 %

- Switzerland, Retail Sales, Total, excluding motor vehicles and fuels, Change Y/Y for Oct 2021 (FSO, Switzerland) at 1.20 % (vs 2.50 % prior)

- United States, Jobless Claims, National, Continued for W 20 Nov (U.S. Dept. of Labor) at 1.96 Mln (vs 2.05 Mln prior), below consensus estimate of 2.00 Mln

- United States, Jobless Claims, National, Initial for W 27 Nov (U.S. Dept. of Labor) at 222.00 k (vs 199.00 k prior), below consensus estimate of 240.00 k

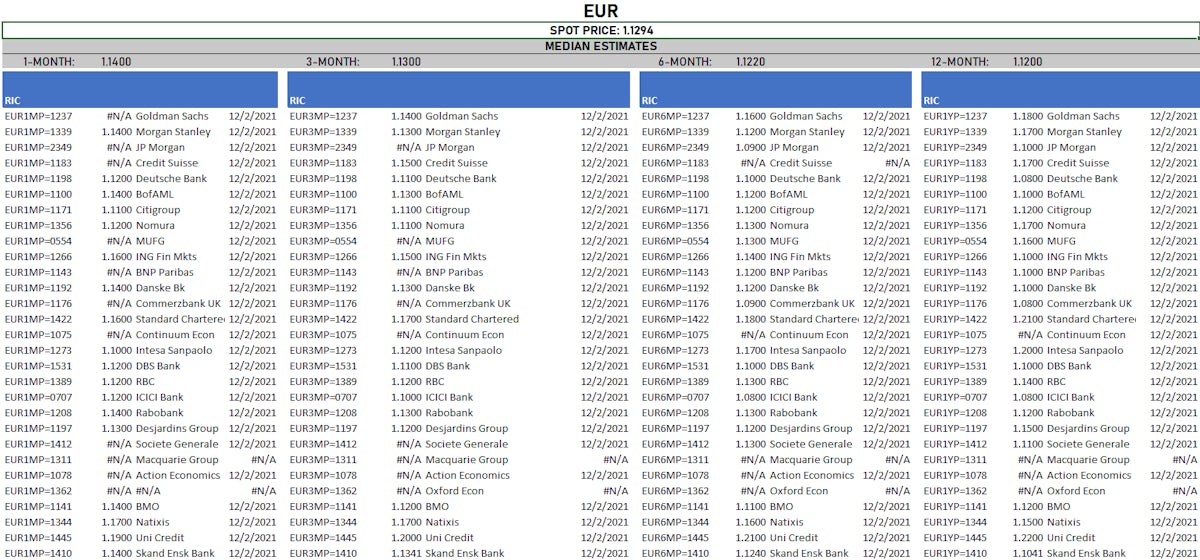

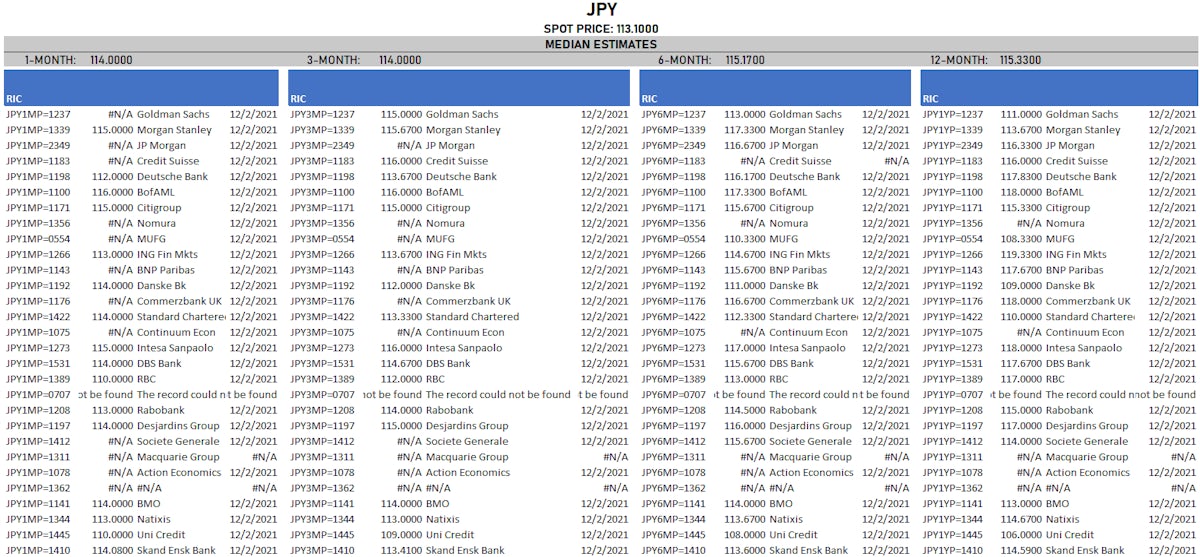

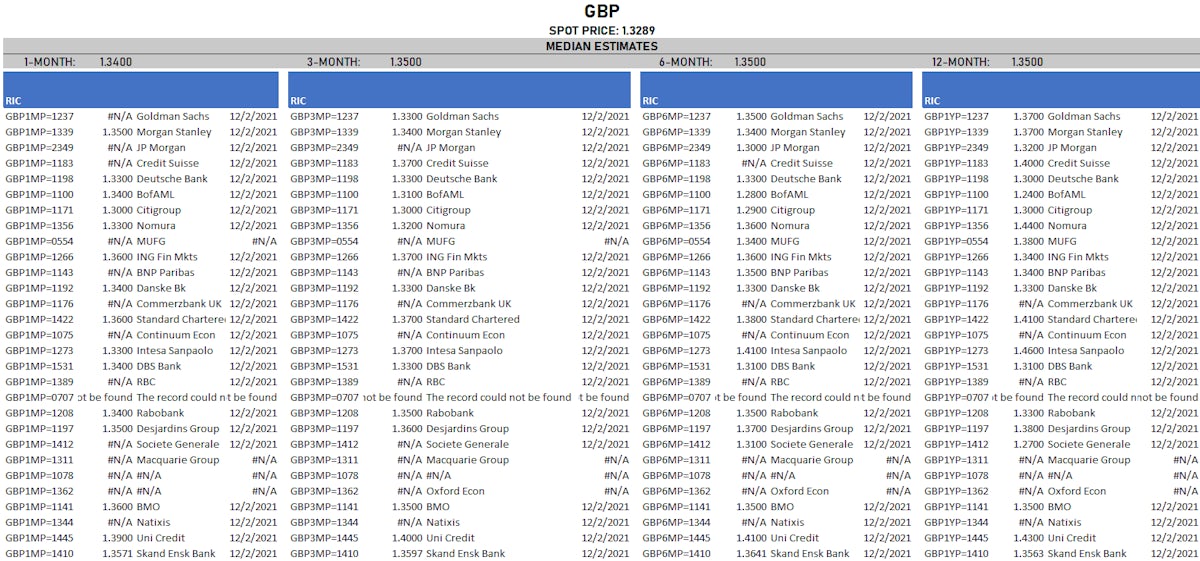

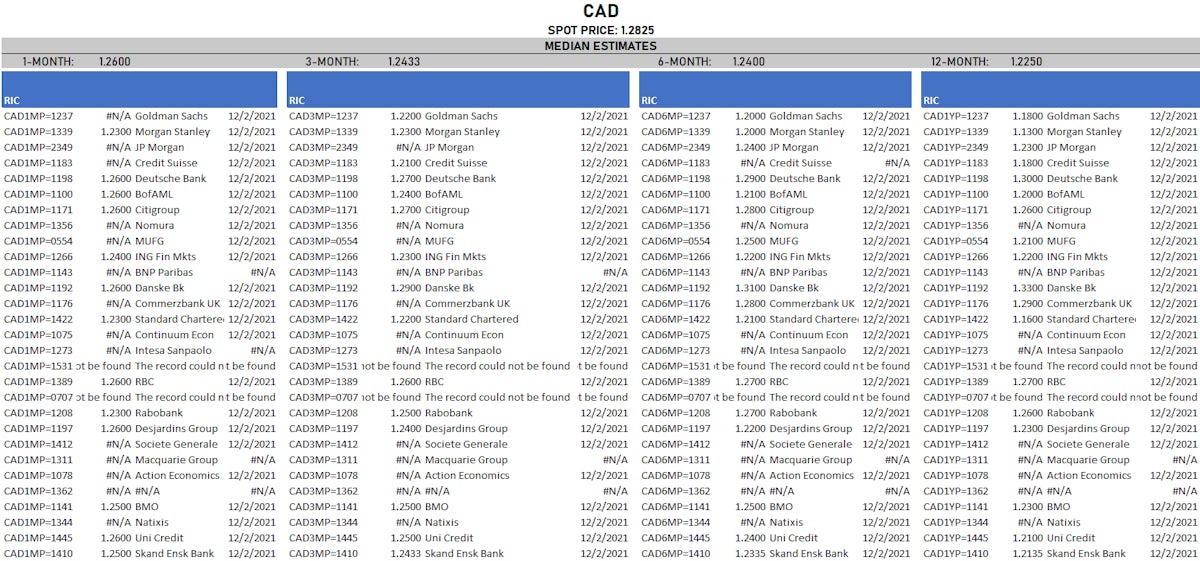

MONTHLY REUTERS FX POLL

- Euro spot price seen weakening slightly towards 1.1200; notable bears are JP Morgan (see 1.1000 in 12 months) and Deutsche Bank (see 1.0800 in 12 months)

- Japanese yen spot price seen weakening towards 115.00, with BofAML and Deutsche both seeing a potential for an extension to 118.00

- British pound spot median 12-month forecast at 1.3500, with the most bearish forecasts from BofAML and Societe Generale (1.2400 and 1.2700 respectively)

- Canadian dollar seen stronger with a median 12-month forecast at 1.2250, with BMO and Desjardins pretty much in line with that at 1.2300

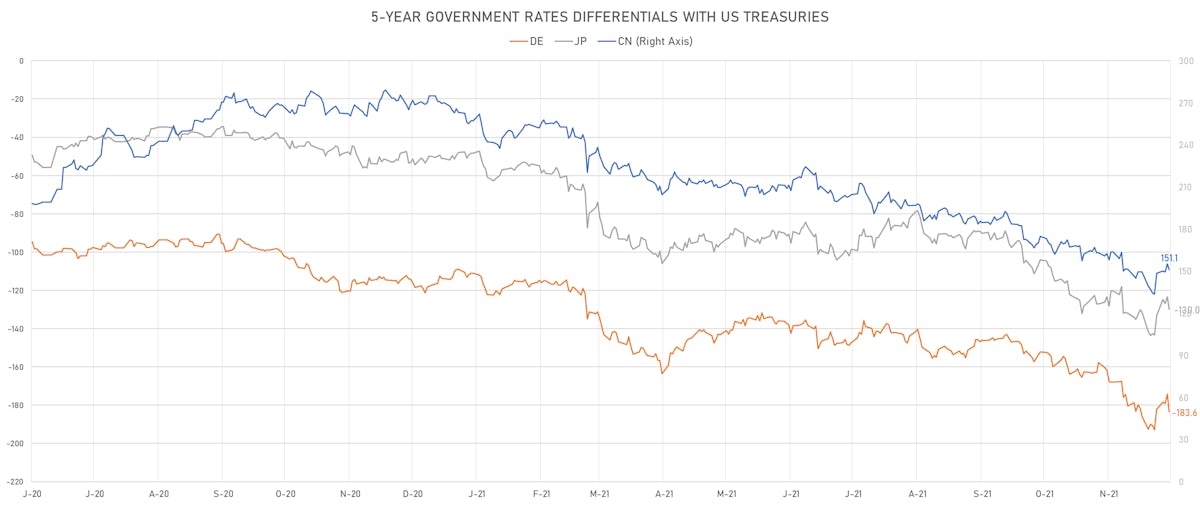

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +8.0 bp at 182.1 bp (YTD change: +71.0 bp)

- US-JAPAN: +5.3 bp at 128.7 bp (YTD change: +80.4 bp)

- US-CHINA: +2.6 bp at -152.6 bp (YTD change: +104.5 bp)

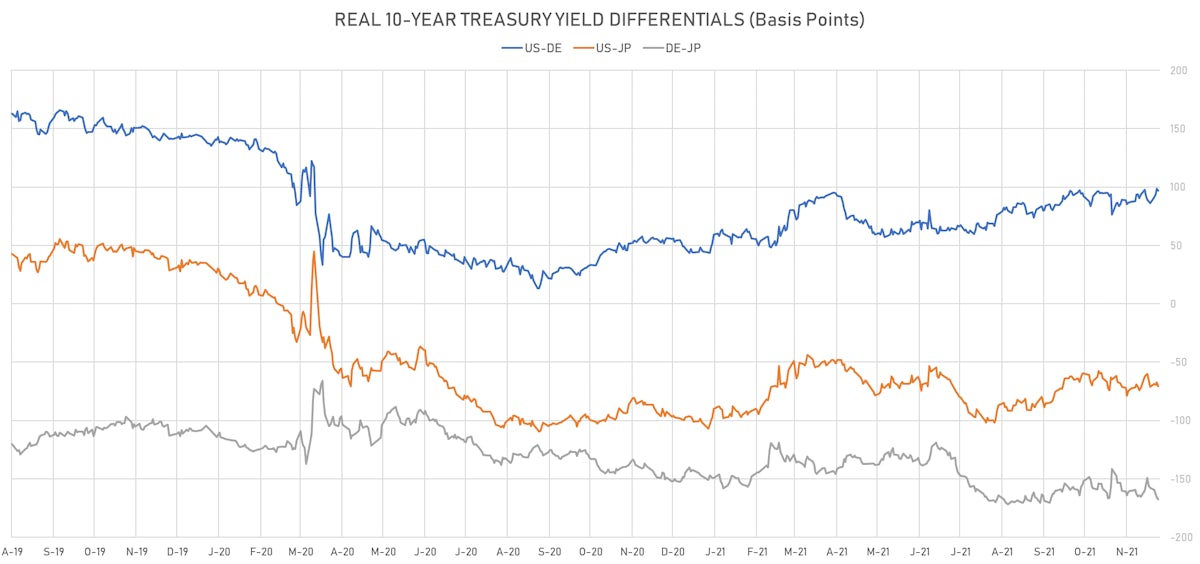

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.0 bp at 96.7 bp (YTD change: +50.6bp)

- US-JAPAN: -3.3 bp at -70.6 bp (YTD change: +30.9bp)

- JAPAN-GERMANY: +1.3 bp at 167.3 bp (YTD change: +19.7bp)

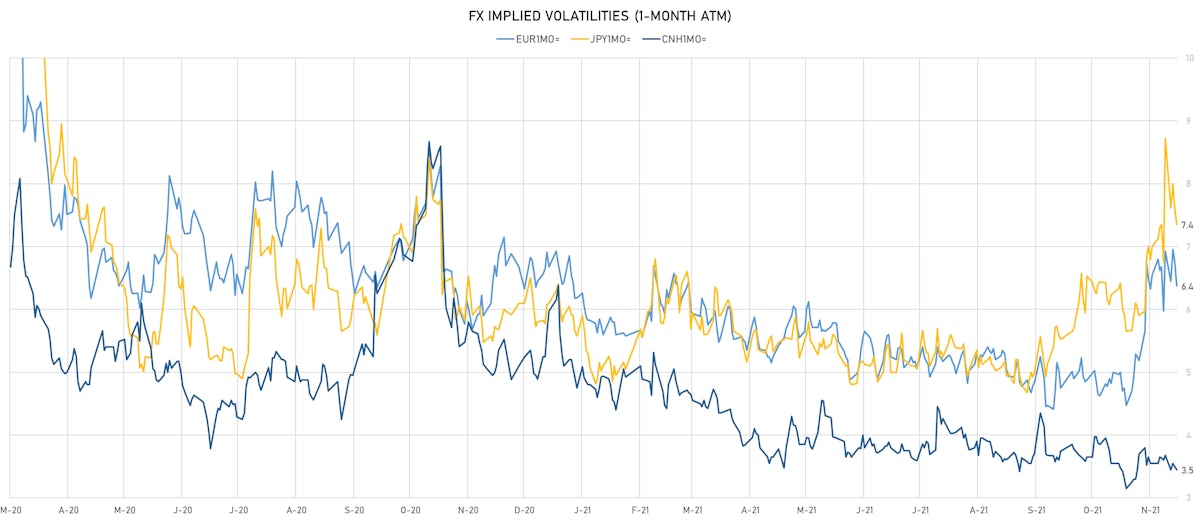

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.15, up 0.02 (YTD: -0.02)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.38, down -0.4 (YTD: -0.3)

- Japanese Yen 1M ATM IV currently at 7.35, down -0.3 (YTD: +1.3)

- Offshore Yuan 1M ATM IV unchanged at 3.45 (YTD: -2.5)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 66.3 basis points to 2,967 bp (1Y range: 1,092-3,111bp)

- Brazil (rated BB-): down 10.4 basis points to 236 bp (1Y range: 141-266bp)

- Colombia (rated BB+): down 8.0 basis points to 204 bp (1Y range: 83-227bp)

- South Africa (rated BB-): down 5.8 basis points to 229 bp (1Y range: 178-246bp)

- Chile (rated A-): down 3.7 basis points to 87 bp (1Y range: 43-95bp)

- Peru (rated BBB): down 3.4 basis points to 94 bp (1Y range: 52-105bp)

- Mexico (rated BBB-): down 3.0 basis points to 112 bp (1Y range: 79-124bp)

- Vietnam (rated BB): down 2.5 basis points to 103 bp (1Y range: 89-112bp)

- Panama (rated BBB-): down 2.3 basis points to 95 bp (1Y range: 44-103bp)

- Malaysia (rated BBB+): down 1.8 basis points to 58 bp (1Y range: 34-64bp)

LARGEST FX MOVES TODAY

- Mauritius Rupee up 1.8% (YTD: -7.6%)

- Mexican Peso up 1.1% (YTD: -6.8%)

- Brazilian Real up 0.9% (YTD: -8.0%)

- Malawi Kwacha up 0.8% (YTD: -5.5%)

- Russian Rouble up 0.8% (YTD: +0.4%)

- Colombian Peso up 0.8% (YTD: -13.0%)

- Armenian Dram down 1.0% (YTD: +6.5%)

- Turkish Lira down 3.6% (YTD: -45.9%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 65.9%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.1%

- Surinamese dollar down 34.1%

- Turkish Lira down 45.9%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.1%

- Sudanese Pound down 87.5%