FX

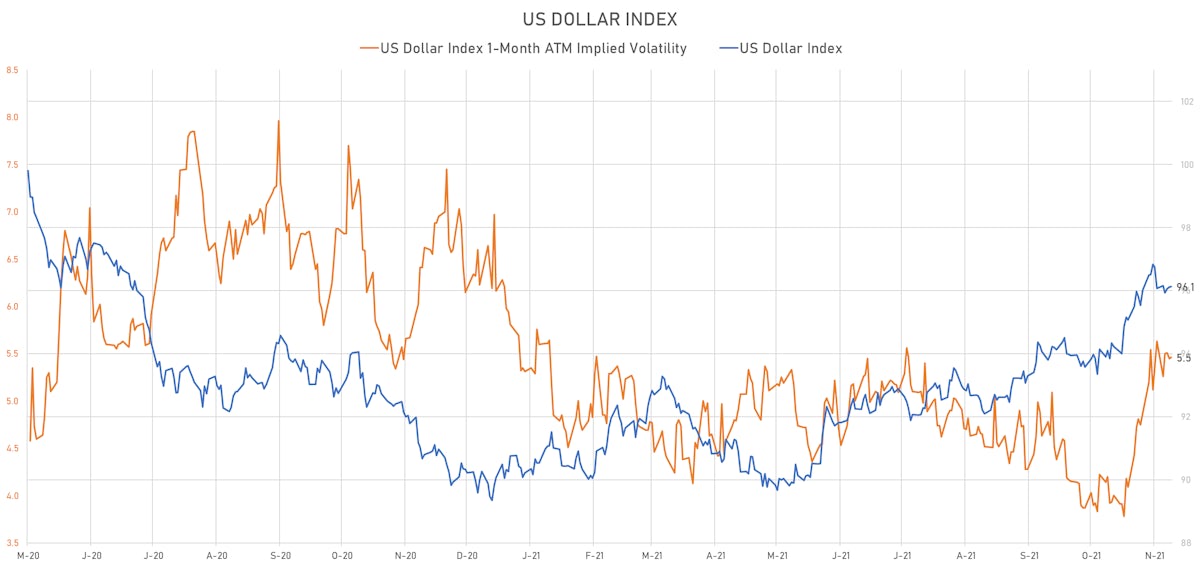

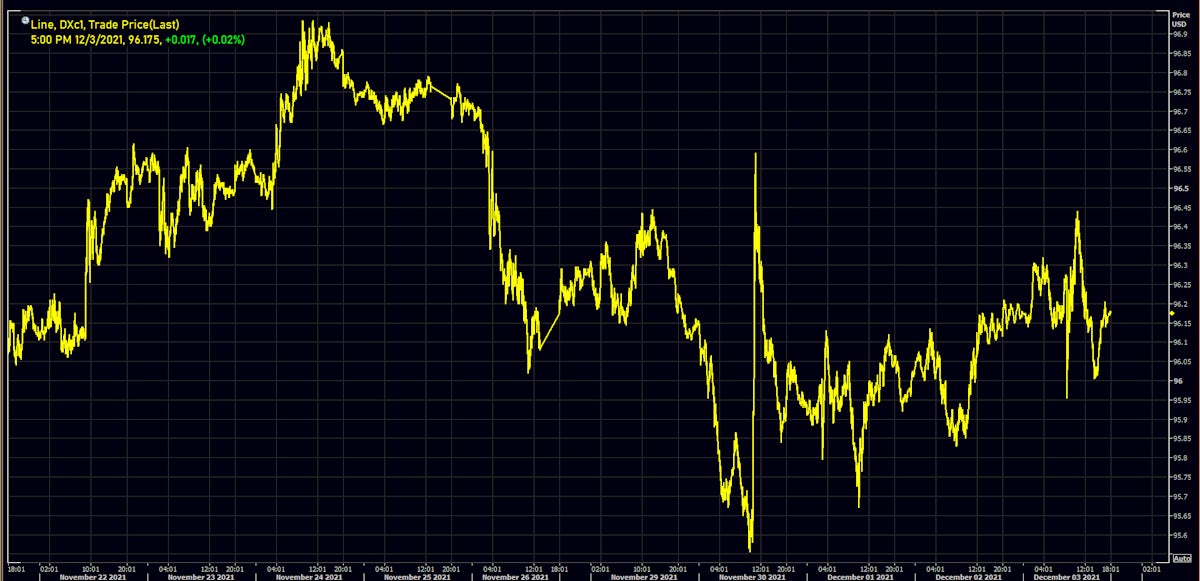

Volatile Week For Currencies Ends On A Quieter Note, With The Dollar Index Edging Up On Friday

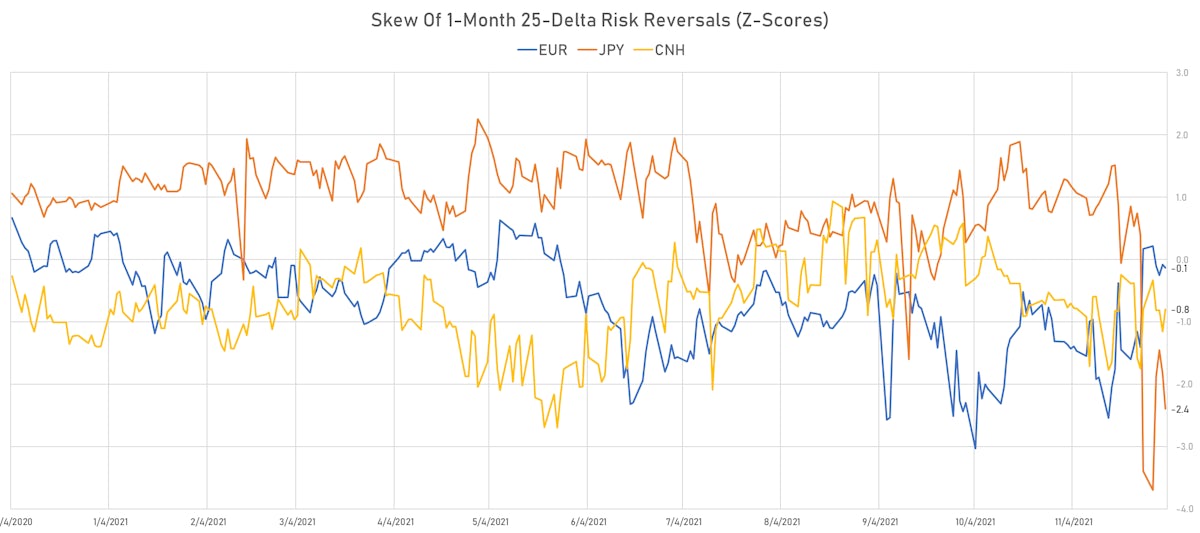

The past week has been a good example of how carry trades have a negative convexity to volatility, while funding currencies like the Japanese Yen and Swiss Franc have a positive convexity (rising the most when volatility is highest)

Published ET

US Dollar Index Front-Month Future Prices | Source: Refinitiv

QUICK SUMMARY

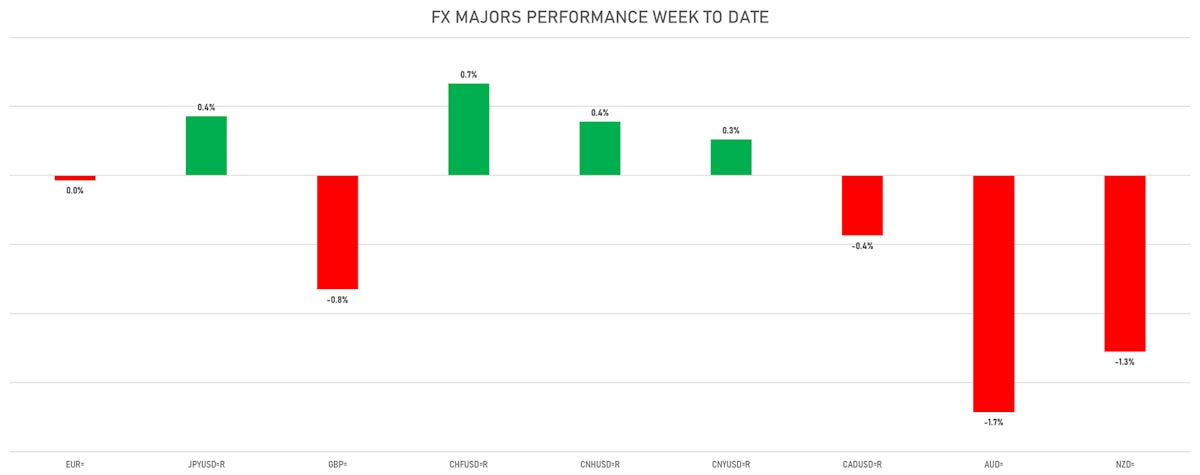

- The US Dollar Index is up 0.03% at 96.13 (YTD: +6.84%)

- Euro up 0.12% at 1.1313 (YTD: -7.4%)

- Yen up 0.32% at 112.80 (YTD: -8.5%)

- Onshore Yuan up 0.01% at 6.3758 (YTD: +2.4%)

- Swiss Franc up 0.23% at 0.9178 (YTD: -3.6%)

- Sterling down 0.57% at 1.3230 (YTD: -3.2%)

- Canadian dollar down 0.26% at 1.2842 (YTD: -0.8%)

- Australian dollar down 1.30% at 0.7001 (YTD: -9.0%)

- NZ dollar down 1.13% at 0.6739 (YTD: -6.2%)

MACRO DATA RELEASES

- Brazil, PMI, Composite, Output, Total for Nov 2021 (Markit Economics) at 52.00 (vs 53.40 prior)

- Brazil, PMI, Services Sector, Business Activity for Nov 2021 (Markit Economics) at 53.60 (vs 54.90 prior)

- Brazil, Production, General industry, Change P/P for Oct 2021 (IBGE, Brazil) at -0.60 % (vs -0.40 % prior), below consensus estimate of 0.60 %

- Brazil, Production, General industry, Change Y/Y for Oct 2021 (IBGE, Brazil) at -7.80 % (vs -3.90 % prior), below consensus estimate of -5.00 %

- Canada, Employment, Absolute change for Nov 2021 (CANSIM, Canada) at 153.70 k (vs 31.20 k prior), above consensus estimate of 35.00 k

- Canada, Unemployment, Rate for Nov 2021 (CANSIM, Canada) at 6.00 % (vs 6.70 % prior), below consensus estimate of 6.60 %

- China (Mainland), PMI, Services Sector, Business Activity, Caixin PMI for Nov 2021 (Markit Economics) at 52.10 (vs 53.80 prior)

- Euro Zone, PMI, Composite, Output, Final for Nov 2021 (Markit Economics) at 55.40 (vs 55.80 prior), below consensus estimate of 55.80

- Euro Zone, PMI, Services Sector, Business Activity, Final for Nov 2021 (Markit Economics) at 55.90 (vs 56.60 prior), below consensus estimate of 56.60

- France, PMI, Composite, Output, Final for Nov 2021 (Markit/CDAF, France) at 56.10 (vs 56.30 prior), below consensus estimate of 56.30

- France, PMI, Services Sector, Business Activity, Final for Nov 2021 (Markit Economics) at 57.40 (vs 58.20 prior), below consensus estimate of 58.20

- Germany, PMI, Composite, Output, Final for Nov 2021 (Markit Economics) at 52.20 (vs 52.80 prior), below consensus estimate of 52.80

- Germany, PMI, Services Sector, Business Activity, Final for Nov 2021 (Markit Economics) at 52.70 (vs 53.40 prior), below consensus estimate of 53.40

- India, IHS Markit, PMI, Services Sector, Business Activity for Nov 2021 (Markit Economics) at 58.10 (vs 58.40 prior), above consensus estimate of 57.80

- Japan, Jibun Bank, PMI, Services Sector, Service PMI for Nov 2021 (Markit Economics) at 53.00 (vs 50.70 prior)

- Russia, PMI, Services Sector, Business Activity for Nov 2021 (Markit Economics) at 47.10 (vs 48.80 prior)

- South Africa, Standard Bank PMI for Nov 2021 (Markit Economics) at 51.70 (vs 48.60 prior)

- Turkey, CPI, Change P/P, Price Index for Nov 2021 (TURKSTAT) at 3.51 % (vs 2.39 % prior), above consensus estimate of 3.00 %

- United Kingdom, Reserves, Gross, Government, Current Prices for Nov 2021 (HM Treasury) at 202,221.35 Mln USD (vs 200,923.27 Mln USD prior)

- United States, Employment, Nonfarm payroll, total, Absolute change for Nov 2021 (BLS, U.S Dep. Of Lab) at 210.00 k (vs 531.00 k prior), below consensus estimate of 550.00 k

- United States, ISM Non-manufacturing, NMI/PMI for Nov 2021 (ISM, United States) at 69.10 (vs 66.70 prior), above consensus estimate of 65.00

- United States, Manufacturers New Orders, Total manufacturing, Change P/P for Oct 2021 (U.S. Census Bureau) at 1.00 % (vs 0.20 % prior), above consensus estimate of 0.50 %

- United States, PMI, Composite, Output, Final for Nov 2021 (Markit Economics) at 57.20 (vs 56.50 prior)

- United States, PMI, Services Sector, Business Activity, Final for Nov 2021 (Markit Economics) at 58.00 (vs 57.00 prior)

- United States, Unemployment, Rate for Nov 2021 (BLS, U.S Dep. Of Lab) at 4.20 % (vs 4.60 % prior), below consensus estimate of 4.50 %

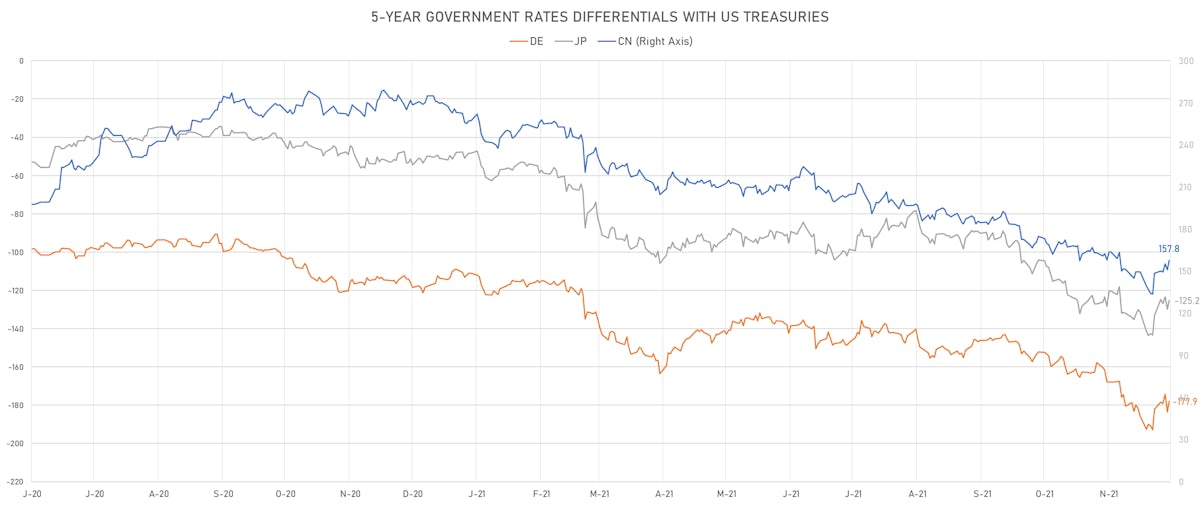

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -5.7 bp at 177.9 bp (YTD change: +66.8 bp)

- US-JAPAN: -4.7 bp at 125.2 bp (YTD change: +76.9 bp)

- US-CHINA: -6.8 bp at -157.8 bp (YTD change: +99.3 bp)

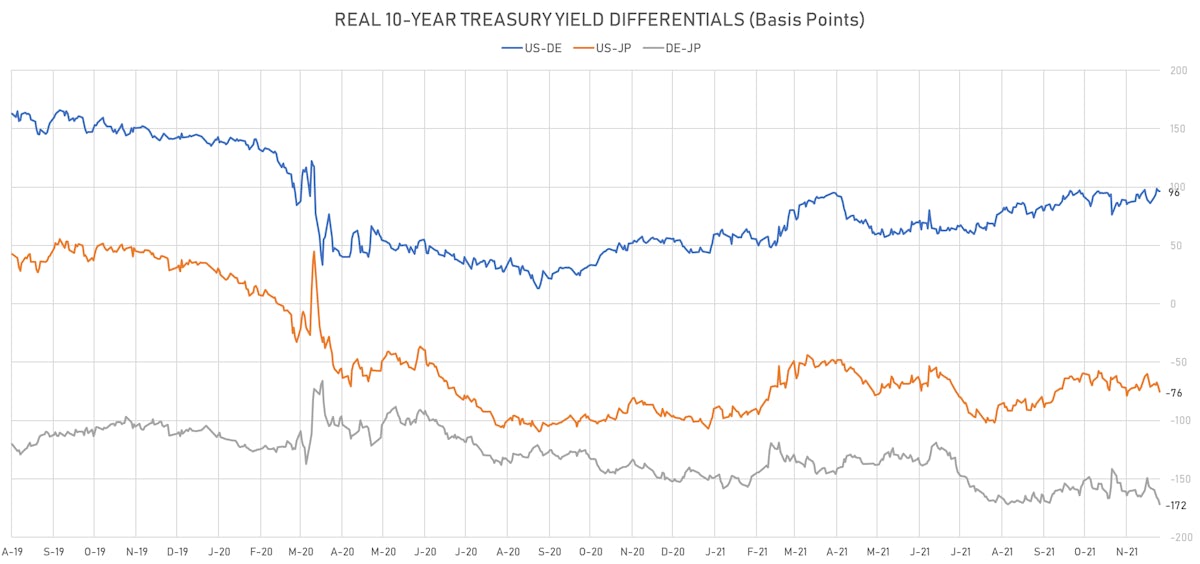

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.4 bp at 96.3 bp (YTD change: +50.2bp)

- US-JAPAN: -5.0 bp at -75.6 bp (YTD change: +25.9bp)

- JAPAN-GERMANY: +4.6 bp at 171.9 bp (YTD change: +24.3bp)

WEEKLY IMM SPECULATIVE NET POSITIONING

- All currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net long US$ positioning

- Euro: increase in net long US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: increase in net long US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: reduction in net long US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

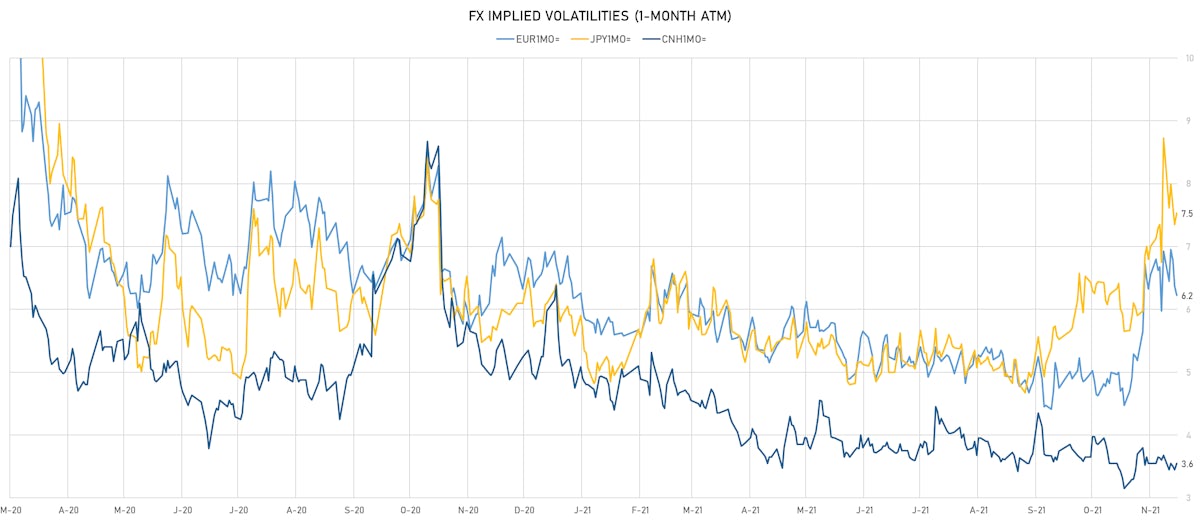

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.96, down -0.19 (YTD: -0.21)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.23, down -0.2 (YTD: -0.5)

- Japanese Yen 1M ATM IV currently at 7.53, up 0.2 (YTD: +1.4)

- Offshore Yuan 1M ATM IV currently at 3.55, up 0.1 (YTD: -2.4)

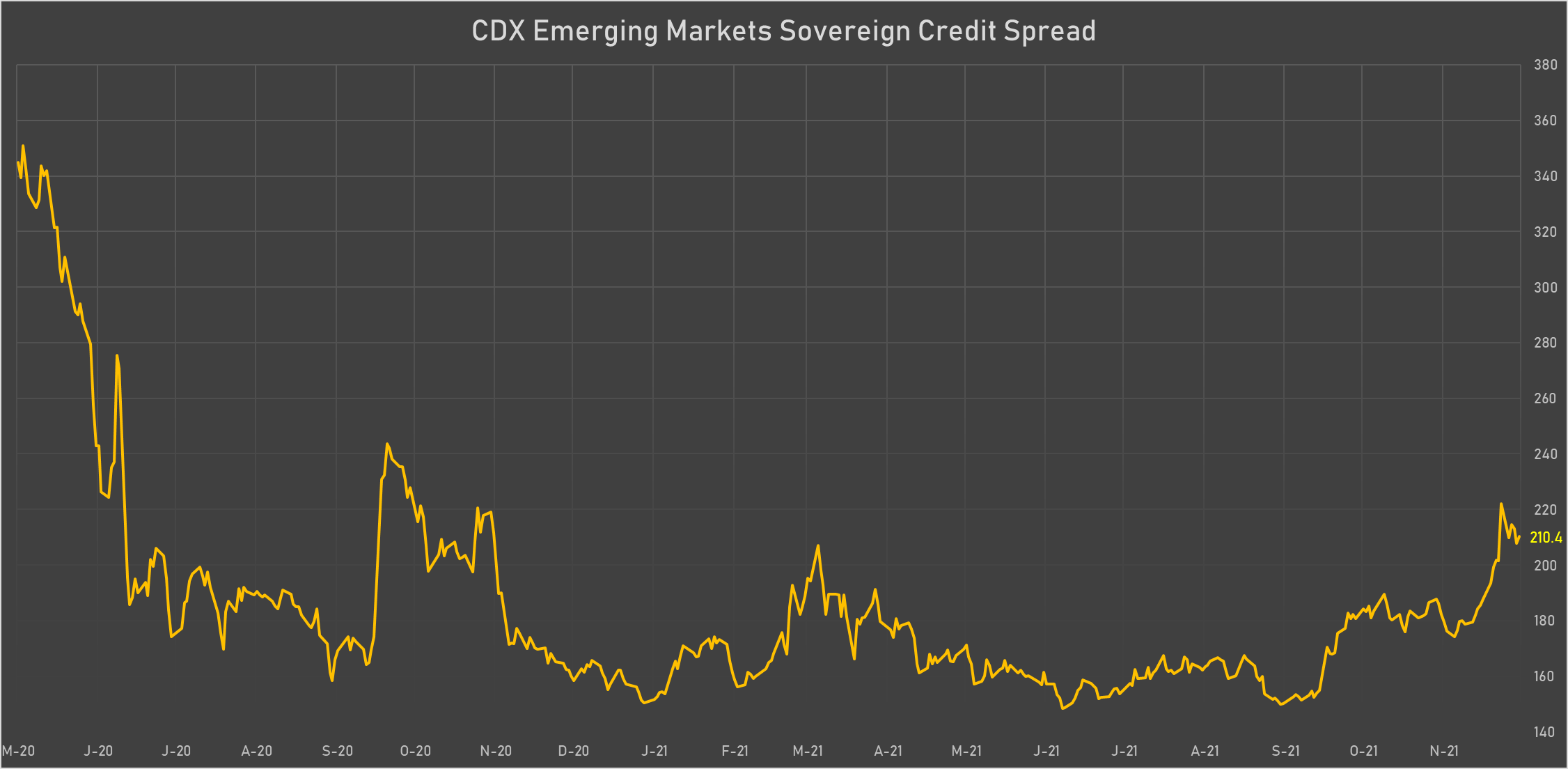

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 123.5 basis points to 2,856 bp (1Y range: 1,092-3,111bp)

- Oman (rated BB-): down 5.4 basis points to 259 bp (1Y range: 223-368bp)

- Vietnam (rated BB): down 2.0 basis points to 103 bp (1Y range: 89-112bp)

- China (rated A+): down 1.3 basis points to 51 bp (1Y range: 27-58bp)

- Malaysia (rated BBB+): down 1.0 basis points to 58 bp (1Y range: 34-64bp)

- Philippines (rated BBB): down 0.9 basis points to 68 bp (1Y range: 34-70bp)

- Indonesia (rated BBB): down 0.7 basis points to 87 bp (1Y range: 66-94bp)

- Chile (rated A-): up 0.9 basis points to 88 bp (1Y range: 43-95bp)

- South Africa (rated BB-): up 1.5 basis points to 230 bp (1Y range: 178-246bp)

- Turkey (rated BB-): up 7.4 basis points to 537 bp (1Y range: 282-530bp)

LARGEST FX MOVES TODAY

- Rwanda Franc up 3.6% (YTD: -1.9%)

- Guinea Franc up 2.9% (YTD: +6.0%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Tonga Pa'Anga up 2.0% (YTD: +1.4%)

- Congo Franc up 1.6% (YTD: +0.6%)

- Ghanaian Cedi down 1.6% (YTD: -6.0%)

- Solomon Is Dollar down 2.3% (YTD: -2.7%)

- Gambian Dalasi down 2.6% (YTD: -2.6%)

- Nicaragua Cordoba down 2.7% (YTD: -3.4%)

- Eritrean Nakfa down 2.7% (YTD: -2.7%)

LARGEST FX MOVES THIS WEEK

- Rwanda Franc up 3.6% (YTD: -1.9%)

- Mexican Peso down 3.0% (YTD: -6.5%)

- Guinea Franc up 2.9% (YTD: +6.0%)

- Polish Zloty up 2.5% (YTD: -8.1%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Gambian Dalasi down 2.6% (YTD: -2.6%)

- Nicaragua Cordoba down 2.7% (YTD: -3.4%)

- Eritrean Nakfa down 2.7% (YTD: -2.7%)

- Seychelles rupee down 2.7% (YTD: +40.9%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 40.9%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 26.8%

- Surinamese Dollar down 34.1%

- Turkish Lira down 45.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%