FX

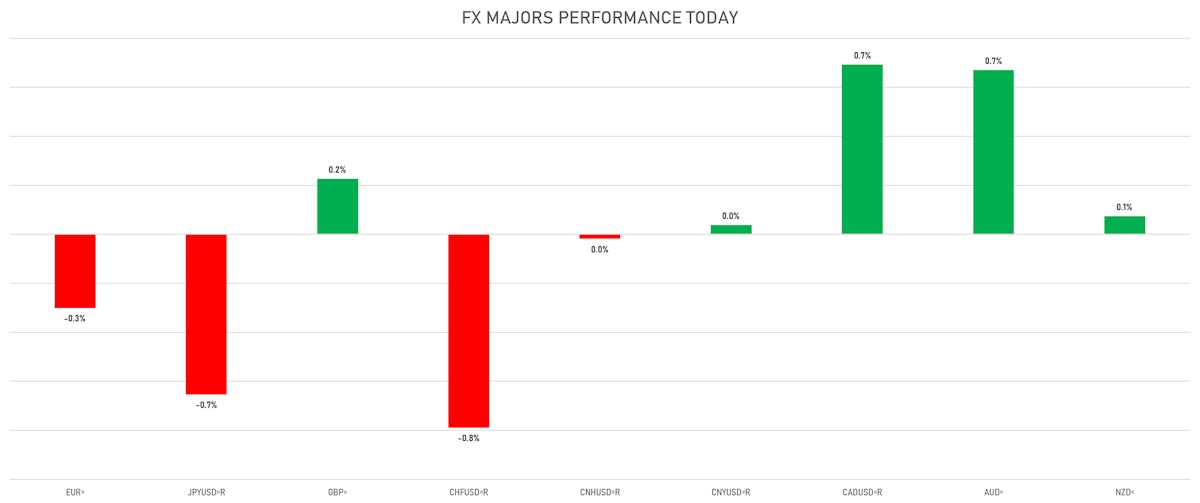

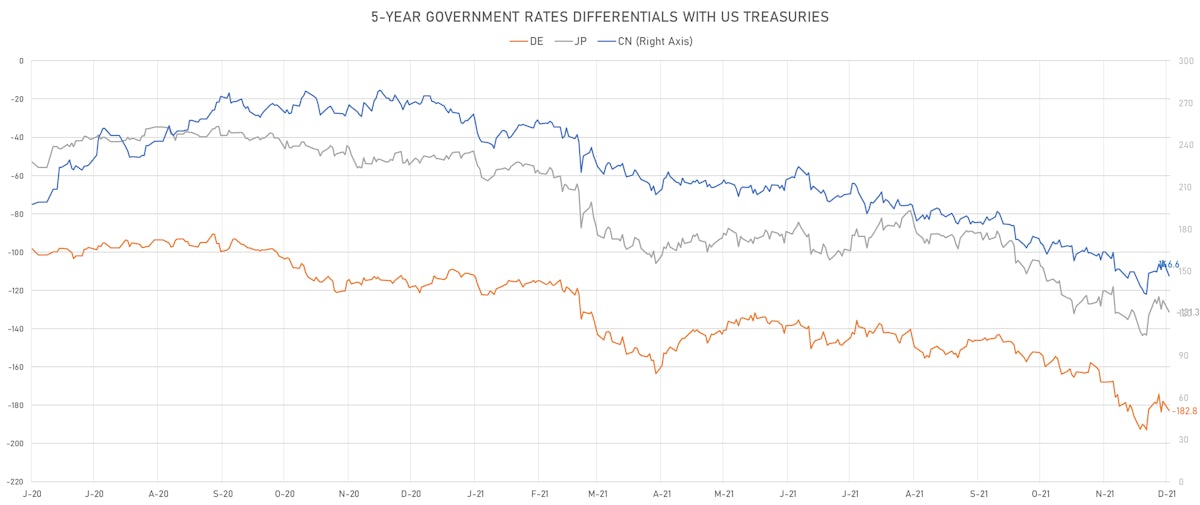

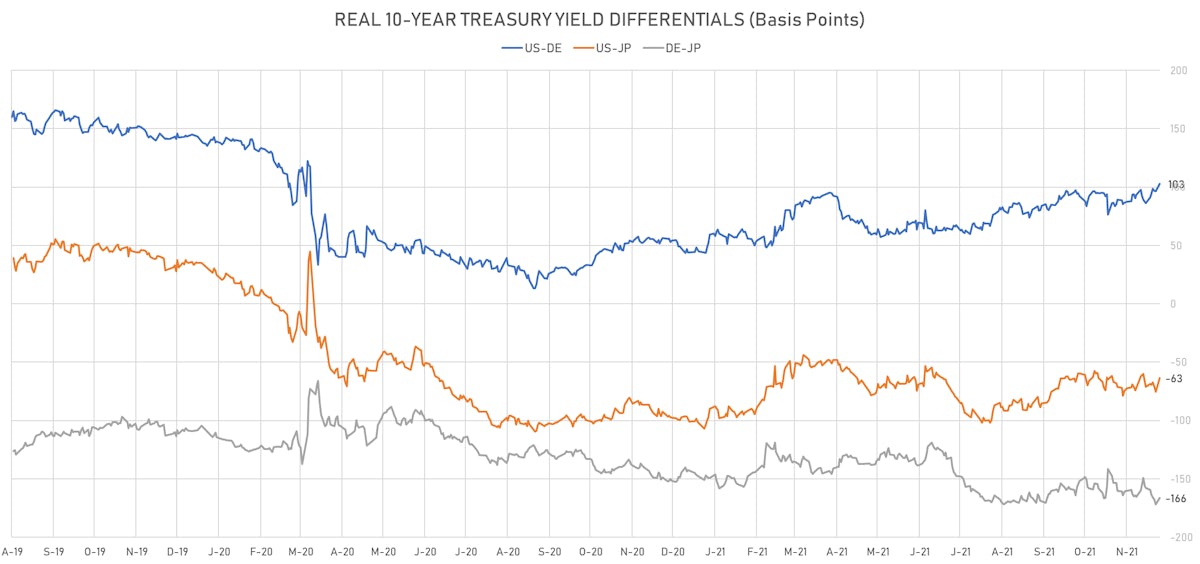

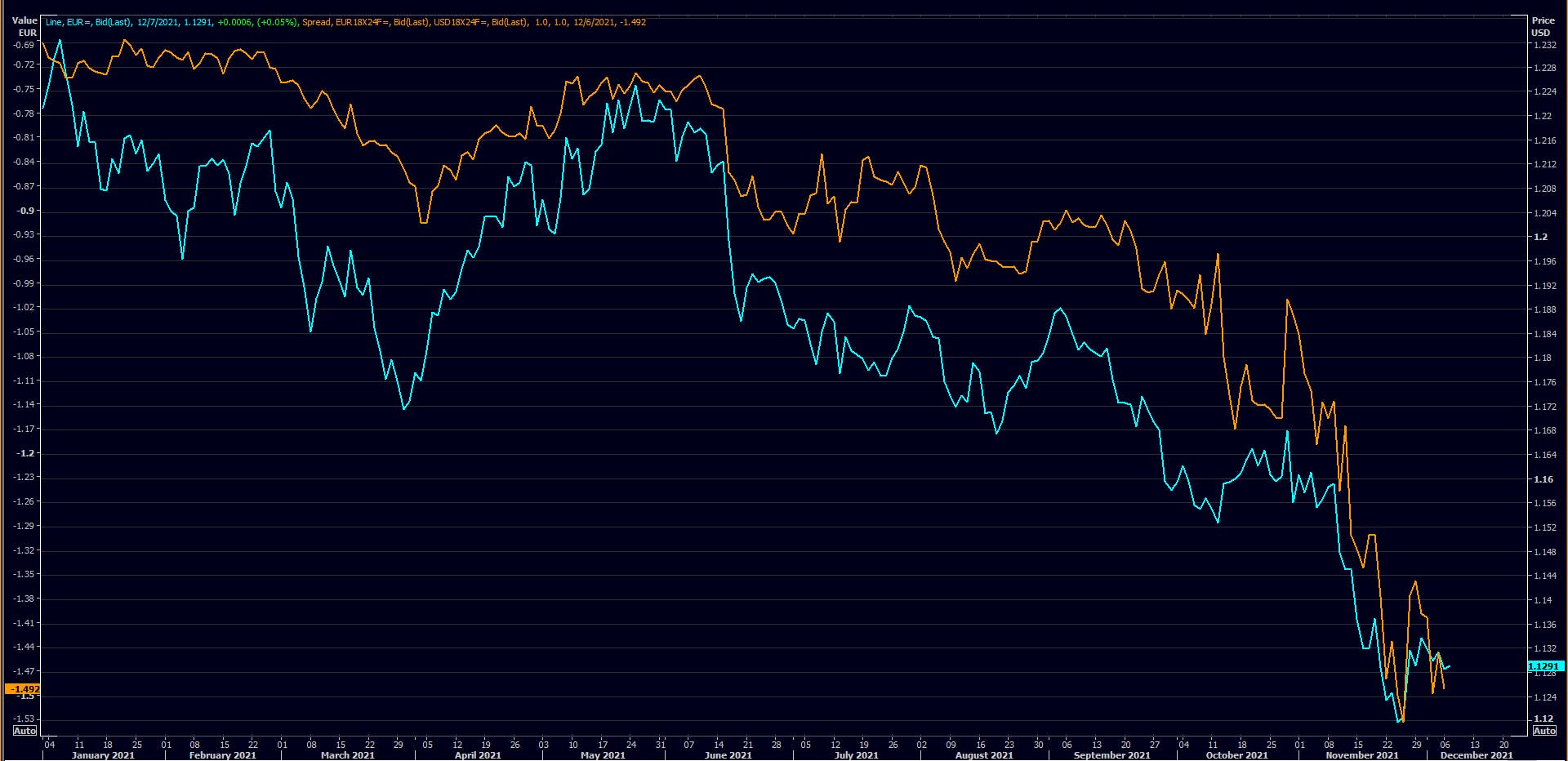

Yen, Swiss Franc, Euro Fall Against The US Dollar On Widening Rates Differentials

Pro-risk currencies like the Canadian Dollar and Australian dollar made good gains today, as core commodities like crude oil and copper rebounded after poor performances last week

Published ET

Euro spot rate vs EUR-USD Rates Differential (6-Month Rates 18 Months Forward) | Source: Refinitiv

QUICK SUMMARY

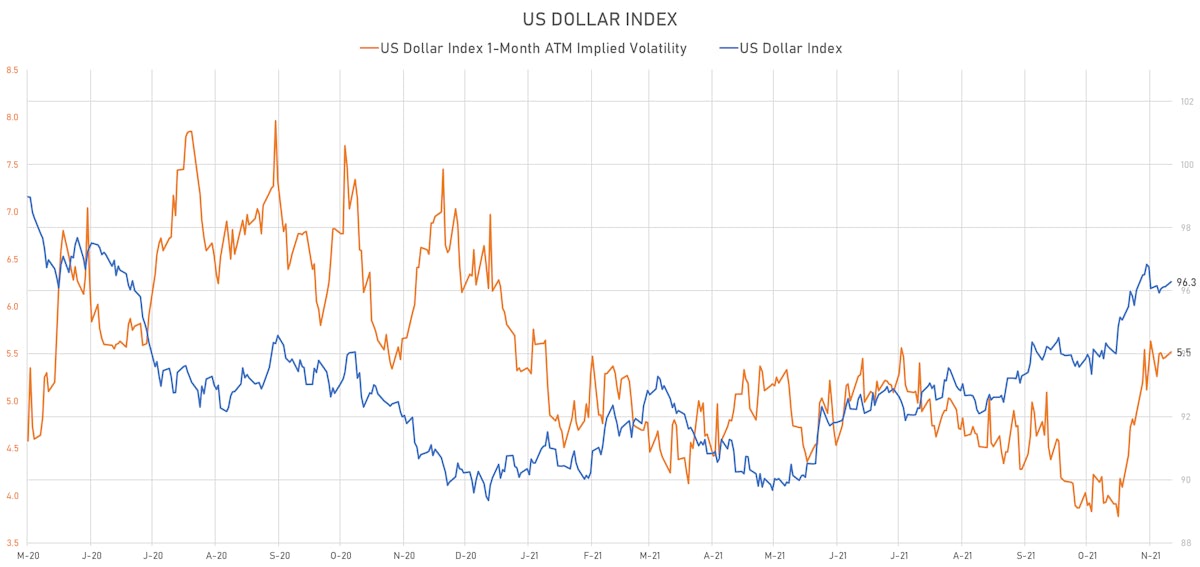

- The US Dollar Index is up 0.16% at 96.29 (YTD: +7.01%)

- Euro down 0.30% at 1.1279 (YTD: -7.6%)

- Yen down 0.65% at 113.54 (YTD: -9.1%)

- Onshore Yuan up 0.04% at 6.3724 (YTD: +2.4%)

- Swiss franc down 0.79% at 0.9251 (YTD: -4.3%)

- Sterling up 0.23% at 1.3261 (YTD: -3.0%)

- Canadian dollar up 0.69% at 1.2756 (YTD: -0.2%)

- Australian dollar up 0.67% at 0.7048 (YTD: -8.4%)

- NZ dollar up 0.07% at 0.6744 (YTD: -6.1%)

MACRO DATA RELEASES

- Czech Republic, Retail Sales, Retail trade (incl. retail sale of automotive fuel), Change Y/Y for Oct 2021 (CSU, Czech Rep) at 5.60 % (vs 3.60 % prior), above consensus estimate of 4.00 %

- Euro Zone, sentix, Investors sentiment for Dec 2021 (Sentix) at 13.50 (vs 18.30 prior), below consensus estimate of 15.90

- Germany, New Orders, Manufacturing industry, Change P/P for Oct 2021 (Deutsche Bundesbank) at -6.90 % (vs 1.30 % prior), below consensus estimate of -0.50 %

- Japan, Family Income and Expenditure Survey, Two-or-more-person Households, Living expenditure, Change P/P for Oct 2021 (MIC, Japan) at 3.40 % (vs 5.00 % prior), below consensus estimate of 3.60 %

- Japan, Family Income and Expenditure Survey, Two-or-more-person Households, Living expenditure, real, Change Y/Y for Oct 2021 (MIC, Japan) at -0.60 % (vs -1.90 % prior), in line with consensus

- Kazakhstan, Policy Rates, Base Repo Rate for Dec 2021 (NBK, Kazakhstan) at 9.75 % (vs 9.75 % prior), below consensus estimate of 10.00 %

- United Kingdom, PMI, CIPS/Markit PMI: Construction - All Activity for Nov 2021 (CIPS/Markit) at 55.50 (vs 54.60 prior)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +5.5 bp at 183.4 bp (YTD change: +72.3 bp)

- US-JAPAN: +5.9 bp at 131.1 bp (YTD change: +82.8 bp)

- US-CHINA: +11.8 bp at -146.0 bp (YTD change: +111.1 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +6.6 bp at 102.9 bp (YTD change: +56.8bp)

- US-JAPAN: +12.2 bp at -63.4 bp (YTD change: +38.1bp)

- JAPAN-GERMANY: -5.6 bp at 166.3 bp (YTD change: +18.7bp)

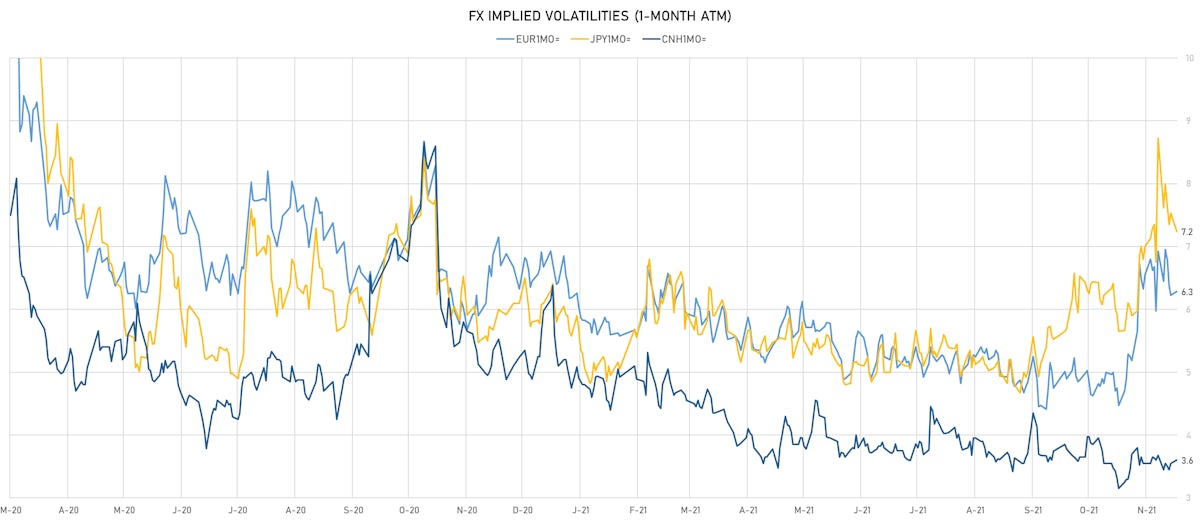

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.12, up 0.16 (YTD: -0.05)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.29, up 0.1 (YTD: -0.4)

- Japanese Yen 1M ATM IV currently at 7.24, down -0.3 (YTD: +1.1)

- Offshore Yuan 1M ATM IV currently at 3.60, up 0.1 (YTD: -2.4)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 223.8 basis points to 2,752 bp (1Y range: 1,092-3,111bp)

- Egypt (rated B+): down 9.0 basis points to 497 bp (1Y range: 283-512bp)

- Brazil (rated BB-): down 3.7 basis points to 232 bp (1Y range: 141-266bp)

- China (rated A+): down 1.6 basis points to 51 bp (1Y range: 27-58bp)

- Peru (rated BBB): down 1.3 basis points to 94 bp (1Y range: 52-105bp)

- Vietnam (rated BB): down 1.2 basis points to 104 bp (1Y range: 89-112bp)

- Panama (rated BBB-): down 1.1 basis points to 94 bp (1Y range: 44-103bp)

- Malaysia (rated BBB+): down 1.0 basis points to 58 bp (1Y range: 35-64bp)

- Chile (rated A-): down 1.0 basis points to 87 bp (1Y range: 43-95bp)

- Russia (rated BBB): up 2.2 basis points to 113 bp (1Y range: 73-122bp)

LARGEST FX MOVES TODAY

- Solomon Islands Dollar up 2.4% (YTD: -0.6%)

- South Africa Rand up 1.1% (YTD: -7.7%)

- New Zambian Kwacha up 1.1% (YTD: +19.7%)

- Vanuatu Vatu down 0.9% (YTD: -4.8%)

- Fiji Dollar down 1.0% (YTD: -3.9%)

- Cape Verde Escudo down 1.0% (YTD: -4.7%)

- Samoa Tala down 1.2% (YTD: -3.4%)

- Tonga Pa'Anga down 1.6% (YTD: -0.2%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 56.4%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 27.1%

- Surinamese dollar down 34.2%

- Turkish Lira down 46.2%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%