FX

Risk-On Sentiment Takes The Canadian And Australian Dollars Higher, Following The Rise In Commodities

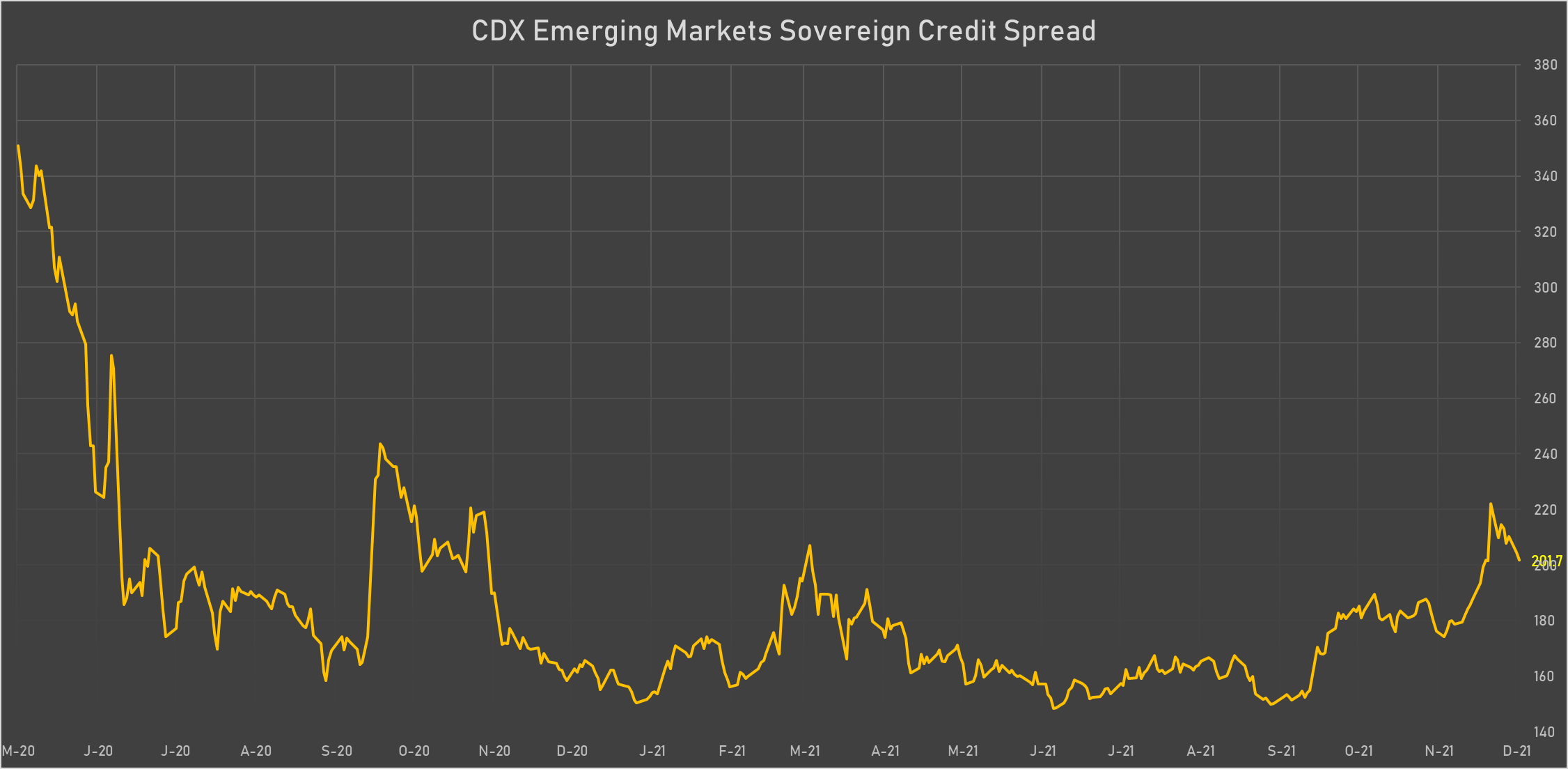

Although rates volatility remains high, most emerging markets did well today, with the tightening in sovereign credit spreads increasing the attractiveness of recently battered carry currencies like the Brazilian real

Published ET

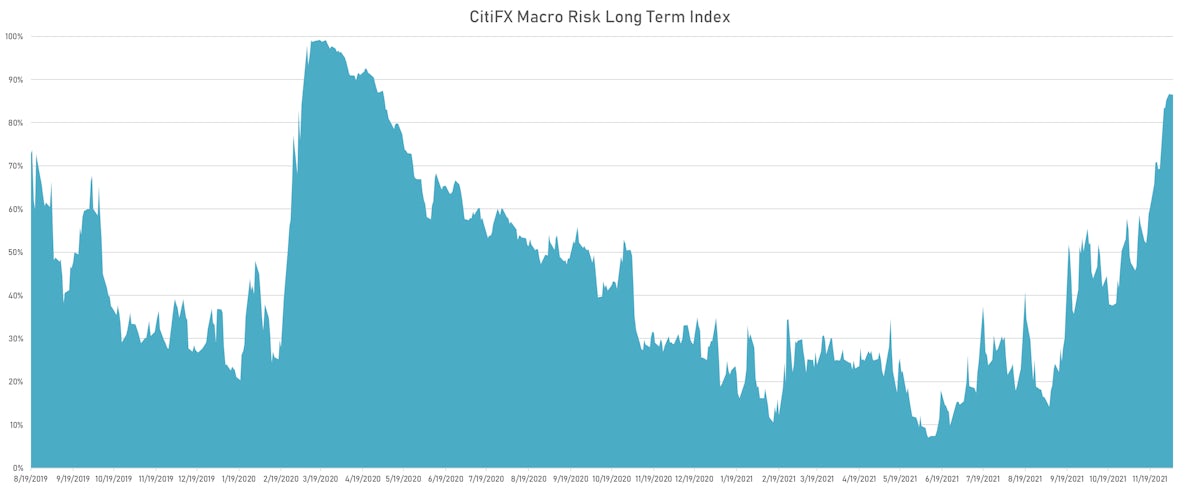

CitiFX Macro Long Term Risk Index | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

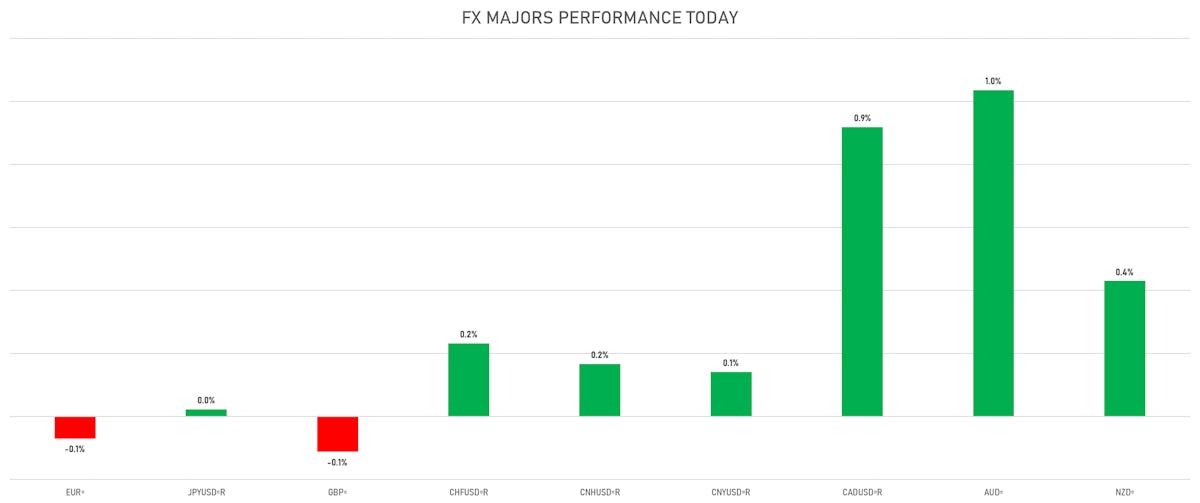

- The US Dollar Index is down -0.01% at 96.28 (YTD: +7.00%)

- Euro down 0.07% at 1.1277 (YTD: -7.7%)

- Yen up 0.02% at 113.44 (YTD: -9.0%)

- Onshore Yuan up 0.14% at 6.3657 (YTD: +2.5%)

- Swiss franc up 0.23% at 0.9238 (YTD: -4.2%)

- Sterling down 0.11% at 1.3249 (YTD: -3.1%)

- Canadian dollar up 0.92% at 1.2640 (YTD: +0.8%)

- Australian dollar up 1.04% at 0.7122 (YTD: -7.4%)

- NZ dollar up 0.43% at 0.6779 (YTD: -5.7%)

MACRO DATA RELEASES

- Australia, Policy Rates, Cash Target Rate for Dec 2021 (RBA, Australia) at 0.10 % (vs 0.10 % prior), in line with consensus

- Canada, Trade Balance, Total, fob for Oct 2021 (CANSIM, Canada) at 2.09 Bln CAD (vs 1.86 Bln CAD prior), above consensus estimate of 2.00 Bln CAD

- China (Mainland), Exports, Change Y/Y for Nov 2021 (China Customs) at 22.00 % (vs 27.10 % prior), above consensus estimate of 19.00 %

- China (Mainland), Imports, Change Y/Y for Nov 2021 (China Customs) at 31.70 % (vs 20.60 % prior), above consensus estimate of 19.80 %

- China (Mainland), Trade Balance, Current Prices for Nov 2021 (China Customs) at 71.72 Bln USD (vs 84.54 Bln USD prior), below consensus estimate of 82.75 Bln USD

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change P/P for Q3 2021 (Eurostat) at 2.20 % (vs 2.20 % prior), in line with consensus

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change Y/Y for Q3 2021 (Eurostat) at 3.90 % (vs 3.70 % prior), above consensus estimate of 3.70 %

- France, Reserve Assets, Current Prices for Nov 2021 (MINEFI, France) at 221,771.00 Mln EUR (vs 216,645.00 Mln EUR prior)

- Germany, Production, Total industry including construction, Change P/P for Oct 2021 (Destatis) at 2.80 % (vs -1.10 % prior), above consensus estimate of 0.80 %

- Germany, ZEW, Current Economic Situation, Germany, balance for Dec 2021 (ZEW, Germany) at -7.40 (vs 12.50 prior), below consensus estimate of 5.00

- Germany, ZEW, Economic Expectations, Germany, balance for Dec 2021 (ZEW, Germany) at 29.90 (vs 31.70 prior), above consensus estimate of 25.10

- Japan, Current Account, Balance, Current Prices for Oct 2021 (BOJ/MOF Japan) at 1,180.10 Bln JPY (vs 1,033.70 Bln JPY prior), below consensus estimate of 1,308.50 Bln JPY

- Japan, GDP, Total, 2nd prelim, Change P/P for Q3 2021 (Cabinet Office, JP) at -3.60 % (vs -3.00 % prior), below consensus estimate of -3.10 %

- Japan, GDP, Total, 2nd prelim, Change P/P for Q3 2021 (Cabinet Office, JP) at -0.90 % (vs -0.80 % prior), below consensus estimate of -0.80 %

- New Zealand, Milk Auction, Average Price, Constant Prices for W 07 Dec (GlobalDairy Trade) at 4,290.00 USD (vs 4,287.00 USD prior)

- New Zealand, Reserve Assets, Current Prices for Nov 2021 (RBNZ) at 21,823.00 Mln NZD (vs 23,426.00 Mln NZD prior)

- Philippines, CPI, Total, inflation rate, Change Y/Y for Nov 2021 (PSA) at 4.20 % (vs 4.60 % prior), above consensus estimate of 3.90 %

- South Africa, GDP, Total, at market prices, Change Y/Y for Q3 2021 (Statistics, SA) at 2.90 % (vs 19.30 % prior), below consensus estimate of 3.50 %

- South Africa, Reserves, Gross gold and other foreign reserves, Current Prices for Nov 2021 (SA Reserve Bank) at 57.62 Bln USD (vs 57.52 Bln USD prior)

- South Africa, Reserves, Reserve Bank, international liquidity position, Current Prices for Nov 2021 (SA Reserve Bank) at 55.16 Bln USD (vs 55.43 Bln USD prior)

- Switzerland, Foreign reserves in convertible foreign currencies, Current Prices for Nov 2021 (Swiss National Bank) at 1,006,404.00 Mln CHF (vs 922,975.00 Mln CHF prior)

- Taiwan, CPI, Change Y/Y, Price Index for Nov 2021 (DGBAS, Taiwan) at 2.84 % (vs 2.58 % prior), above consensus estimate of 2.55 %

- United Kingdom, House Prices, Halifax, UK, Change P/P for Nov 2021 () at 1.00 % (vs 0.90 % prior)

- United States, Trade Balance, Total, Goods and services for Oct 2021 (U.S. Census Bureau) at -67.10 Bln USD (vs -80.90 Bln USD prior), below consensus estimate of -66.80 Bln USD

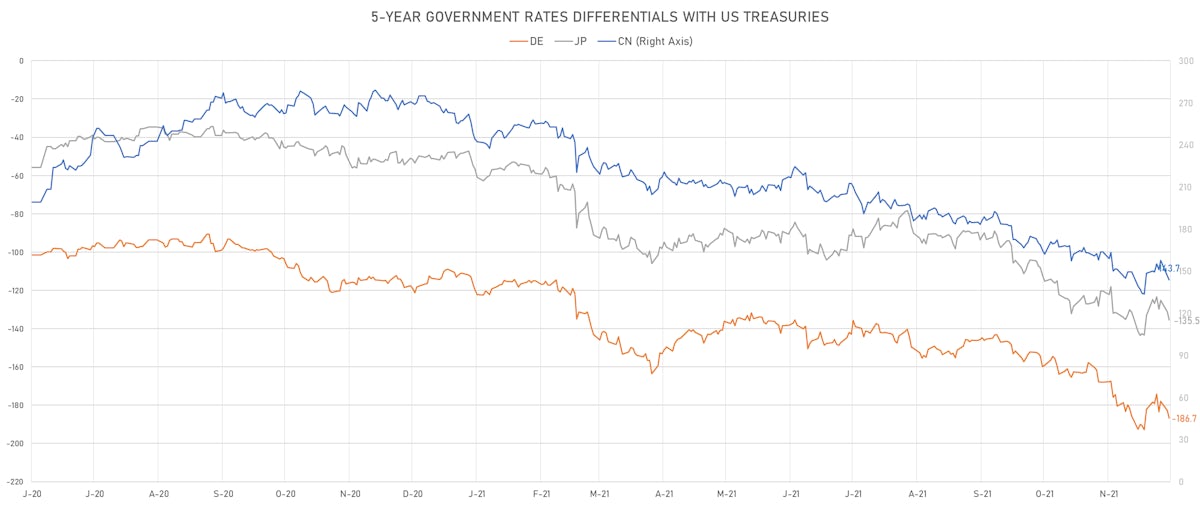

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.5 bp at 185.2 bp (YTD change: +74.1 bp)

- US-JAPAN: +2.3 bp at 133.5 bp (YTD change: +85.2 bp)

- US-CHINA: +1.3 bp at -145.3 bp (YTD change: +111.8 bp)

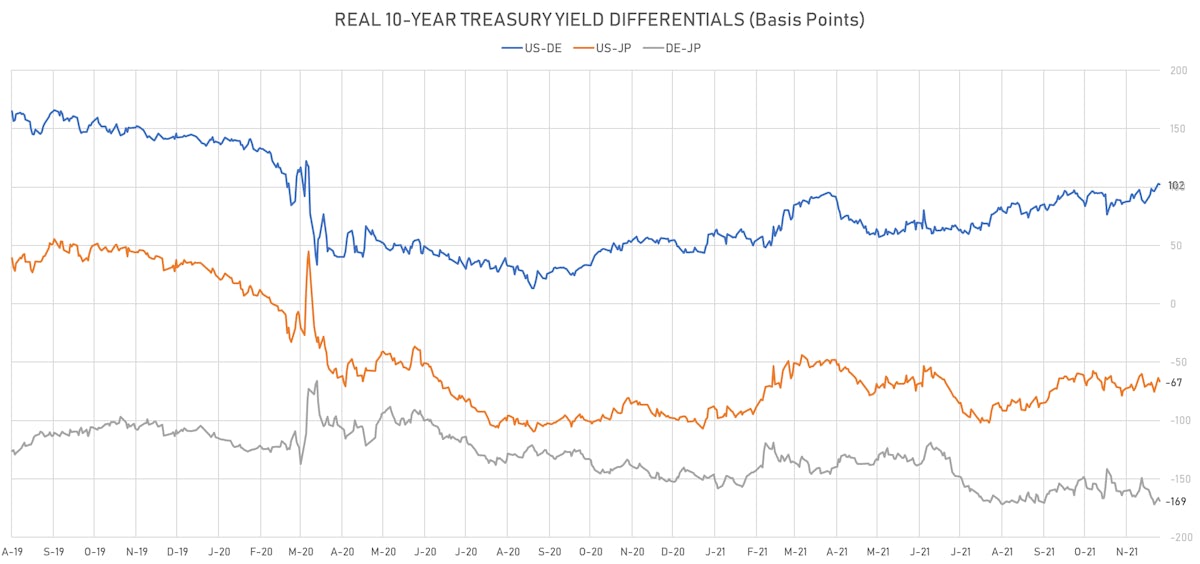

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.7 bp at 102.2 bp (YTD change: +56.1bp)

- US-JAPAN: -3.2 bp at -66.6 bp (YTD change: +34.9bp)

- JAPAN-GERMANY: +2.5 bp at 168.8 bp (YTD change: +21.2bp)

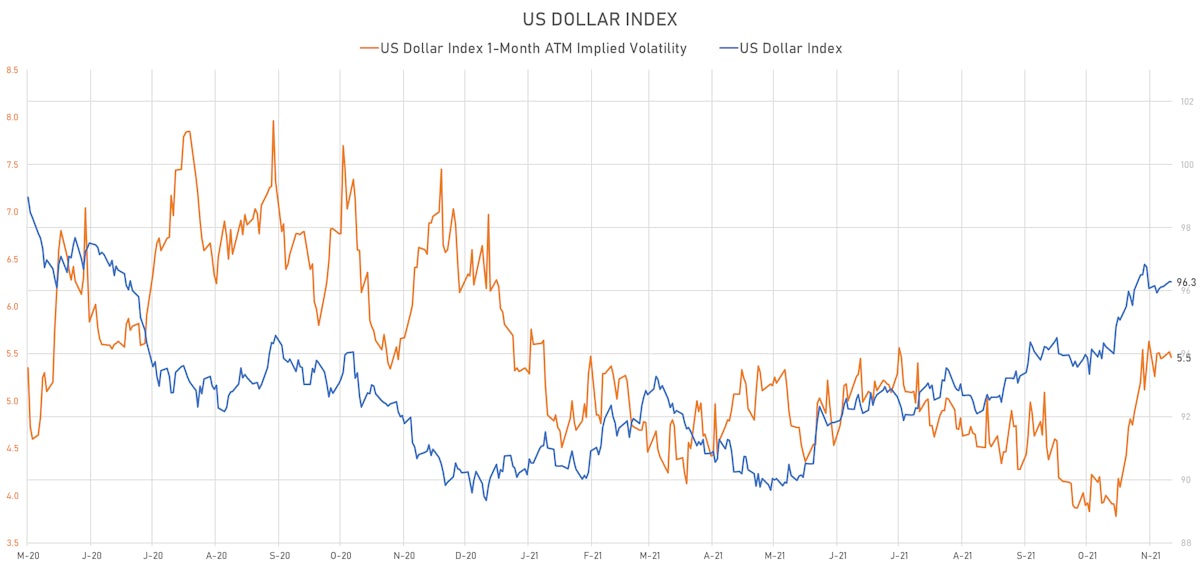

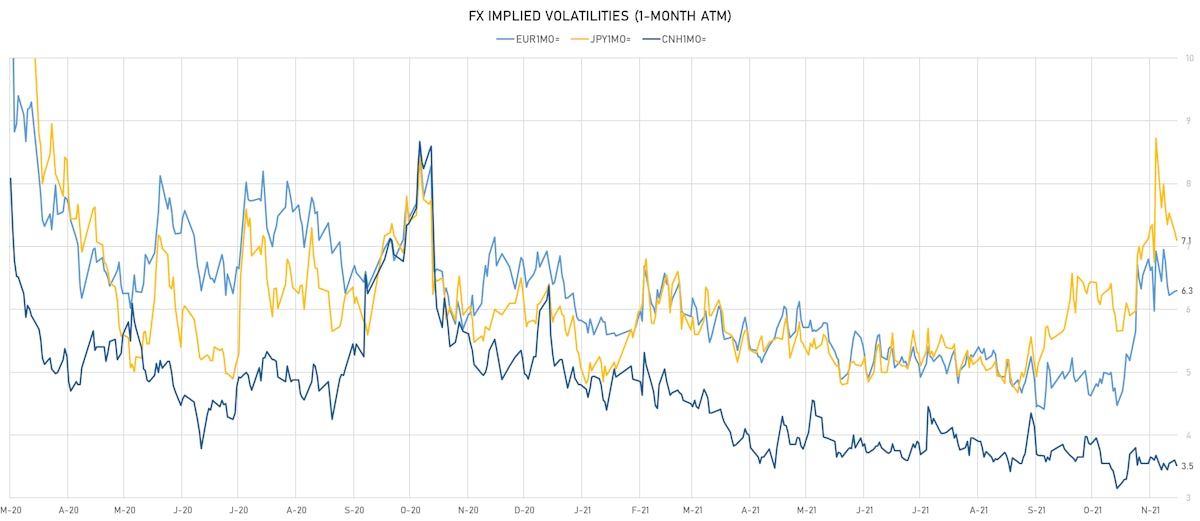

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.05, down -0.07 (YTD: -0.12)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 6.30 (YTD: -0.4)

- Japanese Yen 1M ATM IV currently at 7.10, down -0.1 (YTD: +1.0)

- Offshore Yuan 1M ATM IV currently at 3.51, down -0.1 (YTD: -2.5)

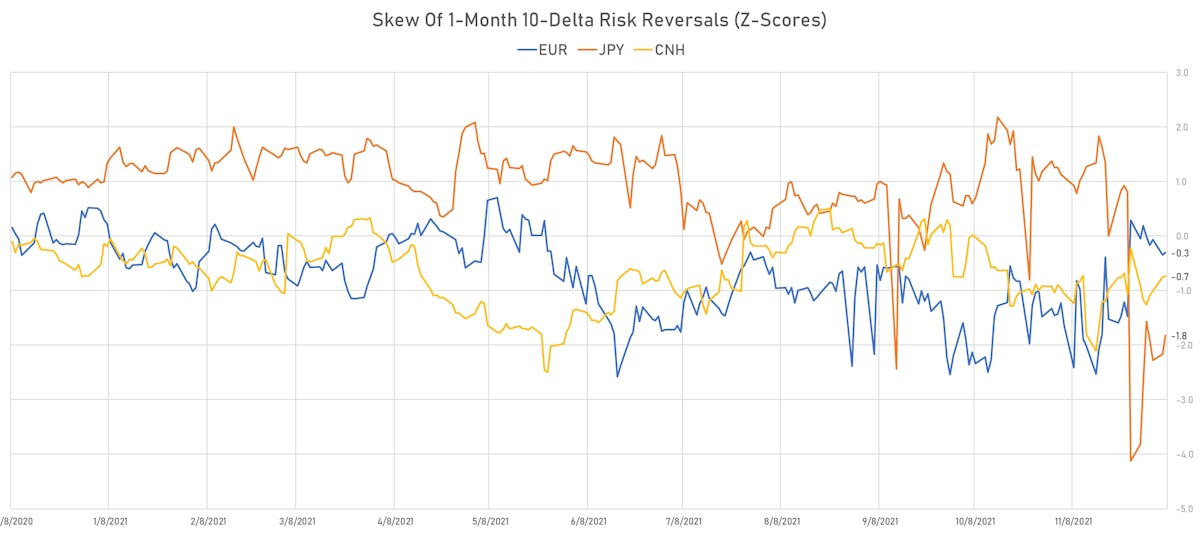

- Risk reversals in the EUR, JPY, CNH coming closer to home, with less of a weakening bias

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 111.8 basis points to 2,619 bp (1Y range: 1,092-3,111bp)

- Turkey (rated BB-): down 35.3 basis points to 496 bp (1Y range: 282-537bp)

- Brazil (rated BB-): down 13.9 basis points to 219 bp (1Y range: 141-266bp)

- Colombia (rated BB+): down 8.0 basis points to 196 bp (1Y range: 86-227bp)

- Mexico (rated BBB-): down 6.8 basis points to 105 bp (1Y range: 79-124bp)

- Indonesia (rated BBB): down 5.2 basis points to 81 bp (1Y range: 66-94bp)

- Panama (rated BBB-): down 4.4 basis points to 90 bp (1Y range: 44-103bp)

- Peru (rated BBB): down 4.3 basis points to 89 bp (1Y range: 52-105bp)

- Philippines (rated BBB): down 3.0 basis points to 65 bp (1Y range: 34-70bp)

- Malaysia (rated BBB+): down 2.9 basis points to 55 bp (1Y range: 35-64bp)

LARGEST FX MOVES TODAY

- Turkish Lira up 2.3% (YTD: -45.0%)

- Ghanaian Cedi up 1.6% (YTD: -4.5%)

- Norwegian Krone up 1.6% (YTD: -4.8%)

- Brazilian Real up 1.4% (YTD: -7.5%)

- New Zambian kwacha up 1.2% (YTD: +21.2%)

- Congo Franc down 1.4% (YTD: -1.4%)

- Jamaican Dollar down 1.4% (YTD: -7.9%)

- Afghani down 1.5% (YTD: -21.2%)

- Haiti Gourde down 1.6% (YTD: -28.2%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 61.2%

- Myanmar Kyat down 25.3%

- Haiti Gourde down 28.2%

- Surinamese dollar down 34.1%

- Turkish Lira down 45.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%