FX

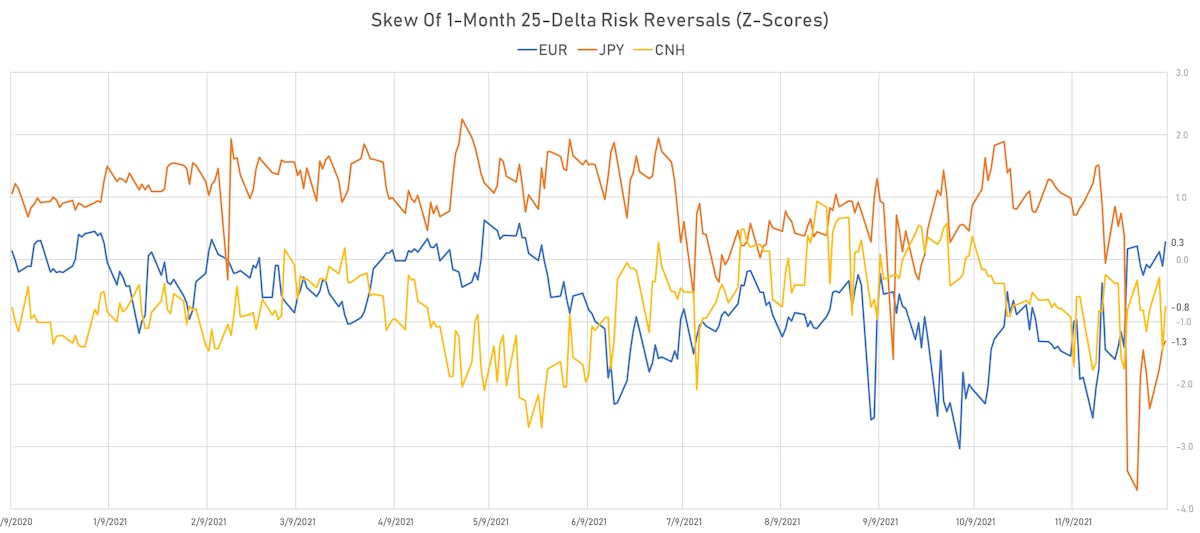

As Rates Volatility Recedes Slightly, Differentials Come Back To The Fore And Drive Yen Down, Euro Up Against The Dollar

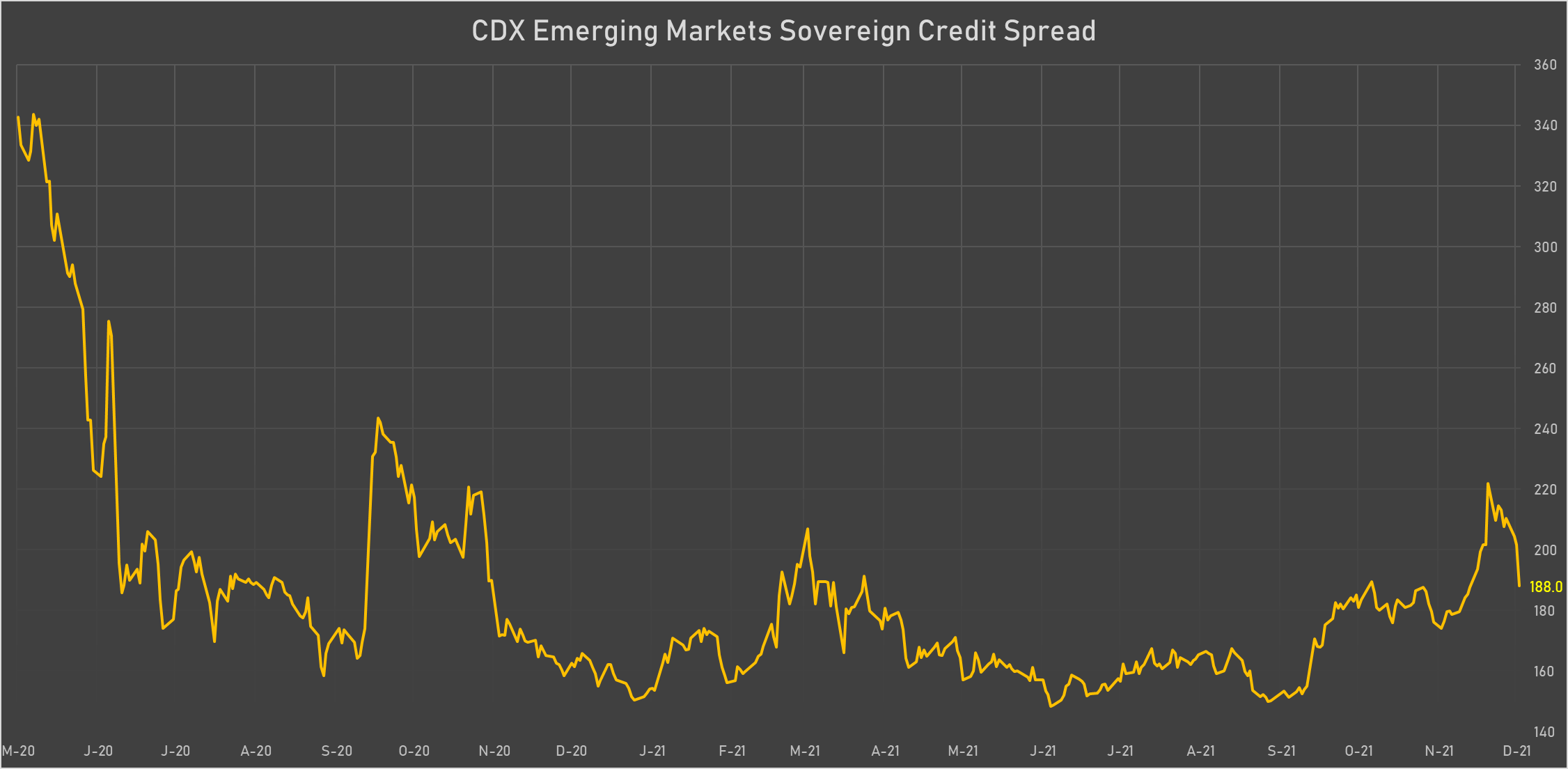

Sovereign credit spreads have come down quite dramatically this week across emerging markets, benefiting currencies like the Mexican peso, Brazilian real, South African rand

Published ET

Brazilian real spot rate and Brazil 5Y USD Sovereign CDS Spread | Source: Refinitiv

QUICK SUMMARY

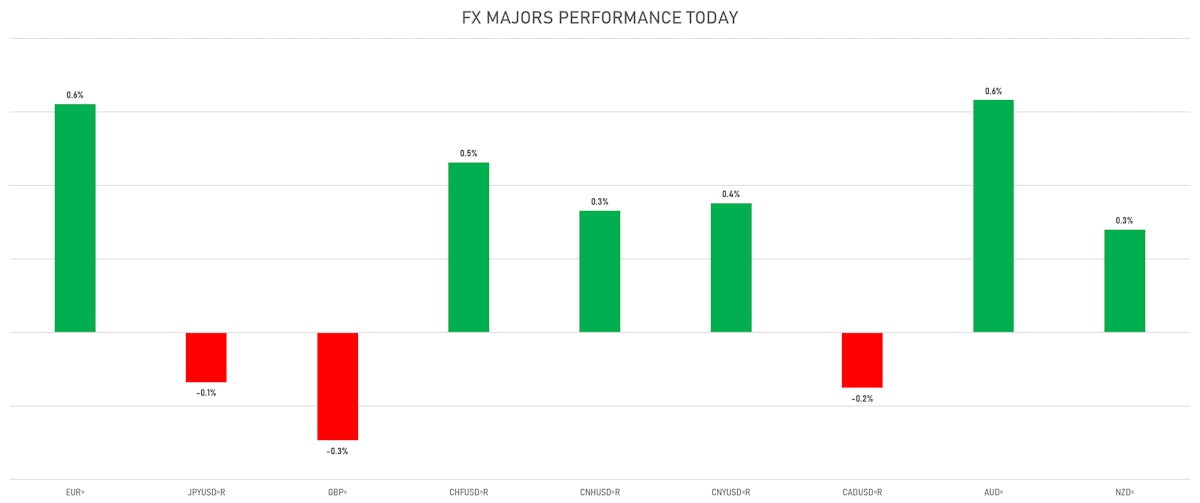

- The US Dollar Index is down -0.32% at 95.97 (YTD: +6.65%)

- Euro up 0.62% at 1.1333 (YTD: -7.2%)

- Yen down 0.14% at 113.73 (YTD: -9.2%)

- Onshore Yuan up 0.35% at 6.3444 (YTD: +2.9%)

- Swiss franc up 0.46% at 0.9209 (YTD: -3.9%)

- Sterling down 0.29% at 1.3203 (YTD: -3.4%)

- Canadian dollar down 0.15% at 1.2660 (YTD: +0.6%)

- Australian dollar up 0.63% at 0.7163 (YTD: -6.9%)

- NZ dollar up 0.28% at 0.6808 (YTD: -5.2%)

MACRO DATA RELEASES

- Brazil, Policy Rates, SELIC Target Rate for 09 Dec (Central Bank, Brazil) at 9.25 % (vs 7.75 % prior), in line with consensus

- Brazil, Retail Sales, Change P/P for Oct 2021 (IBGE, Brazil) at -0.10 % (vs -1.30 % prior), below consensus estimate of 0.80 %

- Brazil, Retail Sales, Change Y/Y for Oct 2021 (IBGE, Brazil) at -7.10 % (vs -5.50 % prior), below consensus estimate of -5.60 %

- Canada, Policy Rates, Overnight Target Rate for 08 Dec (Bank of Canada) at 0.25 % (vs 0.25 % prior), in line with consensus

- Czech Republic, Unemployment, Rate for Nov 2021 (MPSV, Czech Republic) at 3.30 % (vs 3.40 % prior), below consensus estimate of 3.40 %

- Hungary, CPI, All Items, Change Y/Y, Price Index for Nov 2021 (HCSO, Hungary) at 7.40 % (vs 6.50 % prior), above consensus estimate of 7.30 %

- India, Policy Rates, Cash Reserve Ratio for 08 Dec (RBI) at 4.00 % (vs 4.00 % prior), in line with consensus

- India, Policy Rates, Repo Rate for 08 Dec (RBI) at 4.00 % (vs 4.00 % prior), in line with consensus

- India, Policy Rates, Reverse Repo Rate for 08 Dec (RBI) at 3.35 % (vs 3.35 % prior), in line with consensus

- Latvia, CPI, Change P/P for Nov 2021 (Statistics, Latvia) at 1.10 % (vs 1.10 % prior)

- Latvia, CPI, Change Y/Y for Nov 2021 (Statistics, Latvia) at 7.50 % (vs 6.00 % prior)

- Lithuania, CPI, Change P/P for Nov 2021 (Statistics Lithuania) at 0.90 % (vs 1.70 % prior)

- Lithuania, CPI, Change Y/Y, Price Index for Nov 2021 (Statistics Lithuania) at 9.20 % (vs 8.00 % prior)

- Namibia, Policy Rates, Bank Rate for Dec 2021 (Bank of Namibia) at 3.75 % (vs 3.75 % prior)

- Poland, Policy Rates, Reference Rate (7-Day NBP Bill Rate) for Dec 2021 (Central Bank, Poland) at 1.75 % (vs 0.00 % prior), in line with consensus

- Russia, CPI, Change P/P for Nov 2021 (RosStat, Russia) at 1.00 % (vs 1.10 % prior), above consensus estimate of 0.70 %

- Russia, CPI, Change Y/Y for Nov 2021 (RosStat, Russia) at 8.40 % (vs 8.10 % prior), above consensus estimate of 8.10 %

- South Africa, Retail Sales, Change Y/Y for Oct 2021 (Statistics, SA) at 1.80 % (vs 2.10 % prior), in line with consensus

- JOLTS Job Openings for Oct 2021 (BLS, U.S Dep. Of Lab) at 11.03 Mln (vs 10.44 Mln prior), above consensus estimate of 10.37 Mln

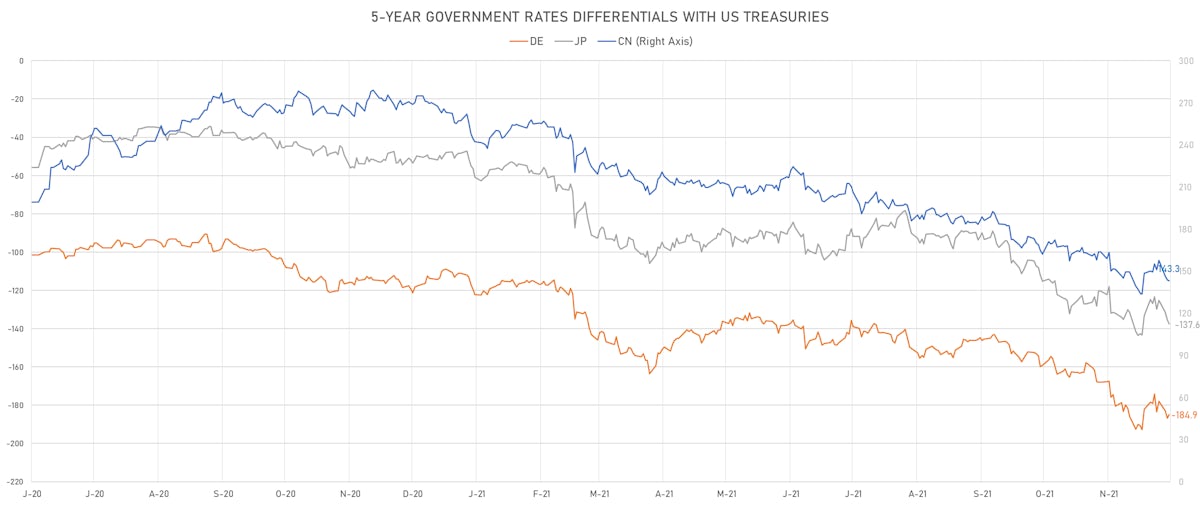

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.3 bp at 184.4 bp (YTD change: +73.3 bp)

- US-JAPAN: +1.0 bp at 136.5 bp (YTD change: +88.2 bp)

- US-CHINA: +0.5 bp at -143.2 bp (YTD change: +113.9 bp)

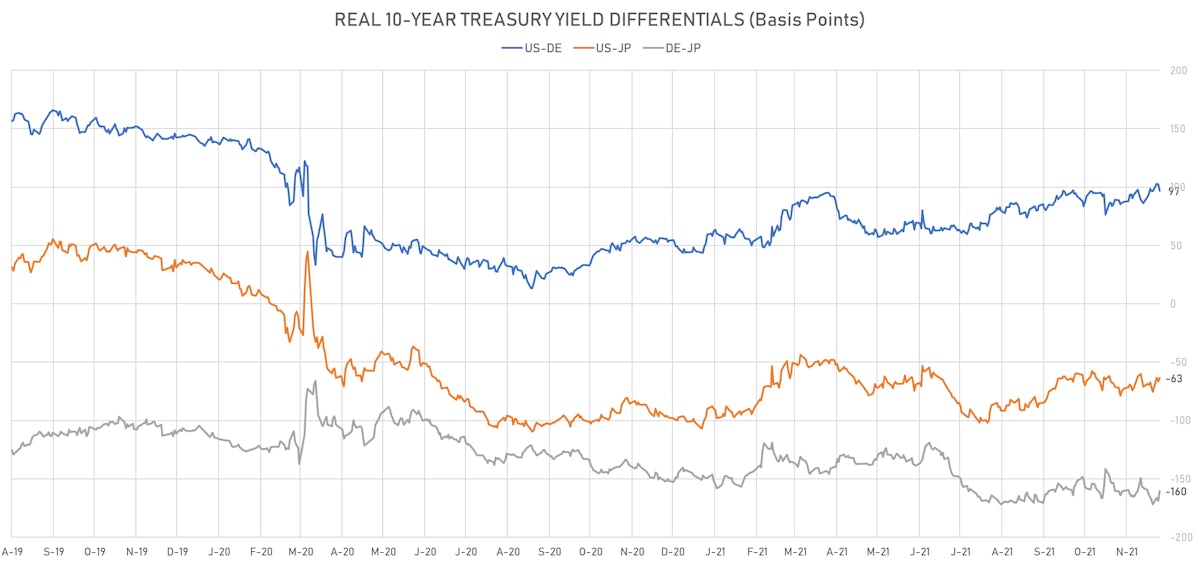

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -5.4 bp at 96.8 bp (YTD change: +50.7bp)

- US-JAPAN: +3.3 bp at -63.3 bp (YTD change: +38.2bp)

- JAPAN-GERMANY: -8.7 bp at 160.1 bp (YTD change: +12.5bp)

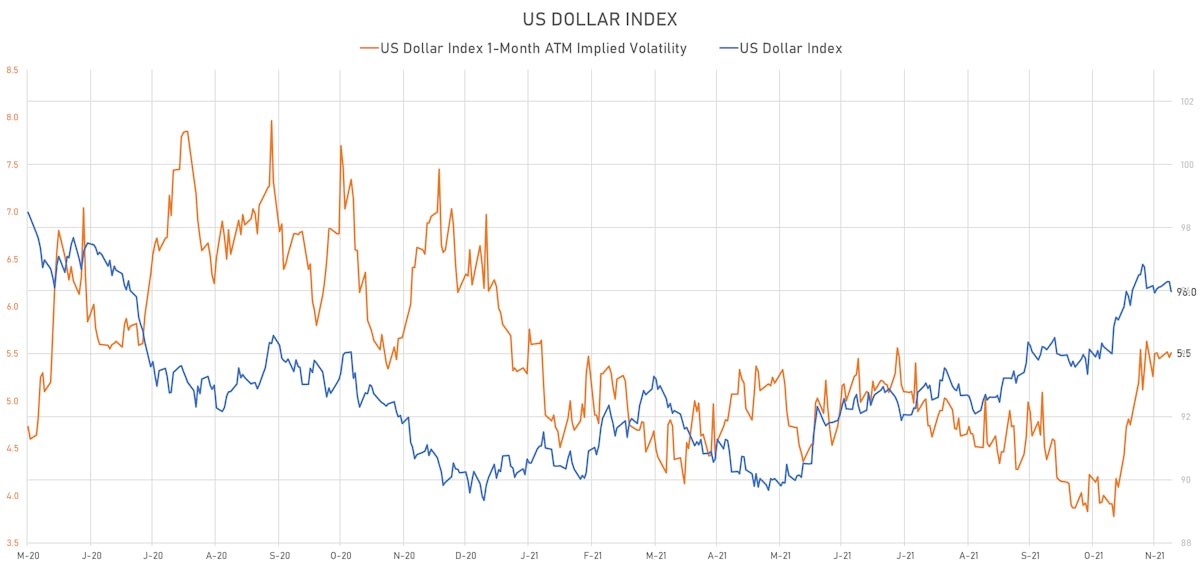

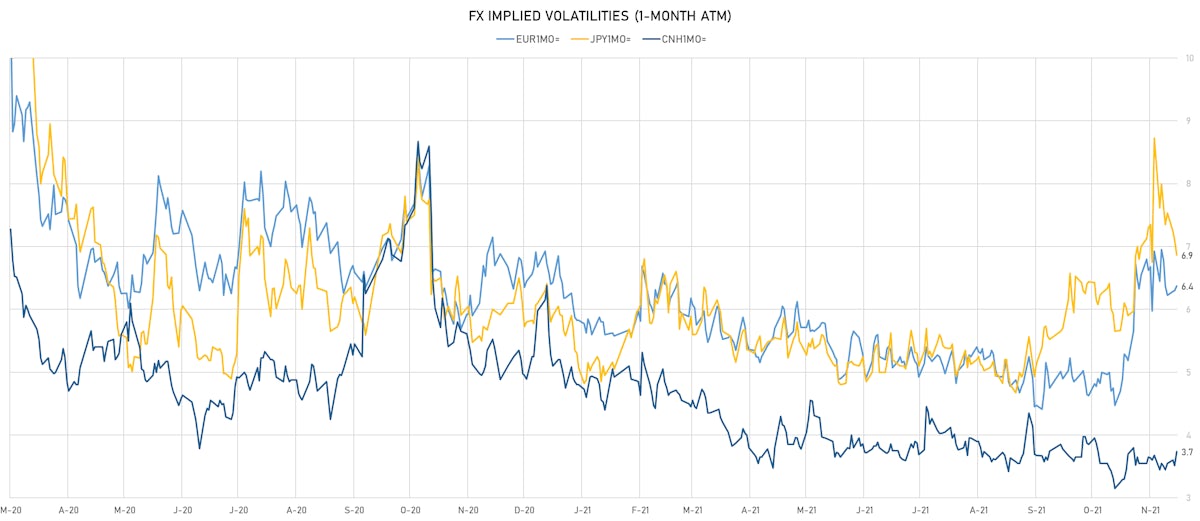

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.00, down -0.05 (YTD: -0.17)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.38, up 0.1 (YTD: -0.3)

- Japanese Yen 1M ATM IV currently at 6.87, down -0.2 (YTD: +0.8)

- Offshore Yuan 1M ATM IV currently at 3.74, up 0.2 (YTD: -2.2)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 44.8 basis points to 2,584 bp (1Y range: 1,092-3,111bp)

- Turkey (rated BB-): down 15.1 basis points to 481 bp (1Y range: 282-537bp)

- Russia (rated BBB): down 5.7 basis points to 105 bp (1Y range: 73-122bp)

- Brazil (rated BB-): down 5.0 basis points to 213 bp (1Y range: 141-266bp)

- South Africa (rated BB-): down 4.4 basis points to 215 bp (1Y range: 178-246bp)

- Mexico (rated BBB-): down 4.4 basis points to 99 bp (1Y range: 79-124bp)

- Vietnam (rated BB): down 4.3 basis points to 98 bp (1Y range: 89-112bp)

- Philippines (rated BBB): down 2.3 basis points to 63 bp (1Y range: 34-70bp)

- Malaysia (rated BBB+): down 2.1 basis points to 53 bp (1Y range: 35-64bp)

- Panama (rated BBB-): down 1.2 basis points to 88 bp (1Y range: 44-103bp)

LARGEST FX MOVES TODAY

- New Zambian kwacha up 3.5% (YTD: +25.4%)

- Jamaican Dollar up 1.6% (YTD: -7.7%)

- Norwegian Krone up 1.5% (YTD: -3.4%)

- Brazilian Real up 1.4% (YTD: -6.1%)

- Hungarian Forint up 1.3% (YTD: -7.8%)

- Israeli shekel up 1.0% (YTD: +3.7%)

- Cape Verde Escudo up 1.0% (YTD: -3.8%)

- Turkish Lira down 1.3% (YTD: -45.7%)

- Mauritius Rupee down 1.7% (YTD: -9.2%)

- Afghani down 5.2% (YTD: -25.3%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 68.3%

- New Zambian kwacha up 25.4%

- Haiti Gourde down 28.2%

- Surinamese dollar down 34.1%

- Turkish Lira down 45.7%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%