FX

US Dollar Rises As Worries About Global Growth Widen Rates Differentials

The Australian dollar is one of the most vulnerable currencies in this context, with the dovish central bank and risk sentiment the two drivers of negative AUD performance

Published ET

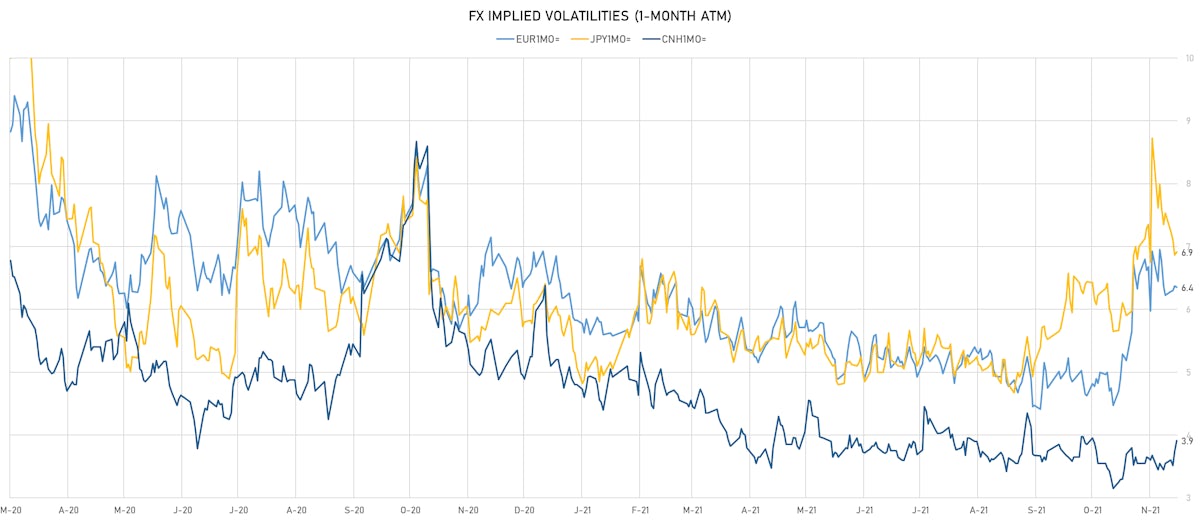

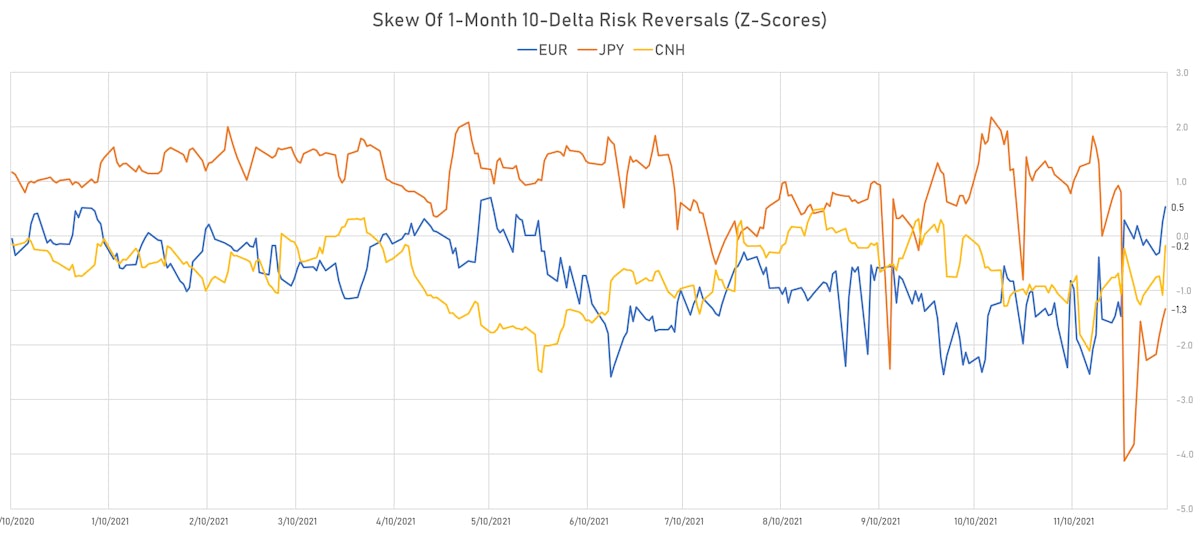

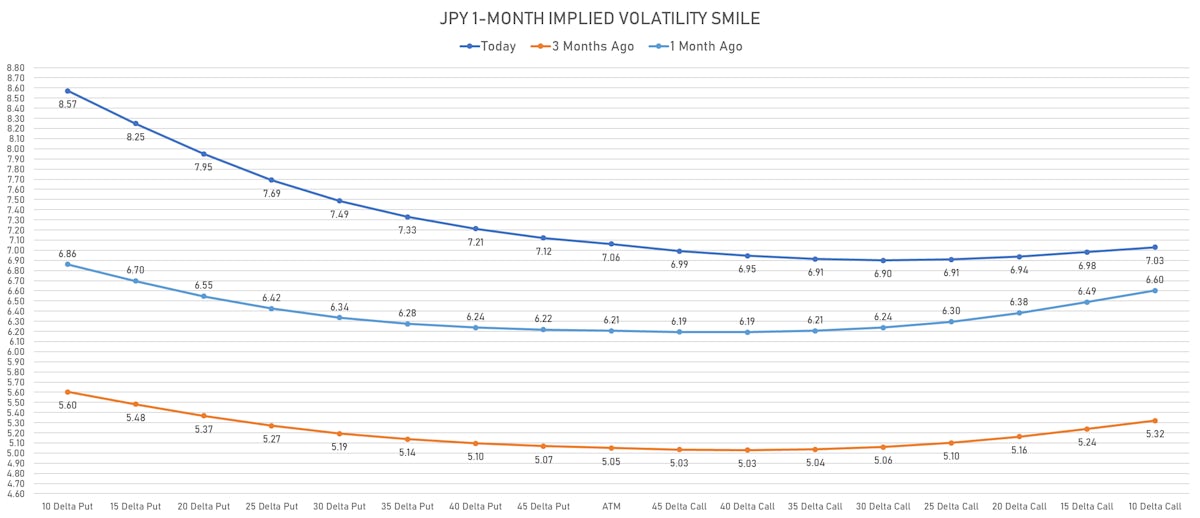

Elevated JPY Implied Volatilities Still Skewed To A Strengthening of the currency | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

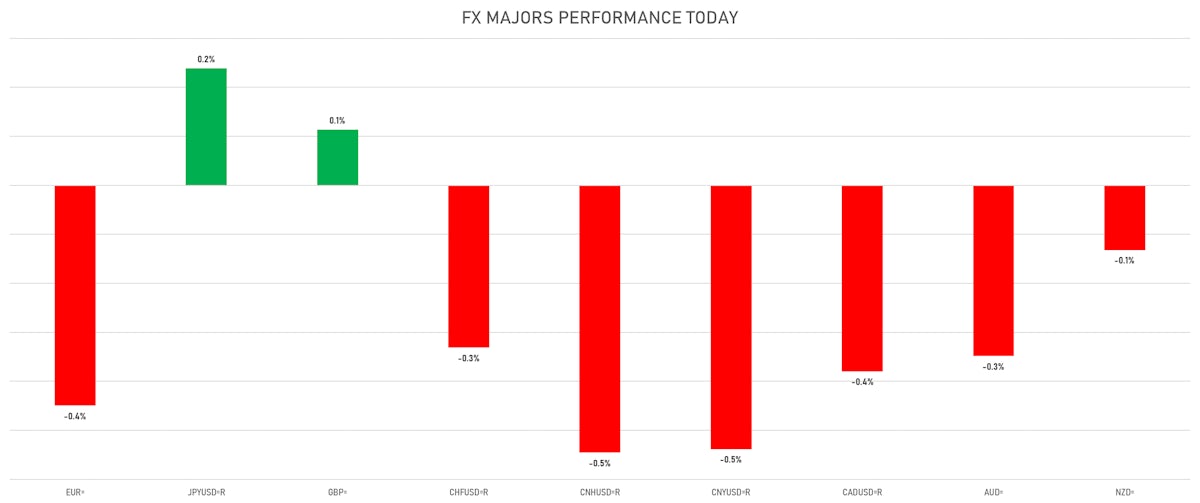

- The US Dollar Index is up 0.25% at 96.21 (YTD: +6.92%)

- Euro down 0.45% at 1.1291 (YTD: -7.5%)

- Yen up 0.24% at 113.39 (YTD: -8.9%)

- Onshore Yuan down 0.54% at 6.3787 (YTD: +2.3%)

- Swiss franc down 0.33% at 0.9234 (YTD: -4.1%)

- Sterling up 0.11% at 1.3224 (YTD: -3.3%)

- Canadian dollar down 0.38% at 1.2702 (YTD: +0.3%)

- Australian dollar down 0.35% at 0.7146 (YTD: -7.1%)

- NZ dollar down 0.13% at 0.6799 (YTD: -5.4%)

MACRO DATA RELEASES

- Argentina, Production, Change Y/Y, Price Index for Oct 2021 (INDEC, Argentina) at 4.30 % (vs 10.10 % prior)

- China (Mainland), CPI, Average, Change Y/Y, Price Index for Nov 2021 (NBS, China) at 2.30 % (vs 1.50 % prior), below consensus estimate of 2.50 %

- China (Mainland), CPI, Change P/P for Nov 2021 (NBS, China) at 0.40 % (vs 0.70 % prior), above consensus estimate of 0.30 %

- China (Mainland), Monetary Financial Institutions, Social Financing, Current Prices for Nov 2021 (PBC) at 2,610.00 Bln CNY (vs 1,590.00 Bln CNY prior), below consensus estimate of 2,700.00 Bln CNY

- China (Mainland), Monetary Financial Institutions, Uses of Funds, Loans, Change Y/Y for Nov 2021 (PBC) at 11.70 % (vs 11.90 % prior), below consensus estimate of 11.90 %

- China (Mainland), Monetary Financial Institutions, Uses of Funds, New loans, Current Prices for Nov 2021 (PBC) at 1,270.00 Bln CNY (vs 826.20 Bln CNY prior), below consensus estimate of 1,555.00 Bln CNY

- China (Mainland), Money supply M2, Change Y/Y for Nov 2021 (PBC) at 8.50 % (vs 8.70 % prior), below consensus estimate of 8.70 %

- China (Mainland), Producer Prices, Change Y/Y, Price Index for Nov 2021 (NBS, China) at 12.90 % (vs 13.50 % prior), above consensus estimate of 12.40 %

- Germany, Exports, Change P/P for Oct 2021 (Deutsche Bundesbank) at 4.10 % (vs -0.70 % prior), above consensus estimate of 0.90 %

- Germany, Imports, Change P/P for Oct 2021 (Deutsche Bundesbank) at 5.00 % (vs 0.10 % prior), above consensus estimate of 0.40 %

- Germany, Trade Balance for Oct 2021 (Deutsche Bundesbank) at 12.50 Bln EUR (vs 13.20 Bln EUR prior), below consensus estimate of 13.40 Bln EUR

- Hungary, Trade Balance, Preliminary, Current Prices for Oct 2021 (HCSO, Hungary) at -335.00 Mln EUR (vs -128.00 Mln EUR prior), below consensus estimate of -175.00 Mln EUR

- Japan, Producer Prices, Domestic, total, Change P/P, Price Index for Nov 2021 (Bank of Japan) at 0.60 % (vs 1.20 % prior), above consensus estimate of 0.30 %

- Japan, Producer Prices, Domestic, total, Change Y/Y, Price Index for Nov 2021 (Bank of Japan) at 9.00 % (vs 8.00 % prior), above consensus estimate of 8.50 %

- Mexico, CPI, Change P/P, Price Index for Nov 2021 (INEGI, Mexico) at 1.14 % (vs 0.84 % prior), above consensus estimate of 1.00 %

- Mexico, CPI, Change Y/Y, Price Index for Nov 2021 (INEGI, Mexico) at 7.37 % (vs 6.24 % prior), above consensus estimate of 7.22 %

- Mexico, CPI, Core CPI, Change P/P, Price Index for Nov 2021 (INEGI, Mexico) at 0.37 % (vs 0.49 % prior), above consensus estimate of 0.32 %

- New Zealand, Electronic card transactions, Retail industry, Change P/P for Nov 2021 (Statistics, NZ) at 9.60 % (vs 10.10 % prior)

- New Zealand, Electronic card transactions, Retail industry, Change Y/Y for Nov 2021 (Statistics, NZ) at 2.90 % (vs -7.60 % prior)

- New Zealand, PMI, Manufacturing Sector, Business NZ PMI for Nov 2021 (D.5824) at 50.60 (vs 54.30 prior)

- Norway, Gross Domestic Product, Change P/P for Oct 2021 (Statistics Norway) at -1.80 % (vs 2.20 % prior)

- Norway, Gross Domestic Product, Mainland Norway, Change P/P for Oct 2021 (Statistics Norway) at 0.00 % (vs 0.60 % prior)

- Peru, Policy Rates, Reference Interest Rate for Dec 2021 (Central Bank, Peru) at 2.50 % (vs 2.00 % prior), in line with consensus

- Serbia, Policy Rates, RS Benchmark Interest Rate, Change P/P for Dec 2021 (NBS, Serbia) at 1.00 % (vs 1.00 % prior), in line with consensus

- Slovakia, Trade Balance, Total, FOB, Current Prices for Oct 2021 (Stat Office of SR) at 290.90 Mln EUR (vs -75.80 Mln EUR prior), above consensus estimate of -75.00 Mln EUR

- South Africa, Current Account, Balance, Balance on current account to GDP, Change Y/Y for Q3 2021 (SA Reserve Bank) at 3.60 % (vs 5.10 % prior), below consensus estimate of 3.65 %

- South Africa, Manuf Production MM, Change P/P for Oct 2021 (Statistics, SA) at -5.90 % (vs 3.80 % prior), below consensus estimate of 0.30 %

- South Africa, Mining Production YY, Change Y/Y for Oct 2021 (Statistics, SA) at 2.10 % (vs -3.40 % prior), above consensus estimate of -0.85 %

- Ukraine, Policy Rates, UA Central Bank Interest Rate for 09 Dec (NBU, Ukraine) at 9.00 % (vs 8.50 % prior), above consensus estimate of 8.75 %

- United Kingdom, RICS Housing Market, Price, England and Wales for Nov 2021 (RICS, United Kingdom) at 71.00 (vs 70.00 prior), above consensus estimate of 70.00

- United States, Jobless Claims, National, Continued for W 27 Nov (U.S. Dept. of Labor) at 1.99 Mln (vs 1.96 Mln prior), above consensus estimate of 1.90 Mln

- United States, Jobless Claims, National, Initial for W 04 Dec (U.S. Dept. of Labor) at 184.00 k (vs 222.00 k prior), below consensus estimate of 215.00 k

- United States, Wholesale Inventories, Change P/P for Oct 2021 (U.S. Census Bureau) at 2.30 % (vs 2.20 % prior), above consensus estimate of 2.20 %

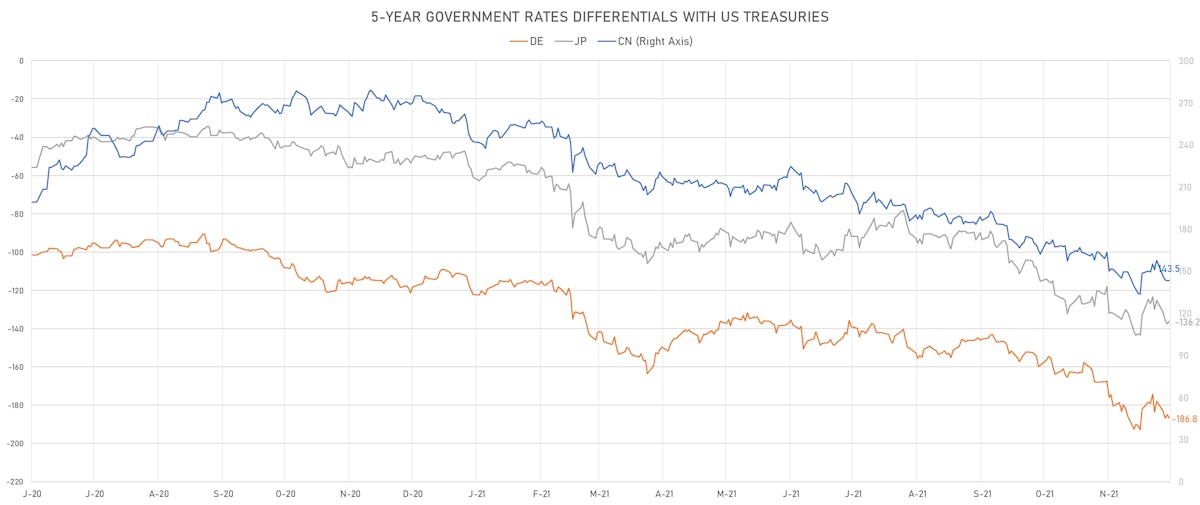

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.4 bp at 187.3 bp (YTD change: +76.2 bp)

- US-JAPAN: -0.8 bp at 136.8 bp (YTD change: +88.5 bp)

- US-CHINA: +0.4 bp at -142.9 bp (YTD change: +114.2 bp)

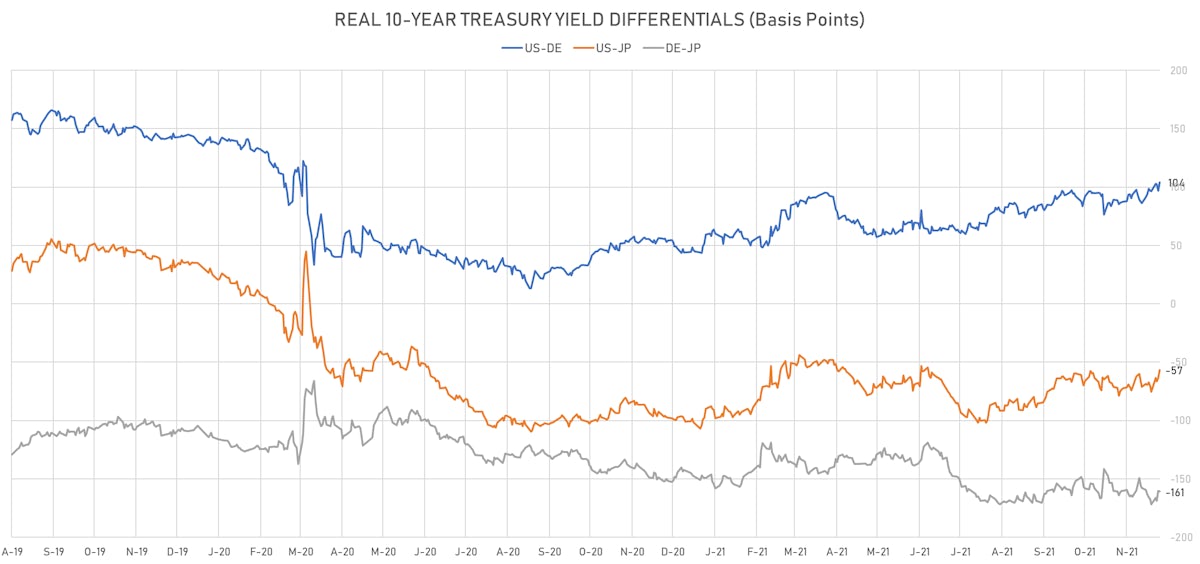

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +7.4 bp at 104.2 bp (YTD change: +58.1bp)

- US-JAPAN: +6.7 bp at -56.6 bp (YTD change: +44.9bp)

- JAPAN-GERMANY: +0.7 bp at 160.8 bp (YTD change: +13.2bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.03, up 0.03 (YTD: -0.14)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 6.35 (YTD: -0.3)

- Japanese Yen 1M ATM IV unchanged at 6.91 (YTD: +0.8)

- Offshore Yuan 1M ATM IV currently at 3.91, up 0.2 (YTD: -2.1)

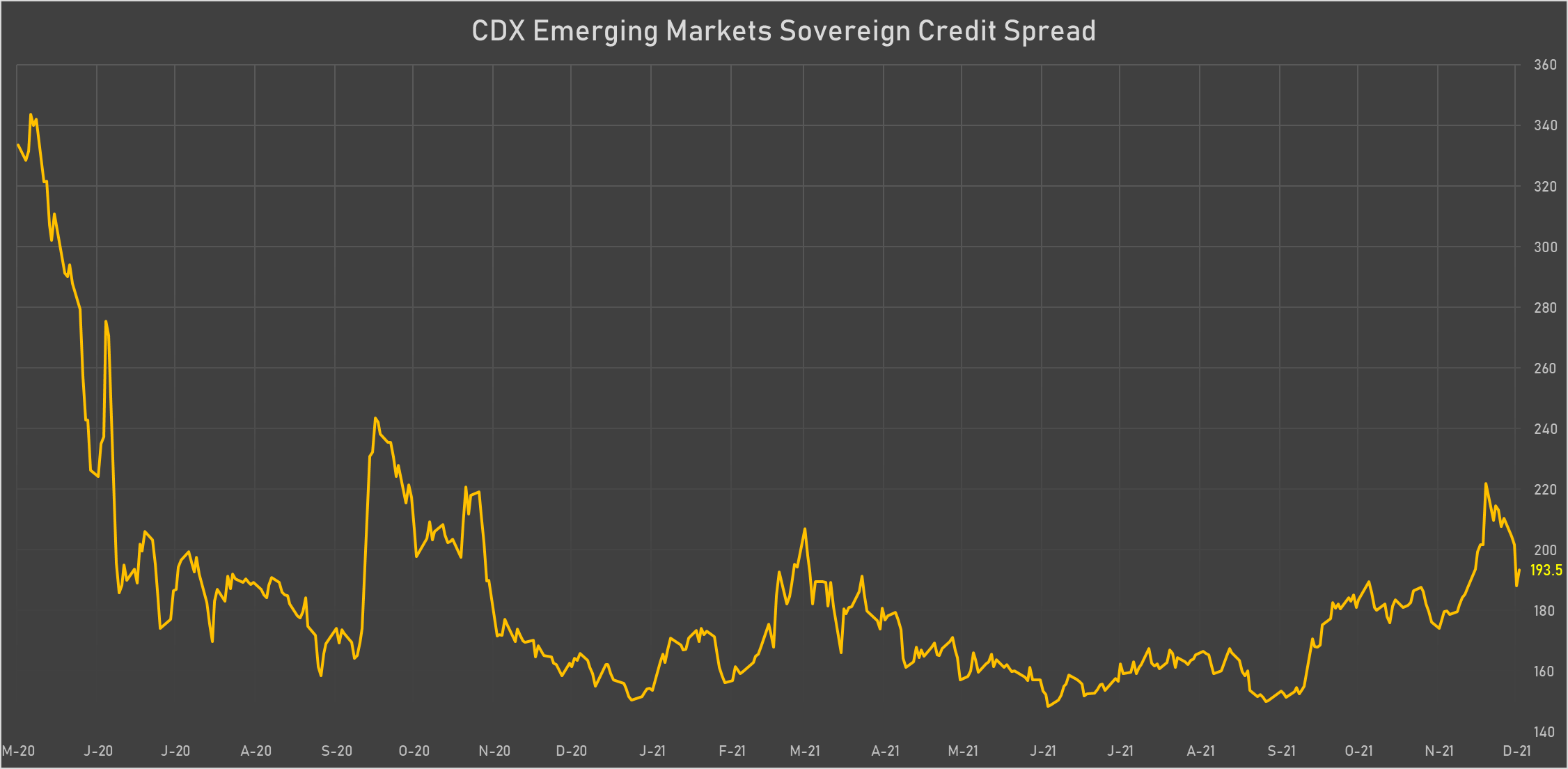

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Egypt (rated B+): down 6.6 basis points to 483 bp (1Y range: 283-512bp)

- Philippines (rated BBB): down 2.3 basis points to 61 bp (1Y range: 34-70bp)

- Malaysia (rated BBB+): down 2.0 basis points to 52 bp (1Y range: 35-64bp)

- Indonesia (rated BBB): down 1.5 basis points to 79 bp (1Y range: 66-94bp)

- Saudi Arabia (rated A): up 0.6 basis points to 51 bp (1Y range: 43-71bp)

- Peru (rated BBB): up 1.0 basis points to 90 bp (1Y range: 52-105bp)

- Panama (rated BBB-): up 1.3 basis points to 90 bp (1Y range: 44-103bp)

- Colombia (rated BB+): up 3.6 basis points to 199 bp (1Y range: 86-227bp)

- Turkey (rated BB-): up 5.3 basis points to 486 bp (1Y range: 282-537bp)

- Brazil (rated BB-): up 5.6 basis points to 220 bp (1Y range: 141-266bp)

LARGEST FX MOVES TODAY

- New Zambian kwacha up 5.2% (YTD: +32.0%)

- North Macedonian denar up 1.1% (YTD: -7.6%)

- Malawi Kwacha up 0.8% (YTD: -4.7%)

- Turkish Lira down 0.8% (YTD: -46.0%)

- Cape Verde Escudo down 1.0% (YTD: -4.7%)

- Chilean Peso down 1.2% (YTD: -16.4%)

- Norwegian Krone down 1.3% (YTD: -4.6%)

- South Africa Rand down 1.4% (YTD: -8.1%)

- Uzbekistan Sum down 1.4% (YTD: -3.1%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 57.9%

- New Zambian Kwacha up 32.0%

- Haiti Gourde down 28.2%

- Surinamese Dollar down 34.0%

- Turkish Lira down 46.0%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%