FX

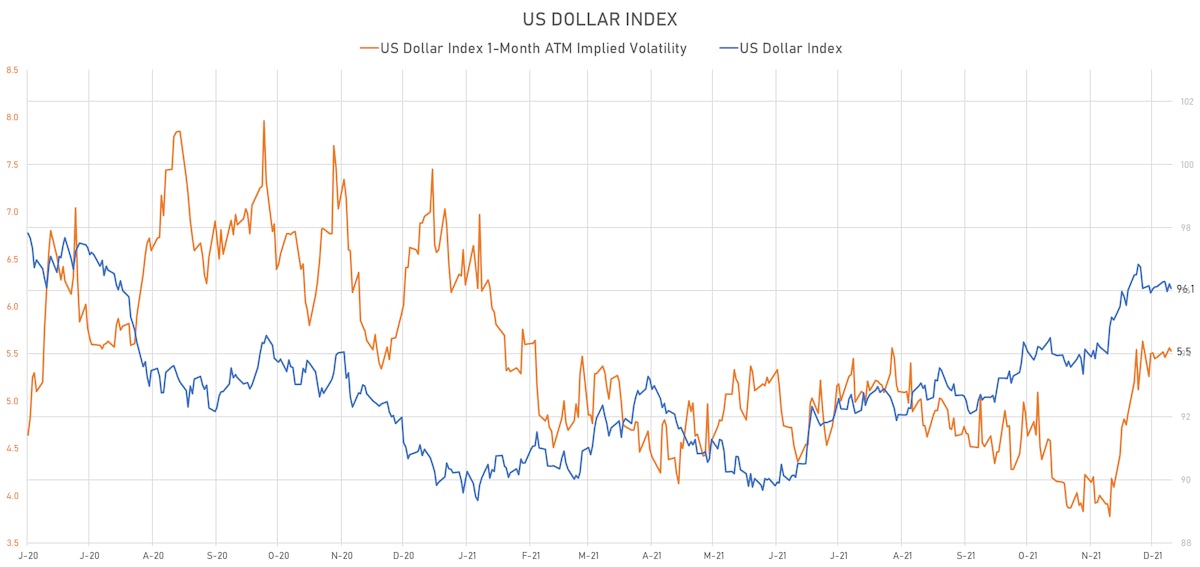

Tightening Rates Differentials Take The US Dollar Index Down To End The Week

A quieter overall week from a macro standpoint, with rates and FX volatilities coming down, but the FOMC next Wednesday will bring back event risk in a big way

Published ET

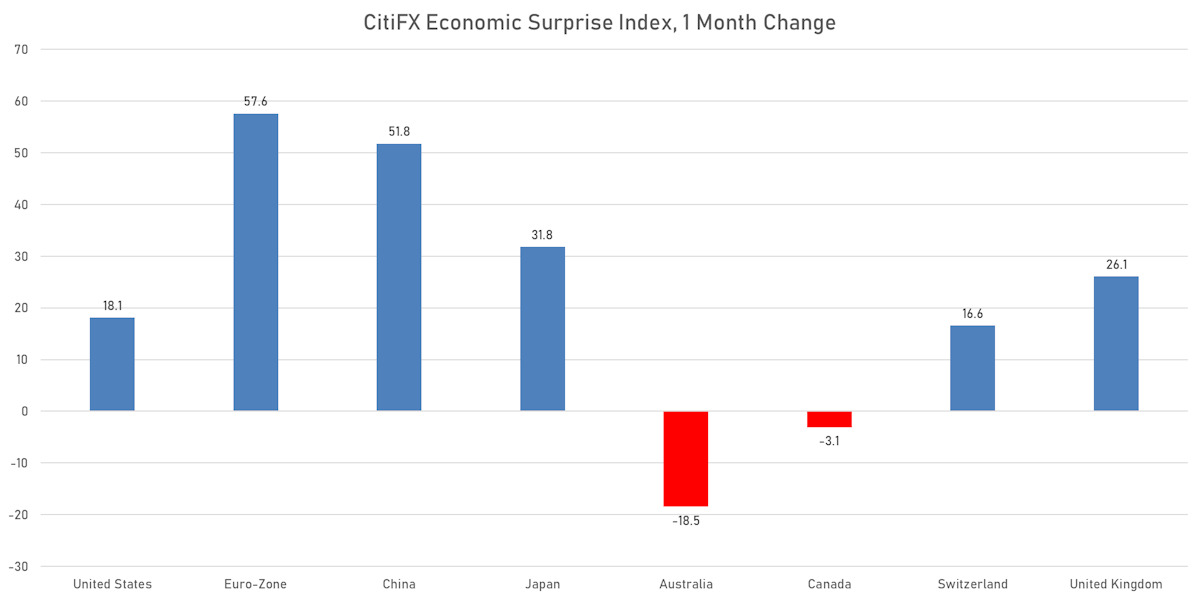

CitiFX Economic Surprise Indices | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

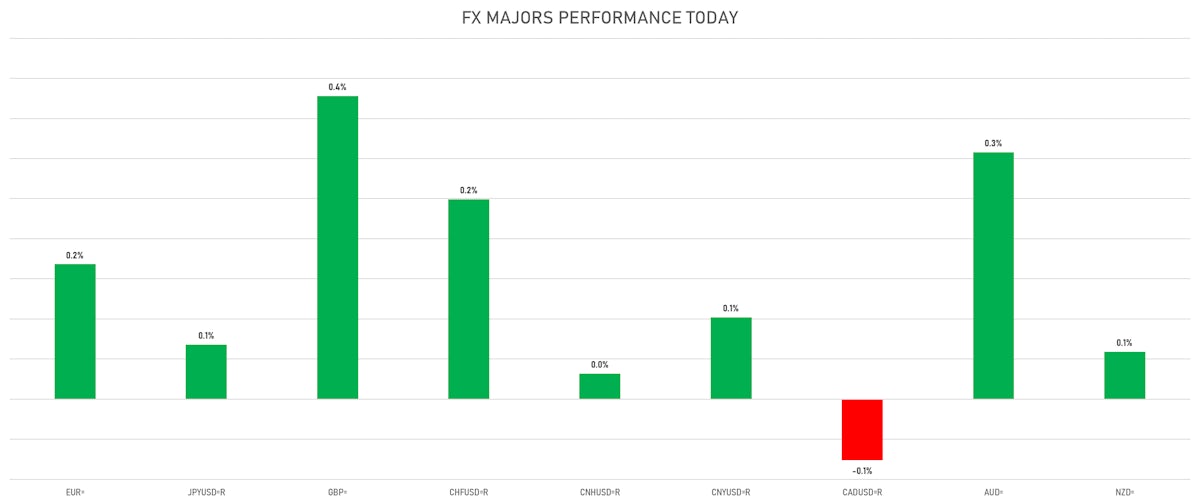

- The US Dollar Index is down -0.15% at 96.07 (YTD: +6.76%)

- Euro up 0.17% at 1.1311 (YTD: -7.4%)

- Yen up 0.07% at 113.38 (YTD: -8.9%)

- Onshore Yuan up 0.10% at 6.3685 (YTD: +2.5%)

- Swiss franc up 0.25% at 0.9209 (YTD: -3.9%)

- Sterling up 0.38% at 1.3269 (YTD: -3.0%)

- Canadian dollar down 0.08% at 1.2720 (YTD: +0.1%)

- Australian dollar up 0.31% at 0.7171 (YTD: -6.8%)

- NZ dollar up 0.06% at 0.6797 (YTD: -5.4%)

WEEKLY IMM NET SPEC POSITIONING DATA

- All currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduction in net long US$ positioning

- Euro: reduction in net long US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: reduction in net long US$ positioning

- New Zealand Dollar: increase in net short US$ positioning

- Brazilian Real: reduction in net long US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net long US$ positioning

MACRO DATA RELEASES

- Brazil, CPI, Broad national index (IPCA), Change P/P for Nov 2021 (IBGE, Brazil) at 0.95 % (vs 1.25 % prior), below consensus estimate of 1.08 %

- Brazil, CPI, Broad national index (IPCA), Change Y/Y for Nov 2021 (IBGE, Brazil) at 10.74 % (vs 10.67 % prior), below consensus estimate of 10.88 %

- Canada, Capacity Utilization, Total industrial for Q3 2021 (CANSIM, Canada) at 81.40 % (vs 82.00 % prior), below consensus estimate of 83.00 %

- Czech Republic, CPI, Change P/P, Price Index for Nov 2021 (CSU, Czech Rep) at 0.20 % (vs 1.00 % prior), below consensus estimate of 0.20 %

- Czech Republic, CPI, Change Y/Y, Price Index for Nov 2021 (CSU, Czech Rep) at 6.00 % (vs 5.80 % prior), below consensus estimate of 6.10 %

- Denmark, CPI, All Items, Change Y/Y, Price Index for Nov 2021 (statbank.dk) at 3.40 % (vs 3.00 % prior)

- Germany, CPI, Final, Change P/P, Price Index for Nov 2021 (Destatis) at -0.20 % (vs -0.20 % prior), in line with consensus

- Germany, CPI, Final, Change Y/Y, Price Index for Nov 2021 (Destatis) at 5.20 % (vs 5.20 % prior), in line with consensus

- Germany, HICP, Final, Change P/P, Price Index for Nov 2021 (Destatis) at 0.30 % (vs 0.30 % prior), in line with consensus

- Germany, HICP, Final, Change Y/Y, Price Index for Nov 2021 (Destatis) at 6.00 % (vs 6.00 % prior), in line with consensus

- Greece, CPI, Change Y/Y, Price Index for Nov 2021 (ELSTAT, Greece) at 4.80 % (vs 3.40 % prior)

- Greece, HICP, Change Y/Y, Price Index for Nov 2021 (ELSTAT, Greece) at 4.00 % (vs 2.80 % prior)

- India, Production, Change Y/Y, Volume Index for Oct 2021 (MOSPI, India) at 3.20 % (vs 3.10 % prior), below consensus estimate of 4.00 %

- Italy, Production, Total industry excluding construction, Change P/P for Oct 2021 (ISTAT, Italy) at -0.60 % (vs 0.10 % prior), below consensus estimate of 0.40 %

- Italy, Production, Total industry excluding construction, Change Y/Y for Oct 2021 (ISTAT, Italy) at 2.00 % (vs 4.40 % prior), below consensus estimate of 3.30 %

- Malaysia, Production, Total industry, Change Y/Y for Oct 2021 (Statistics, Malaysia) at 5.50 % (vs 2.50 % prior), above consensus estimate of 3.80 %

- Mexico, Production, Total industry, Change P/P for Oct 2021 (INEGI, Mexico) at 0.60 % (vs -1.40 % prior), below consensus estimate of 0.90 %

- Mexico, Production, Total industry, Change Y/Y for Oct 2021 (INEGI, Mexico) at 0.70 % (vs 1.60 % prior), below consensus estimate of 1.20 %

- Norway, CPI, All Items, Change P/P, Price Index for Nov 2021 (Statistics Norway) at 0.80 % (vs -0.30 % prior), above consensus estimate of 0.50 %

- Norway, CPI, All Items, Change Y/Y for Nov 2021 (Statistics Norway) at 5.10 % (vs 3.50 % prior), above consensus estimate of 4.60 %

- Norway, CPI, CPI-ATE, All items, Change P/P for Nov 2021 (Statistics Norway) at 0.10 % (vs -0.30 % prior), above consensus estimate of 0.00 %

- Norway, CPI, CPI-ATE, All items, Change Y/Y for Nov 2021 (Statistics Norway) at 1.30 % (vs 0.90 % prior), above consensus estimate of 1.20 %

- Russia, Trade Balance, Total, Free On Board, Current Prices for Oct 2021 (Central Bank, Russia) at 19.78 Bln USD (vs 20.00 Bln USD prior)

- Slovakia, Production, Change Y/Y for Oct 2021 (Stat Office of SR) at -0.60 % (vs -4.90 % prior), above consensus estimate of -5.90 %

- Spain, Production, Total industry excluding construction, Change Y/Y for Oct 2021 (INE, Spain) at -0.90 % (vs 1.20 % prior), below consensus estimate of 0.70 %

- United Kingdom, GDP Estimated YY, Change Y/Y for Oct 2021 (ONS, United Kingdom) at 4.60 % (vs 5.30 % prior), below consensus estimate of 4.90 %

- United Kingdom, GDP Estimated, Change M/M for Oct 2021 (ONS, United Kingdom) at 0.10 % (vs 0.60 % prior), below consensus estimate of 0.40 %

- United Kingdom, GDP estimate 3m/3m for Oct 2021 (ONS, United Kingdom) at 0.90 % (vs 1.30 % prior), below consensus estimate of 1.00 %

- United Kingdom, Production, Manufacturing, Change P/P for Oct 2021 (ONS, United Kingdom) at 0.00 % (vs 0.10 % prior), in line with consensus

- United Kingdom, Production, Manufacturing, Change Y/Y for Oct 2021 (ONS, United Kingdom) at 1.30 % (vs 2.80 % prior), below consensus estimate of 1.70 %

- United Kingdom, Production, Total, excluding construction, Change P/P for Oct 2021 (ONS, United Kingdom) at -0.60 % (vs -0.40 % prior), below consensus estimate of 0.10 %

- United Kingdom, Production, Total, excluding construction, Change Y/Y for Oct 2021 (ONS, United Kingdom) at 1.40 % (vs 2.90 % prior), below consensus estimate of 2.20 %

- United Kingdom, Trade Balance, Goods for Oct 2021 (ONS, United Kingdom) at -13.93 Bln GBP (vs -14.74 Bln GBP prior), above consensus estimate of -14.06 Bln GBP

- United States, CPI - All Urban Samples: All Items, Change Y/Y for Nov 2021 (BLS, U.S Dep. Of Lab) at 6.80 % (vs 6.20 % prior), in line with consensus

- United States, CPI, All items less food and energy, Change Y/Y, Price Index for Nov 2021 (BLS, U.S Dep. Of Lab) at 4.90 % (vs 4.60 % prior), in line with consensus

- United States, CPI, All items, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.80 % (vs 0.90 % prior), above consensus estimate of 0.70 %

- United States, University of Michigan, Total-prelim, Volume Index for Dec 2021 (UMICH, Survey) at 70.40 (vs 67.40 prior), above consensus estimate of 67.10

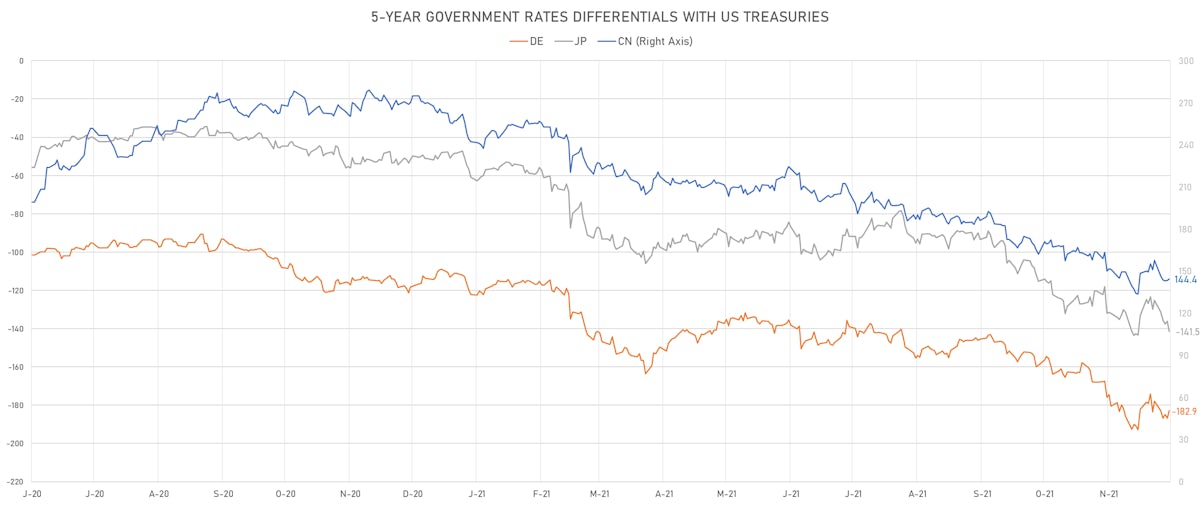

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -3.9 bp at 182.9 bp (YTD change: +71.8 bp)

- US-JAPAN: +5.3 bp at 141.5 bp (YTD change: +93.2 bp)

- US-CHINA: -0.9 bp at -144.4 bp (YTD change: +112.7 bp)

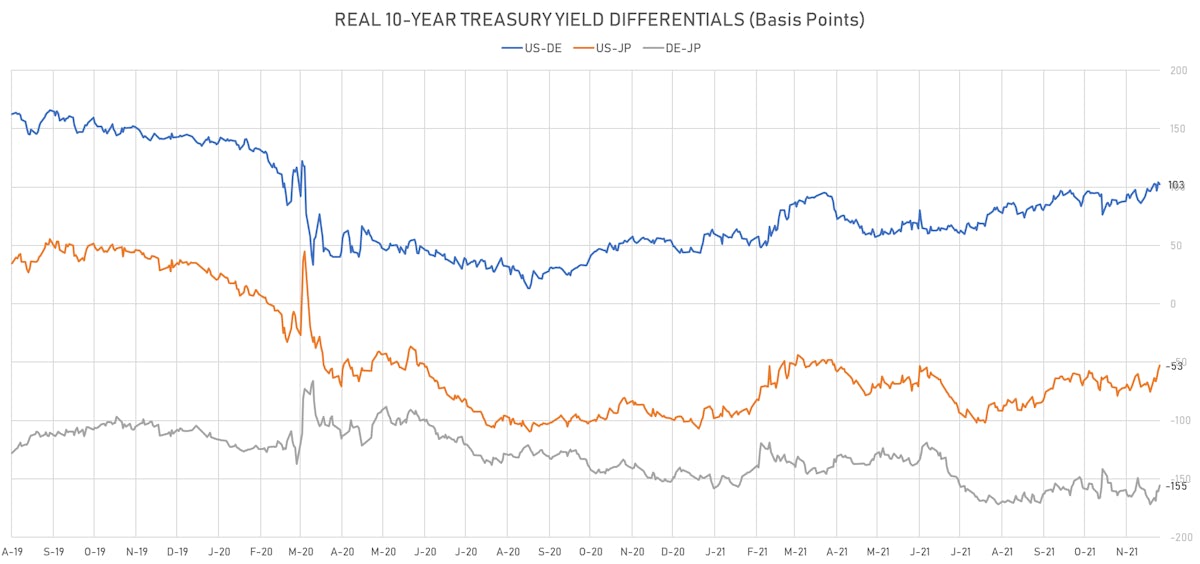

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.6 bp at 102.6 bp (YTD change: +56.5bp)

- US-JAPAN: +3.8 bp at -52.8 bp (YTD change: +48.7bp)

- JAPAN-GERMANY: -5.4 bp at 155.4 bp (YTD change: +7.8bp)

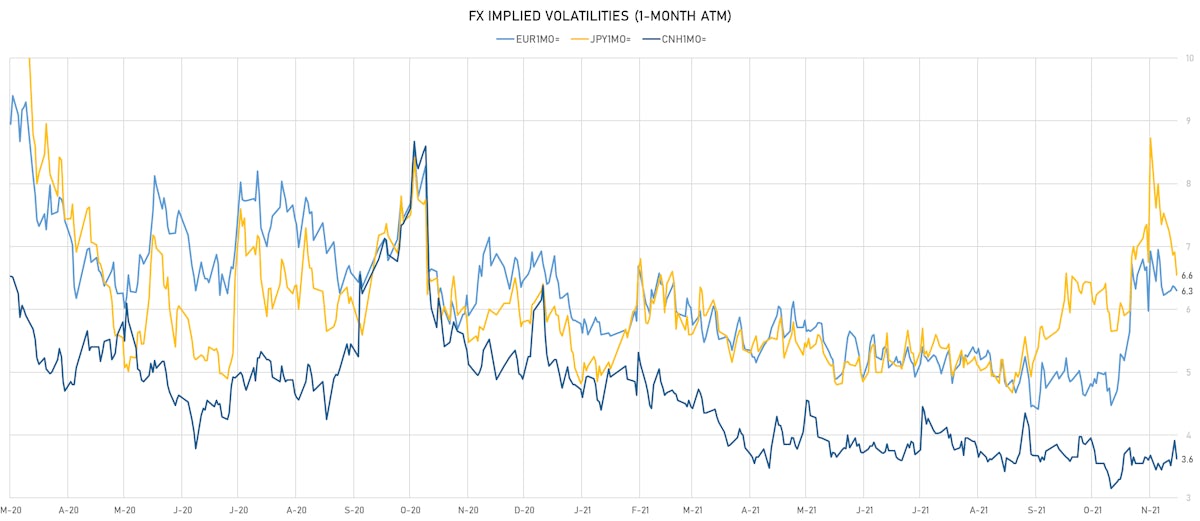

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.09, up 0.06 (YTD: -0.08)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 6.30 (YTD: -0.4)

- Japanese Yen 1M ATM IV currently at 6.55, down -0.4 (YTD: +0.5)

- Offshore Yuan 1M ATM IV currently at 3.63, down -0.3 (YTD: -2.4)

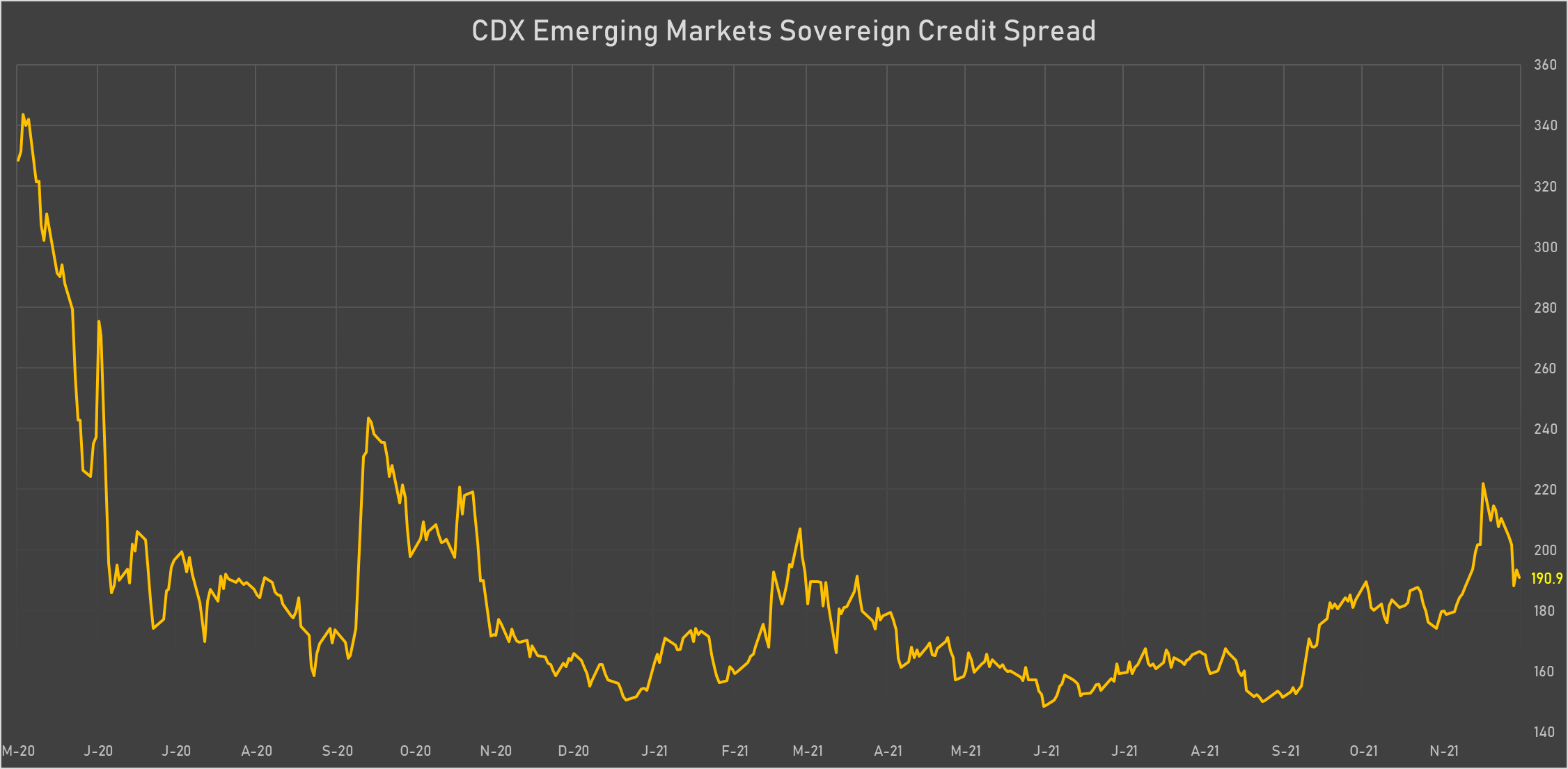

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Morocco (rated BB+): down 2.5 basis points to 86 bp (1Y range: 84-103bp)

- Philippines (rated BBB): down 0.8 basis points to 60 bp (1Y range: 34-70bp)

- Peru (rated BBB): down 0.7 basis points to 89 bp (1Y range: 52-105bp)

- Indonesia (rated BBB): down 0.6 basis points to 78 bp (1Y range: 66-94bp)

- Vietnam (rated BB): down 0.6 basis points to 98 bp (1Y range: 89-112bp)

- Mexico (rated BBB-): down 0.5 basis points to 100 bp (1Y range: 79-124bp)

- Saudi Arabia (rated A): up 0.6 basis points to 51 bp (1Y range: 43-71bp)

- Colombia (rated BB+): up 1.4 basis points to 199 bp (1Y range: 86-227bp)

- South Africa (rated BB-): up 1.9 basis points to 219 bp (1Y range: 178-246bp)

- Turkey (rated BB-): up 12.7 basis points to 499 bp (1Y range: 282-537bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 4.0% (YTD: -4.5%)

- Samoa Tala up 2.1% (YTD: -1.4%)

- Cape Verde Escudo up 1.0% (YTD: -3.8%)

- Honduras Lempira up 0.7% (YTD: -0.2%)

- Turkish Lira down 0.7% (YTD: -46.4%)

- Brazilian Real down 0.7% (YTD: -7.5%)

- Lao Kip down 0.8% (YTD: -15.9%)

- New Zambian Kwacha down 0.8% (YTD: +30.9%)

- Malawi Kwacha down 0.8% (YTD: -5.5%)

LARGEST FX MOVES THIS WEEK

- New Zambian kwacha down 9.4% (YTD: +30.9%)

- Seychelles rupee up 8.9% (YTD: +68.2%)

- CFA Franc BEAC up 3.0% (YTD: -4.5%)

- Norwegian Krone up 2.4% (YTD: -4.1%)

- Samoa Tala up 2.1% (YTD: -1.4%)

- Israeli shekel down 2.1% (YTD: +3.6%)

- Australian Dollar up 1.7% (YTD: -6.8%)

- Mauritius Rupee down 1.7% (YTD: -9.2%)

- Afghani down 6.9% (YTD: -25.6%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 68.2%

- New Zambian kwacha up 30.9%

- Haiti Gourde down 28.2%

- Surinamese dollar down 33.8%

- Turkish Lira down 46.4%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%