FX

US Dollar Rises On Light Macro Agenda, With Busy Week Of Central Bank Meetings Ahead

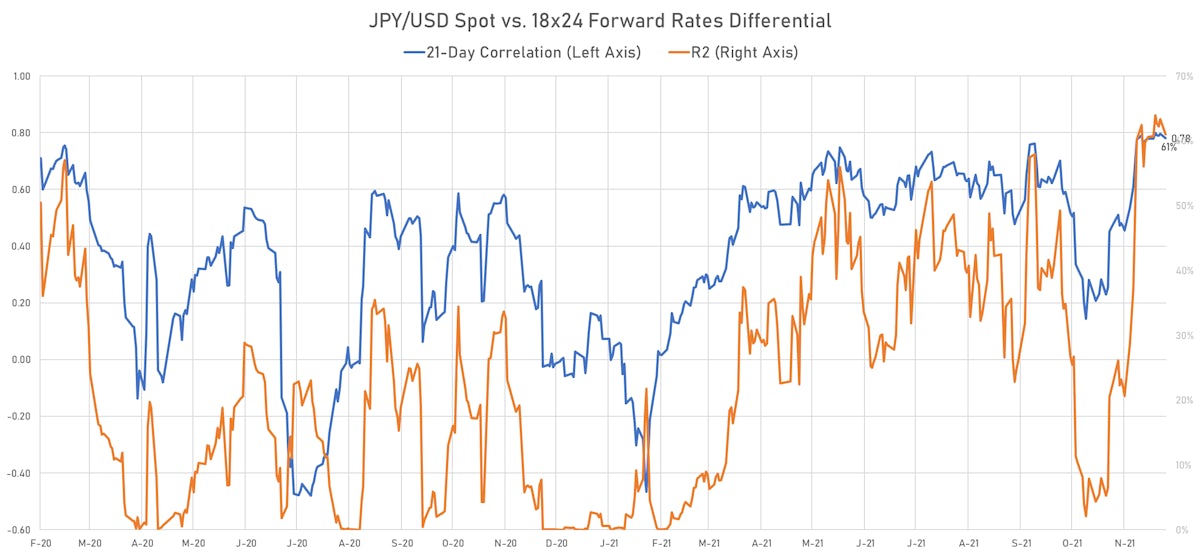

After a strong correlation over the last few weeks, with a macro focus on monetary policy, US-JPY rates differentials and the JPY spot rate have been less tightly coupled since the omicron discovery

Published ET

21-Day Correlation Between Spot JPY and US-JP Forward Rates Differential (6-month rates in 18 months) | Source: ϕpost, Refinitiv data

QUICK SUMMARY

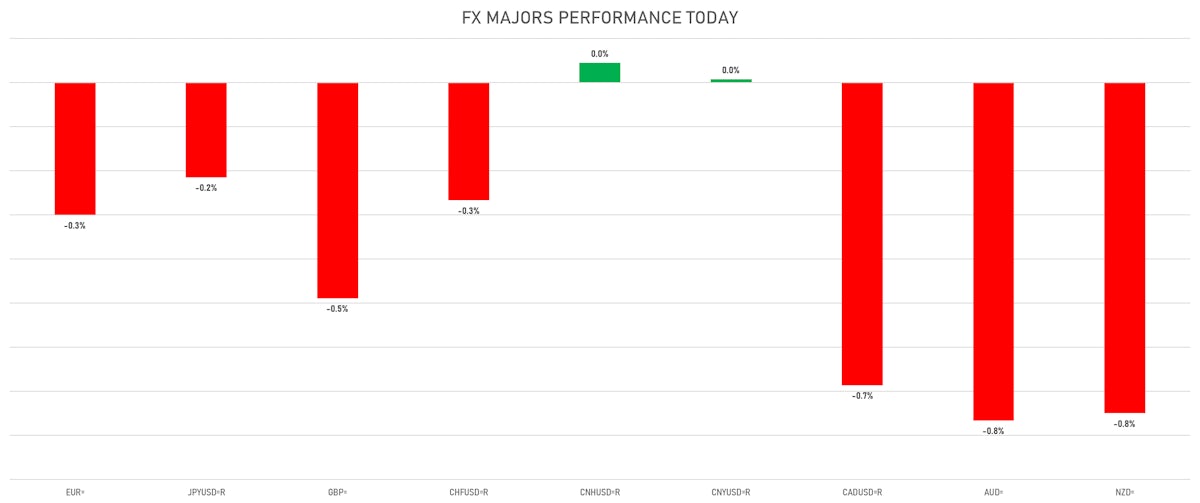

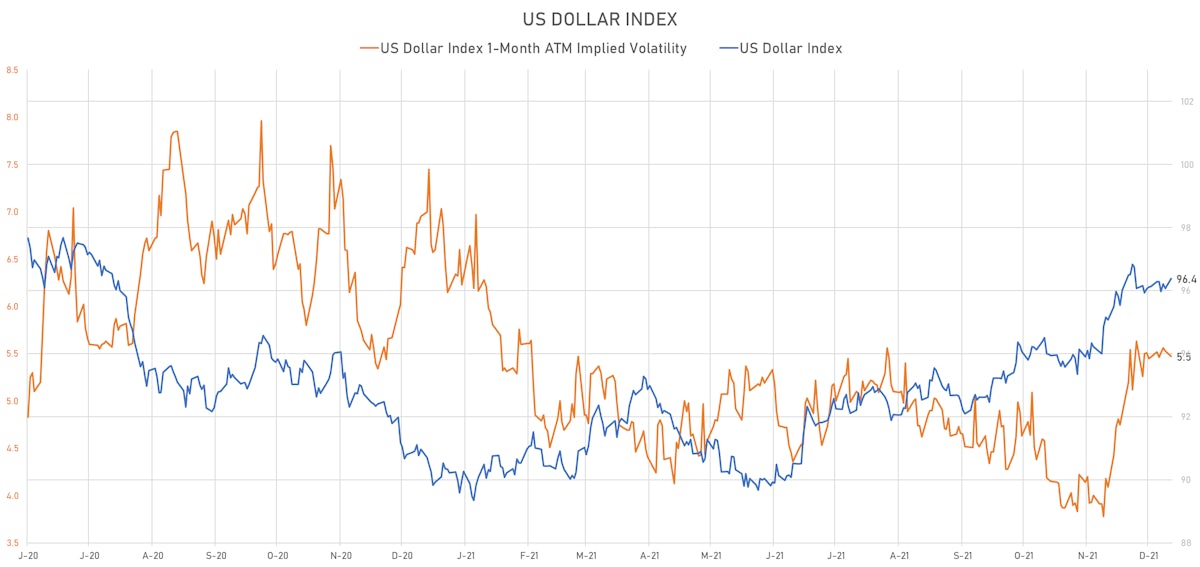

- The US Dollar Index is up 0.32% at 96.38 (YTD: +7.11%)

- Euro down 0.30% at 1.1277 (YTD: -7.7%)

- Yen down 0.22% at 113.63 (YTD: -9.1%)

- Onshore Yuan up 0.01% at 6.3630 (YTD: +2.5%)

- Swiss franc down 0.27% at 0.9228 (YTD: -4.1%)

- Sterling down 0.49% at 1.3204 (YTD: -3.4%)

- Canadian dollar down 0.69% at 1.2809 (YTD: -0.6%)

- Australian dollar down 0.77% at 0.7116 (YTD: -7.5%)

- NZ dollar down 0.75% at 0.6746 (YTD: -6.1%)

MACRO DATA RELEASES

- India, CPI, Rural and urban, General, Change Y/Y, Price Index for Nov 2021 (MOSPI, India) at 4.91 % (vs 4.48 % prior), below consensus estimate of 5.10 %

- Romania, CPI, All Items, Change Y/Y, Price Index for Nov 2021 (NIS, Romania) at 7.80 % (vs 7.94 % prior), below consensus estimate of 8.00 %

- Turkey, Current Account, Balance, Current Prices for Oct 2021 (Central Bank, Turkey) at 3.16 Bln USD (vs 1.65 Bln USD prior), above consensus estimate of 2.40 Bln USD

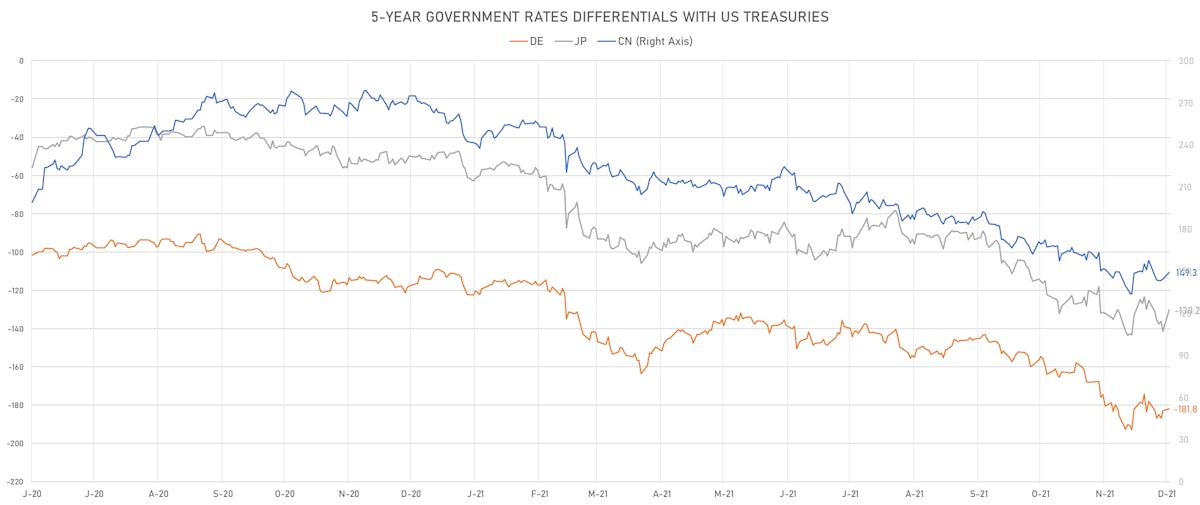

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.3 bp at 182.6 bp (YTD change: +71.5 bp)

- US-JAPAN: -10.4 bp at 131.1 bp (YTD change: +82.8 bp)

- US-CHINA: -3.3 bp at -147.7 bp (YTD change: +109.4 bp)

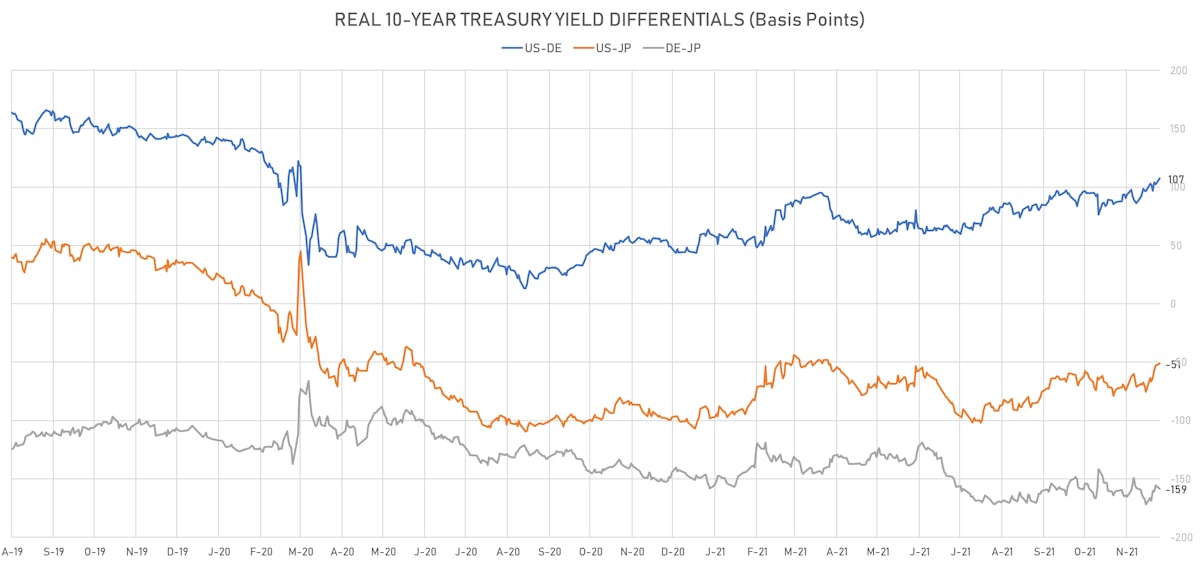

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.8 bp at 107.4 bp (YTD change: +61.3bp)

- US-JAPAN: +1.6 bp at -51.2 bp (YTD change: +50.3bp)

- JAPAN-GERMANY: +3.2 bp at 158.6 bp (YTD change: +11.0bp)

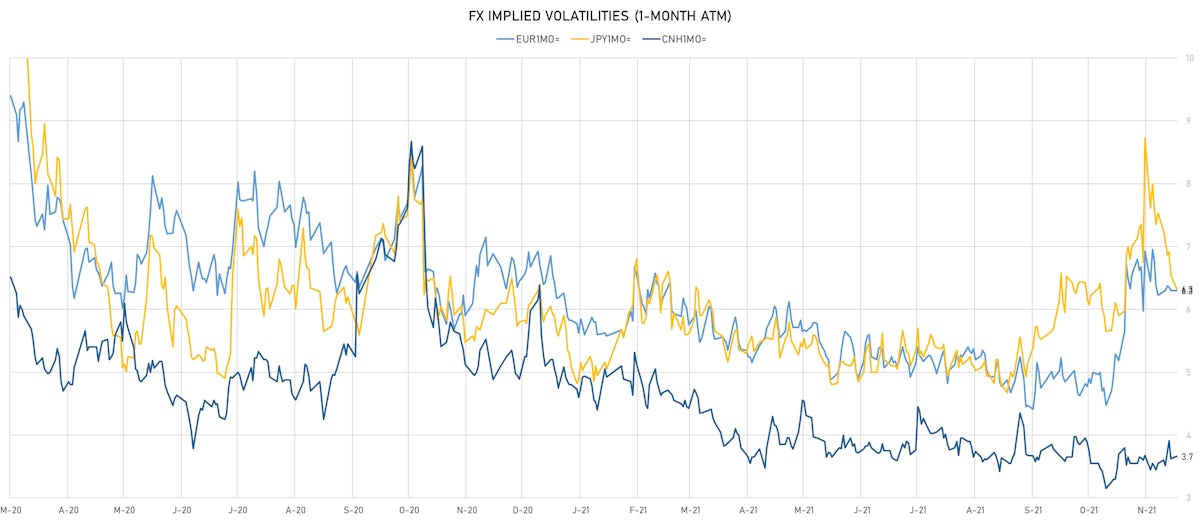

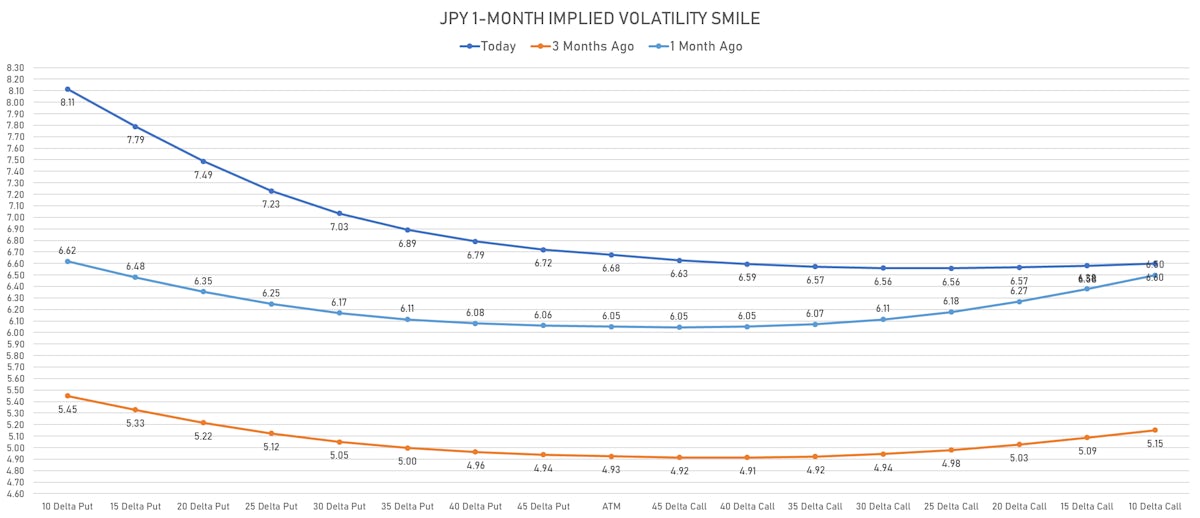

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.96, down -0.13 (YTD: -0.21)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 6.30 (YTD: -0.4)

- Japanese Yen 1M ATM IV currently at 6.33, down -0.2 (YTD: +0.2)

- Offshore Yuan 1M ATM IV unchanged at 3.66 (YTD: -2.3)

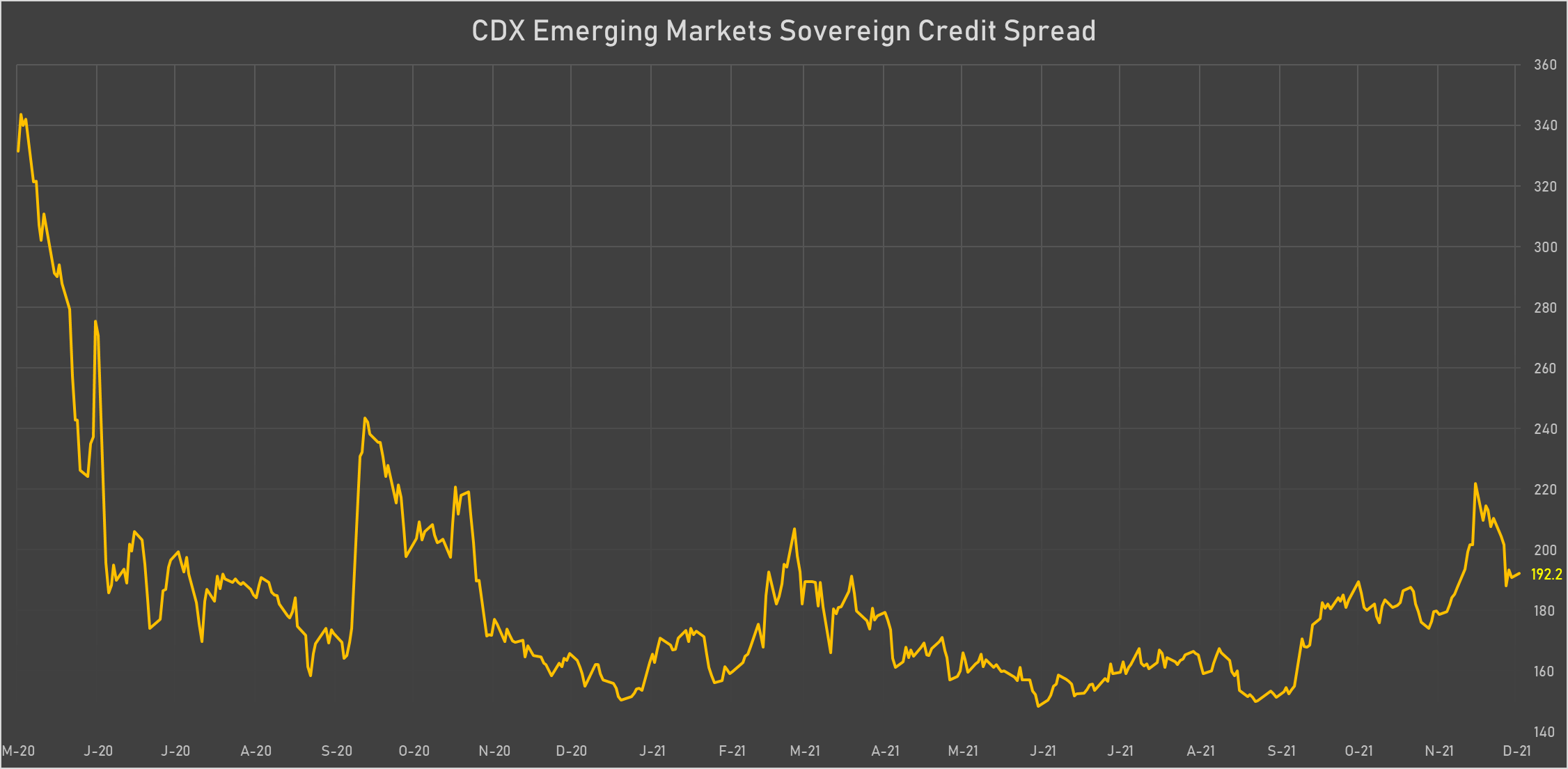

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- South Africa (rated BB-): down 2.7 basis points to 216 bp (1Y range: 178-246bp)

- Indonesia (rated BBB): down 1.0 basis points to 77 bp (1Y range: 66-94bp)

- Mexico (rated BBB-): down 0.9 basis points to 99 bp (1Y range: 79-124bp)

- Philippines (rated BBB): down 0.8 basis points to 59 bp (1Y range: 34-70bp)

- Russia (rated BBB): down 0.6 basis points to 104 bp (1Y range: 75-122bp)

- Panama (rated BBB-): down 0.5 basis points to 89 bp (1Y range: 44-103bp)

- Bahrain (rated B+): up 4.4 basis points to 295 bp (1Y range: 159-298bp)

- Colombia (rated BB+): up 4.8 basis points to 204 bp (1Y range: 86-227bp)

- Turkey (rated BB-): up 13.6 basis points to 512 bp (1Y range: 282-537bp)

- Argentina (rated CCC): up 35.6 basis points to 2,574 bp (1Y range: 1,092-3,111bp)

LARGEST FX MOVES TODAY

- Liberian Dollar up 0.8% (YTD: +16.7%)

- Jamaican Dollar up 0.8% (YTD: -7.3%)

- Qatari Riyal down 0.8% (YTD: -0.8%)

- Hungarian Forint down 0.8% (YTD: -8.9%)

- New Zambian kwacha down 1.0% (YTD: +29.7%)

- Cape Verde Escudo down 1.0% (YTD: -4.7%)

- Norwegian Krone down 1.1% (YTD: -5.2%)

- Brazilian Real down 1.2% (YTD: -8.6%)

- Samoa Tala down 1.7% (YTD: -3.1%)

- Afghani down 7.9% (YTD: -31.4%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 57.9%

- New Zambian kwacha up 29.7%

- Haiti Gourde down 28.2%

- Afghani down 31.4%

- Surinamese dollar down 34.2%

- Turkish Lira down 46.2%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%