FX

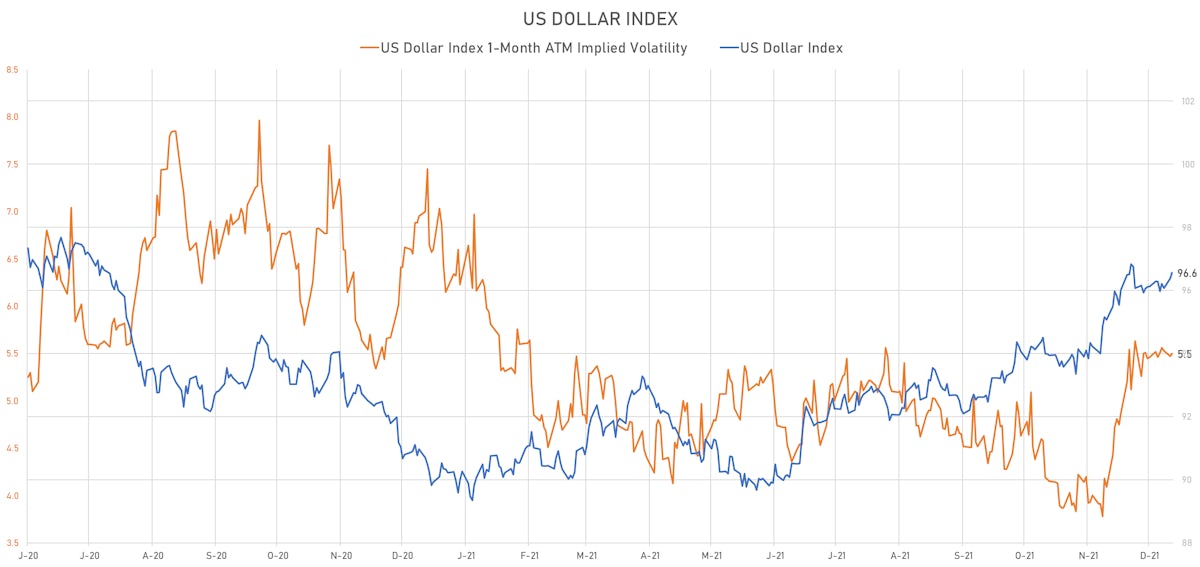

Dollar Index Up Today As Further Rise in US Short-Term Rates Widens Rates Differentials

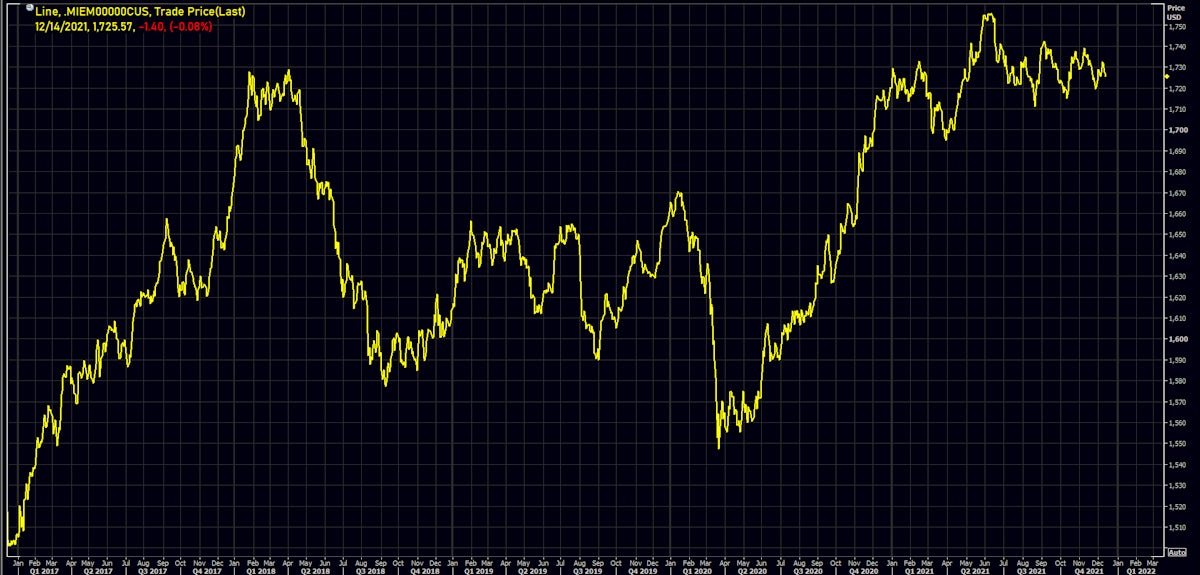

Emerging market currencies have been weakening since the start of the week, with both the Omicron risk-off sentiment and higher US rates making EM carry less attractive

Published ET

MSCI EM Currency Index (USD) | Source: Refinitiv

QUICK SUMMARY

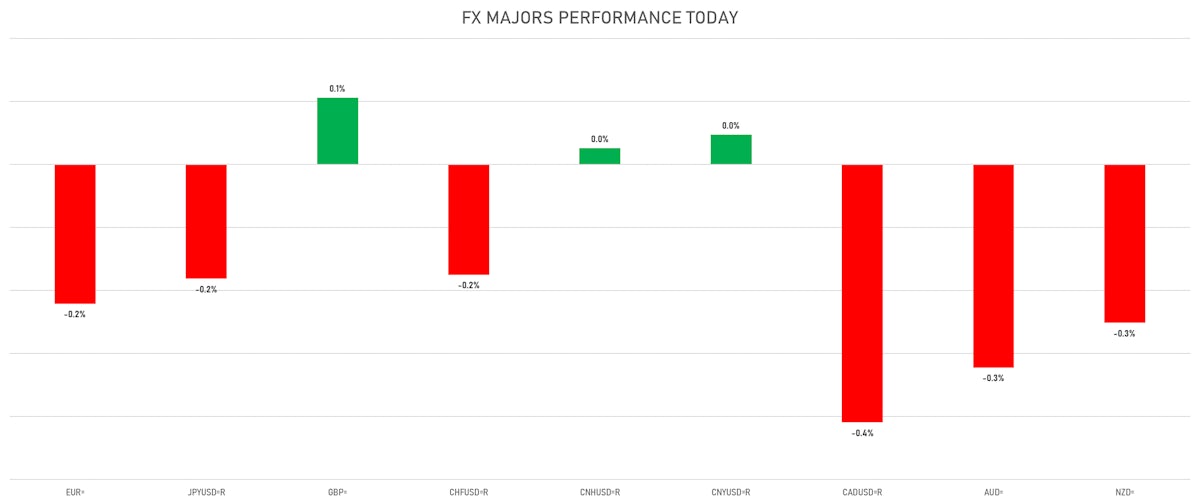

- The US Dollar Index is up 0.19% at 96.56 (YTD: +7.31%)

- Euro down 0.22% at 1.1258 (YTD: -7.8%)

- Yen down 0.18% at 113.78 (YTD: -9.2%)

- Onshore Yuan up 0.05% at 6.3671 (YTD: +2.5%)

- Swiss franc down 0.18% at 0.9238 (YTD: -4.3%)

- Sterling up 0.11% at 1.3230 (YTD: -3.2%)

- Canadian dollar down 0.41% at 1.2859 (YTD: -1.0%)

- Australian dollar down 0.32% at 0.7106 (YTD: -7.6%)

- NZ dollar down 0.25% at 0.6736 (YTD: -6.2%)

MACRO DATA RELEASES

- Argentina, CPI, National, Change P/P for Nov 2021 (INDEC, Argentina) at 2.50 % (vs 3.50 % prior), below consensus estimate of 3.20 %

- Chile, Policy Rates, Monetary Policy Interest Rate for Dec 2021 (Central Bank, Chile) at 4.00 % (vs 2.75 % prior), in line with consensus

- Czech Republic, Current Account, Balance, Current Prices for Oct 2021 (Czech National Bank) at -3.68 Bln CZK (vs -10.04 Bln CZK prior), above consensus estimate of -18.40 Bln CZK

- Euro Zone, Production, Total, excluding construction (EA19), Change P/P for Oct 2021 (Eurostat) at 1.10 % (vs -0.20 % prior), below consensus estimate of 1.20 %

- Euro Zone, Production, Total, excluding construction (EA19), Change Y/Y for Oct 2021 (Eurostat) at 3.30 % (vs 5.20 % prior), above consensus estimate of 3.20 %

- Hungary, Policy Rates, Base Rate for Dec 2021 (Cent. Bank, Hungary) at 2.40 % (vs 2.10 % prior), in line with consensus

- Hungary, Policy Rates, Overnight Deposit Rate for Dec 2021 (Cent. Bank, Hungary) at 2.40 % (vs 1.15 % prior), above consensus estimate of 1.90 %

- India, Wholesale Prices, Change Y/Y, Price Index for Nov 2021 (Econ Adviser, India) at 14.23 % (vs 12.54 % prior), above consensus estimate of 11.90 %

- New Zealand, Current Account, Balance, % of GDP for Q3 2021 (Statistics, NZ) at -4.60 % (vs -3.30 % prior), below consensus estimate of -4.50 %

- New Zealand, Current Account, Balance, Current Prices for Q3 2021 (Statistics, NZ) at -8.30 Bln NZD (vs -1.40 Bln NZD prior), below consensus estimate of -7.91 Bln NZD

- New Zealand, Current Account, Balance, Year ended in quarter, Current Prices for Q3 2021 (Statistics, NZ) at -15.86 Bln NZD (vs -11.23 Bln NZD prior), below consensus estimate of -15.05 Bln NZD

- Poland, Current Account, Balance, Current Prices for Oct 2021 (Central Bank, Poland) at -1,791.00 Mln EUR (vs -1,339.00 Mln EUR prior), below consensus estimate of -960.00 Mln EUR

- Portugal, CPI, All items, national, Change P/P, Price Index for Nov 2021 (INE, Portugal) at 0.40 % (vs 0.50 % prior)

- Portugal, CPI, All items, national, Change Y/Y, Price Index for Nov 2021 (INE, Portugal) at 2.60 % (vs 2.60 % prior)

- Slovakia, CPI, Change P/P for Nov 2021 (Stat Office of SR) at 0.50 % (vs 0.60 % prior), above consensus estimate of 0.40 %

- Slovakia, CPI, Change Y/Y for Nov 2021 (Stat Office of SR) at 5.60 % (vs 5.10 % prior), above consensus estimate of 5.40 %

- Slovakia, CPI, Core CPI, Change P/P for Nov 2021 (Stat Office of SR) at 0.60 % (vs 0.70 % prior), above consensus estimate of 0.50 %

- Slovakia, CPI, Core CPI, Change Y/Y for Nov 2021 (Stat Office of SR) at 6.00 % (vs 5.50 % prior), above consensus estimate of 5.90 %

- South Korea, Exports, Total, FOB (Free On Board), Change Y/Y for Nov 2021 (KOR Customs Service) at 32.00 % (vs 32.10 % prior)

- South Korea, Imports, Total, CIF (Cost Insurance Freight), Change Y/Y for Nov 2021 (KOR Customs Service) at 43.60 % (vs 43.60 % prior)

- Sweden, CPI, All Items, Change P/P, Price Index for Nov 2021 (SCB, Sweden) at 0.50 % (vs 0.20 % prior), above consensus estimate of 0.40 %

- Sweden, CPI, All Items, Change Y/Y, Price Index for Nov 2021 (SCB, Sweden) at 3.30 % (vs 2.80 % prior), above consensus estimate of 3.20 %

- Sweden, CPI, Underlying inflation CPIF, Change P/P, Price Index for Nov 2021 (SCB, Sweden) at 0.50 % (vs 0.20 % prior), above consensus estimate of 0.30 %

- Sweden, CPI, Underlying inflation CPIF, Change Y/Y, Price Index for Nov 2021 (SCB, Sweden) at 3.60 % (vs 3.10 % prior), above consensus estimate of 3.40 %

- United Kingdom, Earnings, Average Weekly, Whole economy, regular pay, 3-month average, Change Y/Y for Oct 2021 (ONS, United Kingdom) at 4.30 % (vs 4.90 % prior), above consensus estimate of 4.00 %

- United Kingdom, Earnings, Average Weekly, Whole economy, total pay, 3-month average, Change Y/Y for Oct 2021 (ONS, United Kingdom) at 4.90 % (vs 5.80 % prior), above consensus estimate of 4.60 %

- United Kingdom, Employed, Change in Level of Employment 3m/3m , Volume for Oct 2021 (ONS, United Kingdom) at 149.00 k (vs 247.00 k prior), below consensus estimate of 228.00 k

- United Kingdom, Unemployment, Claimant count, Absolute change for Nov 2021 (ONS, United Kingdom) at -49.80 k (vs -14.90 k prior)

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Oct 2021 (ONS, United Kingdom) at 4.20 % (vs 4.30 % prior), in line with consensus estimate

- United States, Producer Prices, Final demand less foods and energy, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.70 % (vs 0.40 % prior), above consensus estimate of 0.40 %

- United States, Producer Prices, Final demand less foods and energy, Change Y/Y for Nov 2021 (BLS, U.S Dep. Of Lab) at 7.70 % (vs 6.80 % prior), above consensus estimate of 7.20 %

- United States, Producer Prices, Final demand, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.80 % (vs 0.60 % prior), above consensus estimate of 0.50 %

- United States, Producer Prices, Final demand, Change Y/Y for Nov 2021 (BLS, U.S Dep. Of Lab) at 9.60 % (vs 8.60 % prior), above consensus estimate of 9.20 %

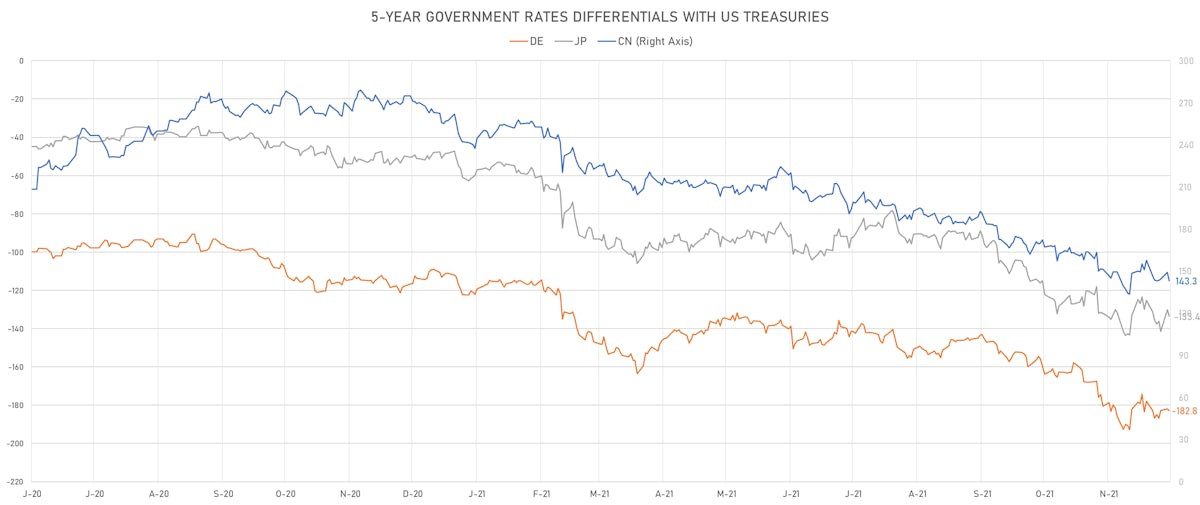

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.7 bp at 182.4 bp (YTD change: +71.4 bp)

- US-JAPAN: +2.9 bp at 133.0 bp (YTD change: +84.8 bp)

- US-CHINA: +5.1 bp at -144.3 bp (YTD change: +112.9 bp)

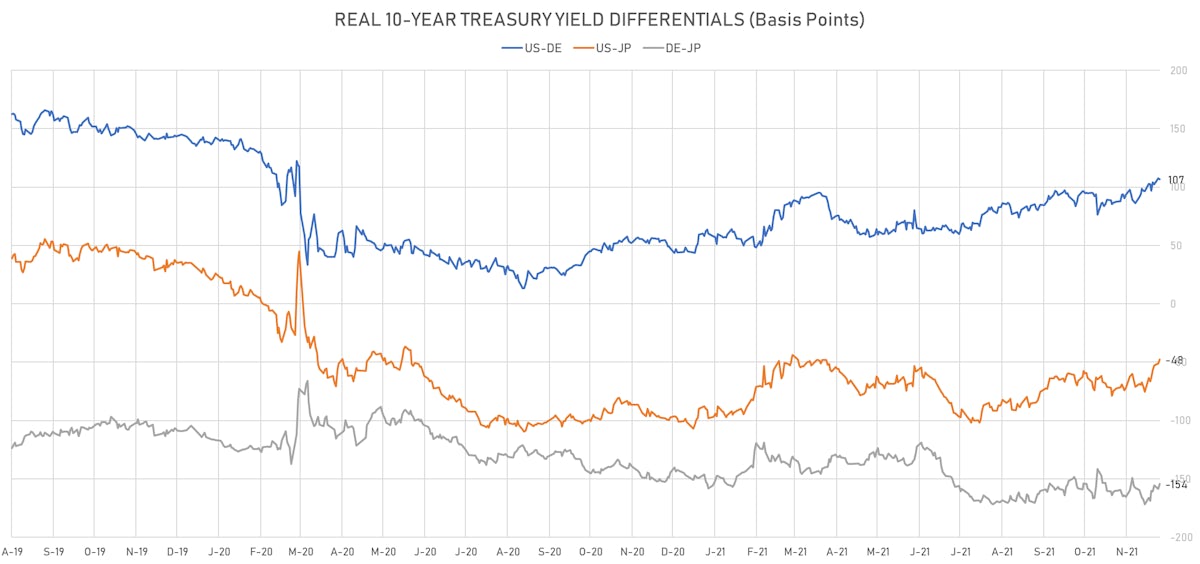

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.7 bp at 106.7 bp (YTD change: +60.6bp)

- US-JAPAN: +3.7 bp at -47.5 bp (YTD change: +54.0bp)

- JAPAN-GERMANY: -4.4 bp at 154.2 bp (YTD change: +6.6bp)

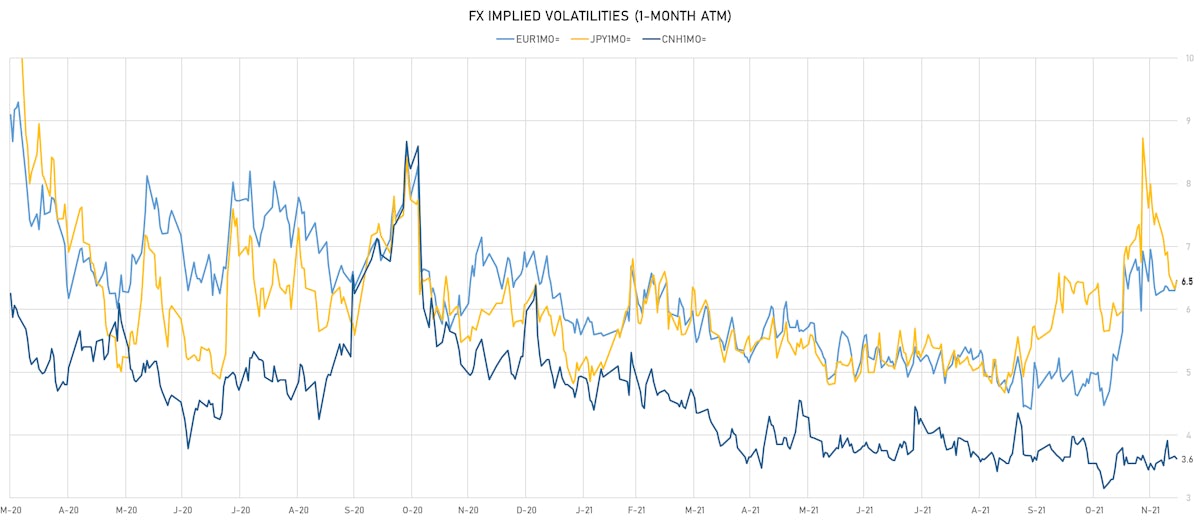

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.90, down -0.06 (YTD: -0.27)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.46, up 0.2 (YTD: -0.2)

- Japanese Yen 1M ATM IV currently at 6.45, up 0.1 (YTD: +0.4)

- Offshore Yuan 1M ATM IV unchanged at 3.63 (YTD: -2.4)

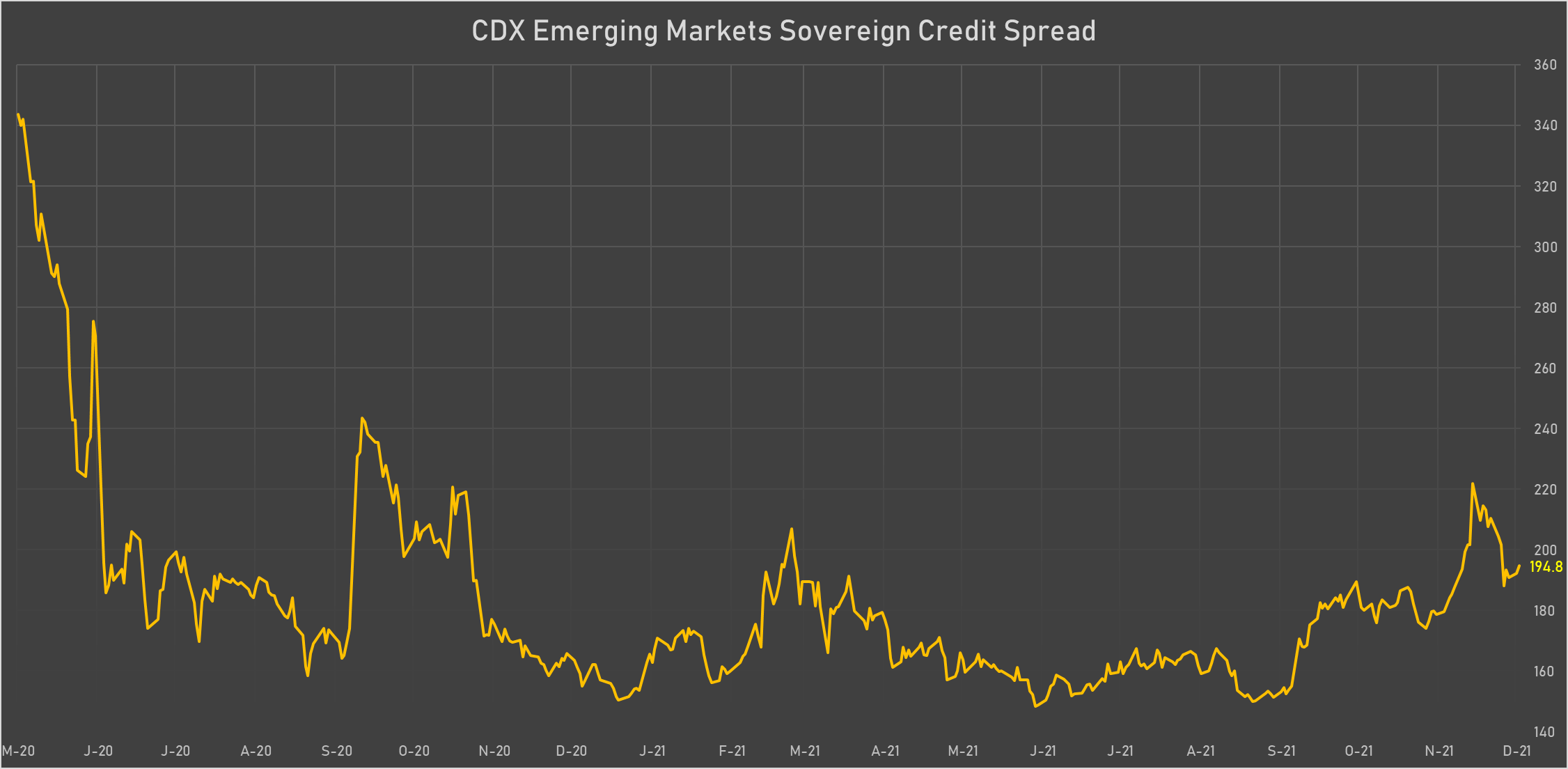

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 123.0 basis points to 2,476 bp (1Y range: 1,092-3,111bp)

- Chile (rated A-): down 1.6 basis points to 84 bp (1Y range: 43-95bp)

- Bahrain (rated B+): down 1.5 basis points to 293 bp (1Y range: 159-298bp)

- Philippines (rated BBB): down 1.2 basis points to 58 bp (1Y range: 34-70bp)

- Panama (rated BBB-): down 0.5 basis points to 88 bp (1Y range: 44-103bp)

- Mexico (rated BBB-): up 0.5 basis points to 100 bp (1Y range: 79-124bp)

- Brazil (rated BB-): up 1.0 basis points to 222 bp (1Y range: 141-266bp)

- Russia (rated BBB): up 1.6 basis points to 106 bp (1Y range: 75-122bp)

- Colombia (rated BB+): up 3.0 basis points to 207 bp (1Y range: 86-227bp)

- Turkey (rated BB-): up 8.5 basis points to 521 bp (1Y range: 282-537bp)

LARGEST FX MOVES TODAY

- Angolan Kwanza up 1.0% (YTD: +15.3%)

- Haiti Gourde up 0.9% (YTD: -27.6%)

- Israeli shekel down 0.8% (YTD: +2.5%)

- Mexican Peso down 1.1% (YTD: -6.3%)

- Colombian Peso down 2.9% (YTD: -14.5%)

- CFA Franc BEAC down 3.0% (YTD: -7.9%)

- Turkish Lira down 3.9% (YTD: -48.4%)

- Afghani down 9.4% (YTD: -37.9%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles rupee up 54.8%

- New Zambian kwacha up 29.9%

- Surinamese dollar down 34.2%

- Afghani down 37.9%

- Turkish Lira down 48.4%

- Syrian Pound down 49.4%

- Libyan Dinar down 70.9%

- Venezuela Bolivar down 76.0%