FX

Euro Rises, Japanese Yen Falls After FOMC Sets Path For Feds Funds Rate Liftoff Next Year

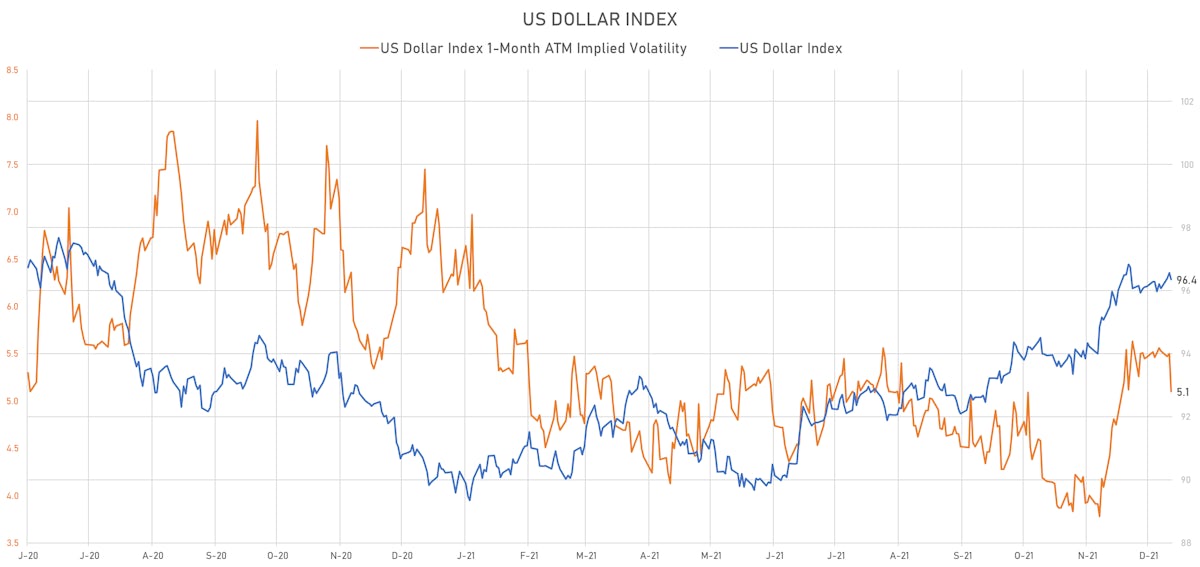

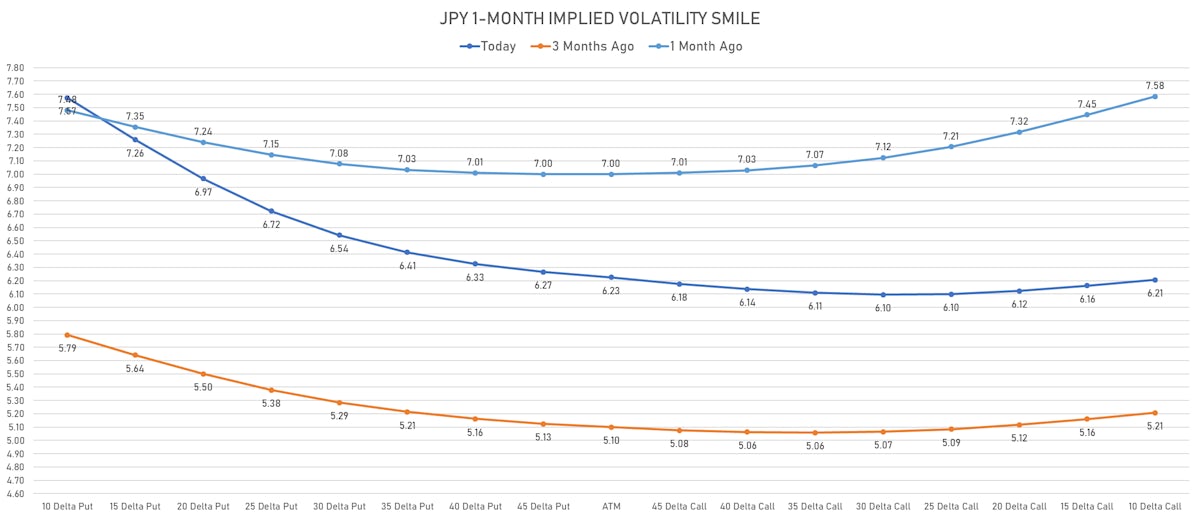

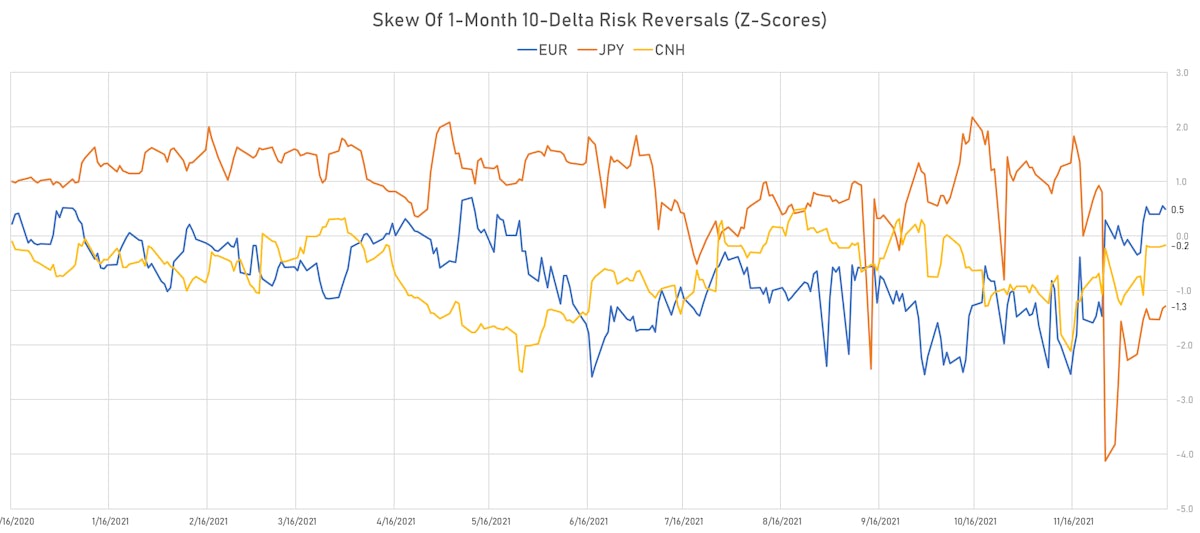

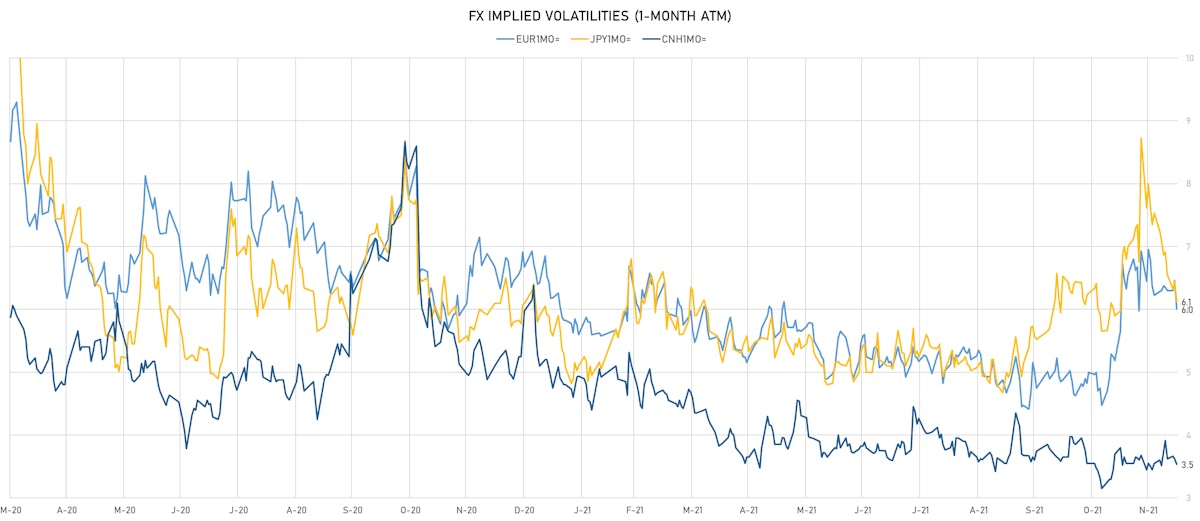

One-month ATM implied volatilities are falling rapidly, and risk reversals in EUR, JPY are showing a moderate skew towards a weakening of the USD, as the consensus and rates differentials favor a stronger dollar

Published ET

EUR CNH JPY 1-Month ATM Implied Volatilities | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

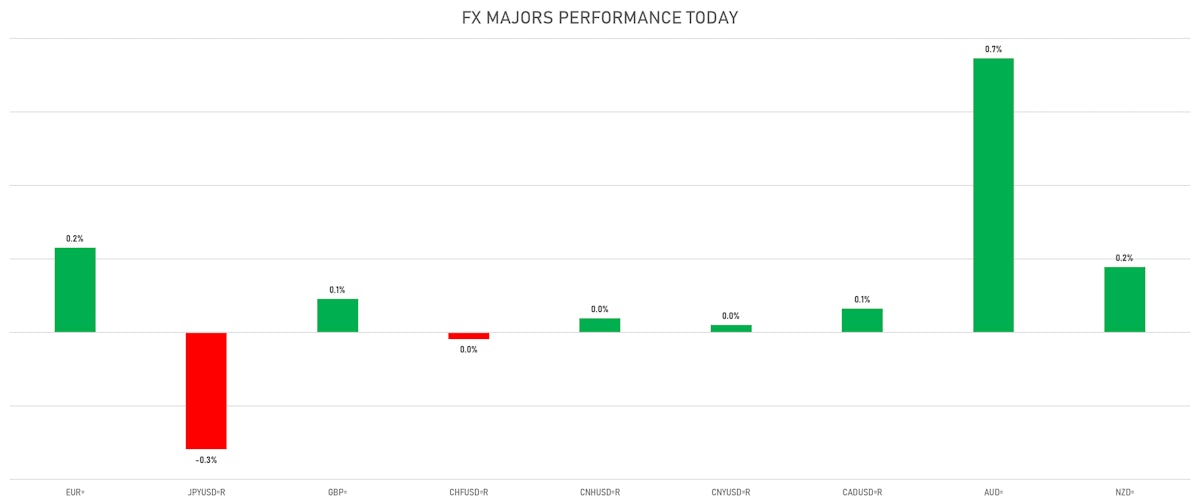

- The US Dollar Index is down -0.21% at 96.36 (YTD: +7.09%)

- Euro up 0.23% at 1.1283 (YTD: -7.6%)

- Yen down 0.32% at 114.09 (YTD: -9.5%)

- Onshore Yuan up 0.02% at 6.3666 (YTD: +2.5%)

- Swiss franc down 0.02% at 0.9244 (YTD: -4.2%)

- Sterling up 0.09% at 1.3250 (YTD: -3.1%)

- Canadian dollar up 0.06% at 1.2854 (YTD: -0.9%)

- Australian dollar up 0.75% at 0.7155 (YTD: -7.0%)

- NZ dollar up 0.18% at 0.6757 (YTD: -6.0%)

MACRO DATA RELEASES

- Australia, Markit PMI, Composite for Dec 2021 (Markit Economics) at 54.90 (vs 55.70 prior)

- Australia, Markit PMI, Manufacturing for Dec 2021 (Markit Economics) at 57.40 (vs 59.20 prior)

- Australia, Markit PMI, Services for Dec 2021 (Markit Economics) at 55.10 (vs 55.70 prior)

- Canada, CPI, Core CPI (Bank of Canada), Change P/P, Price Index for Nov 2021 (CANSIM, Canada) at 0.00 % (vs 0.60 % prior)

- Canada, CPI, Core CPI (Bank of Canada), Change Y/Y, Price Index for Nov 2021 (CANSIM, Canada) at 3.60 % (vs 3.80 % prior), in line with consensus

- Canada, Housing Starts, All areas for Nov 2021 (CMHC, Canada) at 301.30 k (vs 236.60 k prior), above consensus estimate of 234.30 k

- China (Mainland), Investment in Fixed Assets, Urban, Change Y/Y for Nov 2021 (NBS, China) at 5.20 % (vs 6.10 % prior), below consensus estimate of 5.40 %

- China (Mainland), Retail Sales, Consumer goods, Change Y/Y for Nov 2021 (NBS, China) at 3.90 % (vs 4.90 % prior), below consensus estimate of 4.60 %

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Nov 2021 (ECB) at 1,045.37 Bln EUR (vs 1,019.30 Bln EUR prior)

- Finland, Official reserve assets, Current Prices for Nov 2021 (Bank of Finland) at 14,721.00 Mln EUR (vs 14,378.00 Mln EUR prior)

- France, HICP, Change Y/Y, Price Index for Nov 2021 (INSEE, France) at 3.40 % (vs 3.40 % prior), in line with consensus

- France, HICP, Final, Change P/P, Price Index for Nov 2021 (INSEE, France) at 0.40 % (vs 0.40 % prior), in line with consensus

- Indonesia, Trade Balance, Current Prices for Nov 2021 (Statistics Indonesia) at 3.51 Bln USD (vs 5.74 Bln USD prior), below consensus estimate of 4.45 Bln USD

- Italy, HICP, Final, Change P/P, Price Index for Nov 2021 (ISTAT, Italy) at 0.70 % (vs 0.80 % prior), below consensus estimate of 0.80 %

- Italy, HICP, Final, Change Y/Y, Price Index for Nov 2021 (ISTAT, Italy) at 3.90 % (vs 4.00 % prior), below consensus estimate of 4.00 %

- Japan, Exports, Change Y/Y for Nov 2021 (MoF, Japan) at 20.50 % (vs 9.40 % prior), below consensus estimate of 21.20 %

- Japan, Imports, Change Y/Y for Nov 2021 (MoF, Japan) at 43.80 % (vs 26.70 % prior), above consensus estimate of 40.00 %

- Japan, Trade Balance, Current Prices for Nov 2021 (MoF, Japan) at -954.80 Bln JPY (vs -67.40 Bln JPY prior), below consensus estimate of -675.00 Bln JPY

- Mauritius, Policy Rates, Key Repo Rate for Q4 2021 (Bank of Mauritius) at 1.85 % (vs 1.85 % prior)

- New Zealand, GDP, Change P/P for Q3 2021 (Statistics, NZ) at -3.70 % (vs 2.80 % prior), above consensus estimate of -4.50 %

- New Zealand, GDP, Change P/P for Q3 2021 (Statistics, NZ) at -4.70 % (vs 2.60 % prior), below consensus estimate of -4.40 %

- Poland, CPI, Change P/P, Price Index for Nov 2021 (CSO, Poland) at 1.00 % (vs 1.00 % prior)

- Poland, CPI, Change Y/Y, Price Index for Nov 2021 (CSO, Poland) at 7.80 % (vs 7.70 % prior)

- Russia, GDP, Change Y/Y for Q3 2021 (RosStat, Russia) at 4.30 % (vs 4.30 % prior), in line with consensus

- South Africa, CPI, Urban Areas, Headline, Change Y/Y, Price Index for Nov 2021 (Statistics, SA) at 5.50 % (vs 5.00 % prior), above consensus estimate of 5.40 %

- United Kingdom, CPI, All items (CPI), Change Y/Y for Nov 2021 (ONS, United Kingdom) at 5.10 % (vs 4.20 % prior), above consensus estimate of 4.70 %

- United States, Policy Rates, Fed Funds Target Rate for 16 Dec (FOMC, U.S.) at 0.125% (vs 0.13 % prior), in line with consensus

- United States, Policy Rates, Fed Int On Excess Reserves for 16 Dec (FED, U.S.) at 0.15 % (vs 0.15 % prior)

- United States, Retail Sales, Total including food services, Change P/P for Nov 2021 (U.S. Census Bureau) at 0.30 % (vs 1.70 % prior), below consensus estimate of 0.80 %

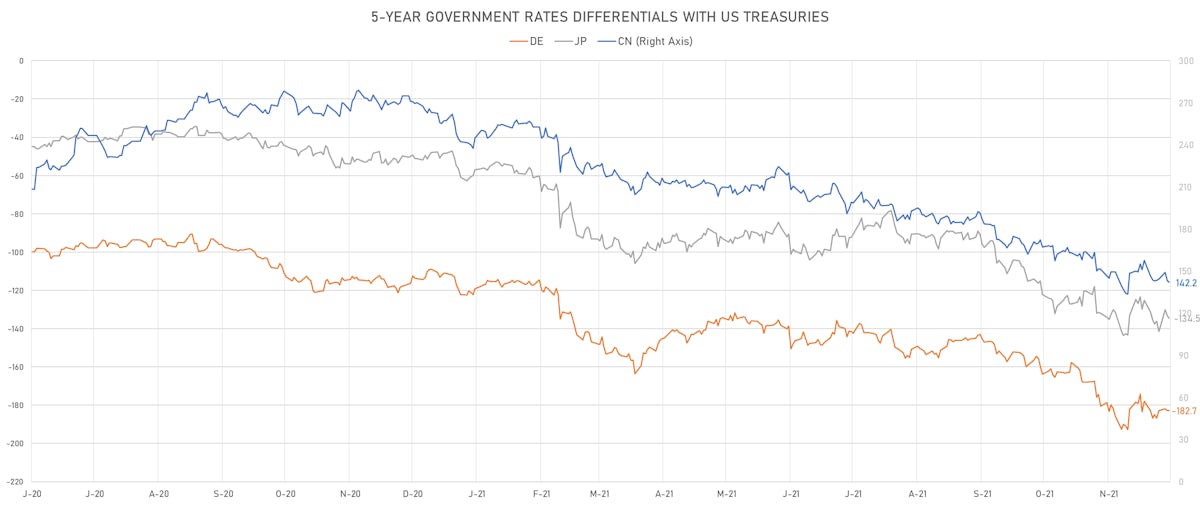

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.4 bp at 183.2 bp (YTD change: +72.1 bp)

- US-JAPAN: +1.6 bp at 135.0 bp (YTD change: +86.7 bp)

- US-CHINA: +0.9 bp at -142.4 bp (YTD change: +114.7 bp)

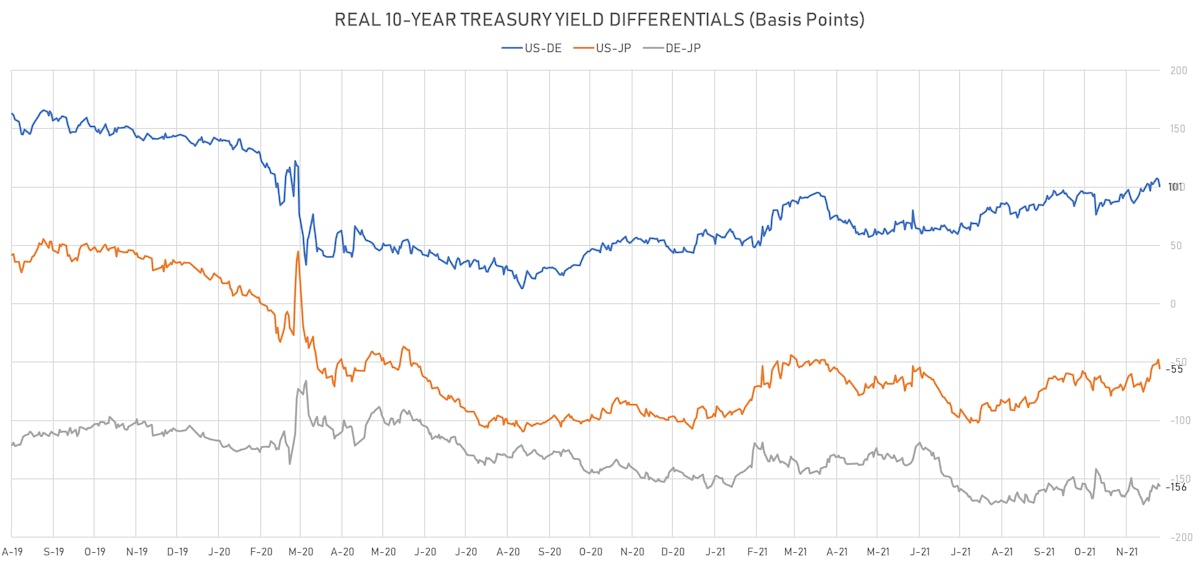

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -5.9 bp at 100.8 bp (YTD change: +54.7bp)

- US-JAPAN: -7.9 bp at -55.4 bp (YTD change: +46.1bp)

- JAPAN-GERMANY: +2.0 bp at 156.2 bp (YTD change: +8.6bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.92, up 0.02 (YTD: -0.25)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.00, down -0.5 (YTD: -0.7)

- Japanese Yen 1M ATM IV currently at 6.13, down -0.3 (YTD: +0.0)

- Offshore Yuan 1M ATM IV currently at 3.54, down -0.1 (YTD: -2.4)

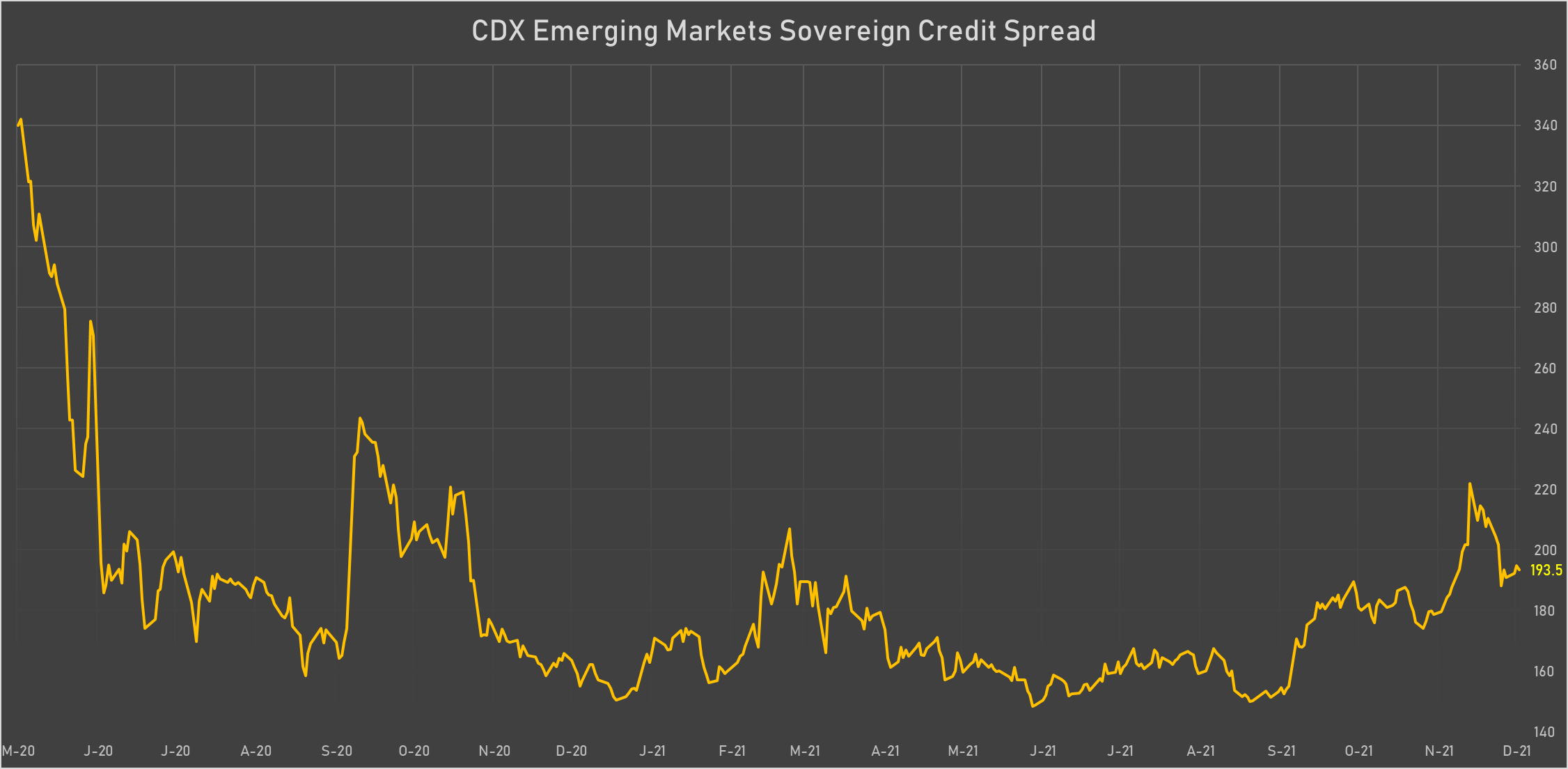

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 21.3 basis points to 2,479 bp (1Y range: 1,092-3,111bp)

- Peru (rated BBB): down 2.8 basis points to 85 bp (1Y range: 52-105bp)

- Panama (rated BBB-): down 1.6 basis points to 87 bp (1Y range: 44-103bp)

- Chile (rated A-): down 1.3 basis points to 82 bp (1Y range: 43-95bp)

- Saudi Arabia (rated A): down 0.6 basis points to 51 bp (1Y range: 43-71bp)

- Morocco (rated BB+): up 0.4 basis points to 87 bp (1Y range: 84-99bp)

- Indonesia (rated BBB): up 0.5 basis points to 76 bp (1Y range: 66-94bp)

- Colombia (rated BB+): up 1.2 basis points to 208 bp (1Y range: 86-227bp)

- Egypt (rated B+): up 3.1 basis points to 487 bp (1Y range: 283-512bp)

- Russia (rated BBB): up 5.6 basis points to 111 bp (1Y range: 75-122bp)

LARGEST FX MOVES TODAY

- Afghani up 12.4% (YTD: -30.2%)

- CFA Franc BEAC up 1.5% (YTD: -6.5%)

- Norwegian Krone up 0.9% (YTD: -4.9%)

- Mauritius Rupee up 0.9% (YTD: -8.4%)

- Mexican Peso up 0.8% (YTD: -5.6%)

- Tonga Pa'anga down 0.7% (YTD: -0.8%)

- Haiti Gourde down 0.9% (YTD: -28.2%)

- Chilean Peso down 0.9% (YTD: -16.5%)

- Turkish Lira down 2.9% (YTD: -49.8%)

YTD BIGGEST WINNERS & LOSERS

- Seychelles Rupee up 57.9%

- New Zambian kwacha up 29.4%

- Afghani down 30.2%

- Surinamese dollar down 34.2%

- Syrian Pound down 49.4%

- Turkish Lira down 49.8%

- Libyan Dinar down 71.0%

- Venezuela Bolivar down 75.9%