FX

US Dollar Stages Modest Recovery After Big Drop On Friday, With Gains Against Euro, Swissie

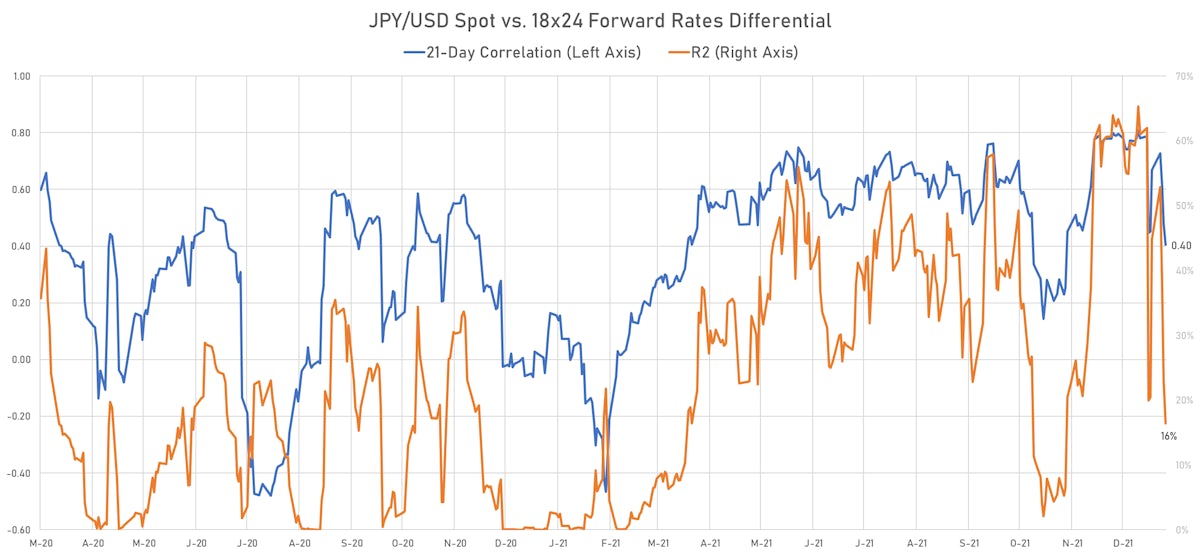

One of the notable developments since the beginning of the year has been the collapse of the correlation between US-JP short rates differentials and the JPY spot rate; prices have been much more driven by risk-on / risk-off moves (deleveraging leading to stronger funding currencies like the yen and euro)

Published ET

Rolling Correlation Between the USD/JPY Spot Rate And US-JP 18x24 Forward Rates Differential | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

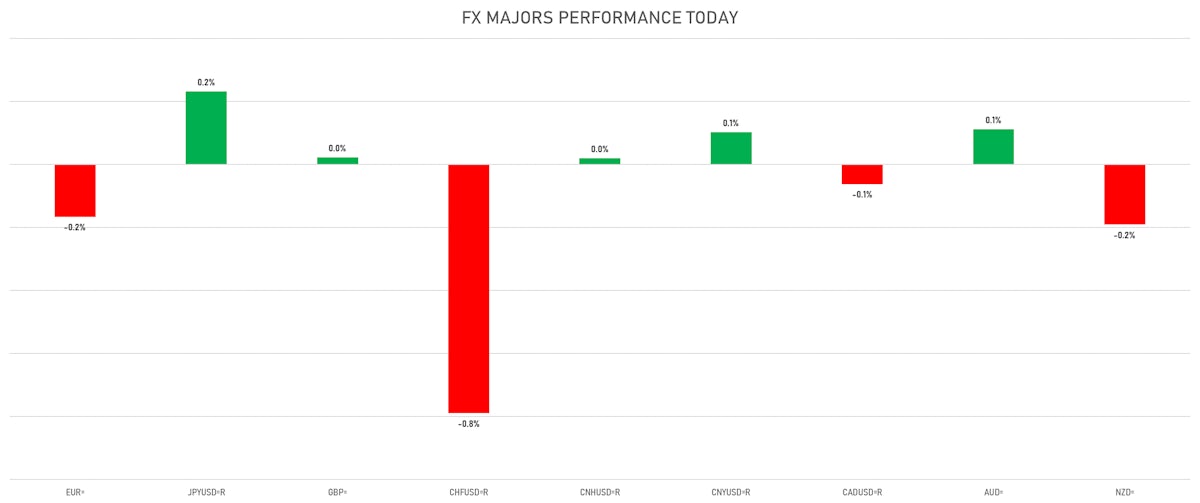

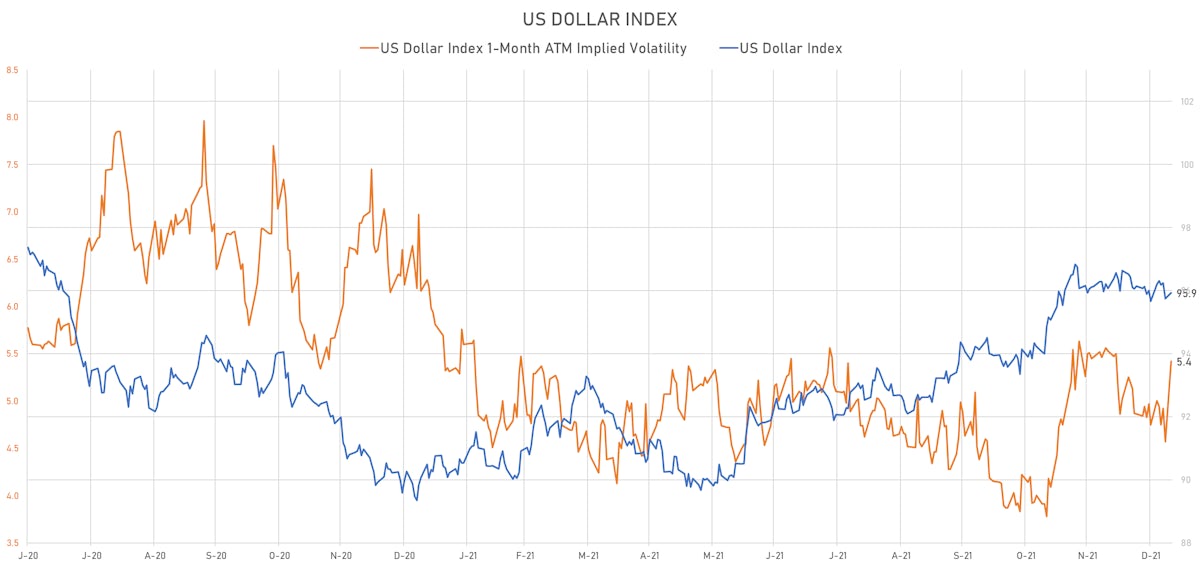

- The US Dollar Index is up 0.20% at 95.94 (YTD: +0.28%)

- Euro down 0.17% at 1.1340 (YTD: -0.2%)

- Yen up 0.23% at 115.30 (YTD: -0.2%)

- Onshore Yuan up 0.10% at 6.3716 (YTD: -0.2%)

- Swiss franc down 0.79% at 0.9263 (YTD: -1.5%)

- Sterling up 0.02% at 1.3588 (YTD: +0.4%)

- Canadian dollar down 0.06% at 1.2653 (YTD: -0.2%)

- Australian dollar up 0.11% at 0.7186 (YTD: -1.0%)

- NZ dollar down 0.19% at 0.6767 (YTD: -0.8%)

MACRO DATA RELEASES

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Nov 2021 (AU Bureau of Stat) at 3.60 % (vs -12.90 % prior)

- Czech Republic, Unemployment, Rate for Dec 2021 (MPSV, Czech Republic) at 3.50 % (vs 3.30 % prior), in line with consensus

- Denmark, CPI, All Items, Change Y/Y, Price Index for Dec 2021 (statbank.dk) at 3.10 % (vs 3.40 % prior)

- Euro Zone, Unemployment, Rate for Nov 2021 (Eurostat) at 7.20 % (vs 7.30 % prior), in line with consensus

- Euro Zone, Investors' sentiment for Jan 2022 (Sentix) at 14.90 (vs 13.50 prior), above consensus estimate of 12.00

- Hungary, Trade Balance, Preliminary, Current Prices for Nov 2021 (HCSO, Hungary) at 81.00 Mln EUR (vs -302.00 Mln EUR prior), above consensus estimate of -330.00 Mln EUR

- Italy, Unemployment, Rate for Nov 2021 (ISTAT, Italy) at 9.20 % (vs 9.40 % prior), below consensus estimate of 9.30 %

- Lithuania, CPI, Change P/P for Dec 2021 (Statistics Lithuania) at 1.20 % (vs 0.90 % prior)

- Lithuania, CPI, Change Y/Y, Price Index for Dec 2021 (Statistics Lithuania) at 10.60 % (vs 9.20 % prior)

- Malaysia, Production, Total industry, Change Y/Y for Nov 2021 (Statistics, Malaysia) at 9.40 % (vs 5.50 % prior), above consensus estimate of 7.30 %

- Norway, CPI, All Items, Change P/P, Price Index for Dec 2021 (Statistics Norway) at 0.70 % (vs 0.80 % prior)

- Norway, CPI, All Items, Change Y/Y for Dec 2021 (Statistics Norway) at 5.30 % (vs 5.10 % prior), above consensus estimate of 5.10 %

- Norway, CPI, CPI-ATE, All items, Change P/P for Dec 2021 (Statistics Norway) at 0.40 % (vs 0.10 % prior)

- Norway, CPI, CPI-ATE, All items, Change Y/Y for Dec 2021 (Statistics Norway) at 1.80 % (vs 1.30 % prior), above consensus estimate of 1.40 %

- Romania, Policy Rates, Policy Rate for 10 Jan (Cent. Bank, Romania) at 2.00 % (vs 1.75 % prior), in line with consensus

- Slovakia, Production, Change Y/Y for Nov 2021 (Stat Office of SR) at 4.30 % (vs -0.60 % prior), above consensus estimate of -2.00 %

- Sweden, Industrial Production, Change Y/Y for Nov 2021 (SCB, Sweden) at 4.20 % (vs 3.70 % prior)

- Sweden, Industrial Production, Change M/M, Volume Index for Nov 2021 (SCB, Sweden) at 0.50 % (vs 1.30 % prior)

- Sweden, Private Sector Production, Change M/M, Volume Index for Nov 2021 (SCB, Sweden) at 0.50 % (vs 1.50 % prior)

- Sweden, Private Sector Production, Change Y/Y for Nov 2021 (SCB, Sweden) at 6.50 % (vs 6.40 % prior)

- United States, Wholesale Inventories, Change P/P for Nov 2021 (U.S. Census Bureau) at 1.40 % (vs 1.20 % prior), above consensus estimate of 1.20 %

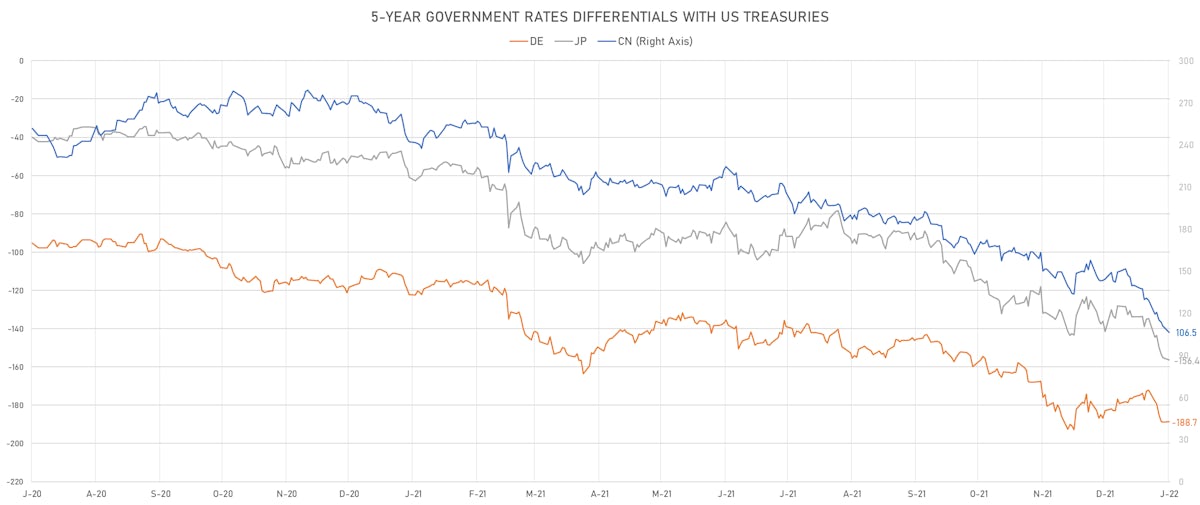

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.6 bp at 190.6 bp (YTD change: +18.5 bp)

- US-JAPAN: +2.6 bp at 157.9 bp (YTD change: +23.2 bp)

- US-CHINA: +6.3 bp at -104.7 bp (YTD change: +24.6 bp)

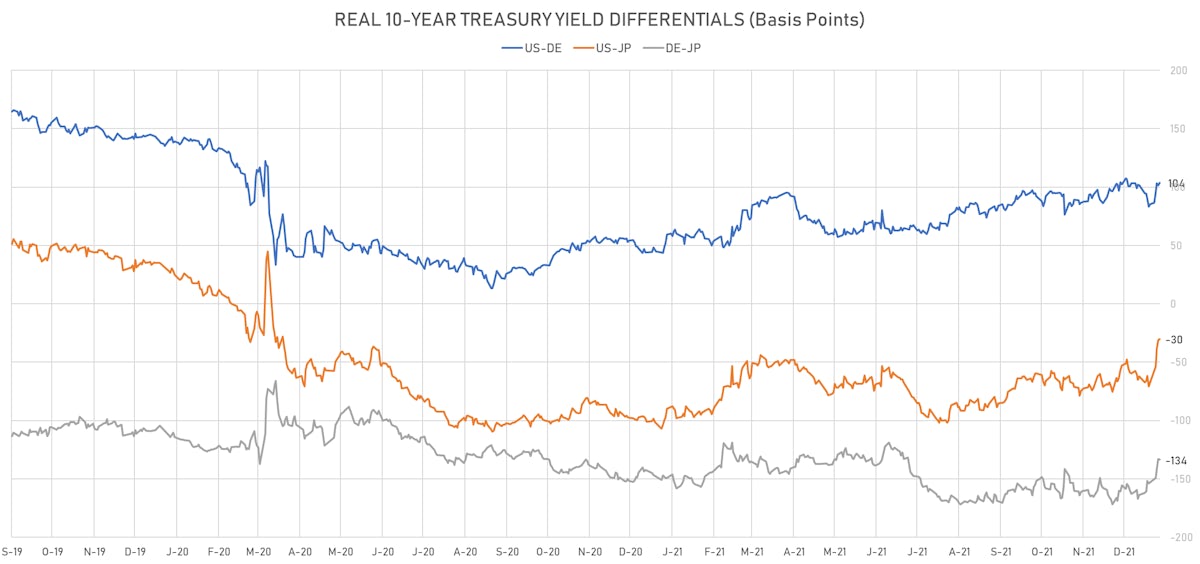

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.0 bp at 101.6 bp (YTD change: +18.4bp)

- US-JAPAN: +1.1 bp at -30.0 bp (YTD change: +40.8bp)

- JAPAN-GERMANY: +0.8 bp at 133.6 bp (YTD change: -20.4bp)

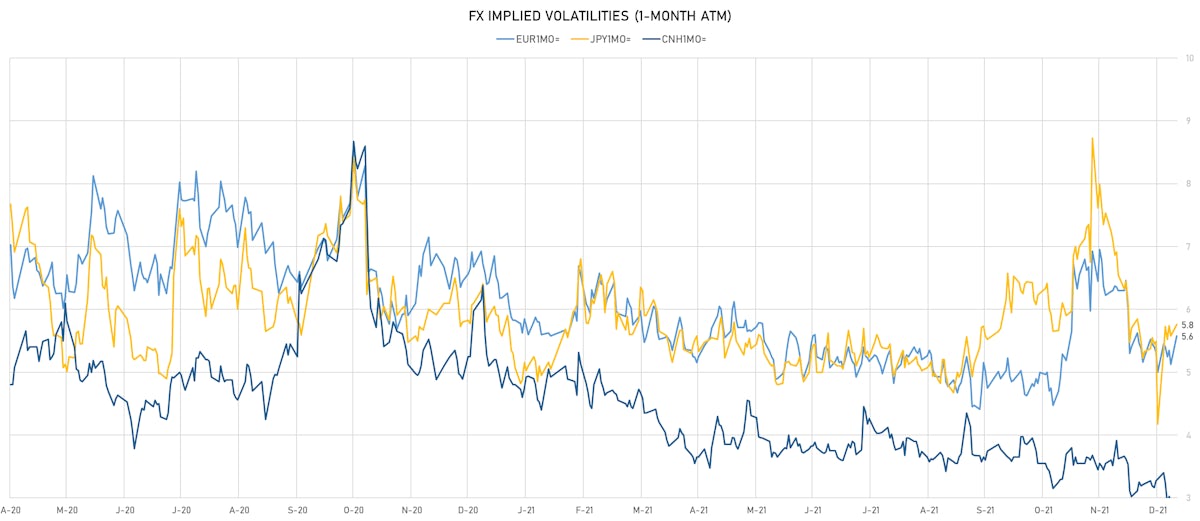

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.00, down -0.08 (YTD: -0.11)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.58, up 0.5 (YTD: +0.6)

- Japanese Yen 1M ATM IV currently at 5.76, up 0.2 (YTD: +1.6)

- Offshore Yuan 1M ATM IV currently at 2.94, unchanged (YTD: -0.4)

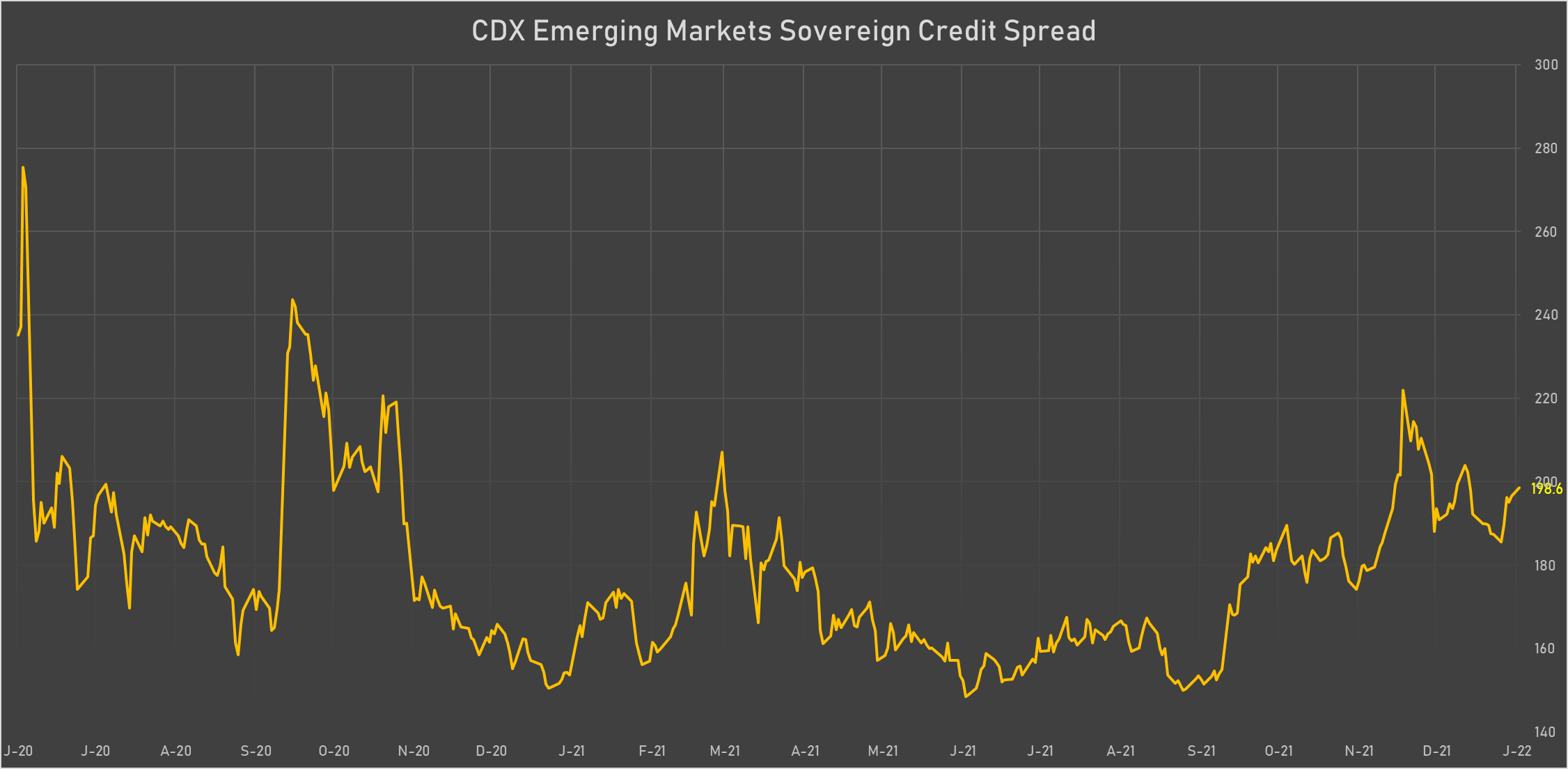

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Vietnam (rated BB): down 1.5 basis points to 98 bp (1Y range: 89-112bp)

- Mexico (rated BBB-): down 0.7 basis points to 95 bp (1Y range: 80-124bp)

- Philippines (rated BBB): up 1.2 basis points to 57 bp (1Y range: 36-70bp)

- Indonesia (rated BBB): up 1.3 basis points to 79 bp (1Y range: 66-94bp)

- Colombia (rated BB+): up 1.8 basis points to 200 bp (1Y range: 93-227bp)

- Morocco (rated BB+): up 4.3 basis points to 90 bp (1Y range: 84-99bp)

- Russia (rated BBB): up 5.4 basis points to 129 bp (1Y range: 75-133bp)

- Turkey (rated BB-): up 12.0 basis points to 577 bp (1Y range: 282-614bp)

- Egypt (rated B+): up 18.8 basis points to 494 bp (1Y range: 283-512bp)

- Argentina (rated CCC): up 122.7 basis points to 2,797 bp (1Y range: 1,114-3,111bp)

LARGEST FX MOVES TODAY

- Fiji Dollar up 1.2% (YTD: +0.5%)

- Russian Rouble up 1.1% (YTD: -0.1%)

- Chilean Peso down 0.8% (YTD: +2.0%)

- Israeli shekel down 0.9% (YTD: -0.8%)

- Swiss Franc down 0.9% (YTD: -1.5%)

- Liberian Dollar down 1.0% (YTD: -2.2%)

- Tunisian Dinar down 1.4% (YTD: +0.1%)

YTD BIGGEST WINNERS & LOSERS

- Hungarian Forint up 2.7%

- Aruba florin up 2.2%

- South Africa Rand up 2.1%

- Chilean Peso up 2.0%

- Czech Koruna up 1.9%

- Liberian Dollar down 2.2%

- Turkish Lira down 3.5%

- Haiti Gourde down 4.2%

- Surinamese dollar down 5.0%

- Seychelles rupee down 11.5%