FX

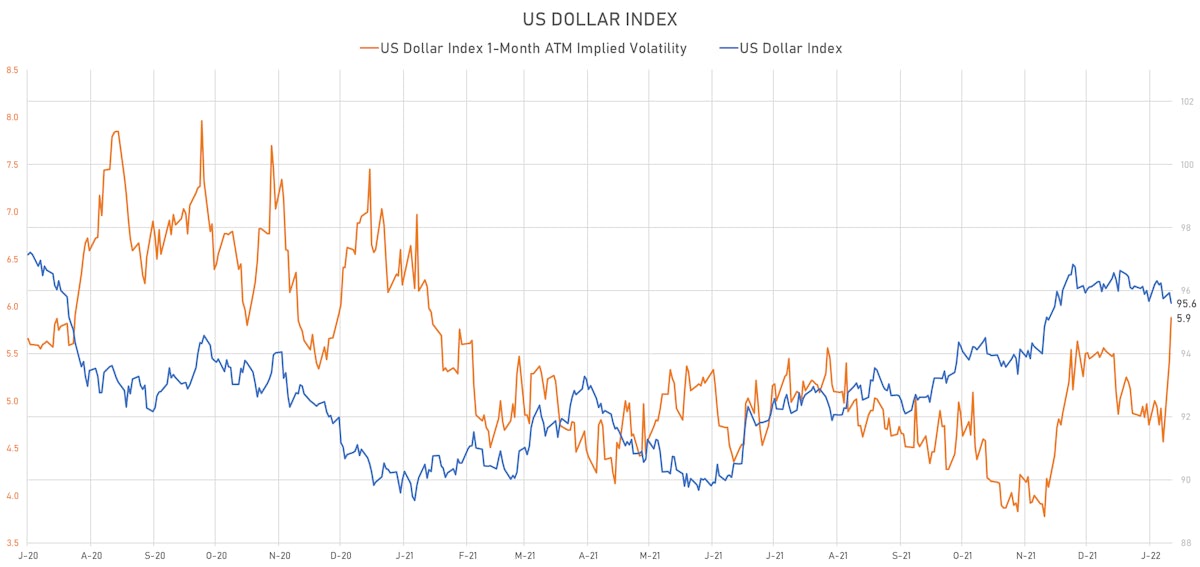

Broad Fall In The US Dollar, With More Dovish Sentiment Around Powell's Confirmation Hearing

However, after a brutal repricing at the front end of the US yield curve last week, this move in the dollar may not last, and could simply be a temporary reprieve ahead of the latest CPI data tomorrow

Published ET

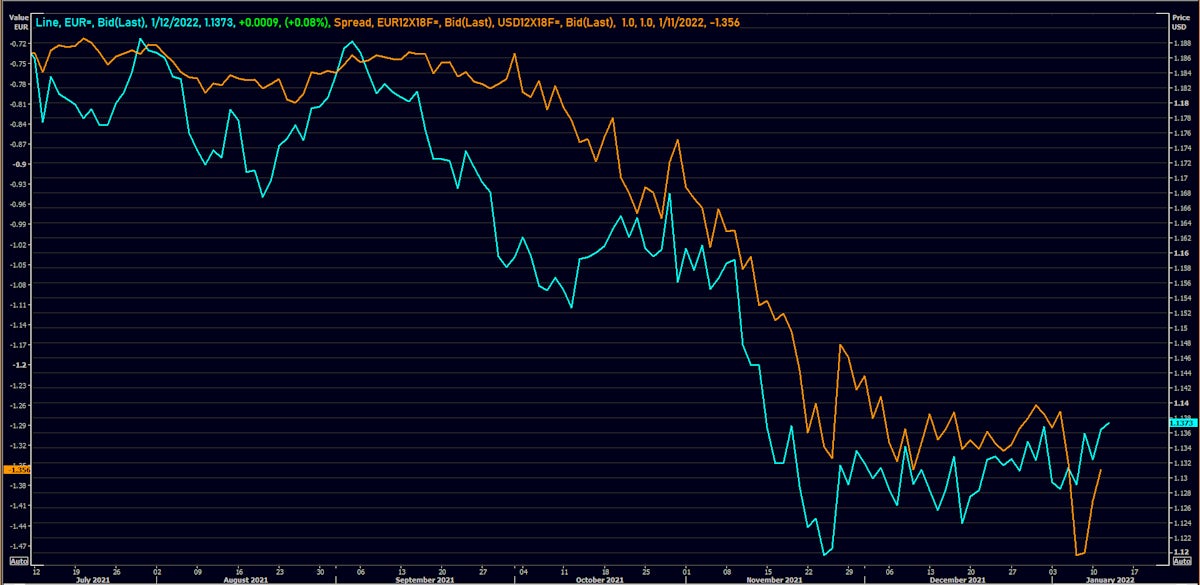

Euro spot rate vs DE-US forward rates differential | Source: Refinitiv

QUICK SUMMARY

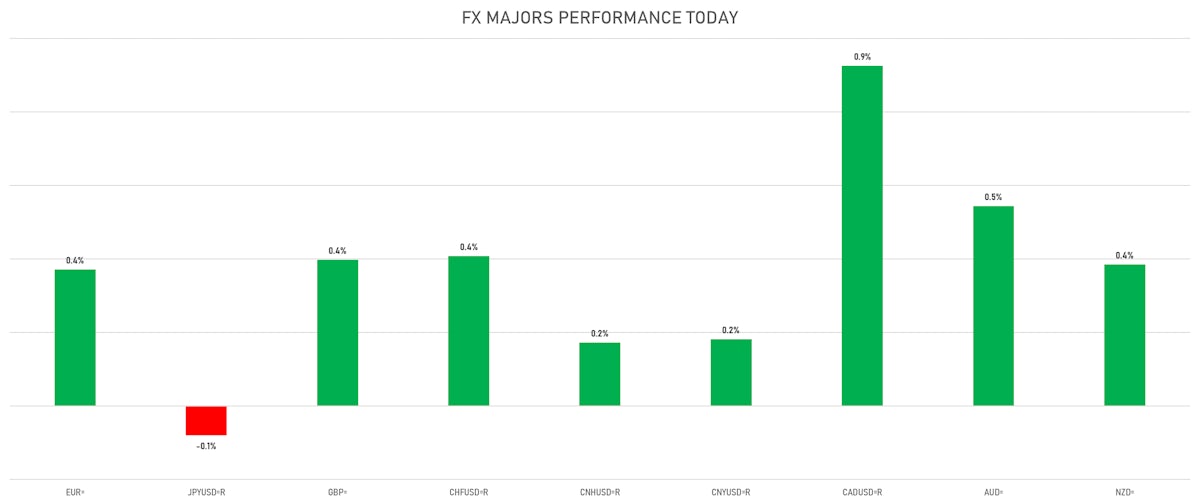

- The US Dollar Index is down -0.34% at 95.61 (YTD: -0.05%)

- Euro up 0.37% at 1.1366 (YTD: 0.0%)

- Yen down 0.08% at 115.30 (YTD: -0.2%)

- Onshore Yuan up 0.18% at 6.3651 (YTD: -0.1%)

- Swiss franc up 0.41% at 0.9234 (YTD: -1.2%)

- Sterling up 0.40% at 1.3629 (YTD: +0.7%)

- Canadian dollar up 0.93% at 1.2562 (YTD: +0.6%)

- Australian dollar up 0.54% at 0.7207 (YTD: -0.7%)

- NZ dollar up 0.38% at 0.6781 (YTD: -0.6%)

MACRO DATA RELEASES

- Australia, Current Account, Goods and Services, Net for Nov 2021 (AU Bureau of Stat) at 9,423.00 Mln AUD (vs 11,220.00 Mln AUD prior), below consensus estimate of 10,600.00 Mln AUD

- Australia, Retail Sales, Total, Final, Change P/P for Nov 2021 (AU Bureau of Stat) at 7.30 % (vs 4.90 % prior), above consensus estimate of 3.90 %

- Brazil, CPI, Broad national index (IPCA), Change P/P for Dec 2021 (IBGE, Brazil) at 0.73 % (vs 0.95 % prior), above consensus estimate of 0.65 %

- Brazil, CPI, Broad national index (IPCA), Change Y/Y for Dec 2021 (IBGE, Brazil) at 10.06 % (vs 10.74 % prior), above consensus estimate of 9.97 %

- Japan, Current Account, Balance, Current Prices for Nov 2021 (BOJ/MOF Japan) at 897.30 Bln JPY (vs 1180.10 Bln JPY prior), above consensus estimate of 585.00 Bln JPY

- Latvia, CPI, Change P/P for Dec 2021 (Statistics, Latvia) at 0.40 % (vs 1.10 % prior)

- Latvia, CPI, Change Y/Y for Dec 2021 (Statistics, Latvia) at 7.90 % (vs 7.50 % prior)

- Mexico, Production, Total industry, Change P/P for Nov 2021 (INEGI, Mexico) at -0.10 % (vs 0.60 % prior), below consensus estimate of 0.50 %

- Mexico, Production, Total industry, Change Y/Y for Nov 2021 (INEGI, Mexico) at 1.60 % (vs 0.70 % prior), below consensus estimate of 2.40 %

- Netherlands, CPI, All items, Change Y/Y for Dec 2021 (CBS - NL) at 5.70 % (vs 5.20 % prior)

- New Zealand, Reserve Assets, Current Prices for Dec 2021 (RBNZ) at 23,585.00 Mln NZD (vs 21,823.00 Mln NZD prior)

- South Africa, Manuf Production MM, Change P/P for Nov 2021 (Statistics, SA) at 3.70 % (vs -5.90 % prior)

- Spain, Production, Total industry excluding construction, Change Y/Y for Nov 2021 (INE, Spain) at 4.80 % (vs -0.90 % prior), above consensus estimate of 0.60 %

- Turkey, Current Account, Balance, Current Prices for Nov 2021 (Central Bank, Turkey) at -2.68 Bln USD (vs 3.16 Bln USD prior), below consensus estimate of -2.68 Bln USD

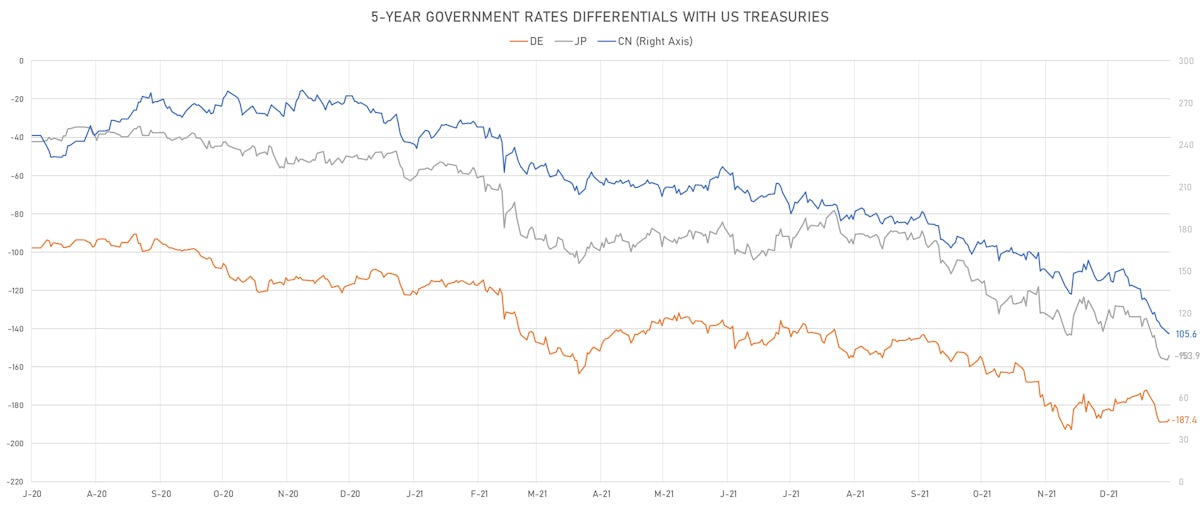

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.1 bp at 186.6 bp (YTD change: +14.5 bp)

- US-JAPAN: -2.0 bp at 154.4 bp (YTD change: +19.7 bp)

- US-CHINA: +0.4 bp at -106.1 bp (YTD change: +23.1 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -6.9 bp at 94.7 bp (YTD change: +11.5bp)

- US-JAPAN: -9.7 bp at -39.7 bp (YTD change: +31.1bp)

- JAPAN-GERMANY: +0.8 bp at 134.4 bp (YTD change: -19.6bp)

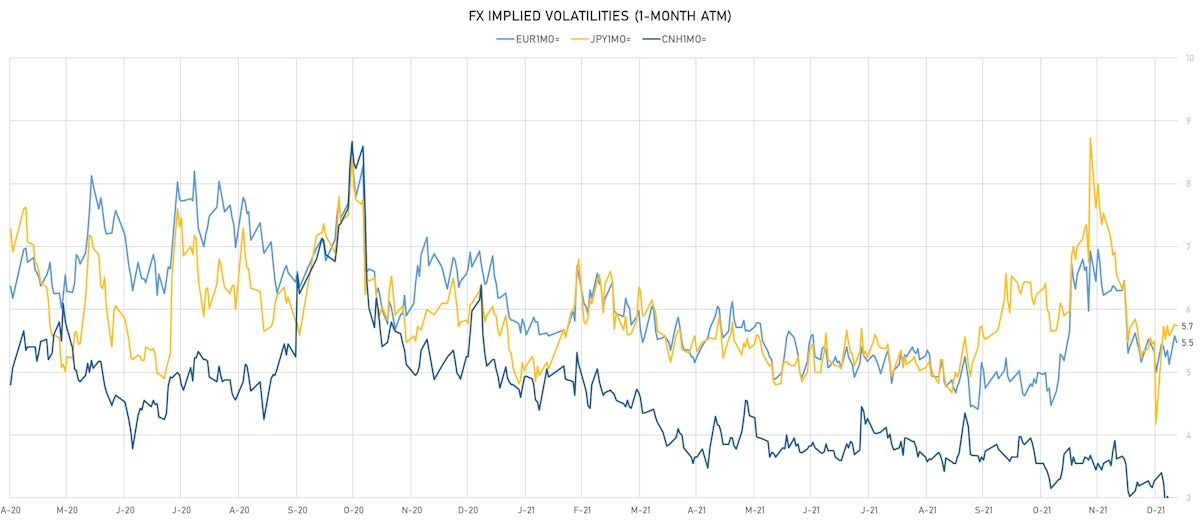

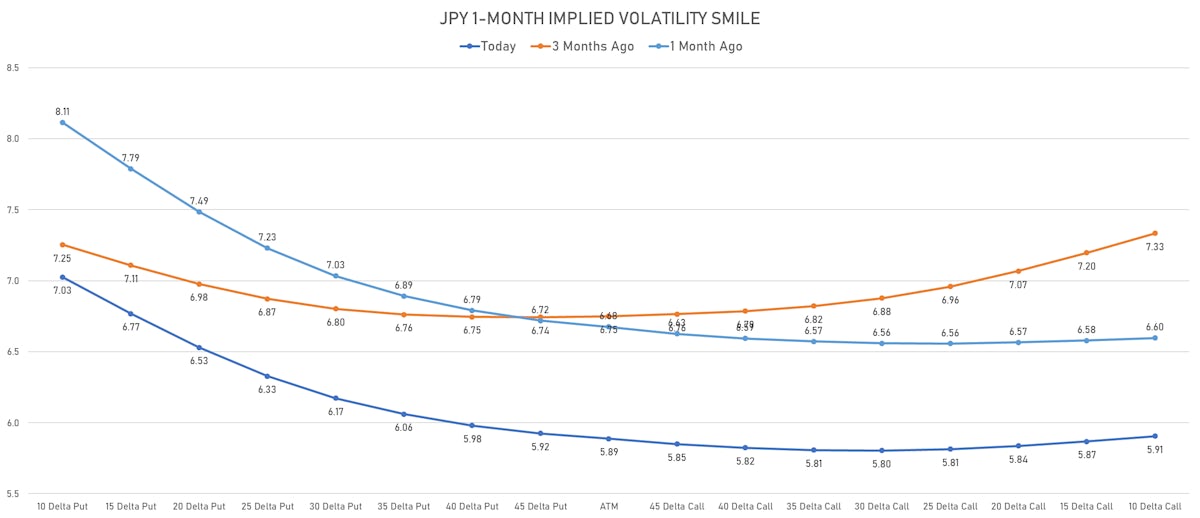

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.15, up 0.15 (YTD: +0.04)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.48, down -0.1 (YTD: +0.5)

- Japanese Yen 1M ATM IV currently at 5.74, down 0.0 (YTD: +1.6)

- Offshore Yuan 1M ATM IV currently at 2.75, down -0.2 (YTD: -0.6)

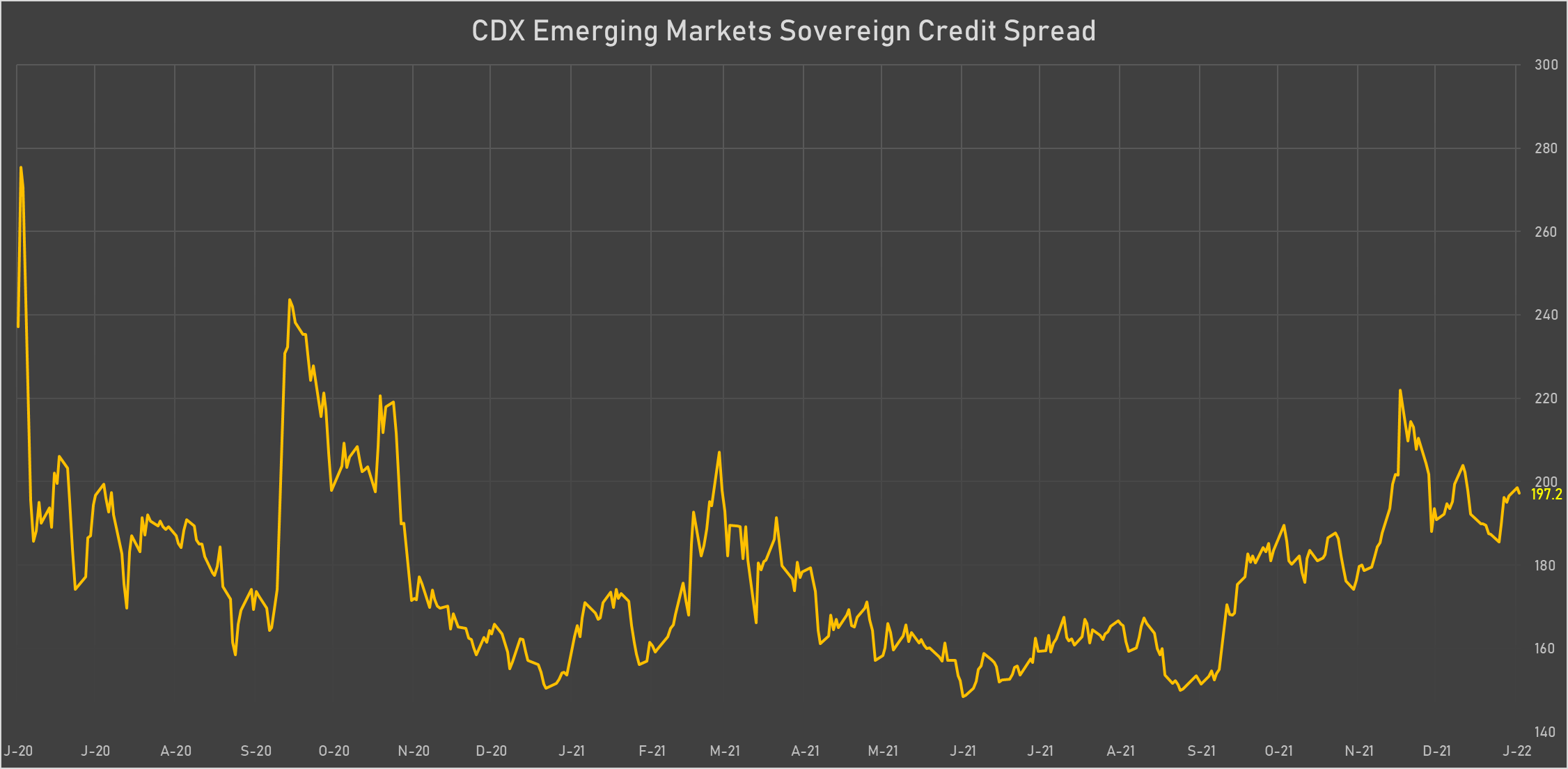

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Turkey (rated BB-): down 6.5 basis points to 570 bp (1Y range: 282-614bp)

- South Africa (rated BB-): down 3.7 basis points to 194 bp (1Y range: 178-246bp)

- Brazil (rated BB-): down 2.7 basis points to 210 bp (1Y range: 148-266bp)

- Russia (rated BBB): down 2.4 basis points to 126 bp (1Y range: 75-133bp)

- Mexico (rated BBB-): down 1.5 basis points to 93 bp (1Y range: 80-124bp)

- Colombia (rated BB+): down 1.5 basis points to 198 bp (1Y range: 93-227bp)

- Indonesia (rated BBB): down 1.2 basis points to 77 bp (1Y range: 66-94bp)

- Peru (rated BBB): down 0.8 basis points to 77 bp (1Y range: 54-105bp)

- Panama (rated BBB-): up 4.7 basis points to 82 bp (1Y range: 47-103bp)

- Argentina (rated CCC): up 23.2 basis points to 2,816 bp (1Y range: 1,114-3,111bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 3.0% (YTD: -1.3%)

- Aruba florin up 2.2% (YTD: +2.2%)

- Brazilian Real up 1.7% (YTD: +0.1%)

- Colombian Peso up 1.5% (YTD: +2.0%)

- North Antilles Guilder up 1.3% (YTD: +1.3%)

- Israeli shekel up 1.0% (YTD: -0.1%)

- Thai Baht up 1.0% (YTD: -0.3%)

- South Africa Rand up 0.9% (YTD: +3.1%)

- Canadian Dollar up 0.8% (YTD: +0.6%)

- Guinea Franc down 1.8% (YTD: +0.9%)

YTD BIGGEST WINNERS & LOSERS

- Hungarian Forint up 3.4%

- South Africa Rand up 3.1%

- Chilean Peso up 2.9%

- Lesotho Loti up 2.9%

- Swaziland Lilangeni up 2.8%

- Aruba florin up 2.2%

- Seychelles rupee down 2.3%

- Liberian Dollar down 2.5%

- Turkish Lira down 3.1%

- Surinamese dollar down 4.8%