FX

Risk-Off Move, Rates Differentials Combine To Push Yen, Swissie Higher Against The USD

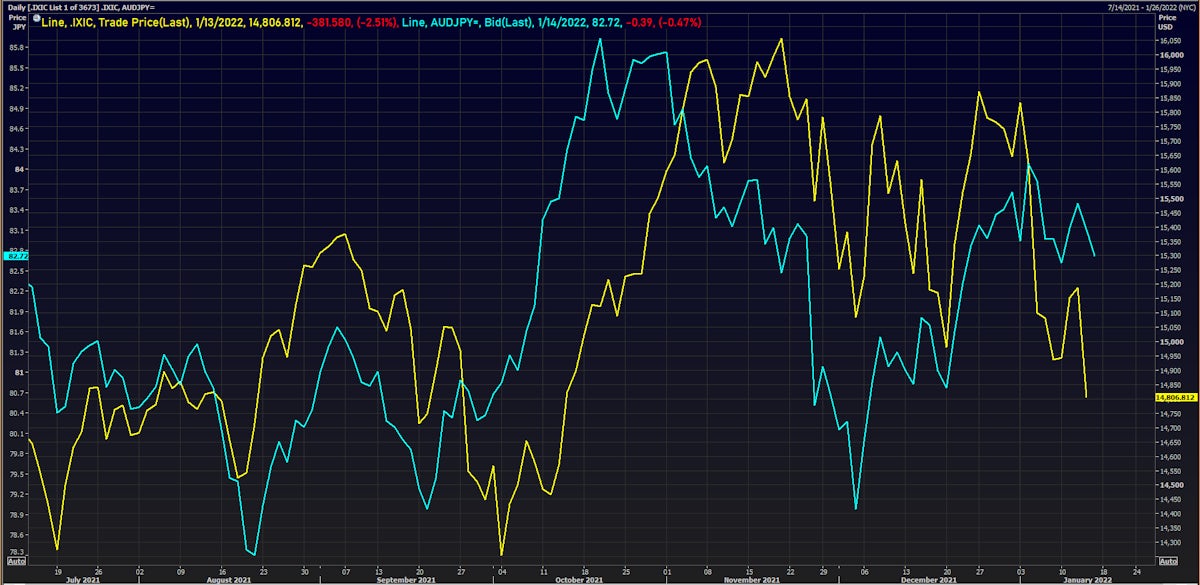

One of the purest risk-off trades has been to go long Japanese Yen, short Aussie Dollar, and we expect to see this continue to play out over the course of the year

Published ET

AUDJPY Spot Rate vs Nasdaq Composite Index | Source: Refinitiv

QUICK SUMMARY

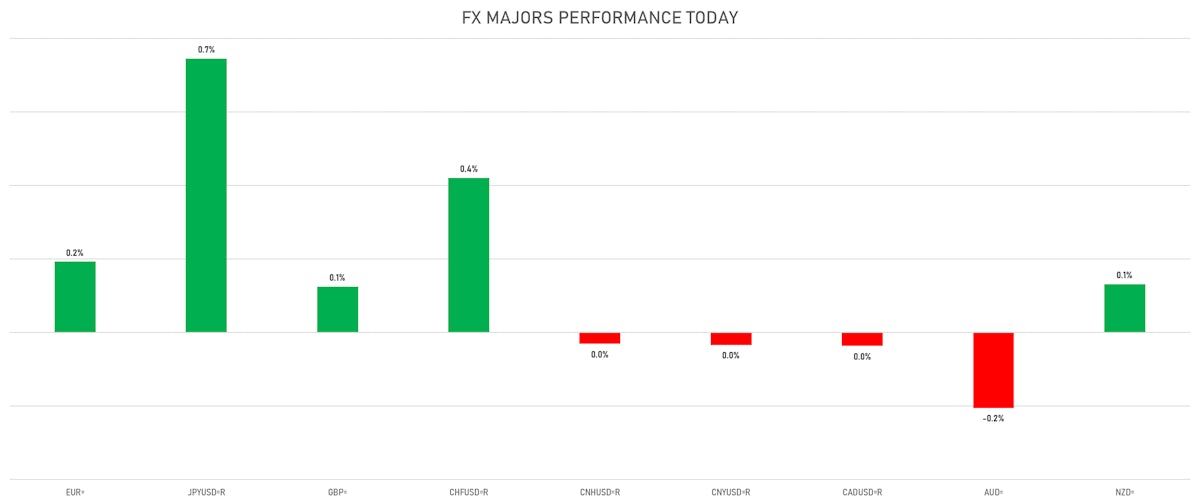

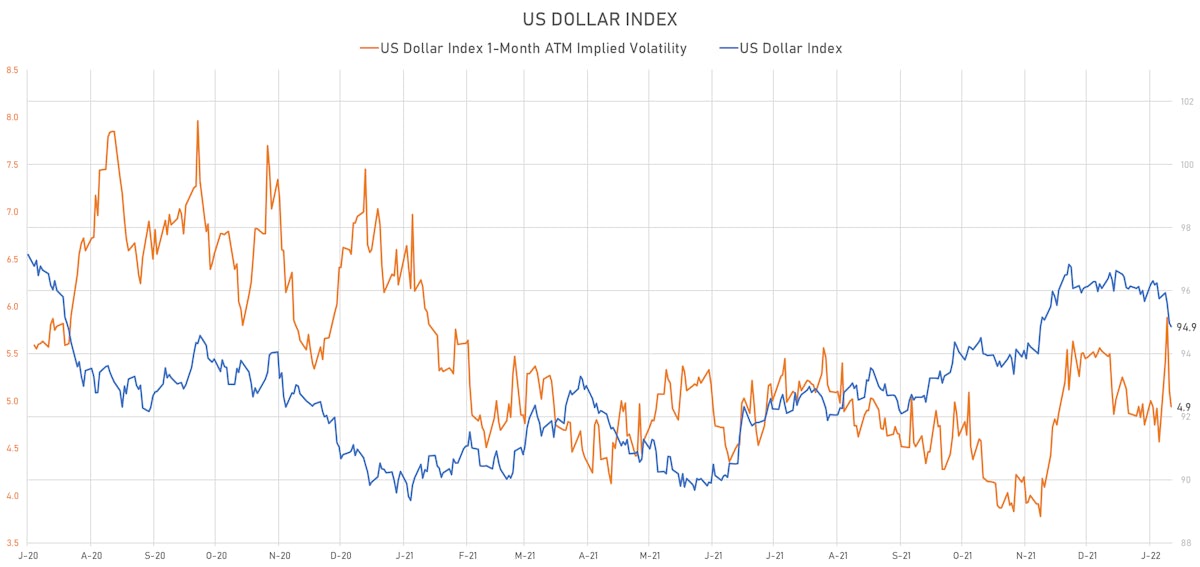

- The US Dollar Index is down -0.12% at 94.86 (YTD: -0.84%)

- Euro up 0.19% at 1.1464 (YTD: +0.8%)

- Yen up 0.75% at 113.76 (YTD: +1.2%)

- Onshore Yuan down 0.03% at 6.3605 (YTD: 0.0%)

- Swiss franc up 0.42% at 0.9103 (YTD: +0.2%)

- Sterling up 0.12% at 1.3718 (YTD: +1.4%)

- Canadian dollar down 0.04% at 1.2513 (YTD: +1.0%)

- Australian dollar down 0.21% at 0.7269 (YTD: +0.1%)

- NZ dollar up 0.13% at 0.6853 (YTD: +0.4%)

MACRO DATA RELEASES

- Argentina, CPI, National, Change P/P for Dec 2021 (INDEC, Argentina) at 3.80 % (vs 2.50 % prior), above consensus estimate of 3.60 %

- Argentina, CPI, Total, Gran Buenos Aires, Change P/P for Dec 2021 (INDEC, Argentina) at 4.10 % (vs 2.30 % prior)

- Argentina, CPI, Total, Gran Buenos Aires, Change Y/Y for Dec 2021 (INDEC, Argentina) at 51.40 % (vs 50.90 % prior)

- Argentina, Public Finances, Central Government, Tax revenues, total, Current Prices for Dec 2021 at 1,179.89 Bln ARS (vs 1,034.96 Bln ARS prior)

- Czech Republic, Current Account, Balance, Current Prices for Nov 2021 (Czech National Bank) at -6.00 Bln CZK (vs -3.68 Bln CZK prior), above consensus estimate of -9.00 Bln CZK

- Czech Republic, Retail Sales, Retail trade (incl. retail sale of automotive fuel), Change Y/Y for Nov 2021 (CSU, Czech Rep) at 13.20 % (vs 5.60 % prior), above consensus estimate of 11.80 %

- Greece, CPI, Change Y/Y, Price Index for Dec 2021 (ELSTAT, Greece) at 5.10 % (vs 4.80 % prior), below consensus estimate of 5.40 %

- Greece, HICP, Change Y/Y, Price Index for Dec 2021 (ELSTAT, Greece) at 4.40 % (vs 4.00 % prior), below consensus estimate of 4.70 %

- Italy, Production, Total industry excluding construction, Change P/P for Nov 2021 (ISTAT, Italy) at 1.90 % (vs -0.60 % prior), above consensus estimate of 0.50 %

- Italy, Production, Total industry excluding construction, Change Y/Y for Nov 2021 (ISTAT, Italy) at 6.30 % (vs 2.00 % prior), above consensus estimate of 3.70 %

- Japan, Producer Prices, Domestic, total, Change P/P, Price Index for Dec 2021 (Bank of Japan) at -0.20 % (vs 0.60 % prior), below consensus estimate of 0.30 %

- Japan, Producer Prices, Domestic, total, Change Y/Y, Price Index for Dec 2021 (Bank of Japan) at 8.50 % (vs 9.00 % prior), below consensus estimate of 8.80 %

- Poland, Current Account, Balance, Current Prices for Nov 2021 (Central Bank, Poland) at -1,112.00 Mln EUR (vs -1,791.00 Mln EUR prior), above consensus estimate of -1,482.00 Mln EUR

- Serbia, Policy Rates, RS Benchmark Interest Rate, Change P/P for Jan 2022 (NBS, Serbia) at 1.00 % (vs 1.00 % prior), in line with consensus

- United States, Jobless Claims, National, Continued for W 01 Jan (U.S. Dept. of Labor) at 1.56 Mln (vs 1.75 Mln prior), below consensus estimate of 1.73 Mln

- United States, Jobless Claims, National, Initial for W 08 Jan (U.S. Dept. of Labor) at 230.00 k (vs 207.00 k prior), above consensus estimate of 200.00 k

- United States, Producer Prices, Final demand less foods and energy, Change P/P for Dec 2021 (BLS, U.S Dep. Of Lab) at 0.50 % (vs 0.70 % prior), in line with consensus

- United States, Producer Prices, Final demand less foods and energy, Change Y/Y for Dec 2021 (BLS, U.S Dep. Of Lab) at 8.30 % (vs 7.70 % prior), above consensus estimate of 8.00 %

- United States, Producer Prices, Final demand, Change P/P for Dec 2021 (BLS, U.S Dep. Of Lab) at 0.20 % (vs 0.80 % prior), below consensus estimate of 0.40 %

- United States, Producer Prices, Final demand, Change Y/Y for Dec 2021 (BLS, U.S Dep. Of Lab) at 9.70 % (vs 9.60 % prior), below consensus estimate of 9.80 %

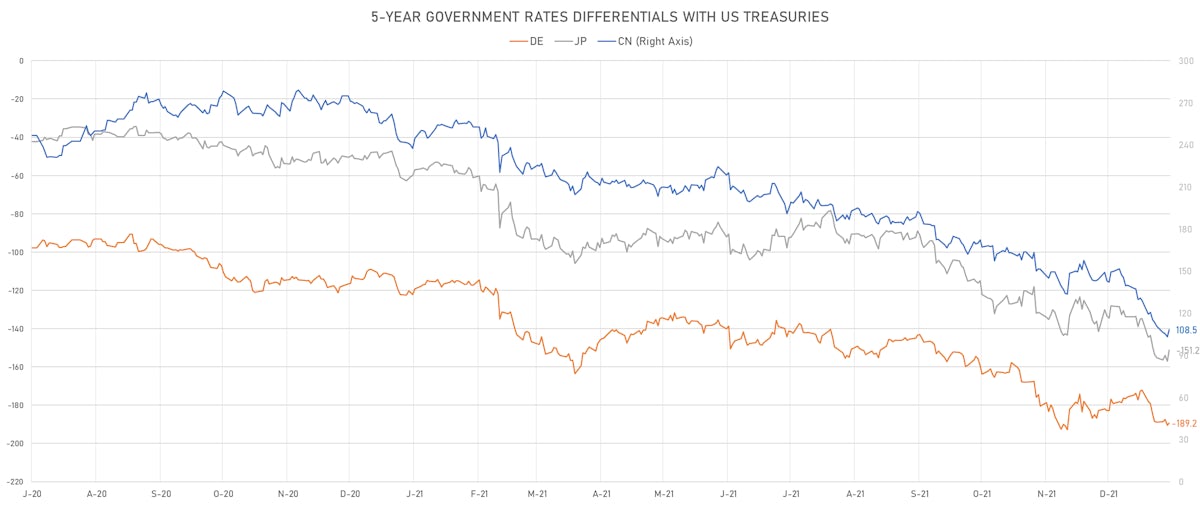

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.7 bp at 192.2 bp (YTD change: +20.1 bp)

- US-JAPAN: -5.5 bp at 151.6 bp (YTD change: +16.9 bp)

- US-CHINA: -2.5 bp at -105.8 bp (YTD change: +23.4 bp)

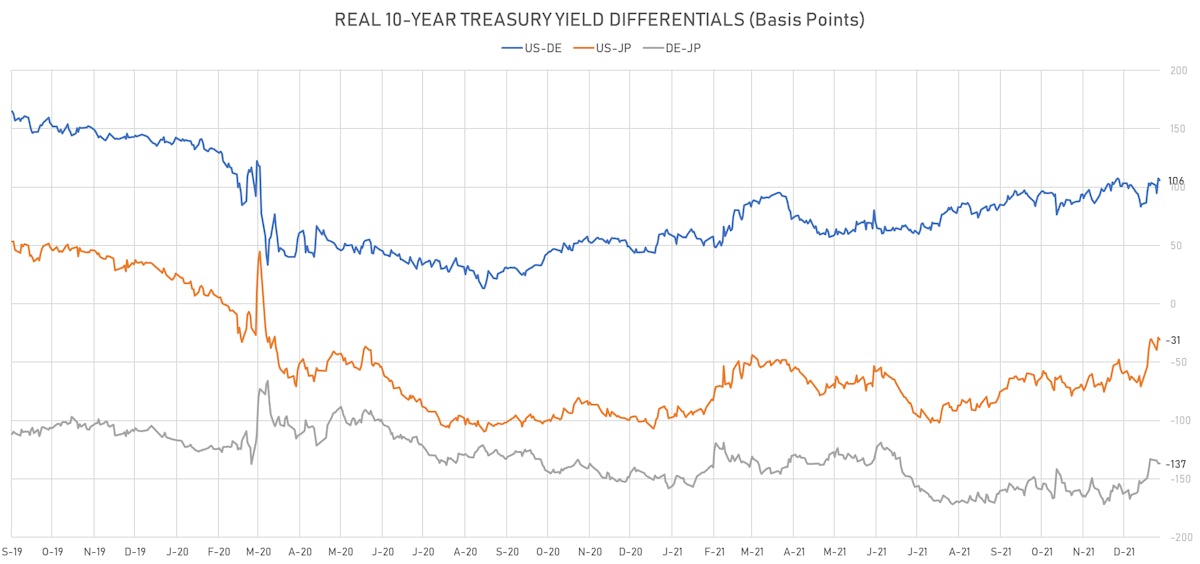

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.5 bp at 106.1 bp (YTD change: +22.9bp)

- US-JAPAN: -1.4 bp at -30.5 bp (YTD change: +40.3bp)

- JAPAN-GERMANY: -0.1 bp at 136.6 bp (YTD change: -17.4bp)

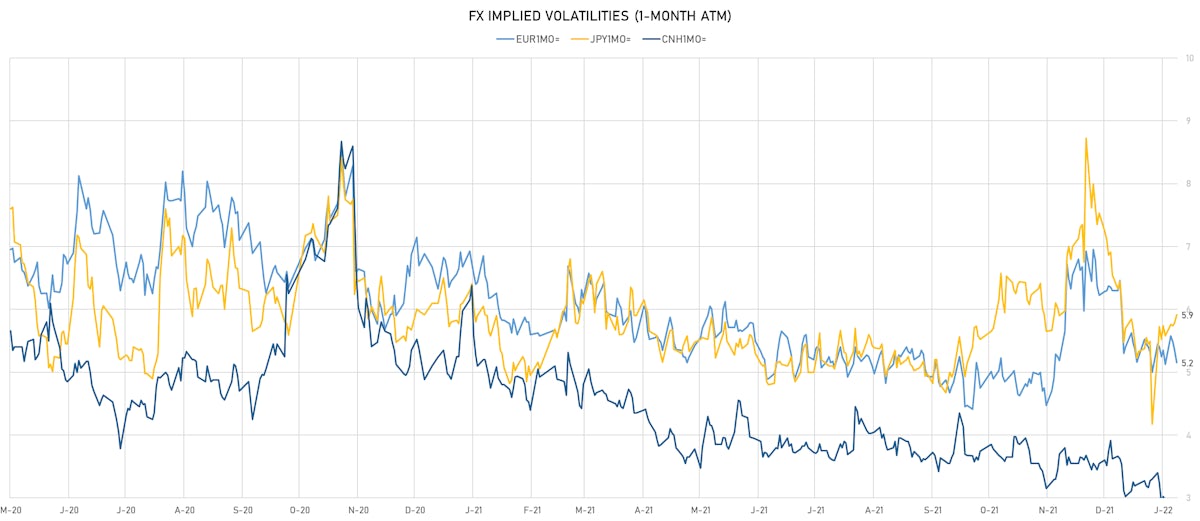

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.10, up 0.03 (YTD: -0.01)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.16, down -0.2 (YTD: +0.2)

- Japanese Yen 1M ATM IV currently at 5.91, up 0.1 (YTD: +1.7)

- Offshore Yuan 1M ATM IV unchanged at 2.89 (YTD: -0.4)

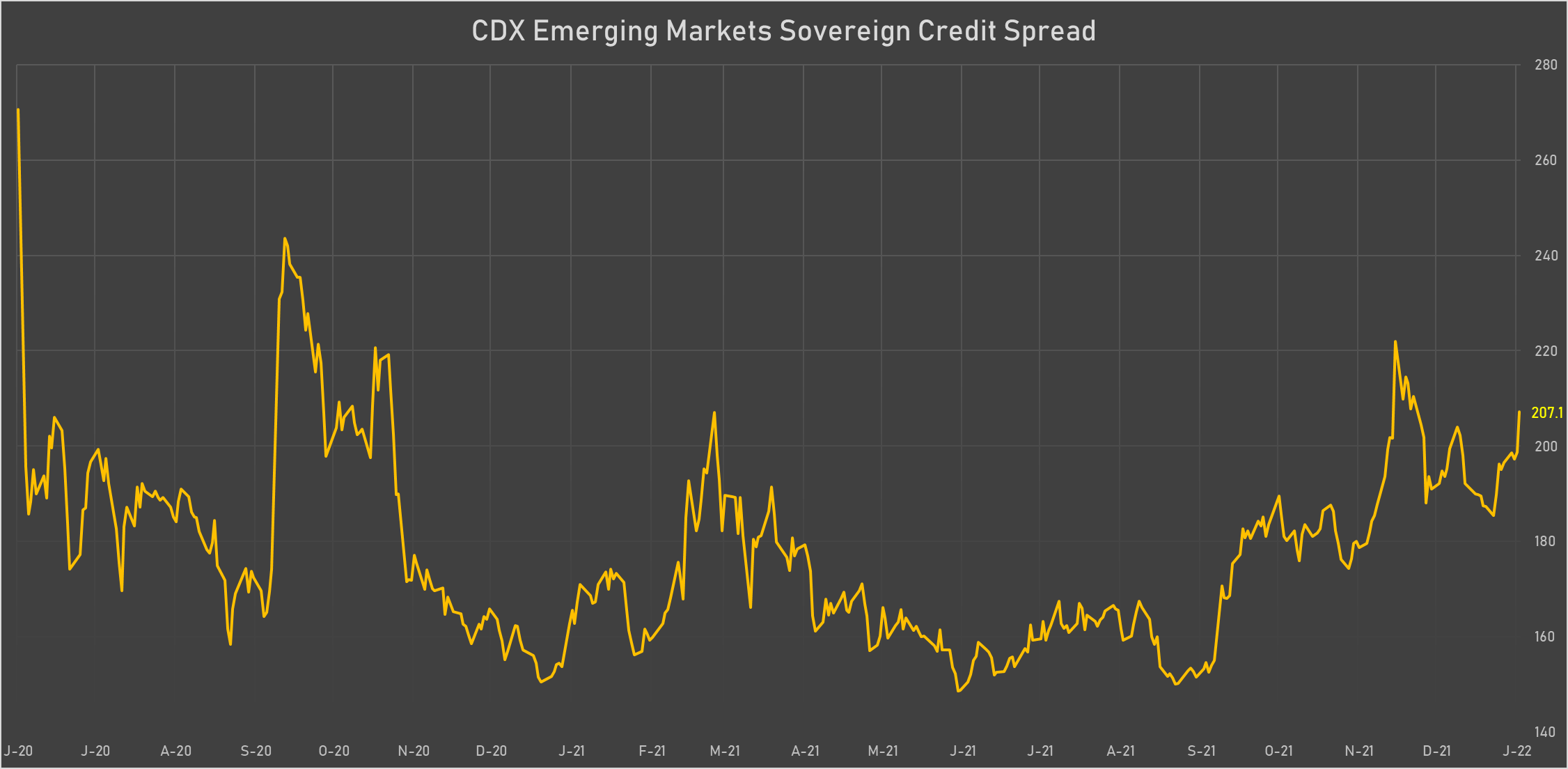

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Philippines (rated BBB): up 1.5 basis points to 60 bp (1Y range: 36-70bp)

- Chile (rated A-): up 1.7 basis points to 78 bp (1Y range: 43-95bp)

- Malaysia (rated BBB+): up 1.7 basis points to 51 bp (1Y range: 36-64bp)

- Indonesia (rated BBB): up 2.0 basis points to 82 bp (1Y range: 66-94bp)

- Mexico (rated BBB-): up 2.8 basis points to 97 bp (1Y range: 80-124bp)

- Panama (rated BBB-): up 3.0 basis points to 86 bp (1Y range: 51-103bp)

- South Africa (rated BB-): up 5.0 basis points to 199 bp (1Y range: 178-246bp)

- Brazil (rated BB-): up 5.4 basis points to 218 bp (1Y range: 148-266bp)

- Russia (rated BBB): up 24.0 basis points to 158 bp (1Y range: 75-134bp)

- Argentina (rated CCC): up 120.0 basis points to 3,078 bp (1Y range: 1,161-3,111bp)

LARGEST FX MOVES TODAY

- CFA Franc BCEAO up 0.9% (YTD: +1.3%)

- Tunisian Dinar up 0.9% (YTD: +0.5%)

- Chilean Peso up 0.8% (YTD: +4.4%)

- Czech Koruna down 0.8% (YTD: +2.2%)

- Malawi Kwacha down 0.8% (YTD: -1.6%)

- Algerian Dinar down 0.8% (YTD: -0.6%)

- Russian Rouble down 2.4% (YTD: -2.0%)

- Turkish Lira down 2.7% (YTD: -2.1%)

- Haiti Gourde down 2.8% (YTD: -5.0%)

- CFA Franc BEAC down 3.4% (YTD: +0.2%)

YTD BIGGEST WINNERS & LOSERS

- Hungarian Forint up 4.9%

- Seychelles rupee up 4.6%

- Chilean Peso up 4.4%

- Namibian Dollar up 4.1%

- South Africa Rand up 3.6%

- Lesotho Loti up 3.3%

- Swaziland Lilangeni up 3.3%

- Angolan Kwanza up 2.9%

- Surinamese dollar down 4.2%

- Haiti Gourde down 5.0%