FX

Widening Rates Differentials With The US Curve Take Down Euro, Swissie To End Week

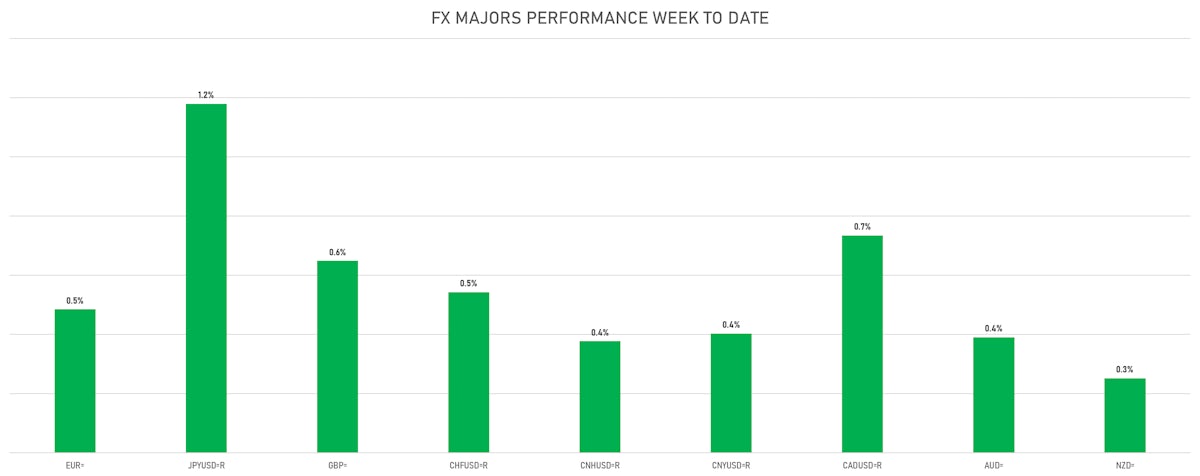

Good week for major currencies against the dollar, with gains across the board, led by the Japanese Yen, Canadian Dollar and Pound Sterling

Published ET

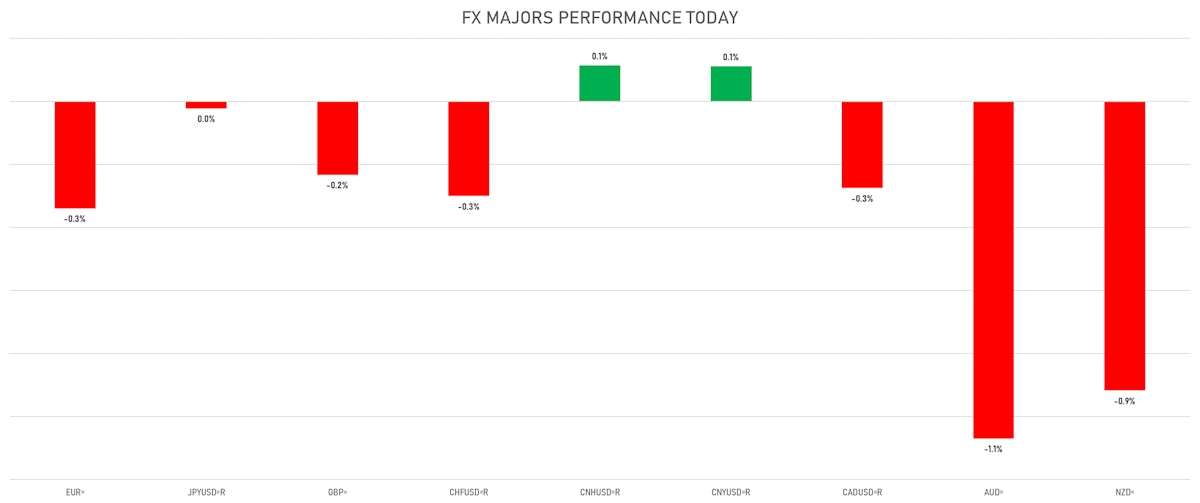

FX Majors Performance Against The US$ This Week | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.32% at 95.17 (YTD: -0.52%)

- Euro down 0.34% at 1.1414 (YTD: +0.4%)

- Yen down 0.02% at 114.20 (YTD: +0.8%)

- Onshore Yuan up 0.11% at 6.3524 (YTD: +0.1%)

- Swiss franc down 0.30% at 0.9139 (YTD: -0.2%)

- Sterling down 0.23% at 1.3673 (YTD: +1.1%)

- Canadian dollar down 0.28% at 1.2553 (YTD: +0.6%)

- Australian dollar down 1.07% at 0.7206 (YTD: -0.7%)

- NZ dollar down 0.92% at 0.6797 (YTD: -0.4%)

MACRO DATA RELEASES

- Brazil, Retail Sales, Change Y/Y for Nov 2021 (IBGE, Brazil) at -4.20 % (vs -7.10 % prior), above consensus estimate of -6.50 %

- China (Mainland), Exports, Change Y/Y for Dec 2021 (China Customs) at 20.90 % (vs 22.00 % prior), above consensus estimate of 20.00 %

- China (Mainland), Imports, Change Y/Y for Dec 2021 (China Customs) at 19.50 % (vs 31.70 % prior), below consensus estimate of 26.30 %

- China (Mainland), Trade Balance, Current Prices for Dec 2021 (China Customs) at 94.46 Bln USD (vs 71.72 Bln USD prior), above consensus estimate of 74.50 Bln USD

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Dec 2021 (ECB) at 1,057.00 Bln EUR (vs 1,045.37 Bln EUR prior)

- France, HICP, Change Y/Y, Price Index for Dec 2021 (INSEE, France) at 3.40 % (vs 3.40 % prior), in line with consensus

- France, HICP, Final, Change P/P, Price Index for Dec 2021 (INSEE, France) at 0.20 % (vs 0.20 % prior), in line with consensus

- India, Wholesale Prices, Change Y/Y, Price Index for Dec 2021 (Econ Adviser, India) at 13.56 % (vs 14.23 % prior), above consensus estimate of 13.50 %

- Poland, CPI, Change P/P, Price Index for Dec 2021 (CSO, Poland) at 0.90 % (vs 0.90 % prior)

- Poland, CPI, Change Y/Y, Price Index for Dec 2021 (CSO, Poland) at 8.60 % (vs 8.60 % prior)

- South Korea, Policy Rates, Base Rate for Jan 2022 (The Bank of Korea) at 1.25 % (vs 1.00 % prior), in line with consensus

- Sweden, CPI, All Items, Change P/P, Price Index for Dec 2021 (SCB, Sweden) at 1.30 % (vs 0.50 % prior), above consensus estimate of 1.20 %

- Sweden, CPI, All Items, Change Y/Y, Price Index for Dec 2021 (SCB, Sweden) at 3.90 % (vs 3.30 % prior), above consensus estimate of 3.80 %

- United Kingdom, GDP Estimated YY, Change Y/Y for Nov 2021 (ONS, United Kingdom) at 8.00 % (vs 4.60 % prior), above consensus estimate of 7.50 %

- United Kingdom, GDP Estimated, Change M/M for Nov 2021 (ONS, United Kingdom) at 0.90 % (vs 0.10 % prior), above consensus estimate of 0.40 %

- United Kingdom, GDP estimate 3m/3m for Nov 2021 (ONS, United Kingdom) at 1.10 % (vs 0.90 % prior), above consensus estimate of 0.80 %

- United Kingdom, Production, Manufacturing, Change P/P for Nov 2021 (ONS, United Kingdom) at 1.10 % (vs 0.00 % prior), above consensus estimate of 0.20 %

- United States, Production, Change P/P for Dec 2021 (FED, U.S.) at -0.10 % (vs 0.50 % prior), below consensus estimate of 0.30 %

- United States, Retail Sales, Total including food services, Change P/P for Dec 2021 (U.S. Census Bureau) at -1.90 % (vs 0.30 % prior), below consensus estimate of 0.00 %

- United States, University of Michigan, Total-prelim, Volume Index for Jan 2022 (UMICH, Survey) at 68.80 (vs 70.60 prior), below consensus estimate of 70.00

WEEKLY CFTC NET USD POSITIONING DATA

- All Currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduction in net long US$ positioning

- Euro: reduction in net long US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: reduction in net long US$ positioning

- New Zealand Dollar: reduction in net long US$ positioning

- Brazilian Real: increase in net long US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

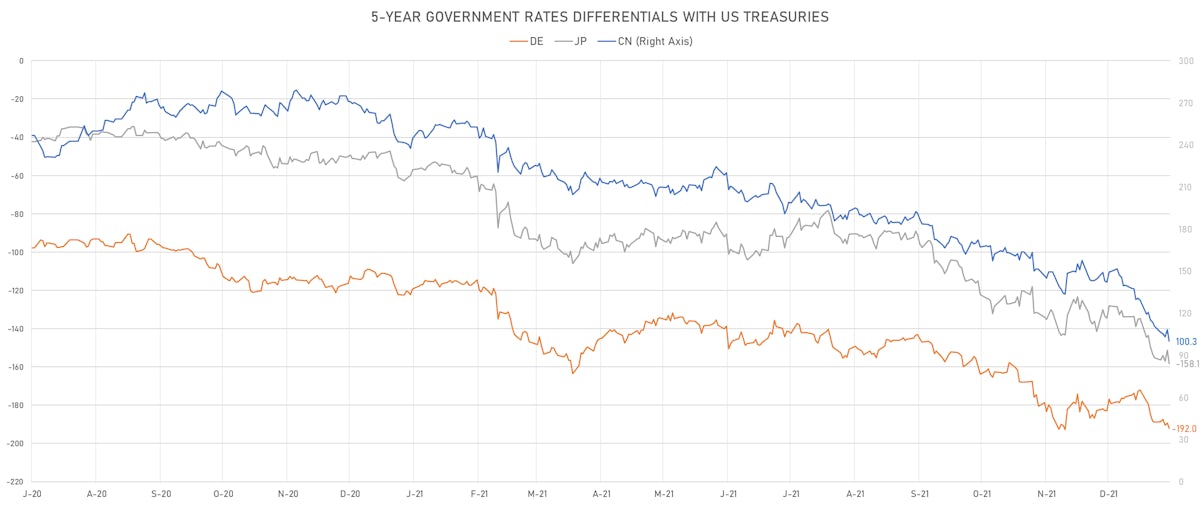

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.8 bp at 192.0 bp (YTD change: +19.9 bp)

- US-JAPAN: +6.9 bp at 158.1 bp (YTD change: +23.4 bp)

- US-CHINA: +8.2 bp at -100.3 bp (YTD change: +28.9 bp)

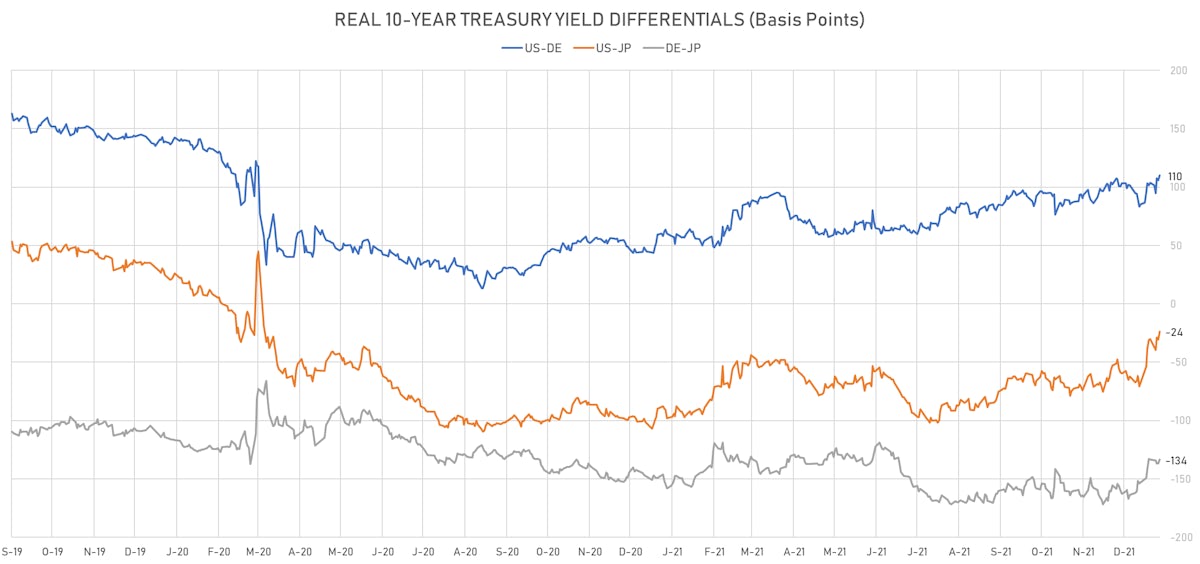

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.8 bp at 109.9 bp (YTD change: +26.7bp)

- US-JAPAN: +6.8 bp at -23.7 bp (YTD change: +47.1bp)

- JAPAN-GERMANY: -3.0 bp at 133.6 bp (YTD change: -20.4bp)

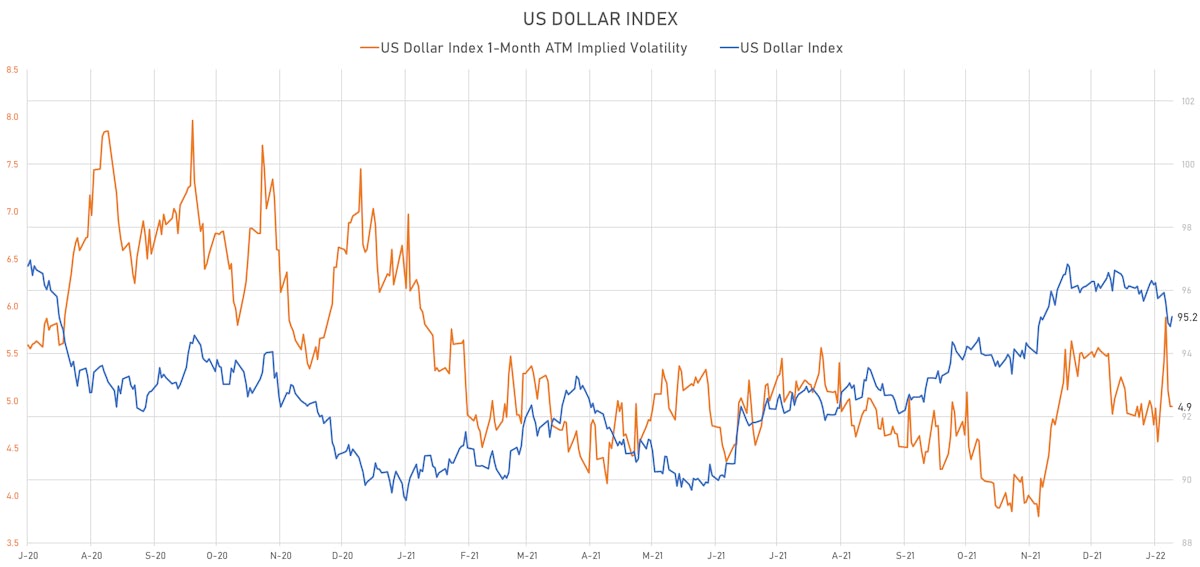

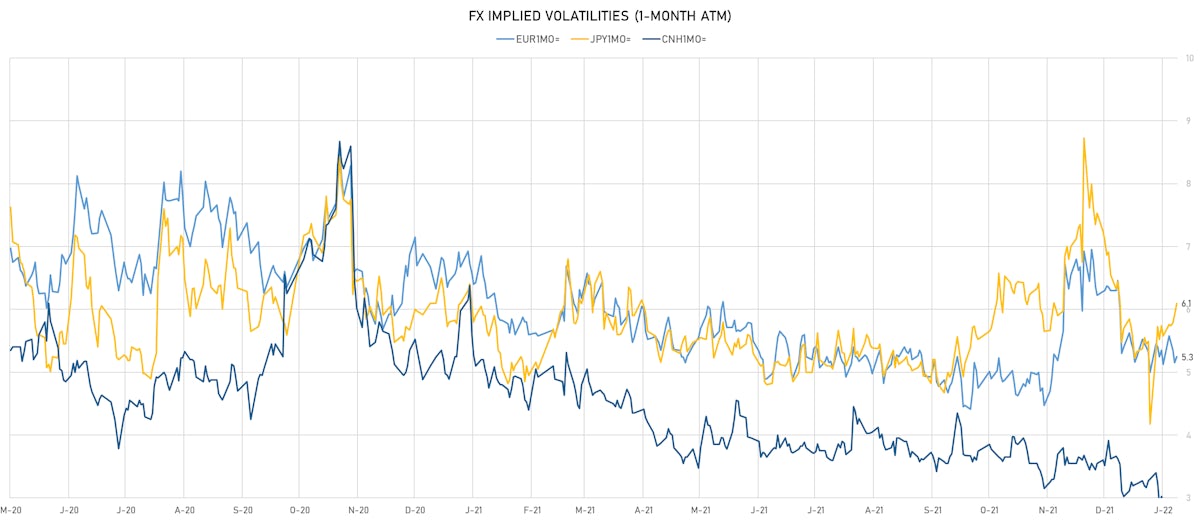

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.17, up 0.07 (YTD: +0.06)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.25, up 0.1 (YTD: +0.3)

- Japanese Yen 1M ATM IV currently at 6.10, up 0.2 (YTD: +1.9)

- Offshore Yuan 1M ATM IV unchanged at 2.93 (YTD: -0.4)

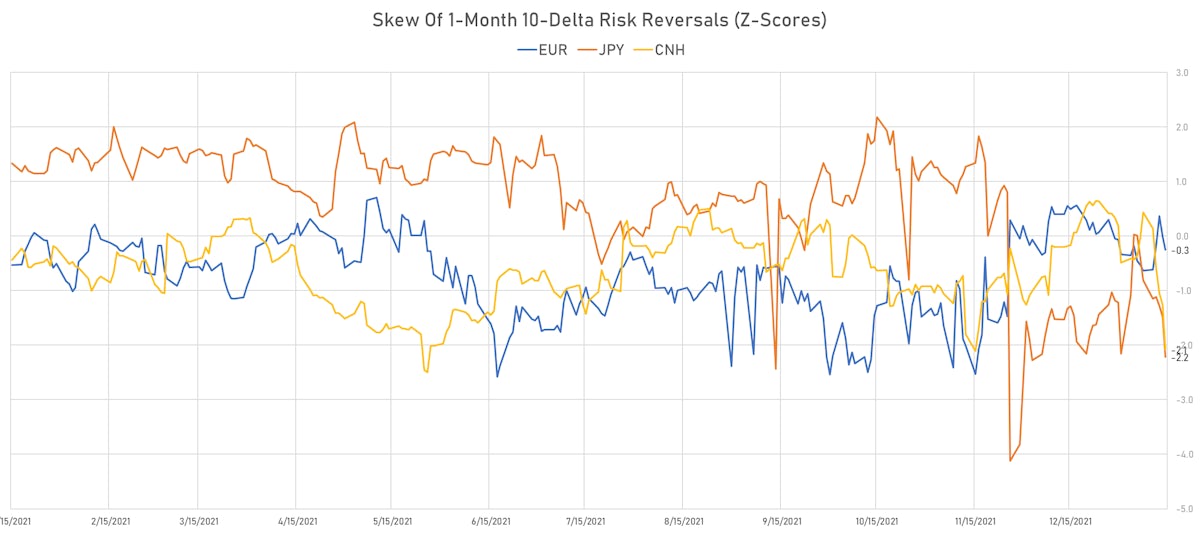

- CNH and JPY risk 1-Month 10-Delta risk reversals are now skewed towards dollar weakness

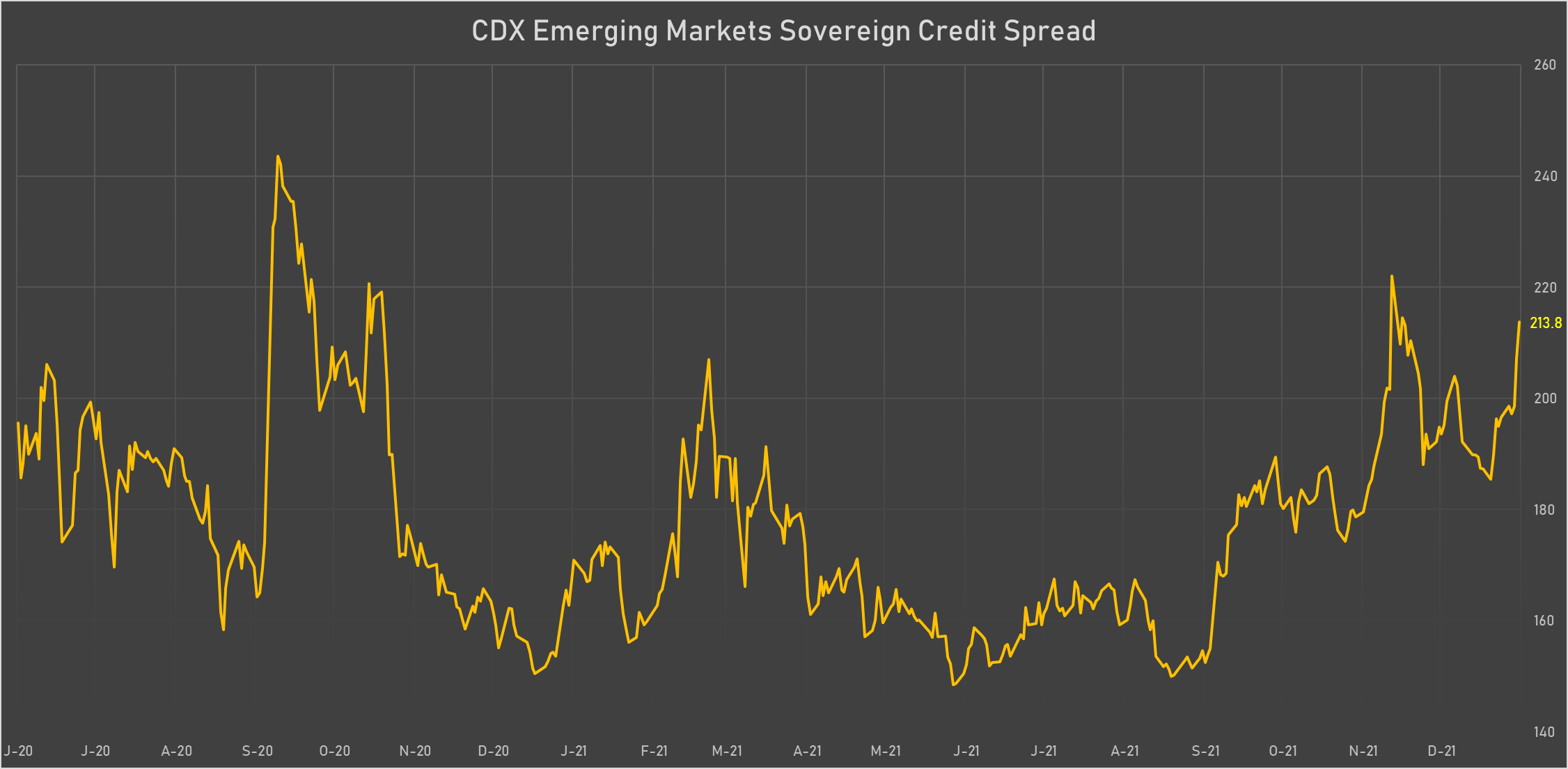

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Philippines (rated BBB): up 2.2 basis points to 61 bp (1Y range: 36-70bp)

- Malaysia (rated BBB+): up 2.6 basis points to 52 bp (1Y range: 36-64bp)

- Chile (rated A-): up 2.9 basis points to 79 bp (1Y range: 43-95bp)

- Indonesia (rated BBB): up 4.1 basis points to 83 bp (1Y range: 66-94bp)

- Vietnam (rated BB): up 4.3 basis points to 104 bp (1Y range: 89-112bp)

- Oman (rated BB-): up 10.8 basis points to 253 bp (1Y range: 223-335bp)

- Bahrain (rated B+): up 13.6 basis points to 298 bp (1Y range: 159-298bp)

- Russia (rated BBB): up 17.3 basis points to 175 bp (1Y range: 75-158bp)

- Egypt (rated B+): up 48.1 basis points to 557 bp (1Y range: 283-512bp)

- Argentina (rated CCC): up 234.9 basis points to 3,277 bp (1Y range: 1,180-3,111bp)

LARGEST FX MOVES TODAY

- Haiti Gourde up 2.9% (YTD: -2.2%)

- Malawi Kwacha up 0.8% (YTD: -0.8%)

- Hungarian Forint down 0.9% (YTD: +3.9%)

- New Zealand $ down 0.9% (YTD: -0.4%)

- Belarusian ruble down 1.0% (YTD: -0.8%)

- Colombian Peso down 1.0% (YTD: +1.6%)

- Tunisian Dinar down 1.0% (YTD: -0.6%)

- Australian Dollar down 1.1% (YTD: -0.7%)

- Swedish Krona down 1.1% (YTD: +0.1%)

- Ghanaian Cedi down 1.5% (YTD: -2.0%)

LARGEST FX MOVES THIS WEEK

- Seychelles rupee down 2.4% (YTD: -2.2%)

- Brazilian Real down 2.3% (YTD: +0.7%)

- Turkish Lira up 2.1% (YTD: -1.5%)

- Haiti Gourde up 2.0% (YTD: -2.2%)

- Peru Sol up 2.0% (YTD: +3.3%)

- Namibian Dollar down 2.0% (YTD: +3.7%)

- Chilean Peso down 1.9% (YTD: +4.0%)

- Lesotho Loti up 1.9% (YTD: +3.7%)

- Swaziland Lilangeni up 1.9% (YTD: +3.6%)

- South Africa Rand up 1.8% (YTD: +4.0%)

YTD BIGGEST WINNERS & LOSERS

- Chilean Peso up 4.0%

- South Africa Rand up 4.0%

- Hungarian Forint up 3.9%

- Namibian Dollar up 3.7%

- Lesotho Loti up 3.7%

- Swaziland Lilangeni up 3.6%

- Peru Sol up 3.3%

- Angolan Kwanza up 2.9%

- Liberian Dollar down 3.3%

- Surinamese dollar down 4.8%