FX

Rates Differentials Take US Dollar Higher Against Euro, Swissie, Sterling

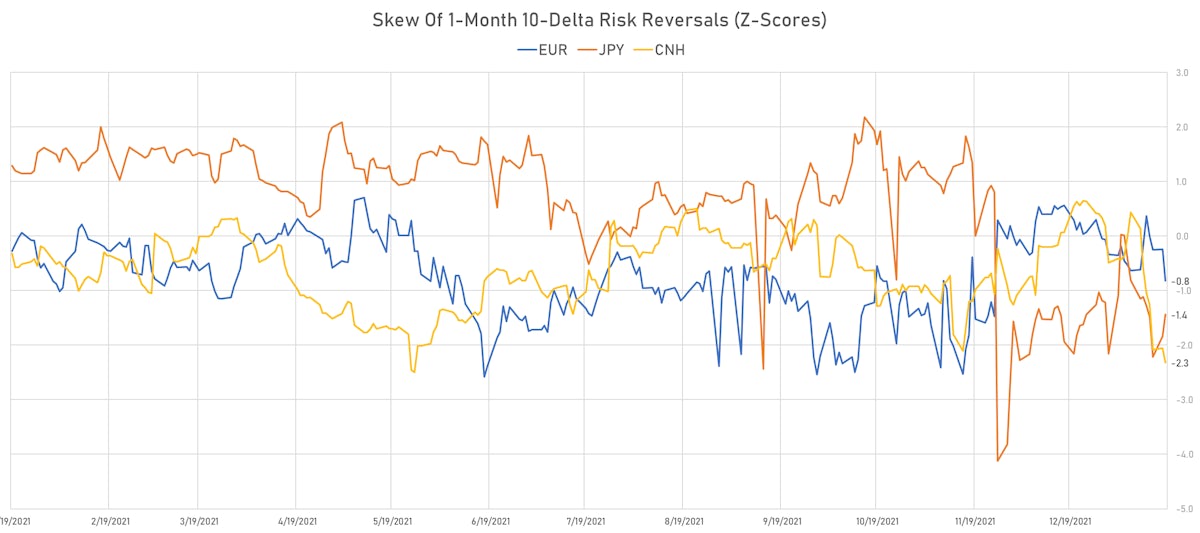

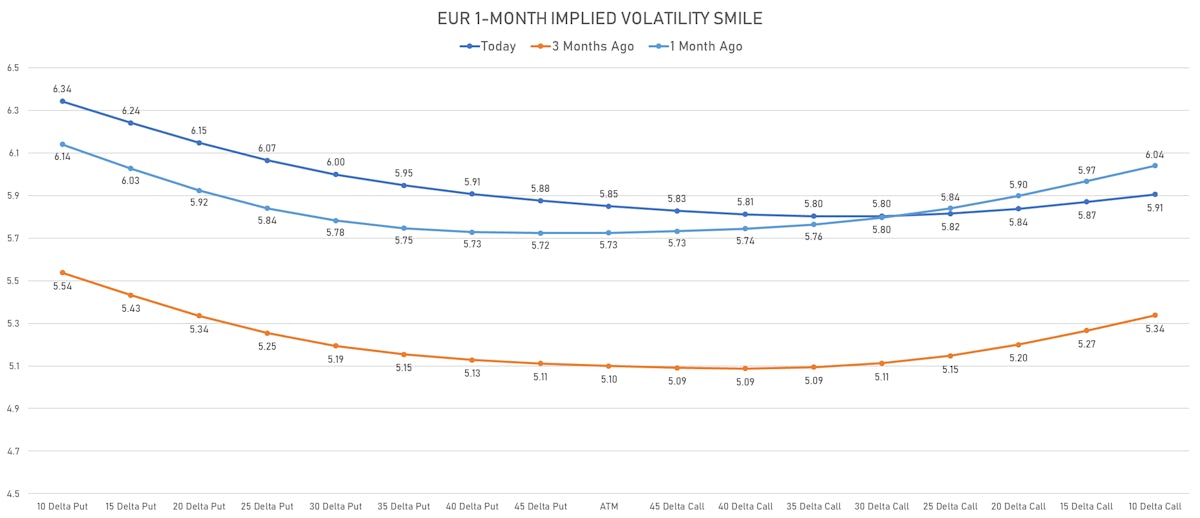

Euro implied volatilities have become more skewed to the downside over the past month, while risk reversals are showing less bias to a strengthening yen (lower risk aversion)

Published ET

Euro 1-Month Implied Volatility Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

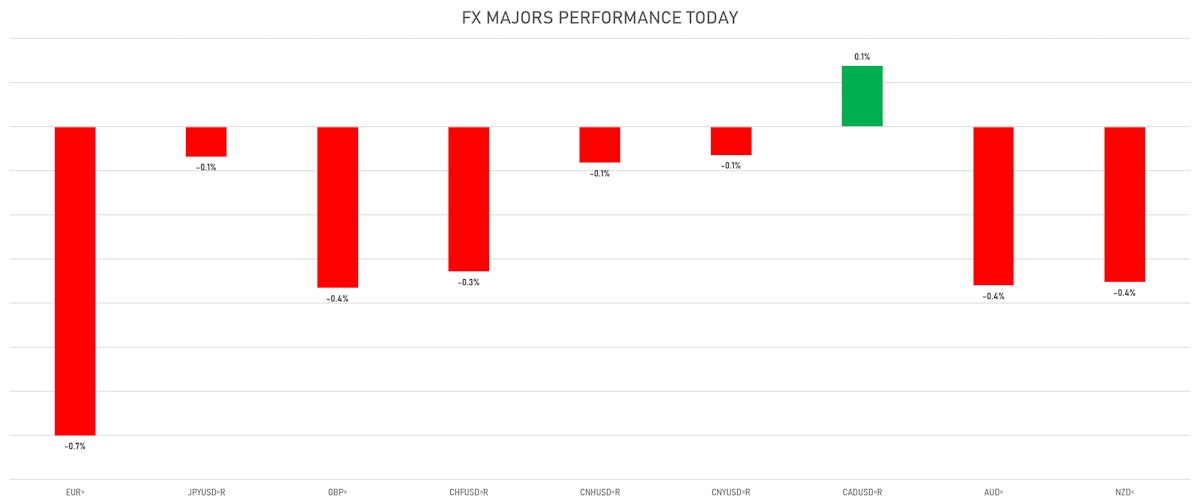

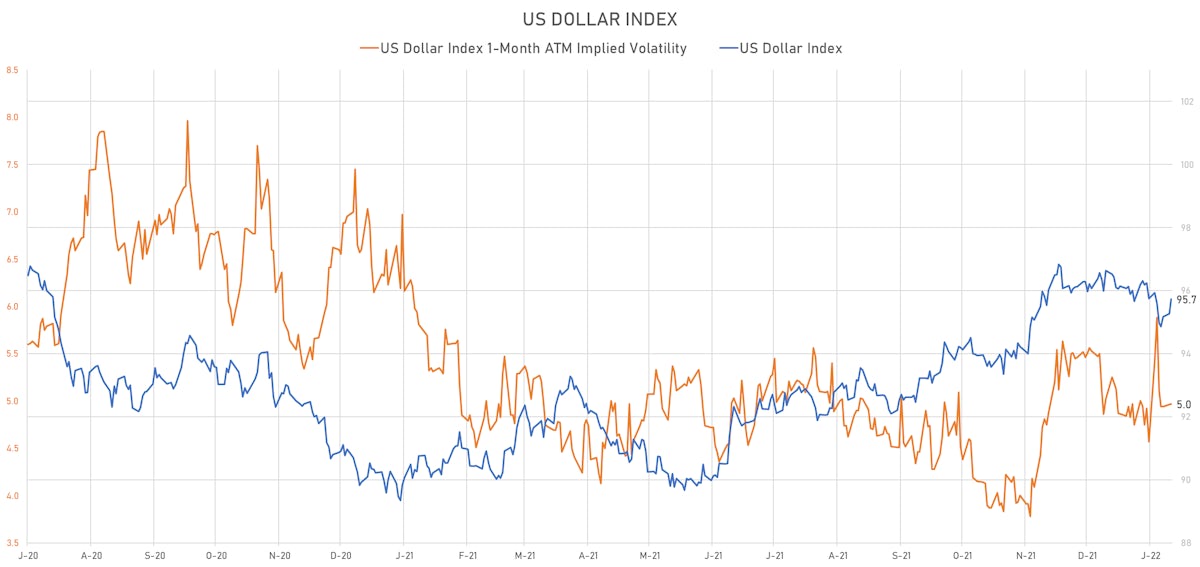

- The US Dollar Index is up 0.50% at 95.74 (YTD: +0.08%)

- Euro down 0.70% at 1.1327 (YTD: -0.4%)

- Yen down 0.07% at 114.69 (YTD: +0.3%)

- Onshore Yuan down 0.06% at 6.3525 (YTD: +0.1%)

- Swiss franc down 0.33% at 0.9169 (YTD: -0.5%)

- Sterling down 0.37% at 1.3595 (YTD: +0.5%)

- Canadian dollar up 0.14% at 1.2505 (YTD: +1.0%)

- Australian dollar down 0.36% at 0.7184 (YTD: -1.0%)

- NZ dollar down 0.35% at 0.6773 (YTD: -0.7%)

MACRO DATA RELEASES

- Canada, Housing Starts, All areas for Dec 2021 (CMHC, Canada) at 236.10 k (vs 301.30 k prior), below consensus estimate of 270.00 k

- Germany, ZEW, Current Economic Situation, Germany, balance for Jan 2022 (ZEW, Germany) at -10.20 (vs -7.40 prior), below consensus estimate of -8.50

- Germany, ZEW, Economic Expectations, Germany, balance for Jan 2022 (ZEW, Germany) at 51.70 (vs 29.90 prior), above consensus estimate of 32.00

- Japan, Policy Rates, BoJ Policy Rate Balance for 18 Jan (Bank of Japan) at -0.10 % (vs -0.10 % prior), in line with consensus

- New Zealand, Milk Auction, Average Price, Constant Prices for W 18 Jan (Global Dairy Trade) at 4,463.00 USD (vs 4,247.00 USD prior)

- South Africa, Mining Production YY, Change Y/Y for Nov 2021 (Statistics, SA) at 5.20 % (vs 2.10 % prior), above consensus estimate of 4.25 %

- United Kingdom, Earnings, Average Weekly, Whole economy, regular pay, 3-month average, Change Y/Y for Nov 2021 (ONS, United Kingdom) at 3.80 % (vs 4.30 % prior), in line with consensus

- United Kingdom, Earnings, Average Weekly, Whole economy, total pay, 3-month average, Change Y/Y for Nov 2021 (ONS, United Kingdom) at 4.20 % (vs 4.90 % prior), in line with consensus

- United Kingdom, Employed, Change in Level of Employment 3m/3m, Volume for Nov 2021 (ONS, United Kingdom) at 60.00 k (vs 149.00 k prior), below consensus estimate of 125.00 k

- United Kingdom, Unemployment, Claimant count, Absolute change for Dec 2021 (ONS, United Kingdom) at -43.30 k (vs -49.80 k prior)

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Nov 2021 (ONS, United Kingdom) at 4.10 % (vs 4.20 % prior), below consensus estimate of 4.20 %

- United States, NAHB/Wells Fargo Housing Market Index for Jan 2022 (NAHB, United States) at 83.00 (vs 84.00 prior), below consensus estimate of 84.00

- United States, New York Fed, General Business Condition for Jan 2022 (FED, NY) at -0.70 (vs 31.90 prior), below consensus estimate of 25.00

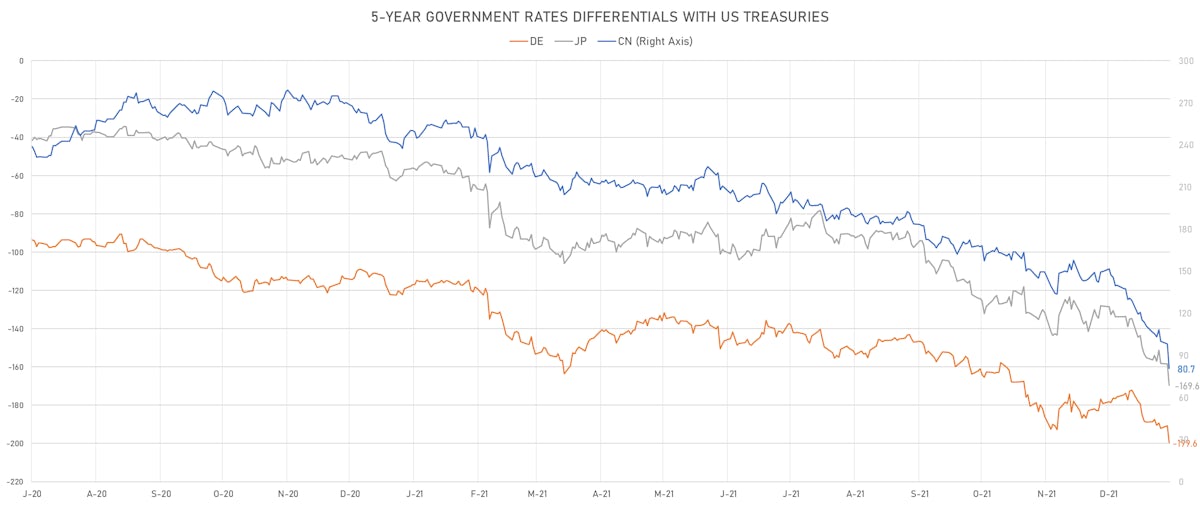

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +11.5 bp at 202.1 bp (YTD change: +30.0 bp)

- US-JAPAN: +13.0 bp at 171.5 bp (YTD change: +36.8 bp)

- US-CHINA: +22.6 bp at -75.7 bp (YTD change: +53.5 bp)

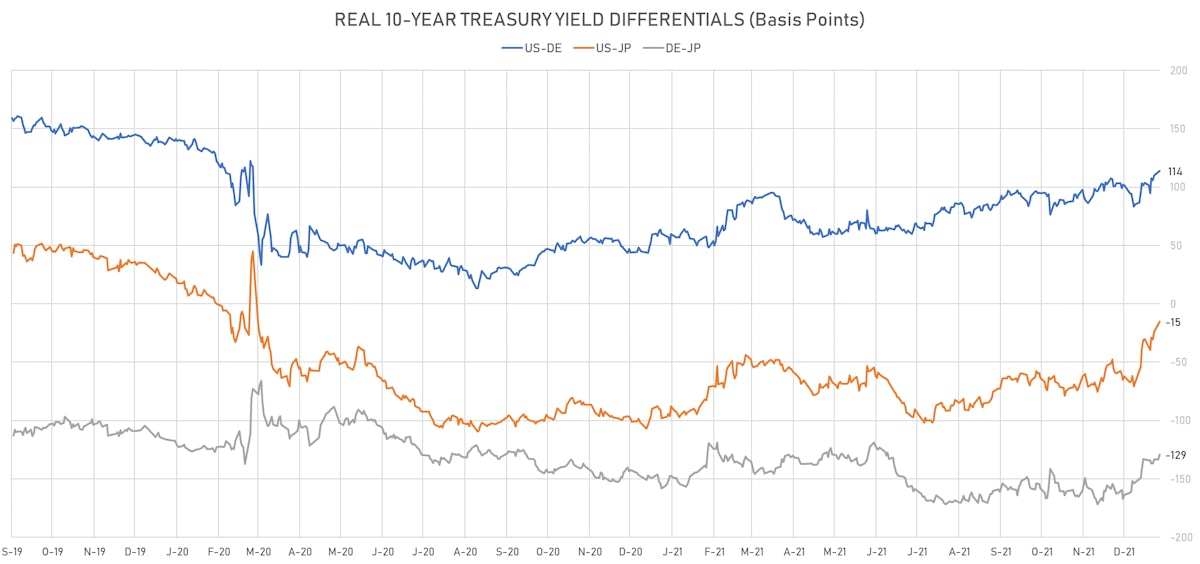

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.1 bp at 114.0 bp (YTD change: +30.8bp)

- US-JAPAN: +8.5 bp at -15.2 bp (YTD change: +55.6bp)

VOLATILITIES TODAY

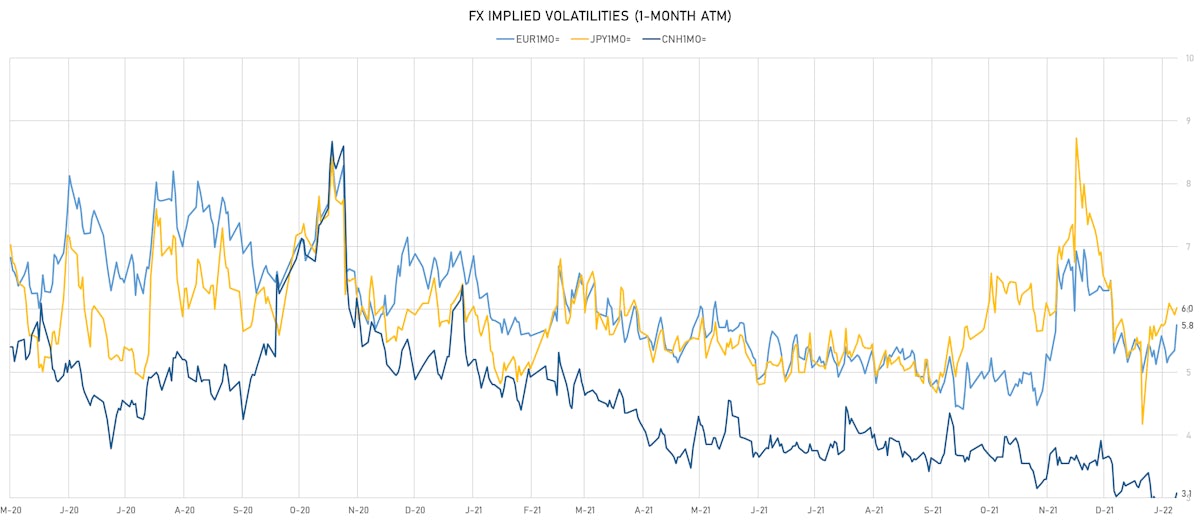

- Deutsche Bank USD Currency Volatility Index currently at 6.27, up 0.07 (YTD: +0.16)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.75, up 0.4 (YTD: +0.8)

- Japanese Yen 1M ATM IV currently at 6.03, up 0.1 (YTD: +1.9)

- Offshore Yuan 1M ATM IV currently at 3.08, up 0.1 (YTD: -0.2), as the PBOC keeps a tight lid on volatility

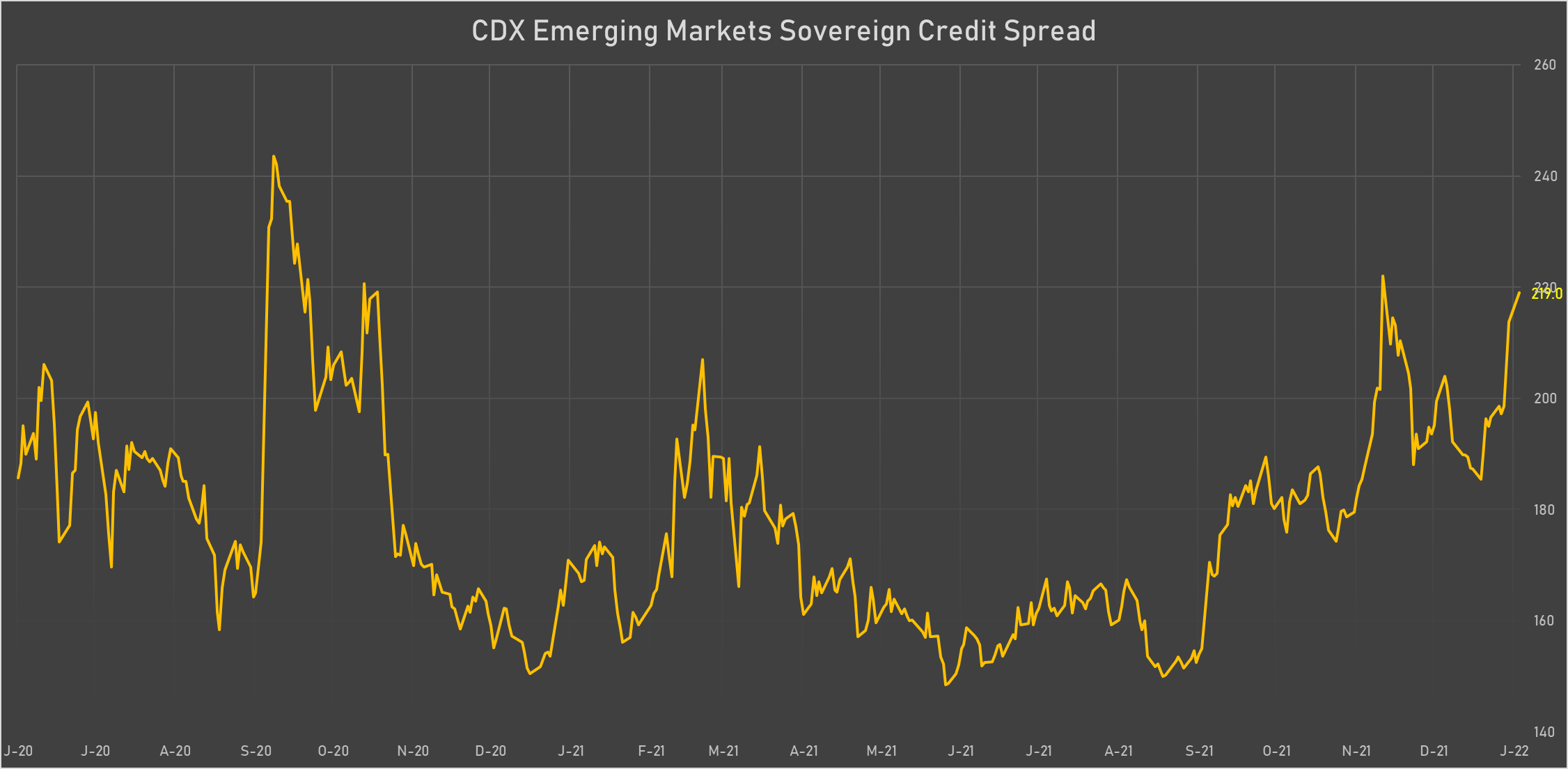

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Egypt (rated B+): down 11.7 basis points to 562 bp (1Y range: 283-573bp)

- Panama (rated BBB-): up 1.2 basis points to 90 bp (1Y range: 51-103bp)

- Chile (rated A-): up 1.9 basis points to 81 bp (1Y range: 43-95bp)

- Morocco (rated BB+): up 2.3 basis points to 93 bp (1Y range: 84-98bp)

- South Africa (rated BB-): up 3.8 basis points to 214 bp (1Y range: 178-246bp)

- Russia (rated BBB): up 3.9 basis points to 196 bp (1Y range: 75-193bp)

- Oman (rated BB-): up 4.2 basis points to 266 bp (1Y range: 223-329bp)

- Brazil (rated BB-): up 4.3 basis points to 226 bp (1Y range: 148-266bp)

- Bahrain (rated B+): up 4.5 basis points to 308 bp (1Y range: 159-303bp)

- Argentina (rated CCC): up 129.8 basis points to 3,403 bp (1Y range: 1,181-3,280bp)

LARGEST FX MOVES TODAY

- Solomon Is Dollar up 1.1% (YTD: -0.8%)

- Brazilian Real down 0.9% (YTD: +0.1%)

- Guinea Franc down 0.9% (YTD: +1.9%)

- South Africa Rand down 0.9% (YTD: +3.1%)

- North Macedonian denar down 1.1% (YTD: 0.0%)

- Hungarian Forint down 1.3% (YTD: +2.8%)

- Fiji Dollar down 1.3% (YTD: +0.5%)

- Swedish Krona down 1.4% (YTD: -1.2%)

YTD BIGGEST WINNERS & LOSERS

- Chilean Peso up 4.2%

- Angolan Kwanza up 3.6%

- South Africa Rand up 3.1%

- Peru Sol up 3.0%

- Namibian Dollar up 2.8%

- Swaziland Lilangeni up 2.8%

- New Zambian kwacha down 3.5%

- Liberian Dollar down 3.6%

- Ukraine Hryvnia down 3.7%

- Surinamese dollar down 4.4%