FX

Risk-Off Trade Takes Down Australian And Canadian Dollar, While Funding Currencies Rise (JPY, EUR, CHF)

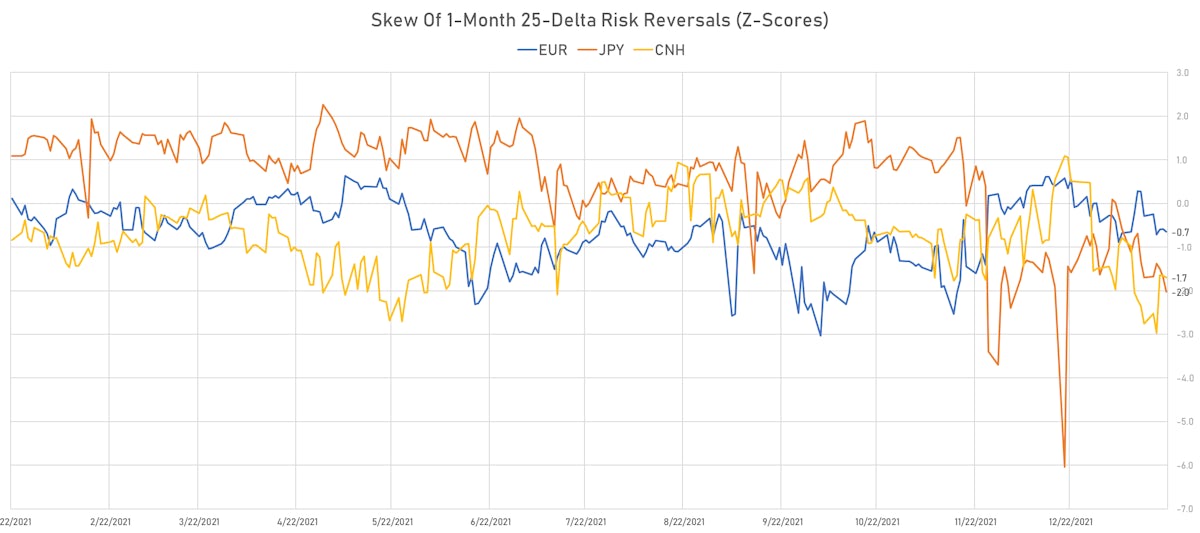

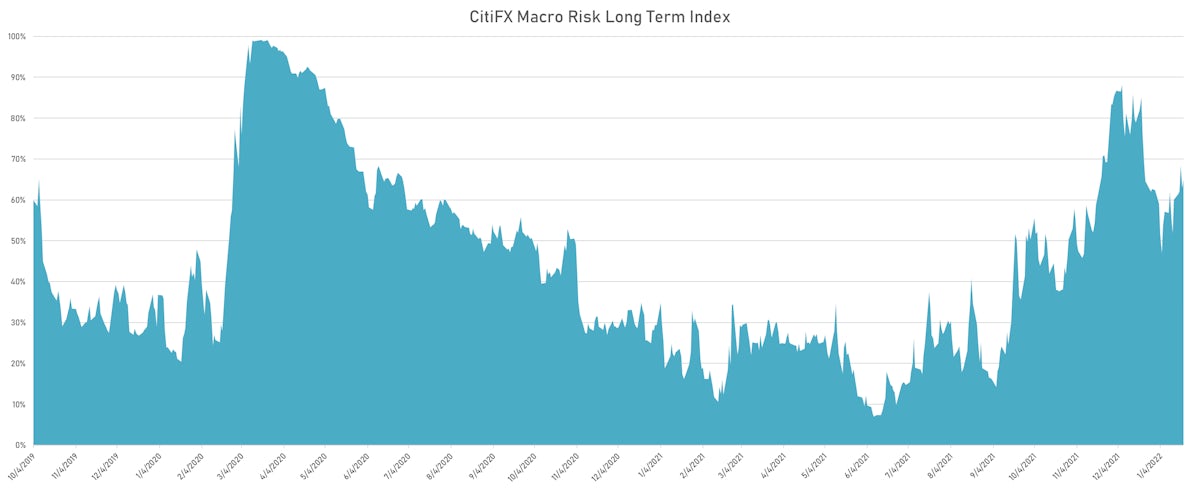

The (still modest) rise in volatility and risk aversion across asset classes we've seen this week, from US technology stocks to bitcoin and other cryptocurrencies, is causing some unwind of levered carry positions in FX

Published ET

CitiFX Long Term Macro Risk Index | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is down -0.14% at 95.65 (YTD: -0.02%)

- Euro up 0.27% at 1.1340 (YTD: -0.2%)

- Yen up 0.35% at 113.68 (YTD: +1.2%)

- Onshore Yuan up 0.03% at 6.3385 (YTD: +0.3%)

- Swiss franc up 0.54% at 0.9112 (YTD: +0.1%)

- Sterling down 0.30% at 1.3554 (YTD: +0.2%)

- Canadian dollar down 0.63% at 1.2581 (YTD: +0.4%)

- Australian dollar down 0.58% at 0.7183 (YTD: -1.1%)

- NZ dollar down 0.50% at 0.6720 (YTD: -1.5%)

MACRO DATA RELEASES

- Canada, Retail Sales, Change P/P for Nov 2021 (CANSIM, Canada) at 0.70 % (vs 1.60 % prior), below consensus estimate of 1.20 %

- Canada, Retail Sales, Retail Sales Ex-Autos MM, Change P/P for Nov 2021 (CANSIM, Canada) at 1.10 % (vs 1.30 % prior), below consensus estimate of 1.30 %

- Denmark, Consumer confidence indicator for Jan 2022 (statbank.dk) at -1.50 (vs -2.10 prior)

- Euro Zone, EC Consumer Survey, All Respondents, Consumer Confidence Indicator, Balance for Jan 2022 (DG ECFIN, France) at -8.50 (vs -8.30 prior), above consensus estimate of -9.00

- Poland, Employment, Average paid in enterprise sector, Change Y/Y for Dec 2021 (CSO, Poland) at 0.50 % (vs 0.70 % prior), below consensus estimate of 0.60 %

- Poland, Producer Prices, Total industry, Change Y/Y for Dec 2021 (CSO, Poland) at 14.20 % (vs 13.20 % prior), above consensus estimate of 13.50 %

- Poland, Production, Change Y/Y for Dec 2021 (CSO, Poland) at 16.70 % (vs 15.20 % prior), above consensus estimate of 13.00 %

- Poland, Wages and Salaries, Average Monthly, Gross, Nominal, Enterprise sector, total, Change Y/Y, Current Prices for Dec 2021 (CSO, Poland) at 11.20 % (vs 9.80 % prior), above consensus estimate of 9.10 %

- Thailand, Exports, Total, customs basis, Change Y/Y for Dec 2021 (Bank of Thailand) at 24.20 % (vs 24.70 % prior), above consensus estimate of 15.50 %

- Thailand, Imports, Total, customs basis, Change Y/Y for Dec 2021 (Bank of Thailand) at 33.40 % (vs 20.50 % prior), above consensus estimate of 18.15 %

- Thailand, Trade Balance, Total, customs basis (USD), Current Prices for Dec 2021 (Bank of Thailand) at -0.35 Bln USD (vs 1.02 Bln USD prior), below consensus estimate of 0.47 Bln USD

- United Kingdom, GfK Consumer confidence index for Jan 2022 (GfK Group) at -19.00 (vs -15.00 prior), below consensus estimate of -15.00

- United Kingdom, Retail Sales, Change, Total including automotive fuel, Change Y/Y for Dec 2021 (ONS, United Kingdom) at -0.90 % (vs 4.70 % prior), below consensus estimate of 3.40 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change P/P for Dec 2021 (ONS, United Kingdom) at -3.60 % (vs 1.10 % prior), below consensus estimate of -0.50 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change Y/Y for Dec 2021 (ONS, United Kingdom) at -3.00 % (vs 2.70 % prior), below consensus estimate of 1.10 %

- United Kingdom, Retail Sales, Total including automotive fuel, Change P/P for Dec 2021 (ONS, United Kingdom) at -3.70 % (vs 1.40 % prior), below consensus estimate of -0.60 %

WEEKLY CFTC NET CURRENCY POSITIONING

- All currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: reduction in net long US$ positioning

- New Zealand Dollar: reduction in net long US$ positioning

- Brazilian Real: increase in net long US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.9 bp at 196.4 bp (YTD change: +24.3 bp)

- US-JAPAN: -1.3 bp at 161.4 bp (YTD change: +26.7 bp)

- US-CHINA: +2.5 bp at -81.1 bp (YTD change: +48.1 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.0 bp at 118.0 bp (YTD change: +34.8bp)

- US-JAPAN: +3.1 bp at -11.3 bp (YTD change: +59.5bp)

- JAPAN-GERMANY: +0.9 bp at 129.3 bp (YTD change: -24.7bp)

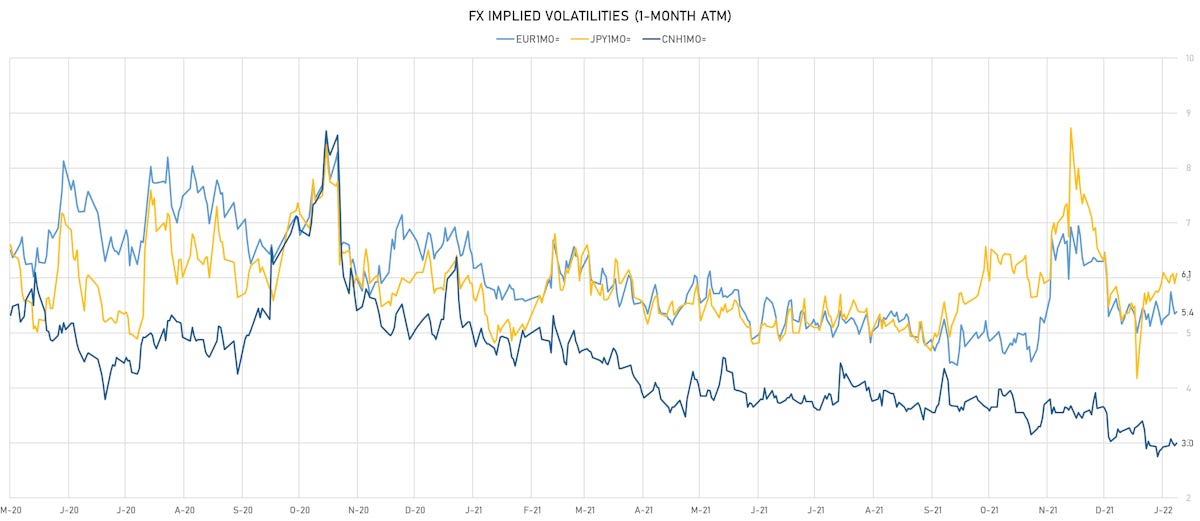

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.48, up 0.15 (YTD: +0.37)

- Euro 1-Month At-The-Money Implied Volatility currently at 5.39, up 0.0 (YTD: +0.4)

- Japanese Yen 1M ATM IV currently at 6.08, up 0.2 (YTD: +1.9)

- Offshore Yuan 1M ATM IV unchanged at 3.00 (YTD: -0.3)

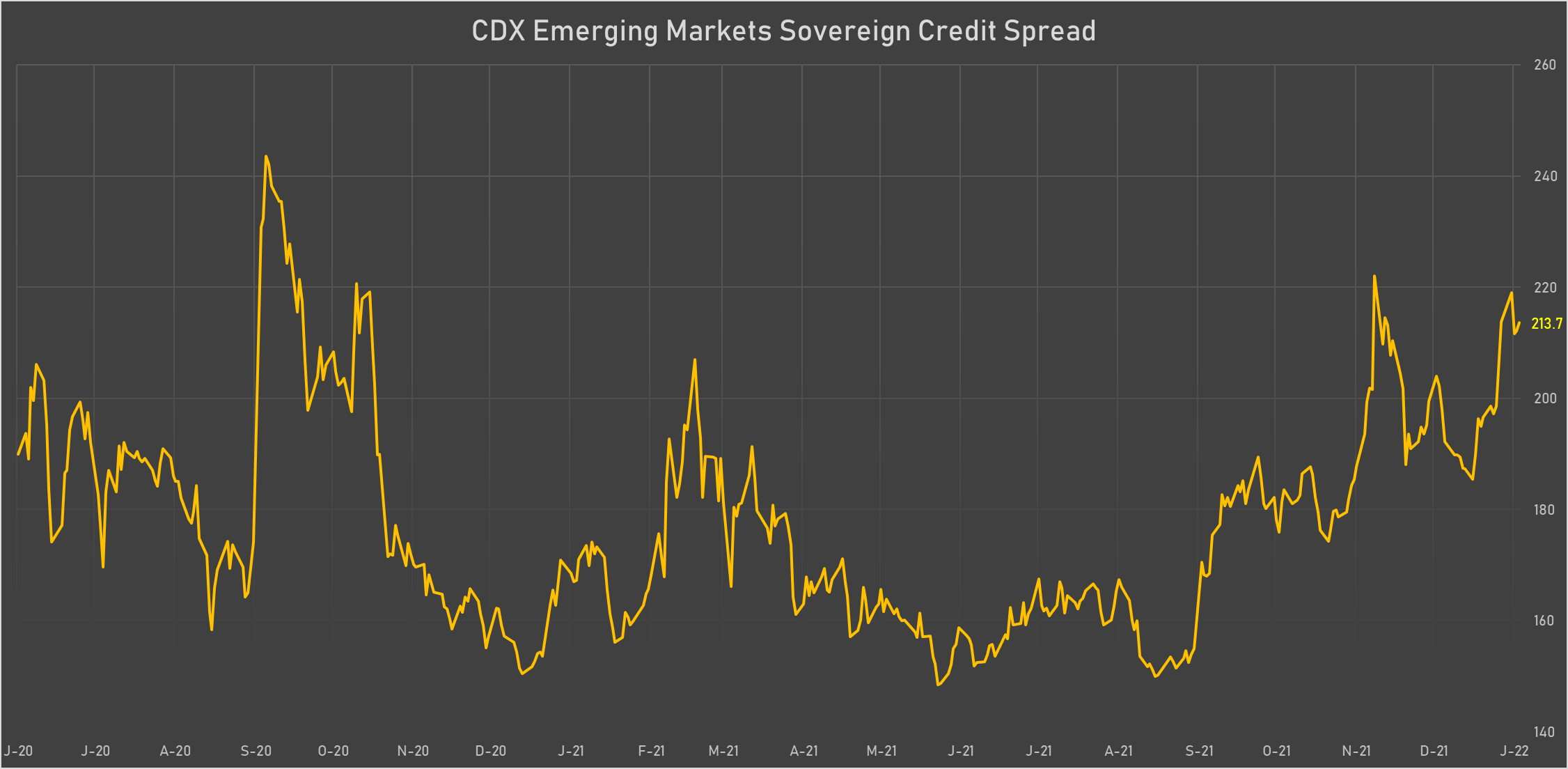

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Chile (rated A-): down 3.5 basis points to 75 bp (1Y range: 43-95bp)

- Saudi Arabia (rated A): up 0.9 basis points to 50 bp (1Y range: 43-71bp)

- Malaysia (rated BBB+): up 1.5 basis points to 55 bp (1Y range: 36-64bp)

- Indonesia (rated BBB): up 1.6 basis points to 87 bp (1Y range: 66-94bp)

- Vietnam (rated BB): up 1.8 basis points to 108 bp (1Y range: 89-112bp)

- Philippines (rated BBB): up 1.9 basis points to 67 bp (1Y range: 36-70bp)

- Mexico (rated BBB-): up 2.1 basis points to 98 bp (1Y range: 80-124bp)

- Brazil (rated BB-): up 4.5 basis points to 219 bp (1Y range: 148-266bp)

- Russia (rated BBB): up 7.2 basis points to 204 bp (1Y range: 75-197bp)

- Argentina (rated CCC): up 124.0 basis points to 3,632 bp (1Y range: 1,199-3,500bp)

LARGEST FX MOVES TODAY

- Sierra Leone Leon up 1.1% (YTD: -0.6%)

- Mauritius Rupee up 0.9% (YTD: -0.4%)

- Angolan Kwanza up 0.9% (YTD: +5.7%)

- Ghanaian Cedi up 0.8% (YTD: -1.9%)

- Armenian Dram down 0.7% (YTD: -0.4%)

- New Zambian kwacha down 0.7% (YTD: -4.8%)

- Brazilian Real down 0.7% (YTD: +2.1%)

- Turkish Lira down 0.8% (YTD: -0.9%)

- Norwegian Krone down 0.9% (YTD: -1.2%)

- Russian Rouble down 1.3% (YTD: -3.6%)

LARGEST FX MOVES THIS WEEK

- Rwanda Franc down 3.2% (YTD: +3.2%)

- Chilean Peso up 2.9% (YTD: +6.7%)

- Angolan Kwanza up 2.7% (YTD: +5.7%)

- Aruba florin down 2.2% (YTD: +2.2%)

- Swaziland Lilangeni up 1.9% (YTD: +5.6%)

- Swedish Krona up 2.0% (YTD: -1.8%)

- Nicaragua Cordoba down 2.2% (YTD: -2.2%)

- Eritrean Nakfa down 2.6% (YTD: -2.6%)

- Gambian Dalasi down 3.2% (YTD: -4.2%)

- Seychelles rupee down 12.2% (YTD: -10.5%)

YTD BIGGEST WINNERS & LOSERS

- Chilean Peso up 6.7%

- South Africa Rand up 5.9%

- Angolan Kwanza up 5.7%

- Swaziland Lilangeni up 5.6%

- Lesotho Loti up 5.6%

- Namibian Dollar up 5.5%

- Peru Sol up 4.4%

- Liberian Dollar down 4.3%

- New Zambian kwacha down 4.8%

- Seychelles rupee down 10.5%