FX

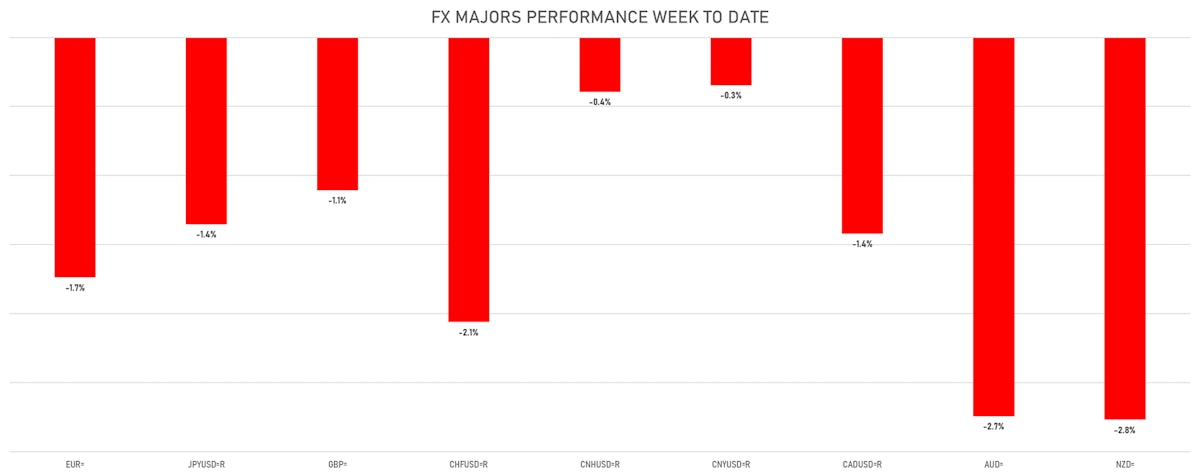

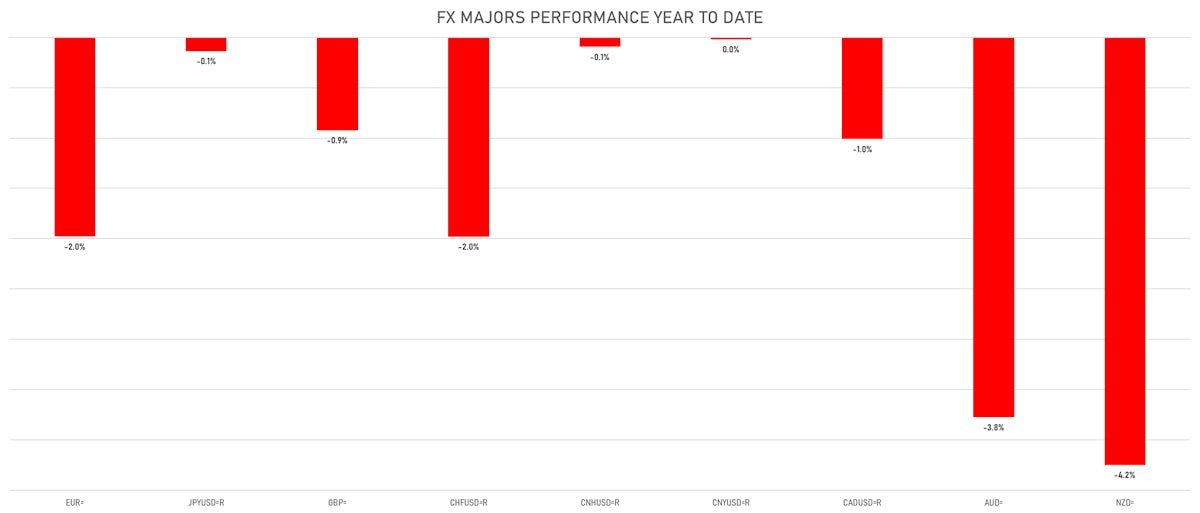

Risk Aversion, Rates Differentials Push The US Dollar Up Against Most Currencies This Week

Antipodean currencies are faring the worst among majors, as they're the most sensitive to global risk sentiment, with the Kiwi dollar now down over 4% year-to-date, and the Aussie pretty close to that as well

Published ET

FX Majors Performance Year To Date | Sources: ϕpost, Refinitiv data

QUICK DAILY SUMMARY

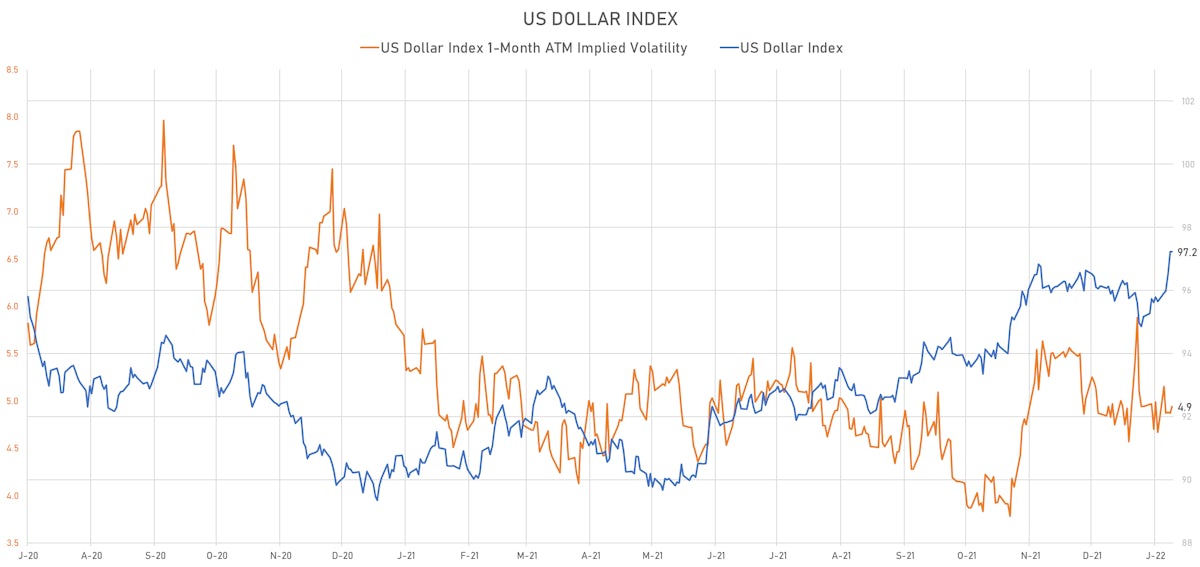

- The US Dollar Index was unchanged at 97.23 (YTD: +1.64%)

- Euro unchanged at 1.1143 (YTD: -2.0%)

- Yen up 0.10% at 115.24 (YTD: -0.1%)

- Onshore Yuan up 0.17% at 6.3605 (YTD: 0.0%)

- Swiss franc unchanged at 0.9307 (YTD: -2.0%)

- Sterling up 0.14% at 1.3404 (YTD: -0.9%)

- Canadian dollar down 0.18% at 1.2761 (YTD: -1.0%)

- Australian dollar down 0.64% at 0.6986 (YTD: -3.8%)

- NZ dollar down 0.71% at 0.6534 (YTD: -4.2%)

MACRO DATA RELEASES

- Angola, Policy Rates, BNA Basic Reference Rate for 31 Jan (Central Bank, Angola) at 20.00 % (vs 20.00 % prior)

- Belgium, GDP, Change P/P for Q4 2021 (NBB, Belgium) at 0.50 % (vs 2.00 % prior), above consensus estimate of 0.40 %

- Brazil, Composite Index, IGP-M inflation, Change P/P, Price Index for Jan 2022 (FGV, Brazil) at 1.82 % (vs 0.87 % prior), below consensus estimate of 2.00 %

- Colombia, Policy Rates, Intervention Rate for Jan 2022 (Cent Bank, Colombia) at 4.00 % (vs 3.00 % prior), above consensus estimate of 3.75 %

- Euro Zone, All Respondents, Total, Consumer Confidence Indicator, Balance for Jan 2022 (DG ECFIN, France) at -8.50 (vs -8.50 prior), in line with consensus

- France, GDP, Total growth, Change P/P for Q4 2021 (INSEE, France) at 0.70 % (vs 3.00 % prior), above consensus estimate of 0.50 %

- Germany, GDP, Flash, Change P/P for Q4 2021 (Destatis) at -0.70 % (vs 1.70 % prior), below consensus estimate of -0.30 %

- Germany, GDP, Flash, Change Y/Y for Q4 2021 (Destatis) at 1.40 % (vs 2.50 % prior)

- Spain, GDP, early flash estimate, Change P/P for Q4 2021 (INE, Spain) at 2.00 % (vs 2.60 % prior), above consensus estimate of 1.40 %

- Sweden, GDP, GDP at market prices, Change Y/Y for Q4 2021 (SCB, Sweden) at 6.20 % (vs 4.70 % prior), above consensus estimate of 5.40 %

- Sweden, GDP, Total at market prices, Change P/P for Q4 2021 (SCB, Sweden) at 1.40 % (vs 2.00 % prior), above consensus estimate of 1.00 %

- Switzerland, KOF composite leading indicator for Jan 2022 (KOF, Switzerland) at 107.80 (vs 107.00 prior), above consensus estimate of 106.30

- United States, Personal Consumption Expenditure, Change P/P for Dec 2021 (BEA, US Dept. Of Com) at -0.60 % (vs 0.60 % prior), in line with consensus

- United States, University of Michigan, Consumer Sentiment Index, Volume Index for Jan 2022 (UMICH, Survey) at 67.20 (vs 68.80 prior), below consensus estimate of 68.70

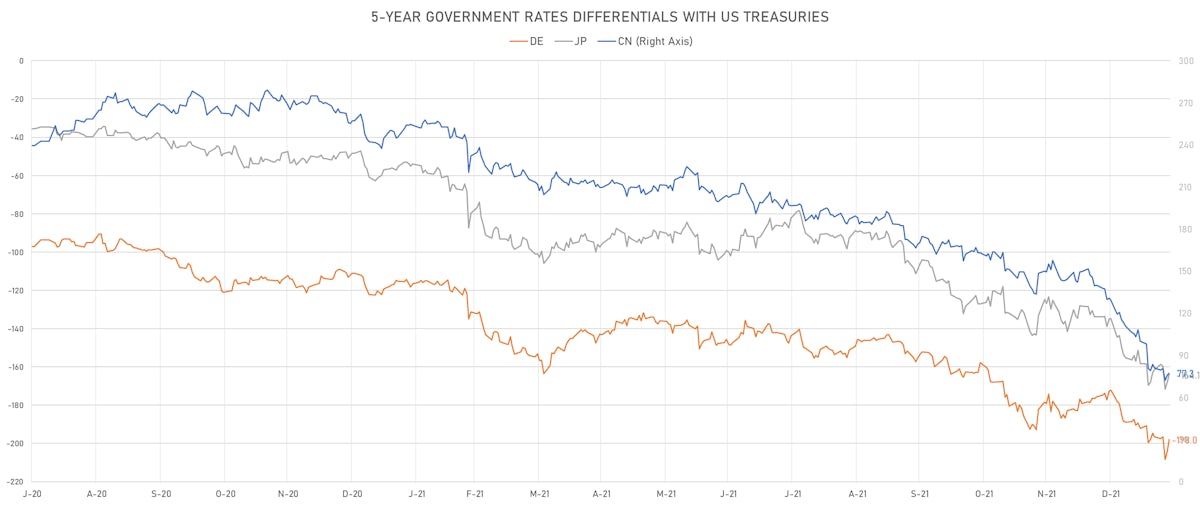

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -5.9 bp at 198.0 bp (YTD change: +25.9 bp)

- US-JAPAN: -3.7 bp at 164.1 bp (YTD change: +29.4 bp)

- US-CHINA: +0.2 bp at -75.7 bp (YTD change: +53.5 bp)

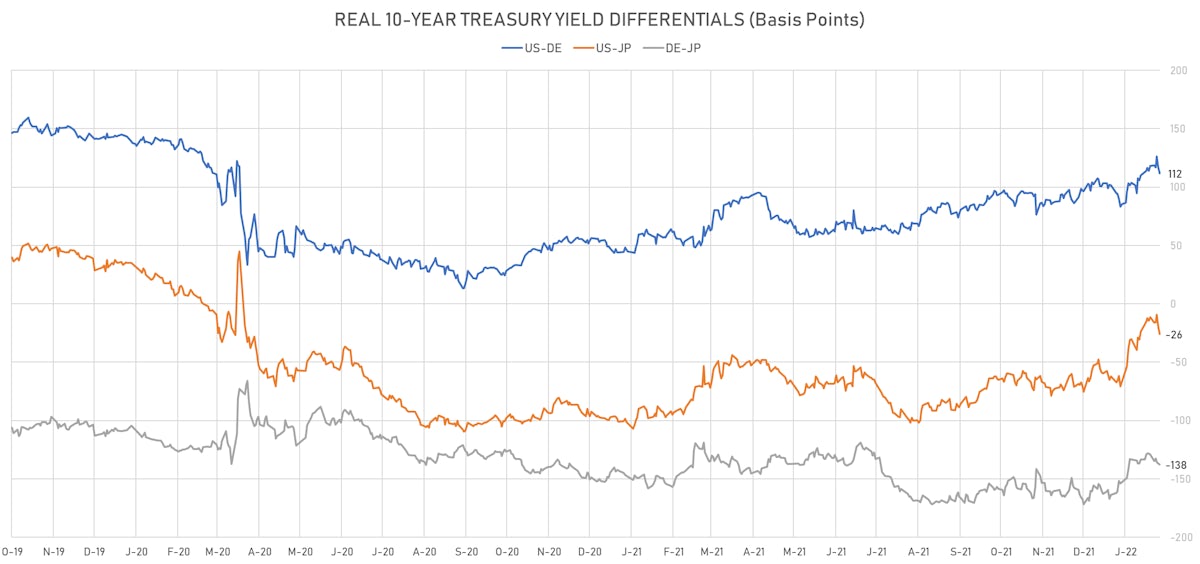

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -5.3 bp at 111.8 bp (YTD change: +28.6bp)

- US-JAPAN: -6.2 bp at -25.9 bp (YTD change: +44.9bp)

- JAPAN-GERMANY: +0.9 bp at 137.7 bp (YTD change: -16.3bp)

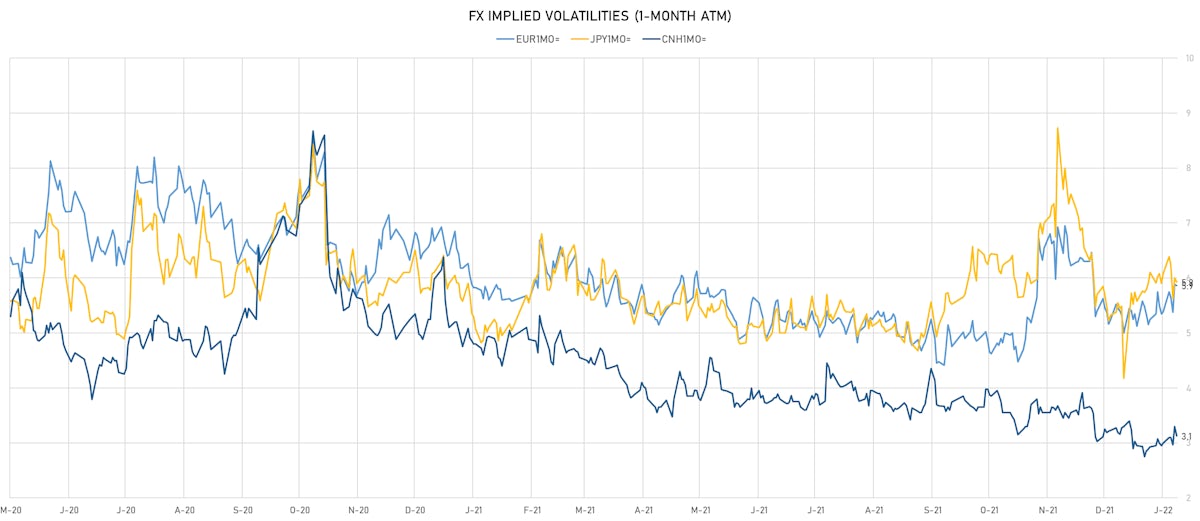

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.62, up 0.01 (YTD: +0.51)

- Euro 1-Month At-The-Money Implied Volatility unchanged at 5.87 (YTD: +0.9)

- Japanese Yen 1M ATM IV currently at 5.93, down -0.1 (YTD: +1.8)

- Offshore Yuan 1M ATM IV currently at 3.13, down -0.2 (YTD: -0.2)

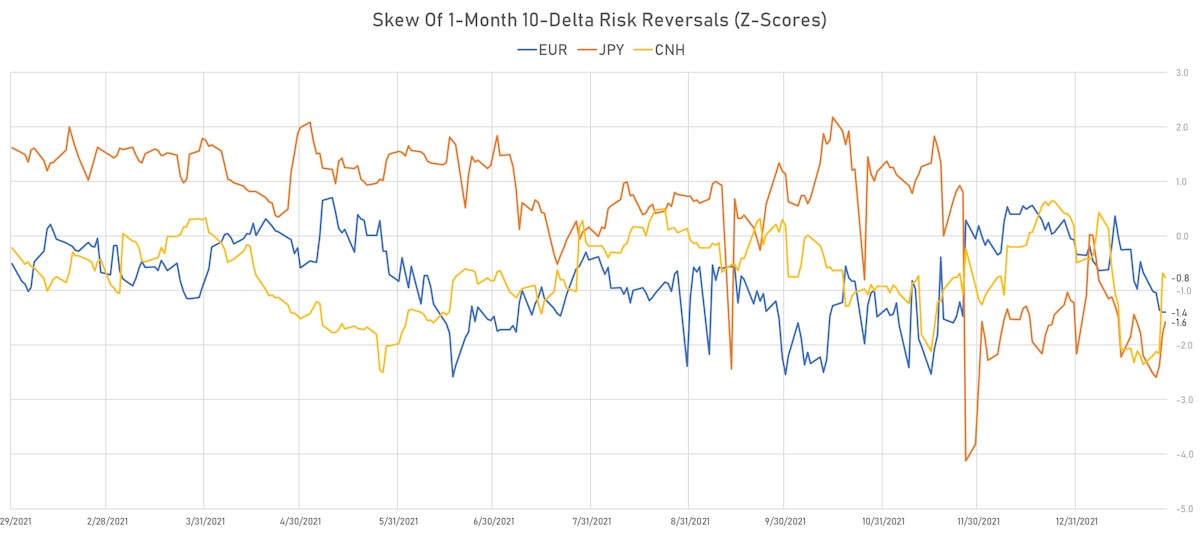

- The skew in EUR 1-Month Implied Volatilities has moved towards to the downside

WEEKLY CFTC NET $ POSITIONING DATA

- All currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: increase in net long US$ positioning

- Brazilian Real: increase in net long US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: reduced their net short US$ positioning

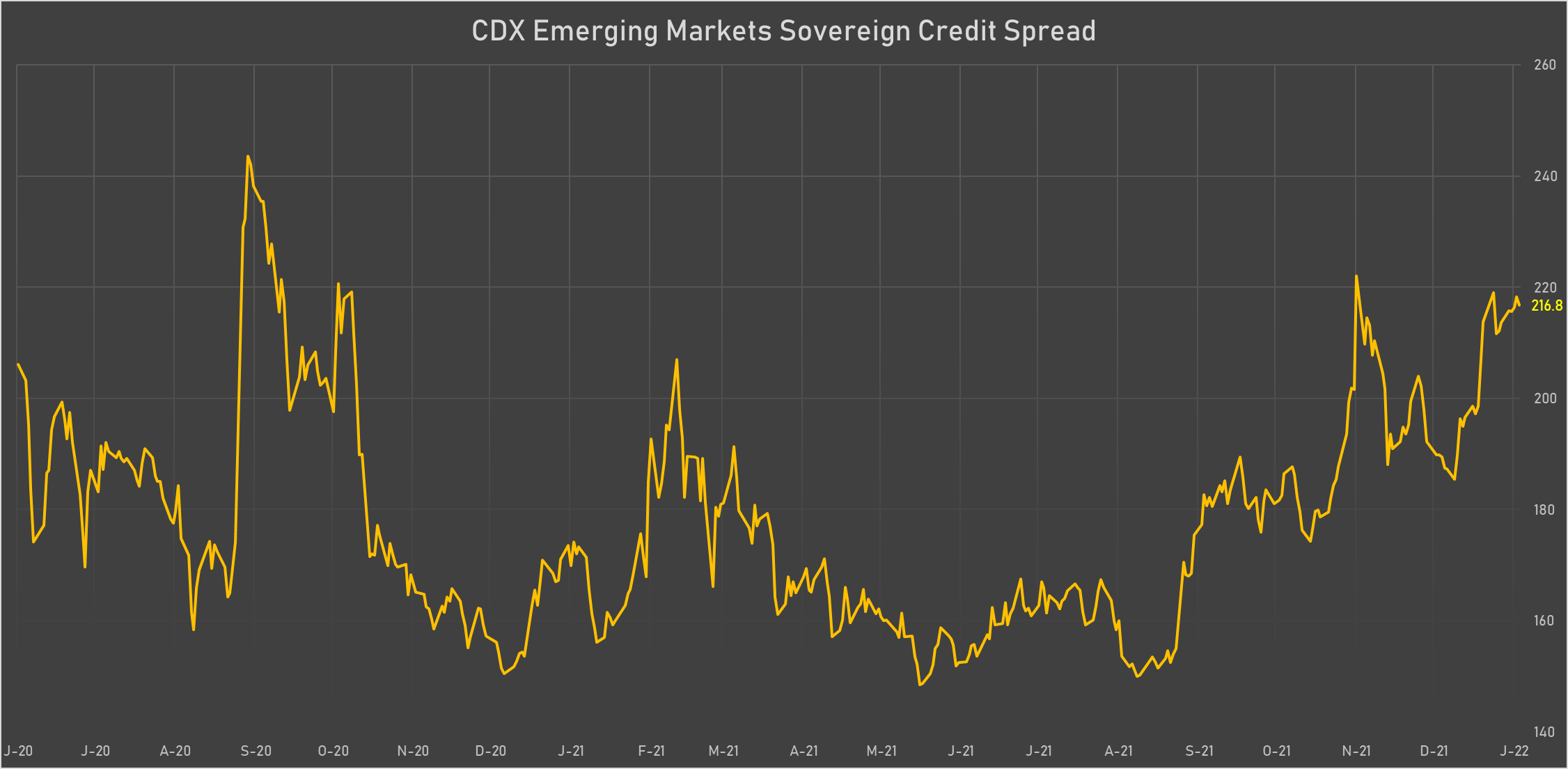

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 400.6 basis points to 3,205 bp (1Y range: 1,227-3,883bp)

- Oman (rated BB-): down 9.3 basis points to 238 bp (1Y range: 223-327bp)

- Saudi Arabia (rated A): up 1.6 basis points to 52 bp (1Y range: 43-71bp)

- Panama (rated WD): up 1.6 basis points to 94 bp (1Y range: 52-103bp)

- Peru (rated BBB): up 1.8 basis points to 83 bp (1Y range: 54-105bp)

- Mexico (rated BBB-): up 2.7 basis points to 105 bp (1Y range: 80-124bp)

- Colombia (rated BB+): up 4.6 basis points to 212 bp (1Y range: 93-227bp)

- South Africa (rated BB-): up 8.9 basis points to 212 bp (1Y range: 178-246bp)

- Turkey (rated BB-): up 12.8 basis points to 535 bp (1Y range: 282-614bp)

- Russia (rated BBB): up 17.2 basis points to 227 bp (1Y range: 75-254bp)

LARGEST FX MOVES TODAY

- Mauritius Rupee up 1.8% (YTD: +0.9%)

- Tunisian Dinar up 1.0% (YTD: -1.3%)

- Mongolia Tugrik up 0.9% (YTD: +0.3%)

- Turkish Lira up 0.8% (YTD: -1.6%)

- Jamaican Dollar up 0.8% (YTD: -1.1%)

- South Africa Rand down 0.8% (YTD: +2.6%)

- Chilean Peso down 1.0% (YTD: +4.8%)

- North Macedonian denar down 1.1% (YTD: -1.6%)

- North Antilles Guilder down 1.2% (YTD: 0.0%)

- Botswana Pula down 1.7% (YTD: 0.0%)

LARGEST FX MOVES THIS WEEK

- Rwanda Franc down 3.0% (YTD: +3.0%)

- Brazilian Real up 2.3% (YTD: +3.8%)

- Botswana Pula down 2.2% (YTD: 0.0%)

- Nicaragua Cordoba down 2.3% (YTD: -2.3%)

- New Zambian kwacha down 2.3% (YTD: -7.5%)

- New Zealand $ down 2.4% (YTD: -4.2%)

- Namibian Dollar down 2.6% (YTD: +1.7%)

- Gambian Dalasi down 2.7% (YTD: -3.7%)

- Eritrean Nakfa down 2.7% (YTD: -2.7%)

- Seychelles rupee up 8.8% (YTD: -7.9%)

YTD BIGGEST WINNERS & LOSERS

- Angolan Kwanza up 5.7%

- Chilean Peso up 4.8%

- Brazilian Real up 3.8%

- Swedish Krona down 4.2%

- Russian Rouble down 4.2%

- New Zealand $ down 4.2%

- Liberian Dollar down 4.9%

- Ukraine Hryvnia down 5.0%

- New Zambian kwacha down 7.5%

- Seychelles rupee down 7.9%