FX

US Dollar Rises Against The Euro And Yen, In Line With Short Rates Differentials

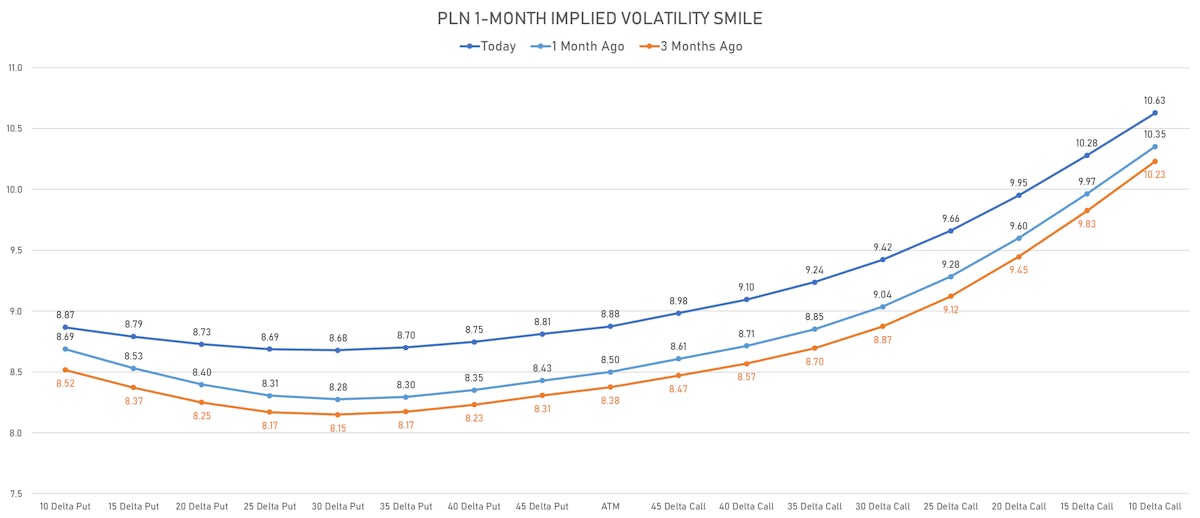

In EM currencies, the shekel weakened 1% today as the bank of Israel sold the currency in the open market, and the Polish zloty was essentially unchanged after a 50bp rate hike widely anticipated by the market

Published ET

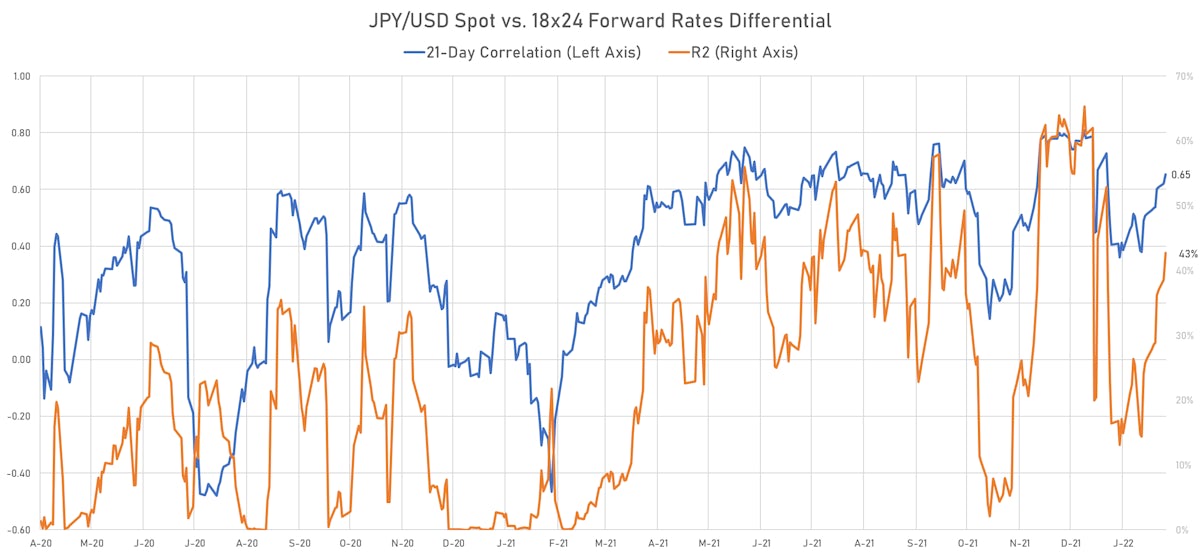

Japanese Yen Spot Rate vs. US-JPY 18x24 Forward Rates Differential | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

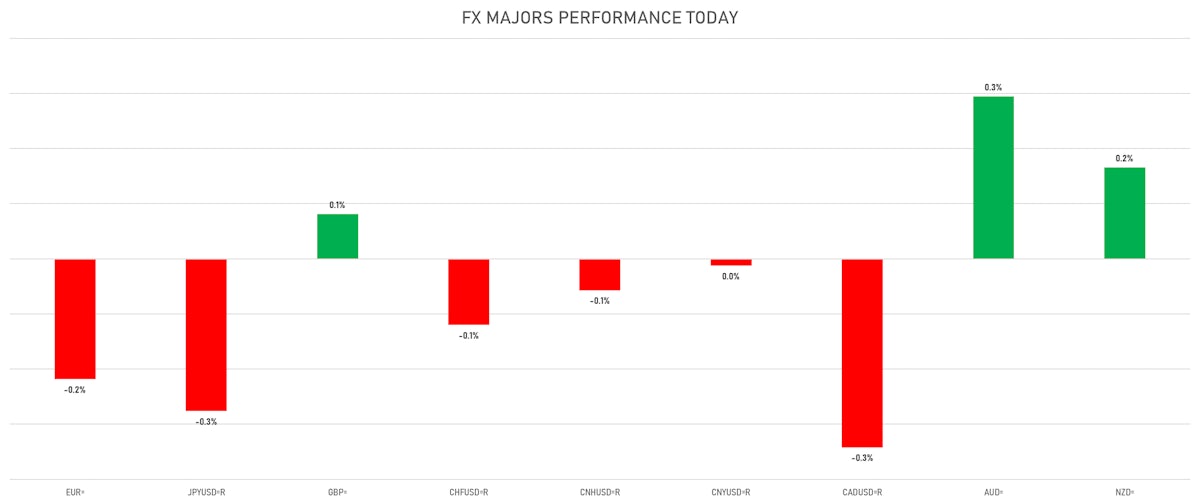

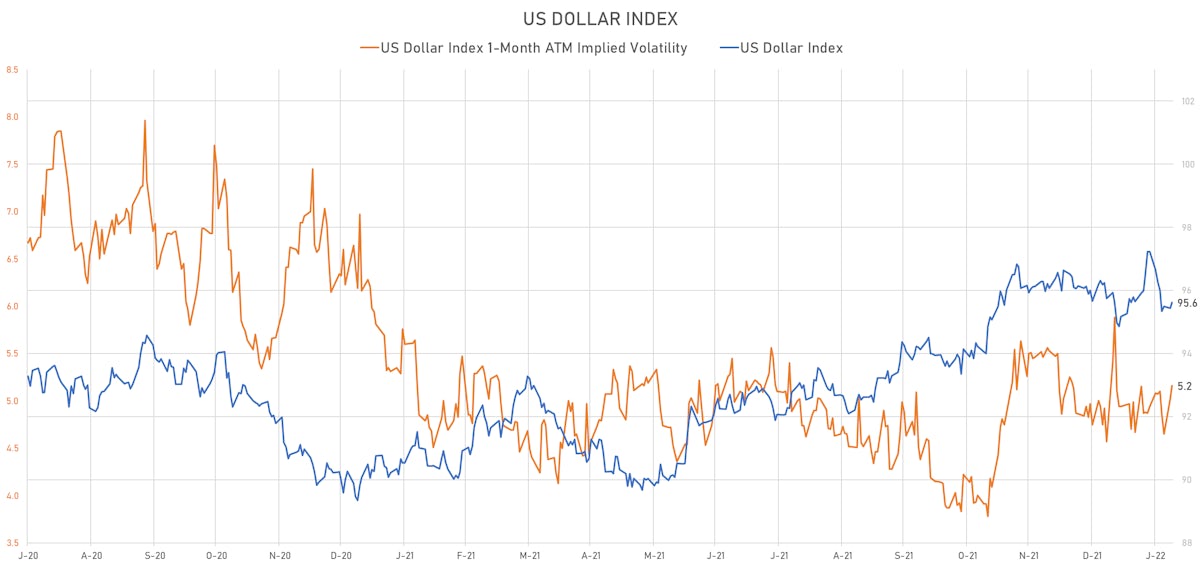

- The US Dollar Index is up 0.21% at 95.63 (YTD: -0.04%)

- Euro down 0.22% at 1.1417 (YTD: +0.4%)

- Yen down 0.28% at 115.45 (YTD: -0.3%)

- Onshore Yuan down 0.01% at 6.3660 (YTD: -0.1%)

- Swiss franc down 0.12% at 0.9249 (YTD: -1.4%)

- Sterling up 0.08% at 1.3545 (YTD: +0.1%)

- Canadian dollar down 0.34% at 1.2711 (YTD: -0.6%)

- Australian dollar up 0.29% at 0.7146 (YTD: -1.6%)

- NZ dollar up 0.17% at 0.6643 (YTD: -2.7%)

MACRO DATA RELEASES

- Argentina, Production, Change Y/Y, Price Index for Dec 2021 (INDEC, Argentina) at 10.10 % (vs 10.10 % prior)

- Canada, Trade Balance, Total, fob for Dec 2021 (CANSIM, Canada) at -0.14 Bln CAD (vs 3.13 Bln CAD prior), below consensus estimate of 2.50 Bln CAD

- Chile, CPI, Change P/P, Price Index for Jan 2022 (INE, Chile) at 1.20 % (vs 0.80 % prior), above consensus estimate of 0.60 %

- Czech Republic, Retail Sales, Retail trade (incl. retail sale of automotive fuel), Change Y/Y for Dec 2021 (CSU, Czech Rep) at 3.30 % (vs 13.20 % prior), below consensus estimate of 7.60 %

- Czech Republic, Unemployment, Rate for Jan 2022 (MPSV, Czech Republic) at 3.60 % (vs 3.50 % prior), below consensus estimate of 3.70 %

- Hong Kong, IHS Markit, Whole Economy, Total for Jan 2022 (Markit Economics) at 48.90 (vs 50.80 prior)

- Hungary, Trade Balance, Preliminary, Current Prices for Dec 2021 (HCSO, Hungary) at 187.00 Mln EUR (vs -76.00 Mln EUR prior), above consensus estimate of -205.00 Mln EUR

- Malaysia, Production, Total industry, Change Y/Y for Dec 2021 (Statistics, Malaysia) at 5.80 % (vs 9.40 % prior), below consensus estimate of 7.10 %

- New Zealand, Reserve Assets, Current Prices for Jan 2022 (RBNZ) at 22,234.00 Mln NZD (vs 23,585.00 Mln NZD prior)

- Poland, Policy Rates, Reference Rate (7-Day NBP Bill Rate) for Feb 2022 (Central Bank, Poland) at 2.75 % (vs 2.25 % prior), 50bp hike in line with consensus

- Slovakia, Trade Balance, Total, FOB, Current Prices for Dec 2021 (Stat Office of SR) at -255.00 Mln EUR (vs -23.10 Mln EUR prior), below consensus estimate of -167.70 Mln EUR

- Spain, Production, Total industry excluding construction, Change Y/Y for Dec 2021 (INE, Spain) at 1.30 % (vs 4.80 % prior), below consensus estimate of 4.40 %

- Sweden, Industrial Production , Change Y/Y for Dec 2021 (SCB, Sweden) at 0.10 % (vs 4.20 % prior)

- Sweden, Industrial Production, Change M/M, Volume Index for Dec 2021 (SCB, Sweden) at -1.20 % (vs 0.50 % prior)

- Sweden, Private Sector Production, Change M/M, Volume Index for Dec 2021 (SCB, Sweden) at 0.60 % (vs 0.50 % prior)

- Sweden, Private Sector Production, Change Y/Y for Dec 2021 (SCB, Sweden) at 7.70 % (vs 6.50 % prior)

- United States, Trade Balance, Total, Goods and services for Dec 2021 (U.S. Census Bureau) at -80.70 Bln USD (vs -80.20 Bln USD prior), above consensus estimate of -83.00 Bln USD

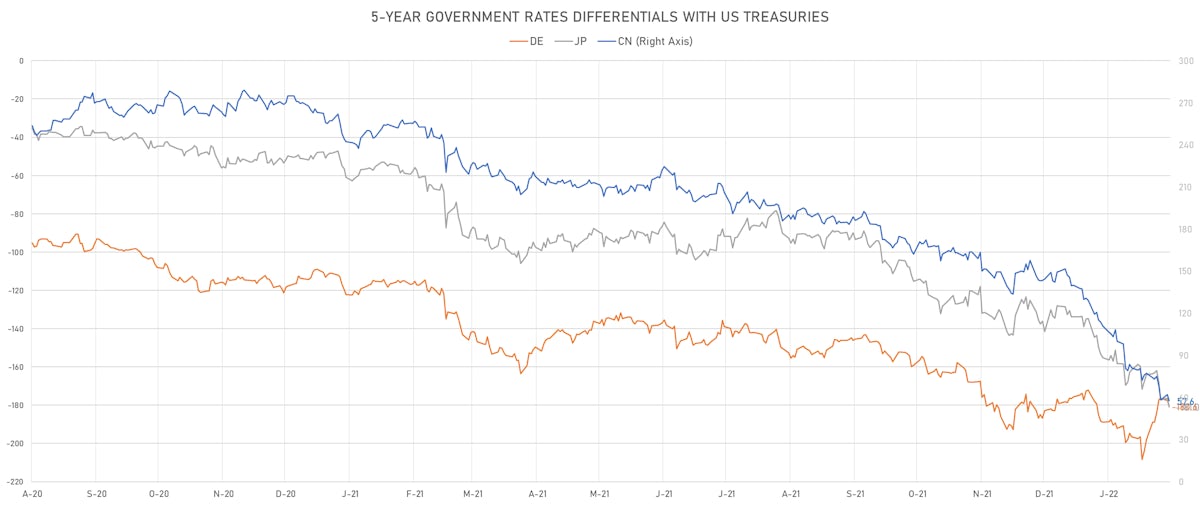

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.1 bp at 178.6 bp (YTD change: +6.5 bp)

- US-JAPAN: +2.5 bp at 178.8 bp (YTD change: +44.1 bp)

- US-CHINA: +0.9 bp at -61.3 bp (YTD change: +67.9 bp)

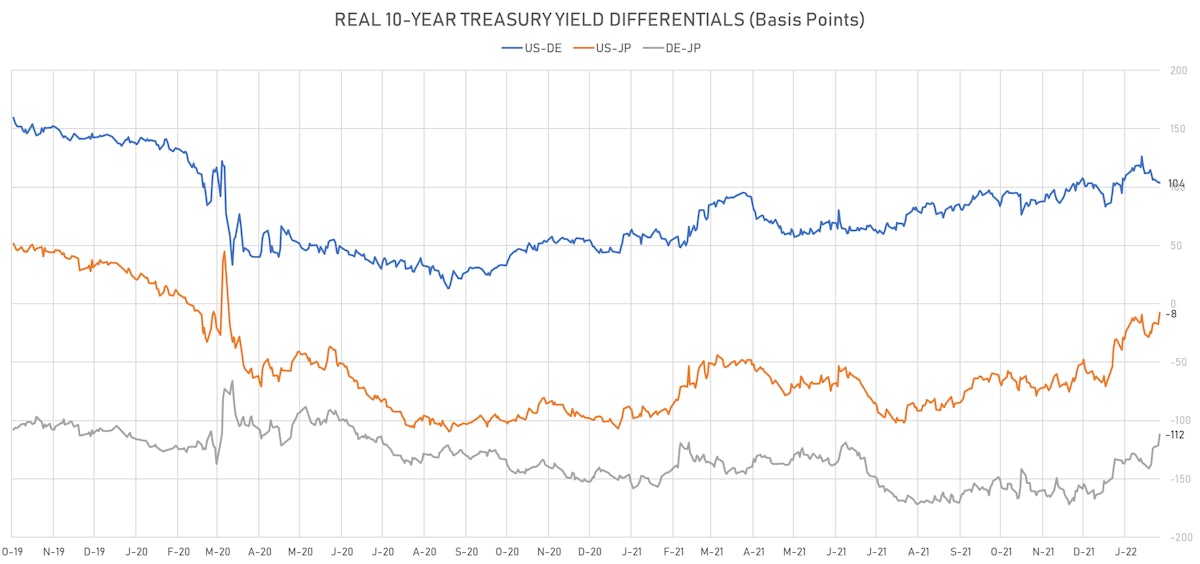

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.4 bp at 103.7 bp (YTD change: +20.5bp)

- US-JAPAN: +9.5 bp at -7.8 bp (YTD change: +63.0bp)

- JAPAN-GERMANY: -9.9 bp at 111.5 bp (YTD change: -42.5bp)

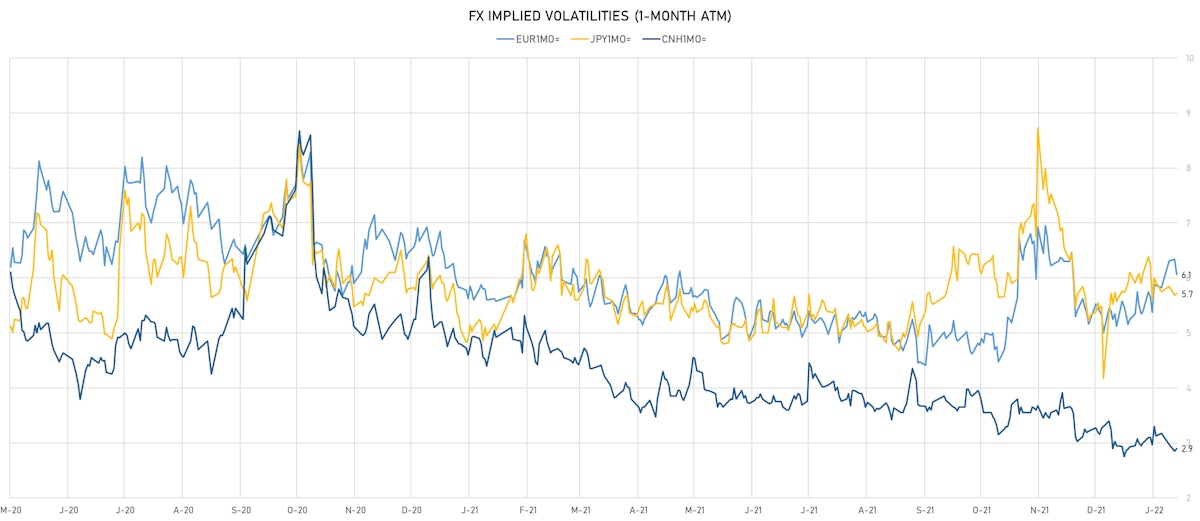

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.96, up 0.01 (YTD: +0.85)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.06, down -0.3 (YTD: +1.1)

- Japanese Yen 1M ATM IV unchanged at 5.71 (YTD: +1.5)

- Offshore Yuan 1M ATM IV unchanged at 2.90 (YTD: -0.4)

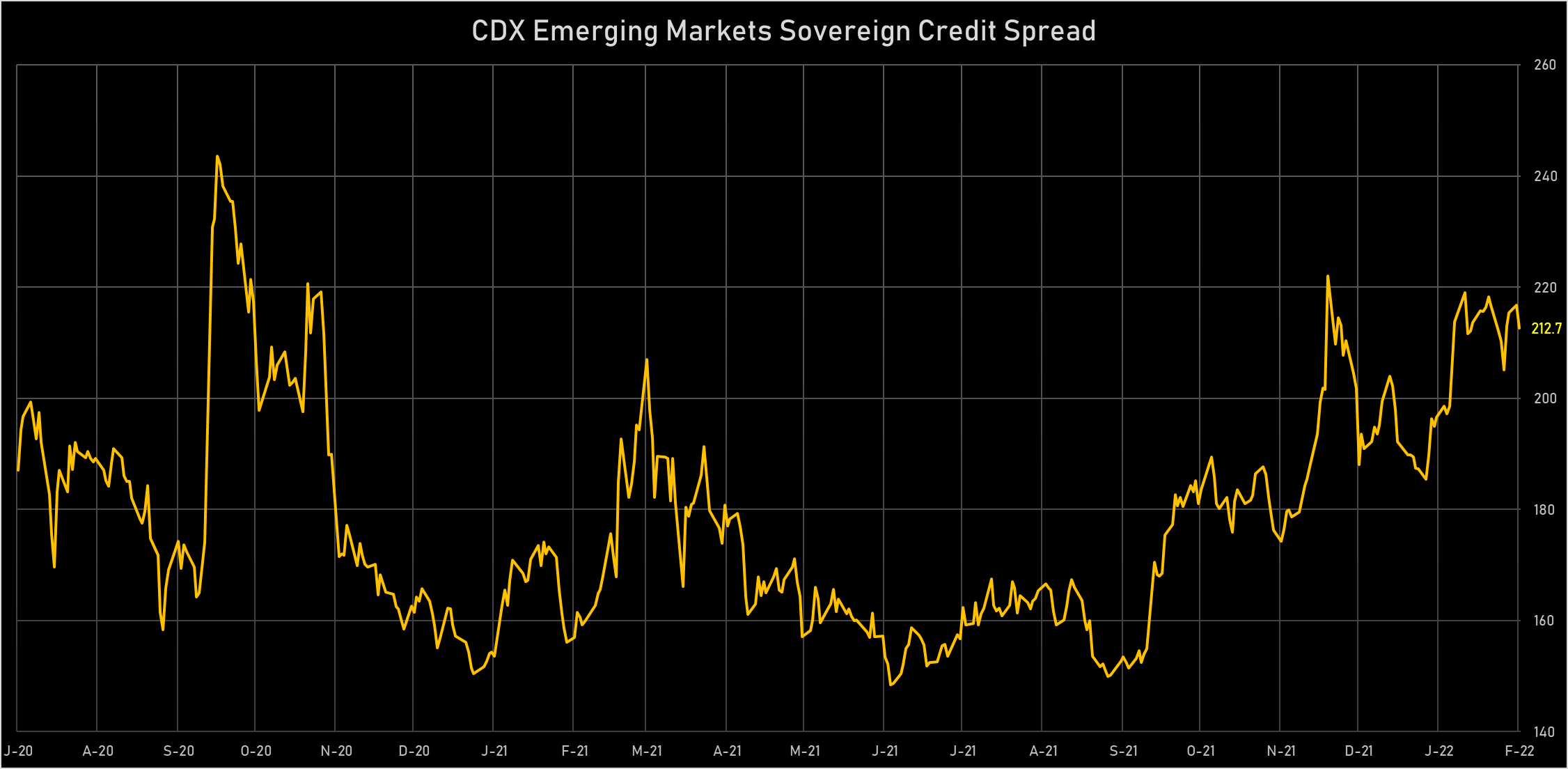

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 38.1 basis points to 3,103 bp (1Y range: 1,227-3,883bp)

- Russia (rated BBB): down 6.9 basis points to 190 bp (1Y range: 75-254bp)

- South Africa (rated BB-): down 4.1 basis points to 212 bp (1Y range: 178-246bp)

- Oman (rated BB-): down 3.5 basis points to 230 bp (1Y range: 223-313bp)

- Vietnam (rated BB): down 1.3 basis points to 113 bp (1Y range: 89-114bp)

- Panama (rated WD): down 1.2 basis points to 91 bp (1Y range: 55-103bp)

- Qatar (rated AA-): down 1.1 basis points to 51 bp (1Y range: 37-52bp)

- Malaysia (rated BBB+): down 0.8 basis points to 63 bp (1Y range: 36-65bp)

- China (rated A+): down 0.7 basis points to 52 bp (1Y range: 28-58bp)

- Saudi Arabia (rated A): down 0.6 basis points to 52 bp (1Y range: 43-71bp)

LARGEST FX MOVES TODAY

- CFA Franc BEAC up 1.6% (YTD: +1.4%)

- South Africa Rand up 1.0% (YTD: +4.2%)

- Guinea Franc up 0.9% (YTD: +1.9%)

- Norwegian Krone down 0.7% (YTD: -0.2%)

- Israeli Shekel down 0.7% (YTD: -3.2%)

- Congo Franc down 1.0% (YTD: -0.2%)

- Ghanaian Cedi down 1.5% (YTD: -4.3%)

YTD BIGGEST WINNERS & LOSERS

- Afghani up 11.0%

- Georgian Lari up 6.7%

- Angolan Kwanza up 6.5%

- Brazilian Real up 5.9%

- Hungarian Forint up 4.8%

- Iceland Krona up 4.2%

- Ghanaian Cedi down 4.3%

- Liberian Dollar down 5.4%

- Seychelles rupee down 9.3%

- New Zambian kwacha down 9.7%