FX

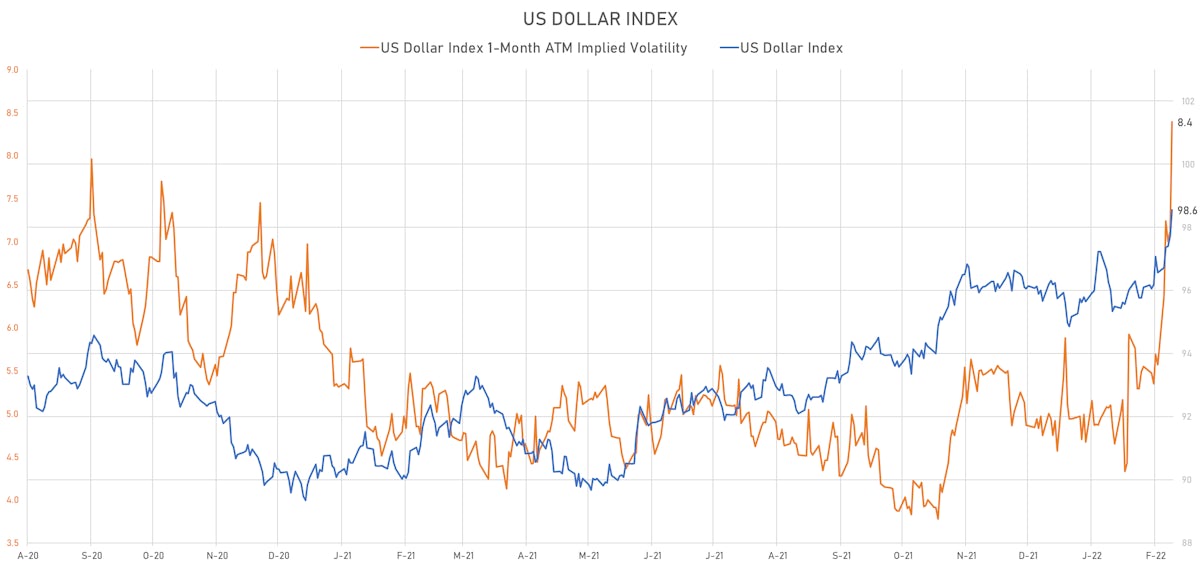

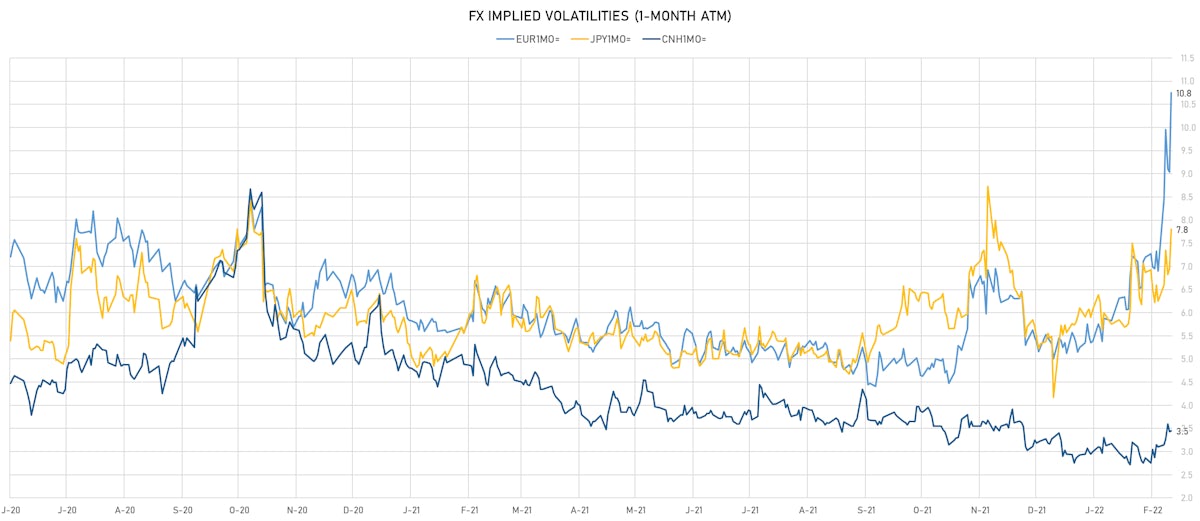

Extreme Moves In Implied Volatilities, Particularly In Downside Euro Protection As Spot Price Falls Below 1.10

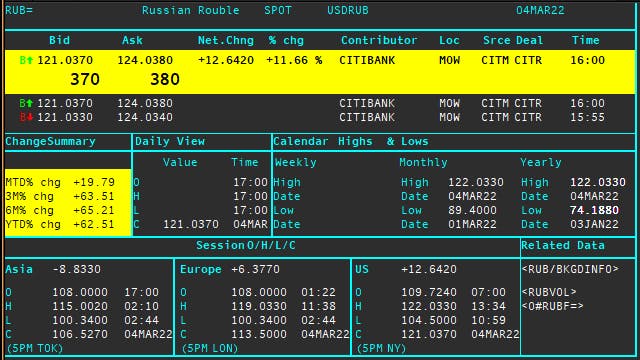

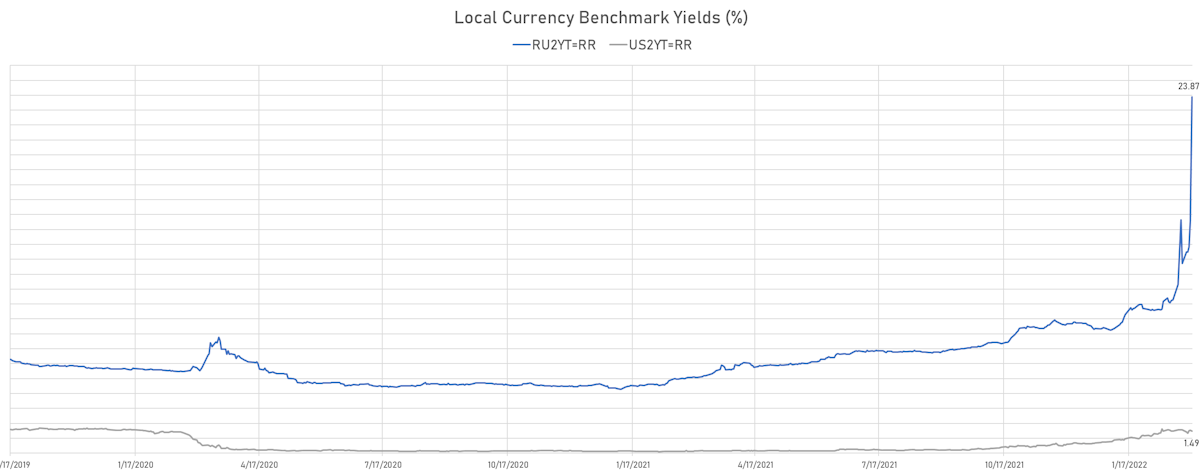

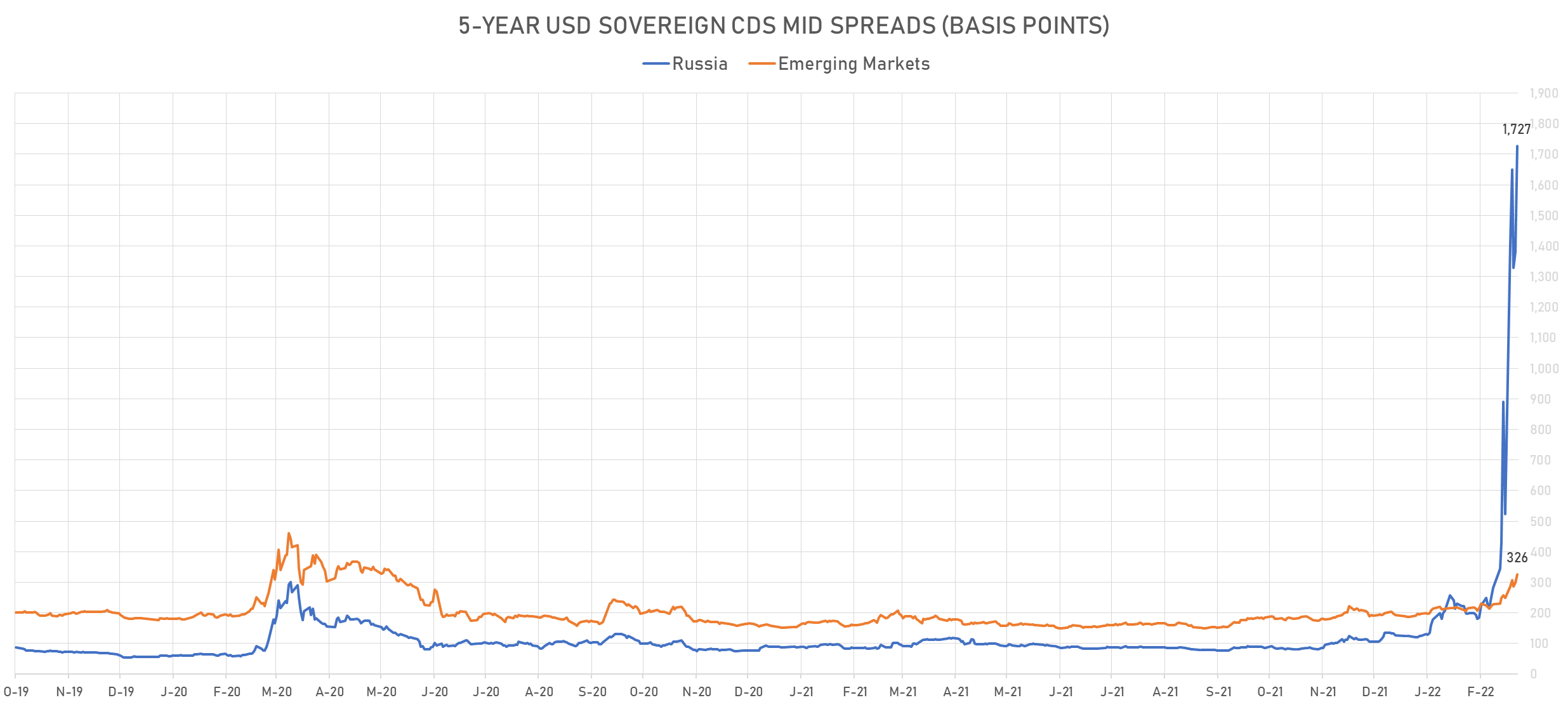

The Rouble ended the week down another 10% against the US Dollar, with the possibility of additional sanctions against Russia weighing enormously on its government debt and the cost of default protection

Published ET

US Treasury 2-Year vs Russian Government 2Y Yield (local currency) | Sources: ϕpost, Refinitiv data

DAILY SUMMARY

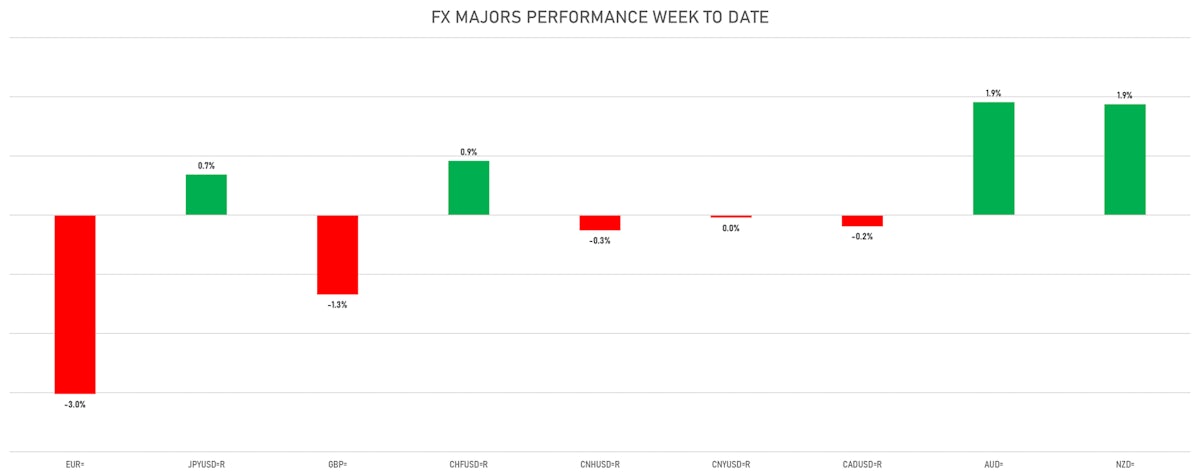

- The US Dollar Index is up 0.84% at 98.55 (YTD: +3.02%)

- Euro down 1.25% at 1.0926 (YTD: -3.9%)

- Yen up 0.58% at 114.78 (YTD: +0.3%)

- Onshore Yuan down 0.01% at 6.3188 (YTD: +0.6%)

- Swiss franc up 0.06% at 0.9165 (YTD: -0.5%)

- Sterling down 0.91% at 1.3225 (YTD: -2.2%)

- Canadian dollar down 0.41% at 1.2730 (YTD: -0.8%)

- Australian dollar up 0.56% at 0.7370 (YTD: +1.5%)

- NZ dollar up 0.88% at 0.6860 (YTD: +0.5%)

MACRO DATA RELEASES

- Brazil, CPI, Sao Paulo, General, Change P/P for Feb 2022 (FIPE, Brazil) at 0.90 % (vs 0.74 % prior)

- Canada, Building Permits, Total residential and non-residential, Change P/P for Jan 2022 (CANSIM, Canada) at -8.80 % (vs -1.90 % prior), below consensus estimate of 2.00 %

- Canada, PMI, Composite for Feb 2022 (Richard Ivey) at 62.20 (vs 57.40 prior)

- Canada, PMI, Composite for Feb 2022 (Richard Ivey) at 60.60 (vs 50.70 prior)

- Euro Zone, Retail Sales, Turnover, (EA19), Change Y/Y for Jan 2022 (Eurostat) at 7.80 % (vs 2.00 % prior), below consensus estimate of 9.10 %

- Euro Zone, Retail Sales, Turnover, Retail trade, except of motor vehicles and motorcycles, Deflated turnover (EA19), Change P/P for Jan 2022 (Eurostat) at 0.20 % (vs -3.00 % prior), below consensus estimate of 1.30 %

- France, Production, Industry excluding construction, Change P/P for Jan 2022 (INSEE, France) at 1.60 % (vs -0.20 % prior), above consensus estimate of 0.50 %

- Germany, Exports, Change P/P for Jan 2022 (Deutsche Bundesbank) at -2.80 % (vs 0.90 % prior), below consensus estimate of 1.00 %

- Germany, Imports, Change P/P for Jan 2022 (Deutsche Bundesbank) at -4.20 % (vs 4.70 % prior), below consensus estimate of 2.00 %

- Germany, Trade Balance for Jan 2022 (Deutsche Bundesbank) at 9.40 Bln EUR (vs 6.80 Bln EUR prior), above consensus estimate of 6.10 Bln EUR

- India, IHS Markit, PMI, Services Sector, Business Activity for Feb 2022 (Markit Economics) at 51.80 (vs 51.50 prior), below consensus estimate of 53.00

- Philippines, CPI, Change P/P for Feb 2022 (PSA) at 0.10 % (vs 1.00 % prior), below consensus estimate of 0.22 %

- Philippines, CPI, Total, inflation rate, Change Y/Y for Feb 2022 (PSA) at 3.00 % (vs 3.00 % prior), below consensus estimate of 3.20 %

- Thailand, CPI, Change Y/Y, Price Index for Feb 2022 (BTEI, Thailand) at 5.28 % (vs 3.23 % prior), above consensus estimate of 4.05 %

- Thailand, CPI, Core CPI, Change Y/Y, Price Index for Feb 2022 (BTEI, Thailand) at 1.80 % (vs 0.52 % prior), above consensus estimate of 0.62 %

- United Kingdom, PMI, CIPS/Markit PMI: Construction - All Activity for Feb 2022 (CIPS/Markit) at 59.10 (vs 56.30 prior), above consensus estimate of 56.30

- United States, Earnings, Average Hourly, Nonfarm payrolls, all employees, total private, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at 0.00 % (vs 0.70 % prior), below consensus estimate of 0.50 %

- United States, Employment, Nonfarm payroll, total private, Absolute change for Feb 2022 (BLS, U.S Dep. Of Lab) at 654.00 k (vs 444.00 k prior), above consensus estimate of 378.00 k

- United States, Employment, Nonfarm payroll, total, Absolute change for Feb 2022 (BLS, U.S Dep. Of Lab) at 678.00 k (vs 467.00 k prior), above consensus estimate of 400.00 k

- United States, Hours Worked, Average Per Week, Nonfarm payrolls, all employees, total private for Feb 2022 (BLS, U.S Dep. Of Lab) at 34.70 hrs (vs 34.50 hrs prior), above consensus estimate of 34.60 hrs

- United States, Unemployment, Rate for Feb 2022 (BLS, U.S Dep. Of Lab) at 3.80 % (vs 4.00 % prior), below consensus estimate of 3.90 %

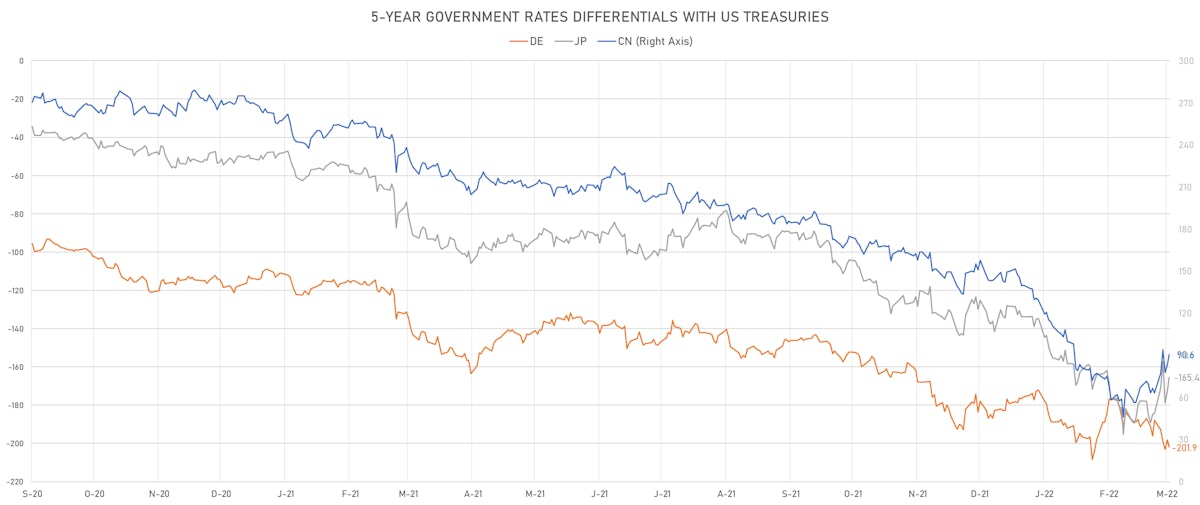

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.8 bp at 201.9 bp (YTD change: +29.8 bp)

- US-JAPAN: -7.2 bp at 165.4 bp (YTD change: +30.7 bp)

- US-CHINA: -7.2 bp at -90.6 bp (YTD change: +38.6 bp)

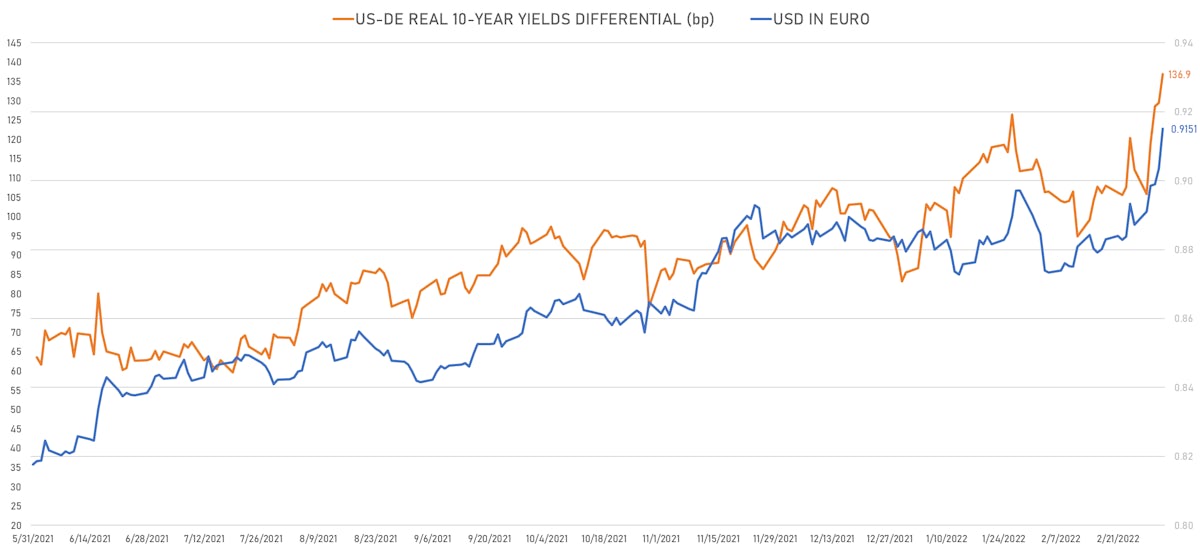

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +7.5 bp at 136.9 bp (YTD change: +53.7bp)

- US-JAPAN: -10.5 bp at -36.9 bp (YTD change: +33.9bp)

- JAPAN-GERMANY: +18.0 bp at 173.8 bp (YTD change: +19.8bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.85, up 0.57 (YTD: +2.74)

- Euro 1-Month At-The-Money Implied Volatility currently at 10.75, up 1.7 (YTD: +5.8)

- Japanese Yen 1M ATM IV currently at 7.80, up 0.9 (YTD: +3.6)

- Offshore Yuan 1M ATM IV unchanged at 3.45 (YTD: +0.2)

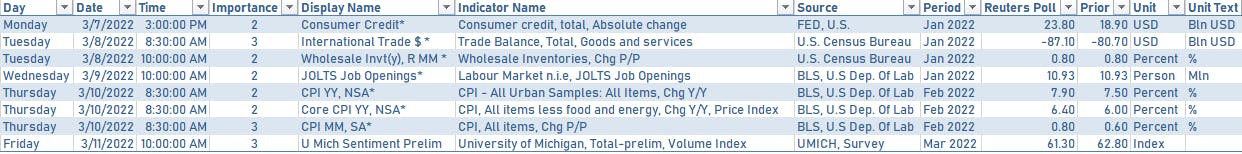

US MACRO DATA IN THE WEEK AHEAD

WEEKLY CFTC NET POSITIONING DATA

- All currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: increase in net long US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: increase in net short US$ positioning

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Russia (rated B+): up 203.8 % to 1,635 bp (1Y range: 75-1,635bp)

- Egypt (rated B+): up 62.6 % to 837 bp (1Y range: 283-837bp)

- Turkey (rated B+): up 17.7 % to 659 bp (1Y range: 305-659bp)

- South Africa (rated BB-): up 10.2 % to 236 bp (1Y range: 178-246bp)

- Chile (rated A-): up 6.6 % to 84 bp (1Y range: 48-95bp)

- Vietnam (rated BB): up 4.8 % to 132 bp (1Y range: 89-132bp)

- Philippines (rated BBB): up 7.6 % to 97 bp (1Y range: 39-97bp)

- Indonesia (rated BBB): up 6.1 % to 114 bp (1Y range: 66-114bp)

- Peru (rated BBB): up 4.7 % to 93 bp (1Y range: 68-105bp)

- Malaysia (rated BBB+): up 4.5 % to 75 bp (1Y range: 38-75bp)

LARGEST FX MOVES THIS WEEK

- Angolan Kwanza up 4.4% (YTD: +17.0%)

- Swedish Krona down 3.9% (YTD: -8.4%)

- Iceland Krona down 4.1% (YTD: -1.5%)

- Armenian Dram down 4.2% (YTD: -4.6%)

- Czech Koruna down 4.4% (YTD: -6.9%)

- Albanian Lek down 4.5% (YTD: -6.4%)

- Ghanaian Cedi down 4.9% (YTD: -12.3%)

- Polish Zloty down 6.4% (YTD: -9.9%)

- Hungarian Forint down 6.6% (YTD: -8.4%)

- Russian Rouble down 10.5% (YTD: -39.5%)