FX

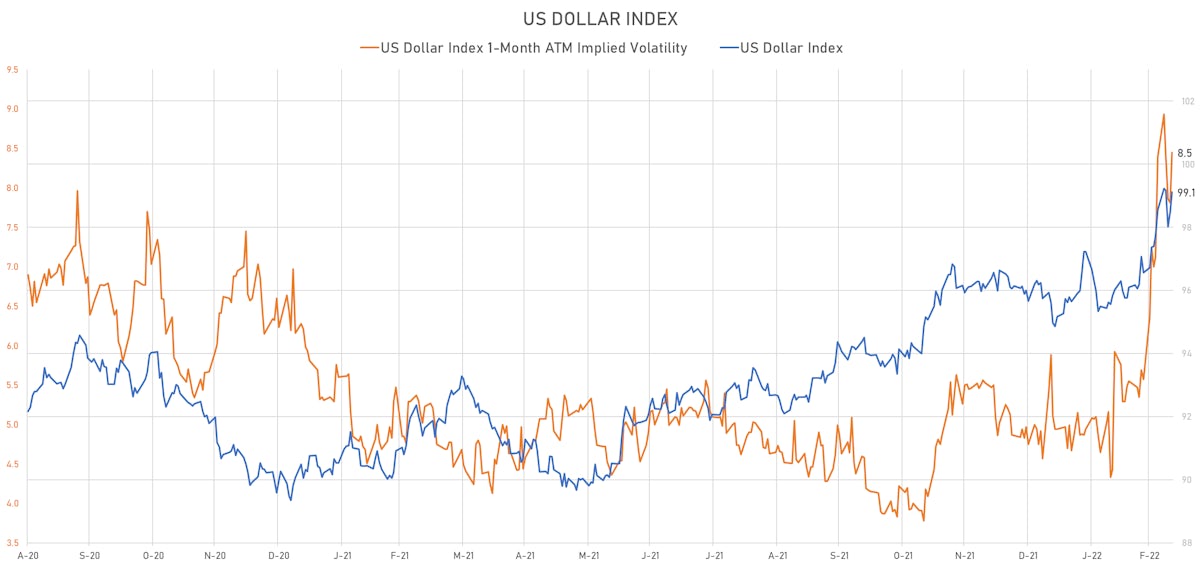

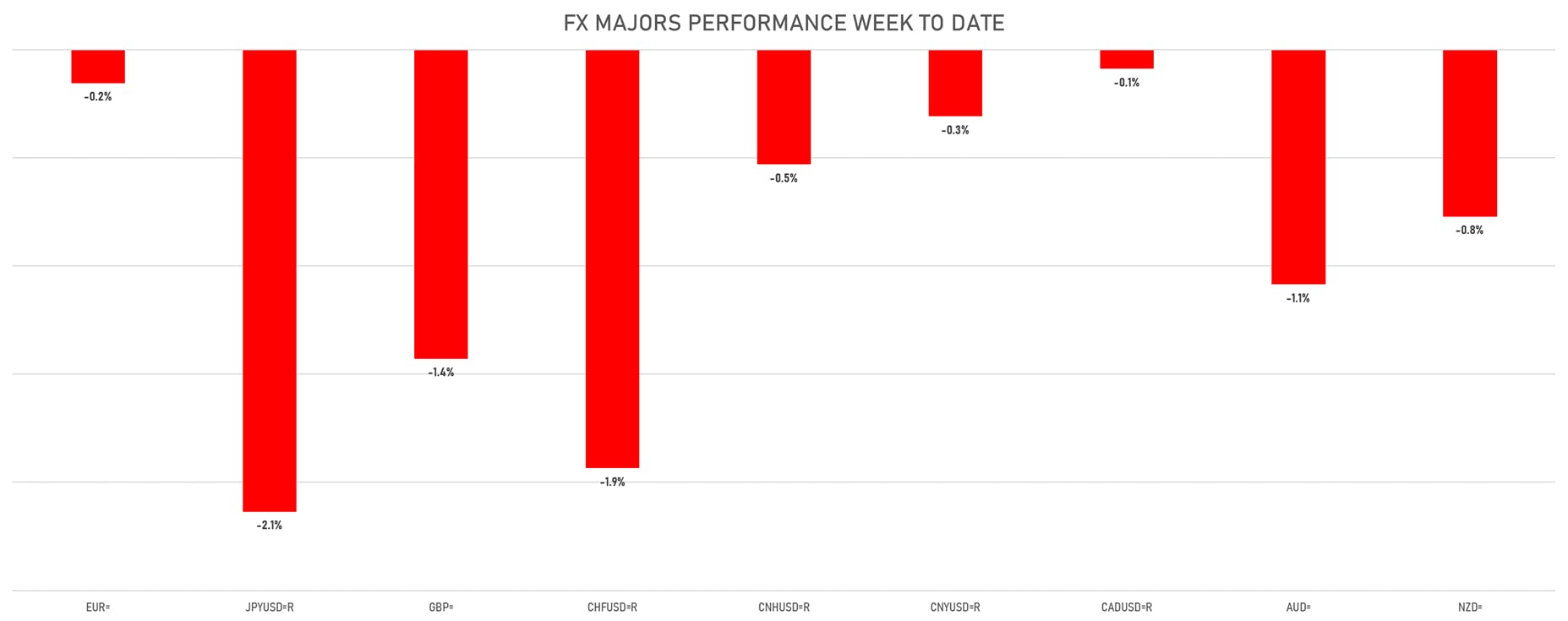

US Dollar Index Ends Volatile Week Modestly Higher, With Both JPY And CHF Falling Close To 2%

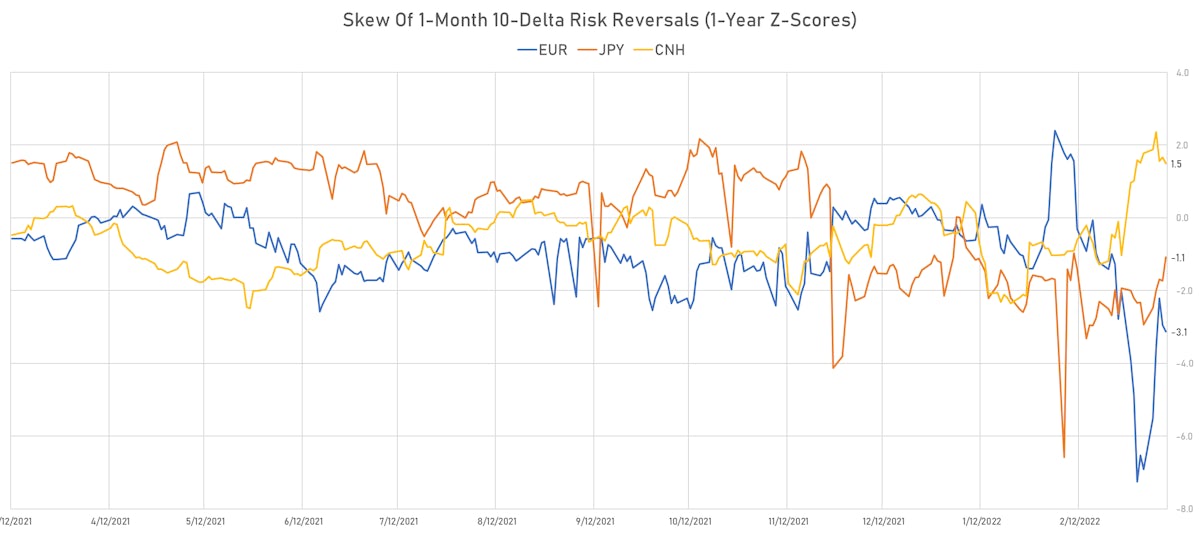

The euro area is obviously more directly affected to the Ukrainian invasion than the US, and the volatility of the single currency has jumped in the past couple of weeks, although the brutal hedging moves into low-delta / high-gamma puts have started to recede

Published ET

QUICK SUMMARY

- The US Dollar Index is up 0.64% at 99.12 (YTD: +3.61%)

- Euro down 0.67% at 1.0909 (YTD: -4.0%)

- Yen down 1.00% at 117.28 (YTD: -1.9%)

- Onshore Yuan down 0.29% at 6.3389 (YTD: +0.3%)

- Swiss franc down 0.49% at 0.9346 (YTD: -2.4%)

- Sterling down 0.36% at 1.3036 (YTD: -3.6%)

- Canadian dollar up 0.22% at 1.2743 (YTD: -0.8%)

- Australian dollar down 0.91% at 0.7290 (YTD: +0.4%)

- NZ dollar down 0.80% at 0.6807 (YTD: -0.2%)

MACRO DATA RELEASES

- Brazil, CPI, Broad national index (IPCA), Change P/P for Feb 2022 (IBGE, Brazil) at 1.01 % (vs 0.54 % prior), above consensus estimate of 0.95 %

- Brazil, CPI, Broad national index (IPCA), Change Y/Y for Feb 2022 (IBGE, Brazil) at 10.54 % (vs 10.38 % prior), above consensus estimate of 10.50 %

- Canada, Employment, Absolute change for Feb 2022 (CANSIM, Canada) at 336.60 k (vs -200.10 k prior), above consensus estimate of 160.00 k

- Canada, Unemployment, Rate for Feb 2022 (CANSIM, Canada) at 5.50 % (vs 6.50 % prior), below consensus estimate of 6.20 %

- China (Mainland), Monetary Financial Institutions, Social Financing, Current Prices for Feb 2022 (PBC) at 1,190.00 Bn CNY (vs 6,170.00 Bn CNY prior), below consensus estimate of 2,215.00 Bn CNY

- China (Mainland), Monetary Financial Institutions, Uses of Funds, Loans, Change Y/Y for Feb 2022 (PBC) at 11.40 % (vs 11.50 % prior), below consensus estimate of 11.50 %

- China (Mainland), Monetary Financial Institutions, Uses of Funds, New loans, Current Prices for Feb 2022 (PBC) at 1,230.00 Bln CNY (vs 3,980.00 Bln CNY prior), below consensus estimate of 1,485.00 Bln CNY

- China (Mainland), Money supply M2, Change Y/Y for Feb 2022 (PBC) at 9.20 % (vs 9.80 % prior), below consensus estimate of 9.50 %

- Czech Republic, Production, Change Y/Y for Jan 2022 (CSU, Czech Rep) at 1.00 % (vs -2.10 % prior), above consensus estimate of -0.40 %

- Germany, CPI, Final, Change P/P, Price Index for Feb 2022 (Destatis) at 0.90 % (vs 0.90 % prior), in line with consensus

- Germany, CPI, Final, Change Y/Y, Price Index for Feb 2022 (Destatis) at 5.10 % (vs 5.10 % prior), in line with consensus

- Germany, HICP, Final, Change P/P, Price Index for Feb 2022 (Destatis) at 0.90 % (vs 0.90 % prior), in line with consensus

- Germany, HICP, Final, Change Y/Y, Price Index for Feb 2022 (Destatis) at 5.50 % (vs 5.50 % prior), in line with consensus

- Hungary, Trade Balance, Preliminary, Current Prices for Jan 2022 (HCSO, Hungary) at -196.00 Mln EUR (vs -378.00 Mln EUR prior), below consensus estimate of 246.00 Mln EUR

- India, Production, Change Y/Y, Volume Index for Jan 2022 (MOSPI, India) at 1.30 % (vs 0.40 % prior), below consensus estimate of 1.50 %

- Malaysia, Production, Total industry, Change Y/Y for Jan 2022 (Statistics, Malaysia) at 4.30 % (vs 5.80 % prior), below consensus estimate of 5.20 %

- Mexico, Production, Total industry, Change P/P for Jan 2022 (INEGI, Mexico) at 1.00 % (vs 1.20 % prior), above consensus estimate of -0.40 %

- Mexico, Production, Total industry, Change Y/Y for Jan 2022 (INEGI, Mexico) at 4.30 % (vs 3.00 % prior), above consensus estimate of 2.40 %

- Slovakia, Trade Balance, Total, FOB, Current Prices for Jan 2022 (Stat Office of SR) at -400.50 Mln EUR (vs -255.00 Mln EUR prior), below consensus estimate of -81.30 Mln EUR

- Spain, CPI, All Items, Change Y/Y, Price Index for Feb 2022 (INE, Spain) at 7.60 % (vs 7.40 % prior), above consensus estimate of 7.40 %

- Spain, CPI, All Items, Total, Final, Change P/P, Price Index for Feb 2022 (INE, Spain) at 0.80 % (vs 0.60 % prior), above consensus estimate of 0.60 %

- Spain, HICP, Total, Final, Change P/P, Price Index for Feb 2022 (INE, Spain) at 0.80 % (vs 0.70 % prior), above consensus estimate of 0.70 %

- Spain, HICP, Total, Final, Change Y/Y, Price Index for Feb 2022 (INE, Spain) at 7.60 % (vs 7.50 % prior), above consensus estimate of 7.50 %

- Turkey, Current Account, Balance, Current Prices for Jan 2022 (Central Bank, Turkey) at -7.11 Bln USD (vs -3.84 Bln USD prior), above consensus estimate of -7.25 Bln USD

- United Kingdom, GDP Estimated YY, Change Y/Y for Jan 2022 (ONS, United Kingdom) at 10.00 % (vs 6.00 % prior), above consensus estimate of 9.30 %

- United Kingdom, GDP Estimated, Change M/M for Jan 2022 (ONS, United Kingdom) at 0.80 % (vs -0.20 % prior), above consensus estimate of 0.20 %

- United Kingdom, GDP estimate 3m/3m for Jan 2022 (ONS, United Kingdom) at 1.10 % (vs 1.00 % prior), above consensus estimate of 0.80 %

- United Kingdom, Production, Manufacturing, Change P/P for Jan 2022 (ONS, United Kingdom) at 0.80 % (vs 0.20 % prior), above consensus estimate of 0.20 %

- United Kingdom, Production, Manufacturing, Change Y/Y for Jan 2022 (ONS, United Kingdom) at 3.60 % (vs 1.30 % prior), above consensus estimate of 3.10 %

- United Kingdom, Production, Total, excluding construction, Change P/P for Jan 2022 (ONS, United Kingdom) at 0.70 % (vs 0.30 % prior), above consensus estimate of 0.10 %

- United Kingdom, Production, Total, excluding construction, Change Y/Y for Jan 2022 (ONS, United Kingdom) at 2.30 % (vs 0.40 % prior), above consensus estimate of 1.90 %

- United Kingdom, Trade Balance, Goods for Jan 2022 (ONS, United Kingdom) at -26.50 Bln GBP (vs -12.53 Bln GBP prior), below consensus estimate of -12.60 Bln GBP

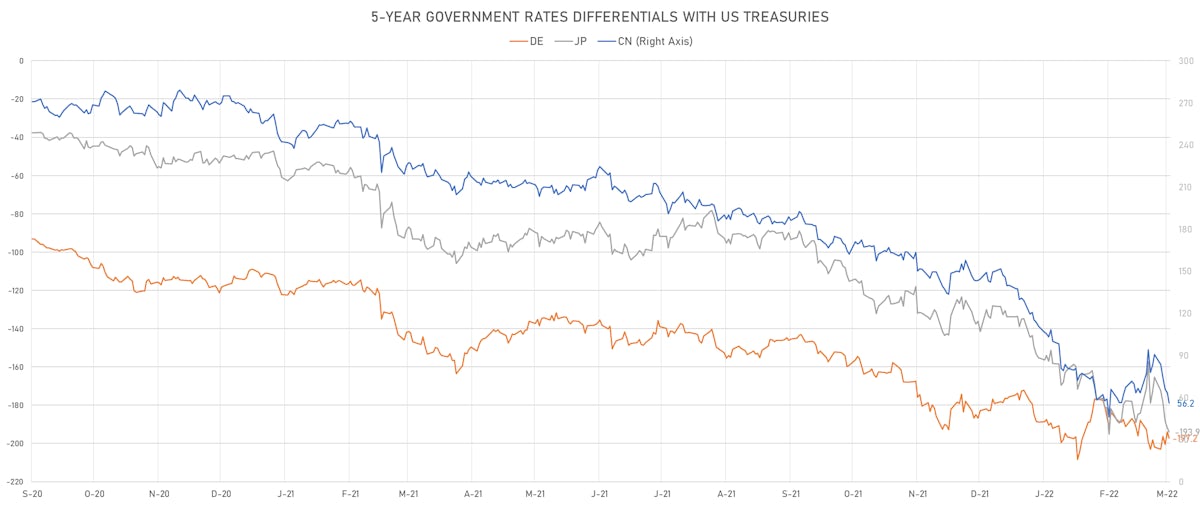

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.3 bp at 197.2 bp (YTD change: +25.1 bp)

- US-JAPAN: +2.1 bp at 193.9 bp (YTD change: +59.2 bp)

- US-CHINA: +7.0 bp at -56.2 bp (YTD change: +73.0 bp)

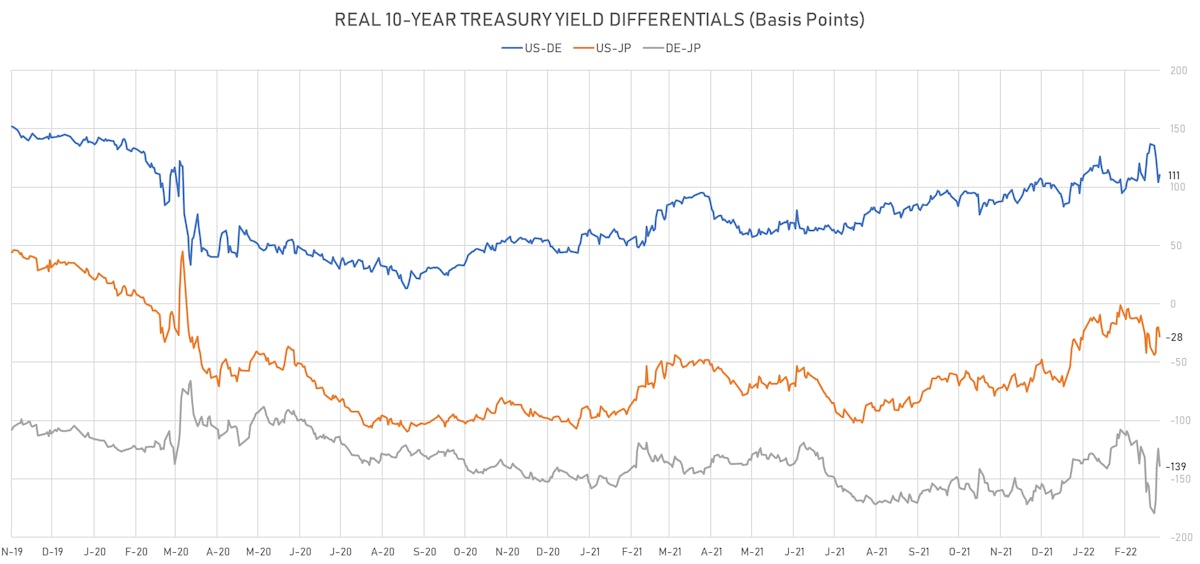

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +6.4 bp at 110.7 bp (YTD change: +27.5bp)

- US-JAPAN: -8.3 bp at -28.1 bp (YTD change: +42.7bp)

- JAPAN-GERMANY: +14.7 bp at 138.8 bp (YTD change: -15.2bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.78, down -0.31 (YTD: +2.67)

- Euro 1-Month At-The-Money Implied Volatility currently at 10.73, up 0.5 (YTD: +5.7)

- Japanese Yen 1M ATM IV currently at 6.89, up 0.3 (YTD: +2.7)

- Offshore Yuan 1M ATM IV currently at 3.55, up 0.4 (YTD: +0.3)

WEEKLY CFTC DATA

- All currencies: increase in net long US$ positioning

- G10: increase in net long US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: reduction in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: reduction in net long US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: reduced their net short US$ positioning

- Mexican Peso: increase in net short US$ positioning

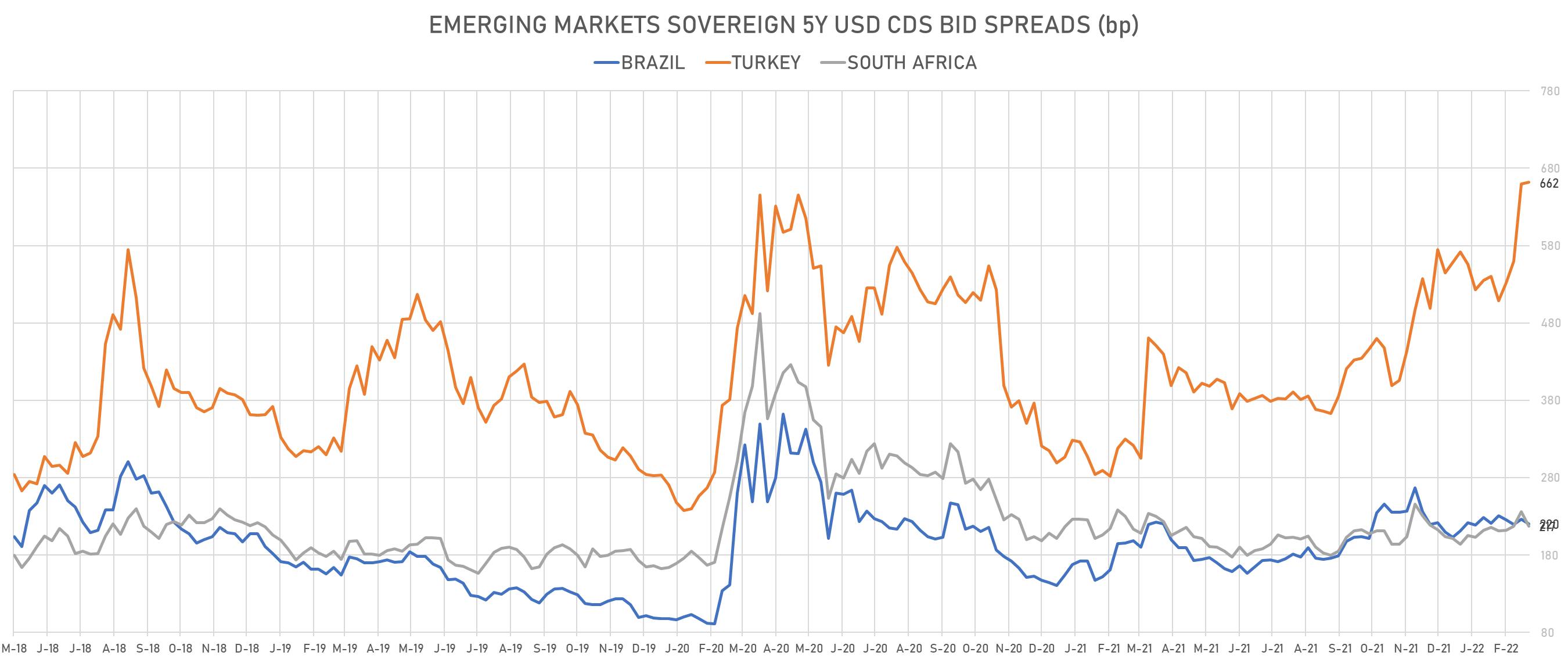

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Colombia (rated BB+): down 4.6 % to 212 bp (1Y range: 105-228bp)

- Malaysia (rated BBB+): down 8.3 % to 68 bp (1Y range: 38-82bp)

- Qatar (rated AA-): down 4.7 % to 51 bp (1Y range: 37-55bp)

- Mexico (rated BBB-): down 3.9 % to 109 bp (1Y range: 81-124bp)

- Chile (rated A-): down 6.2 % to 78 bp (1Y range: 48-95bp)

- Peru (rated BBB): down 6.8 % to 86 bp (1Y range: 68-105bp)

- Panama (rated WD): down 5.7 % to 88 bp (1Y range: 64-103bp)

- South Africa (rated BB-): down 7.9 % to 217 bp (1Y range: 178-246bp)

- Argentina (rated CCC): down 8.0 % to 3,068 bp (1Y range: 1,362-3,883bp)

- Russia (rated C): up 110.1 % to 3,149 bp (1Y range: 75-3,331bp)

LARGEST FX MOVES THIS WEEK

- Georgian Lari up 7.6% (YTD: -4.9%)

- Russian Rouble up 6.4% (YTD: -47.0%)

- Polish Zloty up 4.6% (YTD: -8.0%)

- Albanian Lek up 4.5% (YTD: -5.8%)

- Hungarian Forint up 3.7% (YTD: -7.3%)

- Burundi Franc down 4.8% (YTD: -4.8%)

- Belarusian Rouble down 6.4% (YTD: -22.5%)