FX

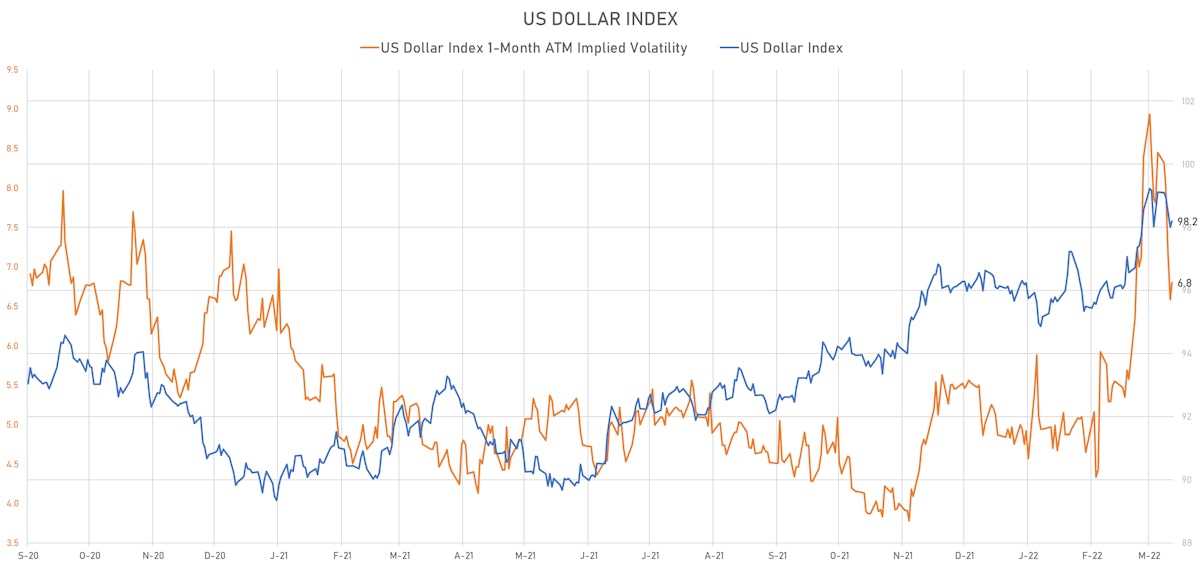

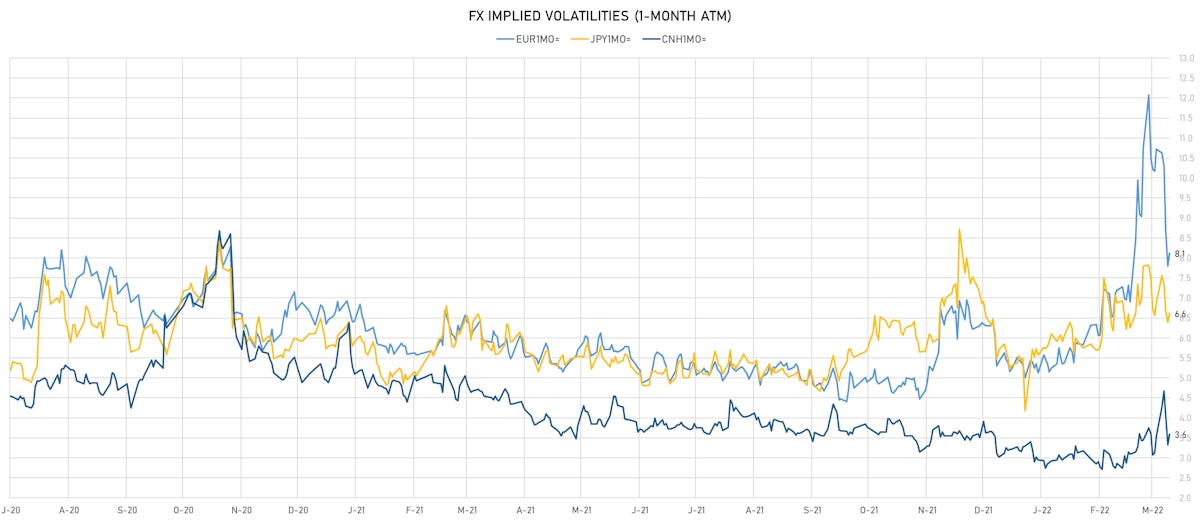

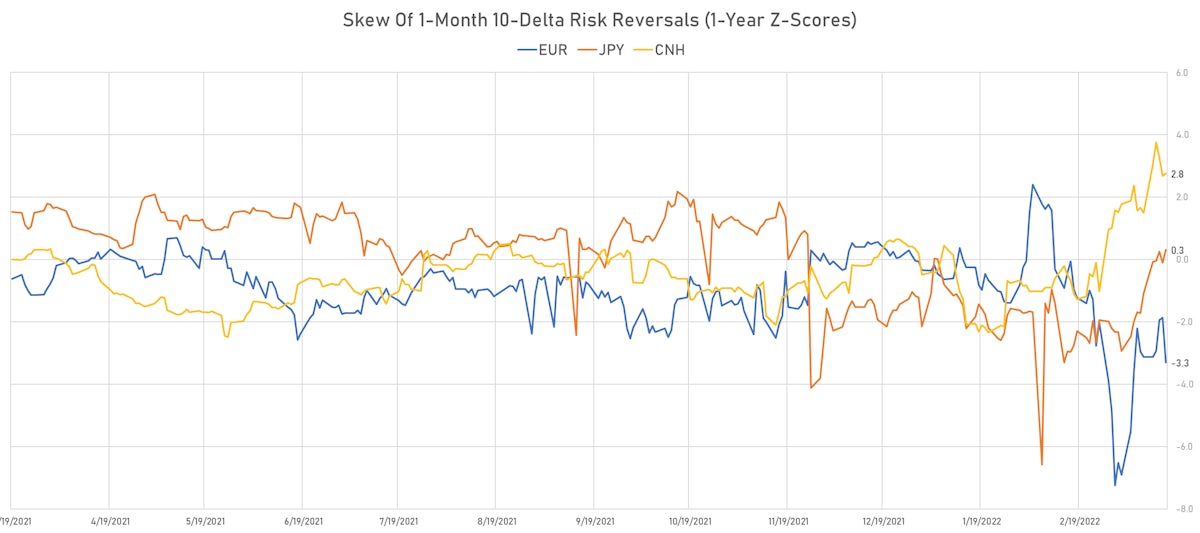

The US Dollar Fell This Week, Along With FX Implied Volatilities; Ukrainian War Fading In The Background, As Monetary Policy Decisions Take The Limelight

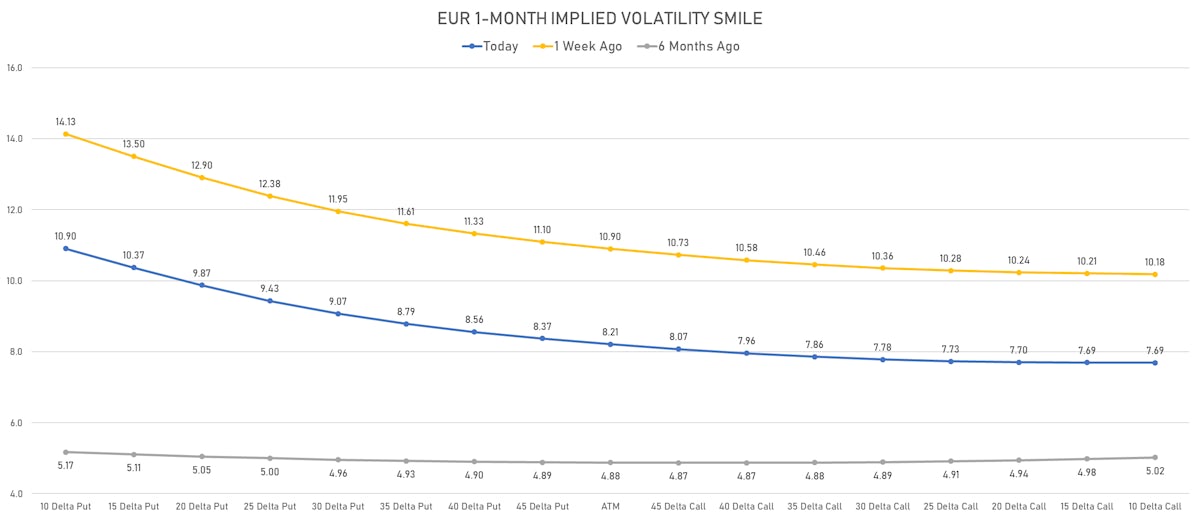

Although ATM implied volatilities fell this week, the skew is still very much to the downside, with the Euro 3-Month 10-delta put / ATM ratio around 1.40, close to the highest levels in the past 5 years

Published ET

Euro 1-Month Implied Volatily Smile | Sources: ϕpost, Refinitiv data

QUICK SUMMARY

- The US Dollar Index is up 0.20% at 98.20 (YTD: +2.65%)

- Euro down 0.31% at 1.1055 (YTD: -2.8%)

- Yen down 0.51% at 119.17 (YTD: -3.4%)

- Onshore Yuan down 0.21% at 6.3609 (YTD: 0.0%)

- Swiss franc up 0.60% at 0.9312 (YTD: -2.0%)

- Sterling up 0.26% at 1.3180 (YTD: -2.6%)

- Canadian dollar up 0.19% at 1.2602 (YTD: +0.3%)

- Australian dollar up 0.56% at 0.7415 (YTD: +2.1%)

- NZ dollar up 0.35% at 0.6903 (YTD: +1.2%)

MACRO DATA RELEASES

- Canada, Retail Sales, Change P/P for Jan 2022 (CANSIM, Canada) at 3.20 % (vs -1.80 % prior), above consensus estimate of 2.40 %

- Canada, Retail Sales, Retail Sales Ex-Autos MM, Change P/P for Jan 2022 (CANSIM, Canada) at 2.50 % (vs -2.50 % prior), above consensus estimate of 2.40 %

- Chile, GDP, Change Y/Y for Q4 2021 (Central Bank, Chile) at 12.00 % (vs 17.20 % prior), below consensus estimate of 13.00 %

- Malaysia, Exports, Total, free on board, Change Y/Y for Feb 2022 (Statistics, Malaysia) at 16.80 % (vs 23.50 % prior), below consensus estimate of 23.80 %

- Malaysia, Imports, Total, cost insurance freight, Change Y/Y for Feb 2022 (Statistics, Malaysia) at 18.40 % (vs 26.40 % prior), below consensus estimate of 25.60 %

- Poland, Employment, Average paid in enterprise sector, Change Y/Y for Feb 2022 (CSO, Poland) at 2.20 % (vs 2.30 % prior), in line with consensus

- Poland, Producer Prices, Total industry, Change Y/Y for Feb 2022 (CSO, Poland) at 15.90 % (vs 14.80 % prior), above consensus estimate of 15.10 %

- Poland, Production, Change Y/Y for Feb 2022 (CSO, Poland) at 17.60 % (vs 19.20 % prior), above consensus estimate of 16.60 %

- Poland, Wages and Salaries, Average Monthly, Gross, Nominal, Enterprise sector, total, Change Y/Y, Current Prices for Feb 2022 (CSO, Poland) at 11.70 % (vs 9.50 % prior), above consensus estimate of 10.00 %

- Russia, Policy Rates, Central bank key rate for Mar 2022 (Central Bank, Russia) at 20.00 % (vs 9.50 % prior), in line with consensus

- Slovakia, Unemployment, Rate, Total, registered for Feb 2022 (UPSVAR, Slovakia) at 6.90 % (vs 7.00 % prior), below consensus estimate of 6.98 %

- Sweden, Unemployment, Rate, Total (SCB), 15-74 years for Feb 2022 (SCB, Sweden) at 7.90 % (vs 8.30 % prior)

- United States, Existing-Home Sales, Single-Family and Condos, total for Feb 2022 (NAR, United States) at 6.02 Mln (vs 6.50 Mln prior), below consensus estimate of 6.10 Mln

- United States, Existing-Home Sales, Single-Family and Condos, total, Change P/P for Feb 2022 (NAR, United States) at -7.20 % (vs 6.70 % prior)

WEEKLY CFTC NET MANAGED MONEY POSITIONING

- All currencies: increase in net long US$ positioning

- G10: increase in net long US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: reduction in net long US$ positioning

- Canadian Dollar: increase in net short US$ positioning

- New Zealand Dollar: reduction in net long US$ positioning

- Brazilian Real: reduced their net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduced their net short US$ positioning

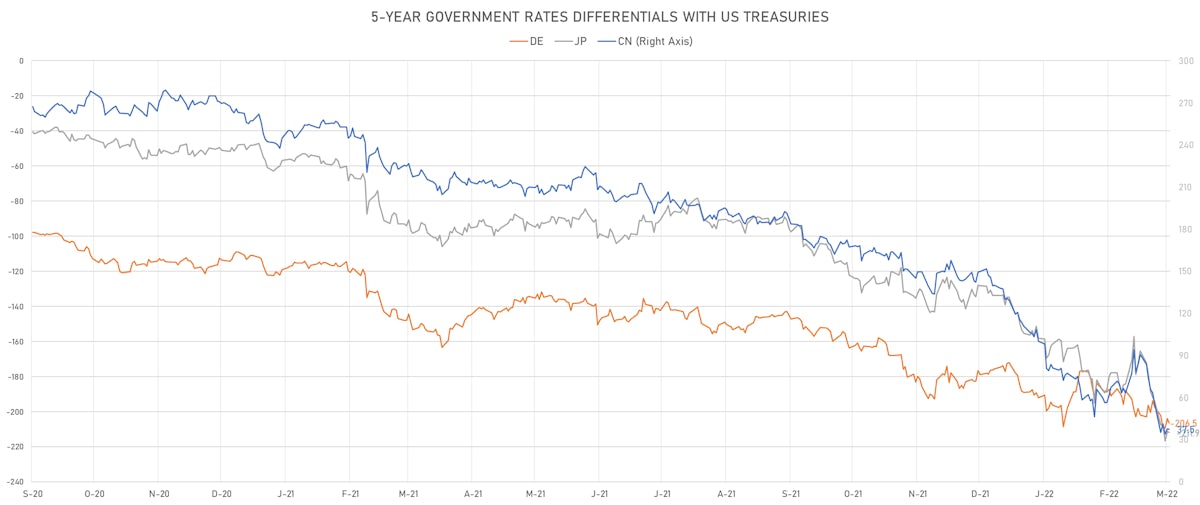

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.6 bp at 206.5 bp (YTD change: +34.4 bp)

- US-JAPAN: +0.5 bp at 211.9 bp (YTD change: +77.2 bp)

- US-CHINA: +0.4 bp at -37.5 bp (YTD change: +91.7 bp)

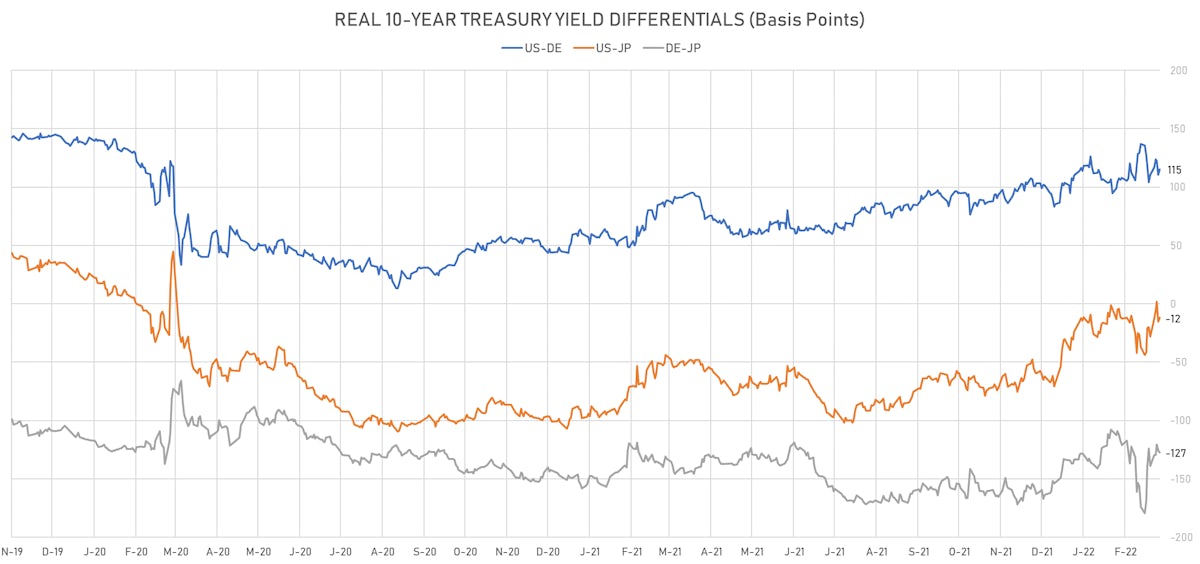

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.9 bp at 115.3 bp (YTD change: +32.1bp)

- US-JAPAN: +3.3 bp at -12.0 bp (YTD change: +58.8bp)

- JAPAN-GERMANY: +1.6 bp at 127.3 bp (YTD change: -26.7bp)

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.24, down -0.50 (YTD: +2.13)

- Euro 1-Month At-The-Money Implied Volatility currently at 8.11, up 0.3 (YTD: +3.1)

- Japanese Yen 1M ATM IV currently at 6.61, up 0.2 (YTD: +2.4)

- Offshore Yuan 1M ATM IV currently at 3.59, up 0.3 (YTD: +0.3)

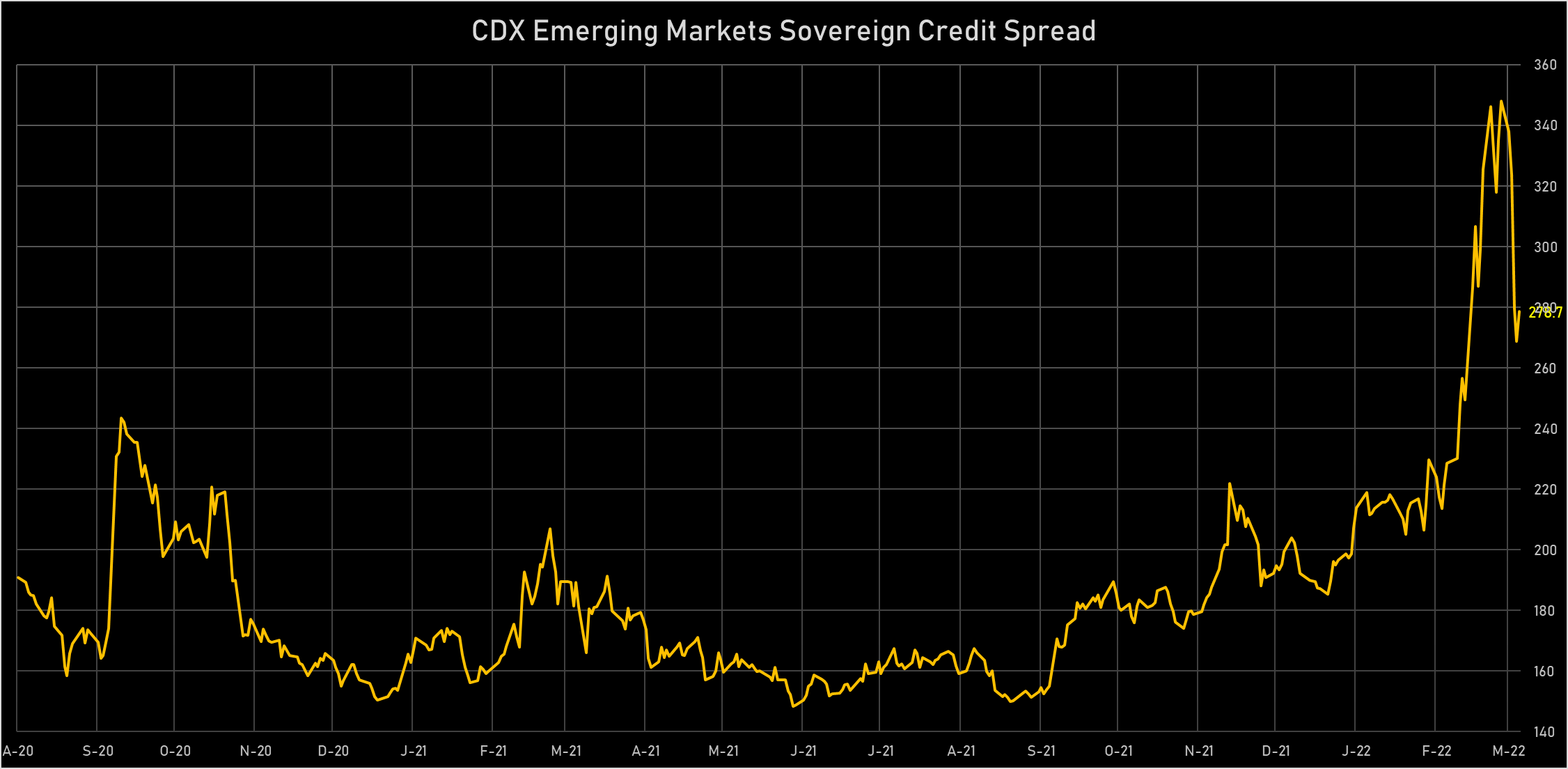

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Russia (rated C): down 53.3 % to 1,563 bp (1Y range: 75-3,331bp)

- Egypt (rated B+): down 22.2 % to 580 bp (1Y range: 283-1,005bp)

- Mexico (rated BBB-): down 12.6 % to 95 bp (1Y range: 81-124bp)

- Chile (rated A-): down 14.1 % to 68 bp (1Y range: 48-95bp)

- Malaysia (rated BBB+): down 13.2 % to 58 bp (1Y range: 38-82bp)

- Peru (rated BBB): down 16.0 % to 72 bp (1Y range: 70-105bp)

- Indonesia (rated BBB): down 21.6 % to 86 bp (1Y range: 66-124bp)

- Colombia (rated BB+): down 19.1 % to 171 bp (1Y range: 105-228bp)

- Philippines (rated BBB): down 20.2 % to 75 bp (1Y range: 39-106bp)

- Vietnam (rated BB): down 15.2 % to 107 bp (1Y range: 89-141bp)

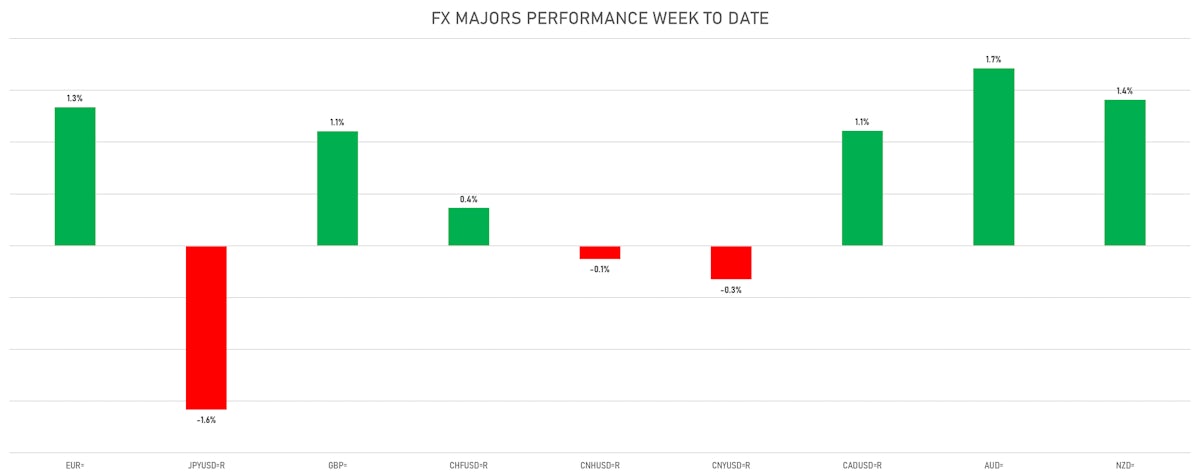

LARGEST FX MOVES THIS WEEK

- Russian Rouble up 24.1% (YTD: -34.2%)

- Armenian Dram up 6.0% (YTD: -1.8%)

- Kazakhstan Tenge up 3.5% (YTD: -14.6%)

- Swedish Krona up 3.3% (YTD: -4.1%)

- Burundi Franc up 3.3% (YTD: -1.6%)

- Angolan Kwanza up 3.3% (YTD: +22.1%)

- Gambian Dalasi down 3.7% (YTD: -4.8%)

- Ghanaian Cedi down 4.2% (YTD: -16.9%)

- Uzbekistan Sum down 4.4% (YTD: -6.0%)

- Sri Lanka Rupee down 7.2% (YTD: -27.5%)