FX

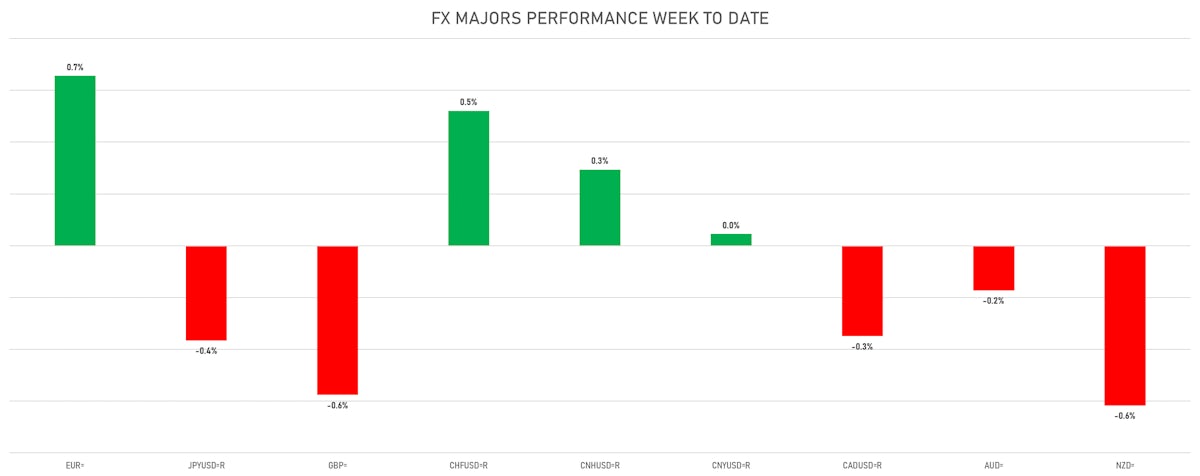

Lack Of Additional Sanctions Against Russia Leads To A Return Of Risk Appetite, With EM Currencies The Main Beneficiaries

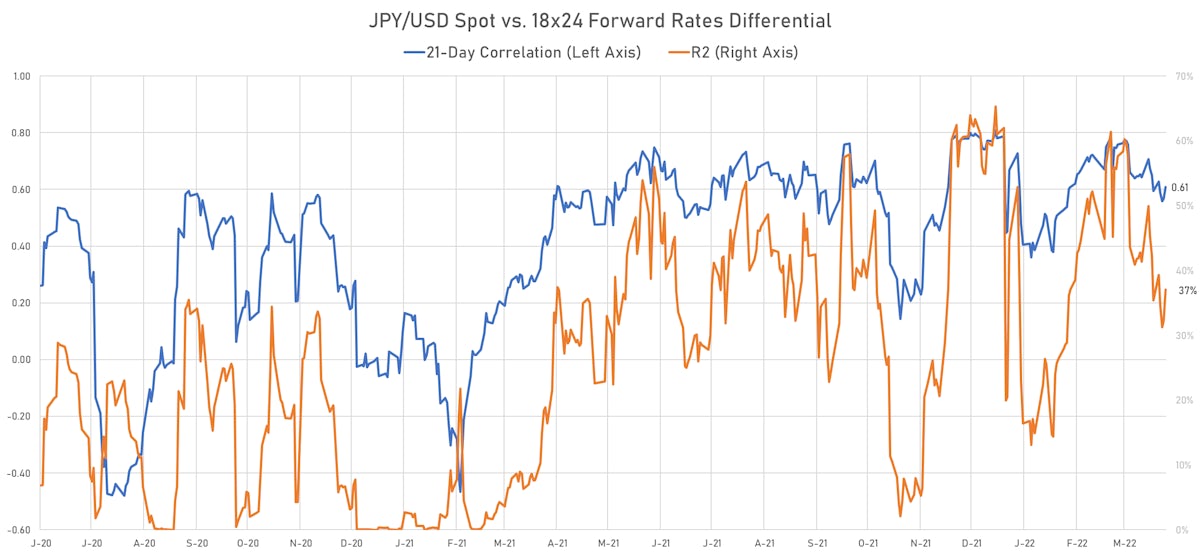

Rates differentials continue to push the yen lower, as the BoJ keeps buying JGBs to maintain control of the curve, with no sign yet that the central bank is worried about importing inflation with a weak currency

Published ET

Japanese yen spot rate vs US-JP 18X21 forward rates differential | Source: Refinitiv

DAILY FX SUMMARY

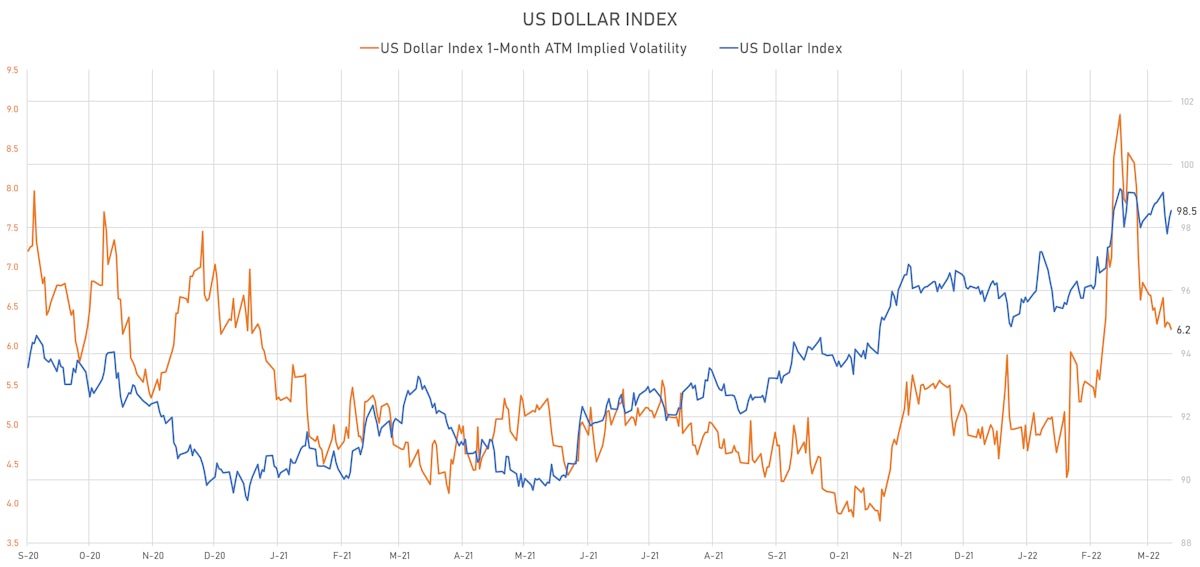

- The US Dollar Index is up 0.25% at 98.54 (YTD: +3.00%)

- Euro down 0.11% at 1.1053 (YTD: -2.8%)

- Yen down 0.66% at 122.49 (YTD: -6.0%)

- Onshore Yuan down 0.36% at 6.3625 (YTD: -0.1%)

- Swiss franc down 0.30% at 0.9254 (YTD: -1.4%)

- Sterling down 0.16% at 1.3112 (YTD: -3.1%)

- Canadian dollar down 0.15% at 1.2518 (YTD: +0.9%)

- Australian dollar up 0.25% at 0.7499 (YTD: +3.3%)

- NZ dollar down 0.09% at 0.6928 (YTD: +1.5%)

MACRO DATA RELEASES

- Brazil, PMI, Manufacturing Sector for Mar 2022 (S&P Global) at 52.30 (vs 49.60 prior)

- Brazil, Production, General industry, Change P/P for Feb 2022 (IBGE, Brazil) at 0.70 % (vs -2.40 % prior), above consensus estimate of 0.30 %

- Brazil, Production, General industry, Change Y/Y for Feb 2022 (IBGE, Brazil) at -4.30 % (vs -7.20 % prior), above consensus estimate of -5.20 %

- Canada, PMI, Manufacturing Sector, Markit Mfg PMI SA for Mar 2022 (S&P Global) at 58.90 (vs 56.60 prior)

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for Mar 2022 (S&P Global) at 48.10 (vs 50.40 prior), below consensus estimate of 50.00

- Euro Zone, CPI, Change Y/Y for Mar 2022 (Eurostat) at 7.50 % (vs 5.90 % prior), above consensus estimate of 6.60 %

- Euro Zone, CPI, Total excluding energy and unprocessed food, Change Y/Y, Price Index for Mar 2022 (Eurostat) at 3.20 % (vs 2.90 % prior), below consensus estimate of 3.30 %

- Euro Zone, PMI, Manufacturing Sector, Total, Final for Mar 2022 (S&P Global) at 56.50 (vs 57.00 prior), below consensus estimate of 57.00

- France, PMI, Manufacturing Sector, Total, Final for Mar 2022 (S&P Global) at 54.70 (vs 54.80 prior), below consensus estimate of 54.80

- Germany, PMI, Manufacturing Sector, Total, Final for Mar 2022 (S&P Global) at 56.90 (vs 57.60 prior), below consensus estimate of 57.60

- Indonesia, CPI, Change Y/Y for Mar 2022 (Statistics Indonesia) at 2.64 % (vs 2.06 % prior), above consensus estimate of 2.56 %

- Indonesia, S&P Global, PMI, Manufacturing Sector, S&P Global PMI, Manufacturing for Mar 2022 (S&P Global) at 51.30 (vs 51.20 prior)

- Italy, PMI, Manufacturing Sector for Mar 2022 (S&P Global) at 55.80 (vs 58.30 prior), below consensus estimate of 57.00

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for Mar 2022 (S&P Global) at 54.10 (vs 53.20 prior)

- Mexico, PMI, Manufacturing Sector for Mar 2022 (S&P Global) at 49.20 (vs 48.00 prior)

- Russia, PMI, Manufacturing Sector for Mar 2022 (S&P Global) at 44.10 (vs 48.60 prior)

- South Korea, S&P Global, PMI, Manufacturing Sector, S&P Global PMI, Manufacturing for Mar 2022 (S&P Global) at 51.20 (vs 53.80 prior)

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Mar 2022 (S&P Global) at 49.40 (vs 50.40 prior)

- United Kingdom, PMI, Manufacturing Sector for Mar 2022 (S&P Global) at 55.20 (vs 55.50 prior), below consensus estimate of 55.50

- United States, Employment, Nonfarm payroll, total, Absolute change for Mar 2022 (BLS, U.S Dep. Of Lab) at 431.00 k (vs 678.00 k prior), below consensus estimate of 490.00 k

- United States, ISM Manufacturing, PMI total for Mar 2022 (ISM, United States) at 57.10 (vs 58.60 prior), below consensus estimate of 59.00

- United States, PMI, Manufacturing Sector, Total, Final for Mar 2022 (S&P Global) at 58.80 (vs 58.50 prior)

- United States, Unemployment, Rate for Mar 2022 (BLS, U.S Dep. Of Lab) at 3.60 % (vs 3.80 % prior), below consensus estimate of 3.70 %

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY at 218.7 bp (YTD change: +46.6 bp)

- US-JAPAN at 255.5 bp (YTD change: +120.8 bp)

- US-CHINA at 5.3 bp (YTD change: +134.5 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +6.7 bp at 151.3 bp (YTD change: +68.1bp)

- US-JAPAN: +5.1 bp at 15.0 bp (YTD change: +85.8bp)

- JAPAN-GERMANY: +1.6 bp at 136.3 bp (YTD change: -17.7bp)

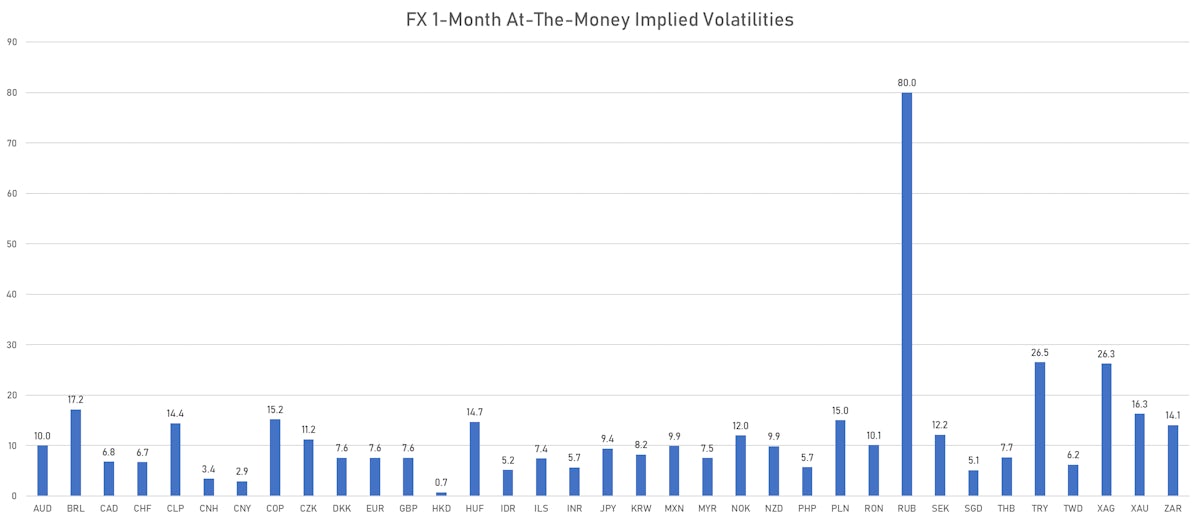

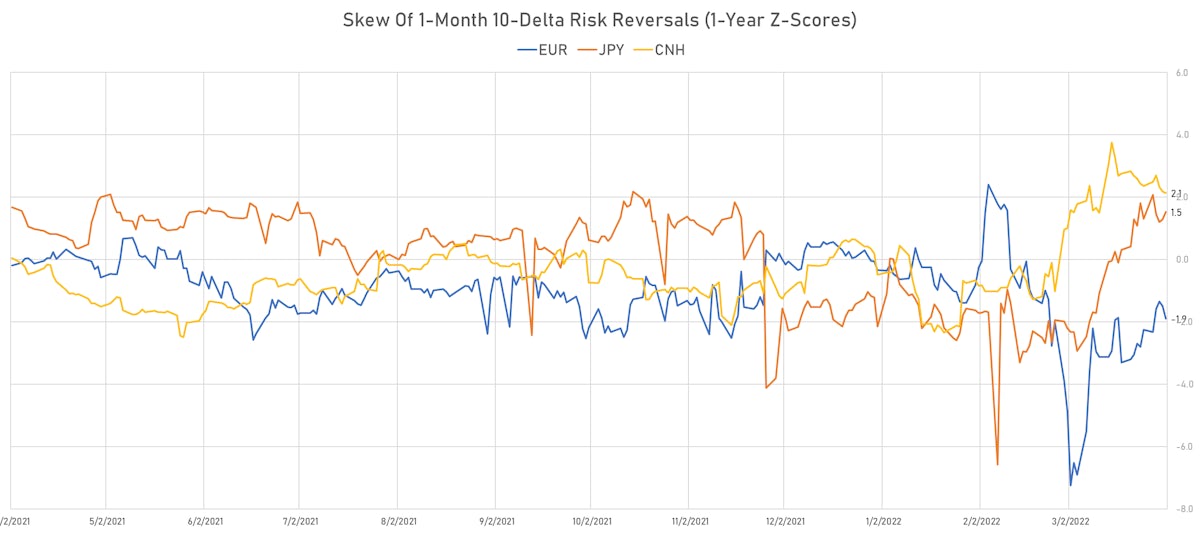

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.18, up 0.18 (YTD: +2.07)

- Euro 1-Month At-The-Money Implied Volatility currently at 7.40, down -0.2 (YTD: +2.4)

- Japanese Yen 1M ATM IV currently at 8.98, up 0.1 (YTD: +4.8)

- Offshore Yuan 1M ATM IV currently at 3.26, down -0.1 (unchanged YTD)

LARGEST FX MOVES THIS WEEK

- Russian Rouble up 16.1% (YTD: -15.0%)

- Kyrgyzstan Som up 15.7% (YTD: +4.0%)

- Burundi Franc up 3.2% (YTD: -1.7%)

- Haiti Gourde up 2.9% (YTD: -4.1%)

- Georgian Lari up 2.7% (YTD: +0.7%)

- Hungarian Forint up 2.5% (YTD: -2.4%)

- Peru Sol up 2.5% (YTD: +9.7%)

- Malagasy Ariary up 2.4% (YTD: -0.1%)

- Brazilian Real up 2.3% (YTD: +19.6%)

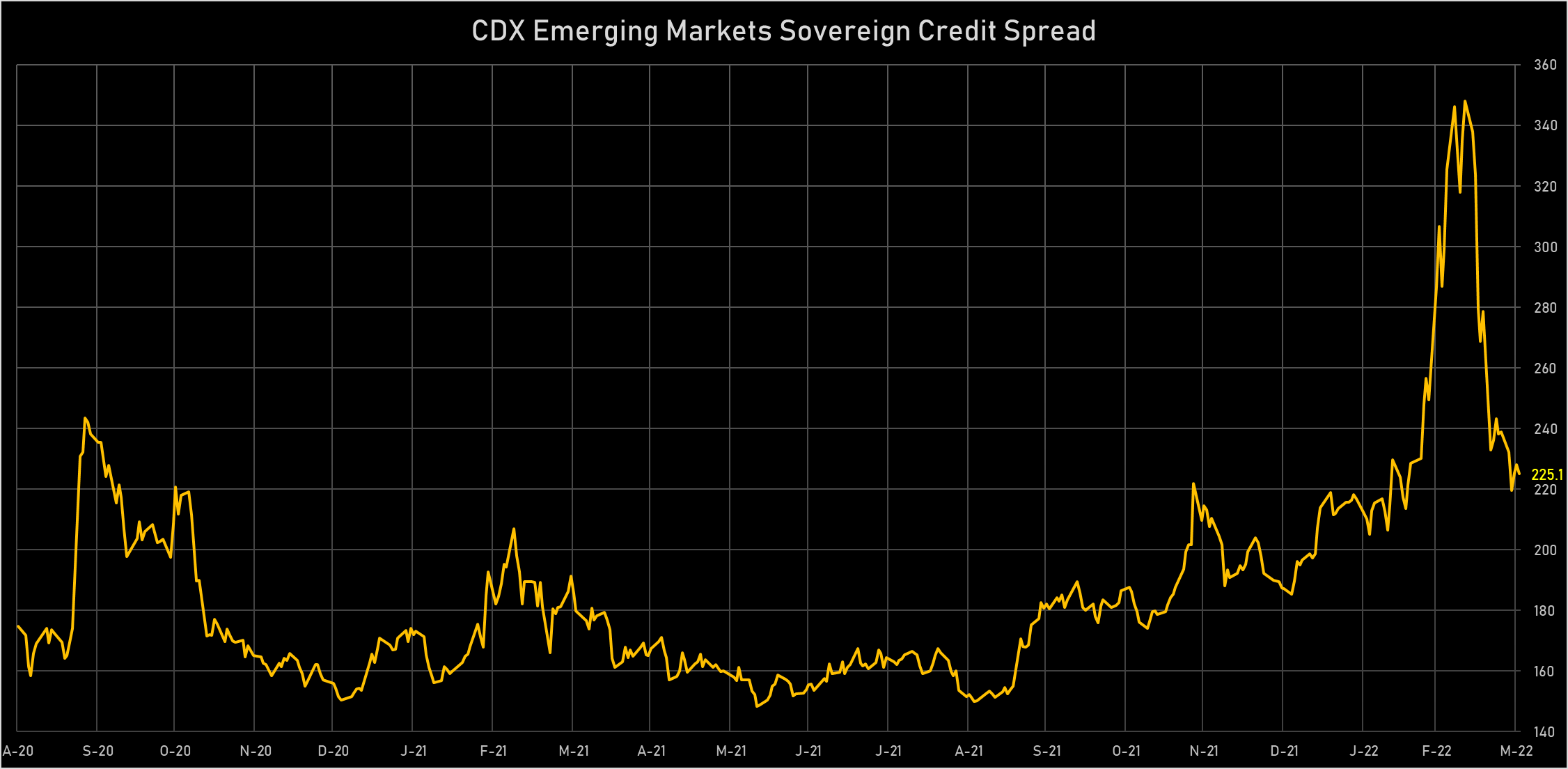

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Chile (rated A-): down 5.7 % to 68 bp (1Y range: 48-95bp)

- Turkey (rated B+): down 6.7 % to 548 bp (1Y range: 363-685bp)

- Mexico (rated BBB-): down 5.5 % to 98 bp (1Y range: 81-124bp)

- Panama (rated WD): down 4.0 % to 79 bp (1Y range: 64-103bp)

- Peru (rated BBB): down 4.5 % to 76 bp (1Y range: 72-105bp)

- Egypt (rated B+): down 12.4 % to 517 bp (1Y range: 302-1,005bp)

- Russia (rated WD): down 15.5 % to 2,486 bp (1Y range: 75-3,331bp)

- Indonesia (rated BBB): down 11.6 % to 84 bp (1Y range: 66-124bp)

- Vietnam (rated BB): down 10.0 % to 101 bp (1Y range: 89-141bp)

- Philippines (rated BBB): down 10.3 % to 80 bp (1Y range: 41-106bp)

WEEKLY MANAGED MONEY POSITIONING (CFTC)

- All currencies: increase in net long US$ positioning

- G10: increase in net long US$ positioning

- Emerging: reduced their net short US$ positioning

- Euro: reduced their net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: reduction in net long US$ positioning

- New Zealand Dollar: reduced their net short US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning