FX

The Euro Continued To Fall This Week, With The War In Ukraine And The Risk Of A Russian Nat Gas Ban Now Putting The EU On The Edge Of A Recession

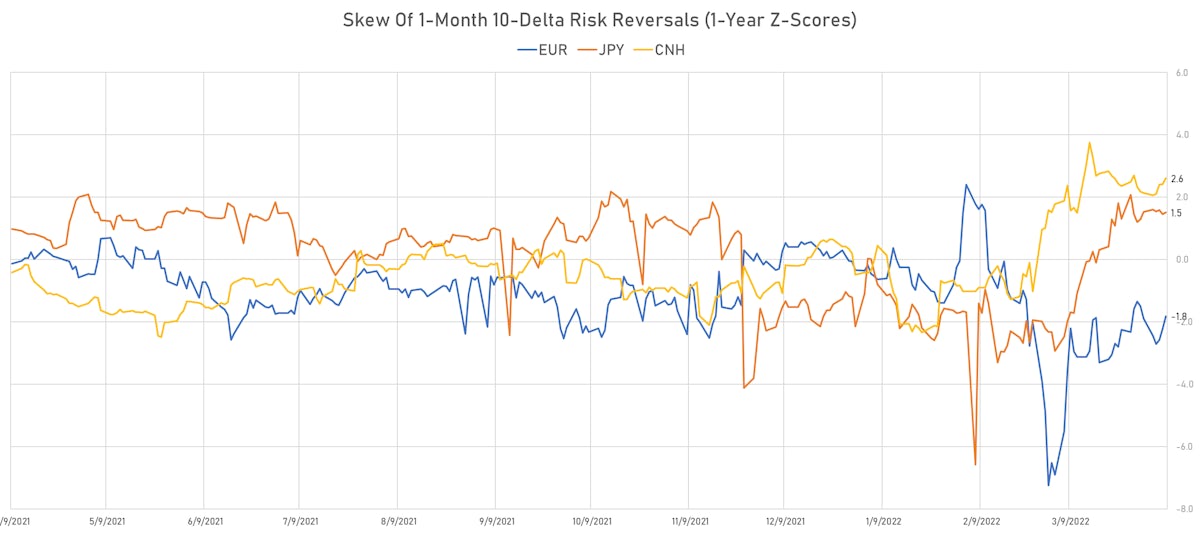

Euro options positioning is skewed to the downside with the first round of the French presidential elections now upon us; a win by Le Pen would push the spot further down towards 1.0500 with a widening of the OATs-Bunds spreads (and a likely spillover into BTPs)

Published ET

Euro & EUR-USD 12X18 Forward Rates Differential | Source: Refinitiv

DAILY FX SUMMARY

- The US Dollar Index is up 0.08% at 99.84 (YTD: +4.36%)

- Euro down 0.02% at 1.0876 (YTD: -4.3%)

- Yen down 0.32% at 124.32 (YTD: -7.4%)

- Onshore Yuan down 0.07% at 6.3610 (YTD: -0.1%)

- Swiss franc down 0.07% at 0.9346 (YTD: -2.4%)

- Sterling down 0.32% at 1.3031 (YTD: -3.7%)

- Canadian dollar up 0.16% at 1.2568 (YTD: +0.5%)

- Australian dollar down 0.32% at 0.7455 (YTD: +2.7%)

- NZ dollar down 0.67% at 0.6844 (YTD: +0.3%)

MACRO DATA RELEASES

- Brazil, CPI, Broad national index (IPCA), Change P/P for Mar 2022 (IBGE, Brazil) at 1.62 % (vs 1.01 % prior), above consensus estimate of 1.30 %

- Brazil, CPI, Broad national index (IPCA), Change Y/Y for Mar 2022 (IBGE, Brazil) at 11.30 % (vs 10.54 % prior), above consensus estimate of 10.98 %

- Canada, Employment, Absolute change for Mar 2022 (CANSIM, Canada) at 72.50 k (vs 336.60 k prior), below consensus estimate of 80.00 k

- Canada, Unemployment, Rate for Mar 2022 (CANSIM, Canada) at 5.30 % (vs 5.50 % prior), in line with consensus

- Chile, CPI, Change P/P, Price Index for Mar 2022 (INE, Chile) at 1.90 % (vs 0.30 % prior), above consensus estimate of 1.05 %

- Czech Republic, Unemployment, Rate for Mar 2022 (MPSV, Czech Republic) at 3.40 % (vs 3.50 % prior), in line with consensus

- Greece, CPI, Change Y/Y, Price Index for Mar 2022 (ELSTAT, Greece) at 8.90 % (vs 7.20 % prior)

- Greece, HICP, Change Y/Y, Price Index for Mar 2022 (ELSTAT, Greece) at 8.00 % (vs 6.30 % prior)

- Hungary, CPI, All Items, Change Y/Y, Price Index for Mar 2022 (HCSO, Hungary) at 8.50 % (vs 8.30 % prior), below consensus estimate of 8.70 %

- India, Policy Rates, Cash Reserve Ratio for 08 Apr (RBI) at 4.00 % (vs 4.00 % prior), in line with consensus

- India, Policy Rates, Repo Rate for 08 Apr (RBI) at 4.00 % (vs 4.00 % prior), in line with consensus

- India, Policy Rates, Reverse Repo Rate for 08 Apr (RBI) at 3.35 % (vs 3.35 % prior), in line with consensus

- Latvia, CPI, Change P/P for Mar 2022 (Statistics, Latvia) at 3.30 % (vs 1.60 % prior)

- Latvia, CPI, Change Y/Y for Mar 2022 (Statistics, Latvia) at 11.50 % (vs 8.70 % prior)

- Lithuania, CPI, Change P/P for Mar 2022 (Statistics Lithuania) at 2.40 % (vs 1.80 % prior)

- Lithuania, CPI, Change Y/Y, Price Index for Mar 2022 (Statistics Lithuania) at 15.70 % (vs 14.20 % prior)

- Norway, Gross Domestic Product, Change P/P for Feb 2022 (Statistics Norway) at 0.70 % (vs -1.60 % prior)

- Norway, Gross Domestic Product, Mainland Norway, Change P/P for Feb 2022 (Statistics Norway) at 0.50 % (vs -0.90 % prior), below consensus estimate of 0.90 %

- Russia, CPI, Change P/P for Mar 2022 (RosStat, Russia) at 7.60 % (vs 1.20 % prior), below consensus estimate of 7.80 %

- Russia, CPI, Change Y/Y for Mar 2022 (RosStat, Russia) at 16.70 % (vs 9.20 % prior), below consensus estimate of 16.90 %

- Russia, GDP, Change Y/Y for Q4 2021 (RosStat, Russia) at 5.00 % (vs 5.00 % prior)

- Russia, GDP, Total-prelim, Change Y/Y for Q4 2021 (RosStat, Russia) at 5.00 % (vs 4.30 % prior), in line with consensus

- Russia, Policy Rates, Central bank key rate for Apr 2022 (Central Bank, Russia) at 17.00 % (vs 20.00 % prior), below consensus estimate of 20.00 %

- Slovakia, Trade Balance, Total, FOB, Current Prices for Feb 2022 (Stat Office of SR) at -258.70 Mln EUR (vs -400.50 Mln EUR prior), below consensus estimate of -239.60 Mln EUR

- Spain, Production, Total industry excluding construction, Change Y/Y for Feb 2022 (INE, Spain) at 3.00 % (vs 1.70 % prior), above consensus estimate of 1.70 %

- Taiwan, CPI, Change Y/Y, Price Index for Mar 2022 (DGBAS, Taiwan) at 3.27 % (vs 2.36 % prior), above consensus estimate of 2.90 %

- Taiwan, Exports, Change Y/Y for Mar 2022 (MoF, Taiwan) at 21.30 % (vs 34.80 % prior), above consensus estimate of 21.00 %

- Taiwan, Imports, Change Y/Y for Mar 2022 (MoF, Taiwan) at 20.30 % (vs 35.30 % prior), below consensus estimate of 20.50 %

- Taiwan, Trade Balance, Current Prices for Mar 2022 (MoF, Taiwan) at 4.66 Bln USD (vs 5.81 Bln USD prior), above consensus estimate of 3.93 Bln USD

- United States, Wholesale Inventories, Change P/P for Feb 2022 (U.S. Census Bureau) at 2.50 % (vs 2.10 % prior), above consensus estimate of 2.10 %

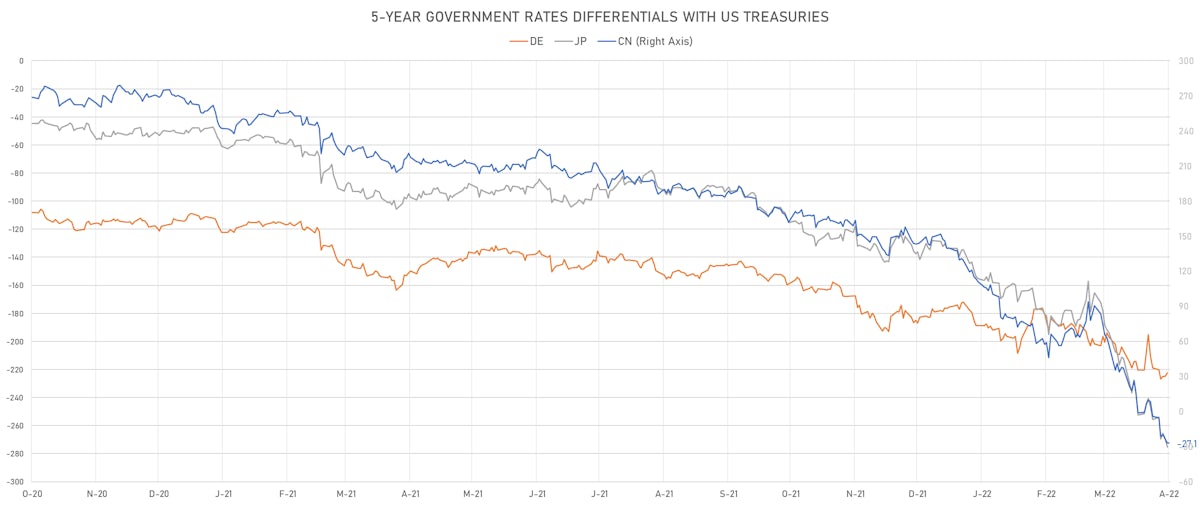

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.6 bp at 222.3 bp (YTD change: +50.2 bp)

- US-JAPAN: +6.0 bp at 275.4 bp (YTD change: +140.7 bp)

- US-CHINA: +3.8 bp at 27.1 bp (YTD change: +156.3 bp)

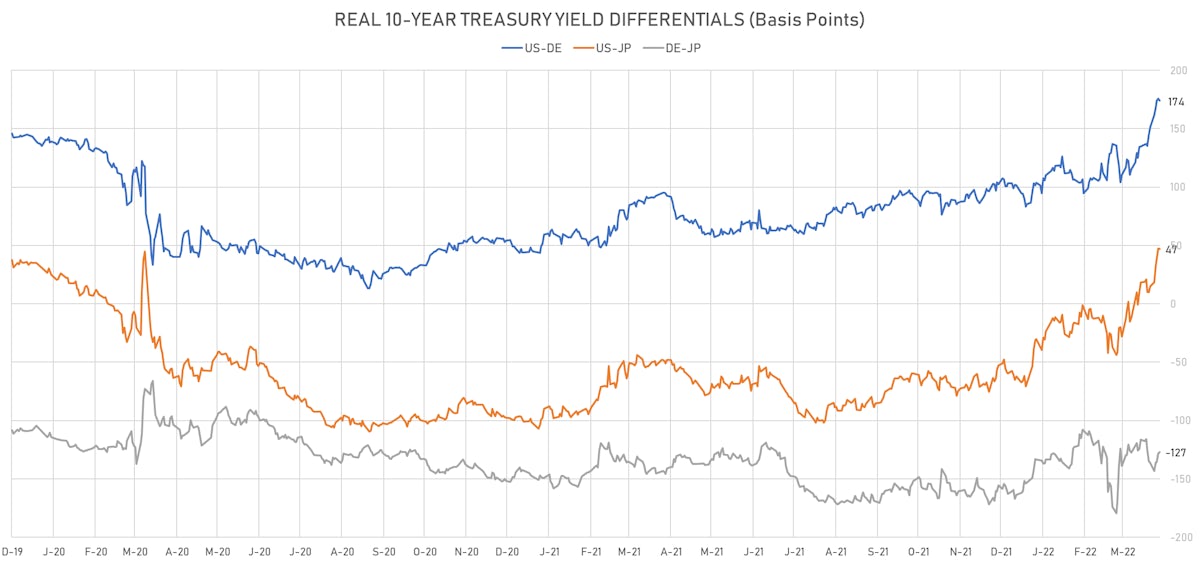

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -2.0 bp at 173.9 bp (YTD change: +90.7bp)

- US-JAPAN: -0.4 bp at 47.1 bp (YTD change: +117.9bp)

- JAPAN-GERMANY: -1.6 bp at 126.8 bp (YTD change: -27.2bp)

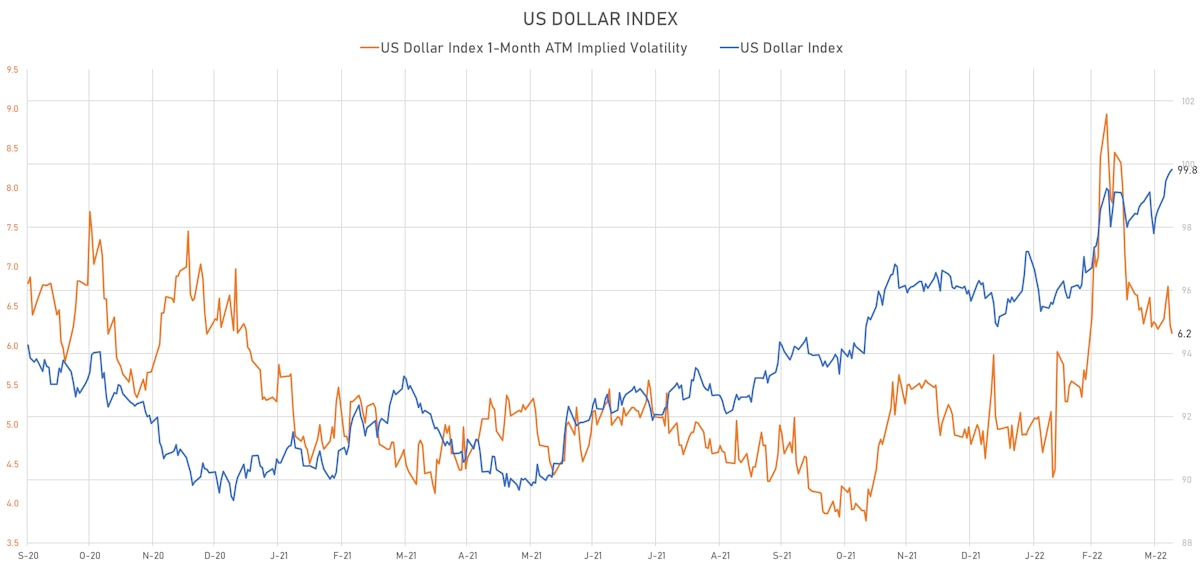

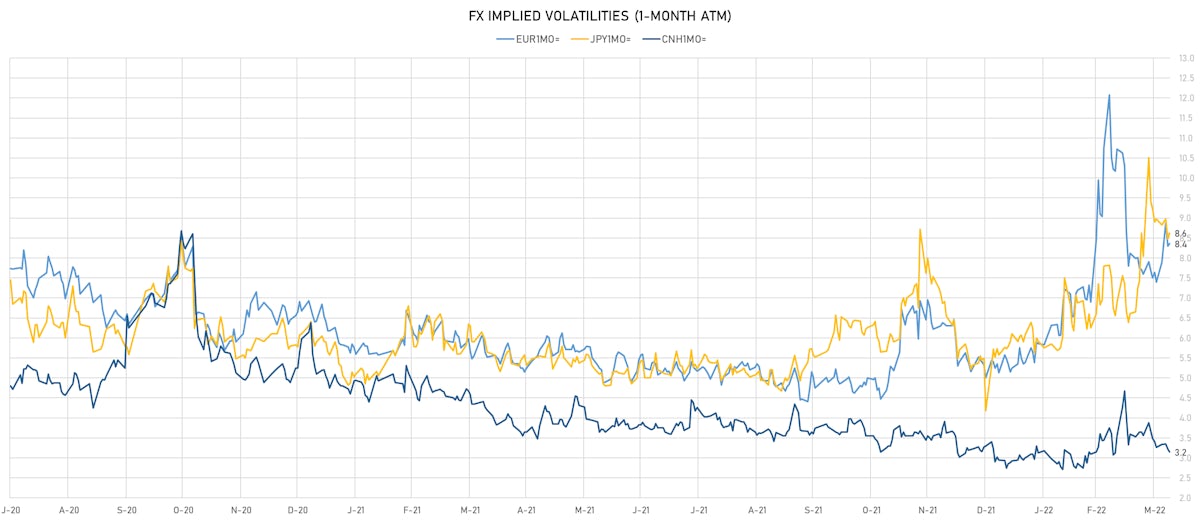

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.34, down -0.11 (YTD: +2.23)

- Euro 1-Month At-The-Money Implied Volatility currently at 8.36, up 0.1 (YTD: +3.4)

- Japanese Yen 1M ATM IV currently at 8.63, up 0.2 (YTD: +4.5)

- Offshore Yuan 1M ATM IV currently at 3.15, down -0.1 (YTD: -0.2)

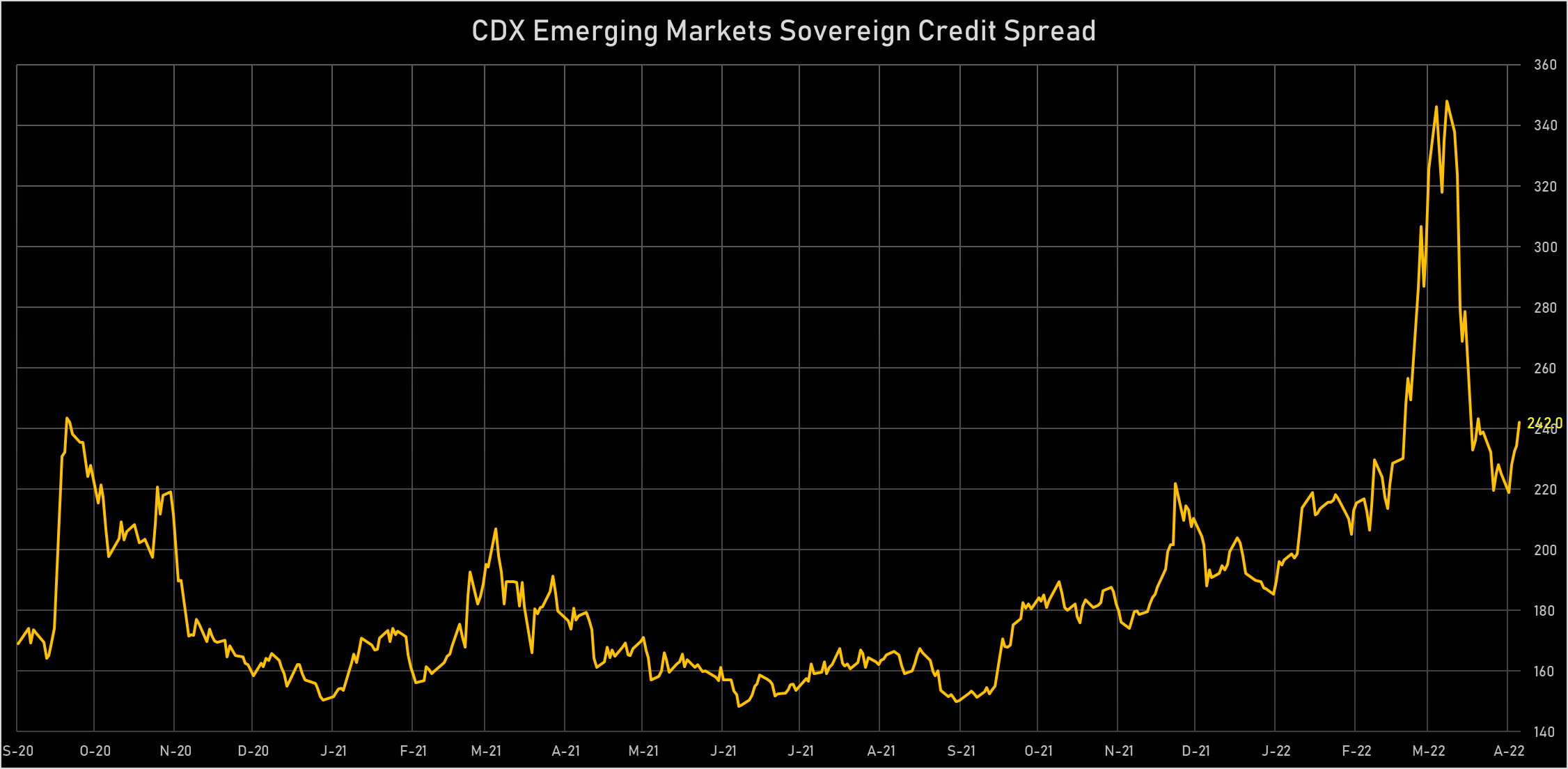

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Chile (rated A-): up 15.3 % to 78 bp (1Y range: 48-95bp)

- Mexico (rated BBB-): up 13.7 % to 111 bp (1Y range: 81-124bp)

- Panama (rated WD): up 13.8 % to 89 bp (1Y range: 64-103bp)

- Peru (rated BBB): up 19.8 % to 91 bp (1Y range: 72-105bp)

- Vietnam (rated BB): up 3.8 % to 107 bp (1Y range: 89-141bp)

- Indonesia (rated BBB): up 5.0 % to 88 bp (1Y range: 66-124bp)

- Philippines (rated BBB): up 3.5 % to 83 bp (1Y range: 41-106bp)

- Malaysia (rated BBB+): up 3.2 % to 69 bp (1Y range: 41-82bp)

- Turkey (rated B+): up 5.9 % to 587 bp (1Y range: 363-685bp)

- Saudi Arabia (rated A): up 4.0 % to 50 bp (1Y range: 43-67bp)

LARGEST FX MOVES THIS WEEK

- Kazakhstan Tenge up 7.3% (YTD: -2.0%)

- Russian Rouble up 6.7% (YTD: -9.3%)

- Tajikistan Somoni up 3.6% (YTD: -9.8%)

- Mauritius Rupee up 3.6% (YTD: +0.9%)

- Belarusian Ruble down 3.4% (YTD: -23.9%)

- Myanmar Kyat down 3.6% (YTD: -3.6%)

- Chilean Peso down 4.0% (YTD: +4.5%)

- Hungarian Forint down 4.2% (YTD: -6.5%)

- Haiti Gourde down 6.3% (YTD: -10.1%)

- Sri Lanka Rupee down 6.5% (YTD: -36.6%)

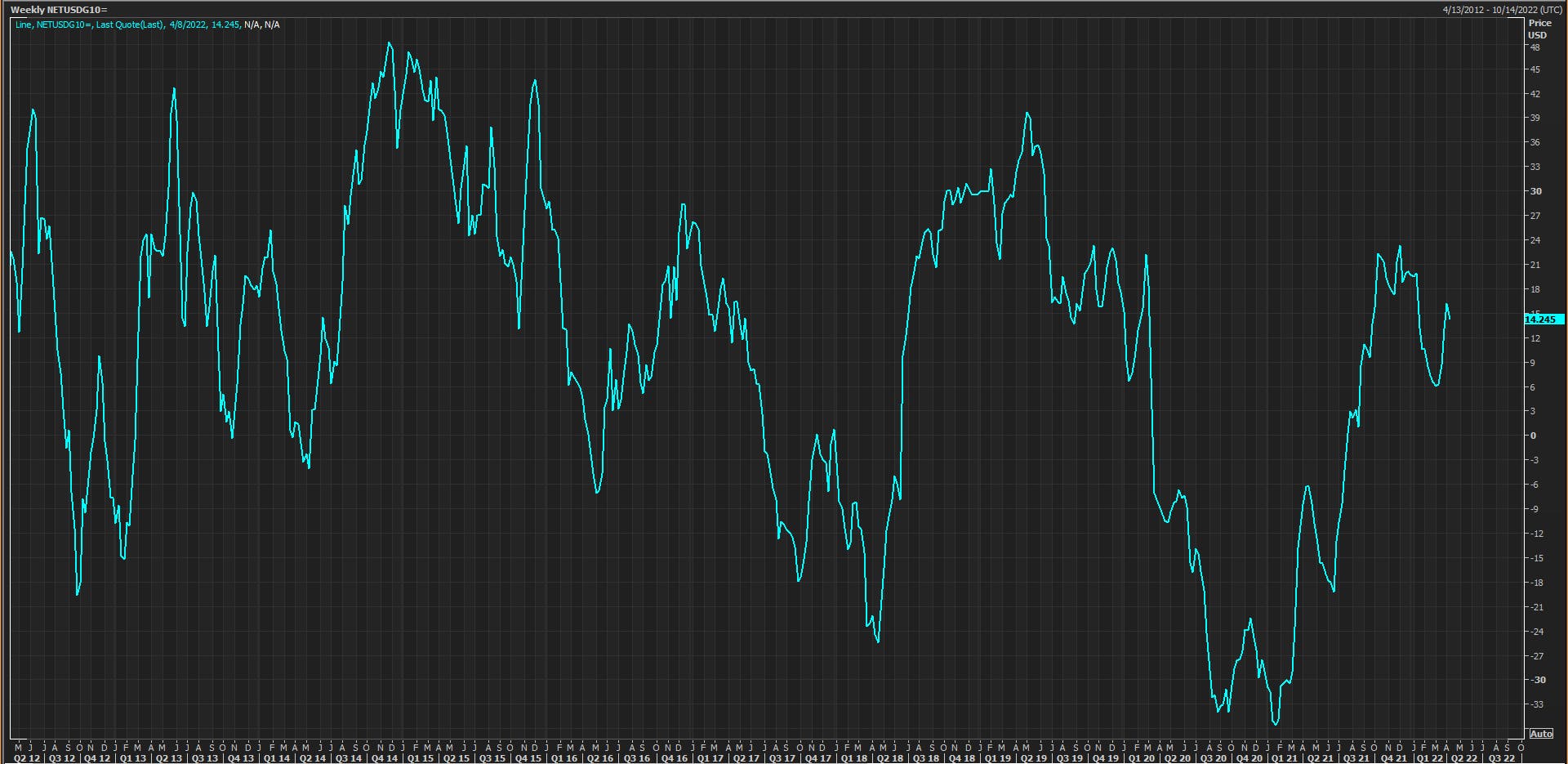

WEEKLY CFTC NET SPECULATIVE POSITIONING

- All currencies: reduced their net short US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: increase in net long US$ positioning

- Australian Dollar: reduction in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: reduction in net long US$ positioning

- New Zealand Dollar: increase in net long US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: reduction in net long US$ positioning