FX

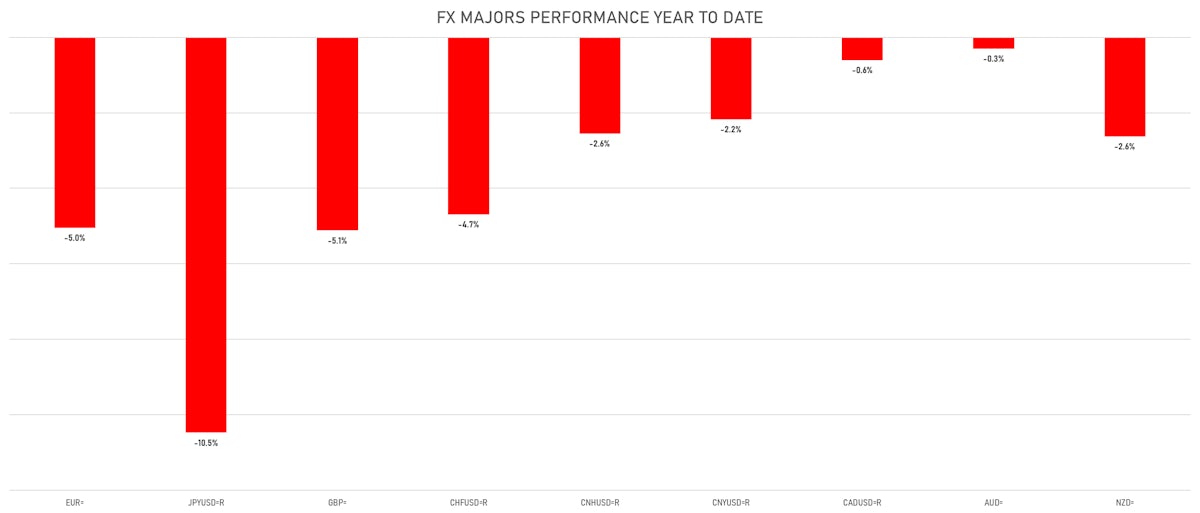

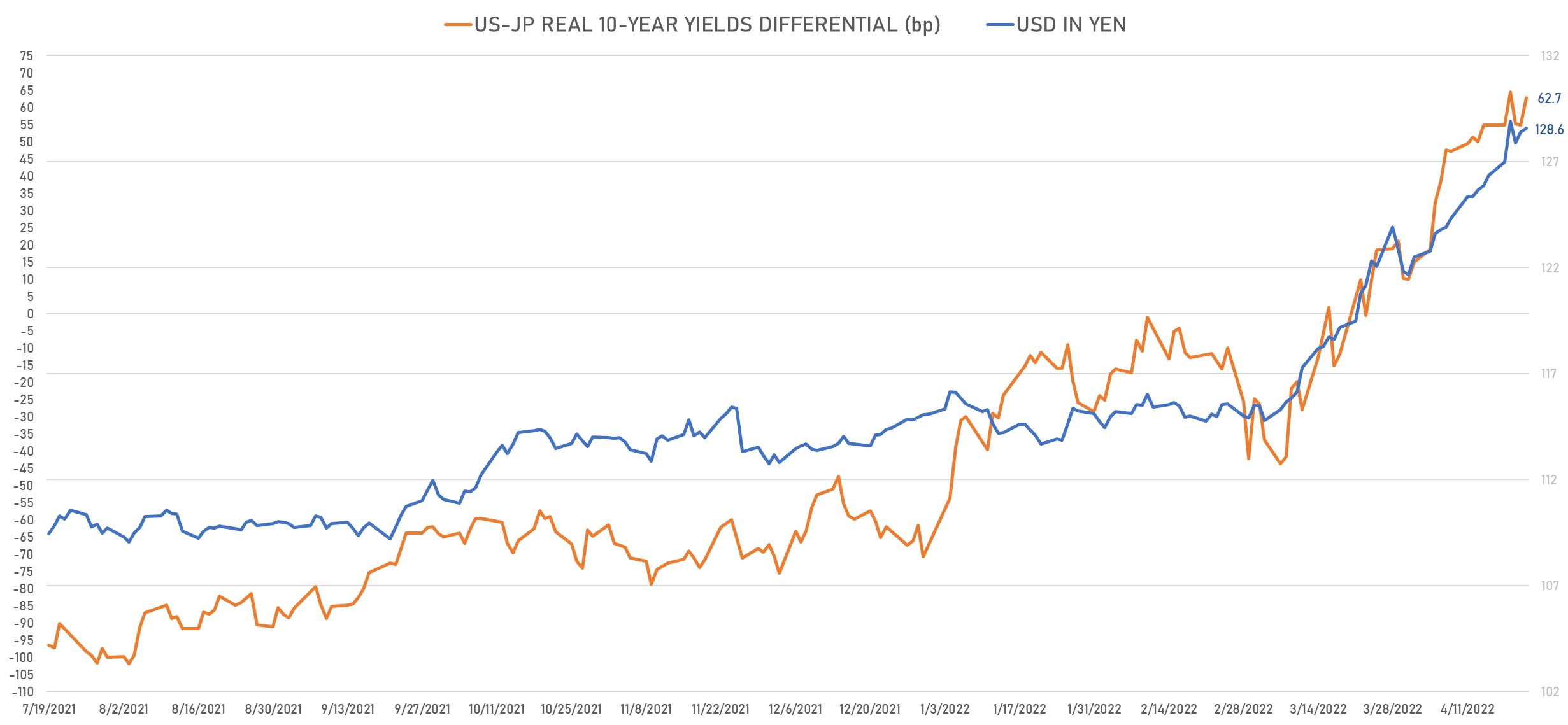

The Japanese Yen Kept Falling Against The US Dollar Closing The Week Above 128, By Far The Worst Performing Major Currency YTD

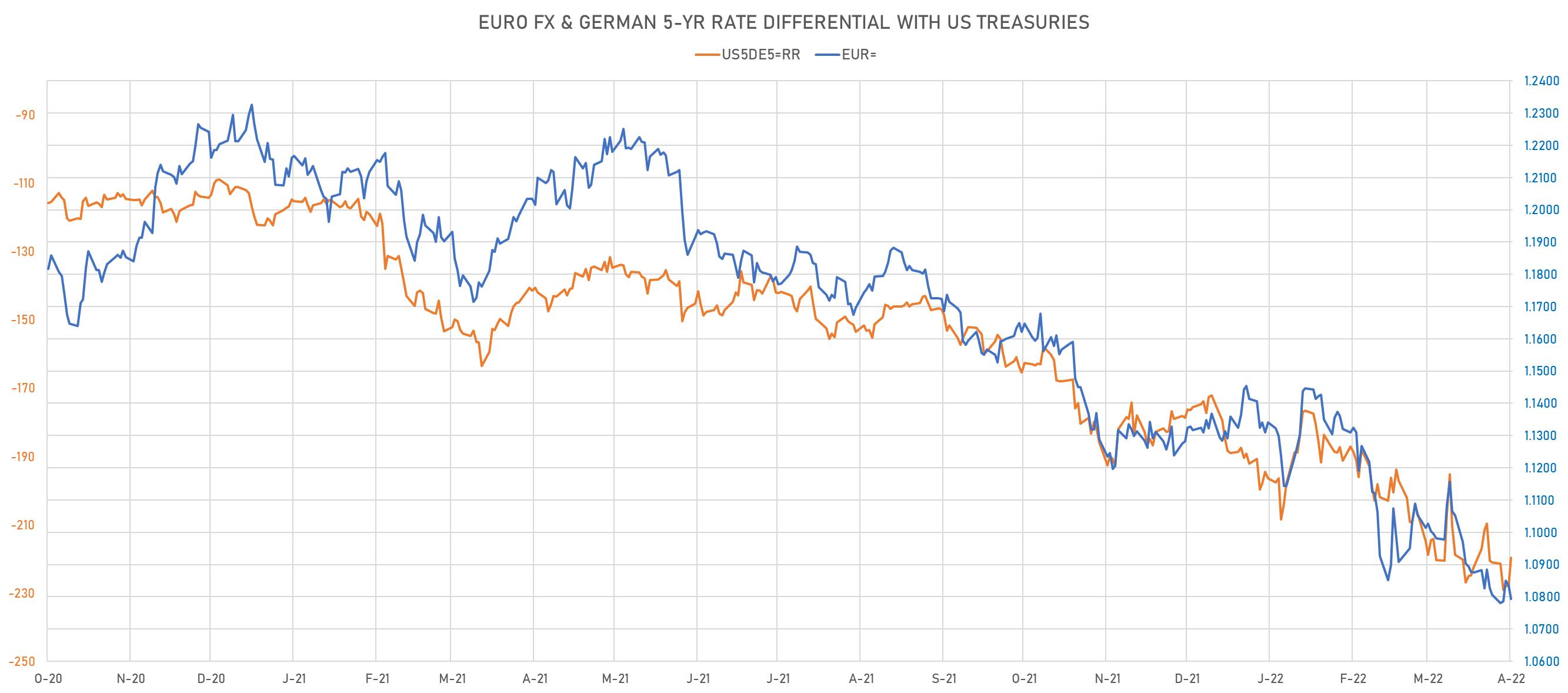

With Euro area PMIs and growth data surprising positively, the possibility of an early liftoff by the ECB is becoming likelier: the front end of the curve looks like the weak point if the ECB hikes 3 times this year (July, September, December)

Published ET

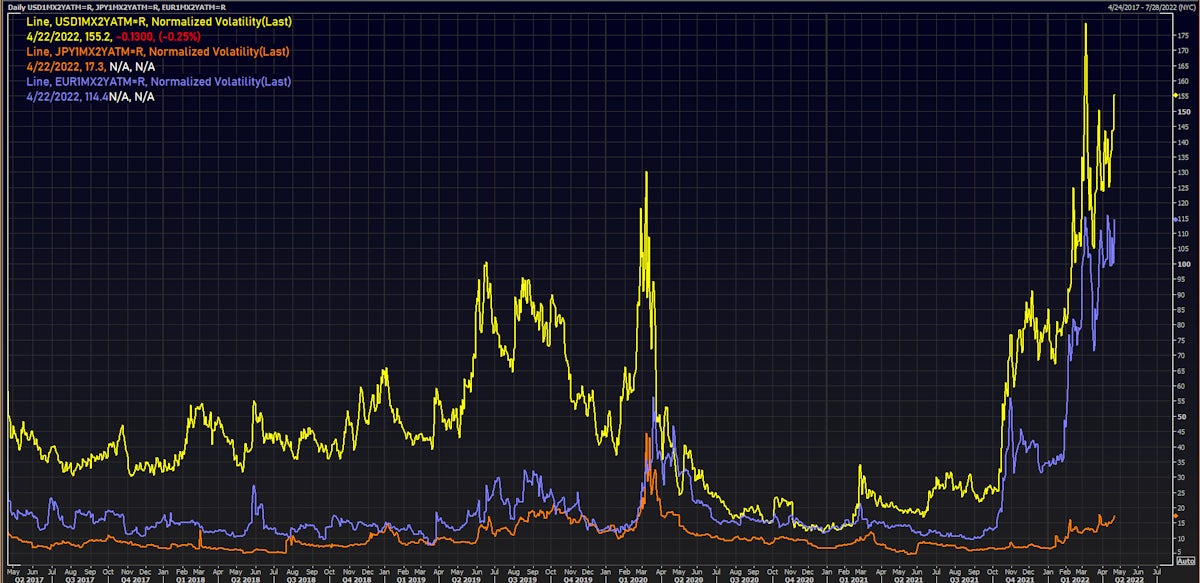

EUR, USD, JPY 1 Month Into 2Y ATM Swaptions Implied Volatilities | Source: Refinitiv

DAILY SUMMARY

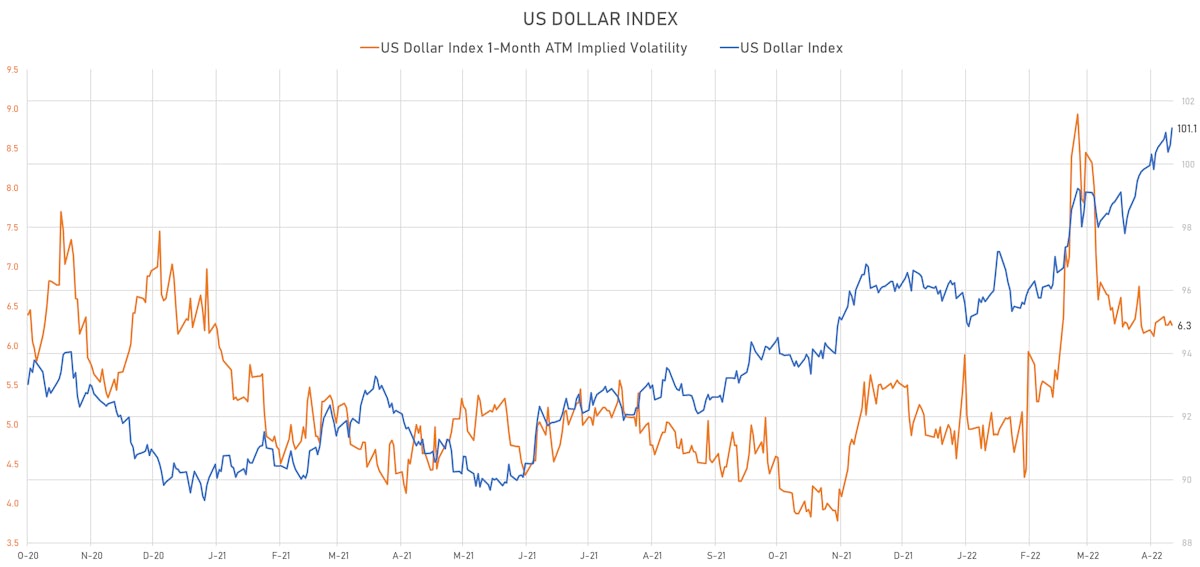

- The US Dollar Index is up 0.53% at 101.14 (YTD: +5.73%)

- Euro down 0.39% at 1.0794 (YTD: -5.0%)

- Yen down 0.14% at 128.56 (YTD: -10.5%)

- Onshore Yuan down 0.77% at 6.5010 (YTD: -2.2%)

- Swiss franc down 0.42% at 0.9571 (YTD: -4.7%)

- Sterling down 1.47% at 1.2837 (YTD: -5.1%)

- Canadian dollar down 1.04% at 1.2710 (YTD: -0.6%)

- Australian dollar down 1.80% at 0.7238 (YTD: -0.3%)

- NZ dollar down 1.42% at 0.6645 (YTD: -2.6%)

MACRO DATA RELEASES

- Canada, Retail Sales, Change P/P for Feb 2022 (CANSIM, Canada) at 0.10 % (vs 3.20 % prior), above consensus estimate of -0.40 %

- Euro Zone, PMI, Composite, Output, Flash for Apr 2022 (S&P Global) at 55.80 (vs 54.90 prior), above consensus estimate of 53.90

- Euro Zone, PMI, Manufacturing Sector, Total, Flash for Apr 2022 (S&P Global) at 55.30 (vs 56.50 prior), above consensus estimate of 54.70

- Euro Zone, PMI, Services Sector, Business Activity, Flash for Apr 2022 (S&P Global) at 57.70 (vs 55.60 prior), above consensus estimate of 55.00

- France, PMI, Composite, Output, Flash for Apr 2022 (S&P Global) at 57.50 (vs 56.30 prior), above consensus estimate of 55.00

- France, PMI, Manufacturing Sector, Total, Flash for Apr 2022 (S&P Global) at 55.40 (vs 54.70 prior), above consensus estimate of 53.00

- France, PMI, Services Sector, Business Activity, Flash for Apr 2022 (S&P Global) at 58.80 (vs 57.40 prior), above consensus estimate of 56.50

- Germany, PMI, Composite, Output, Flash for Apr 2022 (S&P Global) at 54.50 (vs 55.10 prior), above consensus estimate of 54.10

- Germany, PMI, Manufacturing Sector, Total, Flash for Apr 2022 (S&P Global) at 54.10 (vs 56.90 prior), below consensus estimate of 54.50

- Germany, PMI, Services Sector, Business Activity, Flash for Apr 2022 (S&P Global) at 57.90 (vs 56.10 prior), above consensus estimate of 55.50

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Flash for Apr 2022 (S&P Global) at 53.40 (vs 54.10 prior)

- United Kingdom, Retail Sales, Change, Total including automotive fuel, Change Y/Y for Mar 2022 (ONS, United Kingdom) at 0.90 % (vs 7.00 % prior), below consensus estimate of 2.80 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change P/P for Mar 2022 (ONS, United Kingdom) at -1.10 % (vs -0.70 % prior), below consensus estimate of -0.40 %

- United Kingdom, Retail Sales, Total including automotive fuel, Change P/P for Mar 2022 (ONS, United Kingdom) at -1.40 % (vs -0.30 % prior), below consensus estimate of -0.30 %

- United Kingdom, S&P Global/CIPS PMI, Composite, Flash for Apr 2022 (S&P Global) at 57.60 (vs 60.90 prior), below consensus estimate of 59.00

- United Kingdom, S&P Global/CIPS PMI, Manufacturing Flash for Apr 2022 (S&P Global) at 55.30 (vs 55.20 prior), above consensus estimate of 54.00

- United Kingdom, S&P Global/CIPS PMI, Services, Flash for Apr 2022 (S&P Global) at 58.30 (vs 62.60 prior), below consensus estimate of 60.00

- United States, PMI, Composite, Output, Flash for Apr 2022 (S&P Global) at 55.10 (vs 57.70 prior)

- United States, PMI, Manufacturing Sector, Total, Flash for Apr 2022 (S&P Global) at 59.70 (vs 58.80 prior), above consensus estimate of 58.20

- United States, PMI, Services Sector, Business Activity, Flash for Apr 2022 (S&P Global) at 54.70 (vs 58.00 prior), below consensus estimate of 58.00

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -8.3 bp at 219.6 bp (YTD change: +47.5 bp)

- US-JAPAN: -3.0 bp at 292.7 bp (YTD change: +158.0 bp)

- US-CHINA: -2.9 bp at 36.4 bp (YTD change: +165.6 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +3.7 bp at 167.5 bp (YTD change: +84.3bp)

- US-JAPAN: +8.0 bp at 62.7 bp (YTD change: +133.5bp)

- JAPAN-GERMANY: -4.3 bp at 104.8 bp (YTD change: -49.2bp)

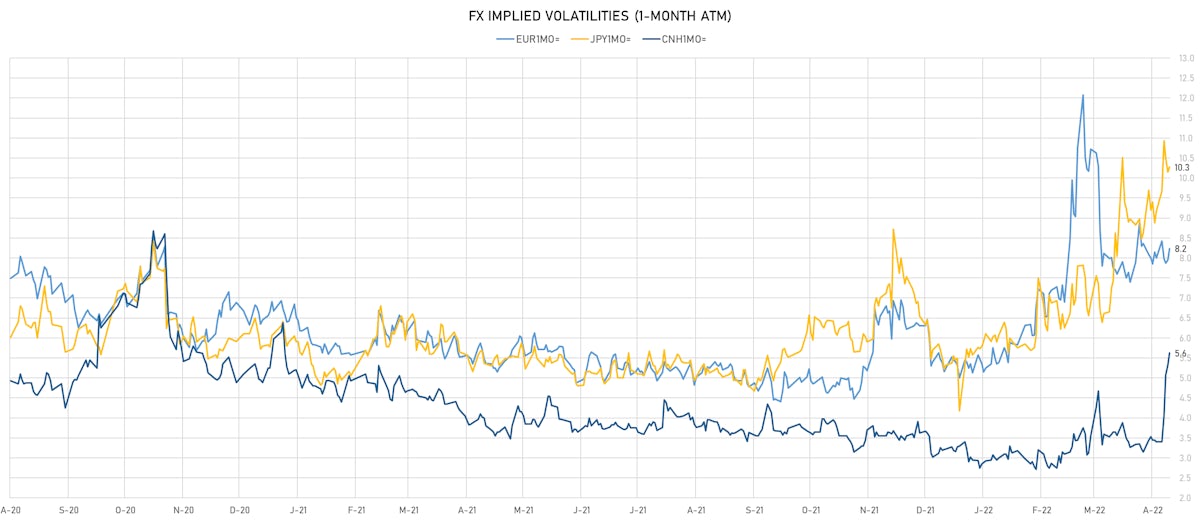

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.50, up 0.28 (YTD: +2.39)

- Euro 1-Month At-The-Money Implied Volatility currently at 8.24, up 0.3 (YTD: +3.2)

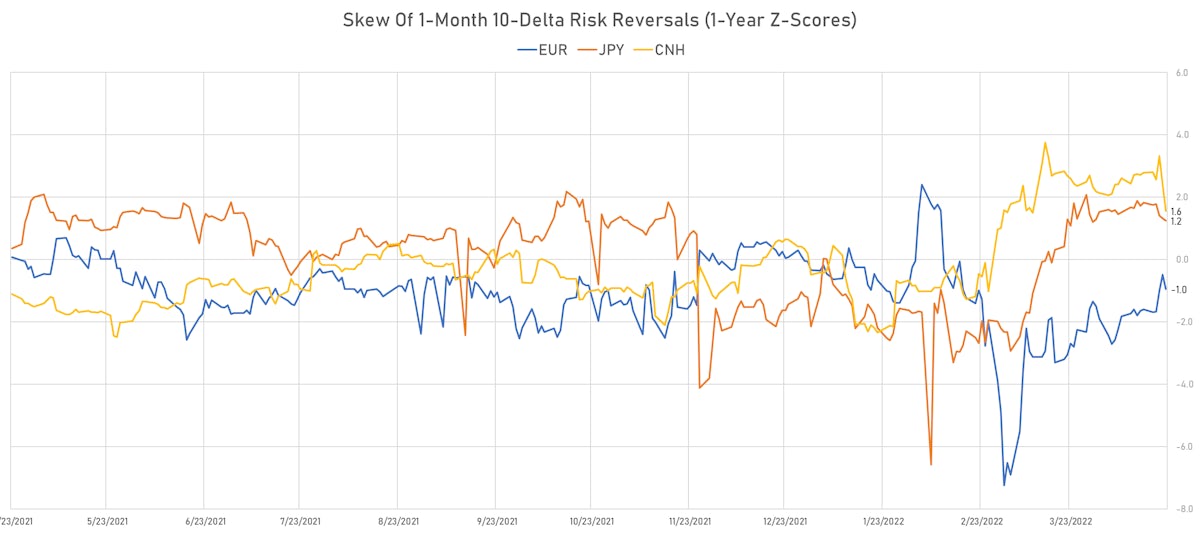

- Japanese Yen 1M ATM IV currently at 10.28, up 0.1 (YTD: +6.1); as we show in our chart at the top of the page, the implied volatilities in Japanese rates look a little low compared to other currencies. With the current uncertainties around a change of fiscal policy from the Japanese government, and a possible end of yield curve targeting by the BoJ, short-term JPY swaptions look attractive.

- Offshore Yuan 1M ATM IV currently at 5.63, up 0.3 (YTD: +2.3)

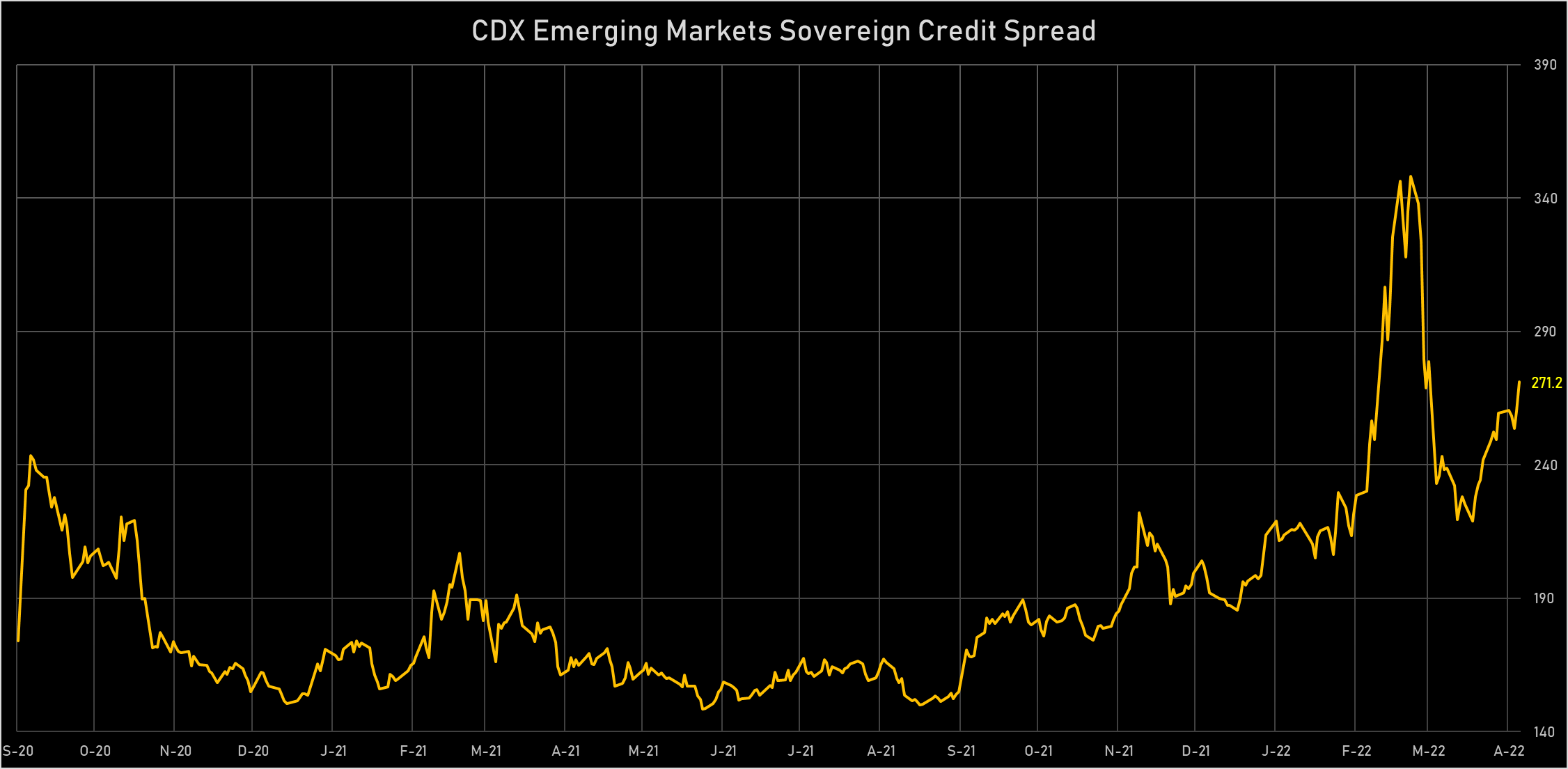

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS THIS WEEK

- Panama (rated WD): up 14.7 % to 111 bp (1Y range: 64-104bp)

- Mexico (rated BBB-): up 12.9 % to 137 bp (1Y range: 81-131bp)

- Hungary (rated BBB): up 10.3 % to 107 bp (1Y range: 47-107bp)

- Chile (rated A-): up 9.3 % to 96 bp (1Y range: 50-95bp)

- Indonesia (rated BBB): up 8.8 % to 106 bp (1Y range: 66-124bp)

- Malaysia (rated BBB+): up 8.5 % to 83 bp (1Y range: 41-82bp)

- Colombia (rated BB+): up 8.1 % to 224 bp (1Y range: 114-228bp)

- Philippines (rated BBB): up 7.7 % to 98 bp (1Y range: 41-106bp)

- Peru (rated BBB): up 7.2 % to 104 bp (1Y range: 72-105bp)

- China (rated A+): up 7.2 % to 70 bp (1Y range: 32-70bp)

LARGEST FX MOVES THIS WEEK

- Russian Rouble up 4.2% (YTD: -6.1%)

- Guinea Franc up 3.6% (YTD: +5.6%)

- New Zambian Kwacha up 3.2% (YTD: -2.3%)

- Pakistani rupee down 3.1% (YTD: -6.0%)

- Colombian Peso down 3.4% (YTD: +5.6%)

- Ukraine Hryvnia down 4.7% (YTD: -11.9%)

- Swaziland Lilangeni down 6.3% (YTD: +2.2%)

- Lesotho Loti down 6.4% (YTD: +2.2%)

- Namibian Dollar down 6.4% (YTD: +2.0%)

- South Africa Rand down 6.6% (YTD: +2.3%)