FX

US Dollar Mostly Weaker Against Major Currencies

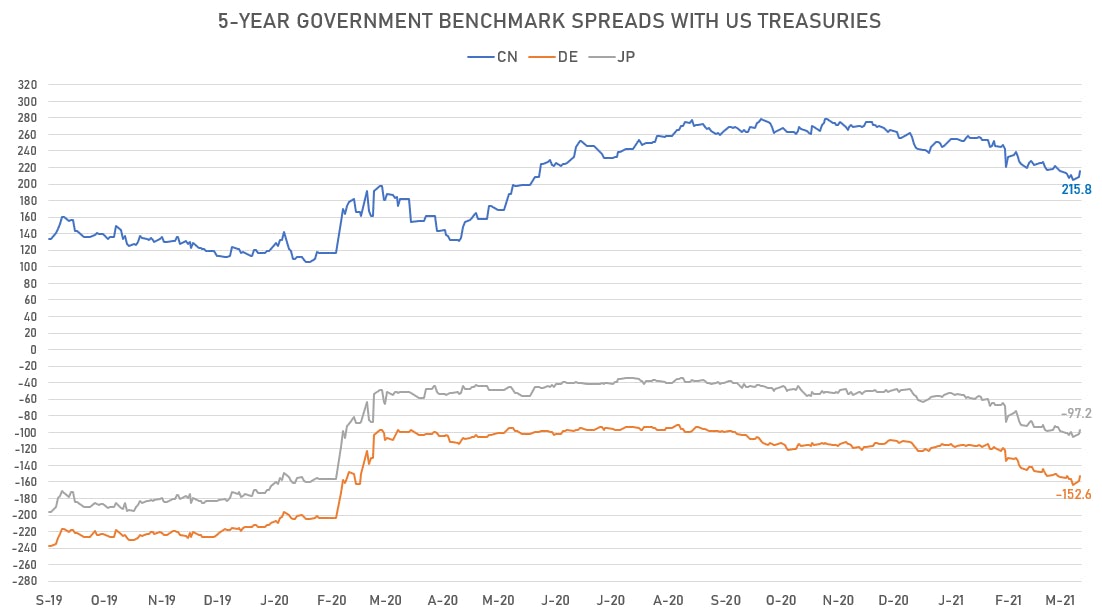

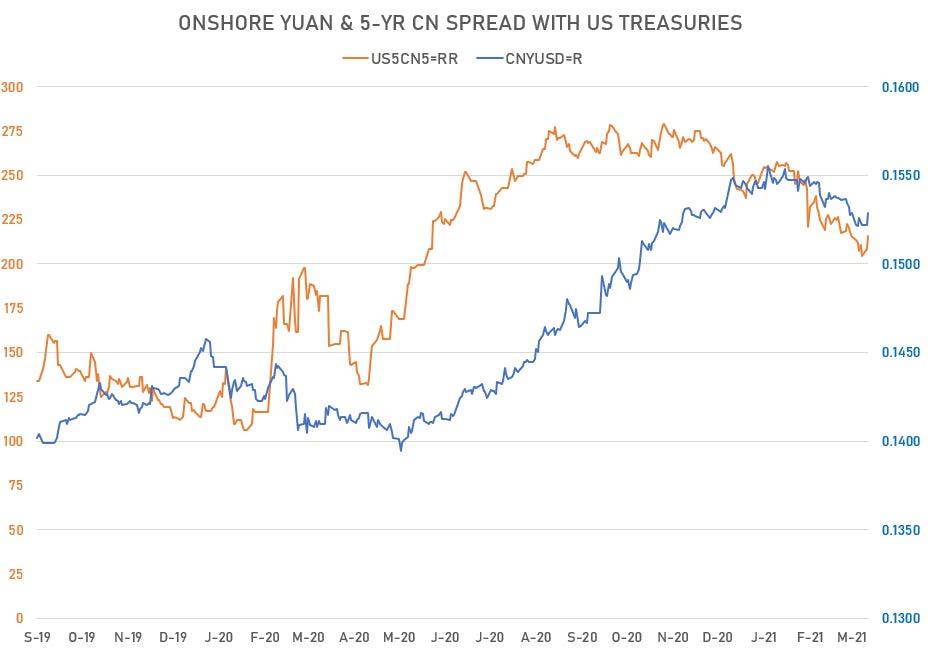

International interest rates catching up a little on US rates

Published ET

Sources: ϕpost analysis, Refinitiv Eikon data

NOTABLE MACRO HEADLINES

- The IMF says China will drive global growth in post-pandemic years, but warns of severe downside risk to India's growth outlook

- The PBOC is thinking of establishing a CNY futures market to improve onshore pricing

- Looking back to the US, markets are awaiting the release of the Fed minutes on Wednesday afternoon for signs of future rate hikes

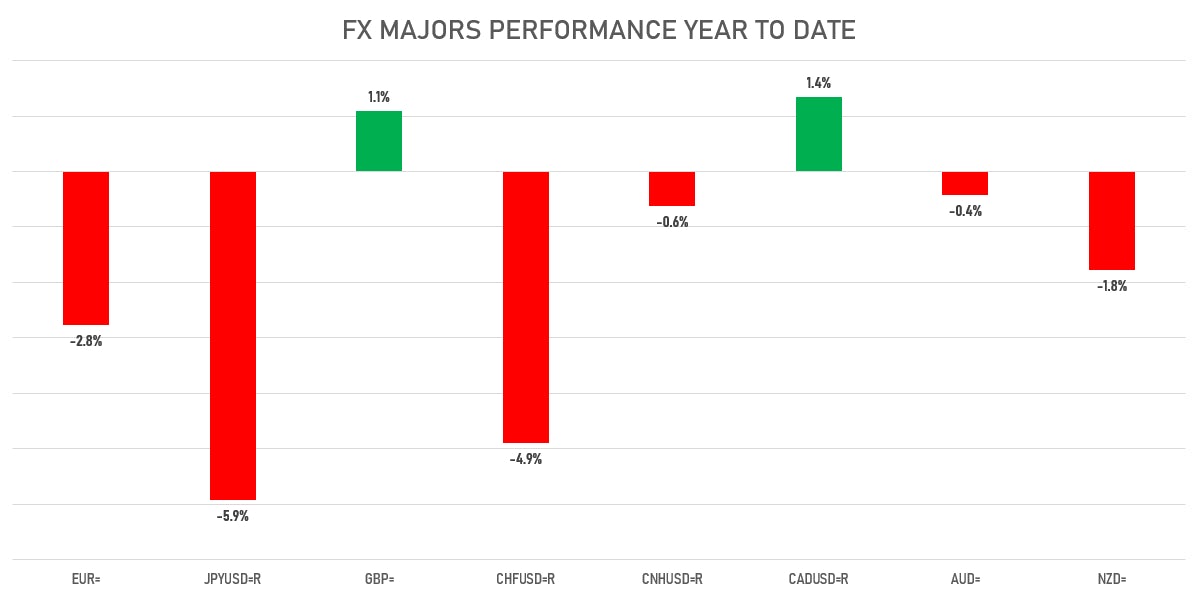

DAILY PERFORMANCE OF MAJOR CURRENCIES

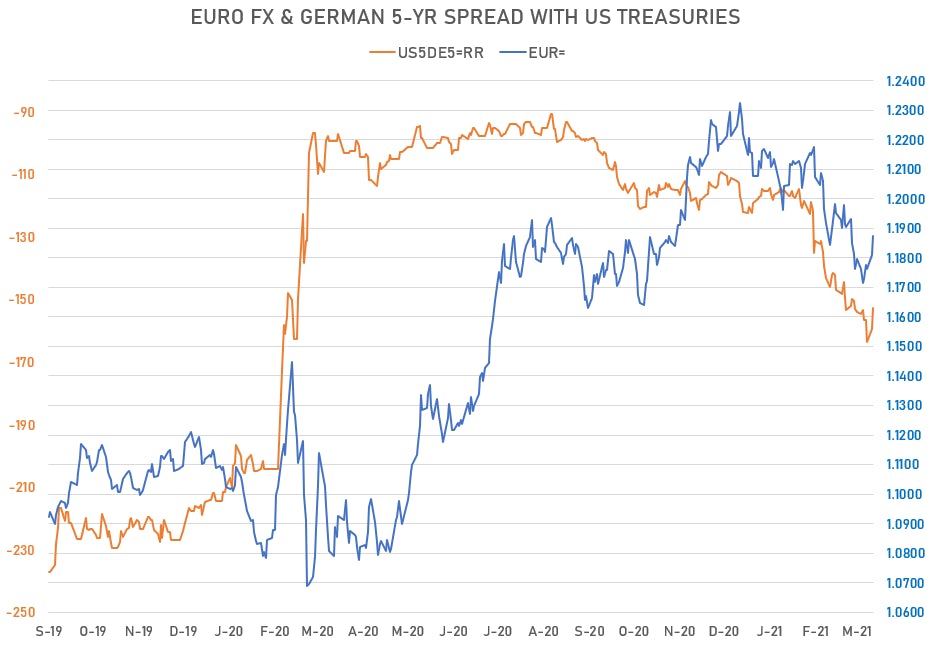

- Euro up 0.5% at 1.1875, with the 5-year German - US interest rates spread 6.7 bp tighter (see charts below)

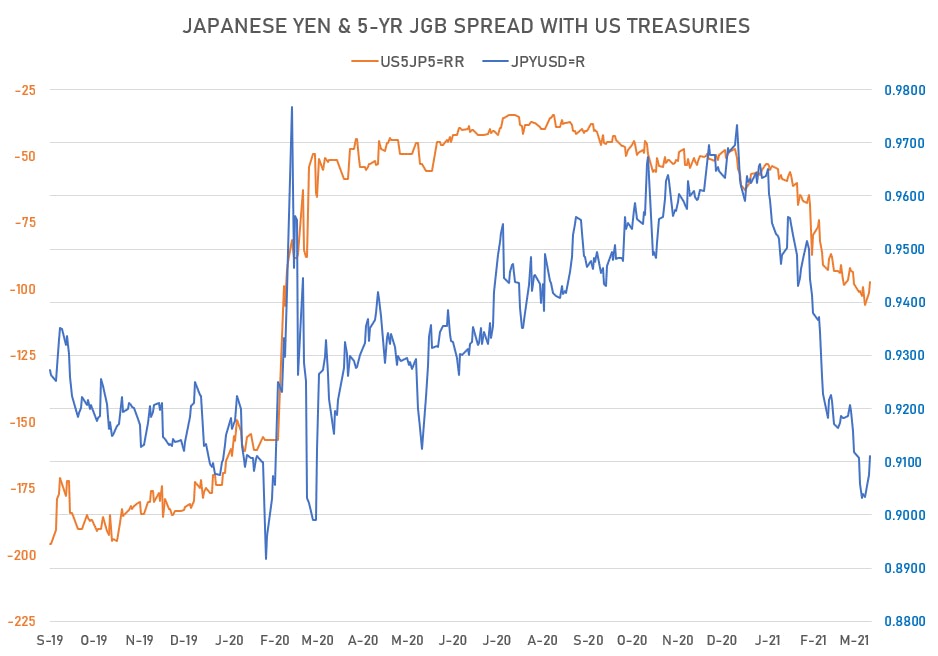

- Yen up 0.4% at 109.74; 5Y Japan - US rates spread 4.4 bp tighter

- Offshore Yuan up 0.2% at 6.5409; 5Y Chinese - US rates spread 7.2 bp wider

- Swiss franc up 0.6% at 0.9308

- Sterling down 0.5% at 1.3823

- Canadian dollar down 0.3% at 1.2563

- Australian dollar up 0.2% at 0.7662

- NZ dollar up 0.0% at 0.7057

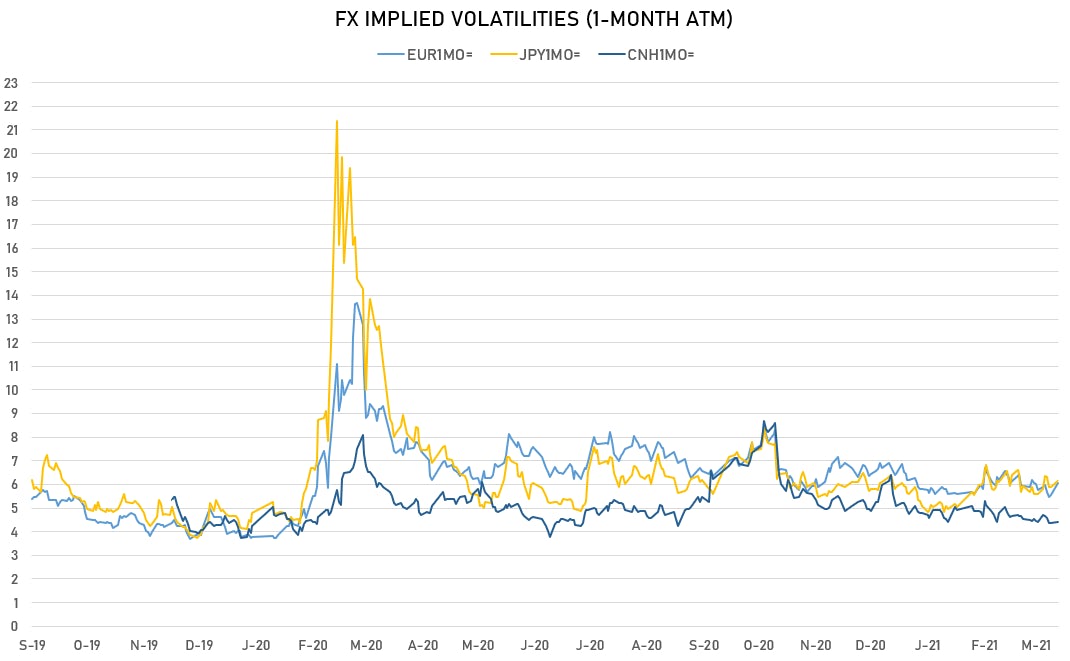

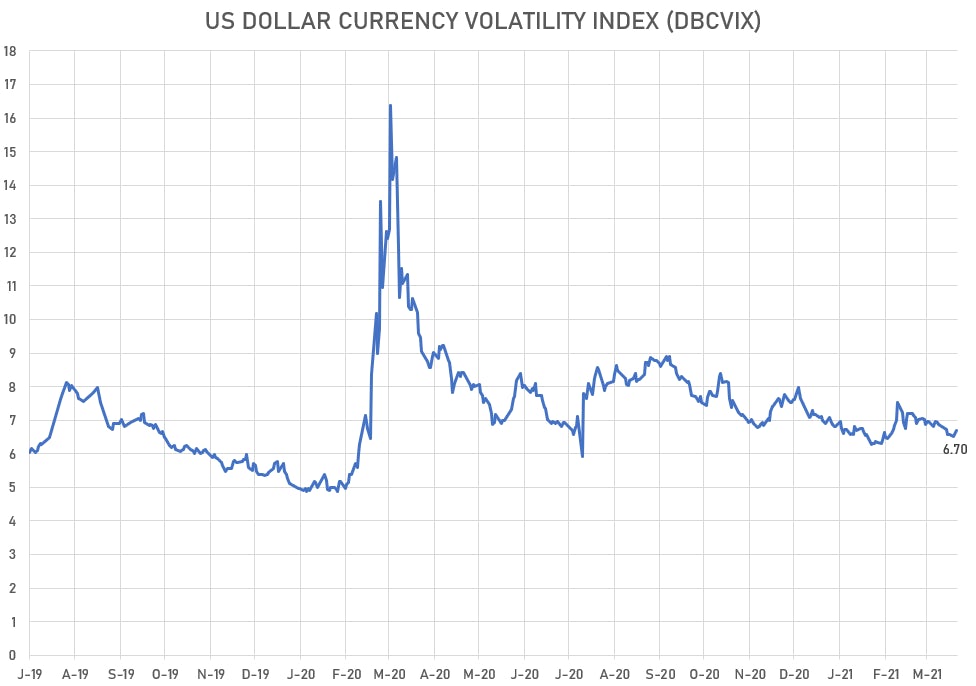

RATES SPREADS AND IMPLIED VOLATILITES

CLOSER LOOK AT TOP MAJORS

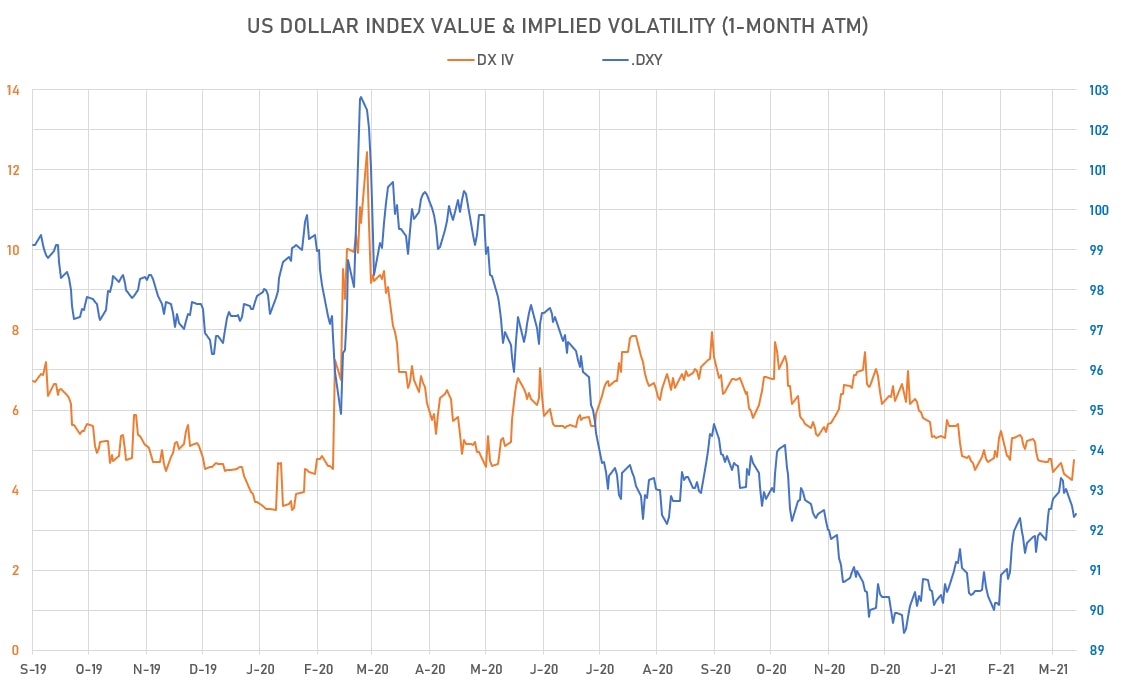

The EUR, JPY and CNY have been largely following spreads in interest rates, with the Japanese currency looking to have overshot by a good margin recently.

US DOLLAR INDEX

NOTABLE EXOTIC MOVERS TODAY

- Mongolia Tugrik up 1.0% (YTD: 1.3%)

- Georgian Lari up 0.9% (YTD: -3.7%)

- Kenyan Shilling up 0.5% (YTD: 1.1%)

- Botswana Pula up 0.4% (YTD: -0.9%)

- Moldovan Leu down 0.5% (YTD: -5.3%)

- Malawi Kwacha down 0.8% (YTD: -2.3%)

- Indian Rupee down 0.9% (YTD: -1.5%)

- Mauritius Rupee down 1.2% (YTD: -2.8%)

- Fiji Dollar down 1.6% (YTD: -1.0%)