FX

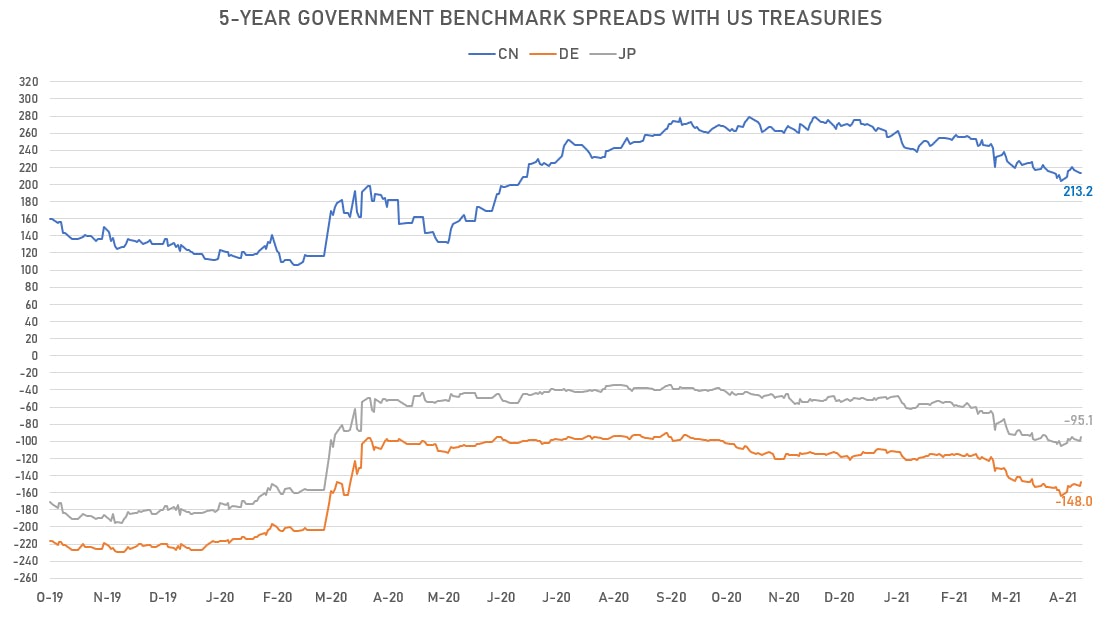

Rates Still Driving Currency Flows

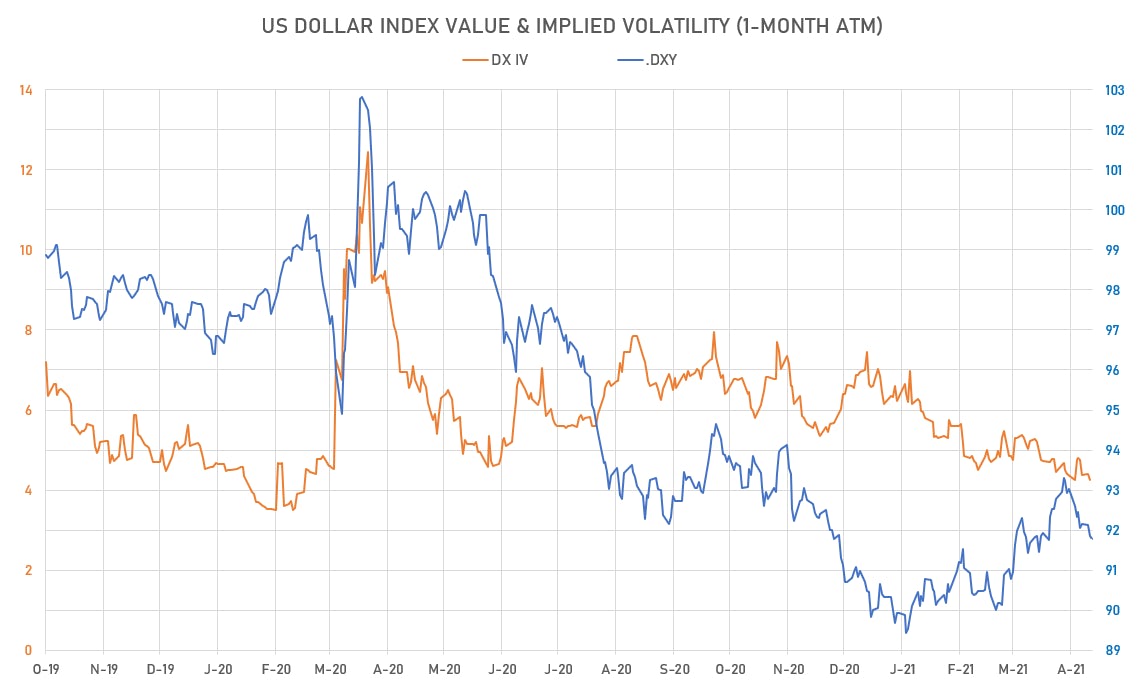

Rates spreads tightening are driving the USD very modestly down

Published ET

Source: ϕpost analysis, Refinitiv Data

NOTABLE MACRO HEADLINES

- Japan core machinery orders for February (seasonally adjusted M/M) were weak: Actual -8.5% vs. Consensus 1.0%

- Seasonally adjusted Eurozone Industrial Production for February 2021 (M/M change) was in line with expectations: Actual-1.0%

vs. Consensus-1.1% (prior 0.80%) - Working day adjusted Eurozone Industrial Production for February 2021 (Y/Y change) was surprisingly weak: Actual -1.6% vs. Consensus 0.10% (prior 0.10%)

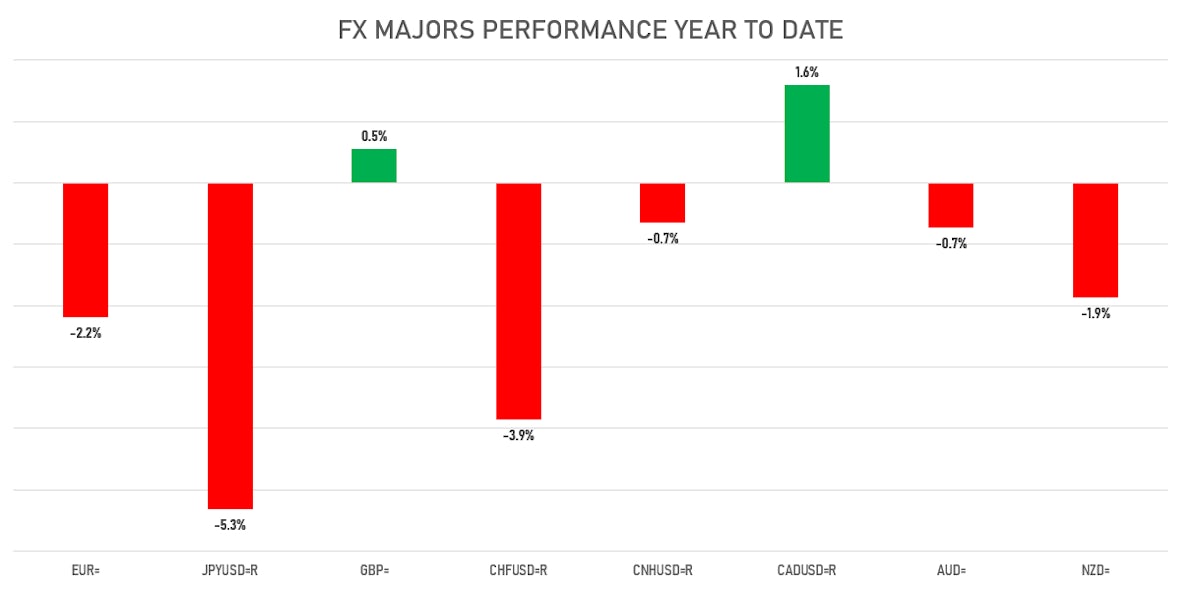

- The US Dollar Index is almost unchanged (down -0.1% at 91.8)

DAILY PERFORMANCES OF MAJOR CURRENCIES ALIGN WITH CHANGES IN RATES SPREADS

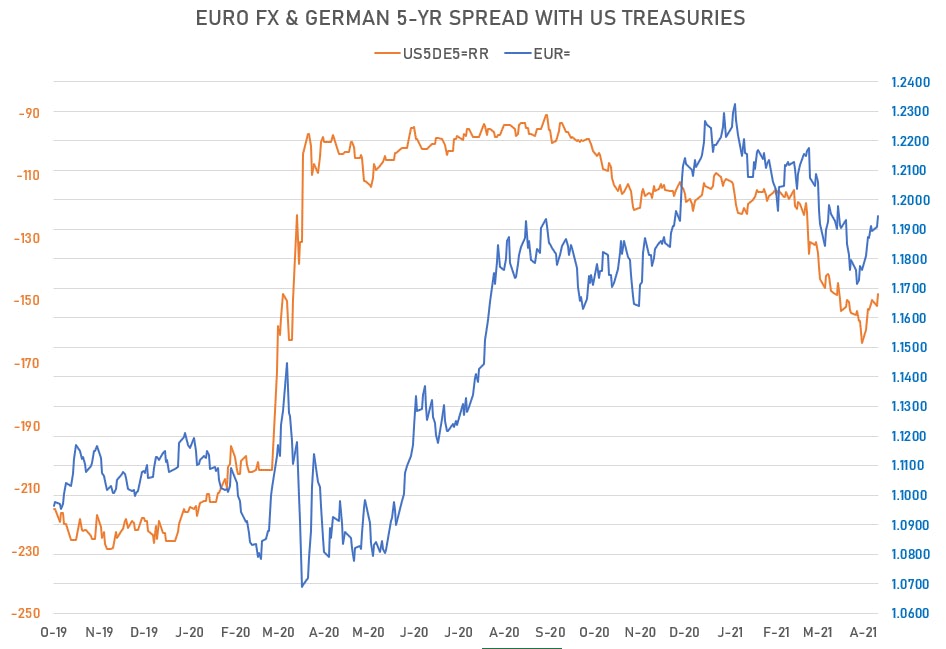

- Euro up 0.3% at 1.1946, with the 5-year German - US interest rates spread 3.8 bp tighter (see charts below)

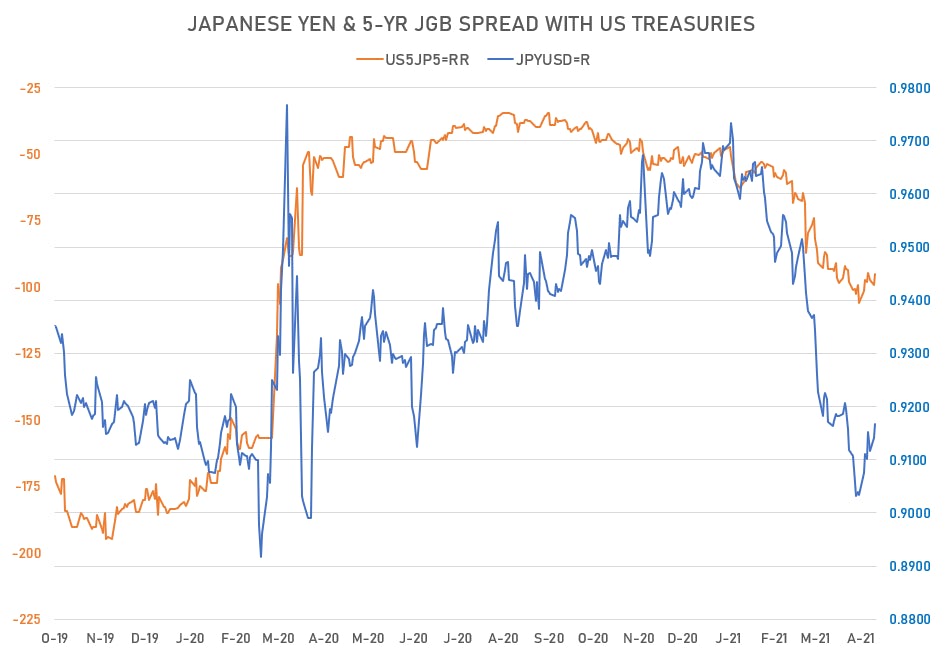

- Yen up 0.3% at 109.05; 5Y Japan - US rates spread 4.2 bp tighter

- Offshore Yuan up 0.0% at 6.5429; 5Y Chinese - US rates spread -0.3 bp tighter

- Swiss franc up 0.2% at 0.9208

- Sterling up 0.1% at 1.3748

- Canadian dollar up 0.2% at 1.2531

- Australian dollar up 0.2% at 0.7638

- NZ dollar up 0.3% at 0.7051

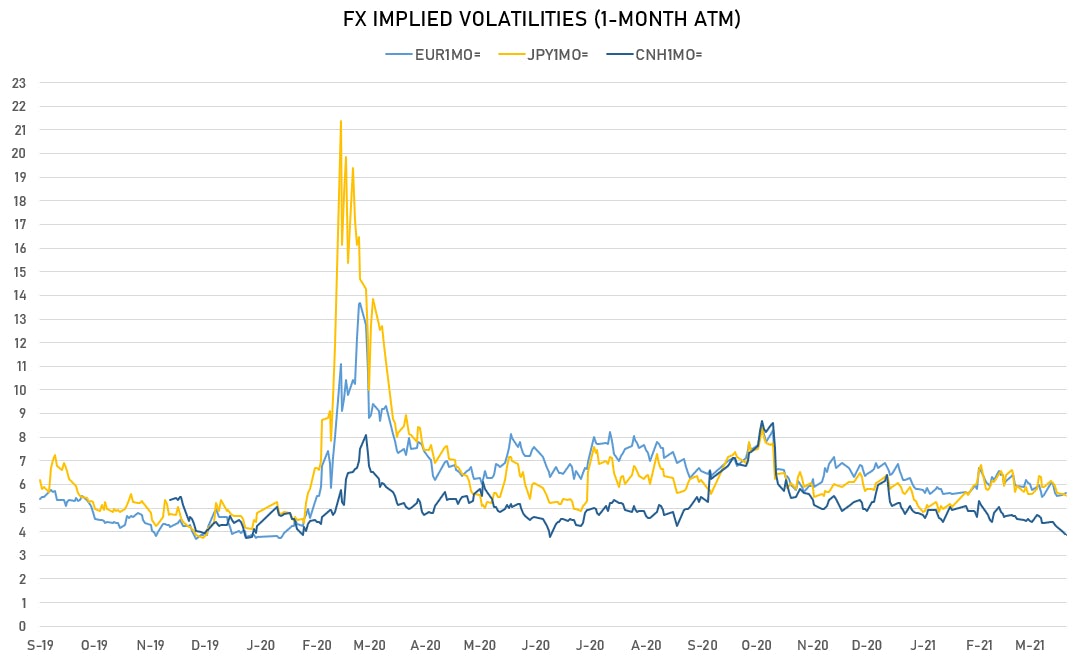

VOLATILITIES LOW, NOTHING MUCH TO SEE

NOTABLE EXOTIC MOVERS TODAY

- Seychelles Rupee up 12.7% (YTD: 34.4%)

- Mozambique Metical up 2.2% (YTD: 32.5%)

- Samoa Tala up 1.2% (YTD: 0.5%) Burundi Franc up 1.1% (YTD: 0.0%)

- Turkish Lira up 0.8% (YTD: -7.7%)

- Kazakhstan Tenge up 0.7% (YTD: -2.2%)

- Moldovan Leu down 0.9% (YTD: -5.1%)

- Tunisian Dinar down 1.0% (YTD: -3.0%)

- Bosnian Mark down 1.2% (YTD: -4.2%)