Macro

US Front-End Yields Drop, Curve Steepens On Positive Risk Sentiment, Despite Hotter Than Expected PPI Data

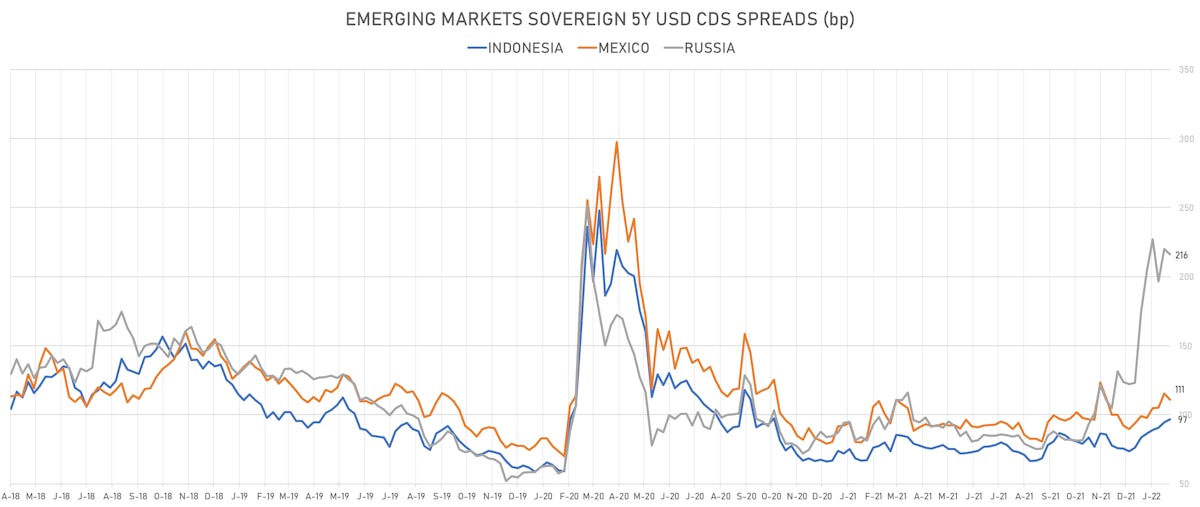

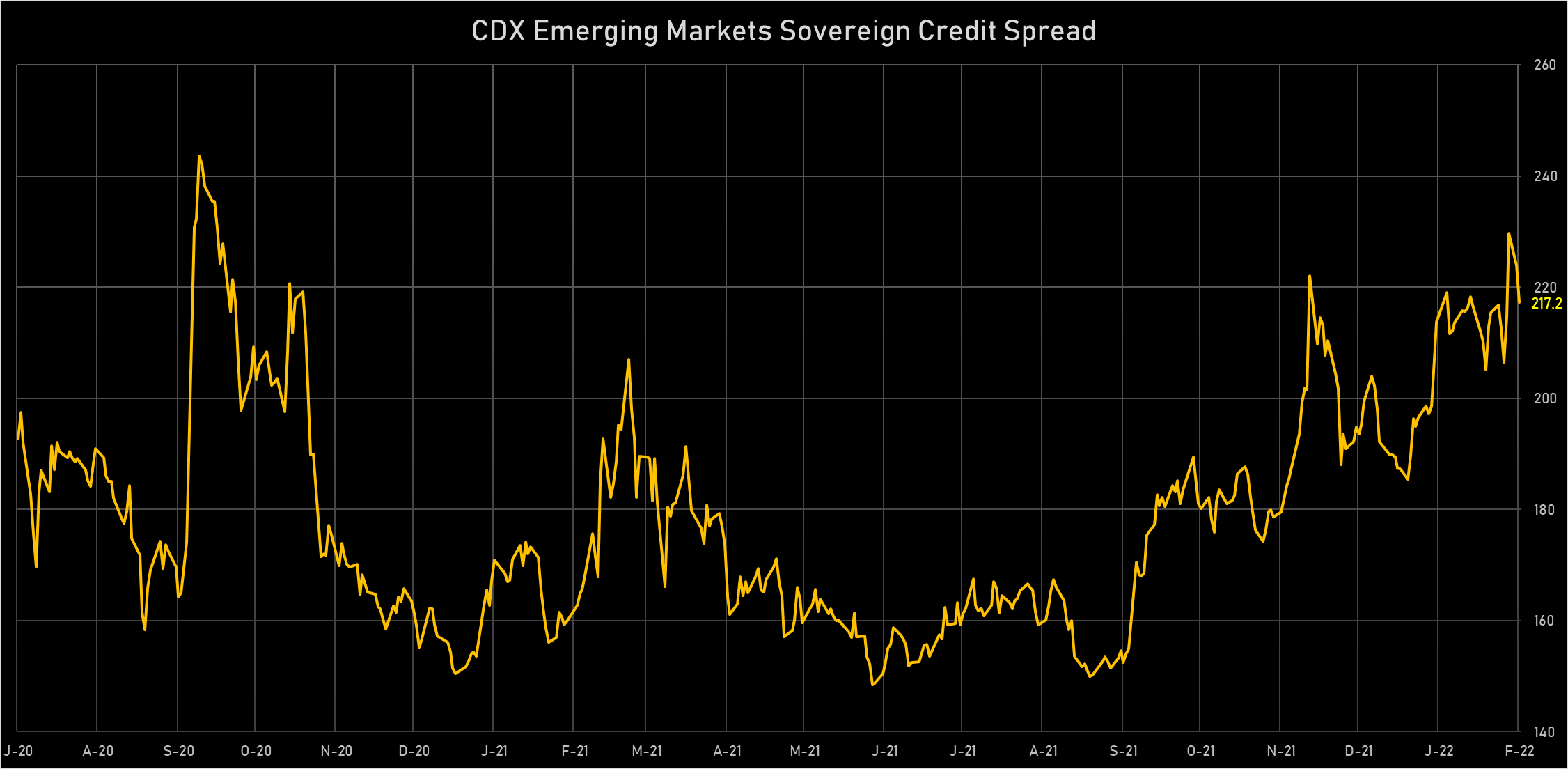

Russia's sovereign CDS spread narrowed by 29 basis points and the Rouble was up 1.6% today, as tension in Ukraine seemed to ease with the end of war games in Belarus and pullback of some troops

Published ET

Sovereign 5Y USD CDS Spreads for Indonesia, Mexico and Russia | Sources: ϕpost, Refinitiv data

US RATES SUMMARY

- 3-Month USD LIBOR +1.0bp today, now at 0.4690%; 3-Month OIS -0.4bp at 0.4010%

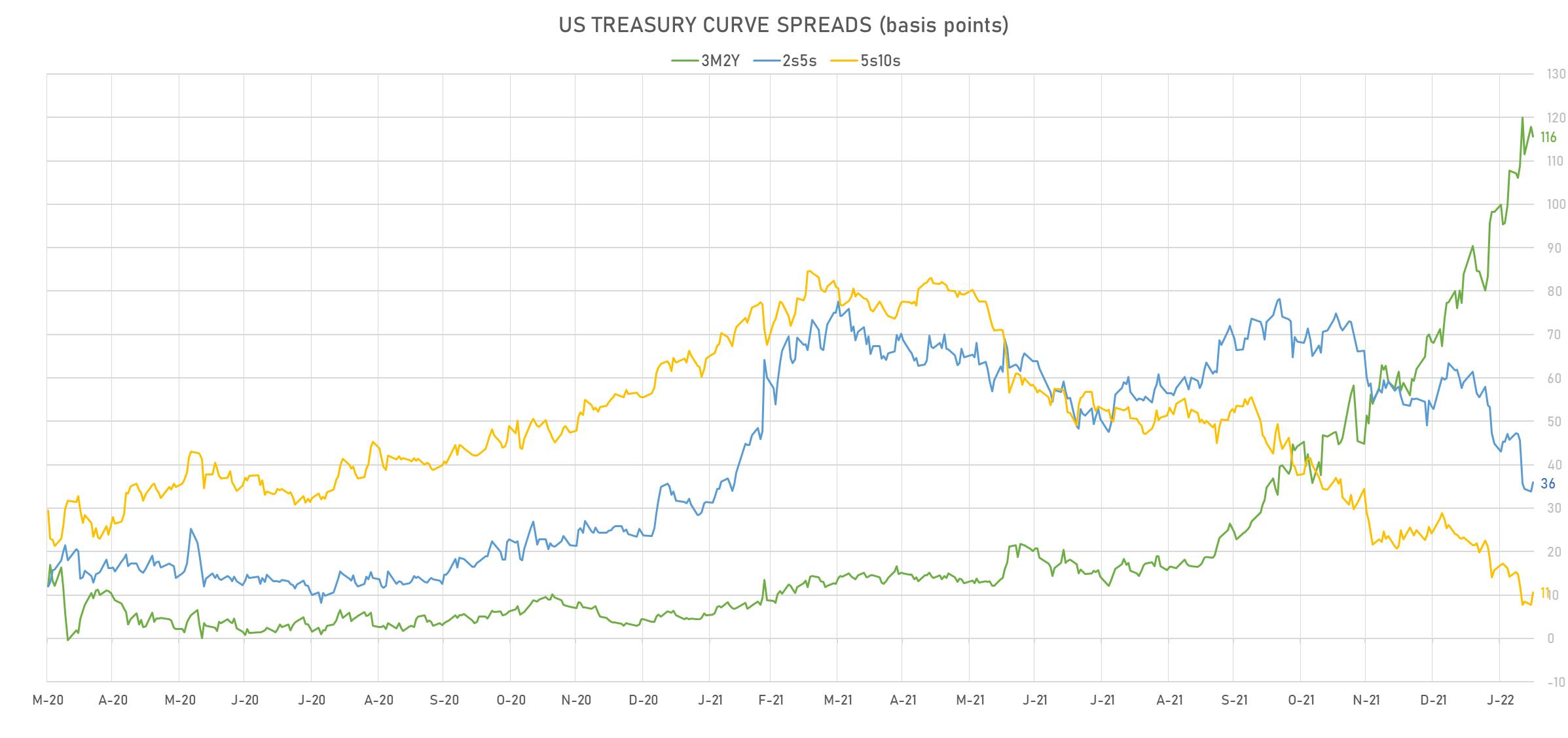

- The treasury yield curve steepened, with the 1s10s spread widening 8.3 bp, now at 93.9 bp (YTD change: -18.8bp)

- 1Y: 1.1040% (down 2.6 bp)

- 2Y: 1.5774% (up 0.7 bp)

- 5Y: 1.9368% (up 2.9 bp)

- 7Y: 2.0307% (up 4.2 bp)

- 10Y: 2.0434% (up 5.8 bp)

- 30Y: 2.3617% (up 7.6 bp)

- US treasury curve spreads: 3m2Y at 115.6bp (down -2.3bp today), 2s5s at 36.0bp (up 2.3bp), 5s10s at 10.7bp (up 2.9bp), 10s30s at 31.8bp (up 1.8bp)

- Treasuries butterfly spreads: 1s5s10s at -77.5bp (down -1.0bp), 5s10s30s at 20.2bp (down -1.3bp)

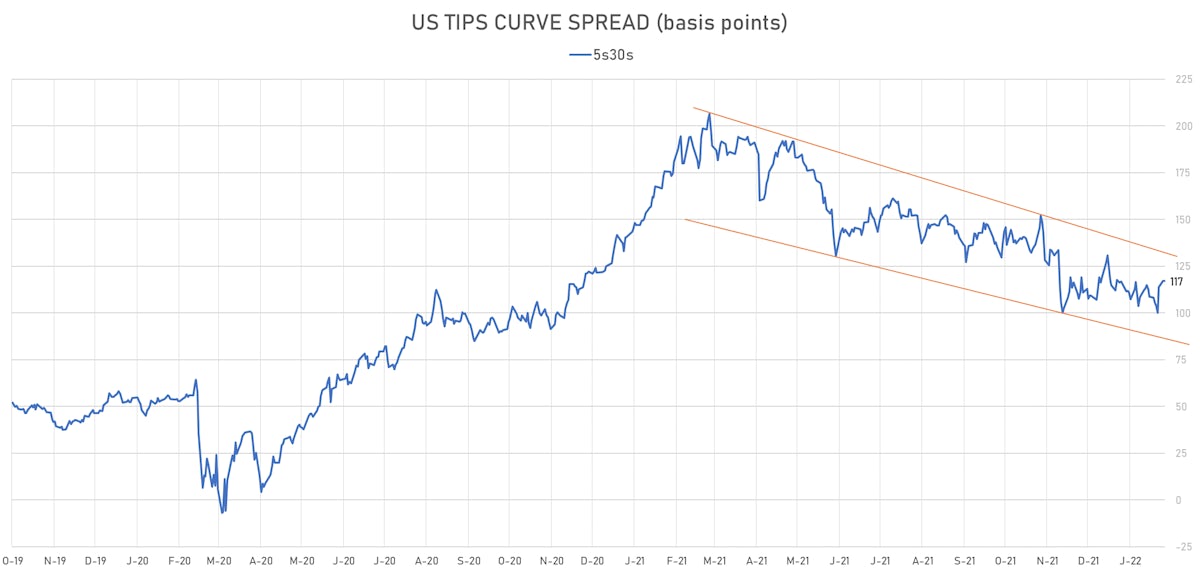

- TIPS 1Y breakeven inflation at 4.49% (down -8.9bp); 2Y at 3.60% (down -6.4bp); 5Y at 2.84% (down -3.9bp); 10Y at 2.49% (down -2.4bp); 30Y at 2.21% (up 1.0bp)

- US 5-Year TIPS Real Yield: +6.9 bp at -0.9850%; 10-Year TIPS Real Yield: +8.1 bp at -0.4400%; 30-Year TIPS Real Yield: +6.9 bp at 0.1870%

US ECON RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 12 Feb (Redbook Research) at 15.40 % (vs 13.30 % prior)

- Net flows total, Current Prices for Dec 2021 (U.S. Dept. Treas.) at -52.40 Bln USD (vs 223.90 Bln USD prior)

- Net foreign acquisition of long-term securities, Current Prices for Dec 2021 (U.S. Dept. Treas.) at 101.90 Bln USD (vs 105.30 Bln USD prior)

- Net purchases (net long-term capital inflows), total, Current Prices for Dec 2021 (U.S. Dept. Treas.) at 114.50 Bln USD (vs 137.40 Bln USD prior)

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Dec 2021 (U.S. Dept. Treas.) at 44.20 Bln USD (vs 66.40 Bln USD prior)

- New York Fed, General Business Condition for Feb 2022 (FED, NY) at 3.10 (vs -0.70 prior), below consensus estimate of 12.15

- PPI ex Food/Energy/Trade MM, Change P/P for Jan 2022 (BLS, U.S Dep. Of Lab) at 0.90 % (vs 0.40 % prior)

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Jan 2022 (BLS, U.S Dep. Of Lab) at 6.90 % (vs 6.90 % prior), above consensus estimate of 6.30 %

- Producer Prices, Final demand less foods and energy, Change P/P for Jan 2022 (BLS, U.S Dep. Of Lab) at 0.80 % (vs 0.50 % prior), above consensus estimate of 0.50 %

- Producer Prices, Final demand less foods and energy, Change Y/Y for Jan 2022 (BLS, U.S Dep. Of Lab) at 8.30 % (vs 8.30 % prior), above consensus estimate of 7.90 %

- Producer Prices, Final demand, Change P/P for Jan 2022 (BLS, U.S Dep. Of Lab) at 1.00 % (vs 0.20 % prior), above consensus estimate of 0.50 %

- Producer Prices, Final demand, Change Y/Y for Jan 2022 (BLS, U.S Dep. Of Lab) at 9.70 % (vs 9.70 % prior), above consensus estimate of 9.10 %

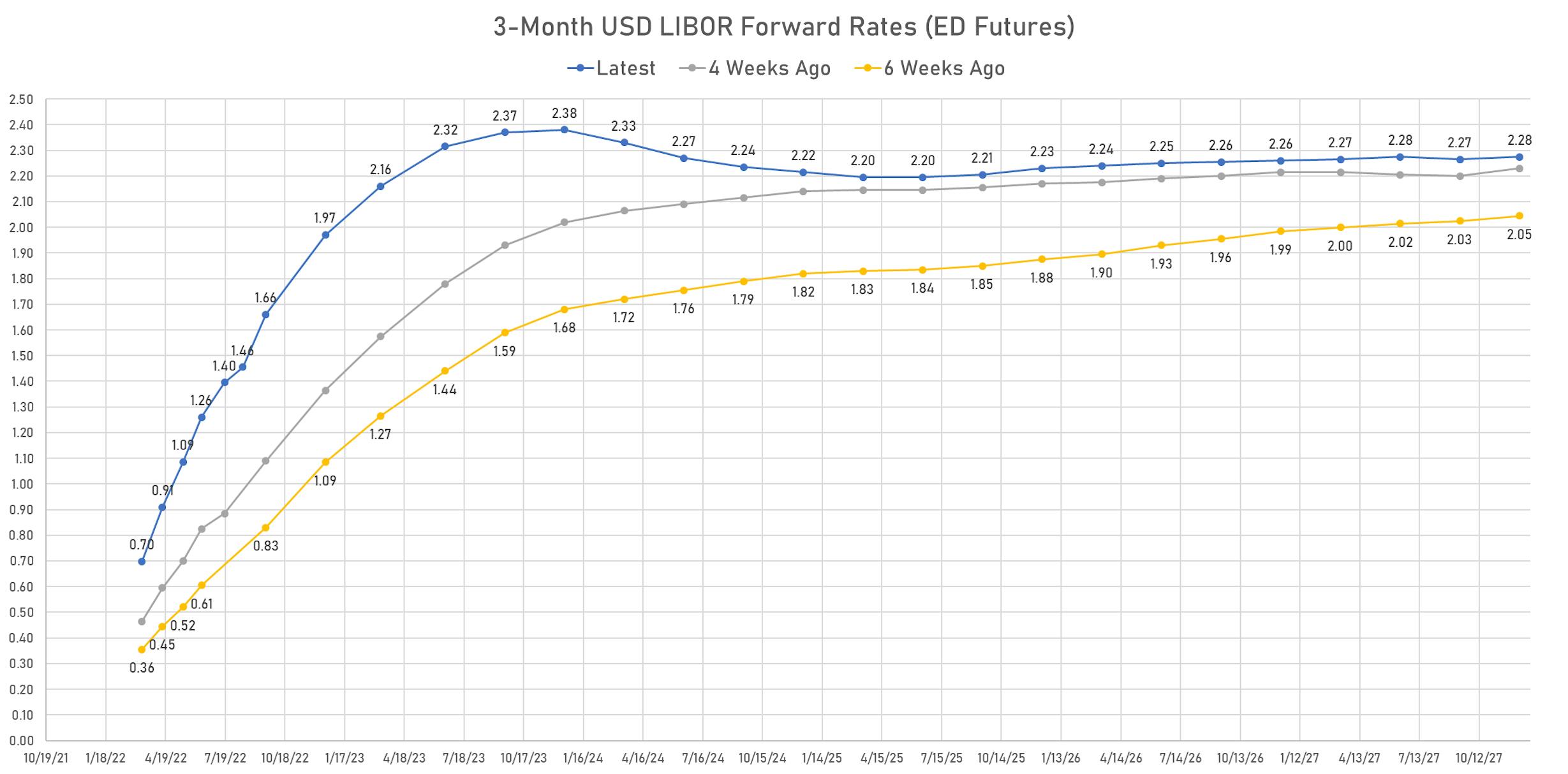

US FORWARD RATES

- Fed Funds futures now price in 39.4bp of Fed hikes by the end of March 2022, 70.1bp (2.80 x 25bp hikes) by the end of May 2022, and price in 6.43 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 41 bp of hikes in 2023 (equivalent to 1.6 x 25 bp hikes), up TRUE bp today, and -16.5 bp of hikes in 2024 (equivalent to -0.7 x 25 bp hikes)

- 1-year US Treasury rate 5 years forward up 7.7 bp, now at 2.1884%, meaning that the 1-year Treasury rate is now expected to increase by 101.4 bp over the next 5 years

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.49% (down -8.9bp); 2Y at 3.60% (down -6.4bp); 5Y at 2.84% (down -3.9bp); 10Y at 2.49% (down -2.4bp); 30Y at 2.21% (up 1.0bp)

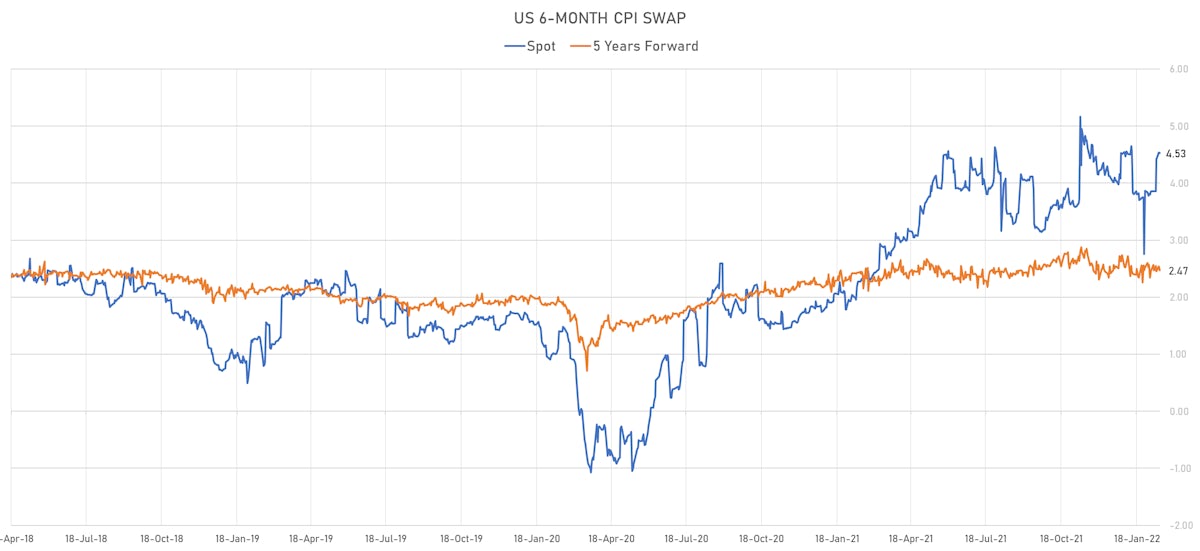

- 6-month spot US CPI swap down -1.1 bp to 4.526%, with a steepening of the forward curve

- US Real Rates: 5Y at -0.9850%, +6.9 bp today; 10Y at -0.4400%, +8.1 bp today; 30Y at 0.1870%, +6.9 bp today

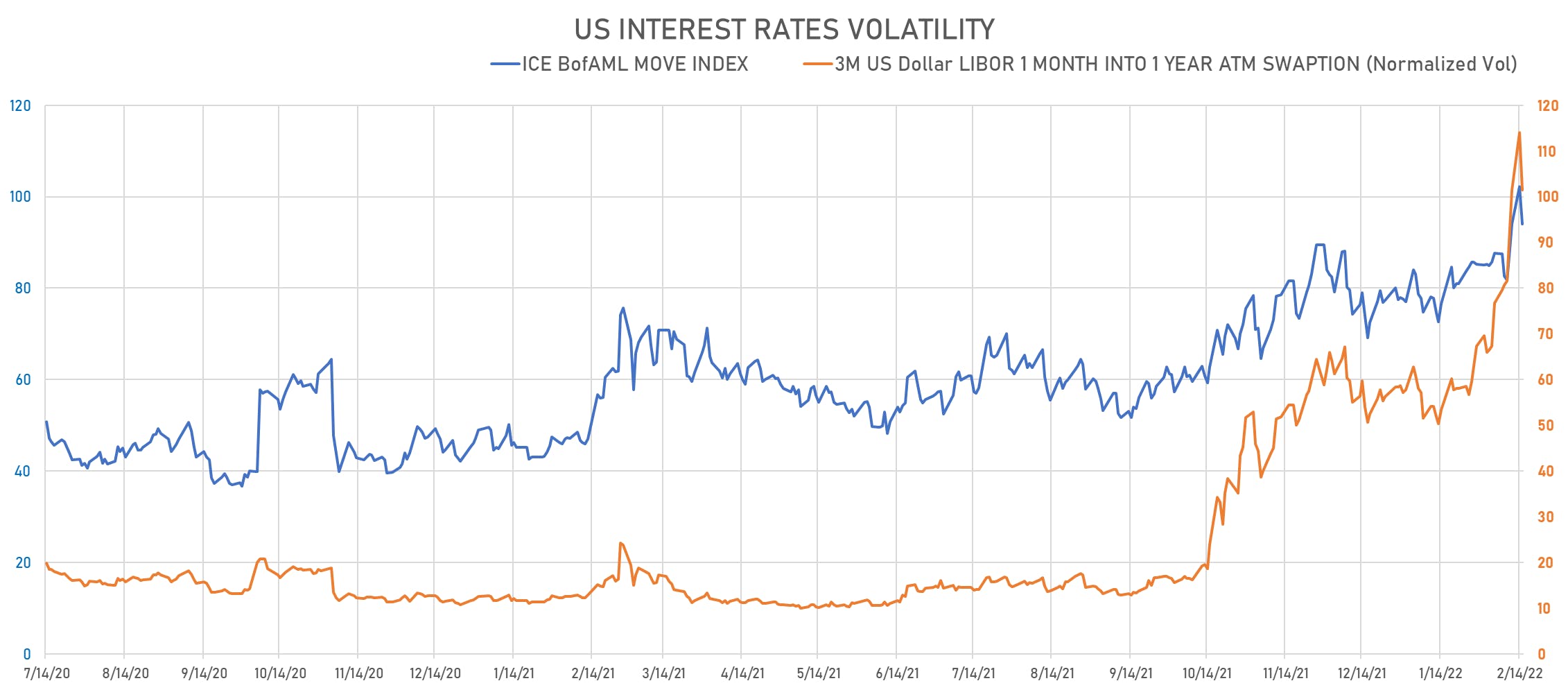

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -12.6% at 101.4%

- 3-Month LIBOR-OIS spread up 1.4 bp at 6.8 bp (12-months range: -5.5-13.4 bp)

GLOBAL MACRO RELEASES

- Canada, Housing Starts, All areas for Jan 2022 (CMHC, Canada) at 230.80 k (vs 236.10 k prior), below consensus estimate of 245.00 k

- Colombia, GDP, Change Y/Y for Q4 2021 (DANE, Colombia) at 10.80 % (vs 13.20 % prior), above consensus estimate of 8.70 %

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Jan 2022 (ECB) at 1,056.84 Bln EUR (vs 1,057.00 Bln EUR prior)

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change P/P for Q4 2021 (Eurostat) at 0.30 % (vs 0.30 % prior), in line with consensus

- Euro Zone, GDP, Total at market prices, Chain-linked (ESA2010), Change Y/Y for Q4 2021 (Eurostat) at 4.60 % (vs 4.60 % prior), in line with consensus

- Finland, Official reserve assets, Current Prices for Jan 2022 (Bank of Finland) at 14,811.00 Mln EUR (vs 14,789.00 Mln EUR prior)

- Germany, ZEW, Current Economic Situation, Germany, balance for Feb 2022 (ZEW, Germany) at -8.10 (vs -10.20 prior), below consensus estimate of -6.00

- Germany, ZEW, Economic Expectations, Germany, balance for Feb 2022 (ZEW, Germany) at 54.30 (vs 51.70 prior), below consensus estimate of 55.00

- Indonesia, Trade Balance, Current Prices for Jan 2022 (Statistics Indonesia) at 0.93 Bln USD (vs 1.02 Bln USD prior), above consensus estimate of 0.19 Bln USD

- Netherlands, GDP, Total, Flash, Change P/P for Q4 2021 (CBS - NL) at 0.90 % (vs 2.10 % prior)

- New Zealand, Milk Auction, Average Price, Constant Prices for W 15 Feb (GlobalDairy Trade) at 4,840.00 USD (vs 4,630.00 USD prior)

- Poland, CPI, Change P/P, Price Index for Jan 2022 (CSO, Poland) at 1.90 % (vs 0.00 % prior), in line with consensus

- Poland, CPI, Change Y/Y, Price Index for Jan 2022 (CSO, Poland) at 9.20 % (vs 0.00 % prior), below consensus estimate of 9.30 %

- United Kingdom, Unemployment, Claimant count, Absolute change for Jan 2022 (ONS, United Kingdom) at -31.90 k (vs -43.30 k prior), below consensus estimate of -28.00 k

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Dec 2021 (ONS, United Kingdom) at 4.10 % (vs 4.10 % prior), in line with consensus

KEY INTERNATIONAL RATES

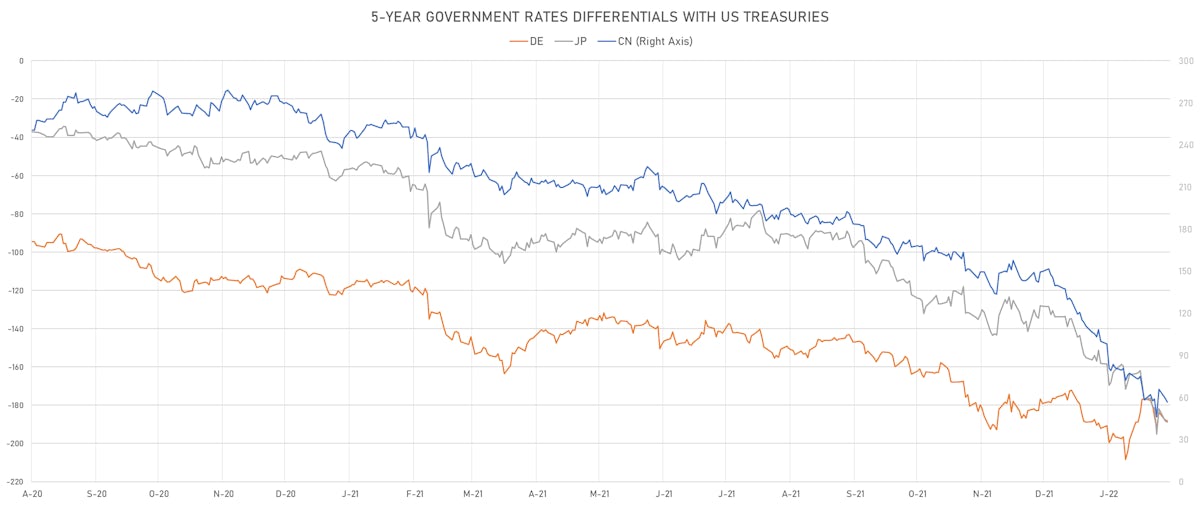

- Germany 5Y: 0.056% (up 2.2 bp); the German 1Y-10Y curve is 5.0 bp steeper at 95.8bp (YTD change: +52.3 bp)

- Japan 5Y: 0.049% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 28.6bp (YTD change: +11.8 bp)

- China 5Y: 2.512% (down -0.8 bp); the Chinese 1Y-10Y curve is 5.6 bp steeper at 92.4bp (YTD change: +41.4 bp)

- Switzerland 5Y: 0.092% (up 6.6 bp); the Swiss 1Y-10Y curve is 3.4 bp steeper at 93.2bp (YTD change: +36.3 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -0.7 bp at 187.4 bp (YTD change: +15.3 bp)

- US-JAPAN: -0.8 bp at 188.1 bp (YTD change: +53.4 bp)

- US-CHINA: -0.6 bp at -57.4 bp (YTD change: +71.8 bp)

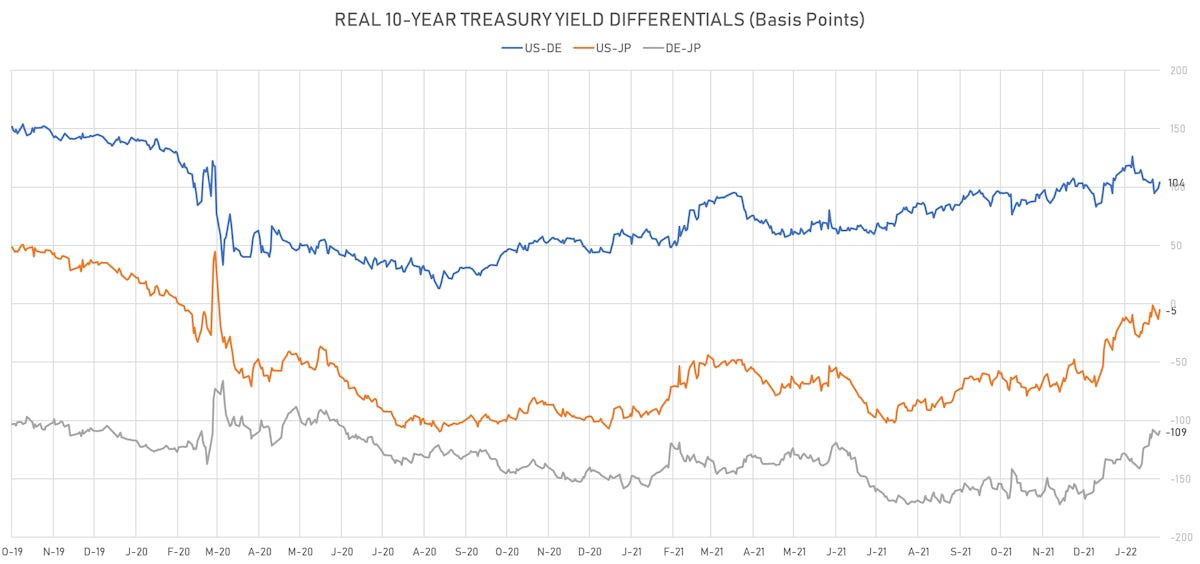

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +4.9 bp at 104.1 bp (YTD change: +20.9bp)

- US-JAPAN: +8.1 bp at -5.2 bp (YTD change: +65.6bp)

- JAPAN-GERMANY: -3.2 bp at 109.3 bp (YTD change: -44.7bp)

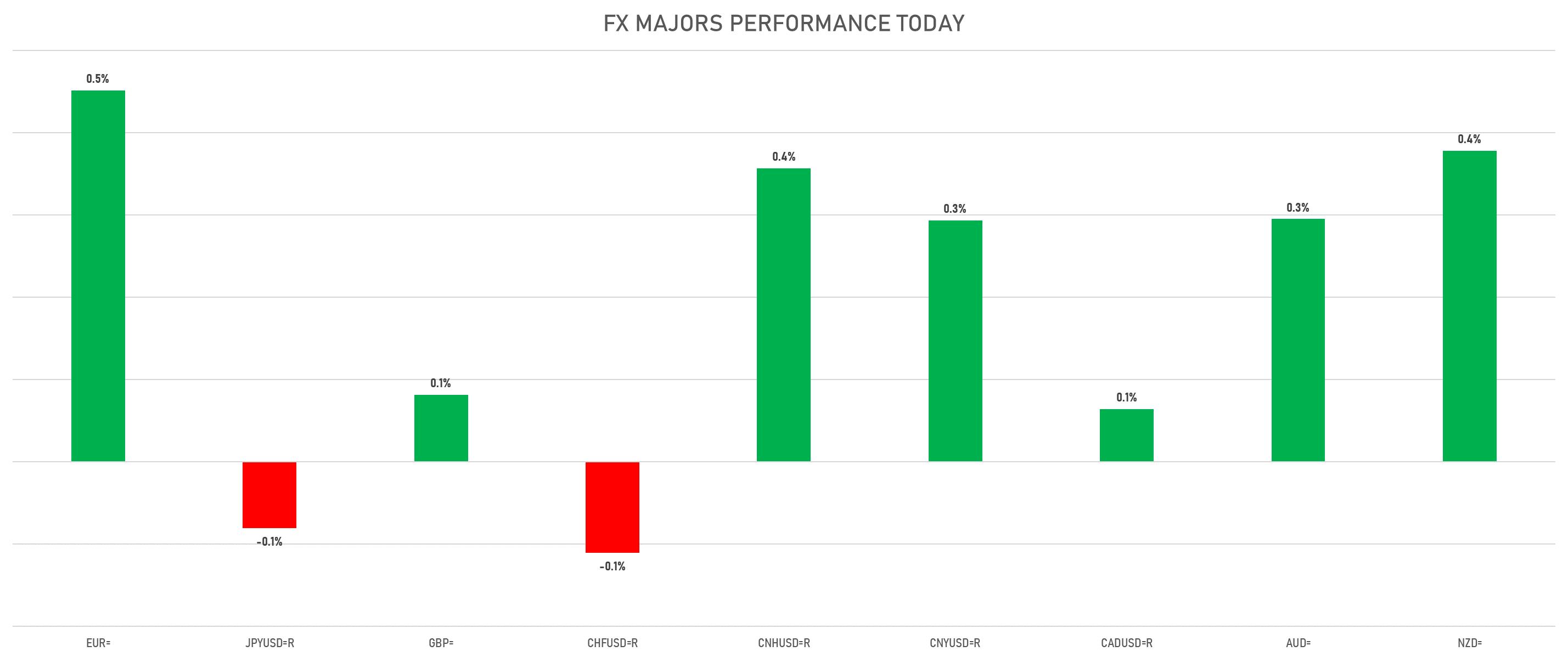

FX SUMMARY

- The US Dollar Index is down -0.32% at 95.99 (YTD: +0.34%)

- Euro up 0.45% at 1.1356 (YTD: -0.1%)

- Yen down 0.08% at 115.62 (YTD: -0.5%)

- Onshore Yuan up 0.29% at 6.3385 (YTD: +0.3%)

- Swiss franc down 0.11% at 0.9252 (YTD: -1.4%)

- Sterling up 0.08% at 1.3537 (YTD: +0.1%)

- Canadian dollar up 0.06% at 1.2722 (YTD: -0.7%)

- Australian dollar up 0.29% at 0.7146 (YTD: -1.6%)

- NZ dollar up 0.38% at 0.6640 (YTD: -2.7%)

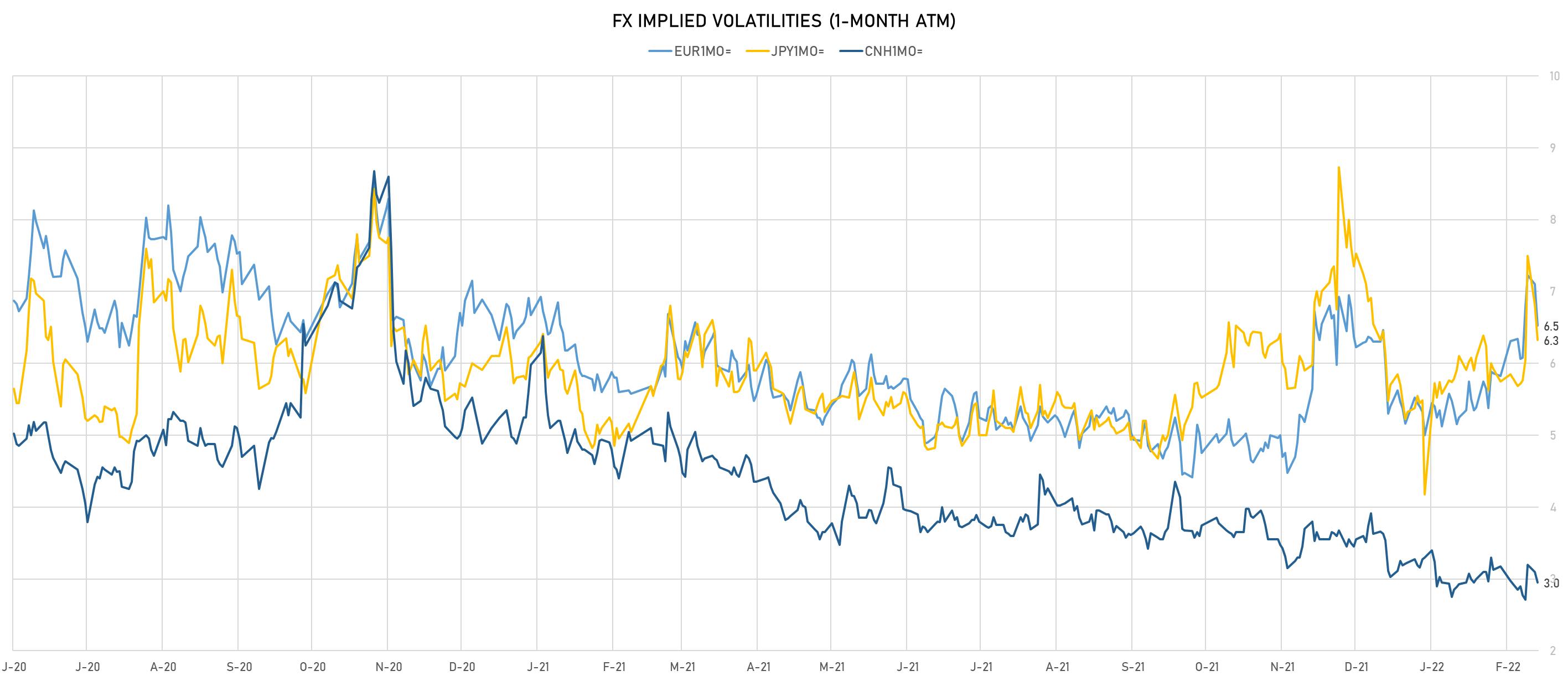

FX VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 6.51, down -0.99 (YTD: +0.40)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.53, down -0.6 (YTD: +1.5)

- Japanese Yen 1M ATM IV currently at 6.33, down -0.5 (YTD: +2.2)

- Offshore Yuan 1M ATM IV currently at 2.95, down -0.2 (YTD: -0.4)

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 103.6 basis points to 3,171 bp (1Y range: 1,305-3,883bp)

- Russia (rated BBB): down 29.0 basis points to 216 bp (1Y range: 75-254bp)

- Oman (rated BB-): down 8.1 basis points to 235 bp (1Y range: 223-312bp)

- South Africa (rated BB-): down 6.7 basis points to 210 bp (1Y range: 178-246bp)

- Mexico (rated BBB-): down 3.7 basis points to 111 bp (1Y range: 81-124bp)

- Chile (rated A-): down 3.1 basis points to 79 bp (1Y range: 43-95bp)

- Peru (rated BBB): down 3.0 basis points to 88 bp (1Y range: 55-105bp)

- Panama (rated WD): down 2.8 basis points to 90 bp (1Y range: 57-103bp)

- China (rated A+): down 1.6 basis points to 52 bp (1Y range: 28-58bp)

- Israel (rated A+): down 1.5 basis points to 56 bp (1Y range: 50-57bp)

LARGEST FX MOVES TODAY

- New Zambian Kwacha up 3.8% (YTD: -7.8%)

- Haiti Gourde up 2.1% (YTD: -1.2%)

- Polish Zloty up 1.7% (YTD: +1.9%)

- Russian Rouble up 1.6% (YTD: -0.8%)

- Chilean Peso up 1.5% (YTD: +6.4%)

- Hungarian Forint up 1.4% (YTD: +4.2%)

- Czech Koruna up 1.3% (YTD: +2.0%)

- Israeli shekel up 1.3% (YTD: -3.4%)

- Iceland Krona up 1.2% (YTD: +4.5%)

- Tonga Pa'anga down 4.1% (YTD: -1.0%)