Macro

Front-End Yields Dip As Fed Minutes Dovish Compared To Expectations, No Discussion Of 50bp Hike in March

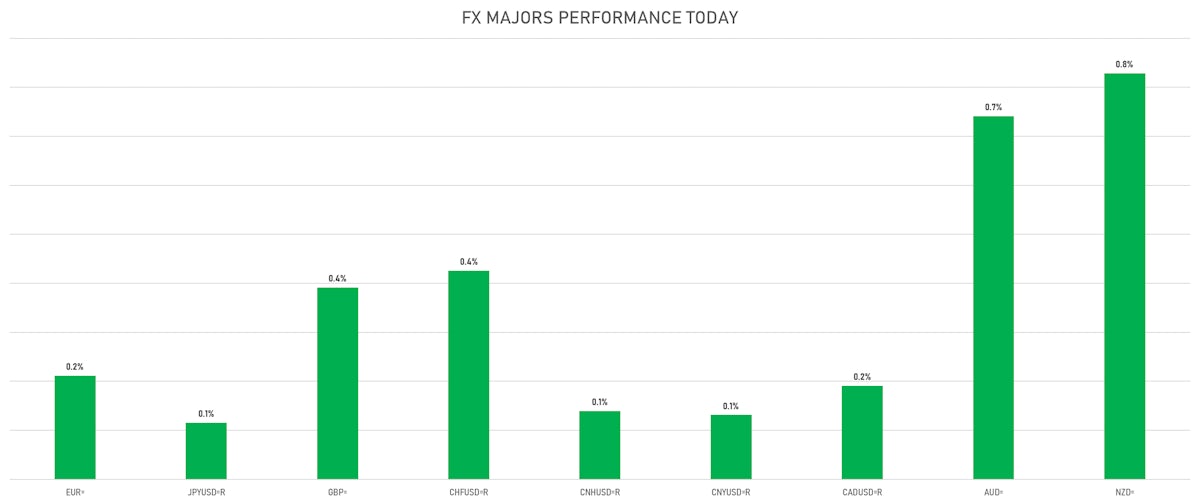

The US dollar was broadly lower today against all major currencies, with volatility falling and high-beta risk-on currencies up significantly (Aussie Dollar up 0.74% and Kiwi Dollar up 0.83%)

Published ET

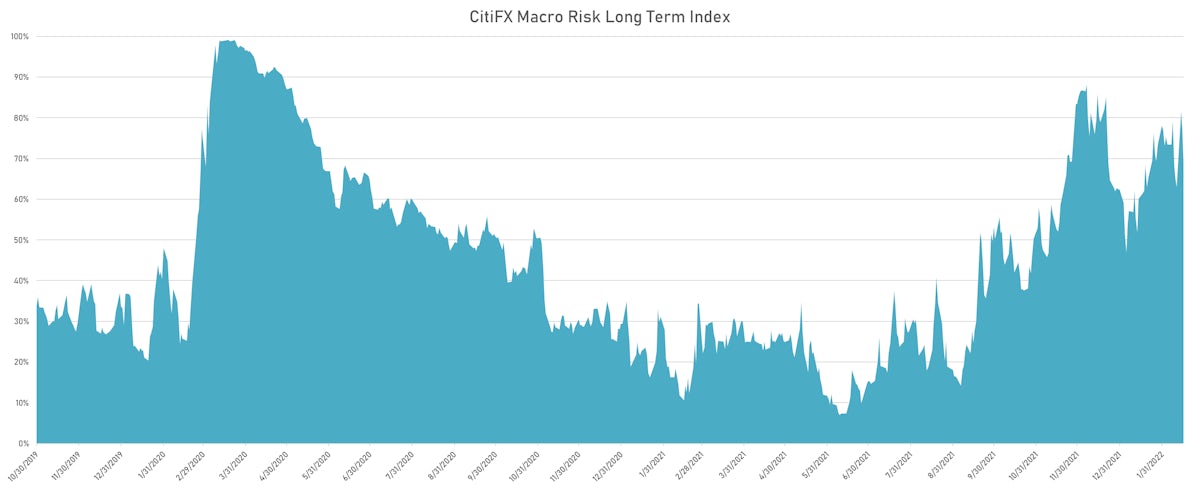

CitiFX Long Term Macro Risk Index | Sources: ϕpost, Refinitiv data

US RATES SUMMARY

- 3-Month USD LIBOR +3.4bp today, now at 0.5030%; 3-Month OIS -1.4bp at 0.3855%

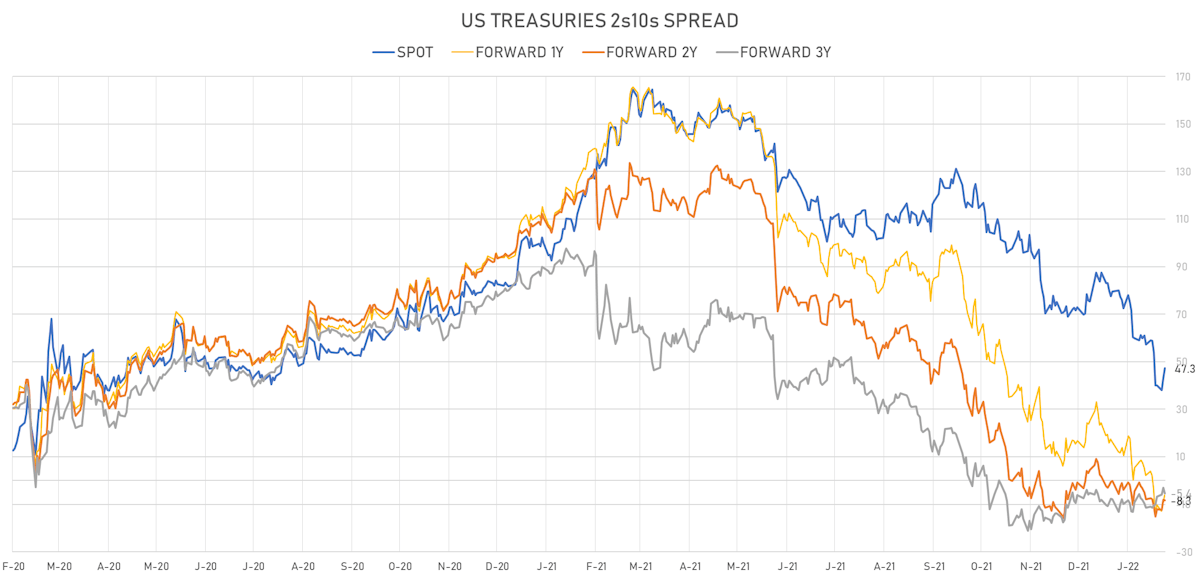

- The treasury yield curve steepened, with the 1s10s spread widening 3.5 bp, now at 96.7 bp (YTD change: -16.1bp)

- 1Y: 1.0730% (down 3.9 bp)

- 2Y: 1.5270% (down 5.0 bp)

- 5Y: 1.9219% (down 1.5 bp)

- 7Y: 2.0210% (down 1.0 bp)

- 10Y: 2.0399% (down 0.4 bp)

- 30Y: 2.3425% (down 1.9 bp)

- US treasury curve spreads: 3m2Y at 113.6bp (down -2.5bp today), 2s5s at 39.4bp (up 3.4bp), 5s10s at 11.8bp (up 1.0bp), 10s30s at 30.3bp (down -1.6bp)

- Treasuries butterfly spreads: 1s5s10s at -80.9bp (down -3.4bp), 5s10s30s at 18.1bp (down -2.1bp)

- TIPS 1Y breakeven inflation at 4.51% (up 2.6bp); 2Y at 3.57% (down -2.8bp); 5Y at 2.81% (down -3.2bp); 10Y at 2.48% (down -1.8bp); 30Y at 2.21% (down -0.5bp)

- US 5-Year TIPS Real Yield: +1.4 bp at -0.9710%; 10-Year TIPS Real Yield: +1.4 bp at -0.4260%; 30-Year TIPS Real Yield: -1.5 bp at 0.1720%

US MACRO RELEASES

- Capacity Utilization, Total index, Change M/M for Jan 2022 (FED, U.S.) at 77.60 % (vs 76.50 % prior), above consensus estimate of 76.80 %

- Export Prices, All commodities, Change P/P, Price Index for Jan 2022 (BLS, U.S Dep. Of Lab) at 2.90 % (vs -1.80 % prior), above consensus estimate of 1.30 %

- Import Prices, All commodities, Change P/P, Price Index for Jan 2022 (BLS, U.S Dep. Of Lab) at 2.00 % (vs -0.20 % prior), above consensus estimate of 1.30 %

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 11 Feb (MBA, USA) at -5.40 % (vs -8.10 % prior)

- Mortgage applications, market composite index for W 11 Feb (MBA, USA) at 537.00 (vs 567.70 prior)

- Mortgage applications, market composite index, purchase for W 11 Feb (MBA, USA) at 279.00 (vs 282.30 prior)

- Mortgage applications, market composite index, refinancing for W 11 Feb (MBA, USA) at 1988.80 (vs 2183.50 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 11 Feb (MBA, USA) at 4.05 % (vs 3.83 % prior)

- NAHB/Wells Fargo Housing Market Index for Feb 2022 (NAHB, United States) at 82.00 (vs 83.00 prior), below consensus estimate of 83.00

- Overall, Total business inventories, Change P/P for Dec 2021 (U.S. Census Bureau) at 2.10 % (vs 1.30 % prior), in line with consensus

- Production, Change P/P for Jan 2022 (FED, U.S.) at 1.40 % (vs -0.10 % prior), above consensus estimate of 0.40 %

- Production, Manufacturing, Total (SIC), Change P/P for Jan 2022 (FED, U.S.) at 0.20 % (vs -0.30 % prior), below consensus estimate of 0.30 %

- Retail Sales, Total excluding bldg material & motor vehicle & parts & gasoline station & food svc, Change P/P for Jan 2022 (U.S. Census Bureau) at 4.80 % (vs -3.10 % prior), above consensus estimate of 1.00 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Jan 2022 (U.S. Census Bureau) at 3.80 % (vs -2.50 % prior)

- Retail Sales, Total including food services, Change P/P for Jan 2022 (U.S. Census Bureau) at 3.80 % (vs -1.90 % prior), above consensus estimate of 2.00 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Jan 2022 (U.S. Census Bureau) at 3.30 % (vs -2.30 % prior), above consensus estimate of 0.80 %

AUCTION RESULTS: $19BN 20-YEAR 2.375% COUPON US TREASURY BOND (912810TF5)

- Solid stats with decent pricing and strong end-user demand (at 83.9% vs 83.2% prior and 79.9% average)

- High yield: 2.396% (vs 2.210% prior), right on the screws, with the when-issued yield rising prior to the bid deadline

- Direct bids: 21.0% (vs 17.0% prior and 18.5% average)

- Indirect bids: 62.9% (vs 66.2% prior and 61.4% average)

- Bid-to-cover: 2.44 (vs 2.48 prior and 2.37 average)

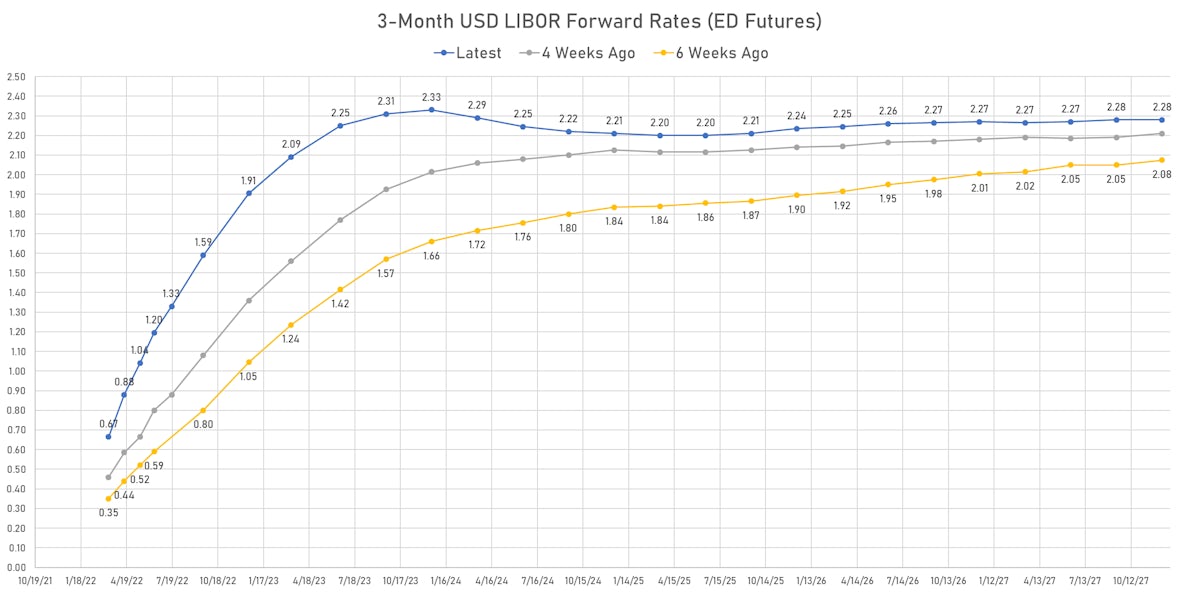

US FORWARD RATES

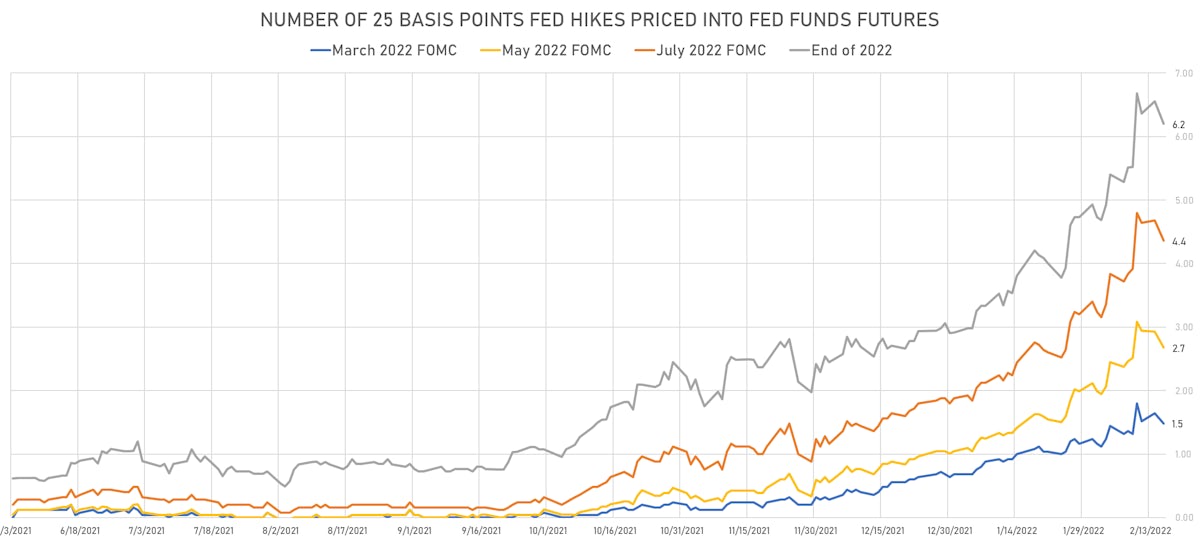

- Fed Funds futures now price in 35.6bp of Fed hikes by the end of March 2022, 65.8bp (2.63 x 25bp hikes) by the end of May 2022, and price in 6.19 hikes by the end of December 2022

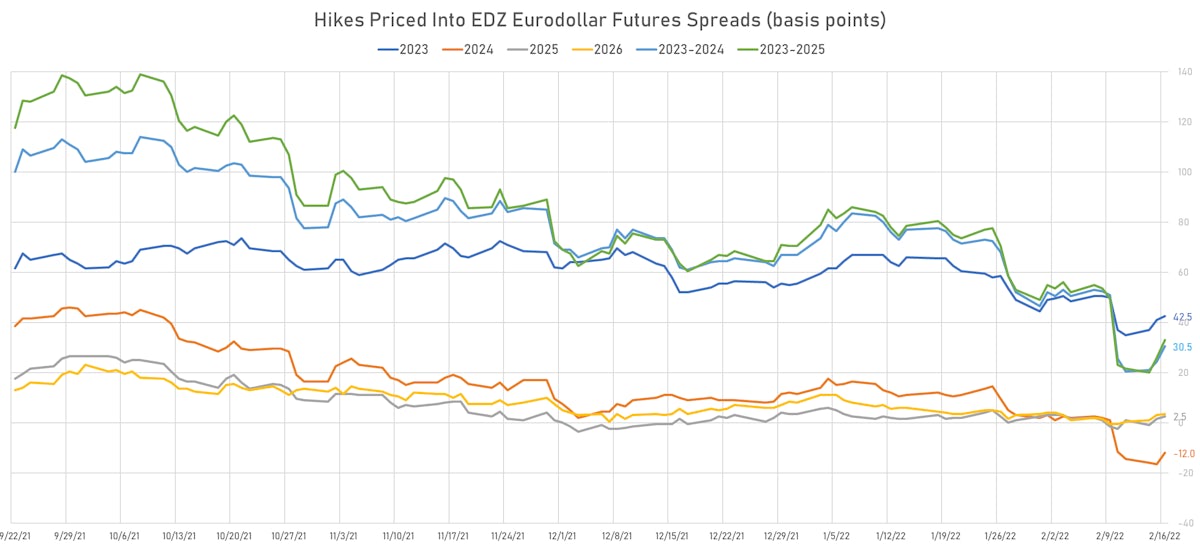

- 3-month Eurodollar futures (EDZ) spreads price in 42.5 bp of hikes in 2023 (equivalent to 1.7 x 25 bp hikes), and -12.0 bp of hikes in 2024 (equivalent to half a 25 bp rate cut)

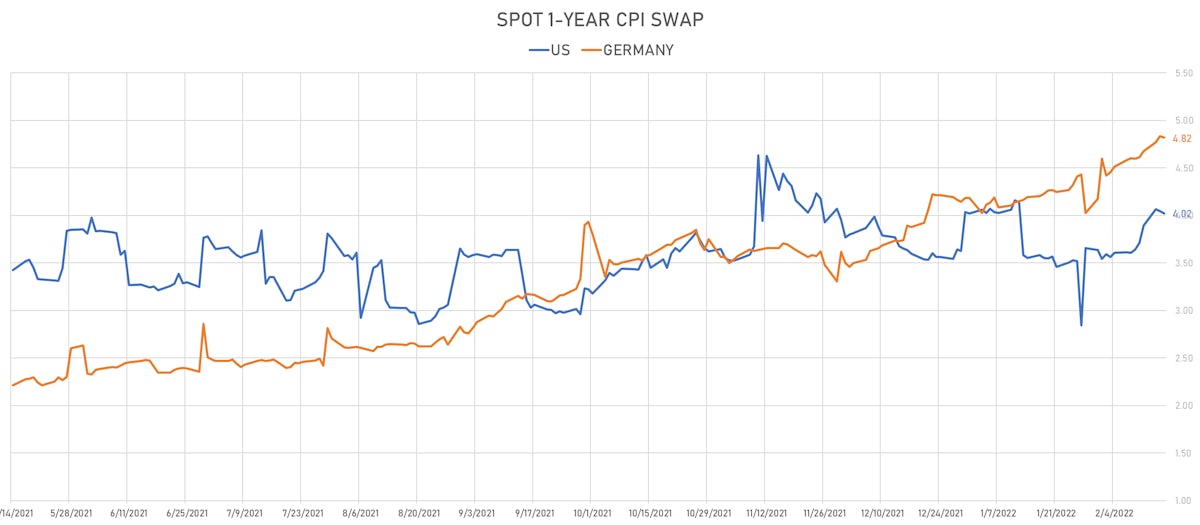

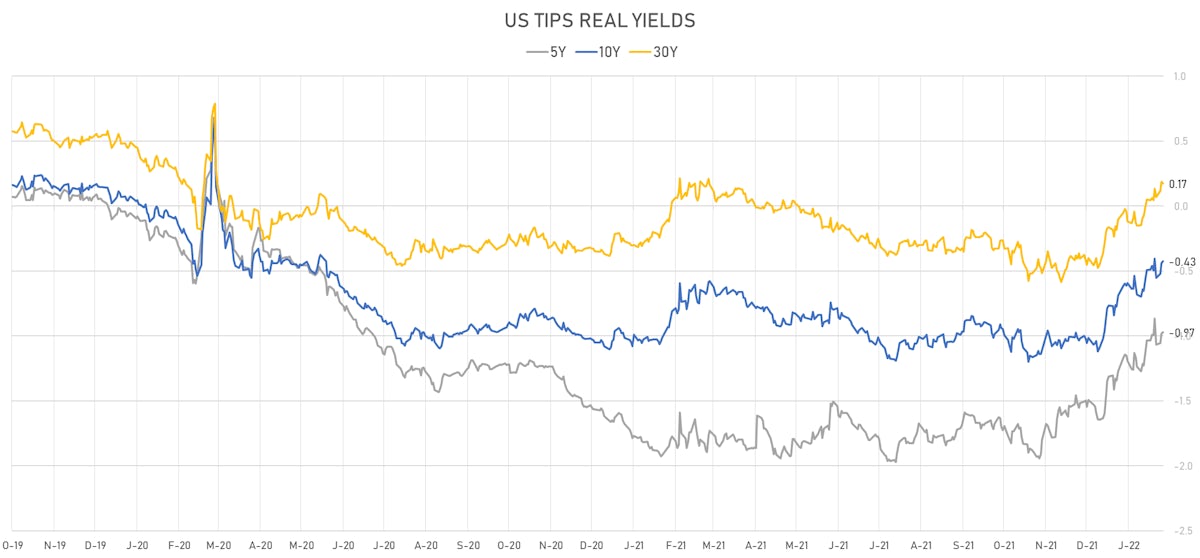

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.51% (up 2.6bp); 2Y at 3.57% (down -2.8bp); 5Y at 2.81% (down -3.2bp); 10Y at 2.48% (down -1.8bp); 30Y at 2.21% (down -0.5bp)

- 6-month spot US CPI swap down -2.2 bp to 4.504%, with a steepening of the forward curve

- US Real Rates: 5Y at -0.9710%, +1.4 bp today; 10Y at -0.4260%, +1.4 bp today; 30Y at 0.1720%, -1.5 bp today

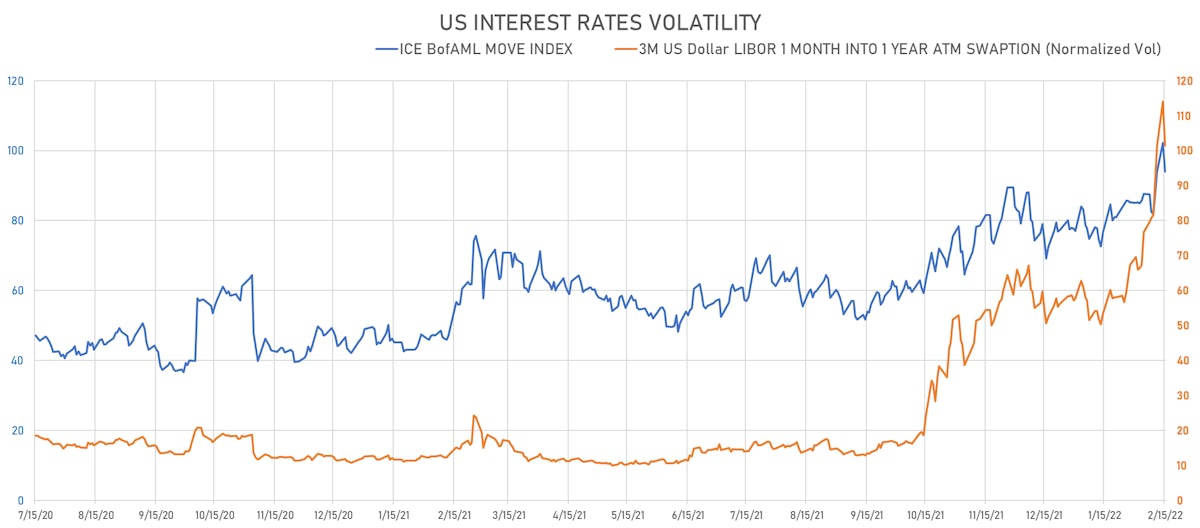

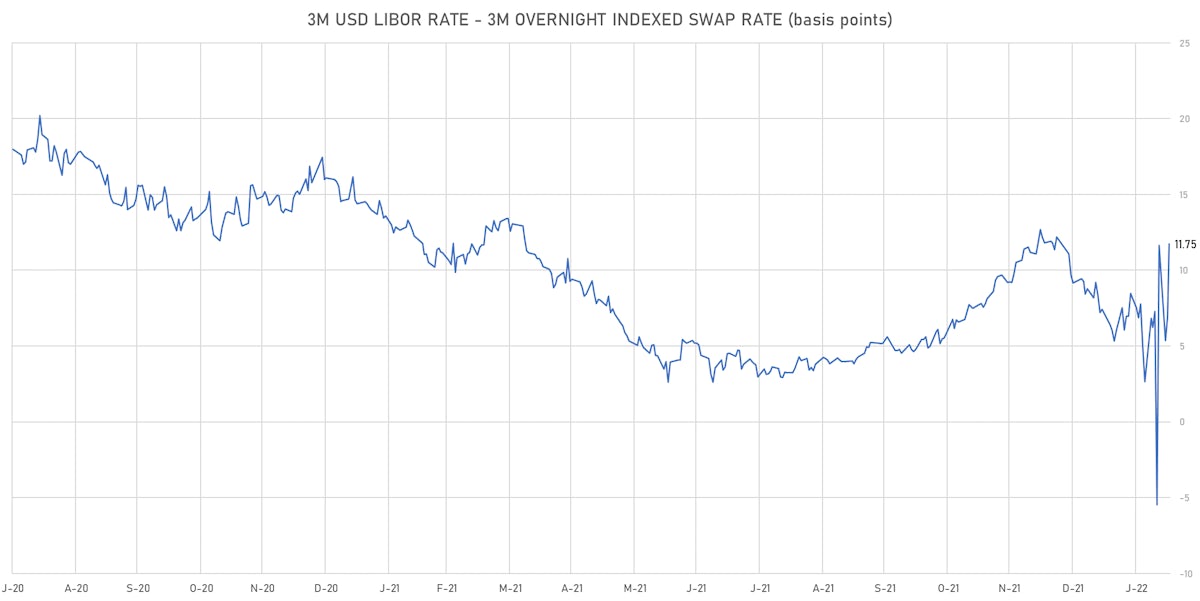

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.7% at 94.7%

- 3-Month LIBOR-OIS spread up 4.8 bp at 11.8 bp (12-months range: -5.5-13.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.039% (down -3.1 bp); the German 1Y-10Y curve is 3.6 bp flatter at 92.6bp (YTD change: +48.7 bp)

- Japan 5Y: 0.054% (up 0.7 bp); the Japanese 1Y-10Y curve is 0.4 bp steeper at 28.3bp (YTD change: +12.2 bp)

- China 5Y: 2.500% (down -1.2 bp); the Chinese 1Y-10Y curve is 4.3 bp flatter at 88.1bp (YTD change: +37.1 bp)

- Switzerland 5Y: 0.048% (down -4.4 bp); the Swiss 1Y-10Y curve is 0.5 bp steeper at 93.3bp (YTD change: +36.8 bp)

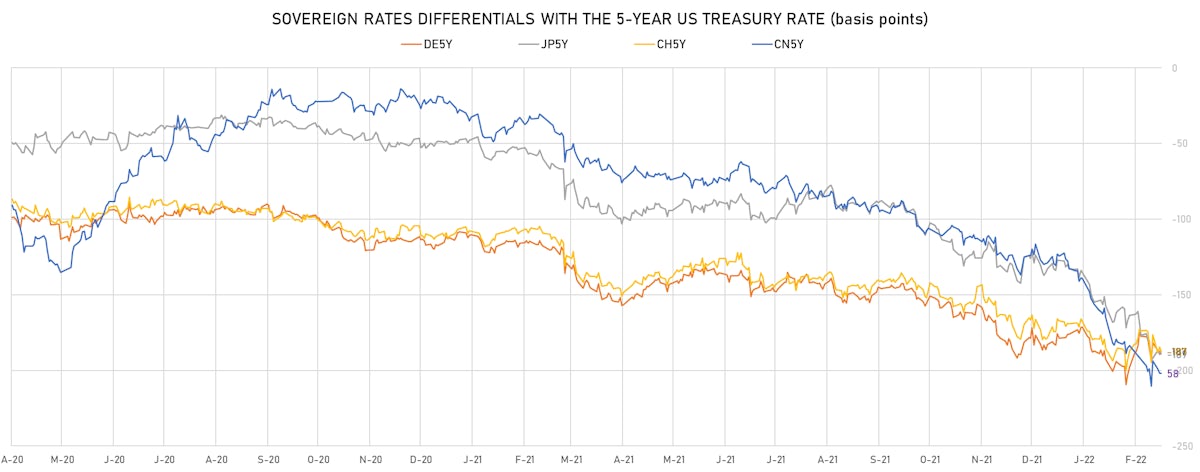

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.5 bp at 187.0 bp (YTD change: +14.9 bp)

- US-JAPAN: -4.3 bp at 184.9 bp (YTD change: +50.2 bp)

- US-CHINA: -1.6 bp at -58.0 bp (YTD change: +71.2 bp)

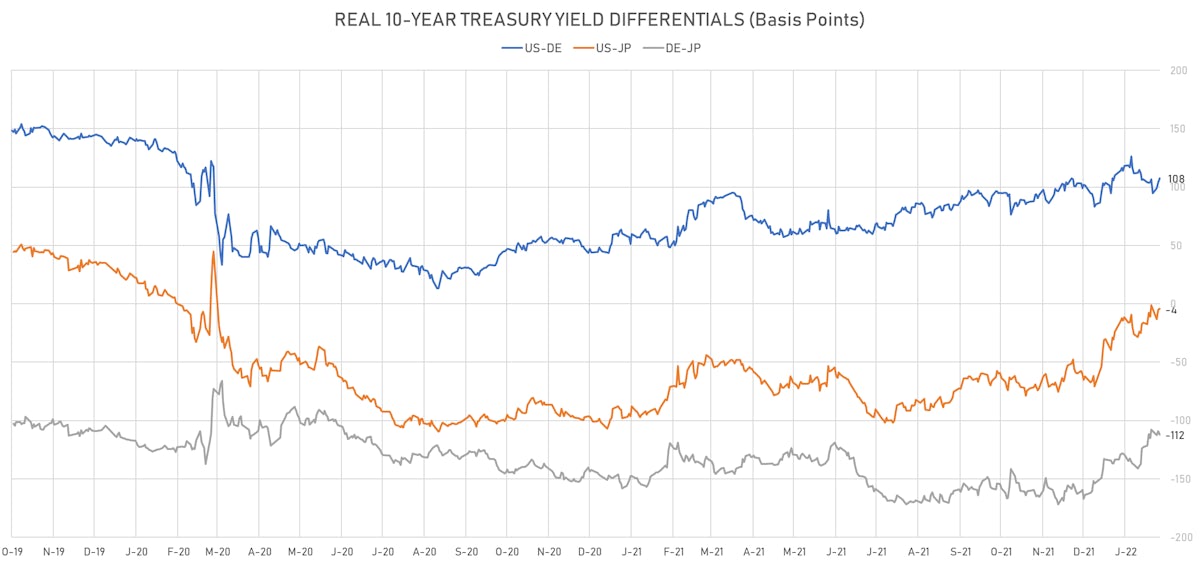

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.6 bp at 107.7 bp (YTD change: +24.5bp)

- US-JAPAN: +0.9 bp at -4.3 bp (YTD change: +66.5bp)

- JAPAN-GERMANY: +2.7 bp at 112.0 bp (YTD change: -42.0bp)

GLOBAL MACRO RELEASES

- Canada, CPI, Core CPI (Bank of Canada), Change P/P, Price Index for Jan 2022 (CANSIM, Canada) at 0.80 % (vs 0.00 % prior)

- Canada, CPI, Core CPI (Bank of Canada), Change Y/Y, Price Index for Jan 2022 (CANSIM, Canada) at 4.30 % (vs 4.00 % prior)

- China (Mainland), CPI, Average, Change Y/Y, Price Index for Jan 2022 (NBS, China) at 0.90 % (vs 1.50 % prior), below consensus estimate of 1.00 %

- China (Mainland), Producer Prices, Change Y/Y, Price Index for Jan 2022 (NBS, China) at 9.10 % (vs 10.30 % prior), below consensus estimate of 9.50 %

- Japan, Exports, Change Y/Y for Jan 2022 (MoF, Japan) at 9.60 % (vs 17.50 % prior), below consensus estimate of 16.50 %

- Japan, Imports, Change Y/Y for Jan 2022 (MoF, Japan) at 39.60 % (vs 41.10 % prior), above consensus estimate of 37.10 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change P/P for Dec 2021 (Cabinet Office, JP) at 3.60 % (vs 3.40 % prior), above consensus estimate of -1.80 %

- Japan, New Orders, Machinery , Private, excluding volatile orders, Change Y/Y for Dec 2021 (Cabinet Office, JP) at 5.10 % (vs 11.60 % prior), above consensus estimate of 0.60 %

- Japan, Trade Balance, Current Prices for Jan 2022 (MoF, Japan) at -2,191.10 Bln JPY (vs -582.40 Bln JPY prior), below consensus estimate of -1,607.00 Bln JPY

- Namibia, Policy Rates, Bank Rate for Feb 2022 (Bank of Namibia) at 4.00 % (vs 3.75 % prior)

- Norway, GDP, Mainland Norway, Change P/P for Q4 2021 (Statistics Norway) at 1.40 % (vs 2.60 % prior), above consensus estimate of 1.20 %

- South Africa, CPI, Urban Areas, Headline, Change Y/Y, Price Index for Jan 2022 (Statistics, SA) at 5.70 % (vs 5.90 % prior), in line with consensus

- United Kingdom, CPI, All items (CPI), Change Y/Y for Jan 2022 (ONS, United Kingdom) at 5.50 % (vs 5.40 % prior), above consensus estimate of 5.40 %

- United States, Production, Change P/P for Jan 2022 (FED, U.S.) at 1.40 % (vs -0.10 % prior), above consensus estimate of 0.40 %

- United States, Retail Sales, Total including food services, Change P/P for Jan 2022 (U.S. Census Bureau) at 3.80 % (vs -1.90 % prior), above consensus estimate of 2.00 %

- Zambia, Policy Rates, BOZ Policy Rate for Feb 2022 (Bank of Zambia) at 9.00 % (vs 9.00 % prior)

FX SUMMARY

- The US Dollar Index is down -0.24% at 95.75 (YTD: +0.10%)

- Euro up 0.21% at 1.1380 (YTD: +0.1%)

- Yen up 0.12% at 115.48 (YTD: -0.3%)

- Onshore Yuan up 0.13% at 6.3286 (YTD: +0.5%)

- Swiss franc up 0.43% at 0.9213 (YTD: -1.0%)

- Sterling up 0.39% at 1.3586 (YTD: +0.4%)

- Canadian dollar up 0.19% at 1.2692 (YTD: -0.5%)

- Australian dollar up 0.74% at 0.7204 (YTD: -0.8%)

- NZ dollar up 0.83% at 0.6694 (YTD: -1.9%)

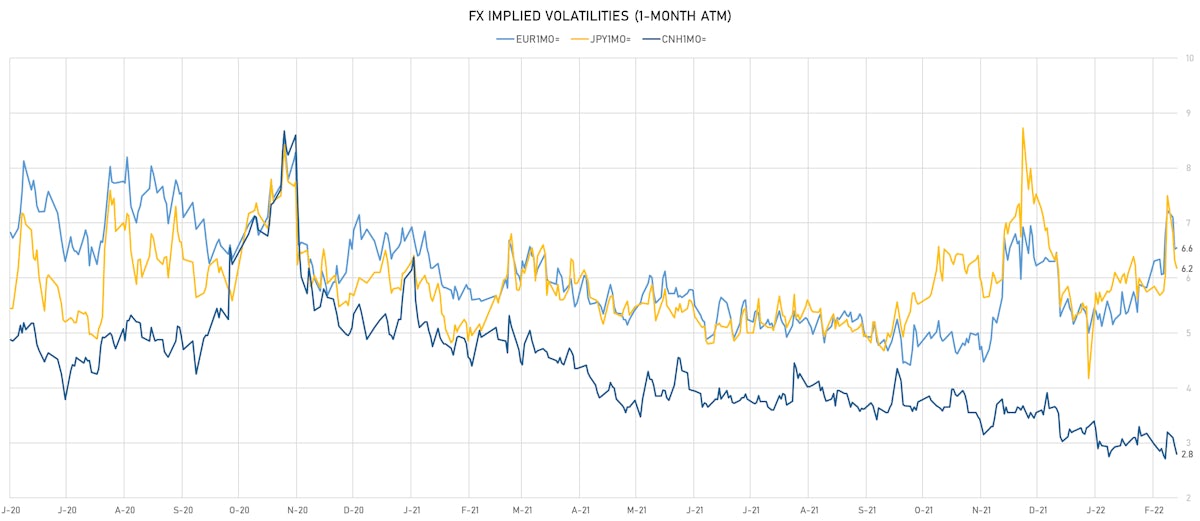

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.12, up 0.61 (YTD: +1.01)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.55, up 0.0 (YTD: +1.6)

- Japanese Yen 1M ATM IV currently at 6.18, down -0.2 (YTD: +2.0)

- Offshore Yuan 1M ATM IV currently at 2.80, down -0.2 (YTD: -0.5)

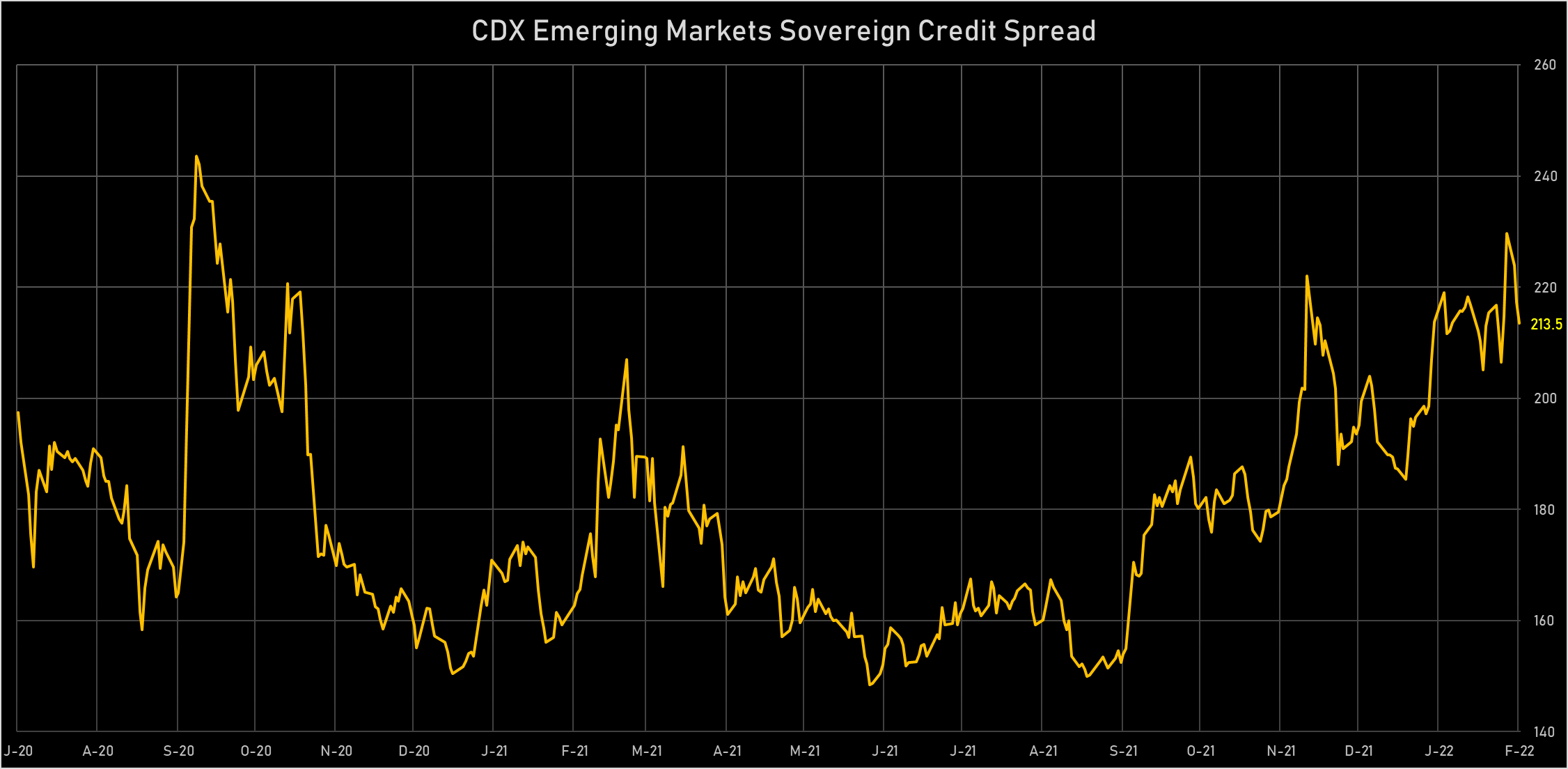

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Argentina (rated CCC): down 64.0 basis points to 3,094 bp (1Y range: 1,330-3,883bp)

- Mexico (rated BBB-): down 2.3 basis points to 108 bp (1Y range: 81-124bp)

- Indonesia (rated BBB): down 2.1 basis points to 95 bp (1Y range: 66-99bp)

- Philippines (rated BBB): down 1.9 basis points to 79 bp (1Y range: 36-83bp)

- Vietnam (rated BB): down 1.8 basis points to 113 bp (1Y range: 89-116bp)

- Malaysia (rated BBB+): down 1.6 basis points to 63 bp (1Y range: 36-67bp)

- Panama (rated WD): down 1.3 basis points to 88 bp (1Y range: 57-103bp)

- Peru (rated BBB): down 1.2 basis points to 87 bp (1Y range: 56-105bp)

- Chile (rated A-): down 1.2 basis points to 77 bp (1Y range: 43-95bp)

- Qatar (rated AA-): down 0.7 basis points to 50 bp (1Y range: 37-52bp)

LARGEST FX MOVES TODAY

- Peru Sol up 1.8% (YTD: +6.6%)

- New Zambian Kwacha up 1.8% (YTD: -6.2%)

- Ghanaian Cedi up 1.1% (YTD: -5.7%)

- Israeli Shekel up 0.8% (YTD: -2.6%)

- Malawi Kwacha up 0.8% (YTD: +0.8%)

- South Africa Rand up 0.8% (YTD: +6.7%)

- Algerian Dinar up 0.7% (YTD: -1.3%)

- Mauritius Rupee down 1.3% (YTD: -0.9%)

- Zimbabwe Dollar down 1.8% (YTD: -8.6%)

- Haiti Gourde down 3.8% (YTD: -5.0%)