Macro

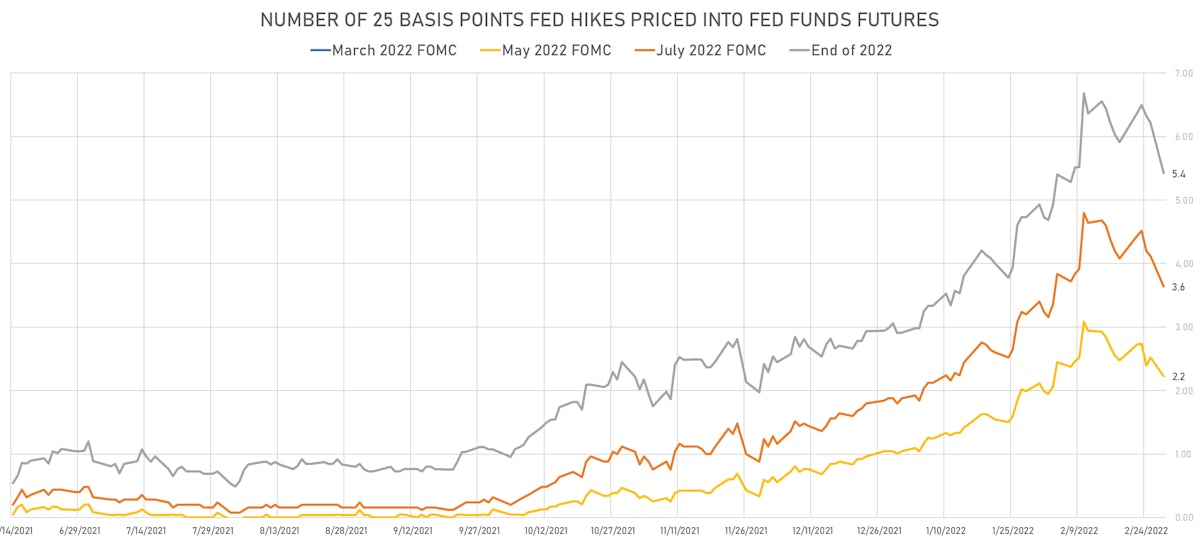

Strong Bid For US Rates Despite Higher Breakevens, With a Bull Flattening Curve, And One Full Hike Has Been Priced Out Over Past Week (5.4 Implied By End 2022)

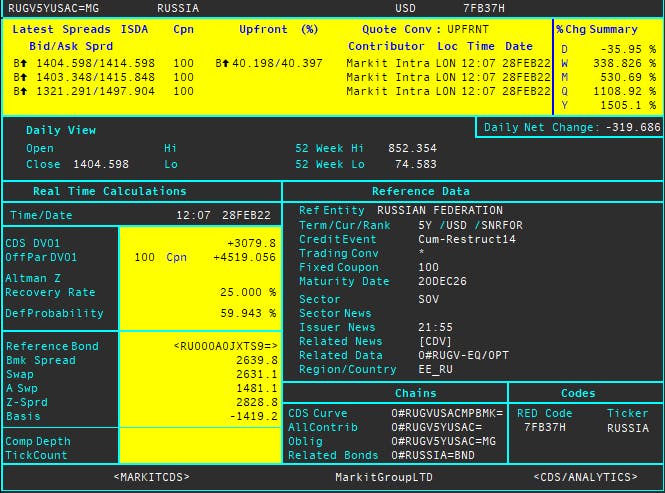

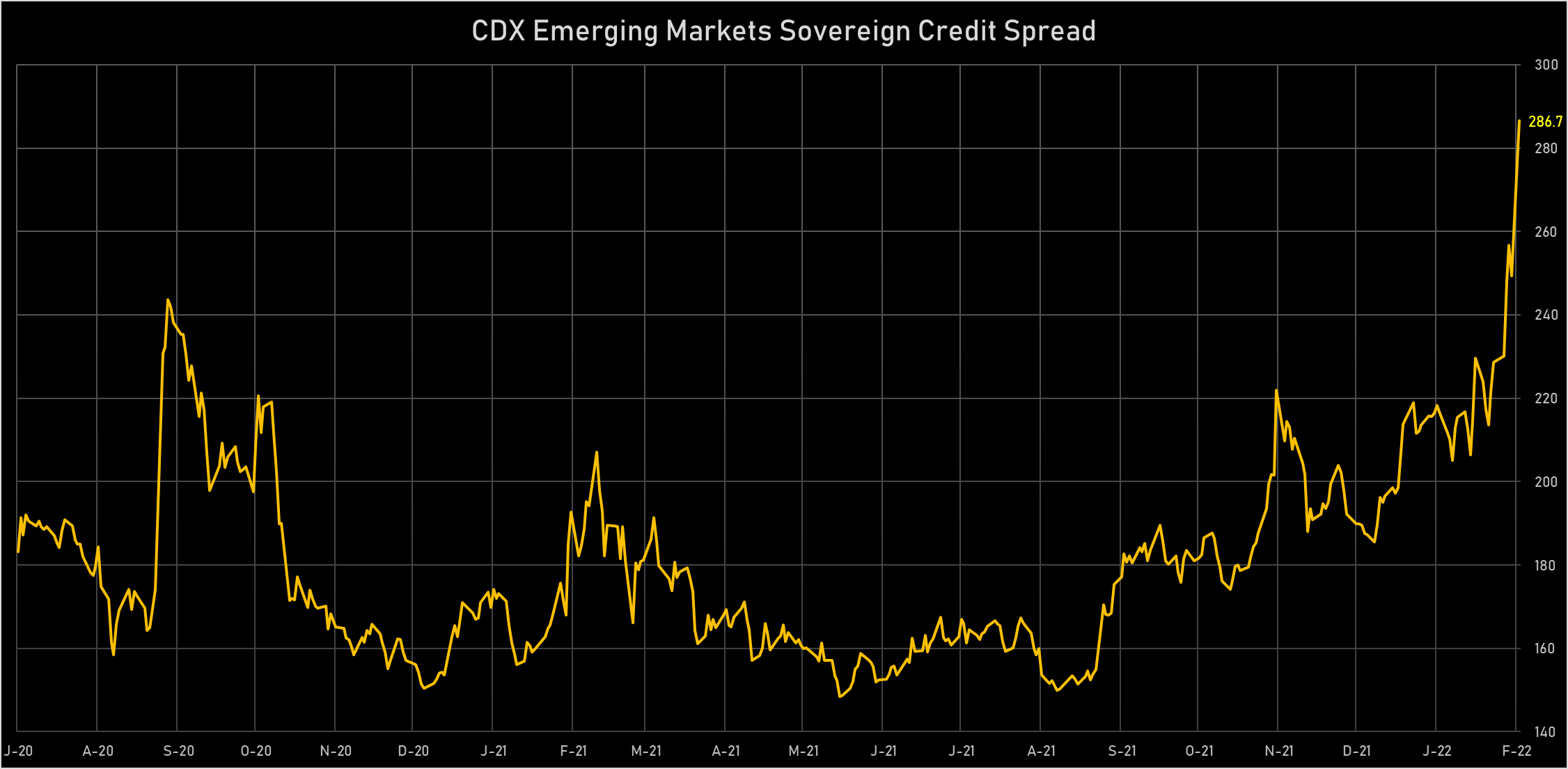

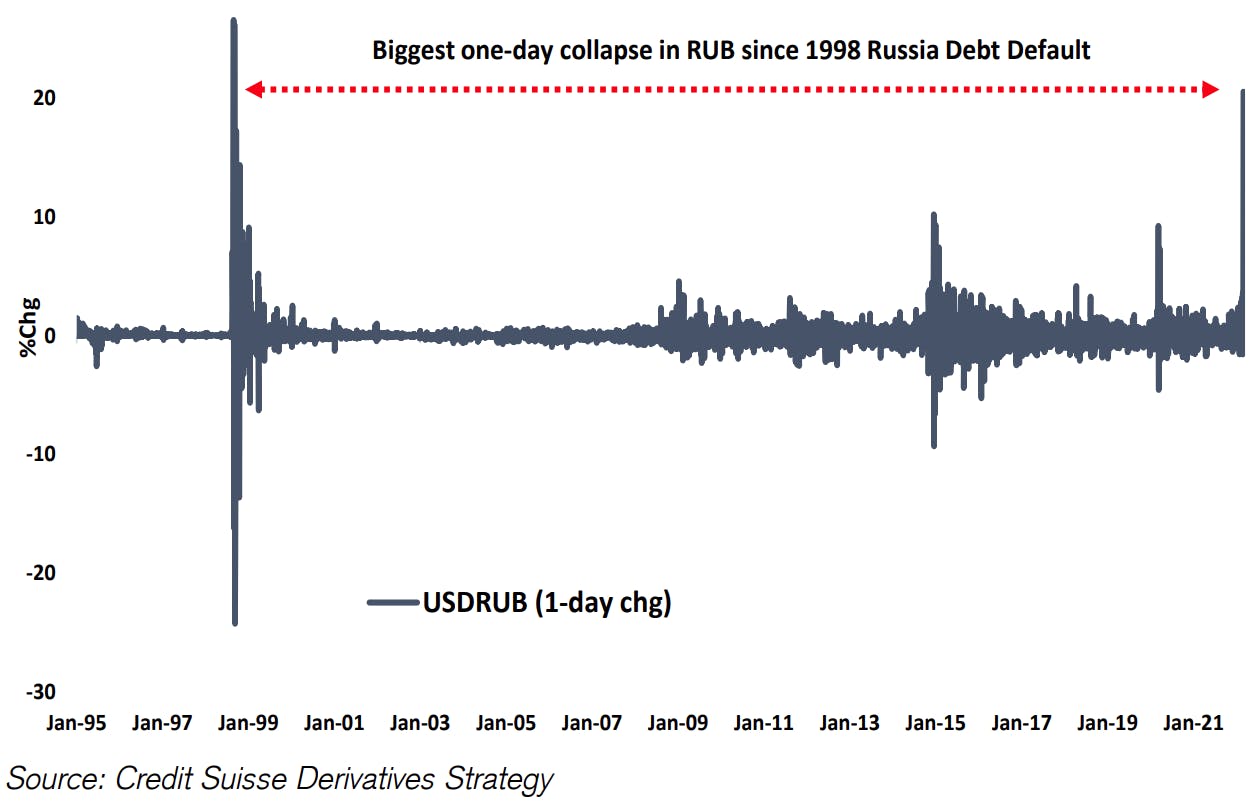

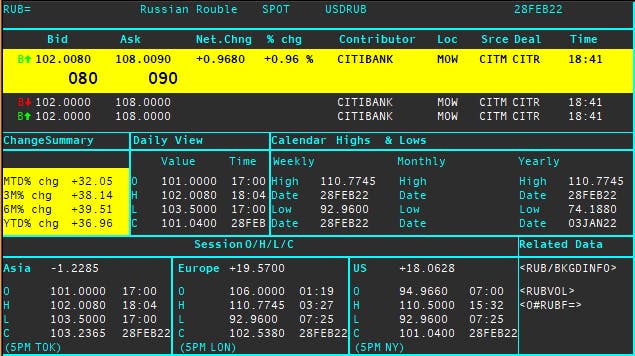

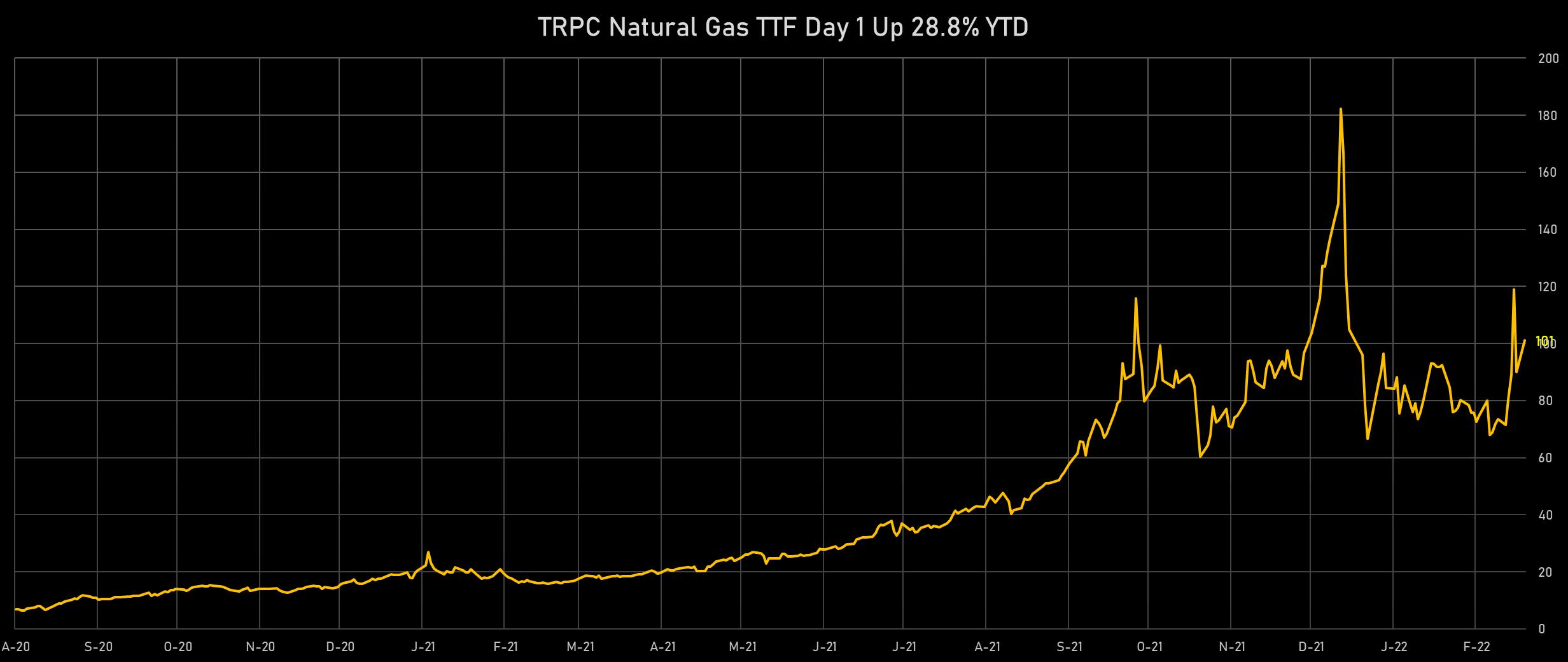

On the Russian front, the Rouble has had the largest percentage drop since the 1998 financial crisis, the government's CDS implied 5Y US$ default probability has surged to 60%, but commodities are doing well (if they can be paid): palladium prices up 5%, European TTF natural gas up 12%, wheat up 10%

Published ET

Russian Government 5Y USD CDS Implied Default Probability | Source: Refinitiv

US RATES DAILY SUMMARY

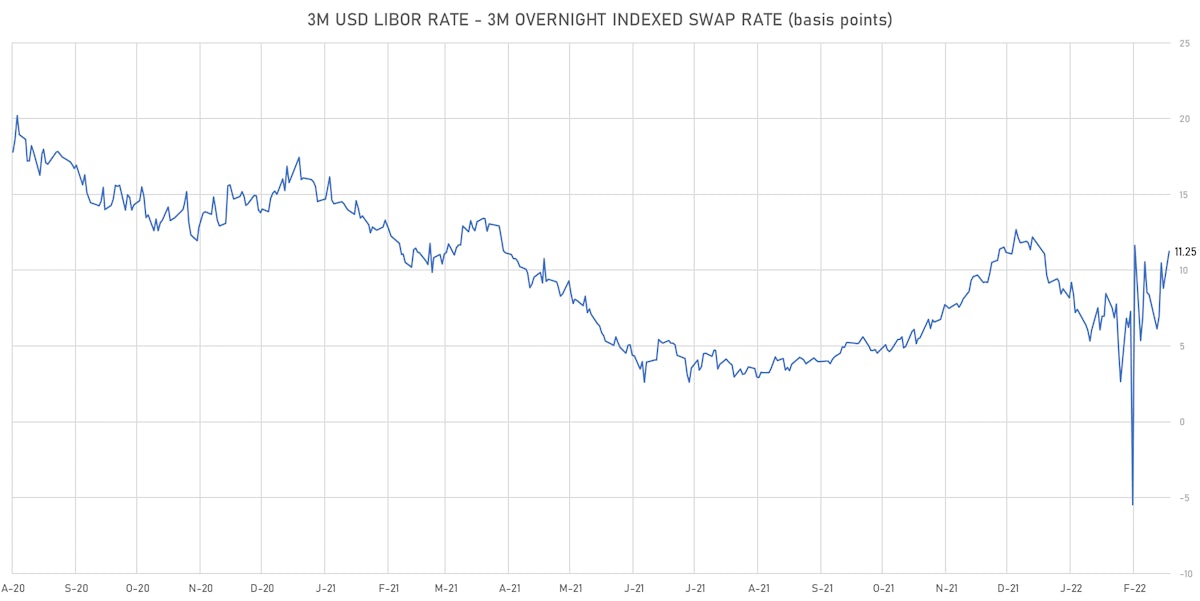

- 3-Month USD LIBOR -1.3bp today, now at 0.5100%; 3-Month OIS -3.8bp at 0.3975%

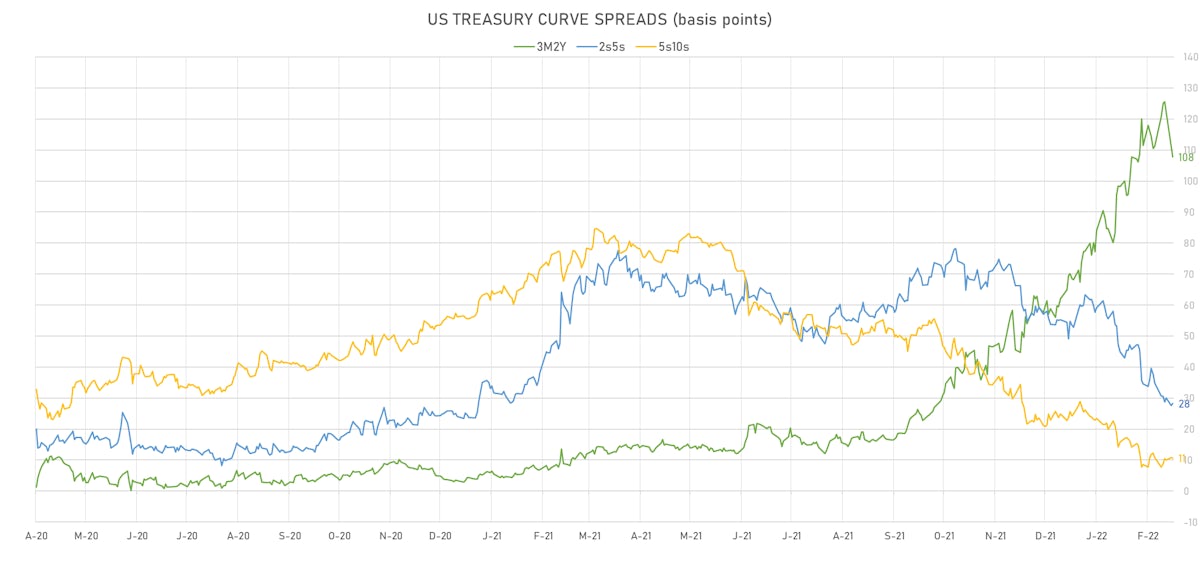

- The treasury yield curve flattened, with the 1s10s spread tightening -4.1 bp, now at 69.5 bp (YTD change: -43.3bp)

- 1Y: 1.1270% (down 10.8 bp)

- 2Y: 1.4363% (down 13.3 bp)

- 5Y: 1.7129% (down 15.7 bp)

- 7Y: 1.8034% (down 15.6 bp)

- 10Y: 1.8216% (down 14.9 bp)

- 30Y: 2.1590% (down 12.6 bp)

- US treasury curve spreads: 3m2Y at 107.8bp (down -14.4bp today), 2s5s at 28.5bp (down -1.6bp), 5s10s at 10.6bp (up 0.5bp), 10s30s at 33.3bp (up 2.0bp)

- Treasuries butterfly spreads: 1s5s10s at -67.6bp (down -4.5bp), 5s10s30s at 22.6bp (up 1.4bp)

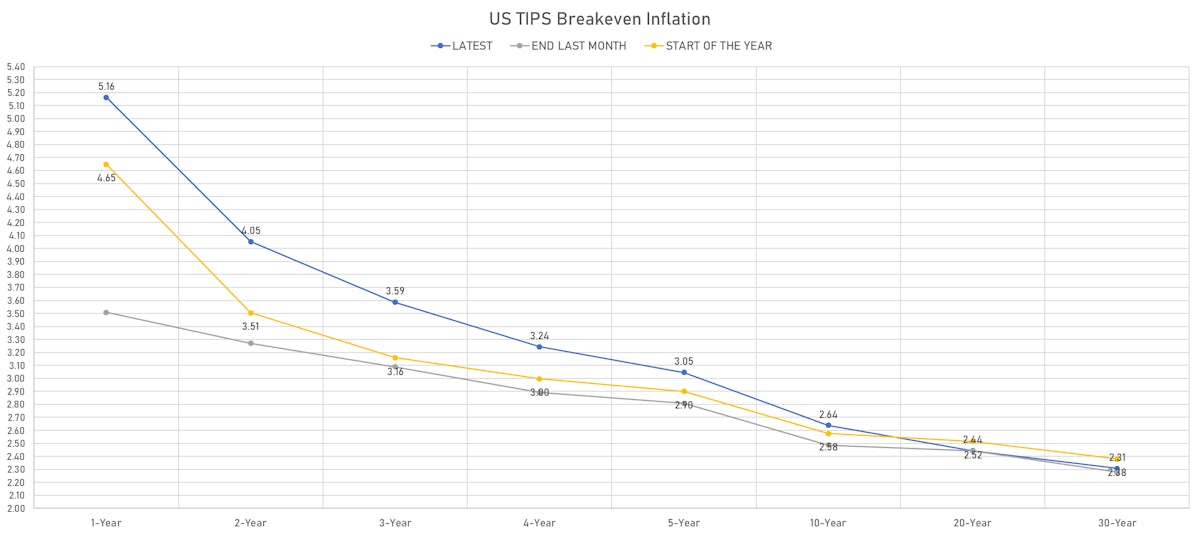

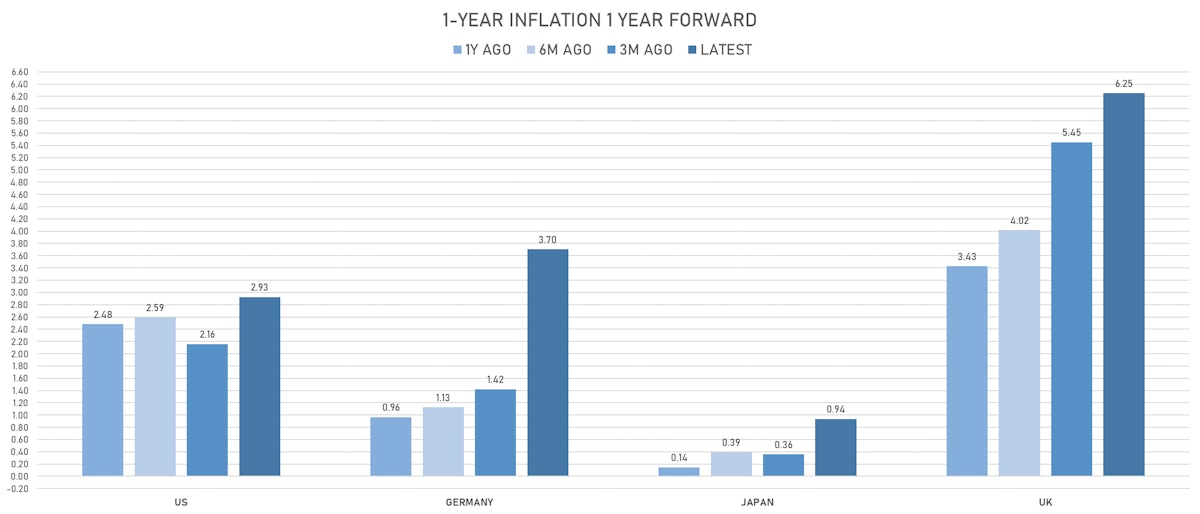

- TIPS 1Y breakeven inflation at 5.16% (up 22.8bp); 2Y at 4.05% (up 13.0bp); 5Y at 3.05% (up 5.7bp); 10Y at 2.64% (up 7.3bp); 30Y at 2.31% (up 10.4bp)

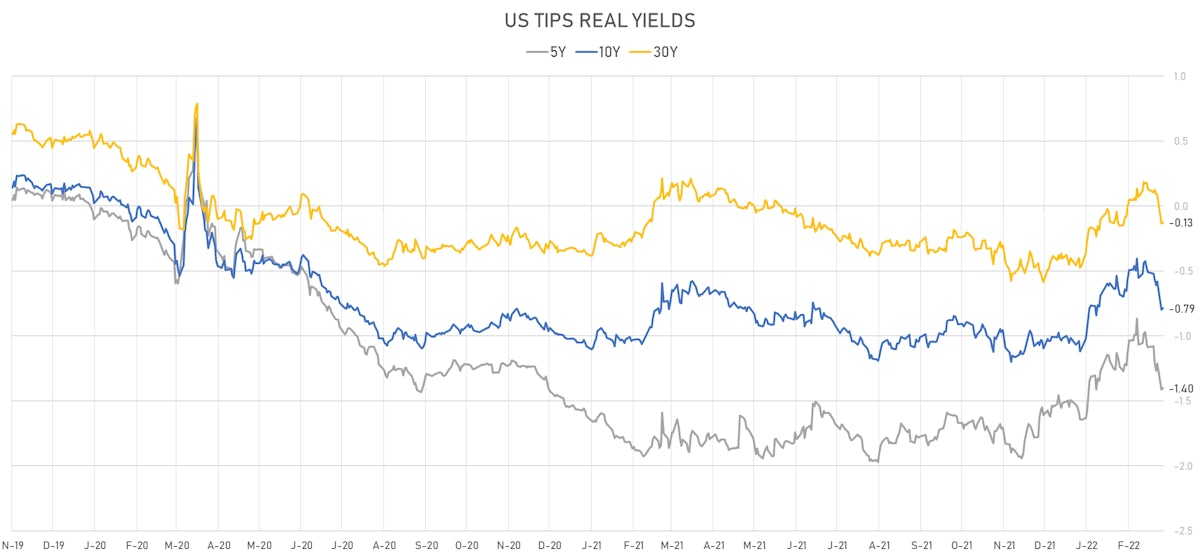

- US 5-Year TIPS Real Yield: +1.3 bp at -1.4000%; 10-Year TIPS Real Yield: +1.4 bp at -0.7850%; 30-Year TIPS Real Yield: +1.1 bp at -0.1260%

US MACRO RELEASES

- Chicago PMI, Total Business Barometer for Feb 2022 (MNI Indicators) at 56.30 (vs 65.20 prior), below consensus estimate of 63.00

- Dallas Fed, General Business Activity for Feb 2022 (Fed Reserve, Dallas) at 14.00 (vs 2.00 prior)

- Retail Inventories Advance, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.70 % (vs 3.30 % prior)

- US Adv Goods Trade Balance, Current Prices for Jan 2022 (U.S. Census Bureau) at -107.63 Bn USD (vs -100.47 Bn USD prior)

- Wholesale Inventories Advance, Change P/P for Jan 2022 (U.S. Census Bureau) at 0.80 % (vs 2.20 % prior)

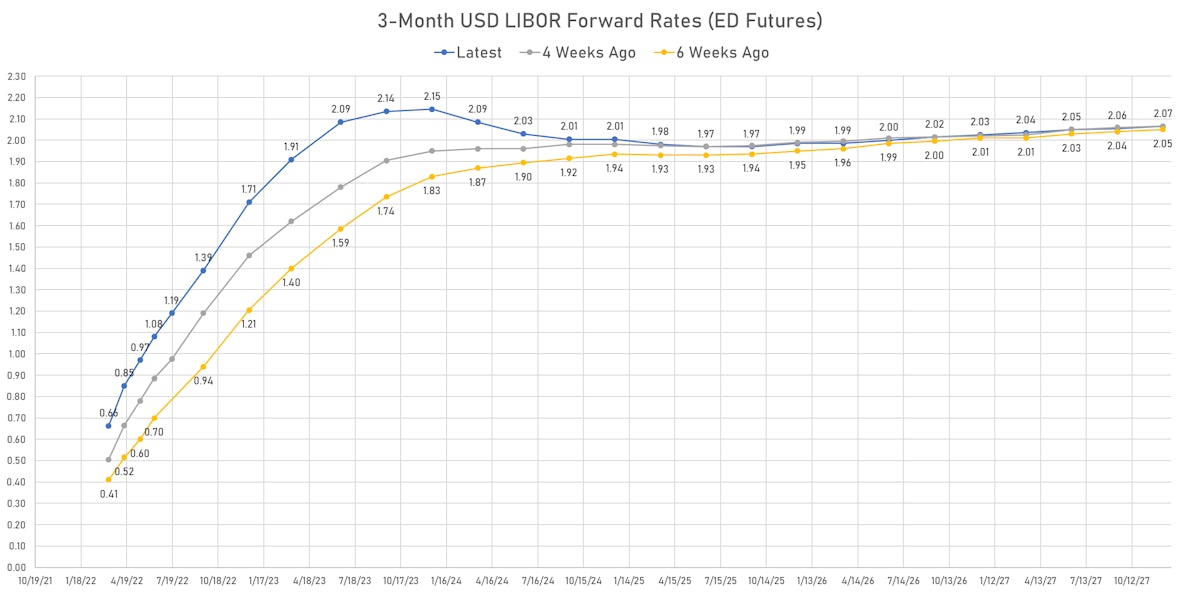

US FORWARD RATES

- Fed Funds futures now price in 27.5bp of Fed hikes by the end of March 2022, 56.5bp (2.26 x 25bp hikes) by the end of May 2022, and price in 5.50 hikes by the end of December 2022

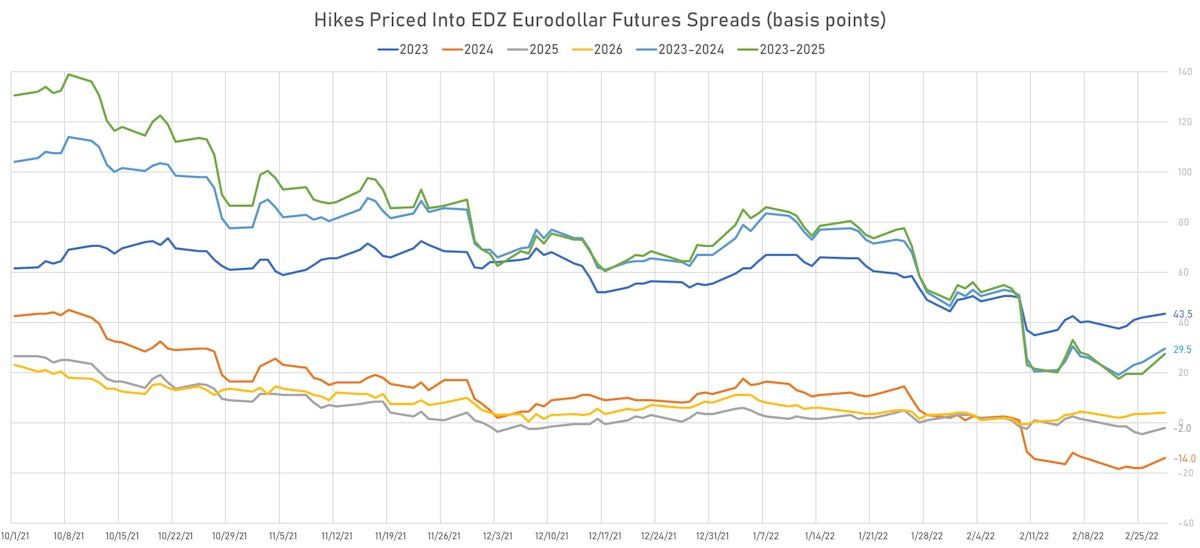

- 3-month Eurodollar futures (EDZ) spreads price in 43.5 bp of hikes in 2023 (equivalent to 1.7 x 25 bp hikes), up 1.5 bp today, and -14.0 bp of hikes in 2024 (equivalent to -0.6 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.16% (up 22.8bp); 2Y at 4.05% (up 13.0bp); 5Y at 3.05% (up 5.7bp); 10Y at 2.64% (up 7.3bp); 30Y at 2.31% (up 10.4bp)

- 6-month spot US CPI swap up 16.4 bp to 4.947%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.4000%, +1.3 bp today; 10Y at -0.7850%, +1.4 bp today; 30Y at -0.1260%, +1.1 bp today

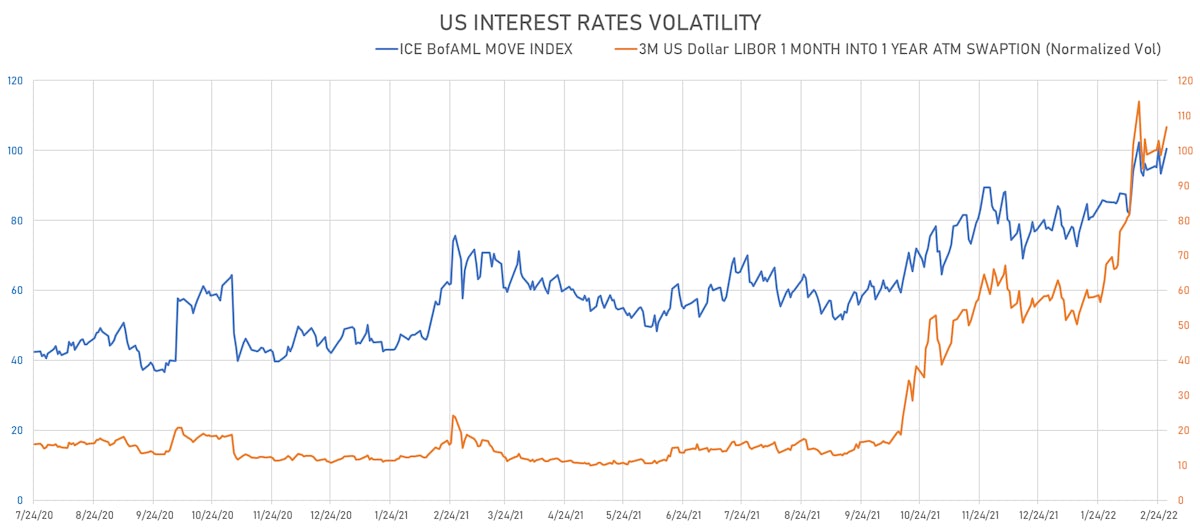

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 8.1% at 106.7%

- 3-Month LIBOR-OIS spread up 2.5 bp at 11.3 bp (12-months range: -5.5-13.4 bp)

KEY INTERNATIONAL RATES

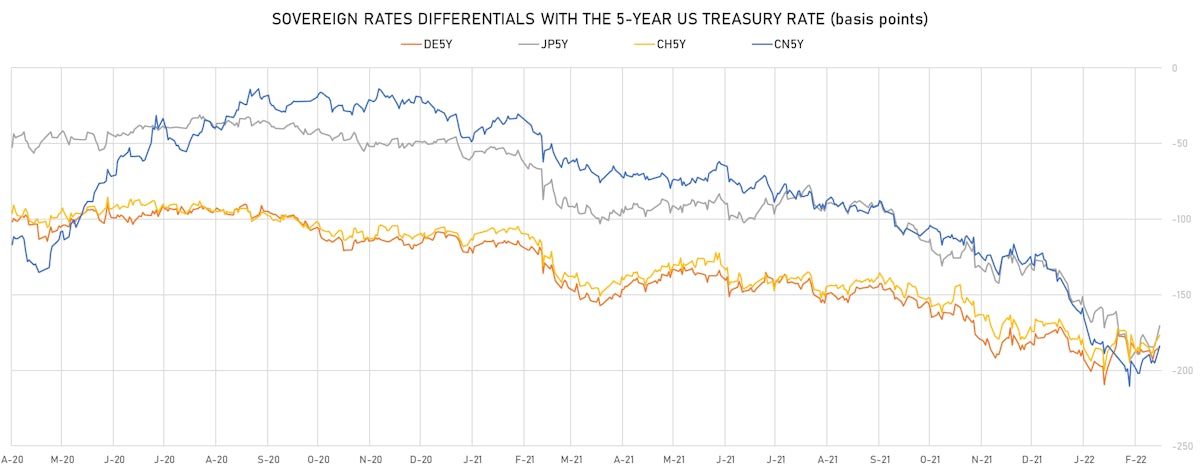

- Germany 5Y: -0.209% (down -13.0 bp); the German 1Y-10Y curve is 6.5 bp flatter at 74.9bp (YTD change: +36.3 bp)

- Japan 5Y: 0.001% (down -2.1 bp); the Japanese 1Y-10Y curve is 2.1 bp flatter at 24.1bp (YTD change: +8.8 bp)

- China 5Y: 2.504% (down -2.4 bp); the Chinese 1Y-10Y curve is 5.0 bp flatter at 72.0bp (YTD change: +21.0 bp)

- Switzerland 5Y: -0.053% (down -9.9 bp); the Swiss 1Y-10Y curve is 0.4 bp steeper at 95.3bp (YTD change: +38.8 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +8.9 bp at 196.9 bp (YTD change: +24.8 bp)

- US-JAPAN: -8.9 bp at 175.4 bp (YTD change: +40.7 bp)

- US-CHINA: -9.5 bp at -73.0 bp (YTD change: +56.2 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -6.3 bp at 105.9 bp (YTD change: +22.7bp)

- US-JAPAN: -15.6 bp at -25.7 bp (YTD change: +45.1bp)

- JAPAN-GERMANY: +9.3 bp at 131.6 bp (YTD change: -22.4bp)

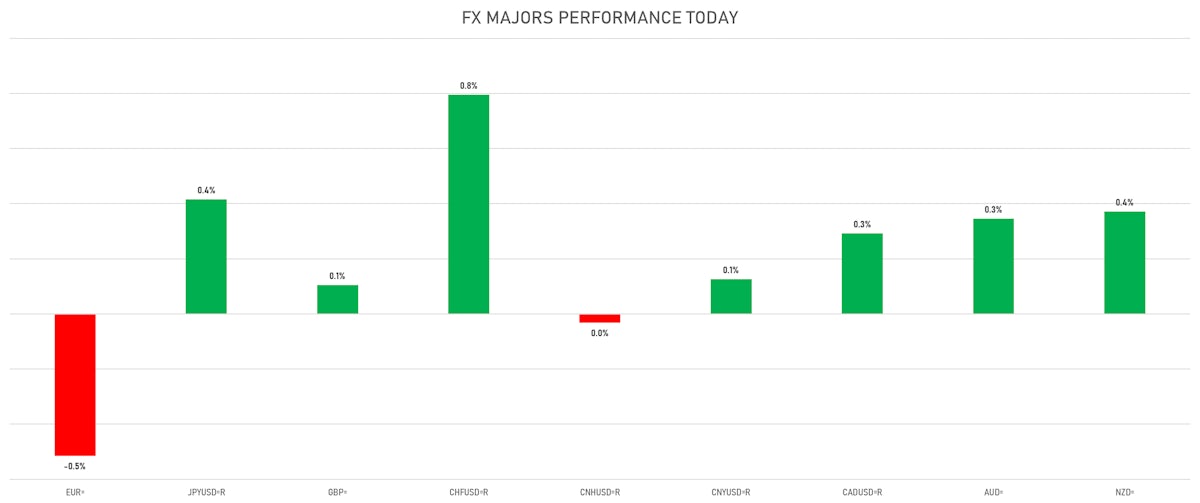

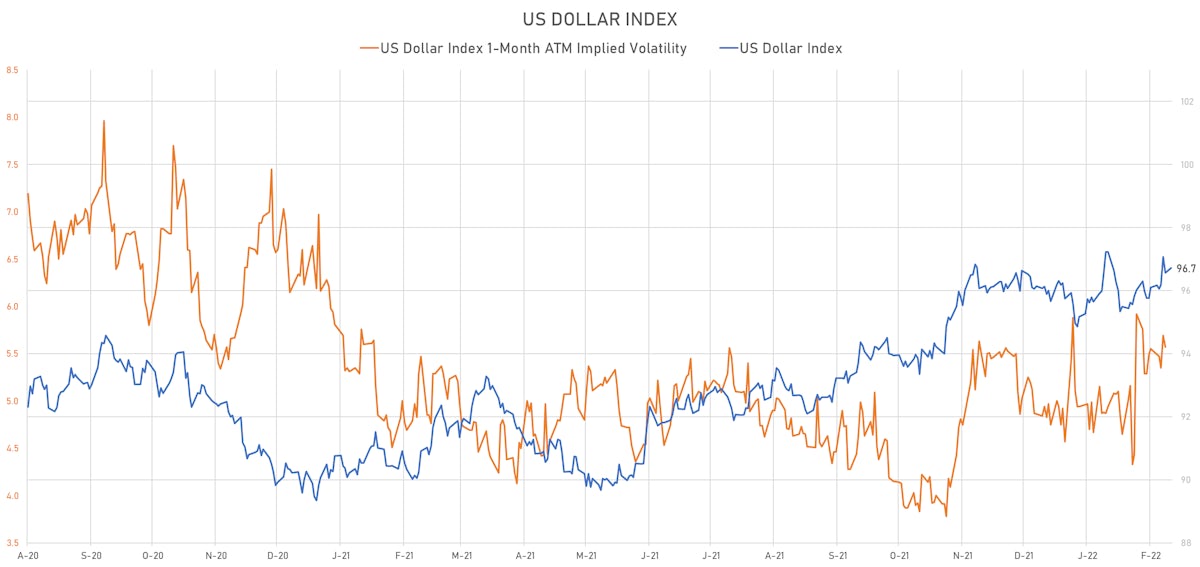

FX DAILY SUMMARY

- The US Dollar Index is up 0.16% at 96.72 (YTD: +1.11%)

- Euro down 0.51% at 1.1209 (YTD: -1.4%)

- Yen up 0.42% at 115.08 (YTD: 0.0%)

- Onshore Yuan up 0.13% at 6.3084 (YTD: +0.8%)

- Swiss franc up 0.80% at 0.9176 (YTD: -0.6%)

- Sterling up 0.10% at 1.3419 (YTD: -0.8%)

- Canadian dollar up 0.29% at 1.2672 (YTD: -0.3%)

- Australian dollar up 0.35% at 0.7257 (YTD: 0.0%)

- NZ dollar up 0.37% at 0.6759 (YTD: -1.0%)

GLOBAL MACRO RELEASES

- Australia, Inventories, Change P/P for Q4 2021 (AU Bureau of Stat) at 1.10 % (vs -1.90 % prior), above consensus estimate of 0.00 %

- Australia, Lending and credit, housing credit (including securitizations), Change P/P for Jan 2022 (RBA, Australia) at 0.70 % (vs 0.70 % prior)

- Australia, Lending and credit, narrow credit, Change P/P for Jan 2022 (RBA, Australia) at 0.60 % (vs 0.80 % prior)

- Australia, Retail Sales, Total, Final, Change P/P for Jan 2022 (AU Bureau of Stat) at 1.80 % (vs -4.40 % prior), above consensus estimate of 0.40 %

- Canada, Current Account, Balance for Q4 2021 (Statistics Canada) at -0.80 Bln CAD (vs 1.37 Bln CAD prior), below consensus estimate of 2.30 Bln CAD

- Canada, Industrial Product Prices, (NAPCS), Industrial product price index, Change P/P, Price Index for Jan 2022 (CANSIM, Canada) at 3.00 % (vs 0.70 % prior)

- Chile, Production, Manufacturing, Change Y/Y for Jan 2022 (INE, Chile) at 2.60 % (vs 2.30 % prior), below consensus estimate of 4.50 %

- Chile, Unemployment, Rate for Jan 2022 (INE, Chile) at 7.30 % (vs 7.20 % prior), above consensus estimate of 7.20 %

- Denmark, GDP, Total, chain linked-prelim, Change P/P for Q4 2021 (statbank.dk) at 1.10 % (vs 1.10 % prior)

- Denmark, GDP, Total, chain linked-prelim, Change Y/Y for Q4 2021 (statbank.dk) at 4.40 % (vs 3.60 % prior)

- India, GDP, At basic price, Change Y/Y for Q3 2021 (CSO, India) at 5.40 % (vs 8.40 % prior), below consensus estimate of 6.00 %

- Japan, Housing Starts, Change Y/Y for Jan 2022 (MLIT, Japan) at 2.10 % (vs 4.20 % prior), above consensus estimate of 1.70 %

- Kenya, CPI, Change Y/Y for Feb 2022 (Statistics, Kenya) at 5.08 % (vs 5.39 % prior)

- Latvia, GDP, Chain linked 2015, Final, Change Y/Y for Q4 2021 (Statistics, Latvia) at 3.50 % (vs 3.10 % prior)

- Norway, Credit indicator (C2), Change Y/Y for Jan 2022 (Norges Bank) at 5.00 % (vs 5.00 % prior)

- Norway, Retail Sales, Change P/P for Jan 2022 (Statistics Norway) at 0.40 % (vs -3.10 % prior), below consensus estimate of 1.50 %

- Portugal, GDP, Change P/P for Q4 2021 (INE, Portugal) at 1.60 % (vs 1.60 % prior)

- Portugal, GDP, Change Y/Y for Q4 2021 (INE, Portugal) at 5.80 % (vs 5.80 % prior)

- South Africa, Credit extended to the domestic private sector, total, Change Y/Y for Jan 2022 (SA Reserve Bank) at 3.12 % (vs 2.58 % prior), above consensus estimate of 2.80 %

- South Africa, Money supply M3, Change Y/Y for Jan 2022 (SA Reserve Bank) at 5.65 % (vs 5.71 % prior)

- South Africa, Trade Balance Total (Including BELN), Current Prices for Jan 2022 (SARS, South Africa) at 3.55 Bln ZAR (vs 30.14 Bln ZAR prior)

- Spain, HICP, Total, Flash, Change Y/Y, Price Index for Feb 2022 (INE, Spain) at 7.50 % (vs 6.20 % prior), above consensus estimate of 6.80 %

- Sweden, Retail Sales, Total excluding petrol stations, Change P/P for Jan 2022 (SCB, Sweden) at 4.50 % (vs -4.40 % prior)

- Sweden, Retail Sales, Total excluding petrol stations, Change Y/Y for Jan 2022 (SCB, Sweden) at 5.10 % (vs 3.30 % prior)

- Switzerland, GDP, Change P/P for Q4 2021 (SECO, Switzerland) at 0.30 % (vs 1.70 % prior), below consensus estimate of 0.40 %

- Switzerland, GDP, Change Y/Y for Q4 2021 (SECO, Switzerland) at 3.70 % (vs 4.10 % prior), in line with consensus

- Switzerland, KOF composite leading indicator for Feb 2022 (KOF, Switzerland) at 105.00 (vs 107.80 prior), below consensus estimate of 108.50

- Switzerland, Reserves, Official reserve assets, Current Prices for Jan 2022 (Swiss National Bank) at 1016732.98 Mln CHF (vs 1014134.16 Mln CHF prior)

- Switzerland, Retail Sales, Total, excluding motor vehicles and fuels, Change Y/Y for Jan 2022 (FSO, Switzerland) at 5.10 % (vs -0.40 % prior)

- Thailand, Current Account, Balance, Current Prices for Jan 2022 (Bank of Thailand) at -2.20 Bln USD (vs -1.40 Bln USD prior)

- Thailand, Current Account, Balance, Trade, Current Prices for Jan 2022 (Bank of Thailand) at 0.60 Bln USD (vs 2.80 Bln USD prior)

- Thailand, Exports, Total, FOB, Change Y/Y for Jan 2022 (Bank of Thailand) at 7.90 % (vs 23.00 % prior)

- Thailand, Imports, Total, Balance Of Payment basis, Change Y/Y for Jan 2022 (Bank of Thailand) at 18.40 % (vs 28.20 % prior)

- Thailand, Production, Value Added, Manufacturing, total, Change Y/Y for Jan 2022 (OIE, Thailand) at 1.99 % (vs 6.83 % prior), below consensus estimate of 4.60 %

- Turkey, Gross Domestic Product (%YOY), Change Y/Y for Q4 2021 (TURKSTAT) at 9.10 % (vs 7.40 % prior), above consensus estimate of 9.00 %

- Turkey, Trade Balance, Current Prices for Jan 2022 (TURKSTAT) at -10.26 Bln USD (vs -6.79 Bln USD prior)

MOVES IN SOVEREIGN 5Y US$ CDS SPREADS TODAY

- Egypt (rated B+): down 46.6 basis points to 527 bp (1Y range: 283-574bp)

- Chile (rated A-): down 4.0 basis points to 81 bp (1Y range: 48-95bp)

- Mexico (rated BBB-): down 3.1 basis points to 113 bp (1Y range: 81-124bp)

- Malaysia (rated BBB+): up 3.4 basis points to 74 bp (1Y range: 38-72bp)

- Philippines (rated BBB): up 4.0 basis points to 93 bp (1Y range: 38-90bp)

- Vietnam (rated BB): up 4.1 basis points to 129 bp (1Y range: 89-125bp)

- Indonesia (rated BBB): up 6.2 basis points to 113 bp (1Y range: 66-107bp)

- China (rated A+): up 8.2 basis points to 65 bp (1Y range: 29-61bp)

- Argentina (rated CCC): up 179.1 basis points to 3,299 bp (1Y range: 1,362-3,883bp)

- Russia (rated BBB): up 552.2 basis points to 1,405 bp (1Y range: 75-852bp), with an implied default probability now at close to 60%

LARGEST FX MOVES TODAY

- Solomon Is Dollar up 2.2% (YTD: +0.1%)

- South Africa Rand down 1.5% (YTD: +4.0%)

- Samoa Tala down 1.7% (YTD: -0.3%)

- Polish Zloty down 1.9% (YTD: -3.7%)

- Hungarian Forint down 2.0% (YTD: -1.5%)

- Georgian Lari down 2.2% (YTD: -2.3%)

- Czech Koruna down 2.3% (YTD: -2.4%)

- CFA Franc BEAC down 3.9% (YTD: -0.8%)

- Kazakhstan Tenge down 6.1% (YTD: -11.6%)

- Russian Rouble down 24.4% (YTD: -30.5%), which is the largest one-day collapse in the currency since the 1998 Russian financial crisis

COMMODITIES TOP GAINERS TODAY

- Baltic Exchange Dirty Tank Index up 17.1% (YTD: 70.4%)

- ICE Europe Newcastle Coal Monthly up 15.0% (YTD: 61.4%)

- TRPC Natural Gas TTF Day 1 up 12.4% (YTD: 28.8%)

- Bursa Malaysia Crude Palm Oil up 10.9% (YTD: 44.7%)

- CBoT Wheat up 10.1% (YTD: 19.0%)

- DCE Coking Coal Continuation Month 1 up 7.4% (YTD: 27.7%)

- CBoT Soybean Oil up 6.0% (YTD: 30.5%)

- CBoT Corn up 5.8% (YTD: 17.0%)

- NYMEX NY Harbor ULSD up 5.8% (YTD: 25.8%)

- TRPC Natural Gas TTF Monthly up 5.4% (YTD: 12.6%)

- ICE Europe Low Sulphur Gasoil up 5.3% (YTD: 30.0%)

- Palladium spot up 5.3% (YTD: 26.8%)

- Baltic Exchange Clean Tank index up 5.0% (YTD: -7.8%)

- Crude Oil WTI Cushing US FOB up 4.9% (YTD: 25.1%)

- NYMEX Light Sweet Crude Oil (WTI) up 4.5% (YTD: 24.3%)

COMMODITIES TOP LOSERS TODAY

- EEX European Union Aviation Allowance Continuation Month 1 down -6.8% (YTD: 2.6%)

- EEX European-Carbon- Secondary Trading down -6.7% (YTD: 2.8%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -6.7% (YTD: 2.6%)

- Zhengzhou Exchange Thermal Coal down -5.5% (YTD: 13.5%)

- Baltic Exchange Capesize Index down -4.4% (YTD: -31.2%)

- ICE-US Cocoa down -3.3% (YTD: -2.7%)

- DCE RBD Palm Oil down -2.8% (YTD: 34.8%)

- SMM Rare Earth Neodymium Metal Spot Price Daily down -2.7% (YTD: 32.0%)

- ICE-US Coffee C down -2.4% (YTD: 2.4%)

- Baltic Exchange Panamax Index down -2.2% (YTD: 3.3%)

- SHFE Bitumen Continuation Month 1 down -2.2% (YTD: 7.7%)

- BALTIC EXCH DRY down -1.7% (YTD: -8.1%)

- SHFE Rubber down -1.6% (YTD: -6.0%)

- NYMEX Henry Hub Natural Gas down -1.5% (YTD: 23.6%)

- Shanghai International Exchange TSR 20 down -1.5% (YTD: 0.4%)