Macro

Inflation Breakevens And Rates Volatility Higher, But Risk Aversion Keeps Treasuries Well Bid; 5-Year TIPS Real Yield Now Down Over 60bp In The Past Week

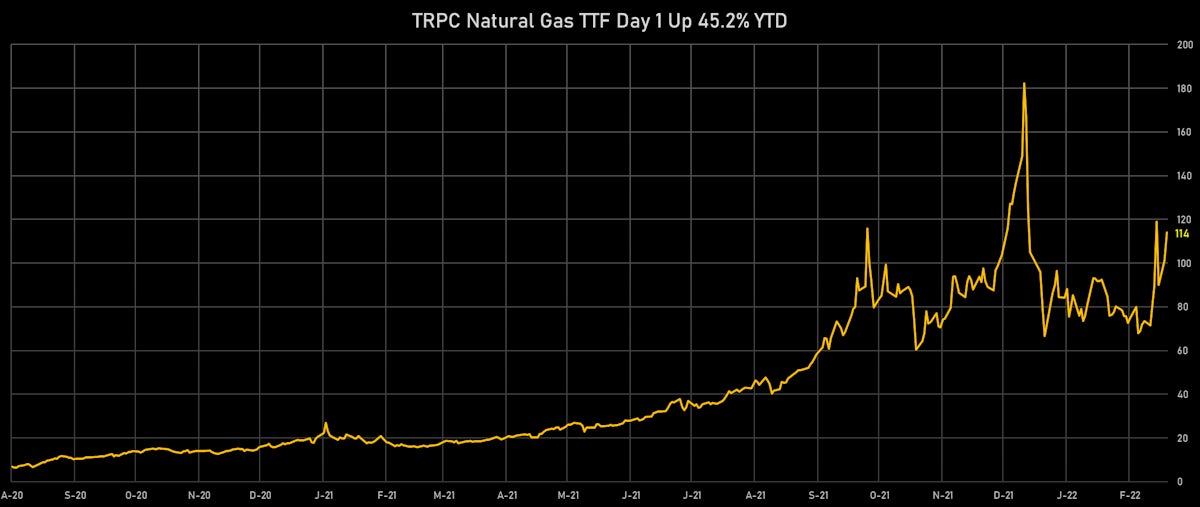

Uncertainty around how Russian sanctions will be applied, and even possibly widened, is driving commodities higher, with Brent crude front month at $110/bbl to and European TTF natural gas up double digits to €114

Published ET

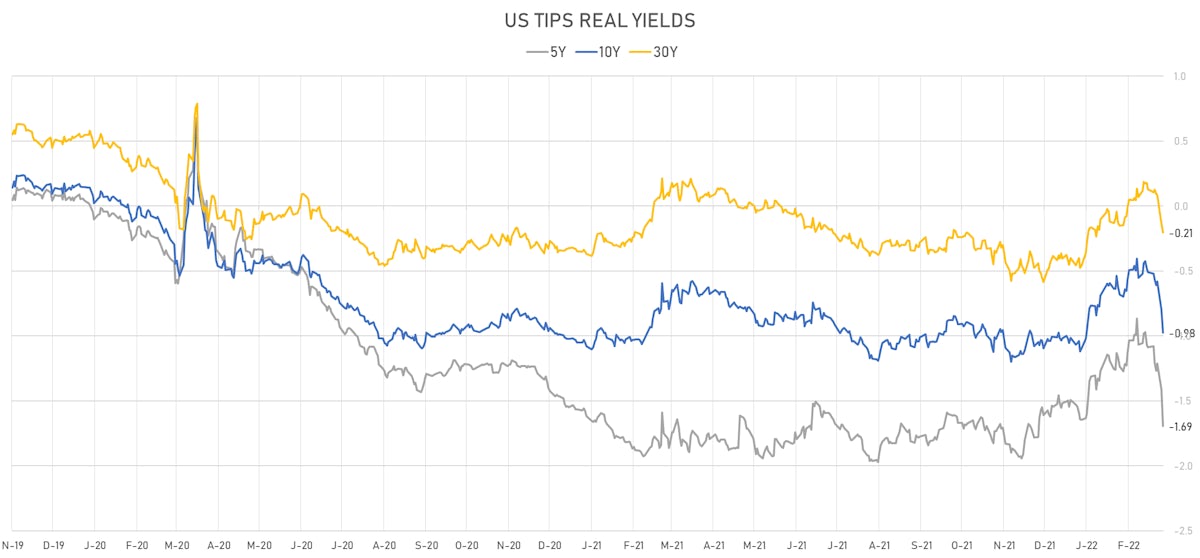

US TIPS Real Yields | Sources: ϕpost, Refinitiv data

US RATES SUMMARY

- 3-Month USD LIBOR +0.7bp today, now at 0.5110%; 3-Month OIS -3.6bp at 0.3620%

- The treasury yield curve flattened, with the 1s10s spread tightening -0.8 bp, now at 70.5 bp (YTD change: -42.3bp)

- 1Y: 1.0110% (down 9.8 bp)

- 2Y: 1.3327% (down 10.4 bp)

- 5Y: 1.5697% (down 14.3 bp)

- 7Y: 1.6683% (down 13.5 bp)

- 10Y: 1.7156% (down 10.6 bp)

- 30Y: 2.1087% (down 5.0 bp)

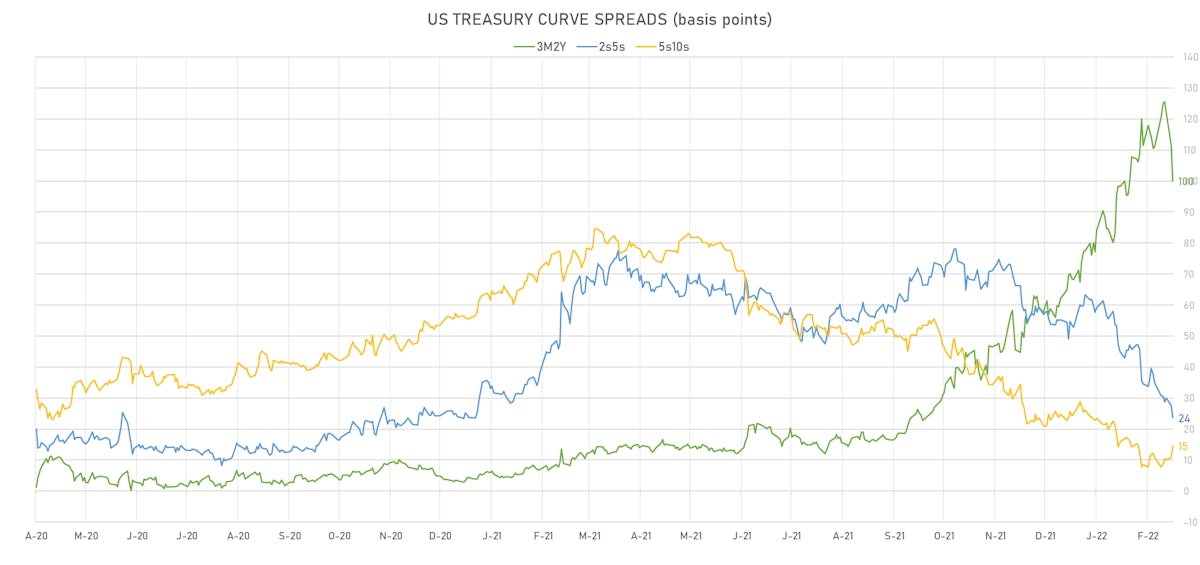

- US treasury curve spreads: 3m2Y at 100.1bp (down -11.4bp today), 2s5s at 24.0bp (down -4.1bp), 5s10s at 13.7bp (up 3.6bp), 10s30s at 38.8bp (up 5.7bp)

- Treasuries butterfly spreads: 1s5s10s at -55.0bp (up 8.1bp today), 5s10s30s at 23.7bp (up 1.1bp)

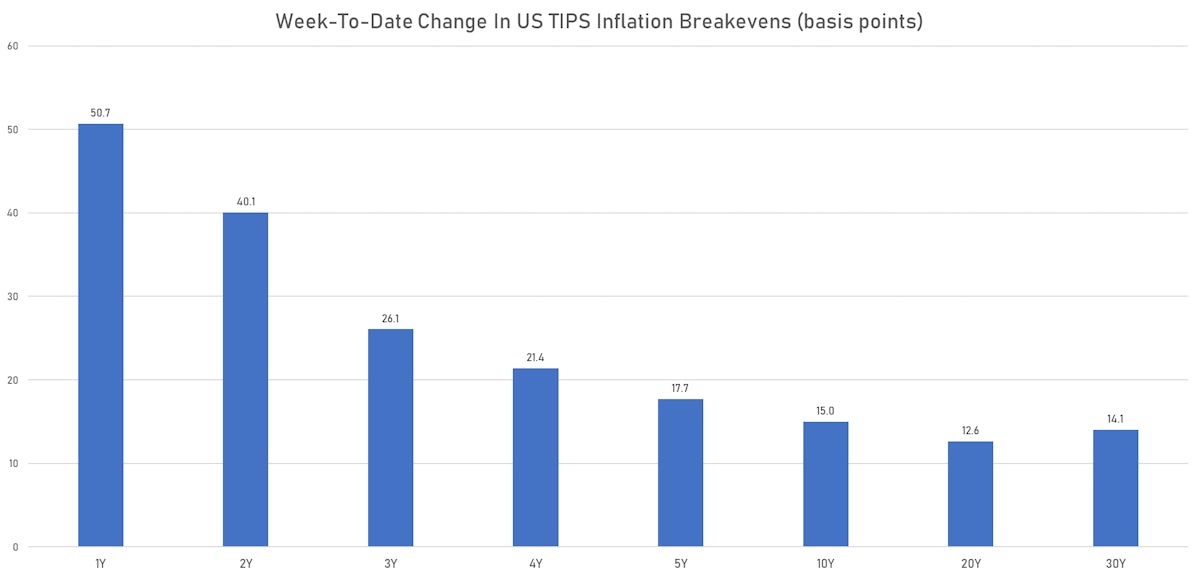

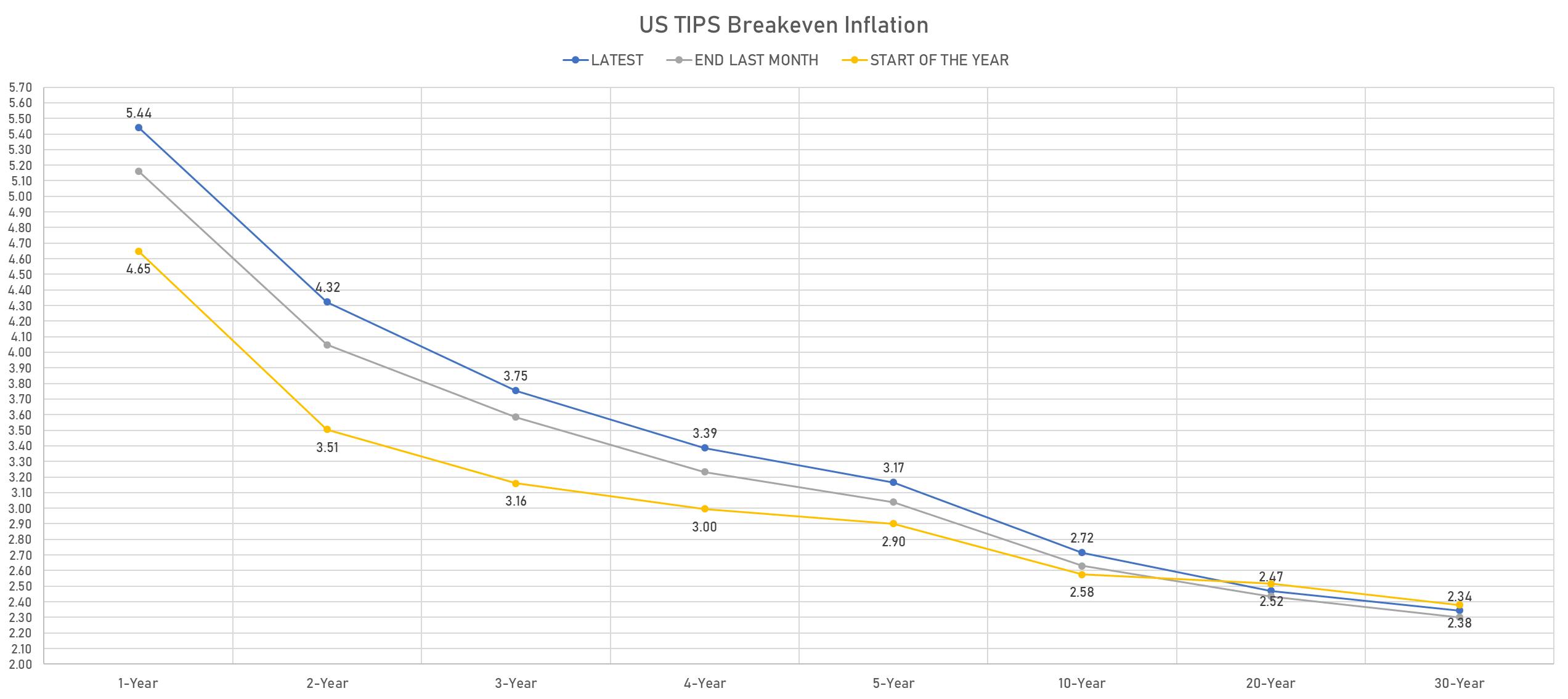

- TIPS 1Y breakeven inflation at 5.44% (up 27.9bp); 2Y at 4.32% (up 27.5bp); 5Y at 3.17% (up 12.7bp); 10Y at 2.72% (up 8.5bp); 30Y at 2.34% (up 4.4bp)

- US 5-Year TIPS Real Yield: -28.1 bp at -1.6940%; 10-Year TIPS Real Yield: -17.6 bp at -0.9750%; 30-Year TIPS Real Yield: -6.9 bp at -0.2060%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 26 Feb (Redbook Research) at 13.40 % (vs 14.50 % prior)

- Construction Spending, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.30 % (vs 0.20 % prior), above consensus estimate of 0.20 %

- Dallas Fed, General Business Activity for Feb 2022 (Fed Reserve, Dallas) at 16.60 (vs 0.60 prior)

- Dallas Fed, Revenue (Sales for TROS) for Feb 2022 (Fed Reserve, Dallas) at 21.90 (vs 2.80 prior)

- ISM Manufacturing, Employment for Feb 2022 (ISM, United States) at 52.90 (vs 54.50 prior)

- ISM Manufacturing, New orders for Feb 2022 (ISM, United States) at 61.70 (vs 57.90 prior)

- ISM Manufacturing, PMI total for Feb 2022 (ISM, United States) at 58.60 (vs 57.60 prior), above consensus estimate of 58.00

- ISM Manufacturing, Prices for Feb 2022 (ISM, United States) at 75.60 (vs 76.10 prior), above consensus estimate of 74.60

- PMI, Manufacturing Sector, Total, Final for Feb 2022 (Markit Economics) at 57.30 (vs 57.50 prior)

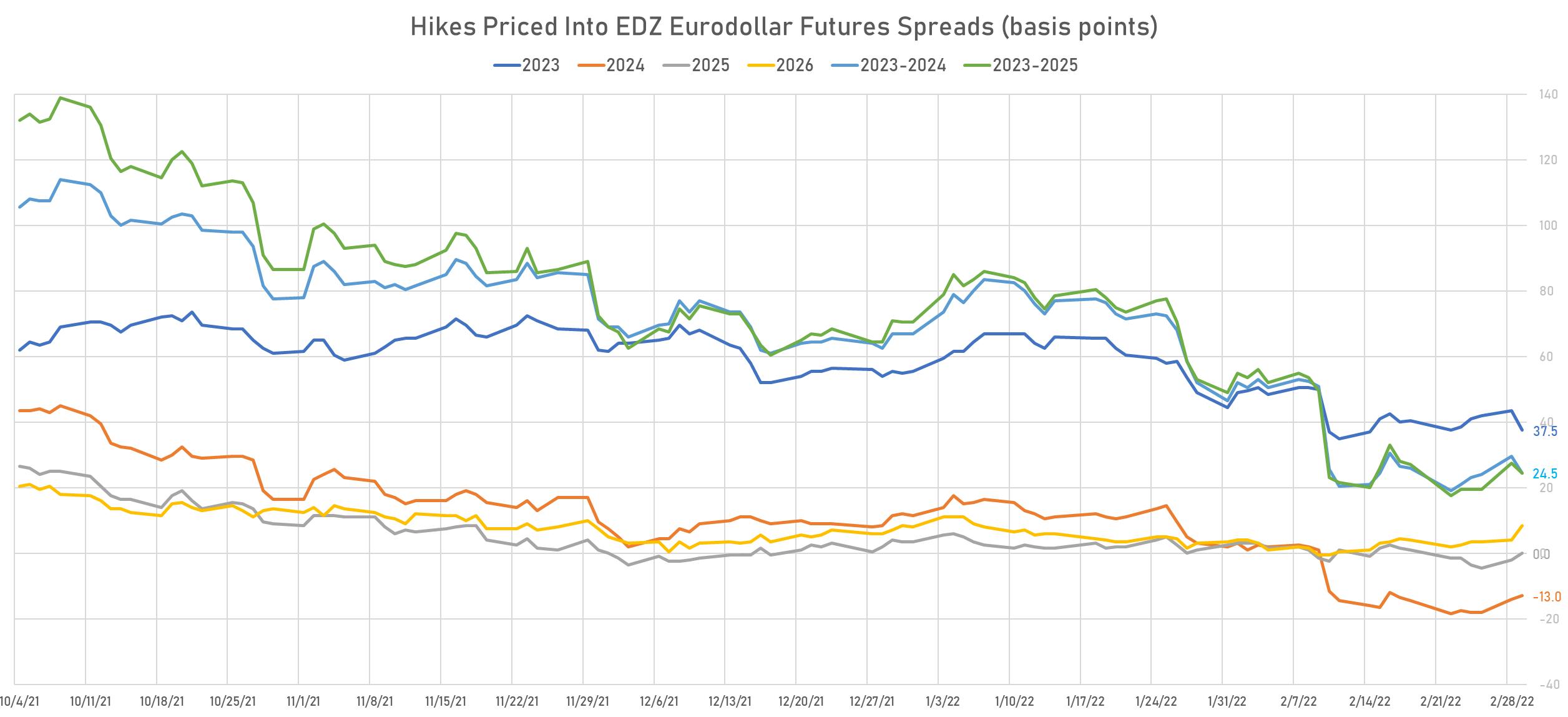

US FORWARD RATES

- Fed Funds futures now price in 27bp of Fed hikes by the end of March 2022, 57bp (2.3 x 25bp hikes) by the end of May 2022, and price in 5.5 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 37.5 bp of hikes in 2023 (equivalent to 1.5 x 25 bp hikes), down -6.0 bp today, and -13.0 bp of hikes in 2024 (equivalent to -0.5 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.44% (up 27.9bp); 2Y at 4.32% (up 27.5bp); 5Y at 3.17% (up 12.7bp); 10Y at 2.72% (up 8.5bp); 30Y at 2.34% (up 4.4bp)

- US Real Rates: 5Y at -1.6940%, -28.1 bp today; 10Y at -0.9750%, -17.6 bp today; 30Y at -0.2060%, -6.9 bp today

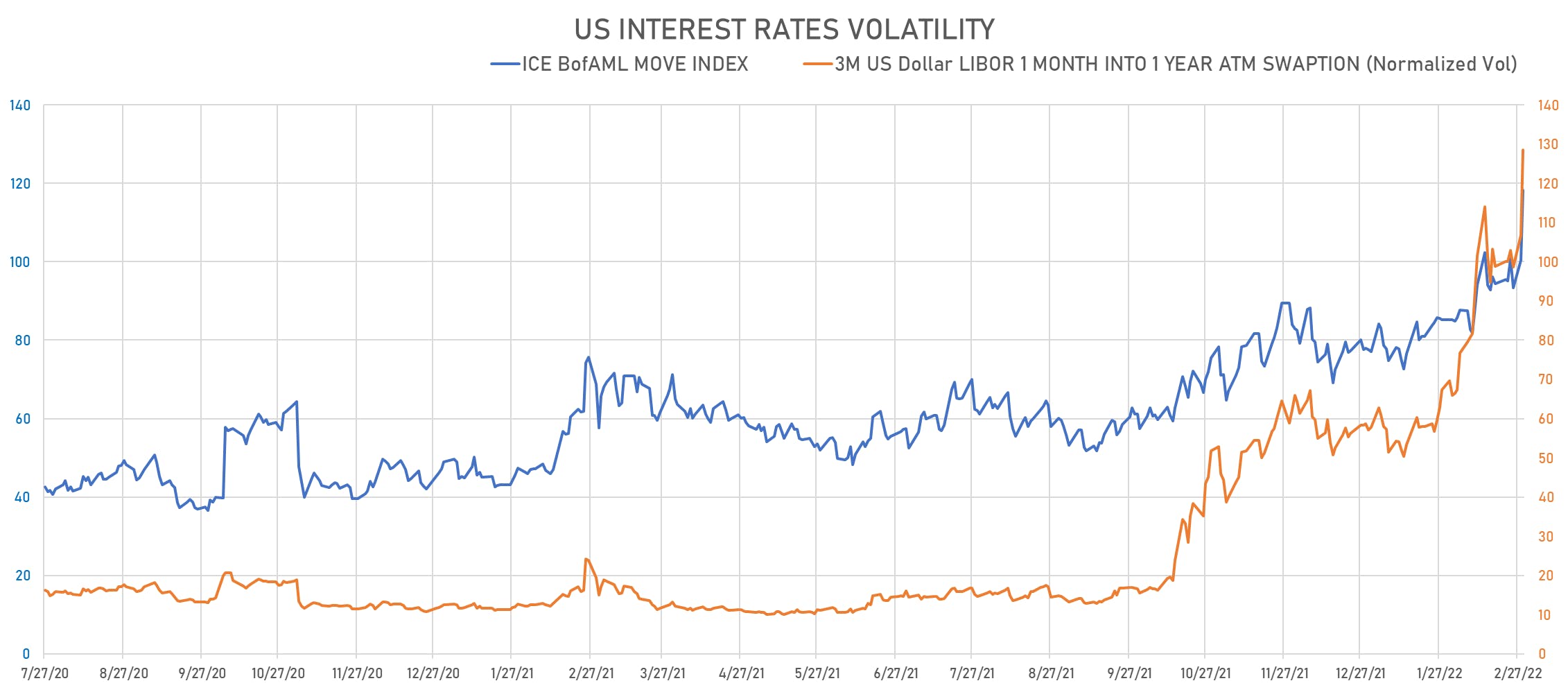

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 21.8 normals at 128.5

- 3-Month LIBOR-OIS spread up 4.2 bp at 14.9 bp (12-months range: -5.5-14.9 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.417% (down -26.2 bp); the German 1Y-10Y curve is 20.0 bp flatter at 57.9bp (YTD change: +16.3 bp)

- Japan 5Y: -0.009% (down -1.8 bp); the Japanese 1Y-10Y curve is 3.7 bp flatter at 21.3bp (YTD change: +5.1 bp)

- China 5Y: 2.529% (up 2.5 bp); the Chinese 1Y-10Y curve is 6.8 bp steeper at 78.8bp (YTD change: +27.8 bp)

- Switzerland 5Y: -0.230% (down -17.7 bp); the Swiss 1Y-10Y curve is 21.3 bp flatter at 81.0bp (YTD change: +17.5 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +11.6 bp at 204.4 bp (YTD change: +32.3 bp)

- US-JAPAN: -5.8 bp at 165.1 bp (YTD change: +30.4 bp)

- US-CHINA: -12.1 bp at -89.3 bp (YTD change: +39.9 bp)

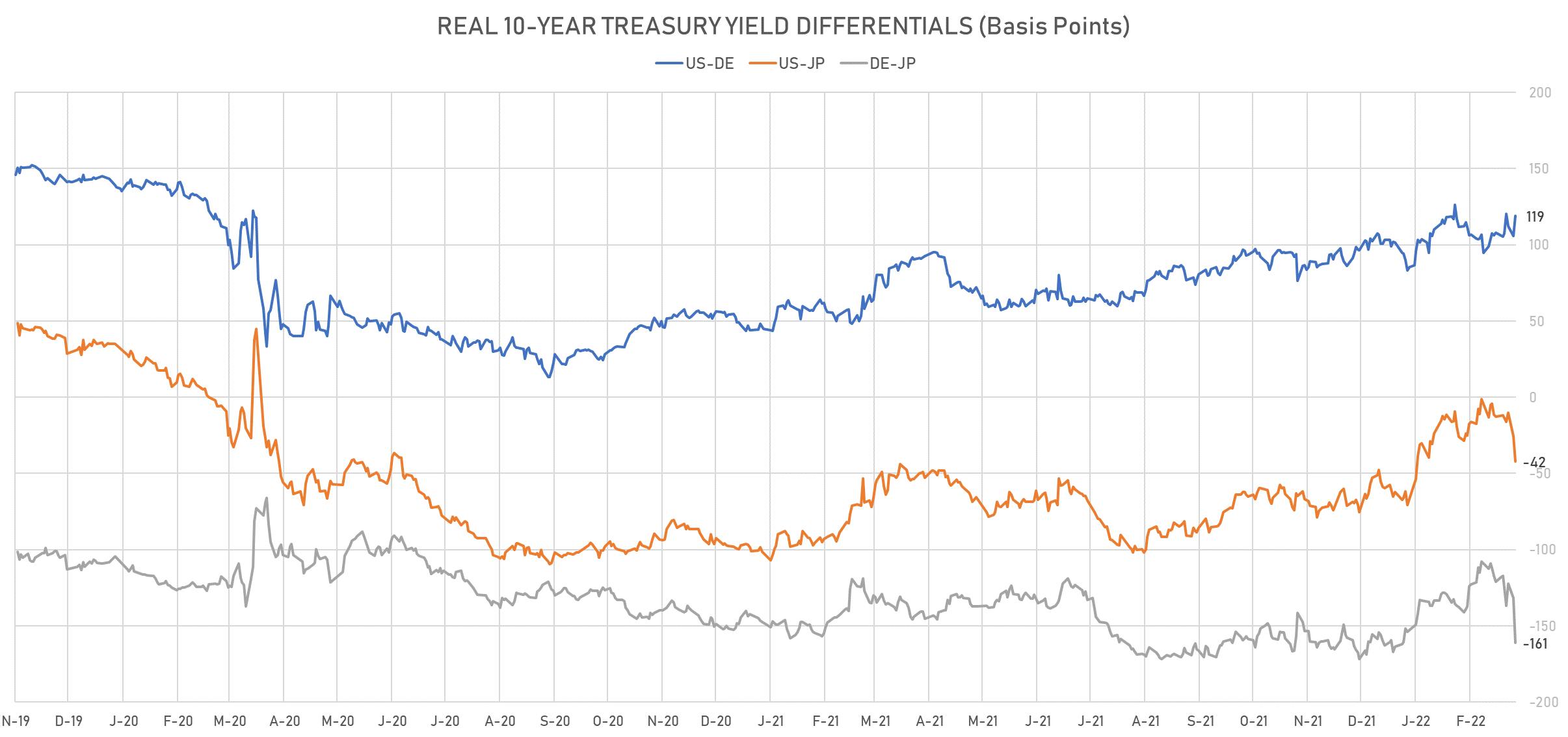

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +13.1 bp at 119.0 bp (YTD change: +35.8bp)

- US-JAPAN: -16.5 bp at -42.2 bp (YTD change: +28.6bp)

- JAPAN-GERMANY: +29.6 bp at 161.2 bp (YTD change: +7.2bp)

FX DAILY SUMMARY

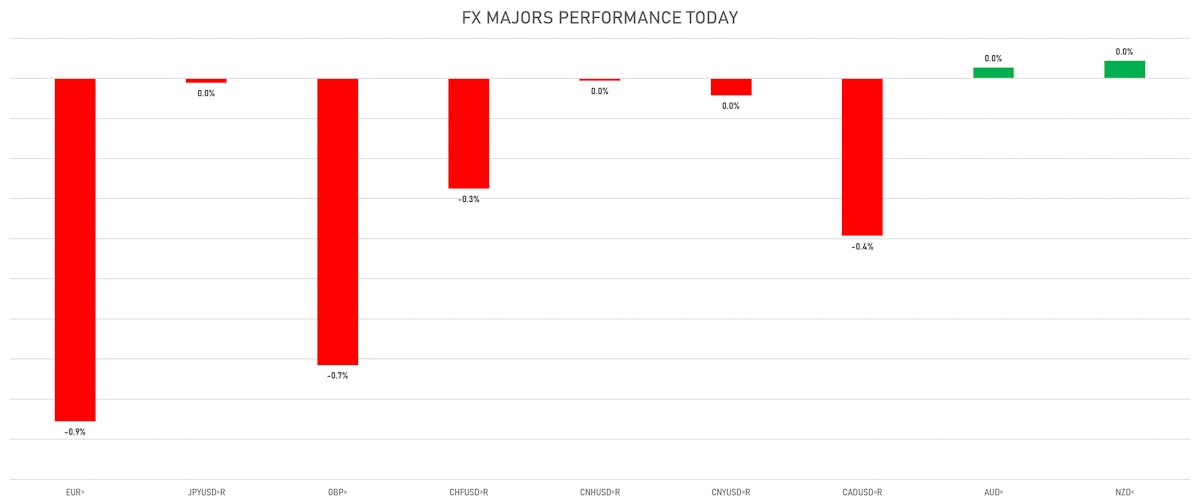

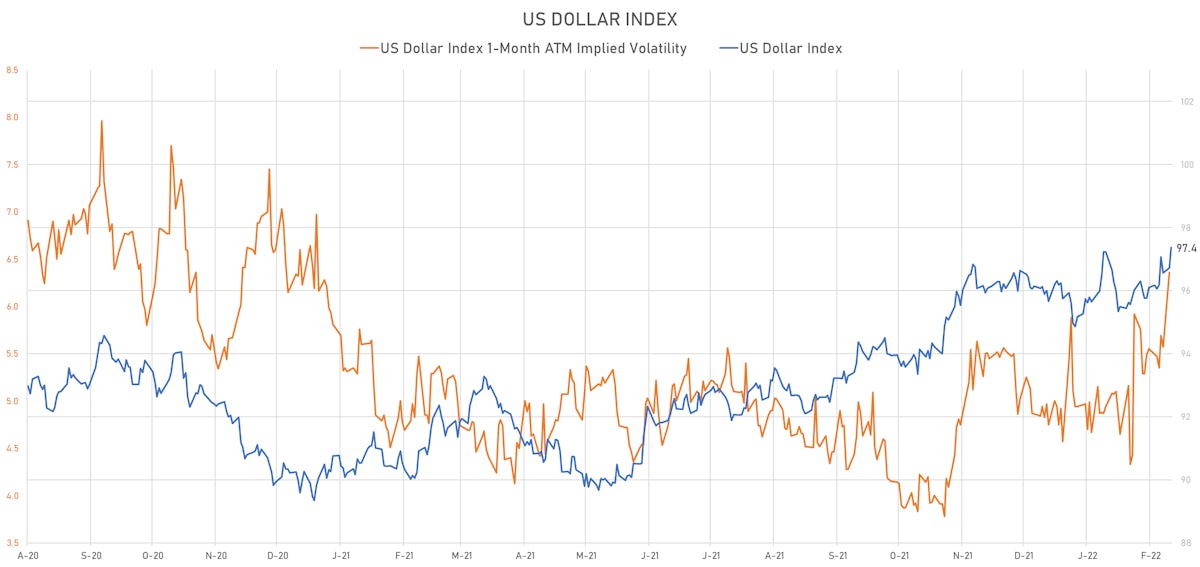

- The US Dollar Index is up 0.67% at 97.37 (YTD: +1.78%)

- Euro down 0.86% at 1.1123 (YTD: -2.2%)

- Yen down 0.01% at 115.01 (YTD: +0.1%)

- Onshore Yuan down 0.04% at 6.3116 (YTD: +0.7%)

- Swiss franc down 0.28% at 0.9191 (YTD: -0.8%)

- Sterling down 0.72% at 1.3323 (YTD: -1.5%)

- Canadian dollar down 0.39% at 1.2728 (YTD: -0.7%)

- Australian dollar up 0.03% at 0.7264 (YTD: +0.1%)

- NZ dollar up 0.04% at 0.6762 (YTD: -0.9%)

GLOBAL MACRO DATA RELEASES

- Australia, Current Account, Balance for Q4 2021 (AU Bureau of Stat) at 12.70 Bln AUD (vs 23.90 Bln AUD prior), below consensus estimate of 14.90 Bln AUD

- Australia, Net exports, Goods and Services, Total, Contributions to GDP Growth for Q4 2021 (AU Bureau of Stat) at -0.20 % (vs 1.00 % prior), above consensus estimate of -1.00 %

- Australia, Policy Rates, Cash Target Rate for Mar 2022 (RBA, Australia) at 0.10 % (unchanged), in line with consensus

- Canada, GDP, All industries, Change P/P for Dec 2021 (CANSIM, Canada) at 0.00 % (vs 0.60 % prior), below consensus estimate of 0.10 %

- Canada, GDP, Total at market prices, annualized, Change P/P for Q4 2021 (CANSIM, Canada) at 6.70 % (vs 5.40 % prior), above consensus estimate of 6.50 %

- Canada, PMI, Manufacturing Sector, Markit Mfg. PMI SA for Feb 2022 (Markit Economics) at 56.60 (vs 56.20 prior)

- China (Mainland), PMI, Manufacturing Sector for Feb 2022 (NBS, China) at 50.20 (vs 50.10 prior), above consensus estimate of 49.90

- China (Mainland), PMI, Manufacturing Sector, Caixin PMI for Feb 2022 (Markit Economics) at 50.40 (vs 49.10 prior), above consensus estimate of 49.30

- Euro Zone, PMI, Manufacturing Sector, Total, Final for Feb 2022 (Markit Economics) at 58.20 (vs 58.40 prior), below consensus estimate of 58.40

- France, PMI, Manufacturing Sector, Total, Final for Feb 2022 (Markit Economics) at 57.20 (vs 57.60 prior), below consensus estimate of 57.60

- Germany, CPI, Flash, Change Y/Y, Price Index for Feb 2022 (Destatis) at 5.10 % (vs 4.90 % prior), in line with consensus

- Germany, HICP, Flash, Change Y/Y, Price Index for Feb 2022 (Destatis) at 5.50 % (vs 5.10 % prior), above consensus estimate of 5.40 %

- Germany, PMI, Manufacturing Sector, Total, Final for Feb 2022 (Markit Economics) at 58.40 (vs 58.50 prior), below consensus estimate of 58.50

- Indonesia, CPI, Change Y/Y for Feb 2022 (Statistics Indonesia) at 2.06 % (vs 2.18 % prior), below consensus estimate of 2.20 %

- Indonesia, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Feb 2022 (Markit Economics) at 51.20 (vs 53.70 prior)

- Italy, HICP, Preliminary, Change P/P, Price Index for Feb 2022 (ISTAT, Italy) at 0.80 % (vs 0.00 % prior), above consensus estimate of 0.20 %

- Italy, HICP, Preliminary, Change Y/Y, Price Index for Feb 2022 (ISTAT, Italy) at 6.20 % (vs 5.10 % prior), above consensus estimate of 5.40 %

- Italy, PMI, Manufacturing Sector for Feb 2022 (Markit Economics) at 58.30 (vs 58.30 prior), above consensus estimate of 58.00

- Japan, PMI, Manufacturing Sector, Jibun Bank Mfg PMI, Final for Feb 2022 (Markit Economics) at 52.70 (vs 52.90 prior)

- Mexico, PMI, Manufacturing Sector for Feb 2022 (Markit Economics) at 48.00 (vs 46.10 prior)

- New Zealand, Milk Auction, Average Price, Constant Prices for W 01 Mar (Global Dairy Trade) at 5,065.00 USD (vs 4,840.00 USD prior)

- Russia, PMI, Manufacturing Sector for Feb 2022 (Markit Economics) at 48.60 (vs 51.80 prior)

- Turkey, PMI, Manufacturing Sector, Istanbul Chamber of Industry PMI for Feb 2022 (Markit Economics) at 50.40 (vs 50.50 prior)

- United Kingdom, PMI, Manufacturing Sector for Feb 2022 (Markit Economics) at 58.00 (vs 57.30 prior), above consensus estimate of 57.30

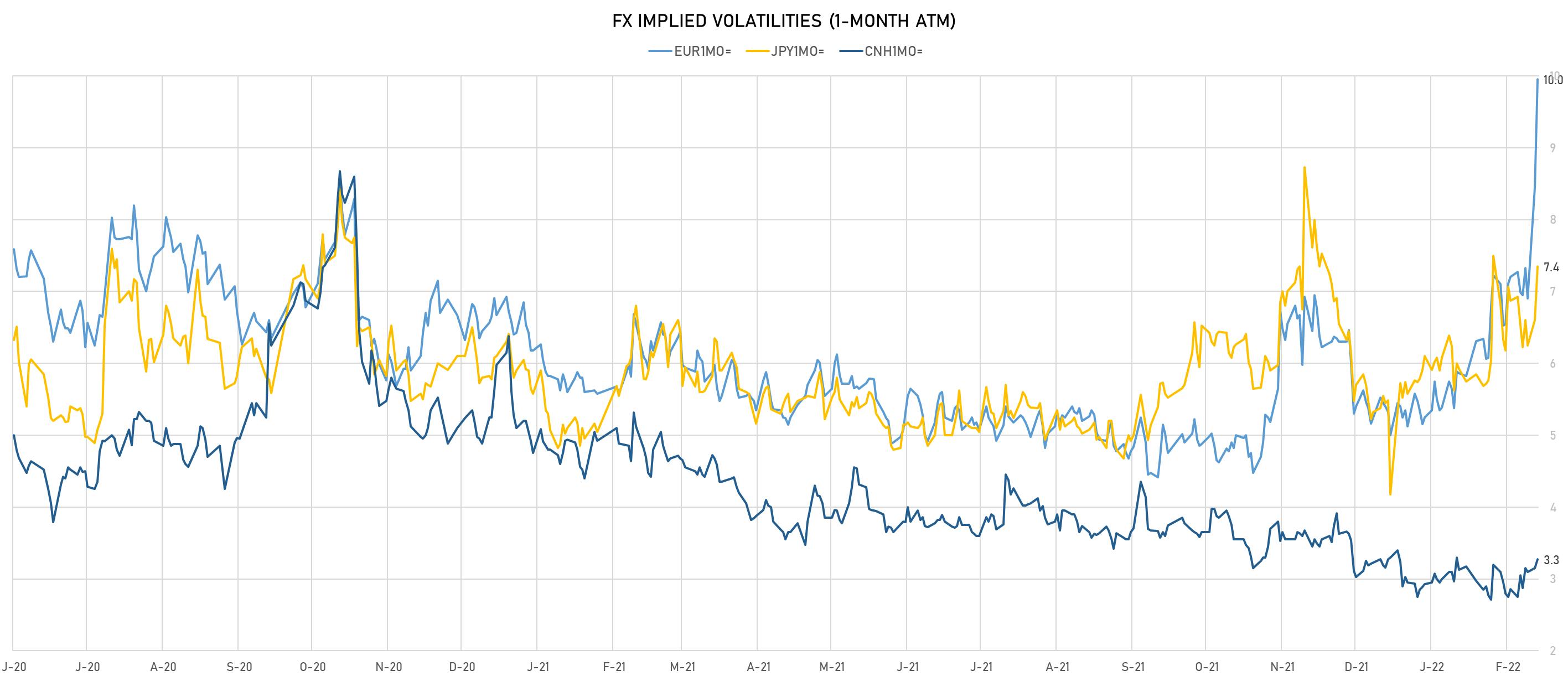

FX VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.66, up 0.05 (YTD: +1.55)

- Euro 1-Month At-The-Money Implied Volatility currently at 9.95, up 1.5 (YTD: +5.0)

- Japanese Yen 1M ATM IV currently at 7.35, up 0.8 (YTD: +3.2)

- Offshore Yuan 1M ATM IV currently at 3.28, up 0.1

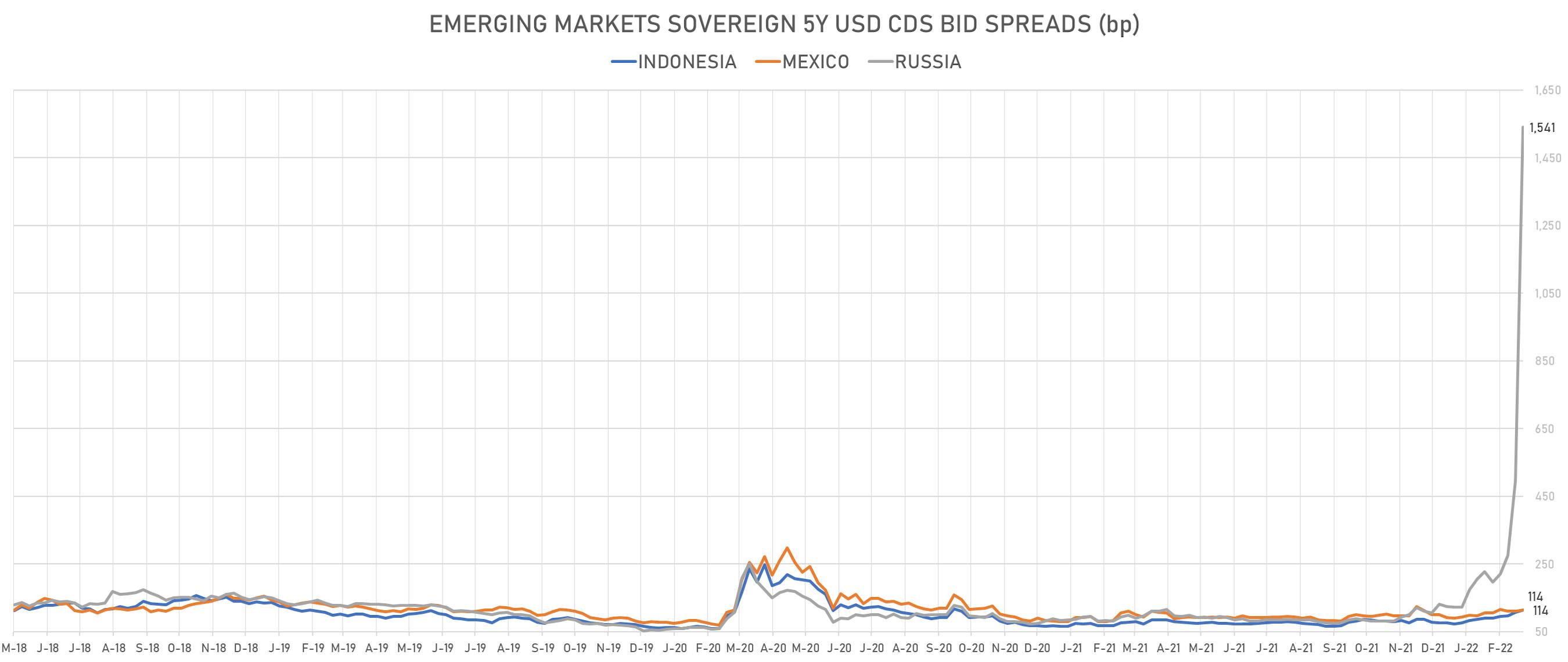

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS TODAY

- Argentina (rated CCC): down 78.1 basis points to 3,259 bp (1Y range: 1,362-3,883bp)

- China (rated A+): down 5.8 basis points to 62 bp (1Y range: 29-66bp)

- Latvia (rated A-): up 3.0 basis points to 53 bp (1Y range: 43-53bp)

- Israel (rated A+): up 3.5 basis points to 62 bp (1Y range: 50-62bp)

- Lithuania (rated A): up 3.5 basis points to 55 bp (1Y range: 44-55bp)

- Poland (rated A-): up 3.5 basis points to 55 bp (1Y range: 44-55bp)

- United Arab Emirates (rated AA-): up 4.0 basis points to 71 bp (1Y range: 61-71bp)

- Slovenia (rated A): up 4.0 basis points to 64 bp (1Y range: 51-64bp)

- Egypt (rated B+): up 10.9 basis points to 538 bp (1Y range: 283-574bp)

- Russia (still rated BBB): up 136.2 basis points to 1,541 bp (1Y range: 75-1,405bp)

LARGEST FX MOVES TODAY

- Belarusian ruble up 5.8% (YTD: -14.4%)

- Colombian Peso up 1.4% (YTD: +4.8%)

- Iceland Krona down 1.1% (YTD: +1.5%)

- Armenian Dram down 1.4% (YTD: -1.8%)

- Swedish Krona down 1.5% (YTD: -6.2%)

- Czech Koruna down 1.6% (YTD: -4.2%)

- CFA Franc BCEAO down 1.8% (YTD: -2.9%)

- Polish Zloty down 1.8% (YTD: -5.5%)

- Georgian Lari down 2.2% (YTD: -4.4%)

- Hungarian Forint down 2.2% (YTD: -4.1%)

COMMODITIES - NOTABLE GAINERS TODAY

- TRPC Natural Gas TTF Monthly up 26.1% (YTD: 41.9%)

- ICE Europe Newcastle Coal Monthly up 14.0% (YTD: 84.0%)

- Brent Forties and Oseberg Dated FOB North Sea Crude up 13.1% (YTD: 43.4%)

- TRPC Natural Gas TTF Day 1 up 12.7% (YTD: 45.2%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 11.2% (YTD: 46.9%)

- NYMEX RBOB Gasoline up 10.4% (YTD: 34.5%)

- Bursa Malaysia Crude Palm Oil up 9.6% (YTD: 58.5%)

- ICE Europe Low Sulphur Gasoil up 9.2% (YTD: 41.9%)

- NYMEX Light Sweet Crude Oil (WTI) up 8.0% (YTD: 34.3%)

- CBoT Wheat up 7.9% (YTD: 28.5%)

- Crude Oil WTI Cushing US FOB up 7.8% (YTD: 34.9%)

- CBoT Corn up 6.1% (YTD: 24.1%)

- CBoT Soybean Oil up 5.4% (YTD: 37.5%)

- Johnson Matthey; Iridium New York 0930 up 5.1% (YTD: 2.5%)

- DCE RBD Palm Oil up 4.8% (YTD: 41.2%)

COMMODITIES - NOTABLE LOSERS TODAY

- EEX European Union Aviation Allowance Continuation Month 1 down -16.4% (YTD: -14.2%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -16.3% (YTD: -14.1%)

- EEX European-Carbon- Secondary Trading down -16.2% (YTD: -13.9%)

- Shanghai International Exchange TSR 20 Rubber down -2.1% (YTD: -1.7%)

- SHFE Bitumen Continuation Month 1 down -1.6% (YTD: 5.9%)

- SHFE Rubber down -1.4% (YTD: -7.2%)

ENERGY COMMODITIES TODAY

- WTI crude front month currently at US$ 106.62 per barrel, up 8.0% (YTD: +34.3%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 107.78 per barrel, up 3.9% (YTD: +32.3%)

- Brent 1-month at-the-money implied volatility at 62.1, up 10.3 vols (12-month range: 26.1-62.1)

- Newcastle Coal (ICE Europe) currently at US$ 313.00 per tonne, up 14.0% (YTD: +84.0%)

- Natural Gas (Henry Hub) currently at US$ 4.63 per MMBtu, up 3.9% (YTD: +28.4%)

- Gasoline (NYMEX) currently at US$ 3.16 per gallon, up 10.4% (YTD: +34.5%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 987.50 per tonne, up 9.2% (YTD: +41.9%)

The Urals-Brent crude spread keeps widening, as buyers are unwilling to take the risk of taking Russian deliveries when it's not clear yet how sanctions apply to oil payments / shipments