Macro

Yields Rise As Powell Confirms Liftoff Is Now A Couple Weeks Away, More Worried About Inflation Than Economic Growth Impact Of Ukraine-Russia War

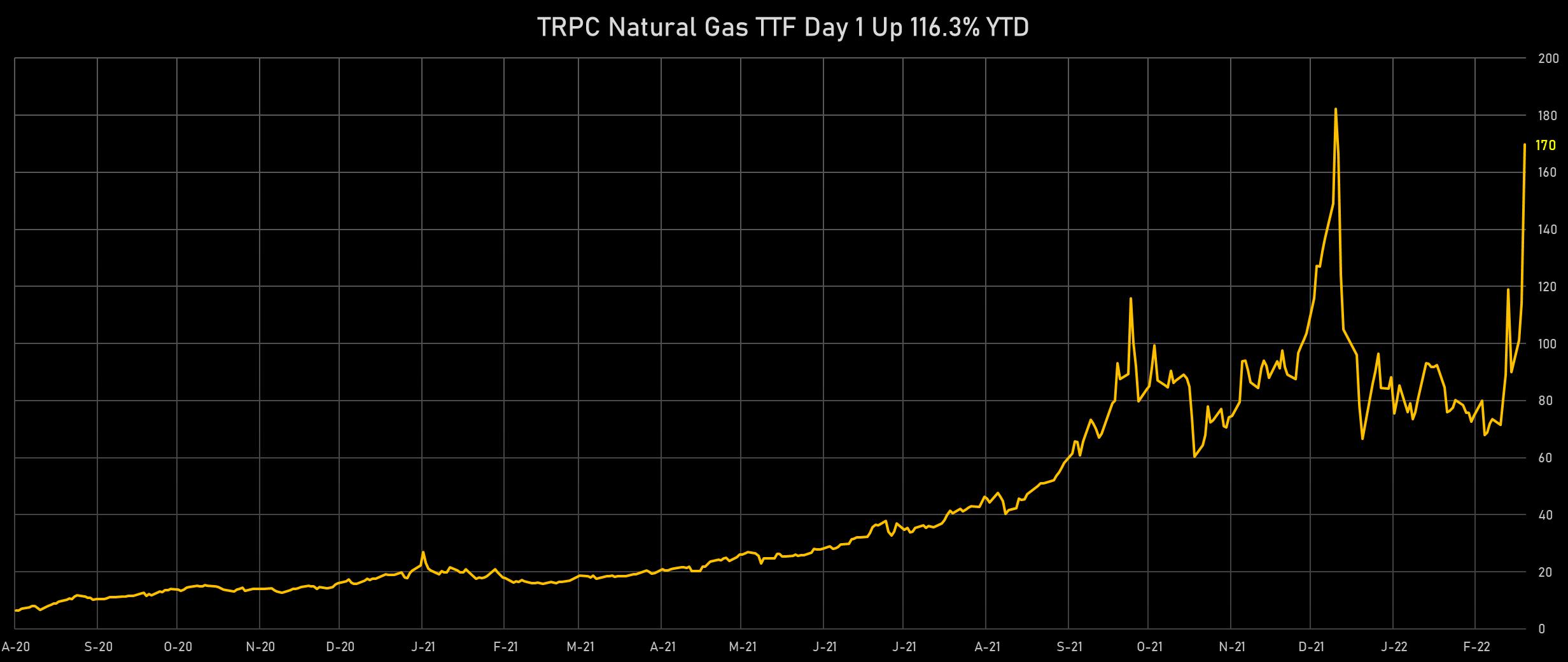

Energy commodities keep rising at a frightening pace, with European TTF natural gas up over 40% and Brent Forties up 6% today, with the historic gap with Urals crude now at around $19

Published ET

TTF Natural Gas Day 1 & Brent Forties Spot Price | Source: Refinitiv

US RATES SUMMARY

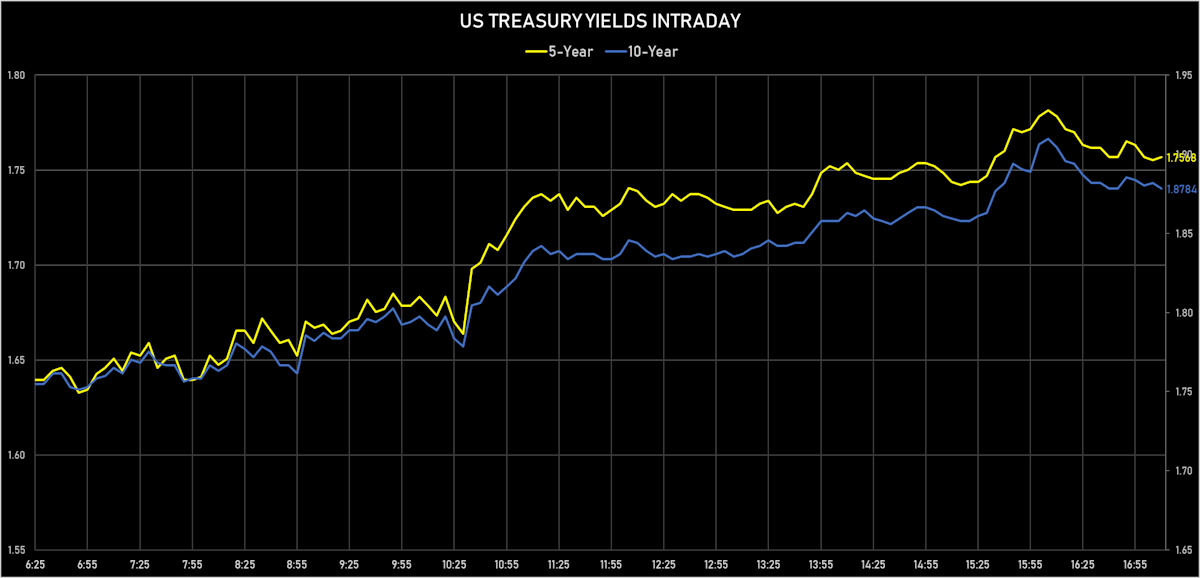

- 3-Month USD LIBOR +3.7bp today, now at 0.5480%; 3-Month OIS +4.6bp at 0.4080%

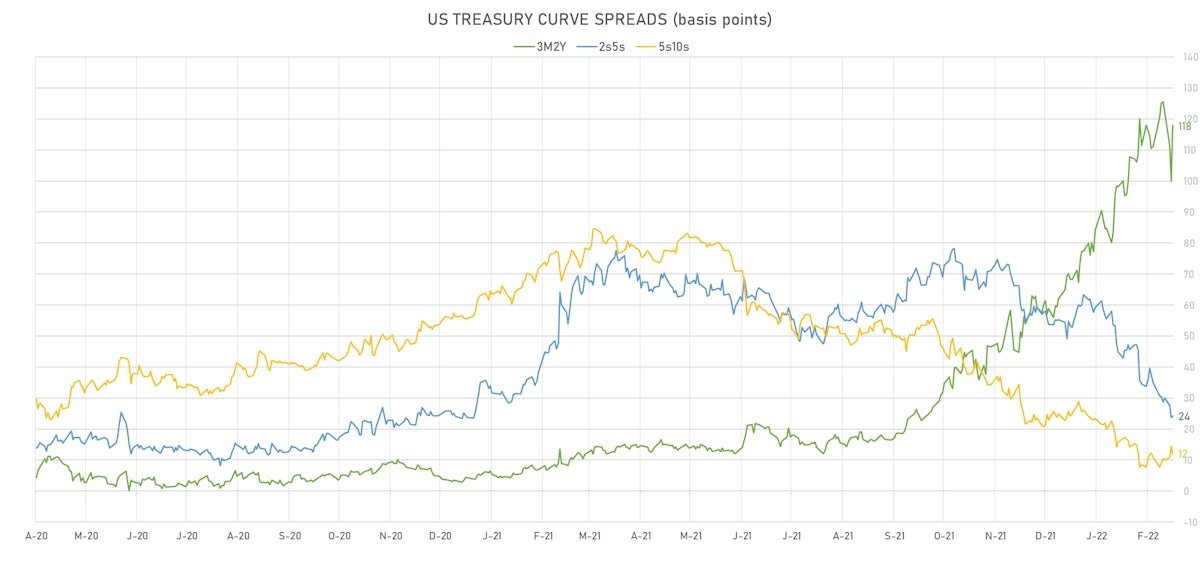

- The treasury yield curve steeper at the front end, flatter from the 2Y out

- 1Y: 1.0447% (up 13.6 bp)

- 2Y: 1.5120% (up 18.1 bp)

- 5Y: 1.7560% (up 18.7 bp)

- 7Y: 1.8433% (up 17.7 bp)

- 10Y: 1.8776% (up 16.3 bp)

- 30Y: 2.2525% (up 14.5 bp)

- US treasury curve spreads: 3m2Y at 117.9bp (up 17.8bp today), 2s5s at 24.4bp (up 0.8bp), 5s10s at 12.2bp (down -2.3bp), 10s30s at 37.5bp (down -1.8bp)

- Treasuries butterfly spreads: 1s5s10s at -59.7bp (down -4.8bp), 5s10s30s at 24.4bp (up 0.7bp)

- TIPS 1Y breakeven inflation at 5.41% (down -4.6bp); 2Y at 4.29% (down -1.2bp); 5Y at 3.20% (up 2.6bp); 10Y at 2.73% (up 3.7bp); 30Y at 2.38% (up 6.4bp)

- US 5-Year TIPS Real Yield: +16.7 bp at -1.5270%; 10-Year TIPS Real Yield: +12.8 bp at -0.8470%; 30-Year TIPS Real Yield: +8.2 bp at -0.1240%

US MACRO RELEASES

- ADP total nonfarm private employment (estimate), Absolute change for Feb 2022 (ADP - Automatic Data) at 475.00 k (vs -301.00 k prior), above consensus estimate of 388.00 k

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 25 Feb (MBA, USA) at -0.70 % (vs -13.10 % prior)

- Mortgage applications, market composite index for W 25 Feb (MBA, USA) at 463.10 (vs 466.40 prior)

- Mortgage applications, market composite index, purchase for W 25 Feb (MBA, USA) at 246.30 (vs 250.70 prior)

- Mortgage applications, market composite index, refinancing for W 25 Feb (MBA, USA) at 1,685.70 (vs 1,677.70 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 25 Feb (MBA, USA) at 4.15 % (vs 4.06 % prior)

US FORWARD RATES

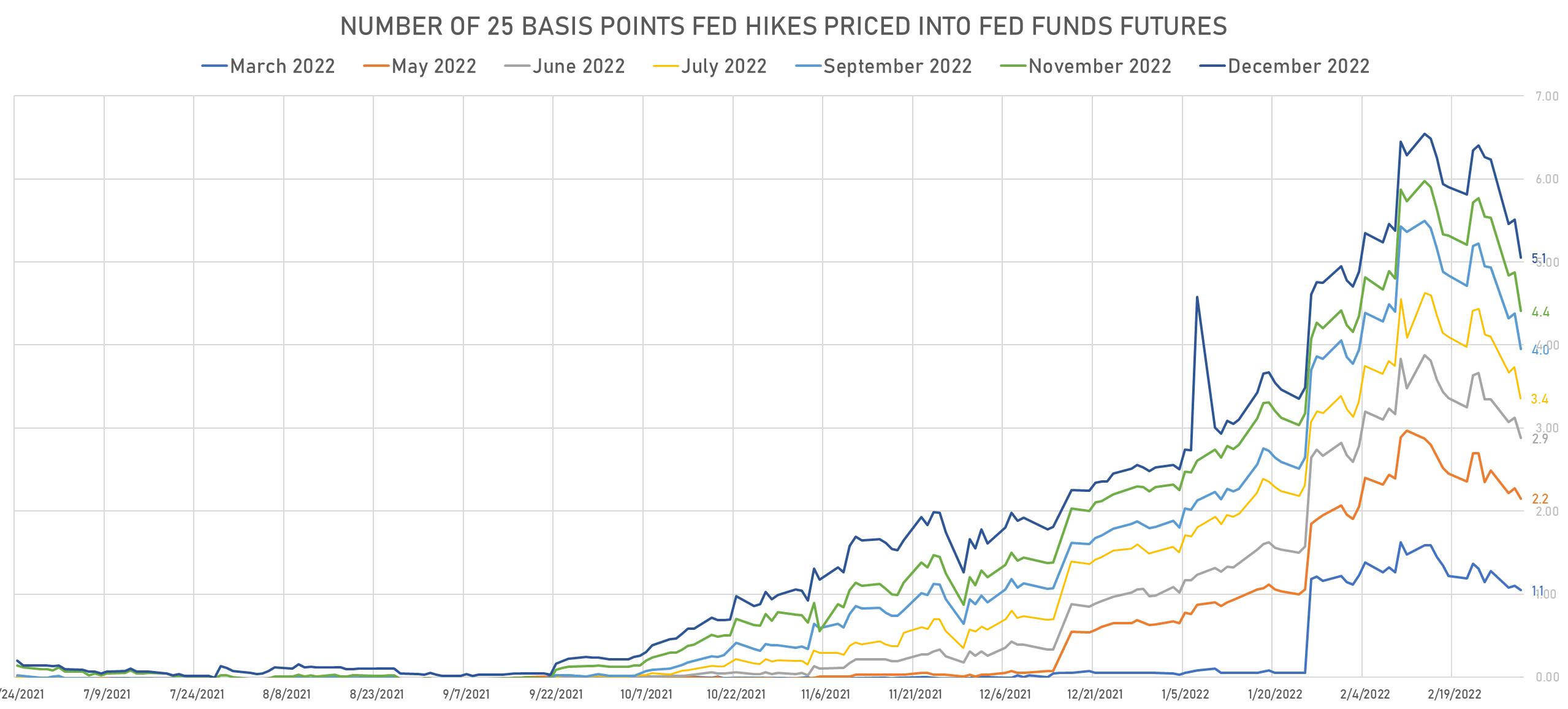

- Fed Funds futures now price in 26.3bp of Fed hikes by the end of March 2022, 53.8bp (2.15 x 25bp hikes) by the end of May 2022, and price in 5.05 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 36.5 bp of hikes in 2023 (equivalent to 1.5 x 25 bp hikes), down -1.0 bp today, and -16.0 bp of hikes in 2024 (equivalent to 0.6 x 25 bp CUT)

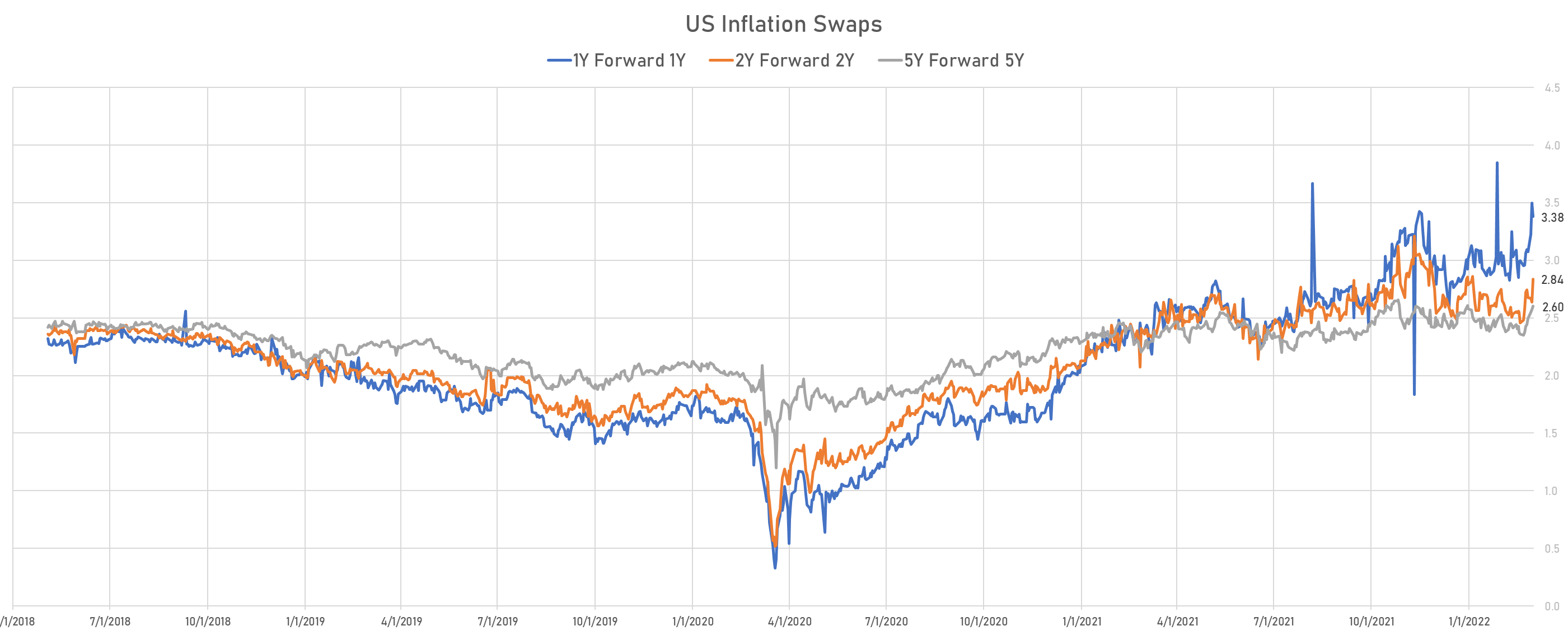

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.41% (down -4.6bp); 2Y at 4.29% (down -1.2bp); 5Y at 3.20% (up 2.6bp); 10Y at 2.73% (up 3.7bp); 30Y at 2.38% (up 6.4bp)

- 6-month spot US CPI swap up 18.7 bp to 5.089%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.5270%, +16.7 bp today; 10Y at -0.8470%, +12.8 bp today; 30Y at -0.1240%, +8.2 bp today

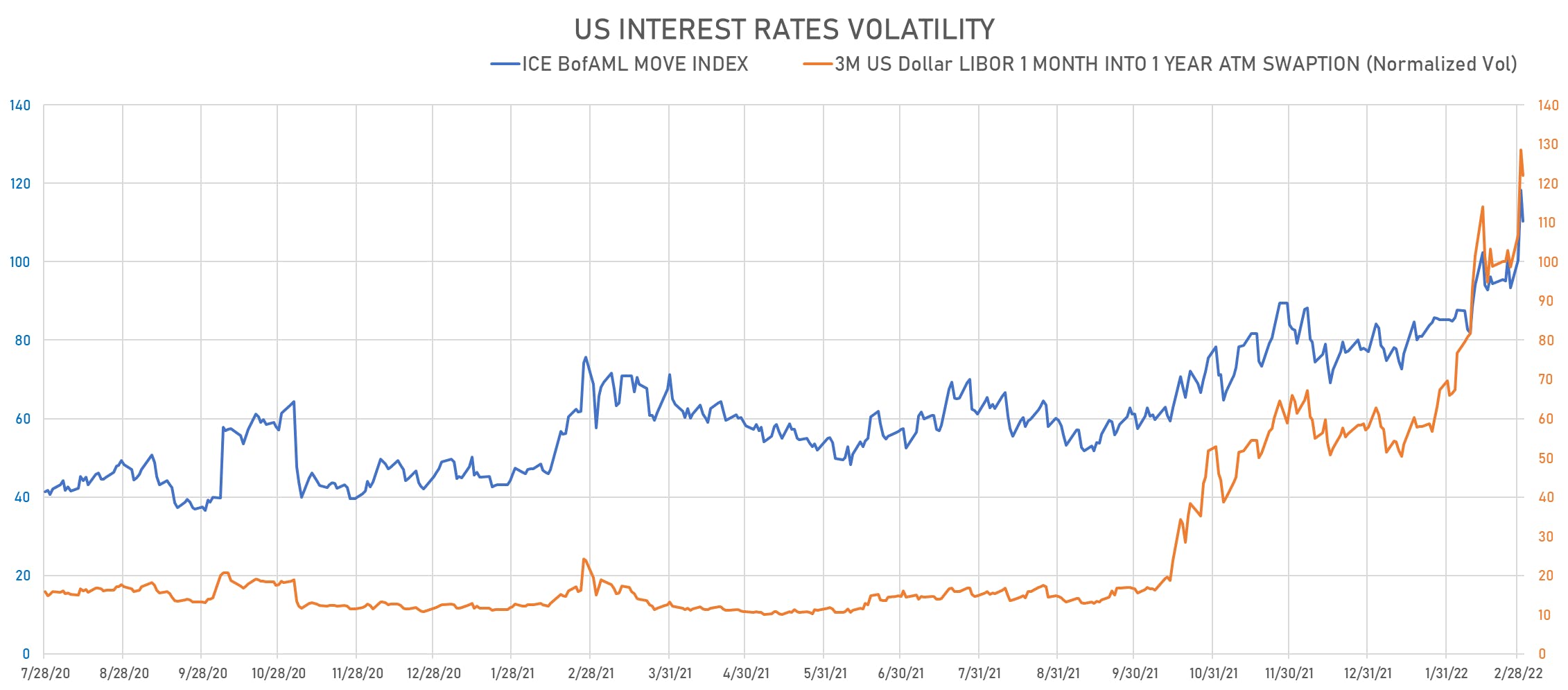

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.6% at 121.9%

- 3-Month LIBOR-OIS spread down -0.9 bp at 14.0 bp (12-months range: -5.5-14.9 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.267% (up 11.7 bp); the German 1Y-10Y curve is 7.6 bp steeper at 68.6bp (YTD change: +23.9 bp)

- Japan 5Y: 0.011% (down -0.6 bp); the Japanese 1Y-10Y curve is 0.4 bp flatter at 24.9bp (YTD change: +4.6 bp)

- China 5Y: 2.555% (up 2.6 bp); the Chinese 1Y-10Y curve is 0.7 bp flatter at 78.1bp (YTD change: +27.1 bp)

- Switzerland 5Y: -0.121% (up 10.9 bp); the Swiss 1Y-10Y curve is 17.9 bp steeper at 86.9bp (YTD change: +35.4 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.9 bp at 200.0 bp (YTD change: +27.9 bp)

- US-JAPAN: +16.1 bp at 173.2 bp (YTD change: +38.5 bp)

- US-CHINA: +12.4 bp at -81.8 bp (YTD change: +47.4 bp)

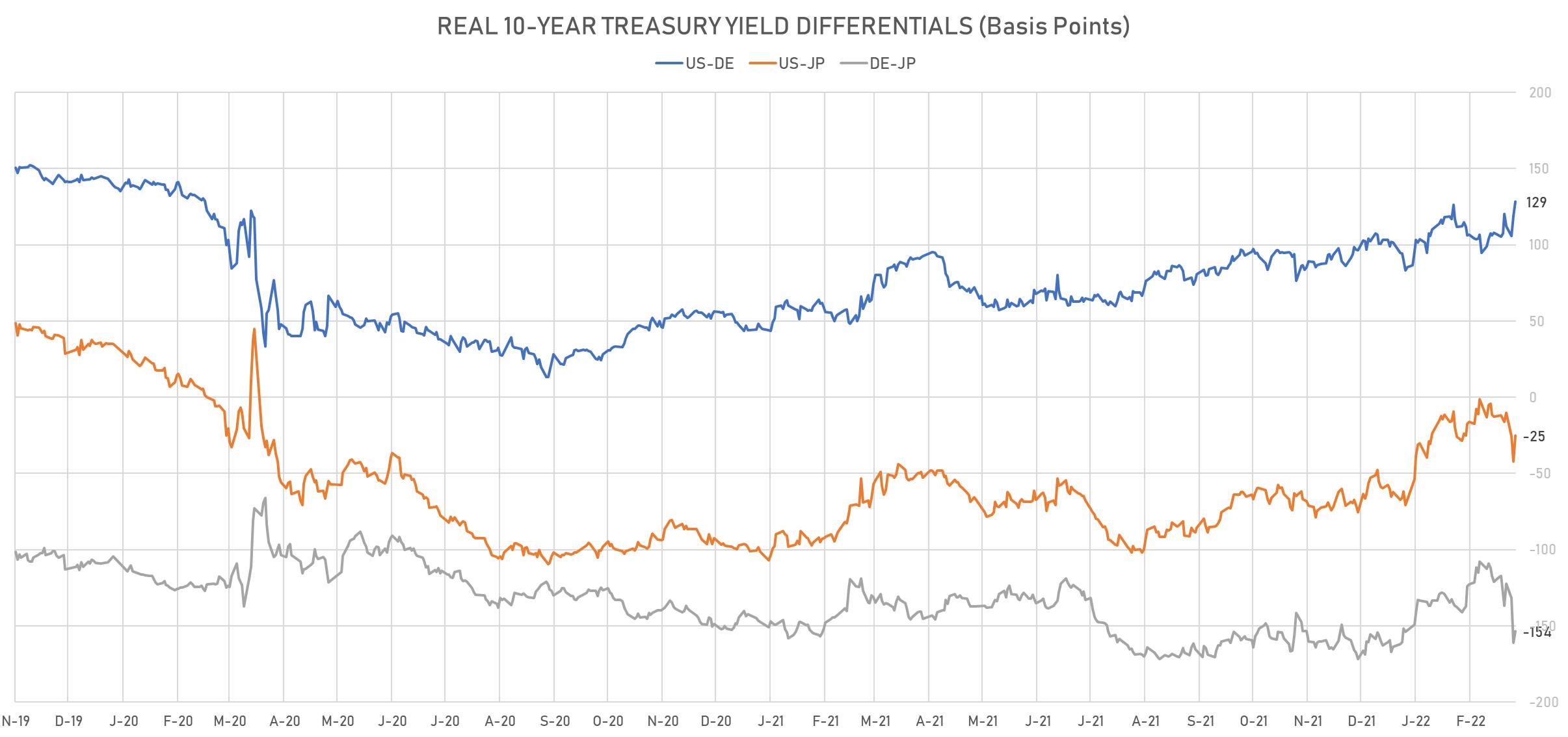

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +9.6 bp at 128.6 bp (YTD change: +45.4bp)

- US-JAPAN: +17.3 bp at -24.9 bp (YTD change: +45.9bp)

- JAPAN-GERMANY: -7.7 bp at 153.5 bp (YTD change: -0.5bp)

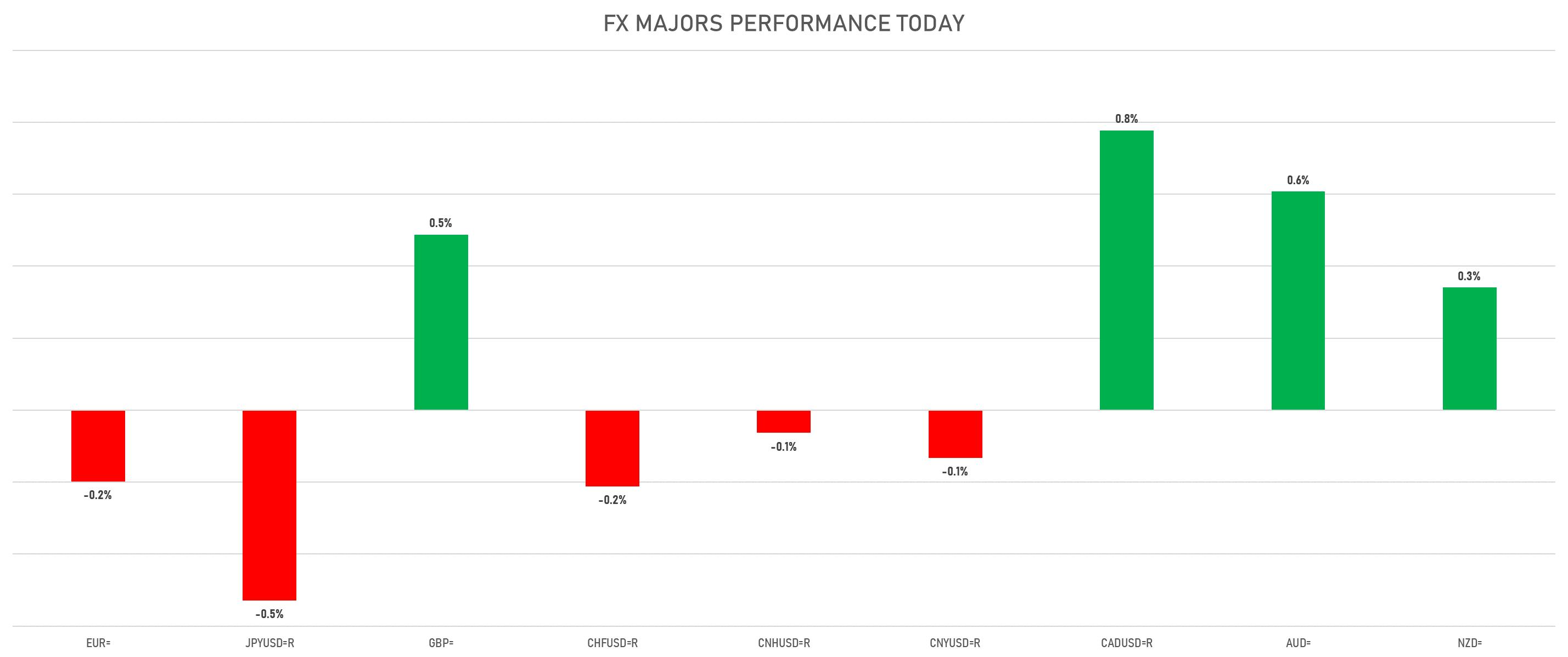

FX DAILY SUMMARY

- The US Dollar Index is up 0.03% at 97.40 (YTD: +1.81%)

- Euro down 0.20% at 1.1104 (YTD: -2.3%)

- Yen down 0.53% at 115.51 (YTD: -0.4%)

- Onshore Yuan down 0.13% at 6.3210 (YTD: +0.6%)

- Swiss franc down 0.21% at 0.9204 (YTD: -0.9%)

- Sterling up 0.49% at 1.3386 (YTD: -1.1%)

- Canadian dollar up 0.78% at 1.2644 (YTD: -0.1%)

- Australian dollar up 0.61% at 0.7292 (YTD: +0.4%)

- NZ dollar up 0.34% at 0.6778 (YTD: -0.7%)

MACRO DATA RELEASES

- Argentina, Public Finances, Central Government, Tax revenues, total, Current Prices for Feb 2022 at 1,166.51 Bln ARS (vs 1,171.94 Bln ARS prior)

- Australia, GDP, Change P/P for Q4 2021 (AU Bureau of Stat) at 3.40 % (vs -1.90 % prior), above consensus estimate of 3.00 %

- Australia, GDP, Change Y/Y for Q4 2021 (AU Bureau of Stat) at 4.20 % (vs 3.90 % prior), above consensus estimate of 3.70 %

- Canada, Policy Rates, Overnight Target Rate for 02 Mar (Bank of Canada) at 0.50 % (a 25bp hike), in line with consensus

- Euro Zone, CPI, Change Y/Y for Feb 2022 (Eurostat) at 5.80 % (vs 5.10 % prior), above consensus estimate of 5.40 %

- Euro Zone, CPI, Total excluding energy and unprocessed food, Change Y/Y, Price Index for Feb 2022 (Eurostat) at 2.90 % (vs 2.40 % prior), above consensus estimate of 2.70 %

- Germany, Unemployment, Change, Absolute change for Feb 2022 (Deutsche Bundesbank) at -33.00 k (vs -48.00 k prior), below consensus estimate of -25.00 k

- Germany, Unemployment, Rate, Registered for Feb 2022 (Deutsche Bundesbank) at 5.00 % (vs 5.10 % prior), below consensus estimate of 5.10 %

- Hungary, GDP, Final, Change Y/Y for Q4 2021 (HCSO, Hungary) at 7.10 % (vs 7.20 % prior)

- India, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Feb 2022 (Markit Economics) at 54.90 (vs 54.00 prior), above consensus estimate of 54.30

- Ireland, Unemployment, Rate, ILO for Feb 2022 (CSO, Ireland) at 5.20 % (vs 5.30 % prior)

- Russia, Unemployment, Rate for Jan 2022 (RosStat, Russia) at 4.40 % (vs 4.30 % prior)

- South Korea, GDP, Change P/P for Q4 2021 (The Bank of Korea) at 1.20 % (vs 1.10 % prior)

- South Korea, GDP, Change Y/Y for Q4 2021 (The Bank of Korea) at 4.20 % (vs 4.10 % prior)

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Feb 2022 (Markit Economics) at 53.80 (vs 52.80 prior)

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change P/P for Feb 2022 (Nationwide, UK) at 1.70 % (vs 0.80 % prior), above consensus estimate of 0.60 %

- United Kingdom, House Prices, Nationwide, United Kingdom, all properties, Change Y/Y for Feb 2022 (Nationwide, UK) at 12.60 % (vs 11.20 % prior), above consensus estimate of 10.70 %

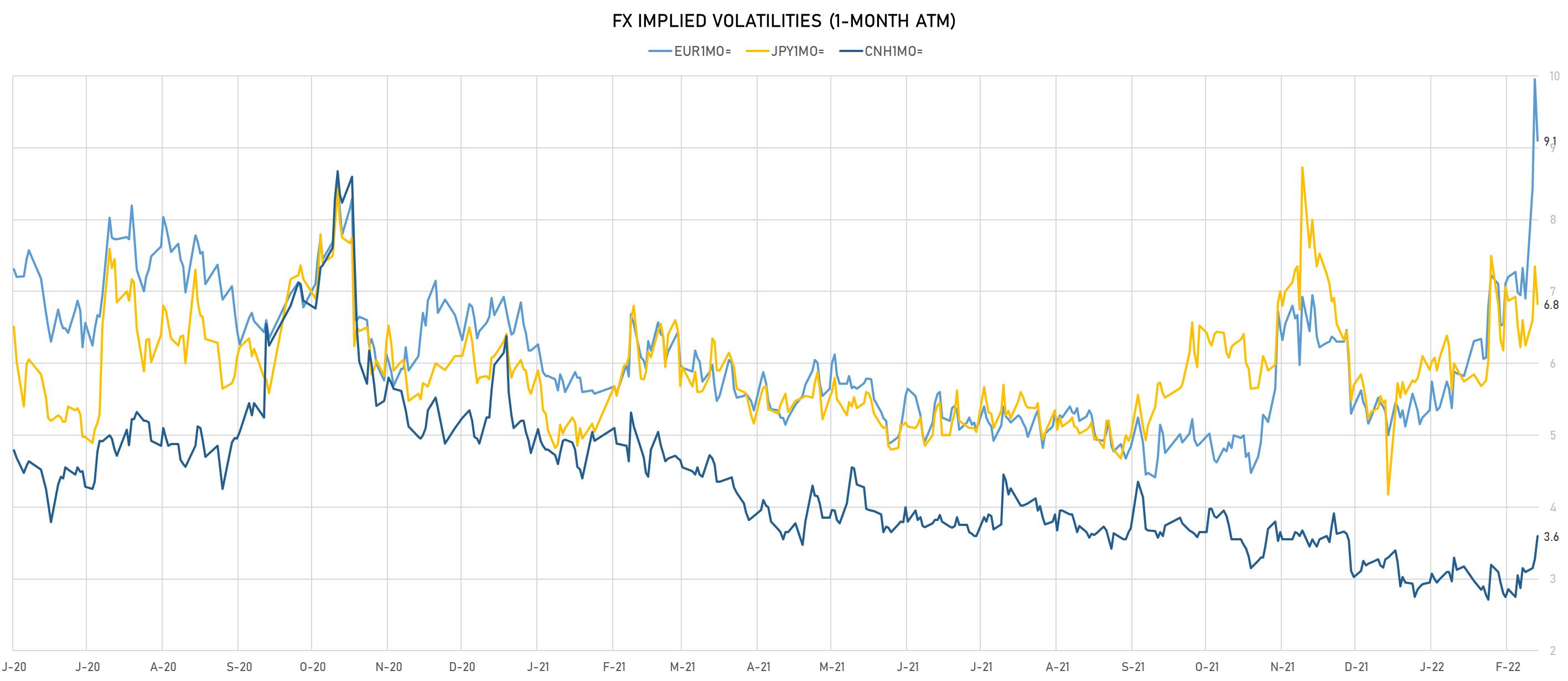

FX VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 9.13, up 1.47 (YTD: +3.02)

- Euro 1-Month At-The-Money Implied Volatility currently at 9.10, down -0.9 (YTD: +4.1)

- Japanese Yen 1M ATM IV currently at 6.83, down -0.5 (YTD: +2.7)

- Offshore Yuan 1M ATM IV currently at 3.60, up 0.3 (YTD: +0.3)

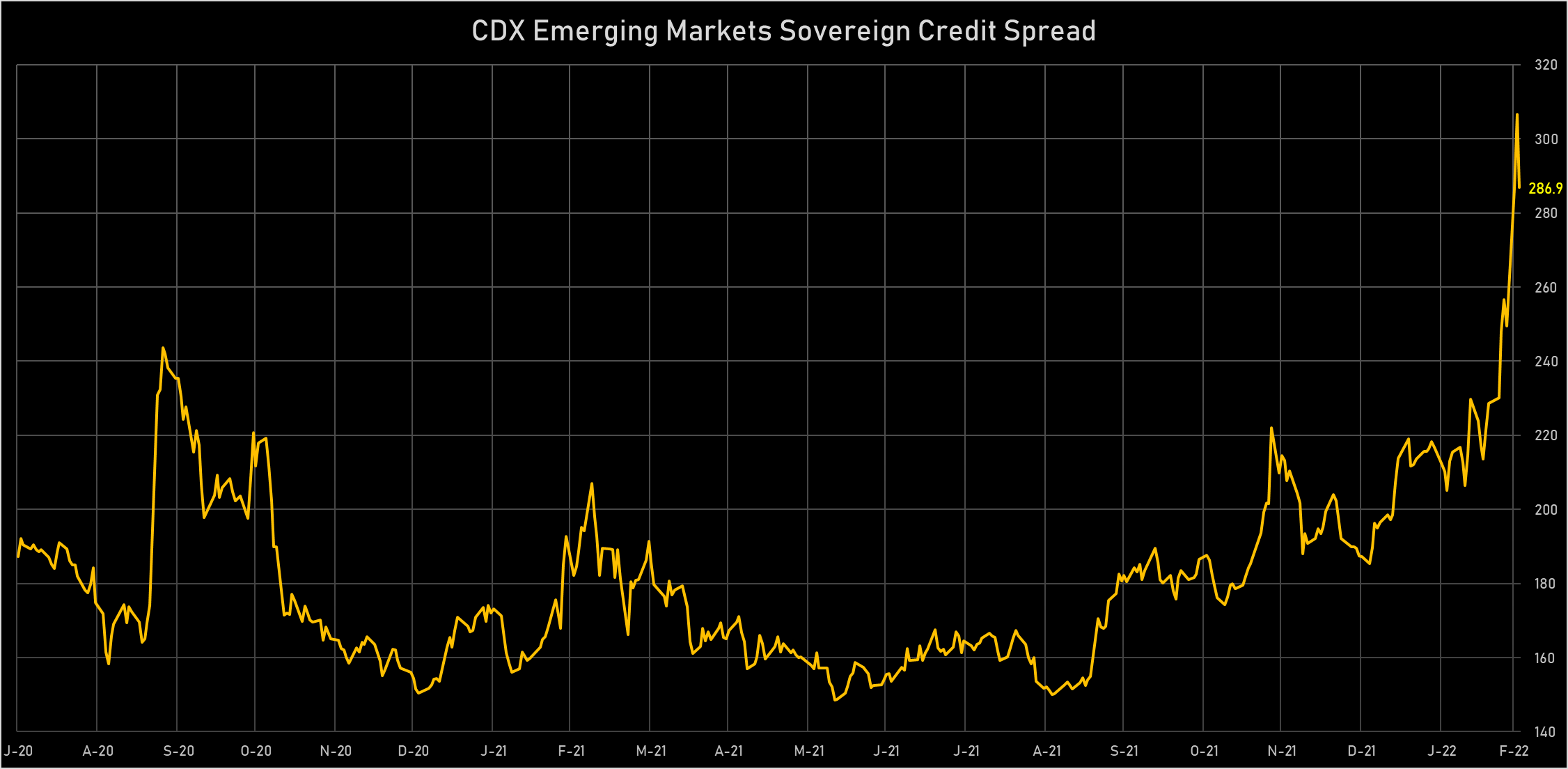

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS TODAY

- Russia (rated B+): down 356.1 basis points to 1,185 bp (1Y range: 75-1,541bp)

- Mexico (rated BBB-): down 4.1 basis points to 110 bp (1Y range: 81-124bp)

- Lithuania (rated A): up 1.5 basis points to 56 bp (1Y range: 44-56bp)

- Poland (rated A-): up 1.5 basis points to 56 bp (1Y range: 44-56bp)

- Philippines (rated BBB): up 2.0 basis points to 94 bp (1Y range: 38-93bp)

- Israel (rated A+): up 2.0 basis points to 64 bp (1Y range: 50-64bp)

- Slovenia (rated A): up 2.0 basis points to 66 bp (1Y range: 51-66bp)

- Latvia (rated A-): up 2.0 basis points to 55 bp (1Y range: 43-55bp)

- United Arab Emirates (rated AA-): up 2.0 basis points to 73 bp (1Y range: 61-73bp)

- Egypt (rated B+): up 16.4 basis points to 554 bp (1Y range: 283-574bp)

LARGEST FX MOVES TODAY

- Russian Rouble up 3.7% (YTD: -30.2%)

- Angolan Kwanza up 1.8% (YTD: +12.1%)

- Barbados Dollar up 1.5% (YTD: 0.0%)

- Peru Sol up 1.3% (YTD: +6.5%)

- Brazilian Real up 1.2% (YTD: +9.2%)

- Botswana Pula down 1.2% (YTD: 0.0%)

- Kazakhstan Tenge down 1.2% (YTD: -12.6%)

- Mauritius Rupee down 1.7% (YTD: -1.7%)

- Moldovan Leu down 2.7% (YTD: -1.6%)

- Ghanaian Cedi down 3.6% (YTD: -11.1%)

LARGEST FX MOVES THIS WEEK

- Dominican Peso up 2.5% (YTD: +5.8%)

- Colombian Peso up 2.3% (YTD: +6.1%)

- Swedish Krona down 2.3% (YTD: -6.9%)

- Armenian Dram down 2.4% (YTD: -2.8%)

- Ghanaian Cedi down 2.9% (YTD: -11.1%)

- Polish Zloty down 3.2% (YTD: -5.5%)

- Czech Koruna down 3.7% (YTD: -4.8%)

- Hungarian Forint down 3.7% (YTD: -4.5%)

- Kazakhstan Tenge down 5.4% (YTD: -12.6%)

- Russian Rouble down 21.3% (YTD: -30.2%)

NOTABLE COMMODITIES GAINERS TODAY

- TRPC Natural Gas TTF Day 1 up 48.9% (YTD: 116.3%)

- TRPC Natural Gas TTF Monthly up 40.8% (YTD: 99.8%)

- ICE Europe Newcastle Coal Monthly up 40.6% (YTD: 158.7%)

- NYMEX NY Harbor ULSD up 10.9% (YTD: 45.9%)

- ICE Europe Low Sulphur Gasoil up 8.5% (YTD: 54.0%)

- ICE Europe Brent Crude up 7.6% (YTD: 42.4%)

- NYMEX RBOB Gasoline up 7.1% (YTD: 44.0%)

- NYMEX Light Sweet Crude Oil (WTI) up 7.0% (YTD: 43.7%)

- Crude Oil WTI Cushing US FOB up 6.8% (YTD: 44.1%)

- Brent Forties and Oseberg Dated FOB North Sea Crude up 6.3% (YTD: 52.5%)

- CME Class III Milk up 6.3% (YTD: 20.7%)

- CME Cash Settled Cheese up 6.2% (YTD: 15.1%)

- SHFE Bitumen Continuation Month 1 up 6.2% (YTD: 12.5%)

- CBoT Wheat up 5.7% (YTD: 35.7%)

NOTABLE COMMODITIES LOSERS TODAY

- Bursa Malaysia Crude Palm Oil down -4.2% (YTD: 51.9%)

- ICE-US Cotton No. 2 down -3.4% (YTD: 6.7%)

- ICE-US Coffee C down -2.9% (YTD: 0.7%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -2.3% (YTD: -11.6%)

- CBoT Soybeans down -1.6% (YTD: 26.3%)

- CBoT Soybean Meal down -1.3% (YTD: 10.7%)

- Gold spot down -0.9% (YTD: 6.2%)

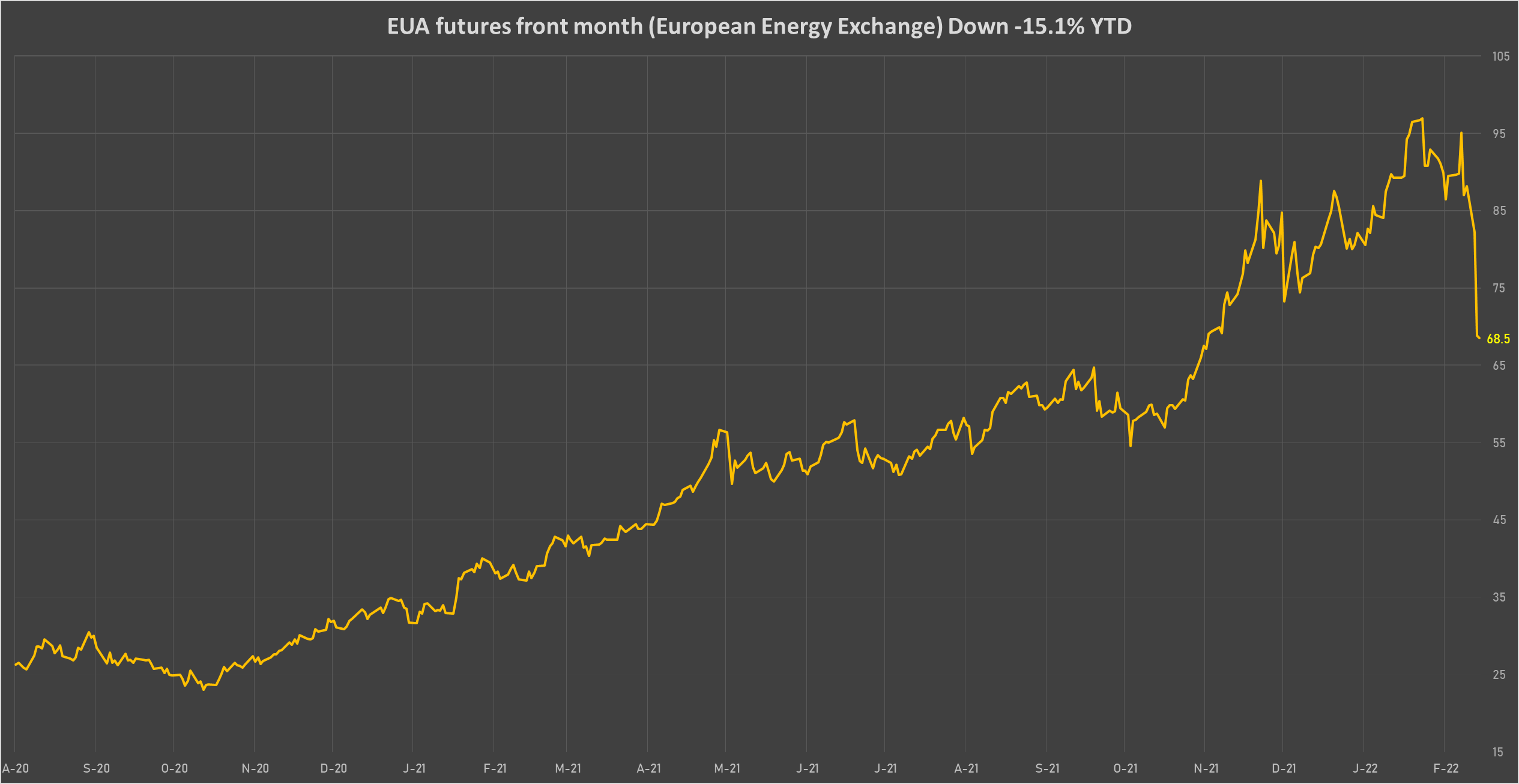

- EEX European Union Aviation Allowance Continuation Month 1 down -0.5% (YTD: -14.7%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -0.5% (YTD: -14.6%)

- SHFE Stannum down -0.5% (YTD: 13.4%)

- Coffee Arabica Colombia Excelso EP Spot down -0.5% (YTD: 6.1%)

- EEX European-Carbon- Secondary Trading down -0.4% (YTD: -14.3%)

- CME Cash settled Butter down -0.3% (YTD: 28.6%)

- Silver spot down -0.3% (YTD: 9.8%)

- CME Live Cattle down -0.3% (YTD: 0.8%)

ENERGY COMMODITIES TODAY

- WTI crude front month currently at US$ 113.43 per barrel, up 7.0% (YTD: +43.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 116.93 per barrel, up 7.6% (YTD: +42.4%)

- Brent 1-month at-the-money implied volatility at 66.8, up 4.7 vols (12-month range: 26.1-66.8)

- Newcastle Coal (ICE Europe) currently at US$ 440.00 per tonne, up 40.6% (YTD: +158.7%)

- Natural Gas (Henry Hub) currently at US$ 4.85 per MMBtu, up 4.1% (YTD: +33.7%)

- Gasoline (NYMEX) currently at US$ 3.43 per gallon, up 7.1% (YTD: +44.0%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 1115.25 per tonne, up 8.5% (YTD: +54.0%)