Macro

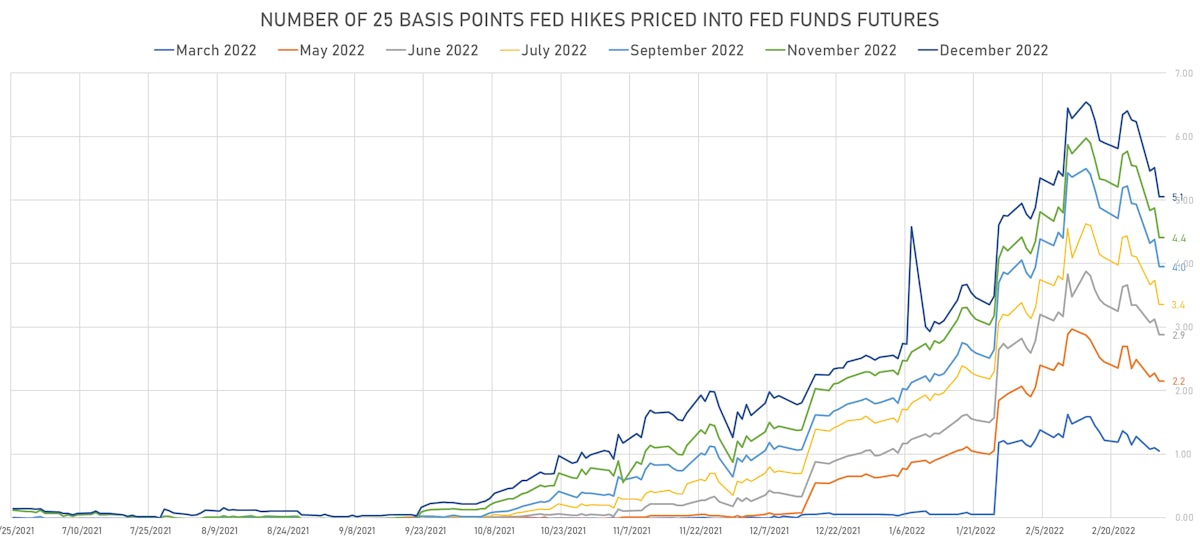

US Curve Flattens Further, 10Y Yield Down 4bp; Market Implied Hikes Down To 5 By The End Of The Year, With Just 1 Hike Priced For 2023

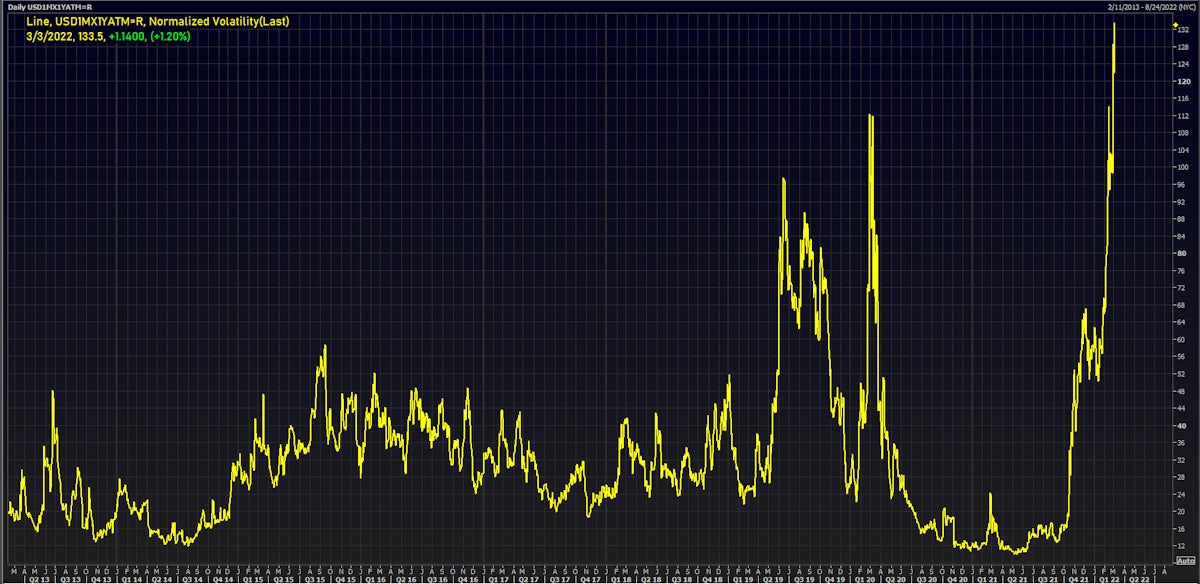

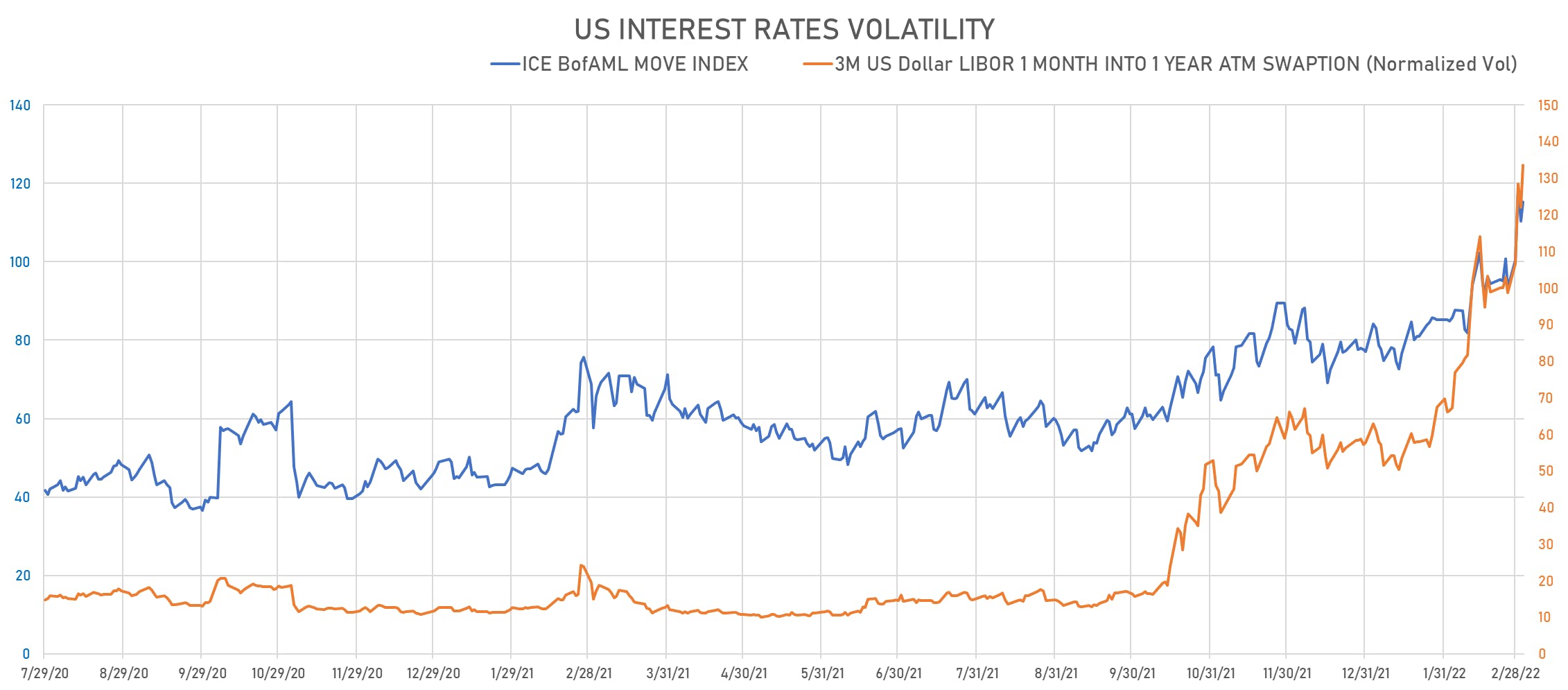

Fed policy uncertainty is driving short-term rates volatility to extreme levels, with many questions up in the air: how front-loaded can rate hikes be? will QT be used to steepen the curve? is inflation stabilizing or still getting worse? how will Ukraine, Iran and the prices of commodities impact inflation?

Published ET

USD 1-month into 1 year ATM swaptions implied volatility (normalized) | Source: Refinitiv

US RATES SUMMARY

- 3-Month USD LIBOR +6.1bp today, now at 0.5830%; 3-Month OIS +1.9bp at 0.4285%

- The treasury yield curve flattened, with the 1s10s spread tightening -4.1 bp, now at 79.6 bp (YTD change: -33.6bp)

- 1Y: 1.0434% (up 0.3 bp)

- 2Y: 1.5250% (up 1.2 bp)

- 5Y: 1.7290% (down 2.6 bp)

- 7Y: 1.8045% (down 3.9 bp)

- 10Y: 1.8396% (down 3.8 bp)

- 30Y: 2.2249% (down 2.8 bp)

- US treasury curve spreads: 3m2Y at 117.5bp (down -0.4bp today), 2s5s at 20.3bp (down -4.1bp), 5s10s at 10.3bp (down -1.9bp), 10s30s at 37.8bp (up 0.2bp)

- Treasuries butterfly spreads: 1s5s10s at -61.7bp (down -2.9bp), 5s10s30s at 27.1bp (up 2.7bp)

- TIPS 1Y breakeven inflation at 5.20% (down -21.0bp); 2Y at 4.11% (down -19.0bp); 5Y at 3.13% (down -7.0bp); 10Y at 2.69% (down -4.3bp); 30Y at 2.35% (down -3.6bp)

- US 5-Year TIPS Real Yield: -0.1 bp at -1.4760%; 10-Year TIPS Real Yield: +1.2 bp at -0.8300%; 30-Year TIPS Real Yield: +0.4 bp at -0.1070%

US MACRO RELEASES

- ISM Non-manufacturing, Business activity for Feb 2022 (ISM, United States) at 55.10 (vs 59.90 prior)

- ISM Non-manufacturing, Employment for Feb 2022 (ISM, United States) at 48.50 (vs 52.30 prior)

- ISM Non-manufacturing, New orders for Feb 2022 (ISM, United States) at 56.10 (vs 61.70 prior)

- ISM Non-manufacturing, NMI/PMI for Feb 2022 (ISM, United States) at 56.50 (vs 59.90 prior), below consensus estimate of 61.00

- ISM Non-manufacturing, Prices for Feb 2022 (ISM, United States) at 83.10 (vs 82.30 prior)

- Jobless Claims, National, Continued for W 19 Feb (U.S. Dept. of Labor) at 1.48 Mln (vs 1.48 Mln prior), above consensus estimate of 1.48 Mln

- Jobless Claims, National, Initial for W 26 Feb (U.S. Dept. of Labor) at 215.00 k (vs 232.00 k prior), below consensus estimate of 225.00 k

- Jobless Claims, National, Initial, four week moving average for W 26 Feb (U.S. Dept. of Labor) at 230.50 k (vs 236.25 k prior)

- Labour Market n.i.e, Unemployment, Announced job layoffs - Tally (Challenger, Gray & Christmas), Volume for Feb 2022 (Challenger) at 15.25 k (vs 19.06 k prior)

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.60 % (vs 1.60 % prior)

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Jan 2022 (U.S. Census Bureau) at 0.70 % (vs 0.70 % prior)

- Manufacturers New Orders, Durable goods total, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.60 % (vs 1.60 % prior)

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.00 % (vs 0.90 % prior)

- Manufacturers New Orders, Total manufacturing excluding transportation, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.00 % (vs 0.10 % prior)

- Manufacturers New Orders, Total manufacturing, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.40 % (vs -0.40 % prior), above consensus estimate of 0.70 %

- PMI, Composite, Output, Final for Feb 2022 (Markit Economics) at 55.90 (vs 56.00 prior)

- PMI, Services Sector, Business Activity, Final for Feb 2022 (Markit Economics) at 56.50 (vs 56.70 prior)

US FORWARD RATES

- Fed Funds futures now price in 26.3bp of Fed hikes by the end of March 2022, 53.8bp (2.15 x 25bp hikes) by the end of May 2022, and price in 5.05 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 30.5 bp of hikes in 2023 (equivalent to 1.2 x 25 bp hikes), down -6.0 bp today, and -21.0 bp of hikes in 2024 (equivalent to -0.8 x 25 bp hikes)

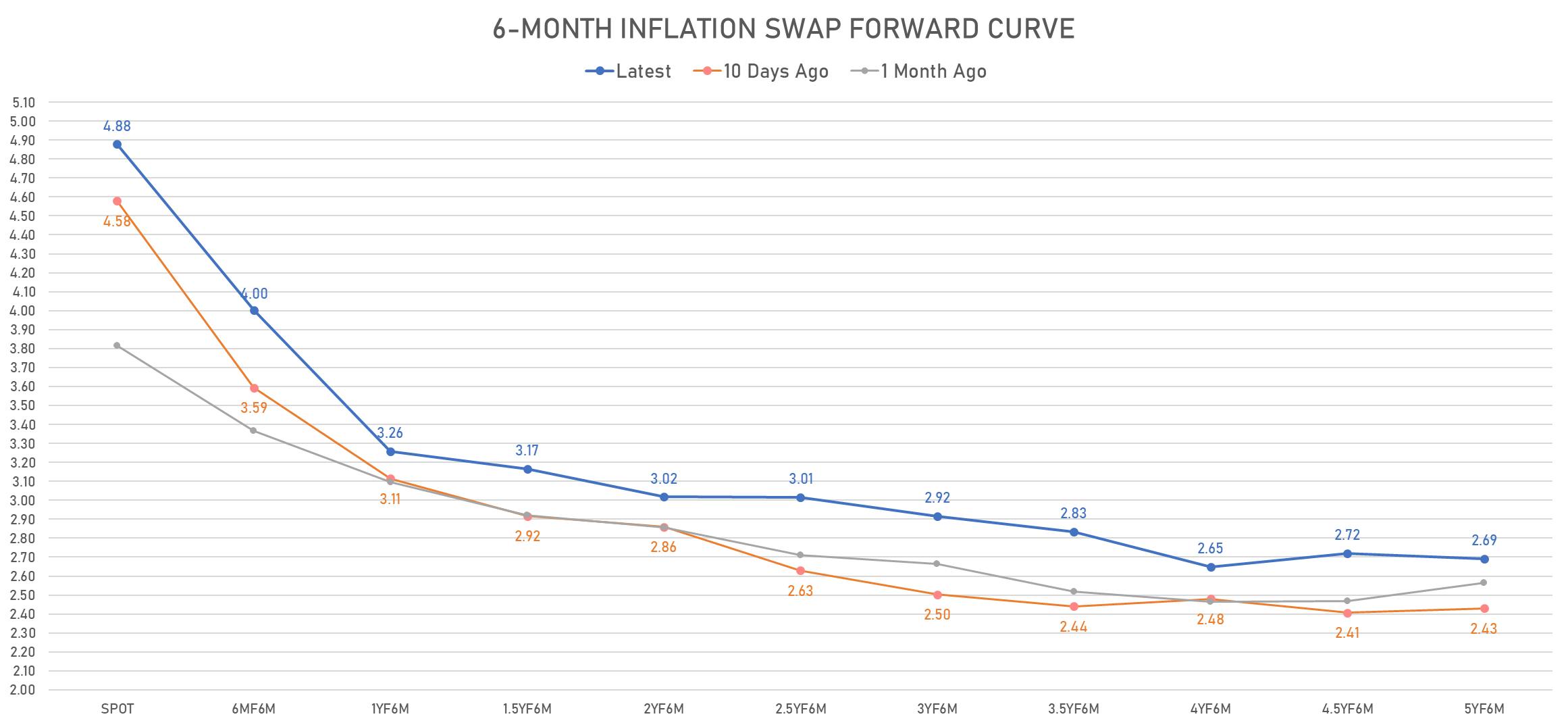

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.20% (down -21.0bp); 2Y at 4.11% (down -19.0bp); 5Y at 3.13% (down -7.0bp); 10Y at 2.69% (down -4.3bp); 30Y at 2.35% (down -3.6bp)

- 6-month spot US CPI swap down -21.1 bp to 4.878%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.4760%, -0.1 bp today; 10Y at -0.8300%, +1.2 bp today; 30Y at -0.1070%, +0.4 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 11.6% at 133.5%

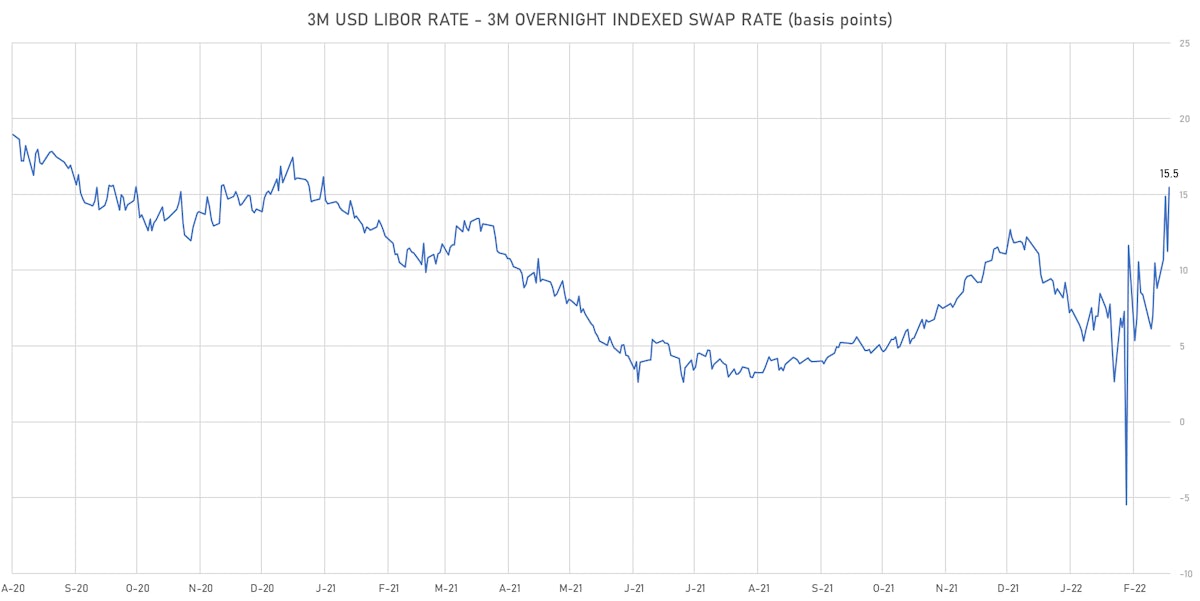

- 3-Month LIBOR-OIS spread up 4.2 bp at 15.5 bp (12-months range: -5.5-15.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.247% (up 0.5 bp); the German 1Y-10Y curve is 1.2 bp steeper at 70.4bp (YTD change: +25.1 bp)

- Japan 5Y: 0.007% (up 2.5 bp); the Japanese 1Y-10Y curve is 3.0 bp steeper at 24.2bp (YTD change: +7.6 bp)

- China 5Y: 2.588% (up 3.3 bp); the Chinese 1Y-10Y curve is 3.3 bp flatter at 74.8bp (YTD change: +23.8 bp)

- Switzerland 5Y: -0.093% (up 1.4 bp); the Swiss 1Y-10Y curve is 7.9 bp flatter at 84.4bp (YTD change: +27.5 bp)

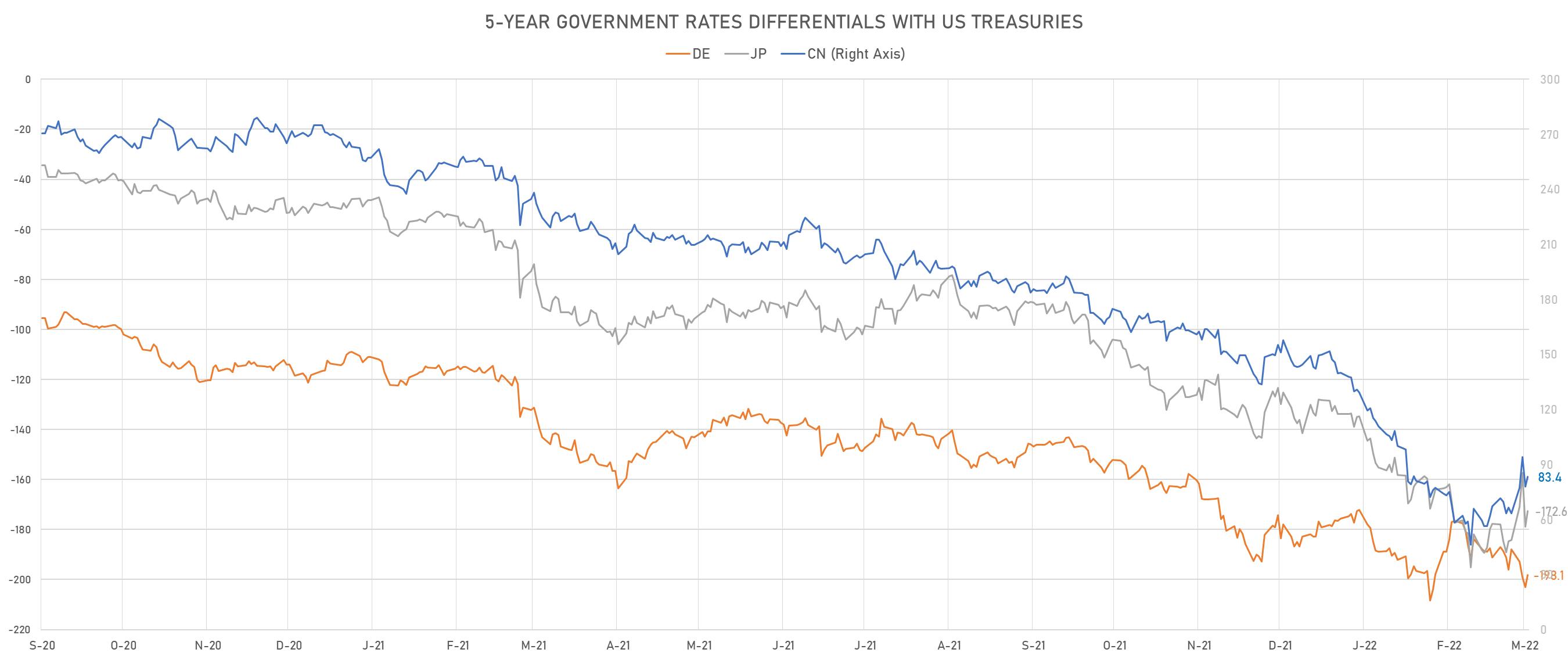

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -8.7 bp at 194.3 bp (YTD change: +22.2 bp)

- US-JAPAN: -9.4 bp at 169.6 bp (YTD change: +34.9 bp)

- US-CHINA: -9.8 bp at -87.8 bp (YTD change: +41.4 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +0.8 bp at 129.4 bp (YTD change: +46.2bp)

- US-JAPAN: -1.5 bp at -26.4 bp (YTD change: +44.4bp)

- JAPAN-GERMANY: +2.3 bp at 155.8 bp (YTD change: +1.8bp)

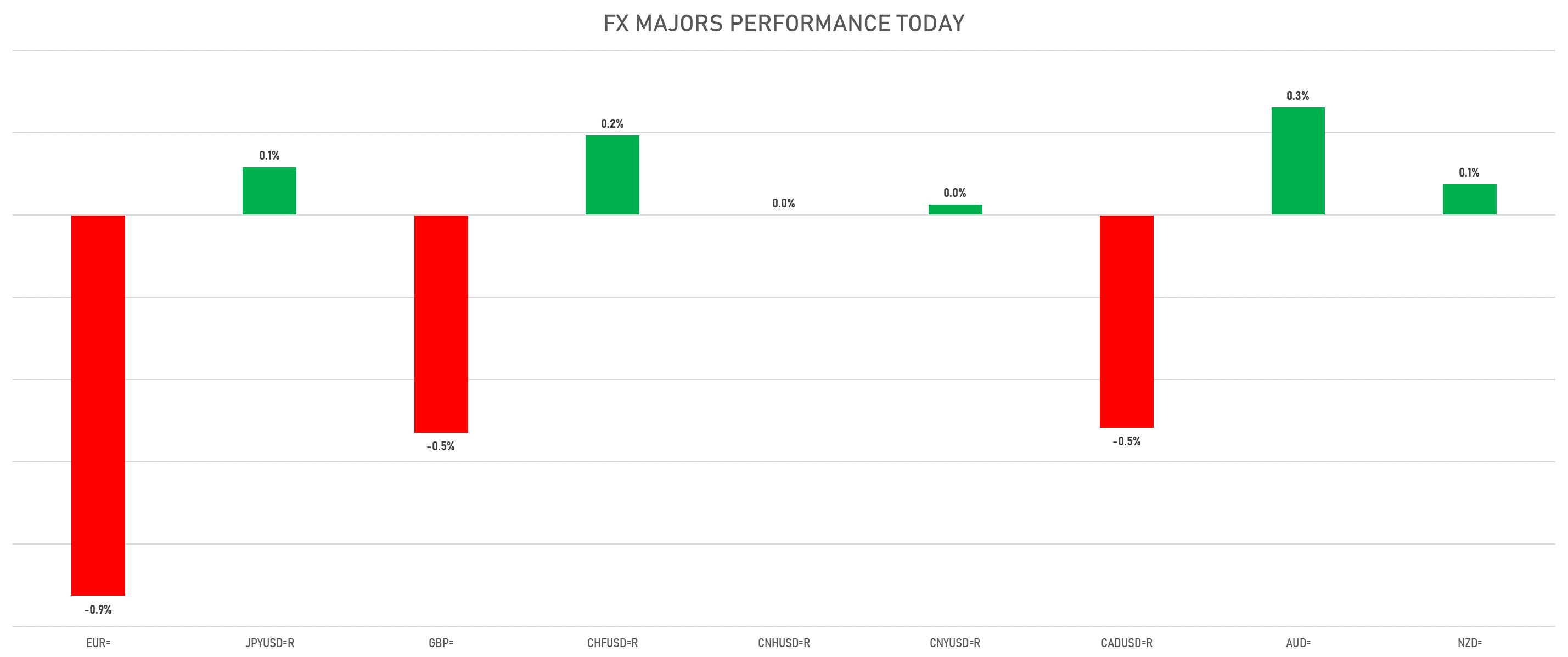

FX SUMMARY

- The US Dollar Index is up 0.35% at 97.74 (YTD: +2.17%)

- Euro down 0.93% at 1.1018 (YTD: -3.1%)

- Yen up 0.12% at 115.37 (YTD: -0.2%)

- Onshore Yuan up 0.03% at 6.3190 (YTD: +0.6%)

- Swiss franc up 0.19% at 0.9187 (YTD: -0.7%)

- Sterling down 0.53% at 1.3332 (YTD: -1.5%)

- Canadian dollar down 0.52% at 1.2696 (YTD: -0.5%)

- Australian dollar up 0.26% at 0.7315 (YTD: +0.8%)

- NZ dollar up 0.07% at 0.6789 (YTD: -0.5%)

GLOBAL MACRO DATA RELEASES

- Australia, Current Account, Goods and Services, Net for Jan 2022 (AU Bureau of Stat) at 12,891.00 Mln AUD (vs 8,356.00 Mln AUD prior), above consensus estimate of 9,050.00 Mln AUD

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Jan 2022 (AU Bureau of Stat) at -27.90 % (vs 8.20 % prior), below consensus estimate of -3.50 %

- Brazil, PMI, Manufacturing Sector for Feb 2022 (Markit Economics) at 49.60 (vs 47.80 prior)

- China (Mainland), PMI, Services Sector, Business Activity, Caixin PMI for Feb 2022 (Markit Economics) at 50.20 (vs 51.40 prior)

- Denmark, Unemployment, Rate, Net for Jan 2022 (statbank.dk) at 2.30 % (vs 2.10 % prior)

- Euro Zone, PMI, Composite, Output, Final for Feb 2022 (Markit Economics) at 55.50 (vs 55.80 prior), below consensus estimate of 55.80

- Euro Zone, PMI, Services Sector, Business Activity, Final for Feb 2022 (Markit Economics) at 55.50 (vs 55.80 prior), below consensus estimate of 55.80

- Euro Zone, Unemployment, Rate for Jan 2022 (Eurostat) at 6.80 % (vs 7.00 % prior), below consensus estimate of 6.90 %

- France, PMI, Composite, Output, Final for Feb 2022 (Markit/CDAF, France) at 55.50 (vs 57.40 prior), below consensus estimate of 57.40

- France, PMI, Services Sector, Business Activity, Final for Feb 2022 (Markit Economics) at 55.50 (vs 57.90 prior), below consensus estimate of 57.90

- Germany, PMI, Composite, Output, Final for Feb 2022 (Markit Economics) at 55.60 (vs 56.20 prior), below consensus estimate of 56.20

- Germany, PMI, Services Sector, Business Activity, Final for Feb 2022 (Markit Economics) at 55.80 (vs 56.60 prior), below consensus estimate of 56.60

- Japan, Jibun Bank, PMI, Services Sector, Service PMI for Feb 2022 (Markit Economics) at 44.20 (vs 42.70 prior)

- Japan, Labour Market n.i.e, Active opening rate for Jan 2022 () at 1.20 (vs 1.16 prior), above consensus estimate of 1.16

- Japan, Unemployment, Rate for Jan 2022 (MIC, Japan) at 2.80 % (vs 2.70 % prior), above consensus estimate of 2.70 %

- Russia, PMI, Services Sector, Business Activity for Feb 2022 (Markit Economics) at 52.10 (vs 49.80 prior)

- Saudi Arabia, IHS Markit, PMI, Composite, Output, IHS Markit PMI for Feb 2022 (Markit Economics) at 56.20 (vs 53.20 prior)

- South Africa, Standard Bank PMI for Feb 2022 (Markit Economics) at 50.90 (vs 50.90 prior)

- Turkey, CPI, Change P/P, Price Index for Feb 2022 (TURKSTAT) at 4.81 % (vs 11.10 % prior), above consensus estimate of 3.80 %

- United Kingdom, Reserves, Gross, Government, Current Prices for Feb 2022 (HM Treasury) at 200892.47 Mln USD (vs 196480.43 Mln USD prior)

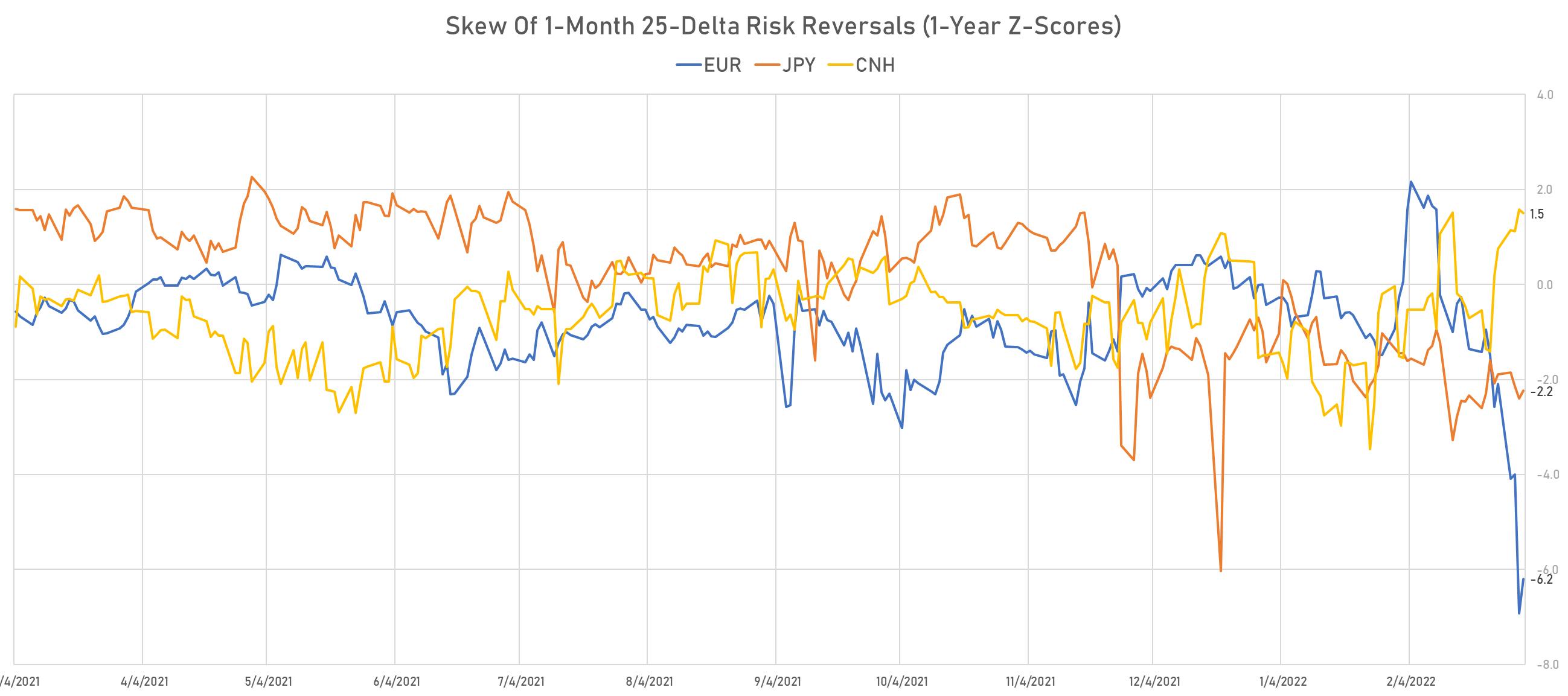

FX VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.28, down -0.85 (YTD: +2.17)

- Euro 1-Month At-The-Money Implied Volatility currently at 9.04, down -0.1 (YTD: +4.0)

- Japanese Yen 1M ATM IV currently at 6.95, up 0.1 (YTD: +2.8)

- Offshore Yuan 1M ATM IV currently at 3.43, down -0.2 (YTD: +0.1)

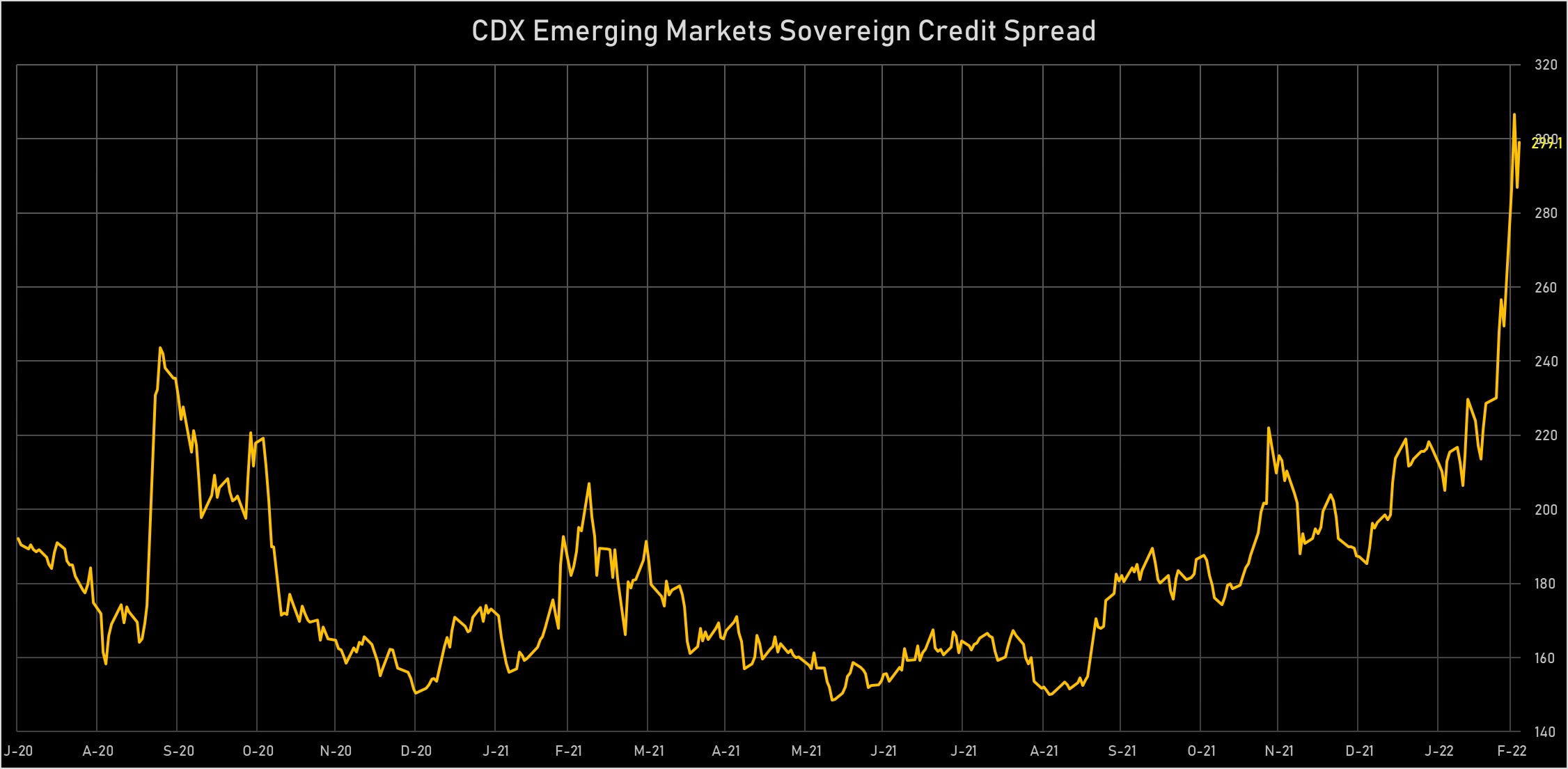

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS TODAY

- Russia (rated B+): down 356.1 basis points to 1,185 bp (1Y range: 75-1,541bp)

- Mexico (rated BBB-): down 4.1 basis points to 110 bp (1Y range: 81-124bp)

- Lithuania (rated A): up 1.5 basis points to 56 bp (1Y range: 44-56bp)

- Poland (rated A-): up 1.5 basis points to 56 bp (1Y range: 44-56bp)

- Philippines (rated BBB): up 2.0 basis points to 94 bp (1Y range: 38-93bp)

- Israel (rated A+): up 2.0 basis points to 64 bp (1Y range: 50-64bp)

- Slovenia (rated A): up 2.0 basis points to 66 bp (1Y range: 51-66bp)

- Latvia (rated A-): up 2.0 basis points to 55 bp (1Y range: 43-55bp)

- United Arab Emirates (rated AA-): up 2.0 basis points to 73 bp (1Y range: 61-73bp)

- Egypt (rated B+): up 16.4 basis points to 554 bp (1Y range: 283-574bp)

LARGEST FX MOVES TODAY

- Russian Rouble up 3.7% (YTD: -30.2%)

- Angolan Kwanza up 1.8% (YTD: +12.1%)

- Barbados Dollar up 1.5% (YTD: 0.0%)

- Peru Sol up 1.3% (YTD: +6.5%)

- Brazilian Real up 1.2% (YTD: +9.2%)

- Botswana Pula down 1.2% (YTD: 0.0%)

- Kazakhstan Tenge down 1.2% (YTD: -12.6%)

- Mauritius Rupee down 1.7% (YTD: -1.7%)

- Moldovan Leu down 2.7% (YTD: -1.6%)

- Ghanaian Cedi down 3.6% (YTD: -11.1%)

COMMODITIES: NOTABLE GAINERS TODAY

- ICE Europe Brent Crude Oil 1 Month At the Money Implied Volatility up 4.71 vols (YTD: +37.1 vols)

- CBoT Wheat up 21.8% (YTD: 65.3%)

- Baltic Exchange Clean Tank index up 6.0% (YTD: 25.0%)

- SGX Iron Ore 62% China CFR Swap Monthly up 5.5% (YTD: 37.0%)

- DCE Iron Ore Continuation Month 1 up 5.2% (YTD: 18.4%)

- ICE Europe Low Sulphur Gasoil up 4.9% (YTD: 61.6%)

- Shanghai International Exchange Bonded Copper up 4.7% (YTD: 6.1%)

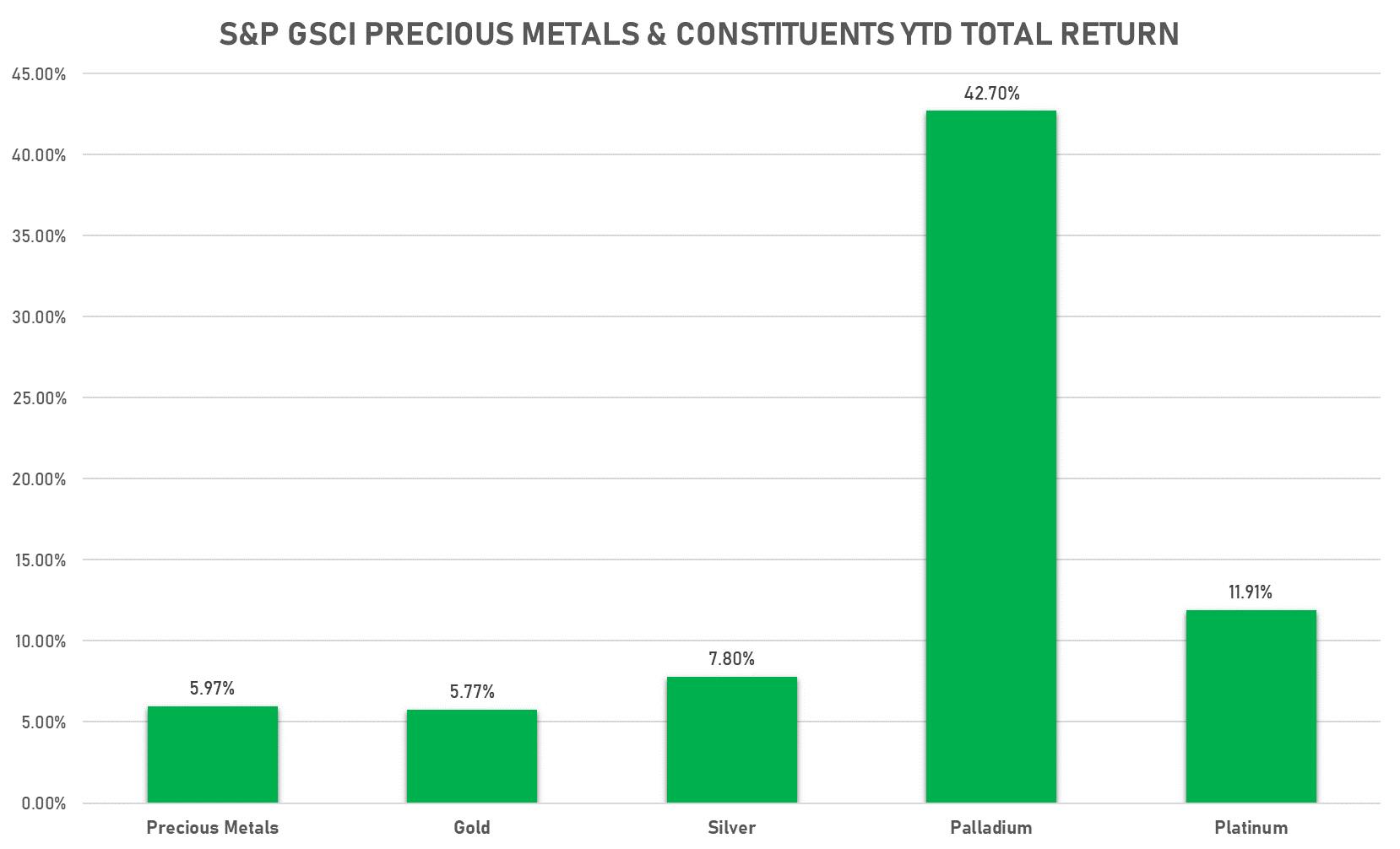

- Palladium spot up 4.1% (YTD: 41.7%)

- Zhengzhou Exchange Thermal Coal up 3.6% (YTD: 27.7%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) up 3.5% (YTD: 34.6%)

- CME Random Length Lumber up 3.2% (YTD: 26.5%)

- SHFE Aluminum up 3.0% (YTD: 16.7%)

- SHFE Bitumen Continuation Month 1 up 2.7% (YTD: 15.6%)

- SHFE Hot Rolled Coil up 2.6% (YTD: 11.3%)

- SHFE Zinc up 2.6% (YTD: 8.7%)

COMMODITIES: NOTABLE LOSERS TODAY

- ICE Europe Newcastle Coal Monthly down -15.9% (YTD: 117.5%)

- TRPC Natural Gas TTF Monthly down -14.5% (YTD: 70.9%)

- Baltic Exchange Capesize Index down -10.9% (YTD: -30.3%)

- TRPC Natural Gas TTF Day 1 down -9.0% (YTD: 96.8%)

- Bursa Malaysia Crude Palm Oil down -4.7% (YTD: 44.7%)

- Brent Forties and Oseberg Dated FOB North Sea Crude down -4.2% (YTD: 46.1%)

- Crude Oil WTI Cushing US FOB down -2.8% (YTD: 40.2%)

- ICE-US Coffee C down -2.7% (YTD: -2.1%)

- NYMEX Light Sweet Crude Oil (WTI) down -2.6% (YTD: 39.8%)

- ICE Europe Brent Crude down -2.2% (YTD: 39.3%)

- EEX European Union Aviation Allowance Continuation Month 1 down -1.7% (YTD: -16.2%)

- EEX European-Carbon- Secondary Trading down -1.7% (YTD: -15.7%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -1.7% (YTD: -16.0%)

- CBoT Soybean Oil down -1.6% (YTD: 40.2%)

- BALTIC Dry Index down -1.5% (YTD: -5.2%)